Alopecia Treatment Market Size, Share, Trends and Forecast by Drug Type, Indication, Gender, Route of Administration, Distribution Channel, and Region, 2025-2033

Alopecia Treatment Market Size and Share:

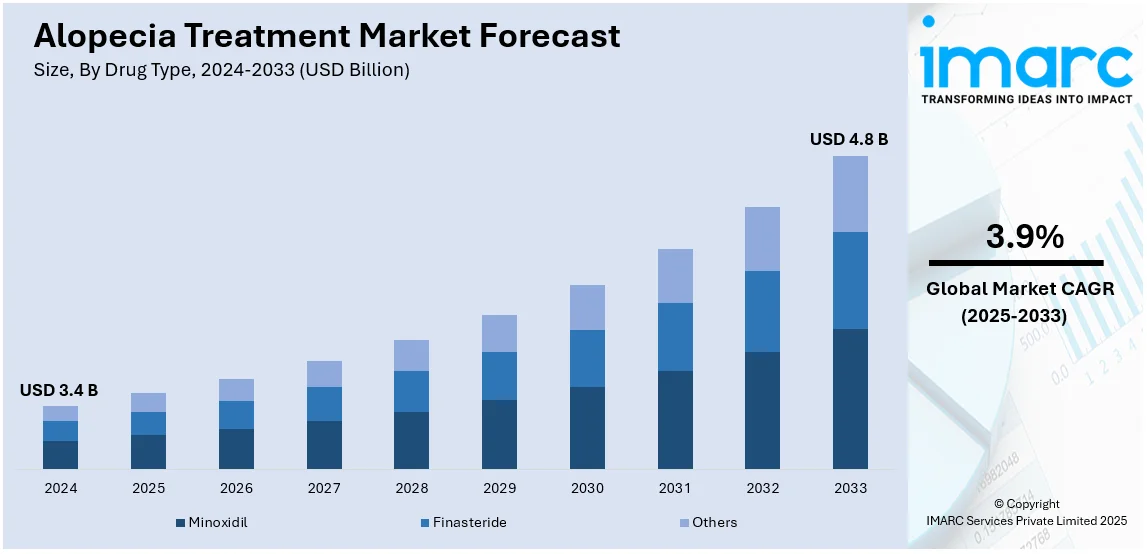

The global alopecia treatment market size was valued at USD 3.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.8 Billion by 2033, exhibiting a CAGR of 3.9% from 2025-2033. North America currently dominates the market, holding a market share of over 38.34% in 2024. The market is driven by the increasing prevalence of alopecia, significant investment in healthcare expenditure, and the growing aesthetic consciousness among consumers highlighting the importance of appearance and self-care.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.4 Billion |

| Market Forecast in 2033 | USD 4.8 Billion |

| Market Growth Rate (2025-2033) | 3.9% |

The alopecia treatment market is experiencing robust growth, driven by rising awareness about hair loss conditions and advancements in medical and cosmetic solutions. Increasing prevalence of alopecia, fueled by factors such as aging, hormonal imbalances, stress, and autoimmune disorders, has significantly boosted demand for effective treatment options. Innovations in therapeutic approaches, including regenerative medicine, stem cell therapy, and advanced pharmaceuticals, have expanded the market's scope. Moreover, the growing influence of social media and increasing disposable income have encouraged consumers to seek professional treatments, further driving market growth. Additionally, the expansion of e-commerce platforms has made alopecia treatments more accessible, especially in developing regions, contributing to the market’s global expansion.

In the United States, the alopecia treatment market is propelled by a high awareness level and strong demand for advanced medical solutions. A well-established healthcare infrastructure supports the development and adoption of innovative treatments, such as oral and topical therapies for alopecia. For instance, in September 2024, Amplifica, a U.S. based pharmaceutical company, announced promising results from its first-in-human trial of AMP-303, a novel intradermal treatment for androgenetic alopecia. The study showed AMP-303 significantly increased hair density and thickness after one treatment, with durable effects and a strong safety profile. The market also benefits from significant investments in research and development, aiming to discover novel solutions for hair regrowth. Moreover, rising consumer preference for non-invasive and aesthetic solutions, alongside the availability of specialized dermatology clinics, positions the U.S. as a leading market for alopecia treatments. Besides this, strategic collaborations and product launch further strengthen its growth trajectory.

