Airport Baggage Handling System Market Size, Share, Trends and Forecast by Identification Technology, Airport Class, Check-In Type, Type, Efficiency, Cost Analysis, and Region, 2026-2034

Airport Baggage Handling System Market Size:

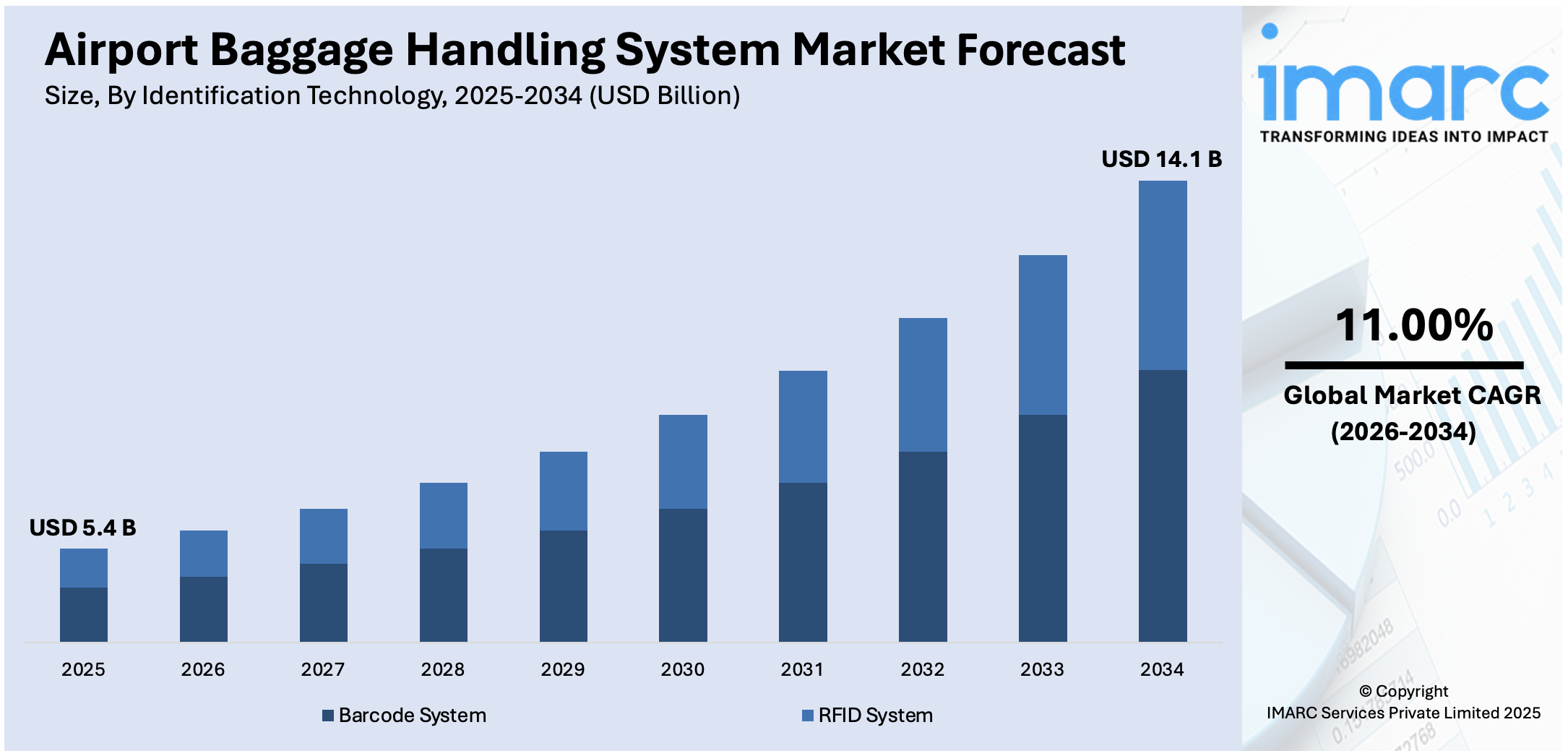

The global airport baggage handling system market size is anticipated to reach USD 5.4 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 14.1 Billion by 2034, exhibiting a CAGR of 11.00% during 2026-2034. Asia-Pacific currently dominates the market, holding a significant market share of over 33.9% in 2025. The widespread adoption of eco-friendly baggage handling solutions, the rising development of lightweight and durable materials for luggage, the growth of e-commerce, and the heavy investments in resilient baggage handling systems are some of the factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 5.4 Billion |

