Aircraft Transparencies Market Size, Share, Trends and Forecast by Aircraft Type, Material, Application, End Use, and Region, 2025-2033

Aircraft Transparencies Market Size and Share:

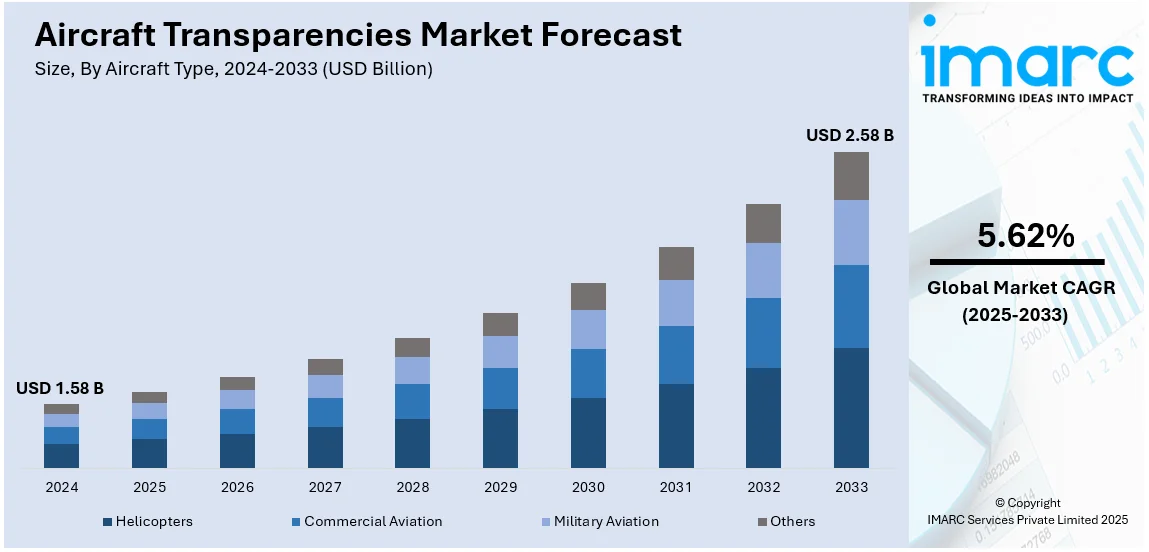

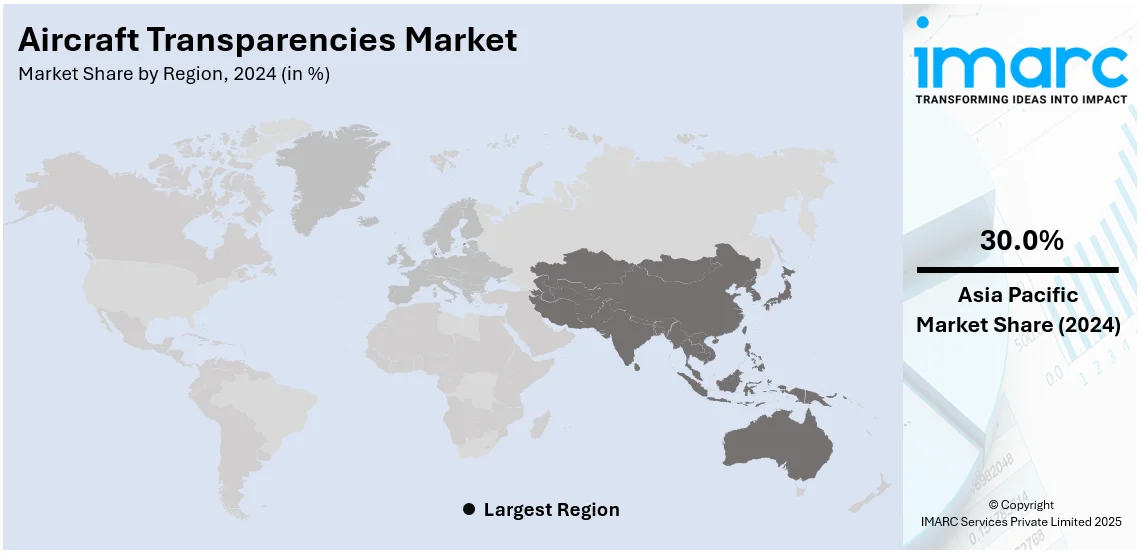

The global aircraft transparencies market size was valued at USD 1.58 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.58 Billion by 2033, exhibiting a CAGR of 5.62% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 30.0% in 2024. The aircraft transparencies market share is expanding, driven by the heightened number of passengers traveling by air, heightened requirement for both short-haul and long-haul flights, and rising emphasis on passenger safety.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.58 Billion |