Alopecia Treatment Market Trends:

Increasing Prevalence of Alopecia

Androgenetic alopecia is a prevalent form of patterned hair loss that is seen in men and women. As per the Journal of the American Academy of Dermatology International (JAAD) published survey in 2023, alopecia affects different racial and gender groups differently, 15% of postmenopausal women and over 50% of elderly males experience it, while thinning hair can begin as early as puberty. Apart from that, one of the crucial factors driving the development of the alopecia treatment market is the increasing incidence of alopecia, a hereditary condition, and disorders such as alopecia areata. The National Alopecia Areata Foundation estimates that 6.7 million Americans and about 160 million individuals worldwide have alopecia areata or may acquire it. Currently, alopecia areata affects about 700,000 persons in the United States. Furthermore, alopecia areata affects about 2% of people worldwide, underscoring the disorder's widespread prevalence that causes hair loss. As per the alopecia treatment market overview, demand in the industry is rising as more individuals become aware and look for efficient treatment solutions. Therefore, people are resorting to medical aid for hair restoration due to advances in medical technology and a wide range of treatment options accessible, leading to a considerable expansion in the market for alopecia therapy.

Rising Healthcare Expenditure

The escalating healthcare expenditure worldwide is a pivotal factor driving the growth trajectory of the alopecia treatment market. Global healthcare spending increased by 21% on average in 2020, as per reports. This number has increased even further by 2021, when it was a startling 25% higher than in 2019. Moreover, the per capita health spending increased in most peer countries between 2021 and 2022. A moderate 2.9% growth in per capita health spending was reported in the US, Australia (2.4%), Canada (0.7%), and the UK (0.5%). Among the countries for whom data was available, Belgium experienced the largest growth in per capita health spending, rising 9.6% between 2021 and 2022. Notably, developed nations show an especially notable increase in healthcare spending, indicating the willingness of individuals to spend money on cutting-edge medical treatments, such as alopecia treatments. Hence, the burgeoning financial capability and enhanced disposable income allow a larger section of the population to avail themselves of the alopecia treatment options, thus contributing to the growth of the market.

Growing Aesthetic Consciousness

Furthermore, the growing emphasis on physical appearance and aesthetic consciousness among individuals globally is significantly contributing to the expansion of the alopecia treatment market. A survey conducted by the International Society of Hair Restoration Surgery (ISHRS) revealed that ISHRS members treated on average 165 surgical patients and 396 non-surgical patients. Moreover, ISHRS members performed surgical procedures between 0-199 hair restoration in 2021 by around two-thirds (65%) of ISHRS members, with an average member performing 179 procedures, while 78% of ISHRS members performed 0-19 hair restoration surgical operations. Members completed an average of 14 hair restoration surgical procedures per month in 2021. As a result, this rising figure illustrates increased self-consciousness among individuals about their appearance, which is exacerbated by social media's effect and the representation of ideal beauty standards. The need to adhere to perceived aesthetic ideals and cultural pressures has resulted in a noteworthy demand for effective hair restoration options. Consequently, the market for alopecia treatments is growing as more people look for ways to improve their physical appearance and deal with their hair loss issues.

Alopecia Treatment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global alopecia treatment market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on drug type, indication, gender, route of administration, and distribution channel.

Analysis by Drug Type:

- Minoxidil

- Finasteride

- Others

Minoxidil is a commonly used medication that effectively treats alopecia in many forms. Minoxidil is a popular and easily accessible therapy option for male and female pattern hair loss. It is available over the counter in many locations. This FDA-approved drug comes in several forms, including foams and topical treatments. It slows down hair loss, stimulates hair growth, and increases blood supply to hair follicles. It is widely adopted due to its relative affordability when compared to prescription drugs and its efficacy in encouraging hair growth. For instance, as per a study by Research Gate, patients were treated with low-dose oral minoxidil (LDOM) for at least 3 months as a treatment for any type of alopecia, which offers a good safety profile to treat hair loss without any life-threatening adverse effects. Thus, the increasing number of alopecia is resulting in the adoption of minoxidil to treat alopecia, positively generating alopecia treatment market revenue.