|

Market Forecast in 2034

|

USD 14.1 Billion |

| Market Growth Rate (2026-2034) | 11.00% |

The market is primarily driven by the growth in air passenger traffic, increasing airport modernization projects, and the demand for automation to enhance efficiency and reduce delays. The rising adoption of advanced technologies like RFID, IoT, and AI for seamless baggage tracking and real-time updates is acting as a key factor in the market. Additionally, strict government regulations on baggage security and the need to minimize mishandling losses further fuel airport baggage handling system market growth. The expansion of smart airports and the integration of cloud-based systems also play a significant role. Emerging economies are witnessing increased investments in airport infrastructure, boosting the market growth. Moreover, the rising preference for self-service baggage solutions and contactless technologies, accelerated by the pandemic, continues to drive innovation in this sector.

To get more information on this market Request Sample

In the United States, the market is driven by rising air travel demand, modernization of aging airport infrastructure, and the adoption of advanced technologies like RFID and AI for efficient baggage tracking. For instance, in March 2024, VTC, the US market leader in BHS design innovation, was chosen to design a new Baggage Handling System for Southwest Airlines’ transfer baggage facility at DEN, utilizing Leonardo’s cross-belt sorter (MBHS – Multi-sorting Baggage Handling System). The introduction of cross-belt sorter technology into the baggage handling system space marks a landmark change in the further adoption of alternative baggage technology solutions in the United States. According to the airport baggage handling system market forecast, increasing investments in airport expansions and upgrades, such as larger hubs and regional airports, further propel growth. Additionally, federal funding for airport improvement projects supports the development of advanced baggage handling systems.

Airport Baggage Handling System Market Trends:

Expanding aviation industry

With the global expansion and the growth of the aviation sector, airports are taking initiatives to meet their challenges, including the saturation of passenger traffic and the density of air traffic. According to the India Brand Equity Foundation, from January to September 2023, local airlines carried 112.86 Million passengers, up 29.10% from the 87.42 Million passengers transported during the year-ago period. It is becoming crucial to deploy efficient systems for managing and transporting baggage that can easily scale up to support passenger movement in the airport. In addition to this, the development and enhancement of baggage processing systems are further leading to increased aviation traffic flow. The growing prominence of cutting-edge automatic systems powered by modern technology is ongoing to meet the high demand of the increasing number of travelers and their luggage.

Increasing modernization of airports worldwide

The upgradation and renovation of the existing airport infrastructure to meet the needs of contemporary air travel is leading to the introduction of innovative baggage handling systems. For instance, in 2023, the Dubai International Airport will undergo a revamp, which will likely continue for the next 5-7 years, and this will lead to DXB handling up to 120 Million annual passengers within the next 15 years. Enhanced and technologically advanced baggage processing guarantees less waiting time and ameliorates airport activities. Such initiatives will help airports to manage the growing number of passengers and implement the needed level of passenger satisfaction and the utilization of airport assets.

