Airsoft Guns Market Size, Share, Trends and Forecast by Product Type, Mechanism Type, Distribution Channel, and Region, 2026-2034

Airsoft Guns Market Size and Share:

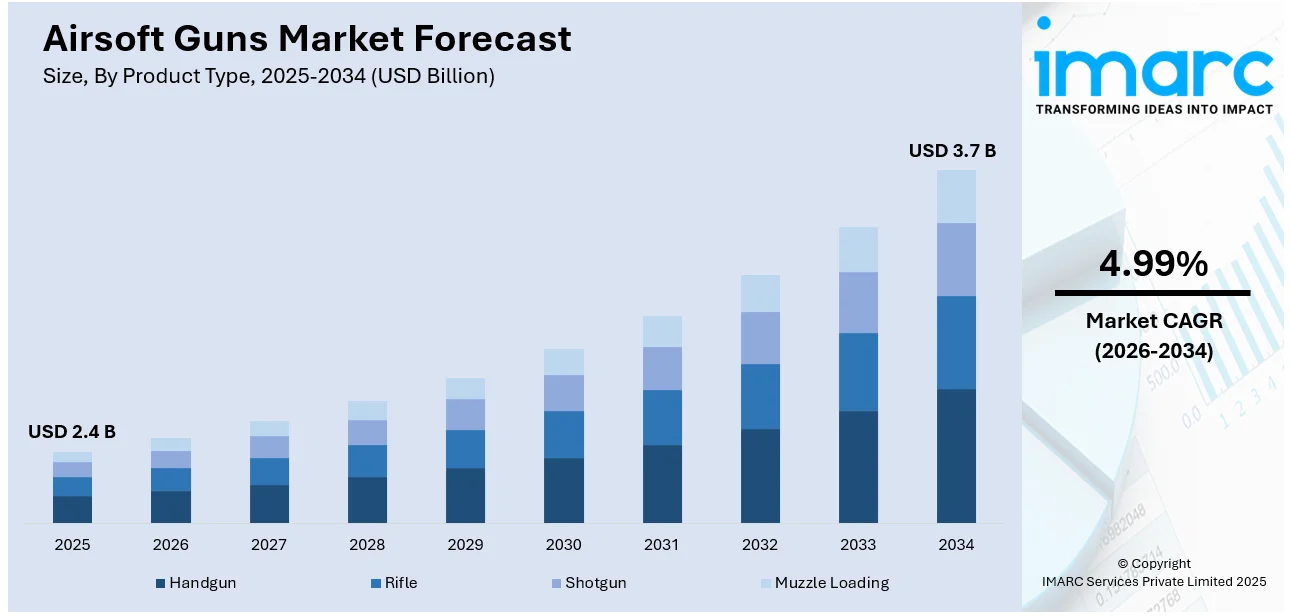

The global airsoft guns market size was valued at USD 2.4 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 3.7 Billion by 2034, exhibiting a CAGR of 4.99% from 2026-2034. North America currently dominates the market, holding an airsoft guns market share of over 38.9% in 2025. The market is experiencing steady growth driven by the expansion of airsoft fields and arenas, increasing availability of airsoft guns through online retail channels at discounted rates, and the rising utilization of gas blowback airsoft guns by sports enthusiasts in this region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 2.4 Billion |

|

Market Forecast in 2034

|

USD 3.7 Billion |

| Market Growth Rate (2026-2034) | 4.99% |

The global airsoft guns market is expanding, fueled by the rising popularity of airsoft both as a recreational activity and a tactical training resource. Airsoft provides an engaging, competitive environment for participants of all ages, contributing to its rising appeal. Moreover, the increasing interest in outdoor activities and team sports is driving the demand for airsoft products. Technological advancements, including the creation of more realistic and high-performance airsoft guns, are also drawing more enthusiasts to the market. The rise in military and law enforcement training using airsoft guns for simulations also contributes to market expansion. Furthermore, the expanding online retail sector and offline stores offering hands-on experiences continue to enhance product accessibility, supporting continued market growth.