Analysis by Indication:

- Androgenic Alopecia

- Alopecia Areata

- Alopecia Totalis

- Others

Androgenic alopecia leads the market with around 37.6% of market share in 2024. Androgenic alopecia, commonly known as male or female pattern baldness, holds the largest segment in the market. It is primarily due to the high prevalence of androgenic alopecia globally, which affects a significant portion of men and women. Additionally, the rising awareness and acceptance of treatment options, coupled with advances in therapeutic techniques such as topical treatments, oral medications, and hair transplant procedures, have further propelled the market growth. Hence key players are introducing advanced product variants to meet these needs. For instance, in February 2024, Pelage Pharmaceuticals, a clinical-stage regenerative medicine company created a novel treatment for hair loss, while announcing the completion of $16.75 million Series A fundraising. The funding will assist the development of a first-in-class treatment for androgenetic alopecia (pattern baldness) and other kinds of alopecia, including chemotherapy-induced hair loss. GV is leading the investment, which is also supported by Main Street Advisors, Visionary Ventures, and YK BioVentures. As a result, the increasing focus on aesthetic appearance and the psychological impact of hair loss has led to the rising demand for effective treatment solutions, solidifying androgenic alopecia's position in the alopecia treatment market outlook.

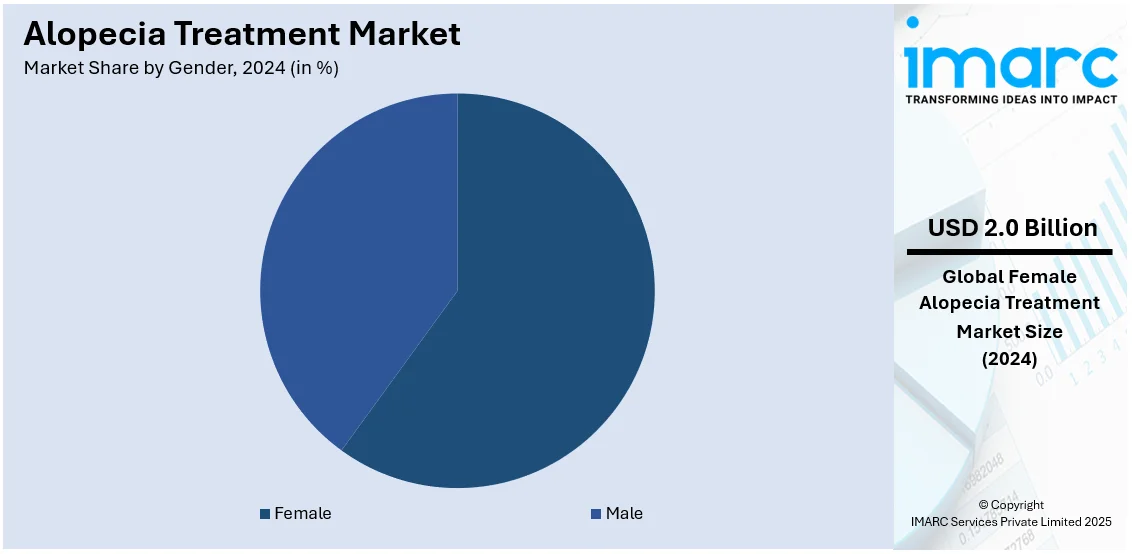

Analysis by Gender:

- Male

- Female

Female leads the market with around 59.8% of market share in 2024. The growing prevalence of alopecia in females coupled with a growing awareness and acceptance of medical treatments for hair loss are influencing the market growth. Women are seeking effective solutions for alopecia due to aesthetic concerns and the psychological impact of hair loss, leading to a significant demand for pharmaceutical and cosmetic treatments. Additionally, the expansion of product offerings specifically designed for female alopecia, including topical solutions, oral medications, and advanced therapies such as platelet-rich plasma (PRP) and low-level laser therapy (LLLT), has further propelled the growth of this segment. As per the American Academy of Dermatology (AAD) association, minoxidil is recognized as an over-the-counter medication approved by the US Food and Drug Administration (FDA) for treating female pattern hair loss (FPHL), since FPHL can be treated with medications that include 2% or 5% minoxidil. Therefore, the growing focus on female-centric marketing strategies and the rising trend of self-care and wellness among women are also contributing to the expansion of alopecia treatment market.

Analysis by Route of Administration:

- Oral

- Topical

- Injectable

Topical segment holds the largest share, as it is widely used and accepted owing to its ease of use. Topical therapies, including minoxidil and corticosteroids, are non-invasive, can be administered directly to the afflicted area, and have fewer systemic adverse effects than oral and injectable options, and are frequently the first line of defense against hair loss. This route of administration is attributed to its popularity among patients who want quick fixes that work well without requiring physician care. According to the Cleveland Clinic, corticosteroids and other anti-inflammatory medications can be used to treat alopecia. It is rubbed topically (into the skin) as an ointment, cream, or foam, or injected into the scalp or other regions for the treatment.

Analysis by Distribution Channel:

- Hospitals

- Retail Pharmacies

- Online Pharmacies

Hospitals lead the market with around 40.3% of market share in 2024. Hospital dominance is attributed to the extensive infrastructure and specialized medical expertise available in hospital settings, which ensure comprehensive diagnosis and tailored treatment plans for alopecia patients. Hospitals often provide a range of therapeutic options, including prescription medications, advanced medical procedures, and supportive care, making them a preferred choice for individuals seeking professional and effective alopecia management. Moreover, hospitals frequently collaborate with leading pharmaceutical companies and research institutions to offer cutting-edge treatments. Hence, the trust and reliability associated with hospital care contribute to their leading position in the alopecia treatment market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 38.34%. The North America alopecia treatment market recent developments are marked by the robust healthcare infrastructure, increasing prevalence of alopecia, and increased awareness about available treatment options. The presence of major pharmaceutical companies and advancements in medical technology further bolster the market in this region. For instance, in June 2023, the U.S. Food and Drug Administration (FDA) announced the approval of ritlecitinib, a Janus kinase (JAK) inhibitor by Yale dermatologist Dr. Brett King, who worked with pharmaceutical company Pfizer for conducting a series of clinical trials with ritlecitinib. It is for the treatment of alopecia areata in adolescents and adults which is an oral medication under the name Litfulo. Furthermore, the growing inclination toward aesthetic procedures and a higher disposable income enable consumers to spend on treatments for hair loss, which is positively increasing the alopecia treatment demand in North America.

Key Regional Takeaways:

United States Alopecia Treatment Market Analysis

In 2024, United States accounted for 93.40% of the market share in North America. Alopecia treatment market in the United States is experiencing huge growth mainly because of heightened awareness about hair loss and a surge in demand for advanced treatments. Pharmaceutical therapies like oral Janus kinase (JAK) inhibitors are increasingly being sought after by people and prove the direction of advanced and effective solutions. This leaves a significant number of around 35 million males and 21 million females within the United States suffering from various forms of hair loss, resulting in an extensive patient population, as per reports. Consumer spending on personal care products also continues to drive the market; consumers increasingly search for remedies that can help improve their looks and make them feel better. At the forefront of the growth have been leading pharmaceutical companies, such as Pfizer and Eli Lilly, in their innovative treatments. Dermatologists play an important role in increasing access of patients to the treatments, but online platforms supplement the sources available to provide the patient with even more information about hair loss, thus increasing their availability.