Rising terrorist threats

The escalating number of terrorist threats on a global scale is bolstering the need for robust and more secure airport baggage handling solutions. For example, in 2018, the SPS Programme has overseen DEXTER (short for Detection of Explosives and firearms to counter TERrorism). This flagship initiative is composed of a number of projects all working together to develop an integrated system of sensors and data fusion technologies capable of detecting explosives and concealed weapons in real time to help secure mass transport infrastructures, such as airports, metro and railway stations. With the rising security concerns, airports are advancing their security measures, including thoroughly screening checked luggage. This initiative to enhance security drives the demand for advanced baggage handling systems with sophisticated screening technologies. To mitigate the risk of potential threats, airports are investing in cutting-edge baggage screening equipment, such as explosive detection systems and advanced imaging technologies. These systems are integrated into baggage handling processes to efficiently identify and intercept prohibited or dangerous items. In addition to this, real-time tracking and monitoring solutions are gaining traction to ensure luggage's secure and traceable movement throughout the airport. Consequently, the growing terrorist threats are prompting airports to allocate substantial resources toward adopting and enhancing technologically advanced airport smart baggage handling solutions. This, in turn, is safeguarding passenger safety and reinforcing the critical role of such systems in maintaining global air travel's integrity and security.

Airport Baggage Handling System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global airport baggage handling system market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on identification technology, airport class, check-in type, type, efficiency, cost analysis, and region.

Analysis by Identification Technology:

- Barcode System

- RFID System

Barcode system stand as the largest component in 2025, holding around 81.1% of the market. The segment focusing on identification technology, specifically the barcode system, plays a significant role in propelling the market's growth. Barcode technology has become a fundamental tool for efficient baggage-handling processes at airports. By encoding essential information onto labels, barcodes facilitate accurate tracking, sorting, and routing of luggage throughout its journey. Airports increasingly adopt advanced barcode systems to improve aircraft ground handling operations. These systems enable real-time monitoring, enhancing visibility and reducing the likelihood of mishandled baggage. Furthermore, integrating barcode technology with other components of baggage handling, such as conveyor systems and sorting mechanisms, ensures smooth and precise luggage flow.

As air travel demand rises, the barcode system segment addresses the critical need for dependable and effective baggage identification. Its role in minimizing delays, enhancing passenger satisfaction, and optimizing operational efficiency positions it as a driving force behind market growth.

