Airport Security Market Report by Type (Access Control, Cyber Security, Security, Screening, Surveillance, and Others), Technology (RFID, Biometrics, 3D scanning, and Others), Equipment Type (Metal Detector, Backscatter X-Ray System, Cabin Baggage Screening Systems, and Others), Airport Type (Civil airports, Military/Government Airports, Private Airports), and Region 2026-2034

Airport Security Market Size:

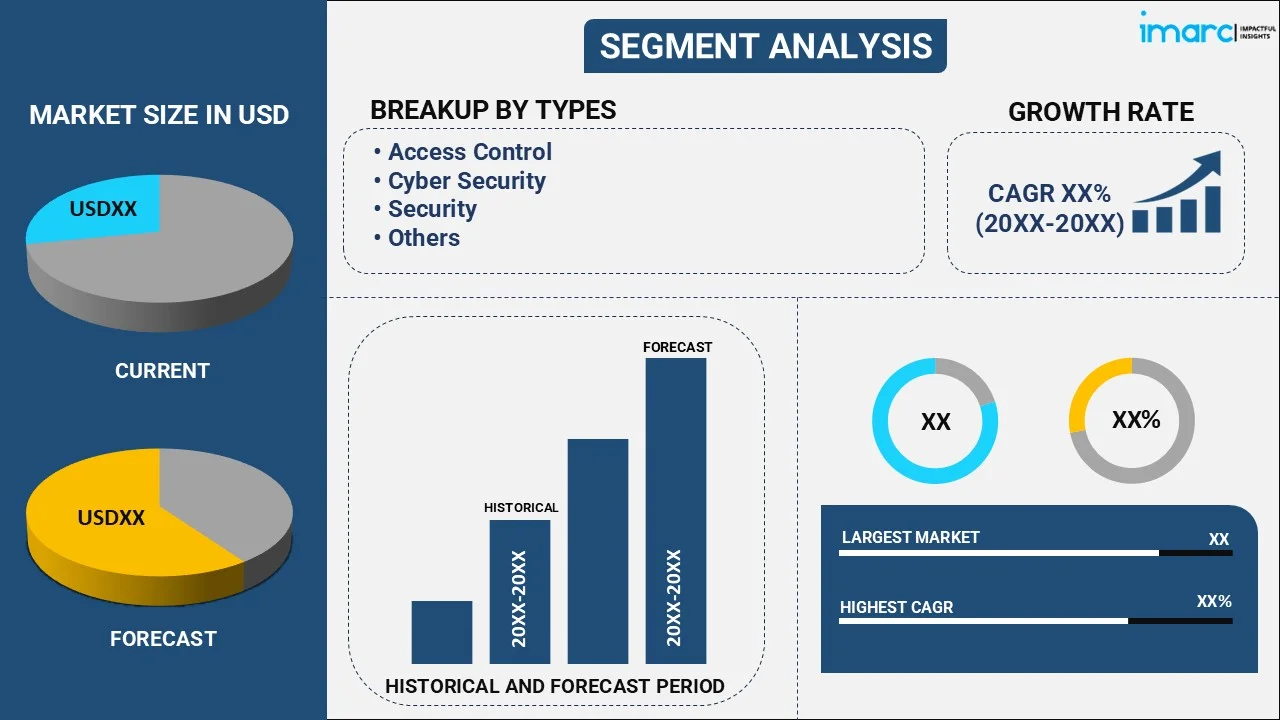

The global airport security market size reached USD 16.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 27.7 Billion by 2034, exhibiting a growth rate (CAGR) of 6.04% during 2026-2034. The rising integration of advanced technologies to enhance the efficiency and accuracy of security systems, implementation of stringent regulations to prevent the occurrence of security breaches, and increasing number of individuals preferring air travel are some of the factors impelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 16.4 Billion |

| Market Forecast in 2034 | USD 27.7 Billion |

| Market Growth Rate 2026-2034 | 6.04% |

Airport Security Market Analysis:

- Major Market Drivers: The market is experiencing moderate growth because of the increasing occurrence of security breaches in airports and rising focus on maintaining passenger safety.

- Key Market Trends: Major trends include the deployment of advanced technologies to strengthen airport security and implementation of stringent government regulations to maintain proper airport security.

- Geographical Trends: Asia Pacific represents the largest segment owing to the increasing integration of technologically advanced security features in various airports and heightened air traffic.

- Competitive Landscape: Some of the major market players in the airport security industry include Hangzhou Hikvision Digital Technology Co. Ltd., Honeywell International Inc., OSI Systems Inc., Pelco Incorporated (Motorola Solutions Inc.), Pure Tech Systems, Robert Bosch GmbH, Smiths Group Plc, Thales Group, Westminister Group Plc, and Zhejiang Dahua Technology Co. Ltd.