|

Market Forecast in 2033

|

USD 2.58 Billion |

| Market Growth Rate (2025-2033) | 5.62% |

One of the fundamental drivers of growth in the market is the continued expansion of global air travel. With a heightened number of passengers traveling by air, the demand for new aircraft has increased. According to industry forecasts, the commercial aviation sector is poised for consistent growth, especially in emerging markets. Airlines are investing in fleet expansion and modern aircraft designs, which require advanced transparencies that can meet new safety standards, performance requirements, and aesthetic preferences. The growing requirement for both short-haul and long-haul flights is directly contributing to the increasing need for new and replacement aircraft transparencies, thereby catalyzing the aircraft transparencies market demand.

The United States has emerged as a major region in the aircraft transparencies market owing to innumerable factors. Innovations in material technology have been a key trend shaping the market in the country. Traditional materials such as acrylic and polycarbonate are being gradually replaced by high-performance composites, including advanced glass and thermoplastic materials. These materials offer superior optical clarity, scratch resistance, and impact strength, which are essential for ensuring the longevity and safety of aircraft components. For instance, the use of laminated glass and layered composites allows for better weight management and improved resistance to extreme environmental conditions such as high altitudes and temperature fluctuations. The development of lighter and more durable materials also contributes to fuel efficiency, which is a critical consideration in modern aircraft design. For example, in 2024, Alaska Airlines declared an investment in JetZero, which is a major firm developing a new blended-wing body (BWB) aircraft that will present up to 50% less fuel burn and minimal emissions.

Aircraft Transparencies Market Trends:

Increasing Demand for Advanced Materials

The demand for advanced materials in the market has significantly risen as the aviation industry continues to push for lighter, stronger, and more durable components. This shift is primarily driven by the need for enhanced performance, safety, and fuel efficiency in modern aircraft. Traditional materials like acrylic and polycarbonate are being supplemented or replaced with advanced composites and specialized coatings that offer superior resistance to harsh environmental factors such as ultraviolet (UV) radiation, high-altitude pressures, and extreme temperature fluctuations. These advancements are essential for ensuring the longevity and functionality of aircraft transparencies, which are subjected to constant wear and tear during operations. For instance, in March 2024, Stratolaunch's supersonic TA-1 test vehicle achieved its first powered flight, advancing hypersonic testing. This launch impacts aircraft transparencies by driving the development of materials capable of withstanding extreme speeds and thermal stress, essential for next-gen hypersonic aviation technologies.

Growing Emphasis on Passenger Safety Features

Passenger safety is a top priority, driving improvements in aircraft transparencies. Moreover, enhanced impact resistance, fire retardancy, and optical clarity contribute to better overall safety, thereby offering a favorable aircraft transparencies market outlook. In particular, the emphasis on optical clarity is essential not only for safety but also for ensuring that passengers can enjoy unobstructed views during their flight. Enhanced clarity in windows contributes to an overall improved passenger experience, which has become a key selling point for airlines competing for customer loyalty. Furthermore, modern aircraft transparencies are increasingly designed to minimize glare and reduce UV radiation exposure, both of which contribute to better passenger comfort and well-being during long flights. For instance, in May 2024, Intelsat launched inflight connectivity on Condor Airlines' new airbus fleet, featuring 2Ku antennas. This development impacts aircraft transparencies by enhancing passenger experience with high-speed connectivity, thereby supporting the integration of transparent, durable inflight window technologies across airbus narrowbody aircraft.

Integration of Anti-Counterfeiting Technologies

As the aerospace industry becomes more sophisticated, so too does the issue of counterfeit components, which pose significant risks to both aircraft safety and operational efficiency. To combat this challenge, the integration of anti-counterfeiting technologies into aircraft transparencies has become a critical development in ensuring the authenticity and traceability of these vital components. Counterfeit parts, which are often substandard or misidentified, can lead to safety hazards and maintenance challenges. The implementation of advanced tracking and authentication systems is a key approach to relieve such risks and maintain the integrity of the aerospace supply chain. For instance, in July 2024, GA Telesis and Alitheon partnered to enhance aircraft transparency with FeaturePrint technology, thereby providing secure traceability for aircraft parts. This innovative solution integrates with the WILBUR platform, ensuring accurate verification of physical parts and eliminating risks associated with counterfeit and misidentified components across the aviation industry.