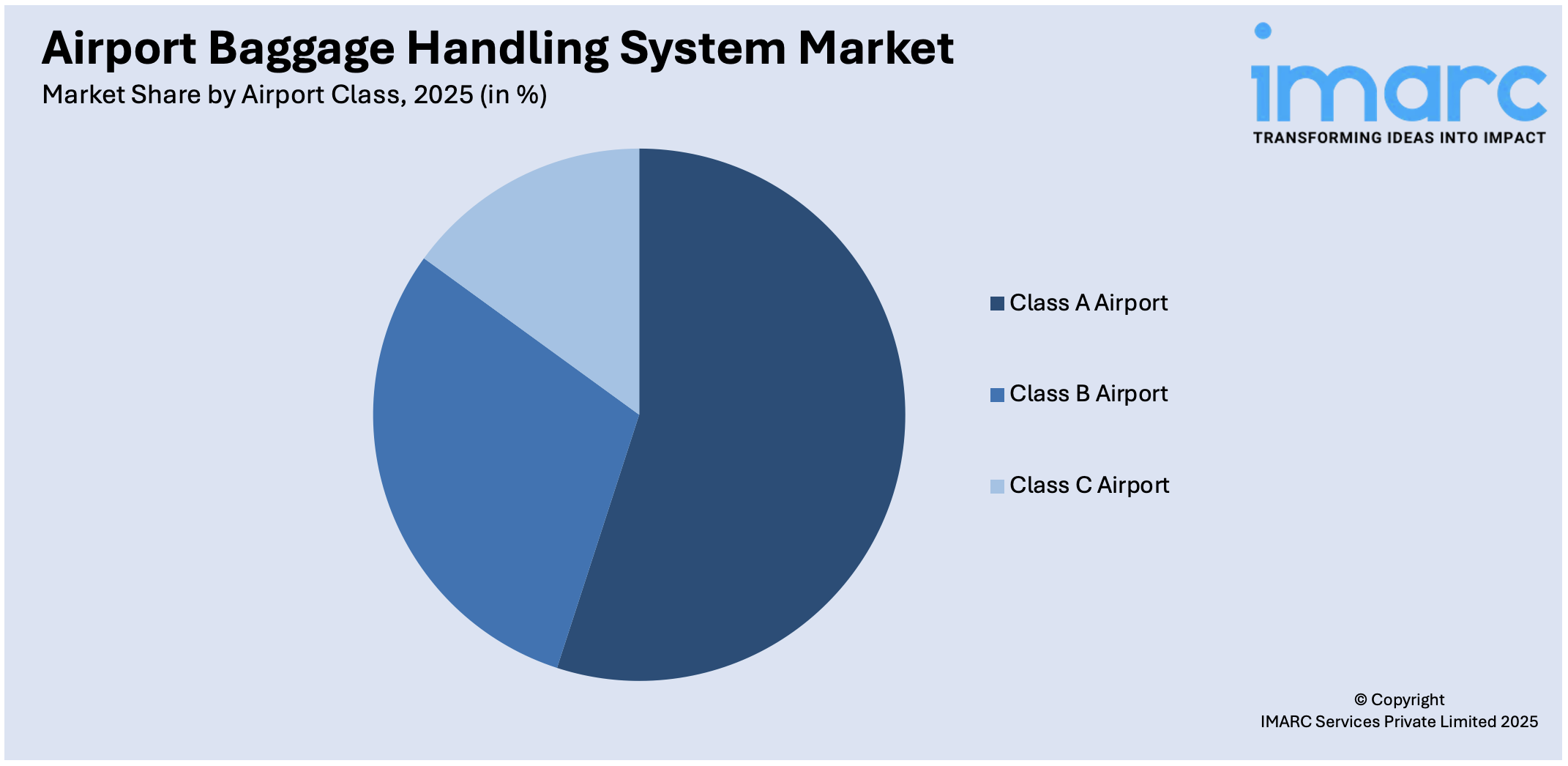

Analysis by Airport Class:

Access the comprehensive market breakdown Request Sample

- Class A Airport

- Class B Airport

- Class C Airport

Class A leads the market with around 53.0% of the market share in 2025. Class A airports, characterized by high passenger volumes and extensive international operations, demand robust and sophisticated baggage handling solutions to manage their operations' complexities effectively. These airports require systems capable of handling large quantities of baggage while maintaining stringent security standards. Furthermore, various leading payers and government authorities are increasingly investing in Class A airports to integrate state-of-the-art automated baggage handling technologies to streamline processing, minimize delays, and enhance the overall passenger experience. For instance, in a bid to enhance airport security measures and streamline passenger experiences, Bengaluru’s Kempegowda International Airport and the upcoming Noida International Airport are introducing cutting-edge CT X-ray machines for security screening. This revolutionary technology, initially tested at Delhi’s Indira Gandhi International Airport, promises to bring about a paradigm shift in airport security procedures. These systems incorporate advanced sorting mechanisms, real-time tracking, and integration with digital platforms to ensure efficient baggage movement.

Analysis by Check-In Type:

- Assisted Service Bag Check-In

- Self-Service Bag Check-In

Assisted service bag check-in leads the market with around 82.3% of the market share in 2025. Assisted service bag check-in involves the involvement of ground staff or self-service kiosks with staff assistance during the check-in process. This approach is beneficial for passengers who require guidance or face specific circumstances. Airports and airlines are increasingly adopting assisted service bag check-in solutions to enhance aircraft ground handling operations and improve passenger experience, especially for those with special needs or who prefer personal assistance. For instance, in March 2021, Vanderlande Industries (VI) Australia was awarded a contract to supply a new baggage handling system (BHS) to Western Sydney International Airport (WSIA). The BHS would utilize digital technology to track, load, and move baggage more efficiently. The new airport is expected to enter operational readiness and acceptance trials (ORAT) in late 2024 and begin operations for international and domestic services in late 2026.