- Challenges and Opportunities: Challenges include evolving threats and regulatory requirements. However, opportunities are arising from technological advancements like artificial intelligence (AI)-driven surveillance, biometric identification systems, and enhanced screening technologies as these innovations improve detection capabilities and streamline passenger processing.

To get more information on this market, Request Sample

Airport Security Market Trends:

Increasing Passenger Traffic

Airports are becoming busier as more people prefer air travel over other modes of transportation for traveling longer distances. As traffic grows, optimized security screens help make sure more people can move through the checkpoint and do so safely. Increasing number of passengers also means the widening and creation of new airport facilities which require state-of-the-art security systems too. In addition to the increased pace of overseas travel, there is a heightened need for security measures capable of handling a broad spectrum of threats, from terrorism to payload smuggling. Airports need advanced screening methods, surveillance tools to keep track of strangers, and effective access control systems for managing increasing passenger inflow. This demand for upgraded security infrastructure to cater to the rising passenger volumes is a significant driver of the market. According to International Air Transport Association (IATA), the recovery in air travel continued in December 2023, and total traffic in 2023 rose 36.9% compared to 2022. International traffic also increased 24.2% in December 2023.

Technological Advancements in Security Systems

Technological advancements in security systems are significantly driving the market. In addition, the deployment of modern technologies such as artificial intelligence (AI), machine learning (ML), and biometric systems further aids in improving the efficiency of security operations. AI-powered video analytics, for example, can enable the real-time monitoring of vast quantities of surveillance footage and detect questionable behavior or possible threats faster than human operators. Passenger panels are biometric (facial recognition) and reduce impact on the boarding process while increasing security. Additionally, advancements in cybersecurity practices are essential to secure airports' data and communication networks from cyberattacks and hackers. These technology advancements benefit not just the integrity of security infrastructure but also passenger experience by reducing processing times and improving efficiency for astute, well-informed decisions. This is leading to the rampant adoption of this state-of-the-art technology by airports around the world. SITA 2024 revealed its latest SITA Airport Operations Total Optimizer at the Passenger Terminal Expo 2024 in Frankfurt, Germany.

Regulatory Compliance and Government Initiatives

The airport security market is likely to see a significant opportunity as strict regulatory requirements and various proactive government initiatives are implemented. Adhering to the stringent security requirements from governments and global aviation organizations aims at securing travelers and infrastructure. Meeting these rules and regulations requires regular updates as well as significant investments in sophisticated security technologies. Moreover, security checks in airports are a major concern of the government to curb growing terrorism and other risk factors. Such support cuts across the board, from underwriting furthering security technologies to providing airports with grants for infrastructure improvements. Recently, Bristol Airport implemented new security rules as per which passengers are allowed to leave liquids, laptops, and electronics inside their bags when they pass through security as the airport authorities invested £11.5m on new and efficient scanners.

Airport Security Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on type, technology, equipment type, and airport type.

Breakup by Type:

To get detailed segment analysis of this market, Request Sample

- Access Control

- Cyber Security

- Security

- Screening

- Surveillance

- Others

Cyber security accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes access control, cyber security, security, screening, surveillance, and others. According to the report, cyber security represented the largest segment.

Cyber security is the primary sector focused on safeguarding sensitive data and communication systems from cyber attacks. These remedies span various platforms and technologies such as firewalls, encryption, intrusion detection systems, and advanced threat intelligence. The rise of cybersecurity is a result of airport digitalization and growing dependence on interconnected systems, leaving the industry open to cyber threats like hacking, phishing, and ransomware. For example, in 2023, Airports Council International (ACI) World launched a cybersecurity airport assessment program, The APEX to help airports examine and identify cyber security vulnerabilities, mitigate risks, and maintain regulatory compliance.

Breakup by Technology:

- RFID

- Biometrics

- 3D scanning

- Others

3D scanning holds the largest share of the industry

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes RFID, biometrics, 3D scanning, and others. According to the report, 3D scanning accounted for the largest market share.

Advanced imaging solutions for comprehensive and thorough passenger, baggage, and cargo screenings are provided by 3D scanning technology. This technology delivers exceptionally high-resolution three-dimensional (3D) images that enable security personnel to identify prohibited items and potential threats with greater precision than ever. 3D scanners can detect hidden objects and distinguish between safe (harmless) materials and dangerous ones, ensuring comprehensive security checks. In 2024, Transportation Security Administration (TSA) launched new and unique 3D scanners at the Newark Liberty International Airport to improve the detection of explosives during summer travel season.