To get more information on this market Request Sample

United States is emerging as a key disruptor with 83.70% shares. The airsoft guns market growth in this region is supported by various key factors. The increasing popularity of airsoft as a recreational sport has expanded the consumer base, with numerous airsoft fields, clubs, and retailers supporting a vibrant community. Technological advancements have resulted in the development of more realistic and high-performance airsoft guns, drawing the attention of both enthusiasts and professionals. The rising trend of outdoor activities and team-based sports has further boosted airsoft guns market demand. Furthermore, the adoption of airsoft guns in military and law enforcement training programs has grown, thanks to their non-lethal nature and cost-efficiency.

Airsoft Guns Market Trends:

Rising Popularity of Airsoft as a Recreational Sport

The increasing demand for airsoft as a leisure activity is another reason for market growth. This is a non-violent activity that mimics military and tactical missions using imitation firearms that fire plastic BBs, harmless to human targets. Airsoft also offers thrill seekers an opportunity that is a little more realistic than paintball or laser tag but still enjoyable because of its accuracy in replication of firearms. Participants can experience a team-based scenario, experience the excitement of playing tactics, and enhance their strategy skills. On top of this, it also has a low entry level barrier compared to other sport shooting games. According to data on firearm ownership and sport shooting participation in the U.S. for 2022, the number of adult participants in sport shooting rose from 34 million to over 63.5 million. The cost of airsoft equipment, which constitutes guns, safety gear, and ammunition, is relatively cheaper than the traditional firearms or any other pastime. This has enabled the game to attract players cut across all ages, from teenagers, to young adults, and even the old. Moreover, the fast proliferation of airsoft groups and events further contributes to the popularity of the game, thus attracting a larger consumer group. Along these lines, airsoft fields and arenas have been springing up for the enjoyment of players in this sport in absolutely safe and immerging conditions. On social networks and forums, people begin to organize competitions and share memories with one another.

Technological Advancements in Airsoft Gun Design and Manufacturing

Continuous innovation and improvement in airsoft gun technology is another significant factor positively impacting the airsoft guns market outlook. Manufacturers are constantly developing new models with enhanced features, realism, and performance, which attract novice and experienced players. In line with this, the incorporation of gas blowback systems. These systems mimic the recoil and cycling of a real firearm, providing a more authentic shooting experience. Moreover, the increasing utilization of gas blowback airsoft guns by sports enthusiasts is strengthening the growth of the market. Additionally, advancements in materials and manufacturing processes are leading to the creation of more durable and reliable airsoft guns. High-quality polymers and metals are used in the construction of gun bodies, ensuring longevity and resistance to wear and tear. Furthermore, the introduction of electric airsoft guns (AEGs) with programmable features, such as adjustable firing modes and rates of fire, is attracting players seeking customization options. These technological innovations help enhance gameplay and contribute to the growth of the market.

Growing Interest in Competitive Airsoft Leagues and Events

The increasing number of competitive airsoft leagues and events worldwide is driving the demand for specialized airsoft equipment, including guns. These leagues often involve organized tournaments, milsim (military simulation) events, and scenario-based competitions that require players to invest in high-quality airsoft guns and gear. According to Ministry of Commerce and Industry, India, there are 107 investment projects in Sports sector in India worth USD 2.48 bn across all the states. The rise of competitive airsoft can be attributed to the desire for a more structured and challenging experience among players. These events often have rules and objectives that require teamwork, strategy, and communication, creating a dynamic and immersive environment. Additionally, many competitive airsoft events have sponsorship and prize incentives, further motivating players to invest in top-tier airsoft guns and accessories. Along with this, the leading market players are designing specialized models optimized for performance and reliability in these scenarios. These guns are often crafted with precision and attention to detail to ensure they meet the rigorous requirements of competitive play, further fueling the growth of the market.