These solutions streamline check-in while ensuring accurate baggage handling and routing, improving operational efficiency. The demand for personalized and efficient services grows as the aviation industry continues to evolve. Assisted service bag check-in systems cater to this demand, aligning with the changing preferences of passengers.

Analysis by Type:

- Conveyor System

- Destination Coded Vehicle

Conveyor system leads the market with around 75.6% of market share in 2025. Conveyor systems are considered highly efficient in baggage handling within airports, offering a reliable and automated solution for aircraft ground handling between various points in the terminal. They enable seamless baggage flow, allowing for quick and accurate movement of luggage from check-in counters to sorting areas and ultimately onto the aircraft. Various leading market players are investing in technologically upgrading the conveyor system to smoothly handle diverse luggage sizes and shapes, ensuring smooth processing for many passengers. For instance, in December 2022, TSA launched a high-tech baggage handling system at Denver International Airport. The Checked Baggage Inspection System (CBIS) features a complicated network of conveyor belts that sort and track the luggage through the security screening process. The cost of the system was nearly USD 160 Million.

Airports across the globe, regardless of size, recognize the importance of conveyor systems in optimizing their operations. With the increasing passenger volume, airports are rapidly undergoing modernization, which is further bolstering the demand for advanced conveyor systems with enhanced features such as automated sorting, tracking, and real-time monitoring grows.

Analysis by Efficiency:

- Below 3000

- 3000 to 6000

- Above 6000

3000 to 6000 leads the market with around 42.4% of the market share in 2025. The segmentation by efficiency, specifically the range of 3000 to 6000, significantly influences the market. This range reflects the throughput capacity of the baggage handling systems, indicating their ability to process a specific volume of luggage within a given time frame. Baggage handling systems falling within the 3000 to 6000 efficiency range are crucial for airports with moderate to high passenger traffic. These systems strike a balance between operational capacity and resource optimization. They ensure that baggage processing remains efficient and timely, preventing bottlenecks and delays during peak hours.

Analysis by Cost Analysis:

- Operational Cost Analysis

- Installation Cost Analysis

Installation cost analysis leads the market with around 89.3% of the market share in 2025. Installation cost analysis plays a crucial role. While upfront expenses for implementing sophisticated baggage handling systems might seem substantial, the long-term benefits overshadow this. Installation costs encompass equipment, integration, maintenance, and training. As airports seek to modernize facilities and comply with stringent security regulations, they are willing to allocate resources for these installations. This expenditure is justified by increased throughput, fewer delays, and better compliance, all of which contribute to market growth.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In 2025, Asia-Pacific accounted for the largest market share of over 33.9%. Asia-Pacific is home to some of the world's busiest airports and is experiencing rapid economic growth, leading to increased air travel and passenger traffic. There has been a rapid increase in investments in airport infrastructure in Asia-Pacific to cater to the growing passenger traffic in the region over the past few years. Airports in China, India, Japan, and South Korea have witnessed exponential growth in passenger traffic. As a result, the airport authorities have increased their investments in expanding existing airports and constructing new airports in the region. For instance, according to the data released by Airport Council International, Asia-Pacific houses 57% of the total 300 new airports planned to open worldwide in the coming years. The newly planned greenfield airport will fulfill the vision of net-zero emissions by 2050. According to ACI (Airport Council International), the Asia-Pacific is expected to account for 58% of the global air passenger demand, resulting in the region upgrading its airport infrastructure capacity with investments totaling USD1.3 Trillion until 2040 to accommodate such growth. With such robust expansion plans, the demand for new airport baggage handling systems in this region is expected to grow during the forecast period.

