Aloe Vera Market Size, Share, Trends and Forecast by Product, Form, Application, and Region, 2026-2034

Aloe Vera Market 2025, Size and Share:

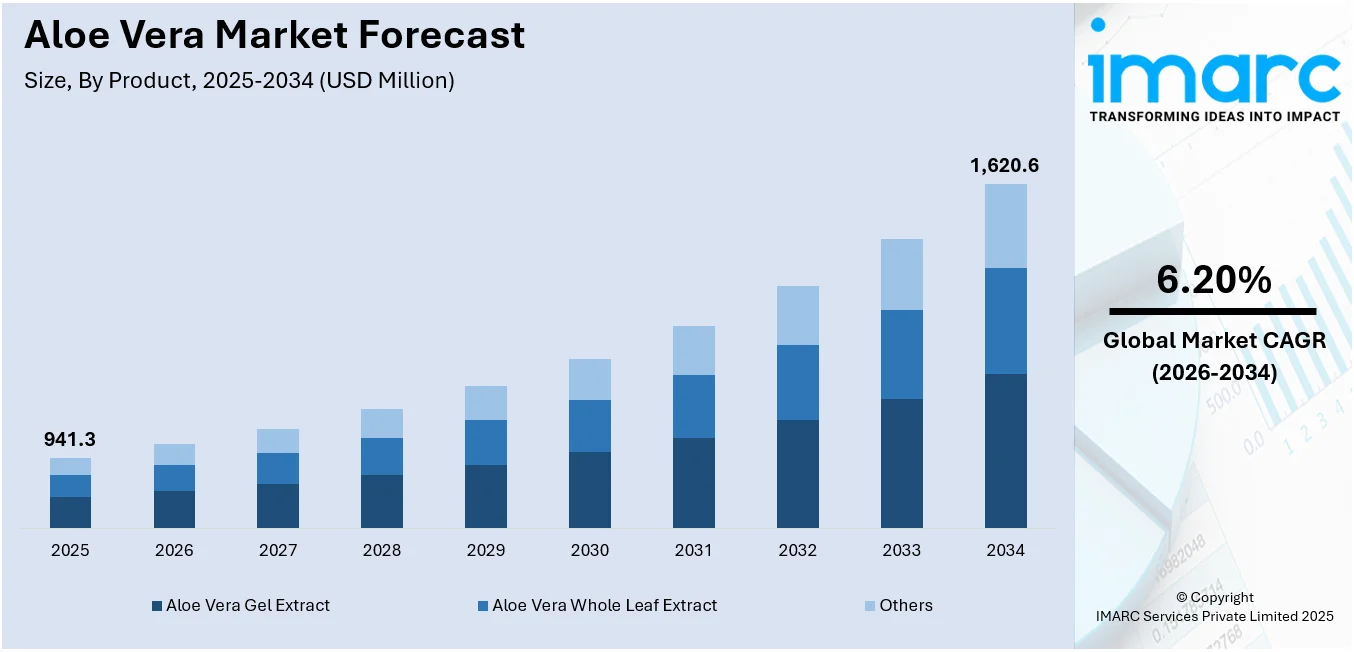

The global aloe vera market size was valued at USD 941.3 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,620.6 Million by 2034, exhibiting a CAGR of 6.20% from 2026-2034. Thailand currently dominates the market. The market is driven by the region’s ideal climate and fertile soil, which ensures optimal conditions for large-scale aloe vera cultivation. Along with this, its strong export network and competitive pricing make it a global leader in supply of aloe vera.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 941.3 Million |

|

Market Forecast in 2034

|

USD 1,620.6 Million |

| Market Growth Rate (2026-2034) | 6.20% |

The increasing preference for natural and organic products is a major factor strengthening the market growth. Aloe vera has soothing, hydrating and healing properties that make it a favored option in beauty products. The growing consciousness about the benefits of plant-based products is driving the utilization of aloe vera. It is known for soothing irritated skin, reducing inflammation and improving skin elasticity. As individuals look for milder and safer skincare alternatives, products made with aloe vera are being widely accepted. It contains anti-aging properties, attracting those who wish to maintain their vibrant and youthful appearance. The increasing emphasis on overall wellness is driving the demand for aloe vera in dietary supplements. Skincare products like moisturizers, facial masks and sunscreens that integrate aloe vera are highly sought after. Aloe vera is often found in products because of its ability to moisturize and rejuvenate skin. The wellness trends are emphasizing the utilization of natural, eco-friendly elements, which further strengthens the market growth.

