Albumin Market Size, Share, Trends and Forecast by Product, Application, End User, and Region, 2025-2033

Albumin Market Size and Share:

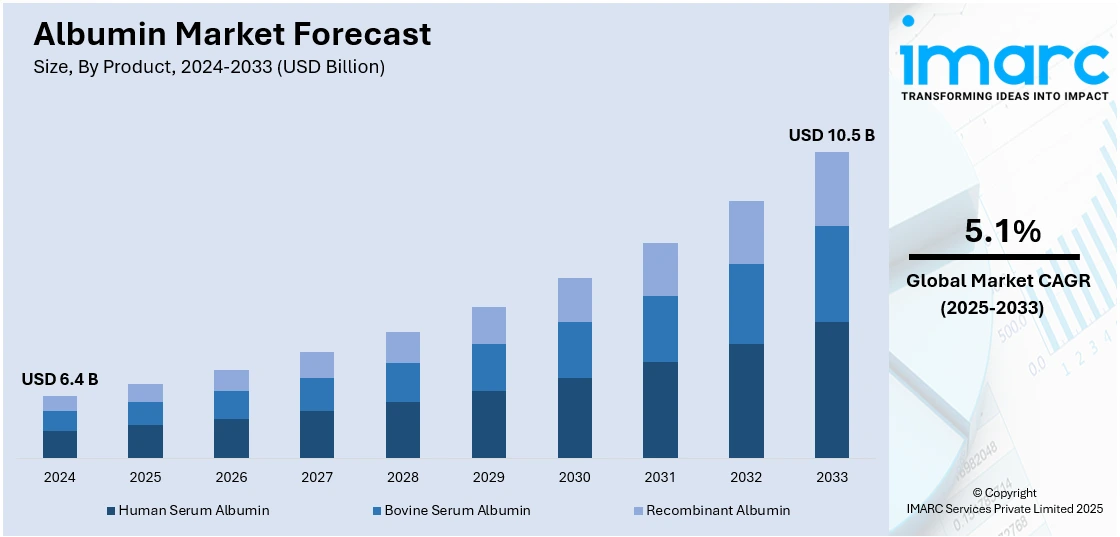

The global albumin market size reached USD 6.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.5 Billion by 2033, exhibiting a growth rate (CAGR) of 5.1% during 2025-2033. North America currently dominates the market, holding a significant share of 38.1% in the market. The market is driven by the rising prevalence of chronic conditions such as liver disorders and nephrotic syndrome, which necessitate albumin-based therapies in critical care. Advancements in recombinant production technologies are enabling scalable, plasma-independent solutions to meet growing demand across therapeutic and pharmaceutical applications. Increasing investments in diagnosis, treatment, and biopharmaceutical research in the North American region, particularly in countries like United States and Canada, are reinforcing regional dominance, further augmenting the global albumin market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.4 Billion |

|

Market Forecast in 2033

|

USD 10.5 Billion |

| Market Growth Rate 2025-2033 | 5.1% |

A major driver of the albumin market is the rising prevalence of chronic diseases such as liver disorders, nephrotic syndrome, and cardiovascular conditions that necessitate albumin-based therapeutic solutions. As these health conditions continue to increase globally, the demand for albumin in critical care settings has expanded significantly. Furthermore, advancements in plasma collection technologies and manufacturing processes have enhanced the production efficiency and availability of albumin products. Moreover, coupled with a growing awareness of albumin's clinical benefits among healthcare professionals, this trend is fostering the adoption of albumin in diverse medical applications, thereby propelling albumin market growth across multiple regions.

To get more information on this market, Request Sample

The United States plays a pivotal role in the albumin market, driven by advanced healthcare infrastructure, extensive research and development initiatives, and a robust plasma collection network. With the presence of leading biopharmaceutical companies and significant investments in therapeutic innovations, the US ensures a steady supply of high-quality albumin products. For instance, in June 2024, Dyadic International announced a partnership with Proliant Health and Biologicals for developing and commercializing animal-free recombinant albumin products. Dyadic will receive a USD 1.5 million completion payment and share profits from PHB’s product sales utilizing Dyadic’s microbial platforms. In addition, the country's stringent regulatory framework promotes product safety and efficacy, enhancing global confidence in US-manufactured albumin. Furthermore, the rising prevalence of chronic conditions such as liver and kidney diseases and increasing demand for albumin in critical care further position the US as a key contributor for expanding the global albumin market size.