Key Regional Takeaways:

North America Airport Baggage Handling System Market Analysis

In North America, the market is driven by the increasing air passenger traffic and the need for improved operational efficiency at airports. The modernization of aging airport infrastructure, along with the expansion of existing airports and construction of new ones, fuels demand. For instance, in July 2024, Alstef Group's recent contract win for the new baggage handling system (BHS) at Montreal Metropolitan Airport (MET) aligns with the airport's transition into a commercial aviation hub, marked by its new brand identity. The construction of the terminal at MET is advancing swiftly, slated to open by the end of 2025 with an overall $200 million investment by terminal operator YHU Infrastructure Partners. The BHS project, awarded to Alstef Group by construction firm PCL, encompasses 28 check-in conveyors, a collector conveyor, and an out-of-gauge line. The addition of CTX 9800 Explosives Detection Systems, high-capacity makeup carousels, and airline sortation aims to streamline operations and enhance the passenger experience. The inbound system comprises two flat-plate carousels. Advancements in automation, such as RFID, AI, and IoT technologies, enhance baggage tracking and minimize mishandling. Additionally, stricter security regulations and the rise of smart airports contribute to market growth.

United States Airport Baggage Handling System Market Analysis

In 2024, US accounted for a share of 92.7% of the North America airport baggage handling system market. The United States airport baggage handling system market is experiencing growth driven by several specific factors. Airports are increasingly adopting advanced automation technologies to streamline operations, reduce mishandling rates, and improve passenger satisfaction, particularly in response to rising air travel demand. According to the International Trade Administration, the number of US citizens travelling to international locations for the year 2023 was 56,62,286 which increased in 2024 by 793,816. The implementation of radio-frequency identification (RFID) and artificial intelligence (AI) in baggage tracking is enhancing operational efficiency by enabling real-time monitoring and predictive maintenance of systems. Additionally, major airports are actively expanding and modernizing their terminals to accommodate larger passenger volumes, fuelling the demand for integrated and scalable baggage handling solutions. Regulatory bodies are mandating enhanced security measures, prompting airports to invest in state-of-the-art screening and sorting systems to comply with stringent safety standards. The growing focus on sustainability is also influencing the adoption of energy-efficient and eco-friendly baggage handling equipment. Airlines and airport authorities are prioritizing customer experience, which is accelerating the deployment of faster and more accurate baggage handling technologies. Furthermore, partnerships between system providers and airport authorities are fostering the integration of digital twins and IoT-enabled systems, ensuring seamless operations. These developments are collectively reshaping the airport baggage handling system market outlook, catering to evolving operational and regulatory requirements across the United States.

Europe Airport Baggage Handling System Market Analysis

The airport baggage handling system market in Europe is currently experiencing robust growth, driven by several region-specific factors. Airports are increasingly upgrading their baggage handling systems to accommodate rising passenger volumes; particularly as post-pandemic travel demand continues to surge. According to Eurocontrol, during the first quarter of 2023, the number of passengers at the top 40 airports across Europe increased significantly compared to 2022 (Jan:+83%, Feb: +56%, Mar: +37%). This is leading to the adoption of advanced technologies like RFID tracking, which are being implemented to enhance real-time baggage monitoring and reduce mishandling rates. Airlines and airport operators are focusing on integrating automated sorting and screening systems to comply with stringent EU regulations regarding security and efficiency. Moreover, regional initiatives like the Single European Sky are encouraging airport modernization projects, including the deployment of high-capacity baggage systems that streamline operations and minimize delays. Sustainability concerns are also influencing the market, with airports prioritizing energy-efficient and eco-friendly baggage handling solutions to align with Europe's green transition goals. Additionally, the growing prominence of hub airports in cities like London, Frankfurt, and Amsterdam is driving investments in scalable, modular baggage handling systems capable of managing complex flight networks. As e-commerce continues to flourish, airports are also equipping systems to handle rising volumes of air cargo and expedited baggage services. These targeted innovations are enabling Europe's airports to meet evolving passenger and operational demands efficiently.