Breakup by Equipment Type:

- Metal Detector

- Backscatter X-Ray System

- Cabin Baggage Screening Systems

- Others

Backscatter X-ray system represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes metal detector, backscatter X-ray system, cabin baggage screening systems, and others. According to the report, backscatter X-ray system represented the largest segment.

The demand for backscatter x-ray systems is largely driven on account of their ultramodern imaging solutions and multi-model features which help identify a wide array of threats. Conventional transmission x-ray systems may overshadow or obscure non-metallic objects like cocaine, methamphetamines, and plastics that might be used to conceal promotional product packaging ideas from the detection system, but backscatter x-rays image provides detailed images of surface objects. This technology uses low dose x-rays that have the ability to bounce items back and return them to detectors, creating high-resolution images for security personnel.

Breakup by Airport Type:

- Civil airports

- Military/Government Airports

- Private Airports

A detailed breakup and analysis of the market based on the airport type have also been provided in the report. This includes civil airports, military/government airports, and private airports.

Civil airports serve commercial airlines and are hubs for domestic and international flights. Civil airports are where passengers and goods transit, so the security measures in these places should be very robust to comply with international standards. This involves a range of complex screening technologies and biometric ID systems, integrated into sprawling surveillance networks. This requires a balance to realize strict security protocols without impeding passenger flow, leading to continued investment in new state-of-the-art training technologies.

Strict security measures are required for military and government airports, such as restricted access controls, advanced perimeter security fences, and sophisticated personnel screening procedures. The main focus is to protect military resources, high-ranking officials, and confidential data from any threats.

Private airports cater to business jets, private charters, and very important person (VIP) passengers. Security at these airports is tailored to the needs of high-profile clients and the specific requirements of private aviation. While private airports typically handle lower passenger volumes than civil airports, they demand high standards of security to ensure the safety and privacy of their clientele. This includes personalized screening processes, secure access control systems, and discreet surveillance measures.

Breakup by Region:

To get more information on the regional analysis of this market, Request Sample

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

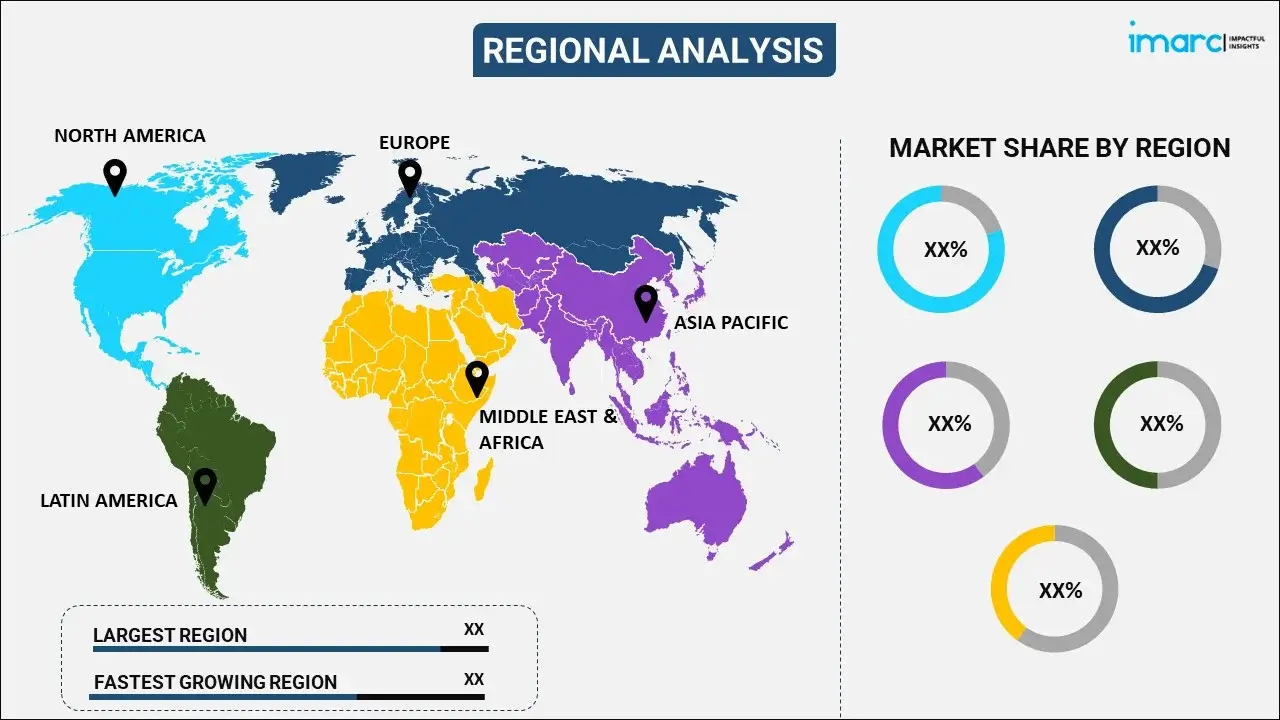

Asia Pacific leads the market, accounting for the largest airport security market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for airport security.