Airsoft Guns Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global airsoft guns market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on product type, mechanism type, and distribution channel.

Analysis by Product Type:

- Handgun

- Rifle

- Shotgun

- Muzzle Loading

Handguns stand as the largest component in 2025, holding around 44.7% of the market. Handguns are compact airsoft guns designed to be used in one hand. They are portable and versatile weapons for close combat. Airsoft handguns are in different models. There are the semi-automatic, gas-powered versions. These weapons are ideal for players who seek agility and accuracy. That's why they become popular in events that require agility and accurate shots. In addition, handgun lovers like the gun's various types and options in modifying it through the availability of numerous accessories. Handguns, thus, will likely continue holding their position on the market due to increased demands for convenient-to-use airsoft guns until the end of 2024.

Analysis by Mechanism Type:

- Spring-powered

- Electric-powered

- Gas-powered

Spring-powered airsoft guns are characterized by their simplicity and reliability. They are operated by manually cocking a spring to compress it, where energy is stored for firing. Such guns are very popular with new players as well as cost-conscious players. While they must be manually cocked for every shot, the spring-powered gun has a known consistency in velocity, making them suitable for informal backyard plinking or target shooting.

The most popular electric-powered airsoft guns are AEGs. They use rechargeable batteries to power an electric motor that compresses the spring and fires the BBs. AEGs have semi-automatic and fully automatic firing modes, which makes them versatile and suitable for various gameplay styles. Their programmable features and compatibility with accessories attract both novice and experienced players seeking customization and realism.

Gas-powered airsoft guns use gas, typically propane or green gas, to propel BBs. These guns offer a realistic blowback action, simulating the recoil of real firearms. Gas guns are favored for their authenticity and are often chosen by players who prioritize realism and milsim (military simulation) scenarios. Besides this, they offer excellent realism, gas guns require regular maintenance, making them more suitable for experienced players.

