Allergy Immunotherapies Market Size, Share, Trends and Forecast by Treatment Type, Allergy Type, Distribution Channel, and Region, 2026-2034

Allergy Immunotherapies Market Size and Share:

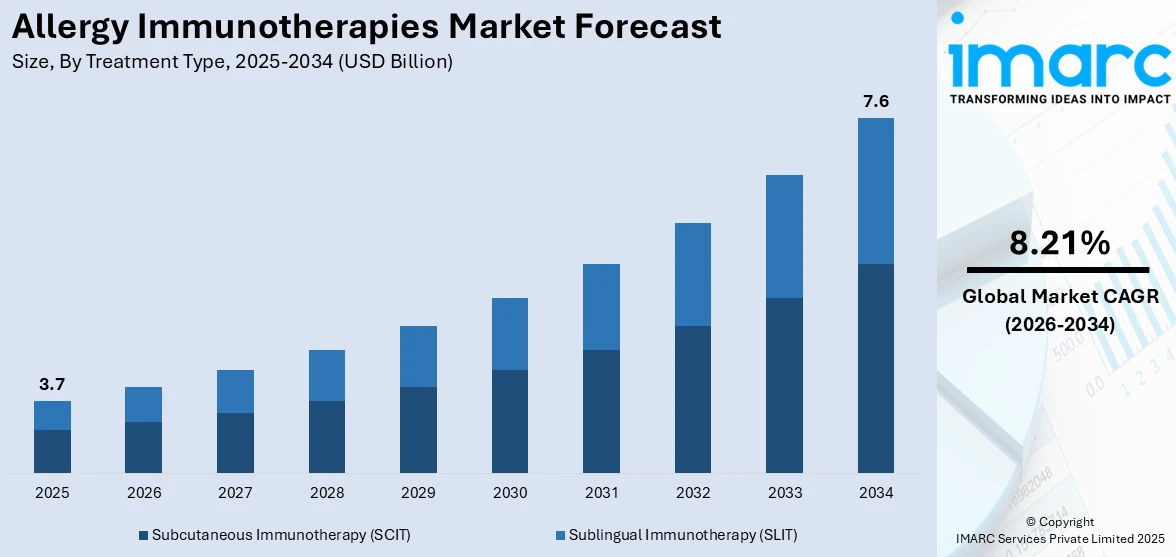

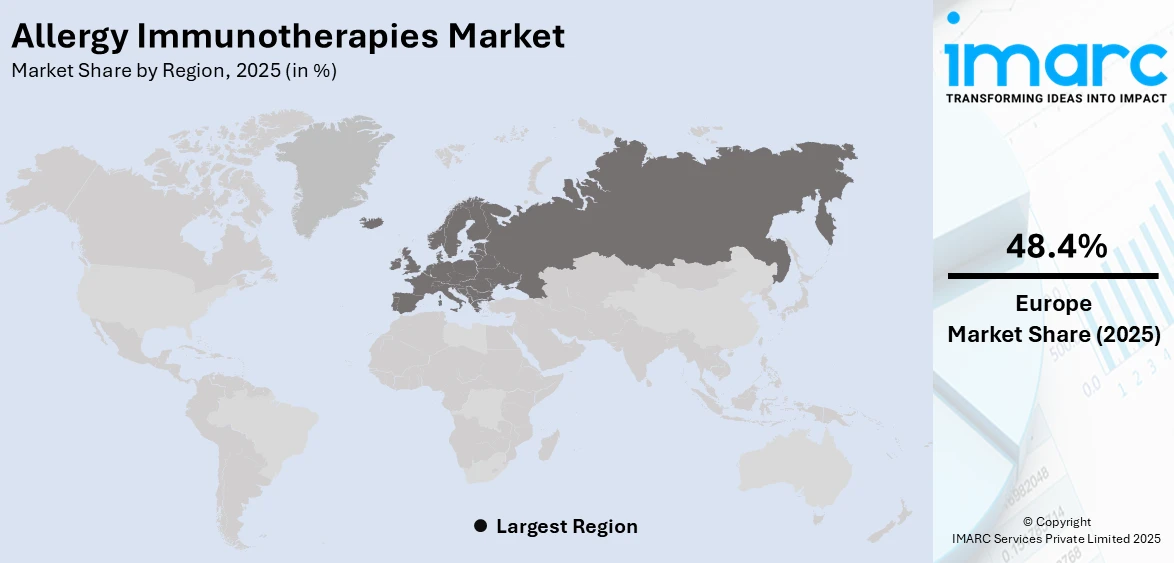

The global allergy immunotherapies market size was valued at USD 3.7 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 7.6 Billion by 2034, exhibiting a CAGR of 8.21% from 2026-2034. Europe currently dominates the market, holding an allergy immunotherapies market share of over 48.4% in 2025. The market is propelled by the rising prevalence of allergic conditions, increasing awareness about immunotherapy as an effective treatment for allergies, significant developments in immunotherapy treatments and technologies, favorable government policies and funding for allergy research, and customized medicine and tailored treatment approaches.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 3.7 Billion |

|

Market Forecast in 2034

|

USD 7.6 Billion |

| Market Growth Rate (2026-2034) | 8.21% |

A major driver in the allergy immunotherapies market is the rising prevalence of allergic disorders globally. Factors such as increasing pollution levels, climate change, and changing lifestyles have contributed to a surge in conditions like allergic rhinitis, asthma, and food allergies. This growing patient pool has heightened the demand for effective long-term treatment solutions beyond symptomatic relief. Immunotherapies, including subcutaneous and sublingual options, offer sustained benefits by desensitizing the immune system. Additionally, advancements in biologics and improved diagnostic tools are driving treatment adoption, while increased awareness and favorable reimbursement policies further supporting the allergy immunotherapies market growth.

To get more information on this market Request Sample

The U.S. allergy immunotherapies market is driven by a high prevalence of allergic conditions, including allergic rhinitis, asthma, and food allergies with a share of 83.50%. Rising environmental pollution, genetic predisposition, and lifestyle factors contribute to increasing cases. The market benefits from strong healthcare infrastructure, advanced diagnostic capabilities, and ongoing research into novel biologic therapies. Growing adoption of sublingual immunotherapy (SLIT) and regulatory approvals for innovative treatments enhance allergy immunotherapies market demand. Additionally, increased awareness among patients and physicians, along with favorable insurance coverage, supports treatment accessibility. The presence of key pharmaceutical companies investing in immunotherapy advancements further strengthens the U.S. market landscape.