Albumin Market Trends:

Increasing Adoption of Recombinant Albumin

A significant trend in the albumin market is the growing adoption of recombinant albumin. The most prevalent protein in plasma is human albumin, which makes up 60% of the total protein in plasma. Its 17 disulphide linkages give it exceptional stability and resistance to environmental stress, and its numerous binding sites allow it to interact with a wide range of goods to stabilize them under various conditions. As per albumin market analysis, recombinant technology allows for the production of albumin without relying on human plasma, thus offering a more consistent and safer product. This method addresses concerns about contamination and supply limitations associated with plasma-derived albumin. According to the Food Drug Administration (FDA), advancements in recombinant DNA technology have facilitated the development of recombinant albumin, which is increasingly being used in various pharmaceutical applications due to its high purity and safety profile. Moreover, this trend is driven by the need for reliable and scalable production methods to meet the rising demand for albumin in medical treatments and drug formulations.

Rising Demand in Drug Delivery Systems

The demand for albumin in drug delivery systems is on the rise due to its excellent biocompatibility and ability to improve the pharmacokinetics of drugs, which is one of the key albumin market trends. Albumin is used as a carrier for drugs, enhancing their stability and half-life in the bloodstream. This trend is particularly notable in the development of albumin-bound drug conjugates, which are designed to target specific cells or tissues, thereby improving the efficacy, and reducing the side effects of drugs. Taylor and Francis highlights that the use of albumin in drug delivery is expanding, with numerous biopharmaceutical companies investing in research and development to explore new applications. The albumin potential can be harnessed in the development of nanomedicines to achieve better treatment results in cancer. This trend reflects the ongoing innovation in the biopharmaceutical industry, the growing recognition of albumin’s potential to revolutionize drug delivery, and the creating a favorable albumin market outlook. The need for advanced drug delivery systems is growing continuously. According to estimates from the United Nations Office on Drugs and Crime (UNODC), demographic trends predict that drug use would increase by 11% globally and by up to 40% in Africa alone by 2030.

Escalating Product Use in Regenerative Medicine

Another key trend in the albumin market is its increasing use in regenerative medicine and tissue engineering. Albumin’s ability to support cell growth and its role as a scaffold material make it valuable in the development of regenerative therapies. This trend is fueled by the growing prevalence of chronic diseases and injuries that require advanced treatment options. The Food Drug Administration (FDA) notes that the therapeutic applications of albumin are expanding beyond traditional uses, with ongoing research into its role in tissue regeneration and wound healing. The push toward personalized medicine and advanced therapeutic techniques further drives the demand for albumin in this field, thereby creating a positive albumin market outlook. This trend has positively changed the albumin market dynamics. Despite everything, there are still very few regenerative medicine products that are approved for use in humans. In 2017, the FDA first licensed CAR T cell therapy, another regenerative medicine treatment. There are currently at least six approved treatments for different kinds of blood malignancies as of March 2022, and this number is predicted to rise.

Expanding Therapeutic Applications and the Rise of Recombinant Albumin

A key trend shaping the market is the expanding role of albumin in therapeutic applications, particularly in treating conditions such as liver failure, hypovolemia, and sepsis. The protein’s ability to stabilize blood volume, maintain oncotic pressure, and enhance drug delivery efficiency has made it indispensable in critical and chronic care settings. The increasing prevalence of these medical conditions is steadily driving the demand for albumin-based treatments across both developed and emerging healthcare markets. Alongside this, the growing emphasis on recombinant albumin is transforming the market, offering a safer and more sustainable alternative to plasma-derived variants. Its consistent quality, reduced risk of contamination, and scalable production potential are driving increased adoption, especially in biologics manufacturing, vaccine development, and cell culture applications. Additionally, advancements in recombinant technology are enabling faster, more cost-effective production, making recombinant albumin increasingly viable for widespread clinical and pharmaceutical use.