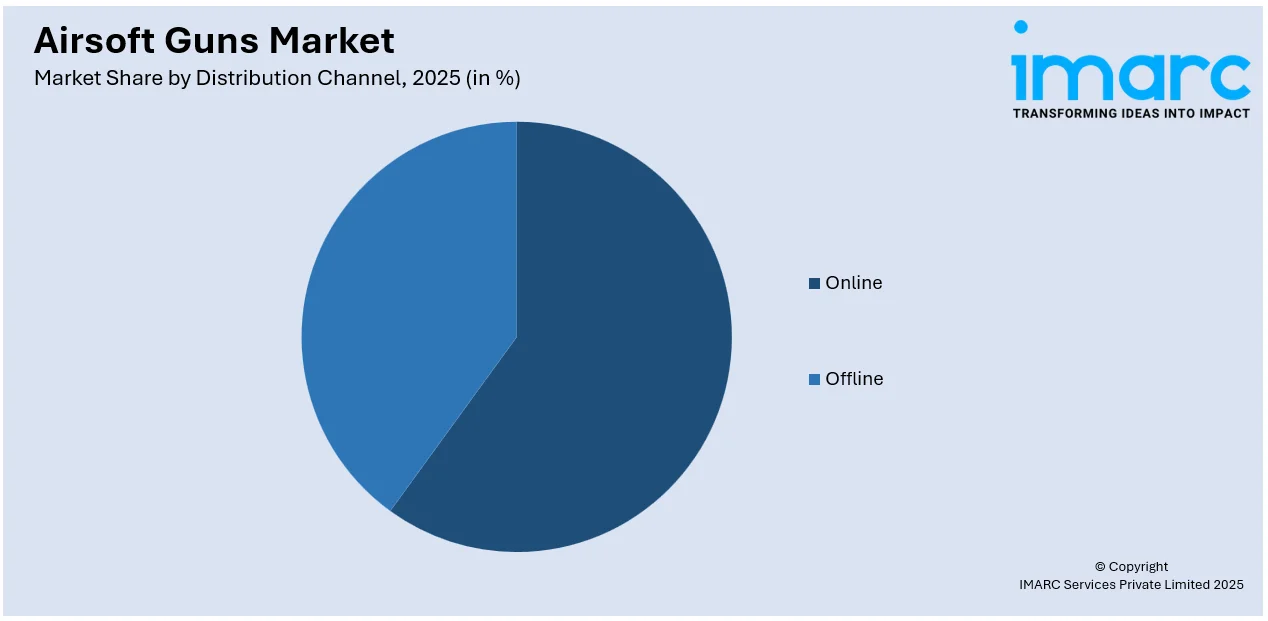

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

Offline leads the market with around 60.3% of market share in 2025. Offline distribution channels include brick-and-mortar stores, specialty airsoft shops, and sporting goods retailers. These physical locations offer customers a hands-on shopping experience, allowing them to inspect and handle airsoft guns before purchase. Knowledgeable staff in these stores can provide expert advice, address customer queries, and offer in-person demonstrations. Additionally, offline channels are often the go-to choice for immediate purchases and for building relationships within the local airsoft community. They also serve as venues for organized events and tournaments, fostering a sense of community among players. Offline channels also benefit from a strong network of after-sales services, including repairs and upgrades, which enhances customer loyalty. With the continued preference for in-person shopping and community engagement, offline distribution is expected to maintain its dominance in the market in 2024 and beyond.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America held the largest market share, exceeding 38.9%, driven primarily by the United States and Canada. The region's strong presence is driven by the widespread popularity of airsoft as a recreational activity and the strong presence of competitive airsoft leagues and events. In particular, the United States boasts a large and active airsoft community, with numerous fields, clubs, and retailers. The North American market is marked by a diverse group of airsoft gun enthusiasts, ranging from casual players to serious competitors, which helps sustain consistent demand for high-quality airsoft products. The region is also witnessing innovations in airsoft technology, with advancements in gun performance, customization, and accessories. As a result, North America is expected to maintain its leadership in the global airsoft market throughout the forecast period.

Key Regional Takeaways:

United States Airsoft Guns Market Analysis

The adoption of airsoft guns is experiencing rapid growth, propelled by the increasing prevalence of sports activities. According to the 15th annual State of the Industry Report from the Sports & Fitness Industry Association and Sports Marketing Surveys USA, a record 242 Million people in the U.S. played a sport or took part in a fitness activity in 2023. Competitive events and recreational clubs have spurred a surge in interest, with participants seeking high-performance gear to enhance their gameplay experience. The demand for diverse equipment types, ranging from pistols to rifles, has broadened significantly as enthusiasts invest in advanced features such as adjustable hop-up systems and realistic designs. Target shooting and tactical simulations have gained immense popularity, fostering a strong community of enthusiasts. Moreover, the inclusion of airsoft as a team-building activity in youth programs and hobbyist gatherings has solidified its role as a mainstream recreational pursuit. This trend is further supported by organized tournaments that provide a platform for players to showcase their skills, encouraging continuous investment in better equipment and accessories tailored to their needs.

Europe Airsoft Guns Market Analysis

The growing allure of airsoft as a recreational activity is contributing to its widespread adoption. With an increasing focus on leisure activities that emphasize physical engagement and social interaction, airsoft is attracting diverse demographics seeking a thrilling outdoor experience. According to reports, EU general government expenditure on recreational and sporting services was approximately USD 64.52 Billion in 2022, increasing from approximately USD 59.71 Billion in 2021. Newcomers are drawn to its versatility, offering scenarios ranging from casual skirmishes to elaborate role-playing missions. Dedicated fields and themed battlegrounds are emerging to cater to enthusiasts, complete with challenging terrains and props that enhance gameplay. The community-driven nature of airsoft has led to the formation of local clubs where players bond over shared interests and skills development. Retailers and manufacturers are responding to demand with innovative designs and gear tailored for recreational players, including lightweight and durable equipment. Partnerships with event organizers further highlight the sport’s growing acceptance, as airsoft continues to gain traction as a fun and inclusive activity.