Allergy Immunotherapies Market Trends:

Increasing Incidence of Allergic Disorders

The global increase in the prevalence of allergic diseases is a major driver of the allergy immunotherapies market. Allergies, such as allergic rhinitis, asthma, and food allergies, have become more common worldwide, particularly in industrialized countries. Environmental factors, such as pollution and changes in lifestyle and dietary habits, have contributed to this increase. According to the World Health Organization (WHO), asthma affected almost 262 Million individuals in 2019 and caused 455,000 deaths. This growing patient population demands effective long-term treatment solutions, thereby boosting the demand for allergy immunotherapies which promise desensitization to allergens and a potential reduction in the severity of allergic reactions.

Significant Advancements in Treatment Technologies

Technological advancements in allergy immunotherapies have revolutionized the approach and effectiveness of treatments for allergic diseases. Innovations such as peptide-based immunotherapies and recombinant allergens mark a significant departure from traditional methods, offering a more personalized and precise treatment pathway. Peptide-based therapies, for instance, utilize small peptides that represent parts of the allergen proteins to induce tolerance without triggering a full immune response, thereby minimizing the risk of severe reactions that are sometimes seen with whole-allergen immunotherapies. According to the IMARC GROUP, the global peptide therapeutics market has reached USD 42.8 Billion in 2023, and is projected to reach USD 86.9 Billion by 2032, exhibiting a CAGR of 7.9% during 2024-2032. Similarly, recombinant allergens, which are genetically engineered to mimic natural allergens, provide a purer and more consistent treatment option that can be finely tuned for dosage and formulation. These technological breakthroughs have improved the safety profile of immunotherapies and have also enhanced their efficacy, leading to higher success rates in desensitizing patients to allergens.