Aircraft Transparencies Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global aircraft transparencies market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on aircraft type, material, application, and end use.

Analysis by Aircraft Type:

- Helicopters

- Commercial Aviation

- Military Aviation

- Others

Commercial aviation leads the market with 58.6% of market share in 2024. Commercial aviation is the biggest segment, given the increased need for air travel around the globe. Commercial aircraft demand large numbers of transparency parts such as windshields on cockpits, passenger windows, and cabin canopies for passengers and crew comfort and safety. Commercial aircraft transparencies must meet stringent regulatory standards for impact resistance, fire resistance, and optical clarity, while also contributing to energy efficiency through features like UV filtering and glare reduction. Additionally, the increasing emphasis on passenger comfort has led to innovations in materials that minimize noise and vibrations, improving the overall flying experience. There is also the shift toward more passenger connectivity and comfort, and smarter transparency technologies such as integrated AR displays and next-generation window designs are therefore influencing the direction of development, further propelling the aircraft transparencies market growth.

Analysis by Material:

- Acrylic

- Glass

- Polycarbonate

Polycarbonate leads the market with 54.8% of the market share in 2024. Polycarbonate is a popular material for aircraft transparencies due to its lightweight, durability, and impact resistance. It is commonly employed in military aircraft, helicopters, and certain commercial applications where weight reduction is a critical factor. Unlike glass, polycarbonate is less prone to shattering upon impact, making it an ideal choice for components exposed to high levels of stress, such as canopies and windshields in high-speed aircraft. It also offers better resistance to extreme temperatures and environmental factors, including UV radiation, compared to traditional glass. Additionally, polycarbonate can be easily molded into complex shapes, providing design flexibility for manufacturers. It offers excellent optical clarity, making it ideal for windows and canopies. For example, PPG aerospace introduced a new polycarbonate windshield for commercial aircraft, enhancing safety and visibility.

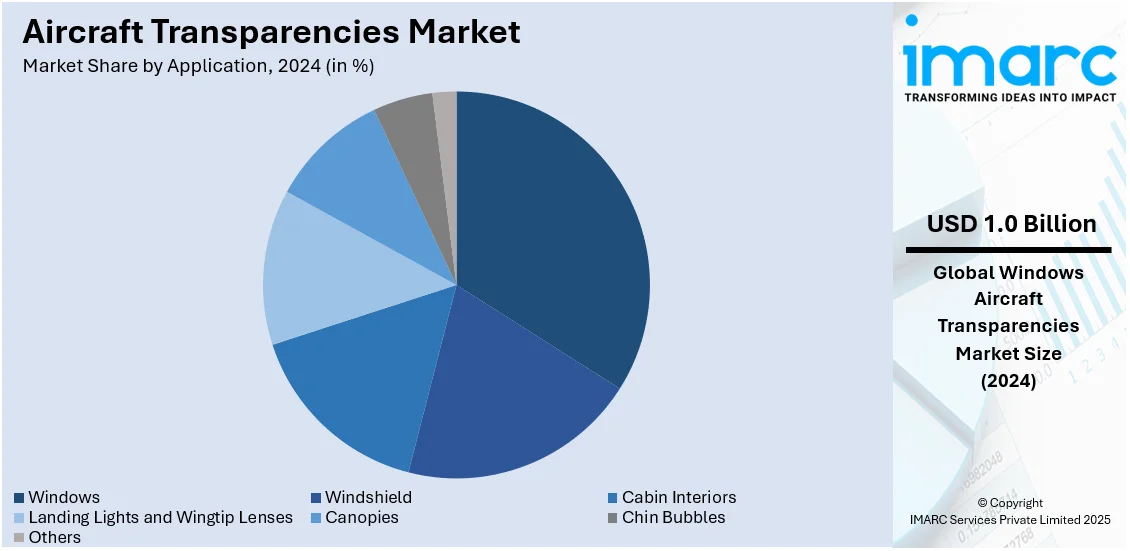

Analysis by Application:

- Windows

- Windshield

- Cabin Interiors

- Landing Lights and Wingtip Lenses

- Canopies

- Chin Bubbles

- Others

Windows hold 33.8% of the market share. The windows segment is a significant portion of the market, primarily driven by the need for clear, durable, and lightweight windows in both commercial and military aviation. Aircraft windows are essential not only for providing visibility and ensuring the safety of passengers and crew but also for contributing to the overall structural integrity of the aircraft. In commercial aviation, windows are designed to meet stringent regulations, including high-pressure tolerance and impact resistance, while also offering thermal and acoustic insulation for passenger comfort. As the demand for air travel continues to rise, airlines are increasingly focusing on replacing older aircraft windows with newer, more advanced materials that enhance safety features and improve fuel efficiency.