To get more information on this market Request Sample

The expansion of aloe vera-based products is significantly driving the market in the United States. The versatility of aloe vera as a component in multiple industries, such as skincare and food and beverage (F&B), is fueling the market expansion. The rising need for natural and organic components in different products is a major element propelling the market growth. Aloe vera is helpful for hydration, healing and enhancing overall health. This corresponds to personal preferences for eco-friendly and clean products. The growing trend of wellness and self-care are encouraging the use of aloe vera products among Americans. Furthermore, businesses in the US are innovating by launching new formulations that integrate aloe vera, appealing to health-aware individuals. For example, in May 2024, Tongue & Cheek launched "Peppy Mint" mouth melts during the 2024 Summer Fancy Food Show in New York. The product has aloe vera and peppermint in dissolving strips for a revitalizing oral-cleansing experience. The cutting-edge solution provides ease and freshness for practical use.

Aloe Vera Market Trends:

Increasing awareness about health benefits of aloe vera

The growing public awareness about the health benefits of aloe vera products is offering a positive market outlook. According to Mindshare’s Wellness Revolution Report, 66% of the global population is becoming more conscious about their health in comparison to the time prior to the pandemic. With the growing interest in natural and plant-based alternatives, aloe vera is gaining traction in skincare items. It boosts immunity and provides hydration, thus expanding its market presence. It is beneficial for detoxifying the body and supporting digestive health. As a result, more and more businesses are introducing aloe-enriched items in different sectors, such as drinks and wellness supplements. The increasing shift towards healthy and natural living is making it essential in many households. Aloe vera's reputation as a versatile and safe ingredient enhances its market growth. The rise in wellness trends, coupled with a greater focus on preventative health, fuels its market expansion.

Rising demand for natural and organic ingredients

Another pivotal driver is the escalating demand for natural and organic ingredients, particularly in the cosmetics and personal care sectors. IFOAM reports that in 2022, the global organic farming area grew by more than 20 million hectares, reaching a total of 96 million hectares. Also, the global beauty and personal care products market size reached USD 529.5 Billion in 2024. Individuals are increasingly prioritizing clean and green products in their health and beauty routines. Aloe vera, known for its natural and organic properties, perfectly aligns with this shift. The rising demand for chemical-free and sustainably sourced ingredients, is driving the market for aloe-based products. Its versatility in personal care products, from creams to shampoos, contributes to its expanding demand. It has antioxidant, anti-inflammatory, and moisturizing benefits attracting individuals seeking healthier alternatives in beauty products. Aloe Vera’s presence in the wellness market is expanding, as more people opt for natural remedies. Its ability to soothe skin, heal wounds and provide hydration makes it highly sought after in the beauty industry.

Therapeutic properties and pharmaceutical applications

The well-documented therapeutic properties of aloe vera play a major role in driving the market's expansion. Aloe vera is effective in addressing a variety of health concerns, ranging from skin conditions to digestive ailments. Its antimicrobial and anti-inflammatory properties make it a crucial ingredient in pharmaceutical products. The global pharmaceutical drug delivery market size was valued at USD 1,465.2 Billion in 2024. With its natural healing and soothing attributes, aloe vera remains a preferred choice for numerous medical applications. Aloe vera is utilized in treating gastrointestinal disorders, including ulcers and irritable bowel syndrome. Its soothing effect on irritated skin, combined with its ability to promote cell regeneration, drives demand in dermatological applications. Pharmaceutical companies are increasingly incorporating aloe vera in creams, gels and ointments for medicinal purposes. As people seek natural remedies and wellness solutions, aloe vera's therapeutic benefits continue to propel market growth.

Growing number of e-commerce platforms

The market is also significantly impacted by the rapid expansion of e-commerce platforms. The proliferation of online retail has made aloe vera products easily accessible to individuals worldwide. According to a NielsenIQ study, 60% of FMCG companies prioritize e-commerce as their main sales channel, with emerging manufacturers achieving growth rates 1.5 times higher than category averages in this space. With the convenience of purchasing aloe vera-based items online, individuals can seamlessly explore and compare a diverse range of products. This accessibility has substantially broadened the market's reach and empowered people to make well-informed decisions. Online promotions, discounts, and offers further incentivize individuals to try new aloe vera products. Social media integration and influencer marketing on e-commerce platforms are encouraging brand visibility and customer engagement. The synergy of online shopping convenience and the abundance of aloe vera options are emerging as a key driver, firmly establishing e-commerce as a pivotal contributor to the market growth.

Aloe Vera Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global aloe vera market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on product, form, and application.