Regulatory and Reimbursement Landscape

The regulatory and reimbursement landscape plays a crucial role in shaping the allergy immunotherapies market, significantly influencing both the development and the widespread adoption of new treatments. Recent years have seen a positive trend in this regard, with regulatory bodies such as the U.S. Food and Drug Administration (FDA) granting approvals to innovative treatments such as sublingual immunotherapy tablets. These approvals are pivotal because they validate the safety and efficacy of new therapies and facilitate broader market access. Concurrently, there has been a marked improvement in insurance coverage for these therapies. This expansion in coverage is crucial for patients, as it alleviates the financial burden associated with long-term allergy management, making these advanced therapies more feasible for a larger number of individuals.

Allergy Immunotherapies Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global allergy immunotherapies market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on treatment type, allergy type, and distribution channel.

Analysis by Treatment Type:

- Subcutaneous Immunotherapy (SCIT)

- Sublingual Immunotherapy (SLIT)

Subcutaneous immunotherapy (SCIT) dominates the allergy immunotherapies market with a significant share of 69% due to its well-established efficacy in providing long-term relief from allergic conditions, particularly allergic rhinitis and asthma. SCIT involves controlled allergen exposure through injections, gradually desensitizing the immune system. Its widespread adoption is driven by strong clinical evidence, physician preference, and higher patient adherence compared to other methods. Despite requiring frequent clinic visits, SCIT remains a preferred option due to its proven ability to modify disease progression. Advancements in formulation and dosing strategies enhance its safety and effectiveness. Additionally, favorable reimbursement policies and regulatory approvals further support SCIT’s strong market presence.

Analysis by Allergy Type:

- Allergic Rhinitis

- Asthma

- Food Allergy

- Venom Allergy

- Others

Allergic rhinitis holds the largest share of 45.3% in the allergy immunotherapies industry due to its high global prevalence and significant impact on quality of life. Factors such as increasing environmental pollution, seasonal pollen exposure, and genetic susceptibility contribute to rising cases. The chronic nature of the condition drives demand for long-term treatment options beyond antihistamines and corticosteroids. Immunotherapies, including subcutaneous and sublingual treatments, provide sustained relief by modifying immune responses. Advancements in targeted therapies and increased awareness among patients and healthcare providers further support market dominance. Favorable reimbursement policies and growing clinical research into innovative treatments continue to drive the allergy immunotherapies market outlook.