Albumin Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global albumin market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, application, and end user.

Analysis by Product:

- Human Serum Albumin

- Bovine Serum Albumin

- Recombinant Albumin

Human serum albumin leads the market with around 72.6% of market share in 2024. This leadership is attributed to its wide range of medical applications in burn treatment, trauma, and hypoalbuminemia. As per the albumin market forecast, rising demand for human serum albumin in pharmaceuticals, therapeutic treatments, and research drives the growth of this segment. In addition, the stabilization of blood volume and pressure in critical care enhances the market appeal of human serum albumin. The recommendations on albumin use in adult critical care are three, pediatric critical care is one, neonatal critical care is two, and cardiovascular surgery is two. This albumin market forecast gives a glimpse into the key role human serum albumin plays in modern medical practices.

Analysis by Application:

- Therapeutics

- Drug Formulation and Vaccine

- Component of Media

- Others

Therapeutics leads the market with around 46.7% of market share in 2024. This dominance is owned to its extensive usage in the treatment of different medical conditions like liver diseases, hypovolemia, shock, burns, and surgical complications. The role of albumin in drug delivery and its therapeutic benefit, which includes maintaining blood volume and pressure, is essential in clinical settings. Furthermore, albumin has emerged as a versatile carrier for therapeutic and diagnostic agents, mainly for diagnosing and treating diabetes, cancer, rheumatoid arthritis, and infectious diseases. The increased incidence of chronic diseases, which further increases the need for effective treatment, adds weight to the market. This way, therapeutics is anticipated to sustain its position as the leading application in market, contributing to the overall albumin market worth.

Analysis by End User:

- Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Research Institutes

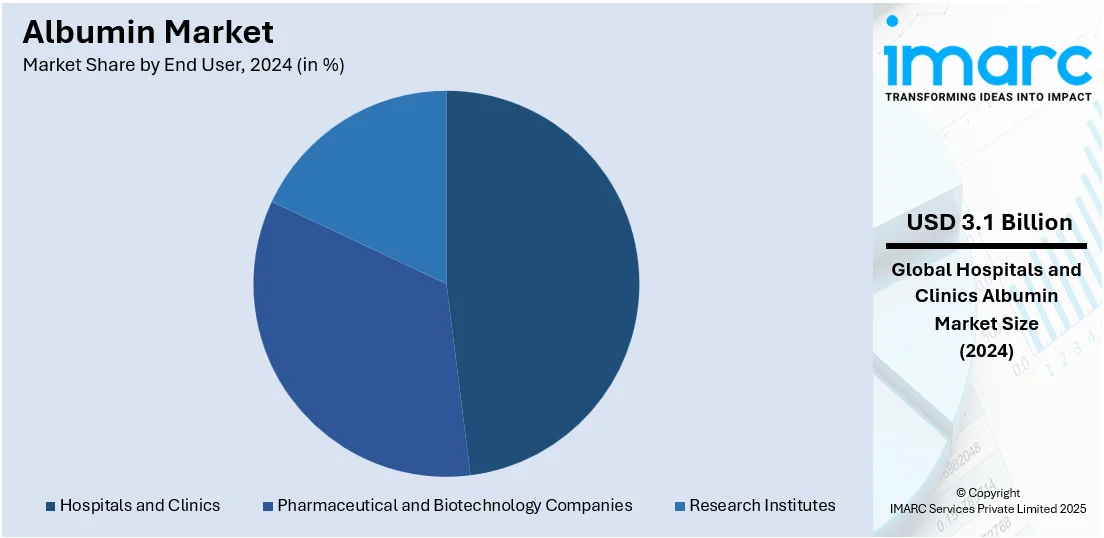

Hospitals and clinics lead the market with around 48.5% of the market share in 2024. Hospitals and clinics are the primary end users of albumin for critical care, surgeries, and treatment of various diseases such as liver diseases and hypovolemia. Thus, the demand for emergency medicine and blood volume expander during surgeries increases the growth in this segment. Albumin is used extensively in different clinical settings to improve hemodynamics, aid fluid removal, and manage complications of cirrhosis. The International Collaboration for Transfusion Medicine Guidelines implemented guidelines on the usage of albumin for patient in critical care, those undergoing cardiovascular surgery, receiving kidney replacement therapy, or experiencing complications of cirrhosis.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 38.1%. This region is principally driven by advanced healthcare infrastructure, significant investment in research and development, and a robust biopharmaceutical industry. The region's well-established healthcare system and high prevalence of chronic diseases increase the demand for albumin in medical treatments. Moreover, albumin is an appealing carrier in nanomedicine due to its unique features like endowing high biocompatibility, biodegradability and non-immunogenicity, and abundant protein in plasma. Additionally, strong governmental support and favorable reimbursement policies enhance the market dynamics. In 2023, the U.S. accounted for a substantial share of the global albumin market, reflecting its dominant position in biopharmaceuticals and innovative healthcare solutions.

Key Regional Takeaways:

United States Albumin Market Analysis

US accounts for 86.50% share of the market in North America. The increasing prevalence of chronic diseases like liver disease, nephrotic syndrome, and hypovolemia, which require albumin as a drug, is driving the US albumin market. According to an industrial report, the US healthcare expenditure, estimated to exceed USD 4.8 Trillion in 2023, ensured sustainable funding for advanced albumin treatments. Furthermore, plasma-based products have also shown significant growth, and the most significant sector in this is albumin synthesis. Advances in technology have led to a rise in the efficiency and cost-effectiveness of techniques for plasma fractionation. Furthermore, the demand for albumin in age-related disorders is due to the increasing elderly population, which was 57.8 Million in 2022, as per an industry report. The growing biopharmaceutical industry uses albumin as a stabilizer for drug formulations, thereby contributing to the growth of the market. The United States leads both production and consumption of albumin in the global market.

The country also has strict guidelines when it comes to the production of Albumin. According to the FDA, only FDA-approved blood facilities supply the human plasma units needed to make the 5% human albumin. The manufacturing procedure includes final container pasteurization and a further bulk pasteurization at 60 f 0.5 "C for 10 to 11 hours.

Europe Albumin Market Analysis

The increasing application of albumin in treatment for diseases such as hypovolemia, burns, and hypoalbuminemia is the most significant factor propelling the market. Germany, France, and the UK are some of the highest demand contributors in the region. At least 2 Million more blood and plasma donors who are willing to donate their blood and/or plasma multiple times a year are now needed in Europe. According to industry statistics, the Netherlands led the world in albumin exports in 2022, totaling about Euro 547 Million (USD 573.96 Million). With an albumin export value of more over Euro 466 Million (USD 488.97), Germany came second on the list. The strict EU requirements on plasma fractionation guarantee excellent albumin products. The incidence of liver diseases is rising, and the growing cases are increasing the usage of treatments in Central and Eastern Europe. Moreover, albumin is used as a stabilizing agent by the biopharmaceutical industry in Europe, which makes a significant contribution to the market. Recombinant albumin innovations are also becoming more popular, which is indicative of Europe's emphasis on environmentally friendly production techniques.

Asia Pacific Albumin Market Analysis

The market is largely driven by the increasing adoption of albumin in treating patients in the region. China and India dominate the market due to their sizable populations, high rates of liver disease, and growing healthcare costs. China's plasma products business is growing and adding to the region's production capacity, accounting for the largest share. In the initial eight months of 2022, China exceeded the U.S. export record for immunological medications, plasma, and other blood "fractions" by a single nation, based on data from the U.S. Census Bureau. Also, India collects approximately 12 Million units of blood annually, and this number is expected to rise to approximately 18 Million units in the coming years, according to industry statistics. This will allow the existing fractionators to increase their capacity, as the supply of supplementary plasma becomes more accessible. Expansion is further driven by the role of albumin in cell culture medium, immunizations, and biopharmaceuticals. The governmental initiatives in countries such as India, aimed at increasing the infrastructure for plasma collection, are also improving supply chains. The increase in medical tourism in Southeast Asia further raises the demand for innovative therapeutic solutions, such as albumin-based treatments.