Analysis by Product:

- Aloe Vera Gel Extract

- Aloe Vera Whole Leaf Extract

- Others

Aloe vera whole leaf extract has the biggest market share because of its diverse uses across different industries. The extract is commonly found in skincare items, health supplements and drinks, resulting in high demand. It is rich in vitamins, minerals, and antioxidants offering considerable advantages for skin health and overall well-being. Whole leaf extract has both gel and latex, making it appropriate for various formulations. Aloe vera is widely utilized for its therapeutic benefits, particularly for skin burns, inflammation, and damage from the sun. The capacity to utilize the entire leaf guarantees optimal nutritional benefits, enhancing its efficiency significantly. Whole leaf extract is more economical than other types of aloe vera, which catalyzes its demand. Its availability in large quantities and the simplicity of processing contribute to its extensive application in numerous sectors. Businesses are utilizing whole leaf extract in their product formulations because of its greater yields and wider range of uses. The increasing inclination towards natural and organic components is greatly driving the demand for whole leaf aloe vera extract.

Analysis by Form:

- Concentrates

- Gels

- Drinks

- Powders

- Capsules

In 2025, drinks lead the segment with approximately 60.0% of market share. These drinks are viewed as a natural solution for enhancing hydration, digestion and skin wellness. Drinks made from aloe vera are abundant in vitamins, minerals and antioxidants, which enhances their nutritional benefits. The rising trend of functional beverages, particularly among health-focused people is increasing the demand for aloe-based drinks. Aloe vera beverages are promoted as energy-improving, detoxifying and beneficial for the skin, attracting a diverse clientele. The growing shift towards plant-based options also aids in the expanding market share of aloe vera beverages. Individuals are looking for natural and organic choices in their diets, which aloe vera-based beverages provides successfully. The adaptability of aloe vera enables multiple flavors and formulations, attracting different preferences. As wellness trends are gaining momentum, aloe-based beverages are now being offered in various formats like juices, teas, and smoothies. The growth of these beverages in retail and online markets is improving their availability across the globe.

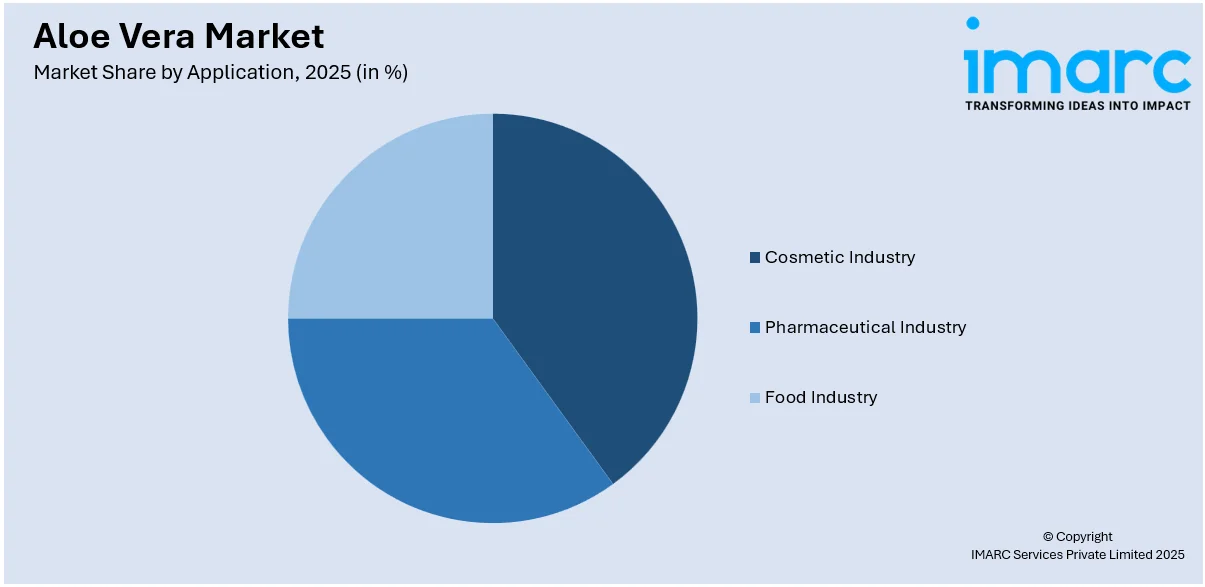

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Pharmaceutical Industry

- Cosmetic Industry

- Food Industry

The cosmetics sector accounts for the biggest market share, holding approximately 40.5% of the market in 2025. Aloe vera is greatly appreciated in cosmetics for its hydrating, calming, and anti-inflammatory properties. It is commonly found in lotions, creams and facial masks, targeting various skin issues. Aloe vera’s capability to heal injuries and alleviate burns is driving its momentum in skincare products. Its organic formulation, devoid of toxic substances, is attracts those looking for natural skincare options. It aids in preserving skin elasticity, diminishing the look of wrinkles and fine lines. It is a well-liked component in sunscreens because of its cooling effect and skin-protective qualities. The increasing demand for natural and eco-friendly beauty items fuels the market growth of aloe vera-infused cosmetics. Numerous people rely on aloe vera for its well-recognized advantages, which catalyzes its demand in skincare products. The increase availability of anti-aging products and procedures promotes their incorporation into sought-after cosmetic formulas. Leading cosmetic brands have acknowledged its advantages, resulting in its extensive incorporation into their product ranges. As beauty ideals change, aloe vera remains crucial in creating innovative and effective beauty products.