Latin America Airport Baggage Handling System Market Analysis

The airport baggage handling system market in Latin America is currently being driven by increasing investments in airport modernization and expansion projects, aimed at enhancing operational efficiency and passenger experience. Governments and private stakeholders are actively implementing advanced baggage handling technologies, such as automated sorting and RFID tagging, to reduce luggage mishandling rates and improve security measures. Rising air traffic across major countries like Brazil, Mexico, and Colombia is prompting airports to scale up their infrastructure, including deploying high-capacity baggage handling systems to manage surging passenger volumes. According to International Air Transport Association (IATA), Brazil’s domestic traffic rose 8.0% in March 2023 compared to 2022. Airlines are increasingly collaborating with airport authorities to integrate seamless baggage tracking systems that align with international aviation standards, such as IATA's Resolution 753. In parallel, the region is witnessing growing adoption of eco-friendly and energy-efficient systems, with airport operators focusing on sustainability as part of their operational strategies. Moreover, the introduction of smart technologies, such as IoT-enabled baggage tracking and data analytics, is helping airports optimize system performance and reduce downtime. These developments are further supported by rising regional trade and tourism, which are boosting demand for reliable and efficient baggage handling solutions in both passenger and cargo segments. Collectively, these factors are shaping the growth trajectory of the Latin American airport baggage handling system market.

Middle East and Africa Airport Baggage Handling System Market Analysis

The airport baggage handling system market in the Middle East and Africa is experiencing growth driven by several specific factors tailored to the region’s unique dynamics. Airports across the region are increasingly integrating advanced technologies such as RFID tagging and automated guided vehicles (AGVs) to enhance the accuracy and efficiency of baggage tracking and reduce mishandling incidents. Governments and private entities are heavily investing in airport infrastructure expansion and modernization projects, particularly in countries like the UAE, Saudi Arabia, and South Africa, to cater to rising passenger traffic and growing airline connectivity. According to the Ministry of Economy, passenger traffic at the UAE's airports grew by 14.2 per cent in the first half of 2024.

Regional hubs are focusing on implementing smart baggage handling solutions as part of their broader digital transformation initiatives to align with global standards and attract international carriers. Simultaneously, airports are adopting modular baggage systems to address scalability needs, ensuring seamless operations during peak travel seasons. The rising prominence of low-cost carriers and regional airlines is further emphasizing the need for cost-effective and reliable baggage management solutions. Moreover, sustainability initiatives are pushing the adoption of energy-efficient systems and environmentally friendly technologies, while the growing demand for real-time data and predictive analytics is reshaping how baggage handling systems are managed and maintained. These factors collectively are reshaping the market landscape in the Middle East and Africa.

Key Leading Airport Baggage Handling System Companies:

The market is highly competitive, featuring key players like Siemens Logistics LLC (Siemens AG), SITA, Vanderlande Industries B.V. (Toyota Industries Corporation), and Daifuku Co., Ltd. (Daifuku Group). Companies focus on innovation, integrating technologies like RFID, IoT, and AI to improve efficiency and accuracy. Partnerships and acquisitions are common strategies to expand market presence and capabilities. For instance, in July 2024, SITA, a technology provider for the airport industry, announced the successful completion of delivery testing for its state-of-the-art Swift Drop Self-Bag Drop (SBD) units in the new Alaska Airlines location at San Francisco International Airport (SFO) Harvey Milk Terminal 1. This milestone marks a significant advancement in passenger processing technology, enhancing the airport experience for millions of travelers. The market also sees competition from emerging regional players offering cost-effective solutions. Increased emphasis on sustainability and smart airport development drives further differentiation among competitors in this evolving landscape.

The report provides a comprehensive analysis of the competitive landscape in the global airport baggage handling system market with detailed profiles of all major companies, including:

- Alstef Group

- Ansir Systems

- Babcock International Group PLC

- Beumer Group

- CIMC Pteris Global

- Daifuku Co., Ltd. (Daifuku Group)

- G&S Airport Conveyor

- Leonardo S.p.A.

- Logplan LLC

- Siemens Logistics LLC (Siemens AG)

- SITA

- Vanderlande Industries B.V. (Toyota Industries Corporation)

Latest News and Developments:

- March 2023: Alstef Group signed a contract worth USD 10.48 Million with Sofia Airport in Bulgaria to supply, install, and maintain a new baggage handling system (BHS). The updated system will allow both full self-service (self-bag drop) at pre-check-in for a flight and will also allow check-in agent-assisted service.