Latin America Albumin Market Analysis

The high prevalence of malnutrition and liver diseases makes therapeutic use of albumin a necessity in the region. The top two countries, Mexico and Brazil, cater to more than 50% of the regional demand. The technique is being highly popular in the area because it is very affordable, and the residents are not well-off there. According to the Brazilian Institute of Studies and Research in Gastroenterology and Other Specialties, the difference was that annual costs were estimated to be BRL 118,759 (USD 19396.51) less in public health services for each patient under SMT plus albumin versus only SMT and BRL 189,675 (USD 30978.98) less in private health services per patient for those given the SMT plus albumin versus SMT. The higher cost of albumin was reduced by decreases in issues and treatments (USD 24421.58 and USD 40761.76, respectively). Additionally, the region's growing biopharmaceutical industry is using albumin in the creation and development of new drugs. The use of albumin is being accelerated by government initiatives to provide access to healthcare, especially in rural areas. In addition, increasing awareness of plasma-derived therapies is a strong growth driver, since Brazil annually spends more than USD 70 Billion on healthcare.

Middle East and Africa Albumin Market Analysis

The therapeutic demand for albumin in this region is driven by increasing incidence rates of hypoalbuminemia and malnutrition. Latest African research indicated that adult hospital malutrition impacts around 45% of the patients.. The growth in the investments in healthcare, more so in the GCC nations is driving the market in Middle East. The UAE and Saudi Arabia are the greatest consumers of plasma-derived goods, such as albumin, with combined healthcare spend of nearly more than USD 50 Billion, reports say.Moreover, the growing medical tourism industry in the region increases the demand for advanced treatment options. Further innovations in cost-effective production of albumin are going to further increase market penetration in this space.

Competitive Landscape:

The competitive landscape of the albumin market is characterized by the presence of established pharmaceutical and biotechnology companies, alongside emerging players focused on innovation. Key participants are leveraging advanced manufacturing technologies, strategic partnerships, and extensive research and development investments to enhance their product portfolios. In addition, the market is marked by robust competition, driven by increasing demand for albumin in therapeutic applications and drug delivery systems. Leading companies are also expanding plasma collection networks and exploring recombinant albumin to address supply challenges. For instance, in 2024, Grifols. a prominent plasma-based products provider prepares to pursue U.S. and European approval for BT524, a concentrated fibrinogen therapy for acquired fibrinogen deficiency, after achieving success in a phase 3 trial, which could drive the company to expand its plasma collection network. Additionally, regional expansions, mergers, and acquisitions are common strategies aimed at strengthening market position and capturing a larger global share.

The report provides a comprehensive analysis of the competitive landscape in the albumin market with detailed profiles of all major companies, including:

- Albumedix Ltd.

- Biotest AG

- Celgene Corporation (Bristol-Myers Squibb Company)

- CSL Limited

- Grifols SA

- HiMedia Laboratories

- Medxbio Pte Ltd.

- Merck KGaA

- Octapharma AG

- Takeda Pharmaceutical Company Limited

- Thermo Fisher Scientific Inc.

- Ventria Bioscience Inc.

Latest News and Developments:

- April 2025: InVitria announced the launch of Optibumin® 25, the first recombinant 25% human serum albumin (rHSA) designed specifically for closed-system biomanufacturing in cell and gene therapies. Unlike plasma-derived albumin, Optibumin 25 offers a GMP-compliant, chemically defined, animal-origin-free formulation, helping manufacturers overcome regulatory, contamination, and scalability challenges.

- May 2025: Orion Corporation announced an exclusive agreement with Shilpa Biocare Private Limited to commercialize Shilpa’s Recombinant Human Albumin in the European market. Shilpa’s albumin, developed through a non-human expression system, offers virus-free, scalable production, addressing key limitations of human-derived albumin. The partnership involves development and regulatory milestone payments, strengthening Orion’s hospital generics portfolio and contributing to advancements in the European albumin market.