Regional Analysis:

- Thailand

- Mexico

- Dominican Republic

- United States

- Costa Rica

- Others

Thailand is a dominant player due to its ideal environment for growing aloe vera cultivation. The country’s tropical climate supports large-scale aloe vera farming, enabling abundant production. Countries well-established agricultural industry ensures high-quality aloe vera cultivation, making it a key global supplier. Aloe vera is widely grown across Thailand, contributing to its leadership in the market. The Government of Thailand supports aloe vera cultivation, encouraging sustainable farming practices and export growth. Thailand’s closeness to other Southeast Asian nations enhances its regional impact in the market. The nation's competitive rates and extensive production are drawing the attention of global buyers and manufacturers. Region’s aloe vera industry is further strengthened by its strong export network. Aloe vera based products, including extracts, gels, and beverages, are in high demand worldwide. As a major exporter, Thailand influences global aloe vera pricing trends, benefiting from economies of scale. Thai producers are cultivating strong relationships with aloe vera product manufacturers, ensuring continued market dominance. The country’s rising customer interest in aloe vera products also contributes to domestic market growth.

Key Regional Takeaways:

United States Aloe Vera Market Analysis

The United States hold 88.20% of the market share in North America. The nation has a strong market for aloe- derived products in health, skincare, food and drinks. The increasing awareness about the benefits of aloe vera among those who prioritize health and environmental sustainability, is strengthening market growth. The rising individual interest in natural and organic products, particularly among Millennials and Gen Z, is propelling the market growth. These groups exhibit a greater preference for organic and natural beauty items than the wider public. As per ESW, 43% of people within this age bracket favor natural skincare, in contrast to 31% of all customers in the US. This shift toward natural options is making aloe vera a favored component in skincare, personal care and dietary supplements. The increasing awareness of the harmful effects of synthetic chemicals is further encouraging the adoption for plant-based solutions. The rise in demand for functional food products like aloe vera-infused beverages, is fueling market growth. The wellness trend, focused on healthier lifestyles and immunity-boosting ingredients, catalyze the demand for aloe vera-based products. The Government of US supports the agricultural sector, including aloe vera cultivation, ensuring a steady local supply. The expansion of e-commerce platforms and the do-it-yourself (DIY) skincare trend are driving the demand for aloe vera products.

Mexico Aloe Vera Market Analysis

The market for aloe vera is thriving due to the country's strong tradition of using natural remedies. This aligns with the preferences of over 400 million people in Latin America, including Mexico. Aloe vera’s versatility in cosmetics, pharmaceuticals, and functional foods makes it a key ingredient across industries. The country’s climate is ideal for growing aloe vera, particularly in regions like Baja California and Sonora. Mexico has a robust export infrastructure that allows aloe vera producers to reach global markets efficiently. Government programs promoting sustainable farming and export practices strengthen Mexico’s international market position. Mexican aloe vera is often used as a key ingredient in cosmetics, skin care and wellness products. The region is also a significant player in the aloe vera beverage market, where its health benefits, such as aiding digestion and promoting skin health, are marketed to a growing health-conscious population.

Dominican Republic Aloe Vera Market Analysis

According to a report by IFAD, the Dominican Republic is a major exporter of organic products. Supported by around 14,000 organic farmers, the country excels in fair-trade and chemical-free cultivation. The country’s warm tropical climate enables large-scale farming, making it a key producer of premium aloe vera. Growing international demand for natural products strengthens the country’s position as a trusted supplier of aloe vera. Dominican aloe vera is highly valued in cosmetics, health, and wellness industries worldwide. People seeking sustainable and organic alternatives further influences the demand for aloe vera products. Government initiatives promote sustainable farming and drive export, which strengthens local producers' competitiveness in the global market. Partnerships with international brands and effective marketing strategies expand the reach of Dominican aloe vera. These efforts highlight the Dominican Republic's leading role in the global aloe vera industry.