Asia Pacific Airsoft Guns Market Analysis

Airsoft guns are increasingly recognized as an effective and economical training alternative for law enforcement and paramilitary personnel. For example, the Indian Army trains approximately 3,100 foreign personnel annually from over 100 countries, including around 450 from African nations. Airsoft guns ability to replicate the weight, feel, and operation of actual firearms makes them an ideal tool for tactical drills and simulated combat scenarios. Training academies and private security organizations are incorporating airsoft into their programs, as it allows trainees to practice critical skills such as room clearing and close-quarters engagement in a controlled, risk-free environment. Simulations using airsoft provide a cost-effective way to refine decision-making, coordination, and response times. Beyond professional use, the availability of specialized training packages for recreational users is encouraging a wider adoption of airsoft gear, as more individuals aspire to experience realistic tactical challenges. Innovations in materials and technology are further driving adoption, as manufacturers respond to demand with increasingly authentic and high-performance equipment.

Latin America Airsoft Guns Market Analysis

The expanding online presence of airsoft gear is significantly influencing adoption trends. E-commerce platforms are making a diverse range of equipment, from entry-level to professional-grade airsoft guns, accessible to a broader audience. According to reports, the Latin America market currently boasts over 300 Million digital buyers. Detailed product descriptions, user reviews, and virtual tutorials are helping new players make informed purchasing decisions. Discounts and promotions frequently offered by online retailers further attract consumers. Virtual marketplaces also serve enthusiasts in remote areas, where access to physical stores might be restricted. The convenience of doorstep delivery and seamless return policies are enhancing user satisfaction, encouraging repeat purchases. Online forums and social media groups are further fostering interest, as players exchange tips and share their experiences, fuelling curiosity among potential participants. This digital growth is not only enabling access but also building a supportive community around the sport.

Middle East and Africa Airsoft Guns Market Analysis

Competitive airsoft events are becoming a strong incentive for attracting new participants. Leagues and tournaments are fostering excitement and camaraderie among enthusiasts, offering opportunities to showcase tactical skills in organized, high-energy environments. These events frequently incorporate unique themes and scenarios, appealing to both experienced players and newcomers. For example, the sports industry in the Middle East is projected to grow by 8.7% by 2026, significantly outpacing the global sector's growth of 3.3% during the same period. Structured competitions have also led to the professionalization of airsoft, with skilled players forming teams and pursuing advanced training to excel in league play. Specialty arenas are accommodating this trend by providing dynamic environments designed for competitive challenges. Spectator interest is growing, further spotlighting airsoft as an engaging recreational pursuit. Local organizers and community leaders are actively promoting these activities, which encourage participation while fostering a sense of community and sportsmanship. This focus on competition is making airsoft an increasingly attractive and sustainable pastime in the region.

Competitive Landscape:

The competitive landscape of the global airsoft guns market is determined by several major players such as manufacturers, retailers, and distributors. Major companies that are gaining dominance over the market will have a high-quality range of airsoft guns and accessories. Their focus is innovation in having features such as increased realism, improved performance, and customization options to attract both recreational players and professional trainers. The other significant factor affecting the market dynamics is competitive pricing and product availability through online platforms and brick-and-mortar stores. Besides, brand loyalty and customer satisfaction are the only ways to hold onto market share. In the recent past, local players are emerging, focusing on regional tastes and preferences, thereby increasing competition. Strategic partnerships, collaborations, and marketing campaigns are the common tactics adopted by players to maintain a competitive edge in this growing industry.

The report provides a comprehensive analysis of the competitive landscape in the airsoft guns market with detailed profiles of all major companies, including:

- A&K Airsoft Limited

- HFC/Ballistic Breakthru Gunnery Corporation

- Colt's Manufacturing Company LLC

- Crosman Corporation

- G&G Armament Taiwan Ltd.