- March 2023: dnata, a leading global air and travel services provider, handled over 82 Million bags through all three terminals at Dubai International airport (DXB) in 2022. dnata handles luggage for over 100 airlines and millions of passengers travelling to 253 destinations from DXB. Merging and processing the flow of passenger baggage and cargo between three terminals, and ensuring the right items are loaded onto the right aircraft at the correct time requires meticulous planning and significant people power. DXB’s Baggage Handling System (BHS) transports luggage using innovative conveyor belts and lifts that move both departing and arriving bags.

- January 2024: Centralny Port Komunikacyjny has launched a tender for the design, delivery, and implementation of the Baggage Handling System (BHS) for CPK airport. The purpose of this competitive dialogue process is to examine the conceptual design of the BHS, focusing on how the system design will be implemented, and to refine the tender description in collaboration with potential operators. Additionally, it aims to confirm the key terms of the contract.

- March 2024: Southwest Airlines recently awarded Leonardo a USD 27 Million contract to provide a new baggage handling solution with cross-belt sorter technology for its transfer bag facility at Denver International Airport. This solution will eliminate a labor-intensive, manual sorting and tail-to-tail transfer bag method. By revamping its baggage handling system, the airline seeks to ensure faster connection times, accommodate tight flight schedules, and increase capacity to manage future passenger volume growth.

- June 2024: This year’s Future Travel Experience conference in Dublin saw the kick-off of the BOOST programme. This is an initiative by Royal Schiphol Group, Future Travel Experience and innovative consultancy firm nlmtd. In the BOOST programme, airports work together on new technologies and improvements in the area of robotics and automation in baggage handling.

Airport Baggage Handling System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Identification Technologies Covered | Barcode System, RFID System |

| Airport Classes Covered | Class A Airport, Class B Airport, Class C Airport |

| Check-In Types Covered | Assisted Service Bag Check-In, Self-Service Bag Check-In |

| Types Covered | Conveyor System, Destination Coded Vehicle |

| Efficiencies Covered | Below 3000, 3000 to 6000, Above 6000 |

| Cost Analysis Covered | Operational Cost Analysis, Installation Cost Analysis |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Alstef Group, Ansir Systems, Babcock International Group PLC, Beumer Group, CIMC Pteris Global, Daifuku Co., Ltd. (Daifuku Group), G&S Airport Conveyor, Leonardo S.p.A., Logplan LLC, Siemens Logistics LLC (Siemens AG), SITA, Vanderlande Industries B.V. (Toyota Industries Corporation), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the airport baggage handling system market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global airport baggage handling system market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the airport baggage handling system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The airport baggage handling system market size is anticipated to reach USD 5.4 Billion in 2025.

The airport baggage handling system market is expected to reach USD 14.1 Billion by 2034 exhibiting a CAGR of 11.00% from 2026-2034.

The market is primarily driven by increasing air passenger traffic, airport modernization projects, and the adoption of advanced technologies like RFID, AI, and IoT for efficient baggage tracking. Rising demand for automation, security enhancements, smart airports, and eco-friendly baggage handling solutions further fuels growth globally.

Asia Pacific dominates the airport baggage handling system market in 2025, accounting for a share exceeding 33.9%. This dominance is fueled by rapid economic growth, increased air travel, and significant investments in airport infrastructure across the region.

Some of the major players in the airport baggage handling system market include Alstef Group, Ansir Systems, Babcock International Group PLC, Beumer Group, CIMC Pteris Global, Daifuku Co., Ltd. (Daifuku Group), G&S Airport Conveyor, Leonardo S.p.A., Logplan LLC, Siemens Logistics LLC (Siemens AG), SITA, and Vanderlande Industries B.V. (Toyota Industries Corporation), among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)