Europe Alopecia Treatment Market Analysis

The alopecia treatment market in Europe is growing significantly, as people are becoming increasingly aware and there is a need for more effective treatments. The European Commission approved LITFULO (ritlecitinib) for the treatment of severe alopecia areata in patients aged 12 years or older in 2023, which was an important development for treatment options. Europe is also home to one of the highest prevalences of hair loss worldwide, with eight of the top ten countries for hair loss being in the region. The Czech Republic, in particular, boasts the highest prevalence of baldness, with more than 40% of adult men suffering from it, as per an industry report. Such a high incidence of alopecia contributes to a significant patient population, thereby further driving demand for advanced therapies. Pharmaceutical treatments are followed by a trend of increasing non-invasive treatments, like laser therapy and stem cell treatment. The concern of personal care and self-esteem among people is making them take these treatments, hence pushing the growth in the market even more.

Asia Pacific Alopecia Treatment Market Analysis

The Asia Pacific alopecia treatment market is growing rapidly, driven by increasing disposable incomes and a growing concern for appearance. In Japan, the prevalence of alopecia areata ranges between 1.45% and 2.18%, according to a study that highlights the significant emotional and social impacts of the condition. The study then determined the self-reported mood, self-esteem, and social interaction effects as 70.2%, 55.8%, and 48.9%, respectively. Such research reminds the importance of more effective treatments that can halt both the medical and psychological aspects of hair loss. Alopecia is increasingly becoming a problem in countries such as China, Japan, and India, and this is further increasing the demand for medical as well as cosmetic solutions. Non-invasive treatments, laser therapy, are becoming popular with market players investing more in R&D to introduce innovative, culturally tailored products. Moreover, hair clinics are multiplying and e-commerce solutions are accelerating the growth of the market.

Latin America Alopecia Treatment Market Analysis

The Latin American market for alopecia treatment is still growing, considering the growing consumers' awareness as well as an increasing availability of treatment options. A 2023 publication by Dermatol Ther (Heidelb) states that though often under-recognized, in many ways it can affect patients' quality of life. Latin America prevalence range for alopecia areata 0.2% to 3.8%. The prevalence in Mexico is estimated between 0.2% and 3.8%, whereas in Peru, it ranges between 0.1% and 0.2%. The prevalence in Colombia was reported at 0.05% in 2018, with the proportion being greater in women. This increasing awareness of the disease, coupled with a large population of patients, is driving up the demand for advanced treatments. The rising trend in cosmetic surgery along with the consumers' preference towards natural treatments are further boosting this market. In the region, leading companies are expanding their distribution networks to accommodate these evolving needs.

Middle East and Africa Alopecia Treatment Market Analysis

Alopecia treatment in the Middle East and Africa is increasingly done for medical and aesthetic reasons. However, no common consensus among the dermatologists on the prevalence of AA exists. For instance, according to a research article, the estimated prevalence of AA among the general population is believed to exceed 10% among more than one-third of dermatologists in Egypt, thereby providing a significant challenge to developing proper treatments. In Saudi Arabia, 42% of dermatologists estimated that the prevalence of AA was between 7–10%. The numbers above are reflective of the wide-reaching scope of alopecia, and as such, this trend is perpetually on the rise in the pharmaceuticals and non-invasive fields. Support for this market has also been increased by rising investments in healthcare, advanced technology in hair restoration, and rising emotions and social impacts of hair loss. More patients now seek key procedures there, such as hair transplants and laser treatments, in such places as South Africa and Egypt, to name only two.

Competitive Landscape:

The key players in the global market are actively engaged in several strategic initiatives to maintain their competitive edge. They are heavily investing in research and development to introduce innovative treatments and therapies that offer enhanced efficacy and fewer side effects. Additionally, these players are focusing on expanding their global presence by entering emerging markets and capitalizing on the growing demand for hair loss solutions. Collaborations and partnerships with dermatological clinics and healthcare providers are becoming increasingly common to ensure a wider distribution network. Moreover, several companies are leveraging digital marketing and e-commerce platforms to promote their products and reach a broader consumer base, emphasizing convenience and accessibility. For instance, in March 2023, Sun Pharma announced the successful acquisition of Concert Pharmaceuticals, Inc. Concert Pharmaceuticals is a late-stage clinical biopharmaceutical organization offering deuruxolitinib, an innovative deuterated oral JAK1/2 inhibitor, for the treatment of adult patients with moderate to severe alopecia areata.