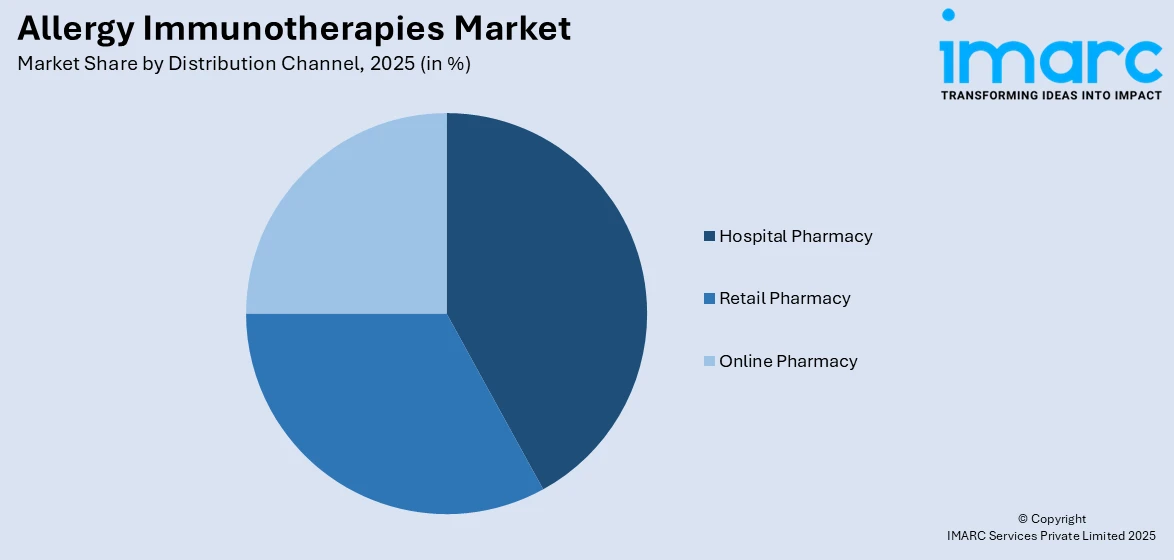

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

Hospital pharmacies lead the allergy immunotherapies market share, accounting for 42% due to their role in providing specialized treatments. These pharmacies ensure access to subcutaneous immunotherapy (SCIT) and biologic therapies, which require professional administration and monitoring. The controlled hospital environment enhances patient safety, adherence, and treatment efficacy. Additionally, hospital pharmacies benefit from favorable reimbursement policies and streamlined procurement processes, ensuring consistent availability of immunotherapy products. The rising prevalence of severe allergic conditions, particularly asthma and anaphylaxis, further drives demand for hospital-based treatment. Advanced diagnostic capabilities in hospitals also support accurate allergy management, reinforcing their dominance in the market.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- Europe

- North America

- Asia Pacific

- Middle East and Africa

- Latin America

According to the allergy immunotherapies market forecast, Europe leads the allergy immunotherapies market with a shar of 48.4% due to a high prevalence of allergic conditions, well-established healthcare infrastructure, and strong regulatory support. Rising cases of allergic rhinitis and asthma, driven by environmental pollution and climate change, boost demand for effective long-term treatments. The region has widespread adoption of both subcutaneous (SCIT) and sublingual (SLIT) immunotherapies, supported by favorable reimbursement policies and physician awareness. Ongoing research, clinical advancements, and regulatory approvals for innovative biologic therapies further strengthen Europe's market position. Additionally, increasing patient awareness, a strong presence of pharmaceutical companies, and government initiatives promoting allergy treatments contribute to market leadership. Europe’s focus on personalized medicine and advanced diagnostics further enhances immunotherapy adoption.

Key Regional Takeaways:

North America Allergy Immunotherapies Market Analysis

The North America allergy immunotherapy market is experiencing continued growth, with a rising incidence of allergies and a growing emphasis on long-term therapy. Immunotherapy, including subcutaneous (SCIT) and sublingual (SLIT) therapy, is increasingly popular with its established efficacy to reduce allergic reactions and improve patient quality of life. The growth of awareness around personalized medicine and increases in biologic use are also driving reform in this area.

Clearances and ongoing work on emerging treatments, such as peptide vaccines and recombinant allergens, are growing therapy options. Expanding healthcare expenditure and enhanced diagnostics are also elevating accessibility of immunotherapy products. However, challenges such as prohibitive expense, extent limitation under cover, and compliance factors still block full-scale usage.

Pharma firms and clinicians are focusing on patient education and innovative delivery formats to improve compliance. With expanding research and collaborative efforts with industries, the North American allergy immunotherapy market will continue to expand.

United States Allergy Immunotherapies Market Analysis

Driving factors of allergy immunotherapies in the United States are significantly influenced by growing investments in healthcare sectors, leading to enhanced research, development, and accessibility of advanced treatment options. According to reports, in the US pharmaceutical industry, there were 25 private equity deals announced in Q3 2024, worth a total value of USD 2.3 Billion. The expanding healthcare infrastructure, supported by both public and private investments, has facilitated the introduction of novel therapies aimed at managing allergic conditions effectively. Rising awareness among patients and healthcare professionals about allergy immunotherapies has contributed to increased adoption, further supported by funding in clinical trials and regulatory advancements. The integration of precision medicine and biopharmaceutical innovations has accelerated the availability of personalized treatments, aligning with the demand for targeted allergy solutions. Market expansion is also driven by increasing collaborations between pharmaceutical companies and research institutions, ensuring continuous advancements in immunotherapy formulations. The growing focus on patient-centric approaches, coupled with healthcare policy reforms, has created a conducive environment for the adoption of allergy immunotherapies.

Asia Pacific Allergy Immunotherapies Market Analysis

Growing allergy immunotherapies adoption due to growing online pharmacy in Asia-pacific is reshaping accessibility and affordability, expanding patient reach through digital platforms. According to India Brand Equity Foundation, India's e-commerce platforms achieved a significant milestone, hitting a GMV of USD 60 Billion in fiscal year 2023, marking a 22% increase from the previous year. The rapid expansion of e-commerce-driven pharmaceutical distribution networks is enabling convenient access to immunotherapy products, eliminating geographical limitations. The increasing adoption of telemedicine is facilitating virtual consultations, enhancing prescription accessibility, and promoting patient adherence. Rising internet penetration and digital health awareness are driving consumer preference for online medication procurement, streamlining the supply chain. Competitive pricing strategies among online pharmacy providers are improving affordability, encouraging broader adoption. Regulatory support for digital healthcare infrastructure is fostering transparency and credibility, ensuring the safe distribution of allergy immunotherapies. Growing partnerships between pharmaceutical manufacturers and online pharmacy platforms are optimizing supply chain efficiency, accelerating product availability. The continuous technological advancements in online healthcare services are strengthening consumer confidence, further driving the market growth of allergy immunotherapies in Asia-pacific.