Costa Rica Aloe Vera Market Analysis

The Costa Rican market benefits from a thriving tourism industry, with an estimated 2.6 million visitors in 2024. This influx of tourists increases the demand for aloe vera-based skincare products in spas and facial treatments. The country’s tropical climate supports year-round aloe vera cultivation, ensuring a consistent and high-quality supply. Health-conscious individuals are incorporating aloe vera into dietary supplements and functional beverages. The demand for aloe vera-based products in Costa Rica is rising, particularly among individuals seeking natural and sustainable alternatives for personal care. The country’s strategic position in Central America also enables efficient distribution to North America and Europe, key markets for aloe vera products. Costa Rica’s commitment to sustainable farming practices and eco-friendly production methods is further fueling the growth of aloe vera cultivation in the region. Government agricultural programs and collaborations with global brands encourage innovation, enhancing Costa Rica’s market position.

Competitive Landscape:

Key players play a crucial role in driving growth through product innovation, strategic partnerships and global distribution. These companies are continually expanding their portfolios by introducing new aloe vera-based products across various industries like skincare, personal care, and food & beverages (F&B). They invest heavily in research and development (R&D) to enhance the quality and effectiveness of aloe vera products, meeting evolving individual preference for organic and natural ingredients. In April 2024, Evion reintroduced its Vitamin E cream with aloe vera to enhance skin hydration and nourishment. The improved formula aimed to reduce dark spots, dullness and environmental damage. It is marketed as a multifunctional daily cream for radiant skin. In addition to this, top companies are also establishing partnerships with suppliers and distributors to enhance their reach and sustain a competitive advantage. They are enhancing their production facilities to accommodate the growing demand for aloe vera in various areas. Businesses are emphasizing on sustainable methods like obtaining aloe vera from organic farms, attracting people who prefer eco-friendly products. Through significant marketing initiatives, these companies contribute to increase awareness of aloe vera's health advantages, thus enhancing its market expansion. Their worldwide presence and distribution networks also enhance the market expansion for aloe vera-based products.

The report provides a comprehensive analysis of the competitive landscape in the aloe vera market with detailed profiles of all major companies.

- Aloe Jaumave S.A. de C.V.

- Aloe Laboratories

- Aloe Plus Lanzarote S.L.

- Aloe Queen Inc.

- Aloe Vera of Australia

- Aloecorp

- Concentrated Aloe Corporation

- Forever Living.com, LLC

- Lily of The Desert

- NOW Foods

- Real Aloe

- Terry Laboratories

Latest News and Developments:

- April 2024: ICHIMARU PHARCOS has launched Fermentage ALOEVERA, a cosmetic ingredient targeting YURAGI skin, seasonal disturbances affecting over 50% of Japanese women. Made from fermented organic aloe vera, it helps restore moisture and stability during environmental changes.

- September 2024: SUUL SUUP launched a premium soju using ingredients from Jeju Island, including aloe vera and tangerines. The drink is marketed as a premium product with unique flavor, highlighting its distinct ingredients. It featured elegant packaging, inspired by the island's forest landscape and is priced higher than regular soju.

Aloe Vera Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Tons, Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Aloe Vera Gel Extract, Aloe Vera Whole Leaf Extract, Others |

| Forms Covered | Concentrates, Gels, Drinks, Powders, Capsules |

| Applications Covered | Pharmaceutical Industry, Cosmetic Industry, Food Industry |

| Regions Covered | Thailand, Mexico, Dominican Republic, United States, Costa Rica, Others |

| Companies Covered | Aloe Jaumave S.A. de C.V., Aloe Laboratories, Aloe Plus Lanzarote S.L., Aloe Queen Inc., Aloe Vera of Australia, Aloecorp, Concentrated Aloe Corporation, Forever Living.com, LLC, Lily of The Desert, NOW Foods, Real Aloe, Terry Laboratories, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the aloe vera market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global aloe vera market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the aloe vera industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global aloe vera market was valued at USD 941.3 Million in 2025.

The global aloe vera market is estimated to reach USD 1,620.6 Million by 2034, exhibiting a CAGR of 6.20% from 2026-2034.

The market is driven by the escalating demand for natural as well as organic products. Rising awareness of Aloe vera's health and skincare benefits is encouraging its use in various industries. Expanding product innovation across personal care, food and beverages attracts more people seeking alternative, plant-based solutions. Sustainable production practices and growing eco-consciousness further strengthens the market's growth in both developed and emerging economies.

Thailand currently dominates the market. The market is driven by the region’s ideal climate and fertile soil, which ensures optimal conditions for large-scale aloe vera cultivation. Along with this, its strong export network and competitive pricing make it a global leader in supply of aloe vera.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)