The report provides a comprehensive analysis of the competitive landscape in the alopecia treatment market with detailed profiles of all major companies, including:

- Aclaris Therapeutics Inc.

- Cellmid Limited

- Cipla Limited

- Dr. Reddy’s Laboratories Ltd.

- GlaxoSmithKline plc

- HCell Inc.

- Johnson & Johnson

- Merck & Co. Inc.

- Pfizer Inc.

- Taisho Pharmaceutical Holdings Co. Ltd

- Teva Pharmaceutical Industries Ltd.

Latest News and Developments:

- July 2024: The FDA announced that they have approved Sun Pharma’s Leqselvi (deuruxolitinib) 8 mg tablets for severe alopecia areata in adults. This JAK1/JAK2 inhibitor showed efficacy in Phase III THRIVE-AA1 and THRIVE-AA2 trials.

- July 2024: Aclaris Therapeutics announced that they have sold future OLUMIANT® (baricitinib) royalties and milestones related to alopecia areata to OMERS for up to USD 31.5 Million, including UD 26.5 Million upfront.

- February 2024: NICE recommended Pfizer’s Ritlecitinib (Litfulo) as the first treatment for severe alopecia areata on the NHS. The oral medication is approved for patients aged 12 and above.

- February 2024: Pelage Pharmaceuticals issued a financing worth USD 16.75 million in Series A funding to launch Phase 2 trials for PP405, a topical treatment of androgenetic alopecia. Results from Phase 1 results showed it was safe, wasn't systemic, and showed robust activation of hair follicle stem cells. Phase 2 trials will examine dosing daily once for men and women.

- December 2023: Aclaris Therapeutics, Inc. entered into an exclusive USD 15 Million patent license agreement with Sun Pharma. Aclaris granted Sun Pharma exclusive rights to specific patents for the use of deuruxolitinib, Sun Pharma’s JAK inhibitor, or other isotopic forms of ruxolitinib, to treat alopecia areata (AA) and androgenetic alopecia (AGA).

Alopecia Treatment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Types Covered | Minoxidil, Finasteride, Others |

| Indications Covered | Androgenic Alopecia, Alopecia Areata, Alopecia Totalis, Others |

| Genders Covered | Male, Female |

| Route of Administrations Covered | Oral, Topical, Injectable |

| Distribution Channels Covered | Hospitals, Retail Pharmacies, Online Pharmacies |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aclaris Therapeutics Inc., Cellmid Limited, Cipla Limited, Dr. Reddy’s Laboratories Ltd., GlaxoSmithKline plc, HCell Inc., Johnson & Johnson, Merck & Co. Inc., Pfizer Inc., Taisho Pharmaceutical Holdings Co. Ltd, Teva Pharmaceutical Industries Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the alopecia treatment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global alopecia treatment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the alopecia treatment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global alopecia treatment market was valued at USD 3.4 Billion in 2024.

The global alopecia treatment market is estimated to reach USD 4.8 Billion by 2033, exhibiting a CAGR of 3.9% from 2025-2033.

The market is driven by rising awareness of hair loss solutions, increasing demand for non-invasive and aesthetic treatments, advancements in medical technologies, and growing investments in research and development. Additionally, the availability of specialized dermatology clinics and innovative therapies further accelerates market growth by catering to diverse patient needs.

North America currently dominates the alopecia treatment market, holding a market share of over 38.34% in 2024. The dominance is driven by high awareness of hair loss treatments, significant advancements in medical research, a robust healthcare infrastructure, and a strong demand for both prescription and over-the-counter products.

Some of the major players in the global alopecia treatment market include Aclaris Therapeutics Inc., Cellmid Limited, Cipla Limited, Dr. Reddy’s Laboratories Ltd., GlaxoSmithKline plc, HCell Inc., Johnson & Johnson, Merck & Co. Inc., Pfizer Inc., Taisho Pharmaceutical Holdings Co. Ltd, Teva Pharmaceutical Industries Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)