Europe Allergy Immunotherapies Market Analysis

Growing allergy immunotherapies adoption due to growing aging population in Europe is intensifying the demand for long-term allergy management solutions, as older individuals exhibit heightened sensitivity to allergens. According to WHO, the population aged 60 and older is rapidly growing in the WHO European Region. In 2021, there were 215 Million; by 2030, it is projected to be 247 Million, and by 2050, over 300 Million. Age-related immune system changes are increasing the prevalence of allergic conditions, necessitating sustained immunotherapy treatments. The rising burden of chronic respiratory allergies among aging individuals is propelling the need for advanced treatment options, fostering the integration of allergy immunotherapies into routine geriatric care. Expanding healthcare initiatives targeting the aging population are promoting early diagnosis and intervention, enhancing treatment effectiveness. Increased governmental healthcare expenditure is strengthening research initiatives, leading to improved therapeutic innovations. Growing awareness of age-related allergic complications is encouraging proactive healthcare approaches, fostering widespread immunotherapy acceptance. The rising emphasis on preventive healthcare for aging individuals is bolstering demand, ensuring sustained market expansion. The continuous evolution of geriatric-focused treatment protocols is facilitating broader accessibility and adoption of allergy immunotherapies in Europe.

Latin America Allergy Immunotherapies Market Analysis

Growing allergy immunotherapies adoption due to growing privatization in healthcare in Latin America is enhancing treatment accessibility and innovation, driving increased investment in advanced allergy management solutions. According to the Brazilian Federation of Hospitals (FBH) and the National Confederation of Health (CNSaúde), of Brazil’s 7,191 hospitals, 62% are private. Expanding private healthcare infrastructure is promoting high-quality medical services, encouraging the adoption of allergy immunotherapies. The rising presence of specialized allergy clinics within the private sector is fostering early diagnosis and personalized treatment plans, improving patient outcomes. Increased collaboration between private healthcare providers and pharmaceutical companies is accelerating immunotherapy development and market penetration. Competitive pricing models within privatized healthcare systems are improving affordability, facilitating wider treatment adoption. The growing preference for premium healthcare services among urban populations is further supporting immunotherapy integration.

Middle East and Africa Allergy Immunotherapies Market Analysis

Increased adoption of allergy immunotherapies because of increased medical facilities in Africa and the Middle East is fueling market growth through enhanced accessibility and quality of healthcare services. As per Dubai Healthcare City Authority report, Dubai's healthcare industry experienced rapid expansion, with 4,482 private medical centers and 55,208 licensed professionals in 2022, which is expected to grow further by 3-6% in facilities and 10-15% in professionals in 2023. The ongoing development of new-age hospitals and specialized allergy treatment centers is promoting early diagnosis and focused immunotherapy solutions. Growing investments in the healthcare infrastructure are boosting medical research capacity, backing the growth of sophisticated immunotherapy treatments. Growth in the presence of skilled healthcare workers who focus on managing allergy is promoting increasing immunotherapy usage. Increasing availability of diagnostic tools is enhancing detection of allergy, encouraging timely intervention.

Competitive Landscape:

The market competition of allergy immunotherapies is defined by pharmaceutical companies that are specialized in developing innovative solution forms. The players compete on the effectiveness of the product, delivery form, and long-term value. The R&D activities are generating new high-tech biologics and new forms of immunotherapy, increasing treatment choices. Regulatory clearances are important drivers of competition as companies strive to differentiate on compliance and clinical progress. Players also focus on strategic partnerships, mergers, and acquisitions to strengthen portfolios. Increasing use of sublingual therapy and injectable immunotherapy drives competition with intense focus on convenience for the patient and enhanced therapeutic benefits. Pricing and reimbursement strategies also impact market positioning.