The Aisa Pacific region is driven by technological advancements and evolving security needs. One prominent trend is the increasing adoption of biometric systems, including facial recognition and fingerprint scanning, to enhance passenger identification and streamline the check-in and boarding processes. These systems are being integrated with existing security frameworks to improve efficiency and reduce passenger wait times. Another notable trend is the deployment of advanced screening technologies such as 3D scanning and computed tomography (CT) for baggage inspection. These technologies provide high-resolution images and automated threat detection capabilities, enabling more accurate and faster screening of both checked and carry-on luggage. Additionally, the region is seeing a rise in the use of artificial intelligence (AI) and machine learning (ML) in surveillance systems. AI-powered video analytics can monitor large volumes of surveillance footage in real-time, identifying suspicious activities and potential threats more efficiently than traditional methods. As per the 2022 Air Transport IT Insights report by SITA, major Chinese airports are investing in IT improvements to digitalize air traffic management smoothly, even with less staff support.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the airport security industry include Hangzhou Hikvision Digital Technology Co. Ltd., Honeywell International Inc., OSI Systems Inc., Pelco Incorporated (Motorola Solutions Inc.), Pure Tech Systems, Robert Bosch GmbH, Smiths Group Plc, Thales Group, Westminister Group Plc, Zhejiang Dahua Technology Co. Ltd, etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Leading companies are focusing on continuous technological advancements. They are developing cutting-edge screening and detection solutions such as computed tomography (CT) scanners, advanced threat detection algorithms, and artificial intelligence (AI)-powered analytics. These innovations improve the accuracy and efficiency of security checks, helping airports handle increasing passenger volumes while maintaining high-security standards. Market leaders are heavily investing in biometric systems, including facial recognition and fingerprint scanning technologies. These systems streamline passenger identification and boarding processes, reducing wait times and enhancing security. The integration of biometric data with airport databases and security frameworks provides seamless and secure access control. Leading companies are also focusing on expanding their service line by providing customizations and flexible solutions. In 2023, Honeywell announced the launch of an updated suite of airside solutions, facilitating enhancements to its gate and turnaround and airfield lighting portfolios, including the Honeywell NAVITAS™ Smart Visual Docking system.

Airport Security Market News:

- April 2024: Smiths Detection, a brand of Smiths group plc, announced the launch of its unique x-ray diffraction (XRDI) technology scanner, the SDX 10060 XDi to combat illegal narcotics and contraband trafficking.

- April 2024: Thales received the Frost & Sullivan 2024 European Company of the Year Award in the cybersecurity for airport security category.

Airport Security Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Access Control, Cyber Security, Security, Screening, Surveillance, Others |

| Technologies Covered | RFID, Biometrics, 3D scanning, Others |

| Equipment Types Covered | Metal Detector, Backscatter X-Ray System, Cabin Baggage Screening Systems, Others |

| Airport Types Covered | Civil airports, Military/Government Airports, Private Airports |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Hangzhou Hikvision Digital Technology Co. Ltd., Honeywell International Inc., OSI Systems Inc., Pelco Incorporated (Motorola Solutions Inc.), Pure Tech Systems, Robert Bosch GmbH, Smiths Group Plc, Thales Group, Westminister Group Plc, Zhejiang Dahua Technology Co. Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the airport security market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the airport security industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The airport security market was valued at USD 16.4 Billion in 2025.

The airport security market is projected to exhibit a CAGR of 6.04% during 2026-2034, reaching a value of USD 27.7 Billion by 2034.

The airport security market is driven by increasing global air travel, rising security concerns, and evolving threats such as terrorism and cyber-attacks. Demand for advanced screening technologies, biometric systems, and integrated surveillance solutions is growing to ensure passenger safety, smooth airport operations, and compliance with strict government security regulations worldwide.

Asia Pacific dominates the airport security market due to the booming air travel, rapid airport expansion, and rising security threats, prompting governments to enforce stricter regulations. The region embraces cutting-edge screening technologies—AI, biometrics, CT scanners and contactless systems—to streamline passenger flow, bolster threat detection, and modernize infrastructure for efficiency and safety.

Some of the major players in the airport security market include Hangzhou Hikvision Digital Technology Co. Ltd., Honeywell International Inc., OSI Systems Inc., Pelco Incorporated (Motorola Solutions Inc.), Pure Tech Systems, Robert Bosch GmbH, Smiths Group Plc, Thales Group, Westminister Group Plc, Zhejiang Dahua Technology Co. Ltd, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)