- May 2025: Meitheal Pharmaceuticals launched a generic version of paclitaxel protein-bound particles for injectable suspension (albumin-bound) in the U.S. through an exclusive licensing agreement with parent company Hong Kong King-Friend. Used to treat metastatic breast cancer, pancreatic adenocarcinoma, and non-small cell lung cancer, this formulation expands Meitheal’s oncology portfolio to 68 injectable products. The launch strengthens affordable cancer care access in the United States pharmaceutical market.

- November 2024: Shilpa Medicare Limited, received permission to carry out Phase III clinical studies for its product, recombinant human albumin. Because recombinant albumin is widely utilized in therapeutics, diagnostics, and the production of biopharmaceuticals, this development puts the company in a position to meet the growing demand for it globally. The approval demonstrates Shilpa Medicare's capacity for biopharmaceutical innovation and its endeavors to broaden its range of high-value biologics.

- June 2024: Proliant Health and Biologicals teamed up with Dyadic International, Inc., a biotechnology business that specializes in the synthesis of industrial enzymes and proteins, to create and market recombinant albumin. The goal of this partnership is to develop a scalable and affordable recombinant albumin production process by utilizing Dyadic's exclusive C1 protein synthesis platform. To launch the solution, Proliant will leverage its experience with albumin applications.

- June 2024: Shilpa Biologicals, a wholly owned subsidiary of Shilpa Medicare filed its first drug master file of recombinant Human Albumin 20% with USFDA. This is a patented product which is environmentally friendly, superior quality, cost competitive, and can be efficiently scaled up.

- July 2023: Grifols SA announced completion of participants enrollment for the third phase of its clinical study PRECIOSA by leveraging prolonged Albutein (a human injectable albumin) treatment to elevate life expectancy in individuals suffering with decompensated cirrhosis.

Albumin Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Human Serum Albumin, Bovine Serum Albumin, Recombinant Albumin |

| Applications Covered | Therapeutics, Drug Formulation and Vaccine, Component of Media, Others |

| End Users Covered | Hospitals and Clinics, Pharmaceutical and Biotechnology Companies, Research Institutes |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Albumedix Ltd, Biotest AG, Celgene Corporation (Bristol-Myers Squibb Company), CSL Limited, Grifols SA, HiMedia Laboratories, Medxbio Pte Ltd, Merck KGaA, Octapharma AG, Takeda Pharmaceutical Company Limited, Thermo Fisher Scientific Inc., Ventria Bioscience Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the albumin market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global albumin market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the albumin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Albumin is a protein found in blood plasma, essential for maintaining osmotic pressure and transporting substances like hormones, drugs, and fatty acids. Produced mainly by the liver, it plays a critical role in fluid balance and overall metabolic functions, with deficiencies often indicating liver or kidney disorders.

The albumin market was valued at USD 6.4 Billion in 2024.

IMARC estimates the albumin market to exhibit a CAGR of 5.1% during 2025-2033.

The albumin market is driven by rising demand for albumin-based therapies in treating liver diseases, hypovolemia, and burns. Increased adoption in drug delivery, advancements in recombinant albumin technology, and growing healthcare expenditures also contribute. Expanding plasma collection facilities and its use in research further support market growth.

According to the report, human serum albumin represented the largest segment byproduct, driven by its widespread use in therapeutic applications, including volume replacement, drug formulation, and treatment of chronic conditions such as liver and kidney diseases.

Therapeutics leads the market by application, owing to its extensive application in treating critical conditions such as hypovolemia, hypoalbuminemia, burns, and shock, as well as its use in managing liver and kidney disorders.

Hospitals and clinics is the leading segment by end user, driven by the increasing demand for albumin-based therapies in emergency care, critical care treatments, and surgical procedures, along with the growing prevalence of chronic diseases requiring hospital-based interventions.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the Albumin market include Albumedix Ltd, Biotest AG, Celgene Corporation (Bristol-Myers Squibb Company), CSL Limited, Grifols SA, HiMedia Laboratories, Medxbio Pte Ltd, Merck KGaA, Octapharma AG, Takeda Pharmaceutical Company Limited, Thermo Fisher Scientific Inc., Ventria Bioscience Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)