The report provides a comprehensive analysis of the competitive landscape in the allergy immunotherapies market with detailed profiles of all major companies, including:

- ALK-Abello A/S

- Allergy Therapeutics

- Stallergenes Greer

- HAL Allergy Holding B.V.

- DBV Technologies

- Merck KGaA

- Aimmune Therapeutics

- Circassia Pharmaceuticals

- Anergis SA

- Biomay AG

Latest News and Developments:

- November 2024: PopVax announced that the U.S. National Institute of Allergy and Infectious Diseases will conduct and sponsor a Phase I clinical trial for its next-generation mRNA-LNP COVID-19 vaccine. The trial, part of Project NextGen, will begin in early 2025 in the U.S. to assess safety and immunogenicity. PopVax's vaccine showed strong antibody responses in preclinical studies, surpassing existing mRNA vaccines. The clinical trial material will be produced at PopVax’s RNA Foundry facility in Hyderabad.

- August 2024: The U.S. FDA has approved neffy, the first epinephrine nasal spray for emergency allergy treatment, including life-threatening anaphylaxis. This alternative to injections aims to reduce delays in treatment, especially for children who fear needles. Neffy provides a critical option for rapid response to allergic reactions. Anaphylaxis, triggered by allergens like food or insect stings, requires immediate epinephrine administration.

- March 2024: FunPep and SHIONOGI have signed an option agreement for the anti-IgE peptide FPP004X, targeting seasonal allergic rhinitis. SHIONOGI gains exclusive global rights for research, development, and commercialization. FunPep will receive JPY 300 Million upfront, with potential payments up to JPY 17.8 Billion. SHIONOGI will also invest JPY 200 Million in FunPep.

- February 2024: Desentum secured 12 Million euros to advance its allergy vaccine development, focusing on birch pollen and peanut allergy treatments. The funding supports ongoing clinical trials in Canada for its birch pollen vaccine, DM-101PX. Preliminary results show promising safety and symptom reduction. Desentum aims to enhance allergen immunotherapy efficiency with its biotechnologically modified hypoallergens.

- January 2024: ALK has completed the first stage of its phase 1 ALLIANCE trial for a new immunotherapy tablet targeting peanut allergy. The sublingual treatment aims to desensitize patients and prevent severe reactions. Initial results confirm safety and tolerability across different doses. The trial’s second phase is expected to conclude later in 2024.

Allergy Immunotherapies Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Treatment Types Covered | Subcutaneous Immunotherapy (SCIT), Sublingual Immunotherapy (SLIT) |

| Allergy Types Covered | Allergic Rhinitis, Asthma, Food Allergy, Venom Allergy, Others |

| Distribution Channels Covered | Hospital Pharmacy, Retail Pharmacy, Online Pharmacy |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | ALK-Abello A/S, Allergy Therapeutics, Stallergenes Greer, HAL Allergy Holding B.V., DBV Technologies, Merck KGaA, Aimmune Therapeutics, Circassia Pharmaceuticals, Anergis SA, Biomay AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the allergy immunotherapies market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global allergy immunotherapies market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the allergy immunotherapies industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The allergy immunotherapies market was valued at USD 3.7 Billion in 2025.

The allergy immunotherapies market was valued at USD 7.6 Billion in 2025 exhibiting a CAGR of 8.21% during 2026-2034.

Key factors driving the allergy immunotherapies market include the rising prevalence of allergic conditions, increasing environmental pollution, and growing awareness of long-term treatment benefits. Advancements in biologic therapies, improved diagnostics, favorable reimbursement policies, and regulatory approvals further boost market growth. Additionally, expanding adoption of subcutaneous and sublingual immunotherapies enhances treatment accessibility and effectiveness.

Europe dominates the allergy immunotherapies market due to high allergy prevalence, strong healthcare infrastructure, favorable policies, and advanced treatment adoption.

Some of the major players in the allergy immunotherapies market include ALK-Abello A/S, Allergy Therapeutics, Stallergenes Greer, HAL Allergy Holding B.V., DBV Technologies, Merck KGaA, Aimmune Therapeutics, Circassia Pharmaceuticals, Anergis SA, Biomay AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)