- ICS Airsoft Inc.

- Lancer Tactical Inc.

- Systema Professional Training Weapon (PTW)

- Tokyo Marui Co. Ltd.

- Umarex GmbH & Co. KG

- Valken Inc.

Latest News and Developments:

- July 2024: Tokyo Marui will launch the M4A1R electric gun on August 6, 2024, priced at around USD 250. Aimed at users aged 14 and older, this model replicates the Colt M4A1 Carbine used by the U.S. military. Crafted with high-quality materials, it provides a realistic experience for young enthusiasts in search of professional-grade equipment.

- July 2024: Shotshow 2024 unveiled exciting new airsoft guns, including the Elite Force M1911, a durable and affordable full blowback CO2 pistol. The Samurai Edge CQB offers precision with an advanced MOSFET for close-quarters combat. Additionally, the Elite Force EyeTrace AK features LED tracer technology for enhanced night operations.

- June 2024: Airsoft Gun India, a top licensed airgun company, has launched a new range of gel blasters. Featuring popular models like the M4A1, SCAR 1, and M9A1, these blasters offer a safe, fun, and affordable alternative to traditional airguns and paintball equipment, catering to both enthusiasts and beginners.

- February 2024: IWA OutdoorClassics 2024, held from February 29 to March 3 in Nuremberg, will showcase a wide range of airsoft firearms among other products in 9 exhibition halls. The event, celebrating its 50th anniversary, serves as a key international meeting point for manufacturers and specialist retailers in the airsoft sector. It highlights the latest innovations and strengthens the global retail network.

- January 2024: GLOCK, Inc. introduced the G29 Gen5 in 10mm and the G30 Gen5 in .45 AUTO, further expanding its 5th Generation series. With over 20 design improvements from the Gen4 models, these new pistols deliver enhanced performance and usability, reflecting GLOCK’s dedication to innovative solutions for changing customer needs.

Airsoft Guns Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Handgun, Rifle, Shotgun, Muzzle Loading |

| Mechanism Types Covered | Spring-powered, Electric-powered, Gas-powered |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United Kingdom, Germany, France, Italy, Spain, Russia, United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | A&K Airsoft Limited, HFC/Ballistic Breakthru Gunnery Corporation, Colt's Manufacturing Company LLC, Crosman Corporation, G&G Armament Taiwan Ltd., ICS Airsoft Inc., Lancer Tactical Inc., Systema Professional Training Weapon (PTW), Tokyo Marui Co. Ltd., Umarex GmbH & Co. KG, Valken Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the airsoft guns market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global airsoft guns market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the airsoft guns industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The airsoft guns market was valued at USD 2.4 Billion in 2025.

IMARC Group estimates the market to reach USD 3.7 Billion by 2034, exhibiting a CAGR of 4.99% from 2026-2034.

Key factors driving the airsoft guns market include the rising popularity of airsoft as a recreational sport, technological advancements in gun performance, increasing demand for tactical training among military and law enforcement, the growing trend of outdoor activities, and the expansion of both online and offline distribution channels.

North America currently dominates the airsoft guns market owing to the widespread popularity of airsoft as a recreational activity, a large and active community, a robust retail presence, and frequent airsoft events and competitions. The U.S. and Canada contribute significantly to market growth with numerous airsoft fields, retailers, and enthusiasts.

Some of the major players in the airsoft guns market include A&K Airsoft Limited, HFC/Ballistic Breakthru Gunnery Corporation, Colt's Manufacturing Company LLC, Crosman Corporation, G&G Armament Taiwan Ltd., ICS Airsoft Inc., Lancer Tactical Inc., Systema Professional Training Weapon (PTW), Tokyo Marui Co. Ltd., Umarex GmbH & Co. KG, Valken Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)