Analysis by End Use:

- Original Equipment Manufacturers (OEM)

- Aftermarket

Aftermarket leads the market with 60.0% of market share in 2024. The aftermarket is essentially the replacement, maintenance, and repair of existing aircraft. In other words, as aircraft grow old and in need of refurbishment or upgrading, there's a need to replace certain parts with the appropriate aftermarket products for continued safety, performance, and regulatory compliance. Aftermarket suppliers provide replacement windshields, windows, canopies, and other transparent components that are prone to wear and tear due to regular use, environmental factors, or operational stresses. This market is driven by the age of the aircraft fleet, the maintenance requirement, and the changing regulatory demands for safety and durability. The aftermarket also derives benefit from airlines and operators seeking to extend the life of older aircraft by replacing or upgrading transparency components with more advanced, durable materials. Furthermore, as the world's aviation industry continues to embrace sustainability, the need for green material and technologies for after-market solutions that will improve the performance and efficiency of old aircraft increases.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 30.0%. One of the primary drivers of growth in the Asia-Pacific market is the rising demand for air travel. As disposable incomes increase, particularly in emerging markets such as China and India, the middle class is expanding rapidly, leading to greater demand for both domestic and international flights. The growing preference for air travel, coupled with the rapid urbanization of many Asia-Pacific countries, has encouraged airlines to invest in expanding and modernizing their fleets. This surge in fleet growth requires advanced transparencies to ensure safety, performance, and passenger comfort. As per the information provided by the Indian Aerospace & Defence Bulletin, in the year 2024 (January-November), scheduled domestic airlines conducted 1.02 million scheduled flights, transporting 146.4 million scheduled passengers, compared to 0.97 million scheduled flights with 138.2 million scheduled passengers in the prior year 2023 (January-November). The volume of domestic travelers transported by scheduled Indian carriers has seen an increase of 5.9% in 2024 relative to the same timeframe in 2023 (January to November).

Key Regional Takeaways:

United States Aircraft Transparencies Market Analysis

The United States hold 85.70% share in North America. The US market is growing because of investments in strong defense and the expanding commercial aviation sector. Recently, the U.S. Department of Defense's 2023 defense budget was about USD 916 billion, with a significant portion set aside for developed aircraft components, including transparencies. Additionally, the commercial aviation sector also experienced healthy demand; Boeing, for instance, delivered 528 aircraft in 2023, indicating steady aircraft production. New generations of fighter aircraft and commercial jets are fueling demand for canopy and window material with high-performance properties. Players like PPG Aerospace and GKN Aerospace continue to lead in lightweight, high-strength, and durable transparencies. Domestic production and government support for R&D ensure technological leaps, while exports place U.S. manufacturers squarely in the world market.

Europe Aircraft Transparencies Market Analysis

The European market is increasing due to more defense budgets and expansion in commercial aviation. According to a government report, Germany, France, and the UK have taken the lead in defense investment, while Germany's defense fund managed to reach USD 107.2 billion by 2022. Airbus, a leader in European aerospace, delivered 735 aircraft in 2023, further strengthening demand in durable, lightweight transparencies. Electrochromic windows and smart coatings improve passenger comfort and operational efficiency. Companies, such as Saint-Gobain Aerospace and GKN Aerospace, are innovating with the EU's sustainability backings for 'green' material use. EU's focus on reducing aircraft emissions is pushing to use advanced transparencies to improve the fuel efficiency and thus strengthen the position of European players in global markets.

Asia Pacific Aircraft Transparencies Market Analysis

The growth of the Asia Pacific market is increasing due to rising defense expenditures and growing commercial aviation. China's defense budget has risen to USD 230 billion in 2022, focussing more on the development of military aircraft. In India's 2023–2024 budget, defense has been assigned a share of USD 72.6 billion to sustain homegrown aircraft programs. In 2023, Airbus delivered 571 aircraft to the Asia Pacific region. The region is placing orders for transparencies for fighter aircraft and future fighters, where product durability and optics are enhanced. Local and foreign aerospace companies forge partnerships that boost innovation. Domestic Indian companies Hindustan Aeronautics Limited (HAL) have collaboration with global entities for technology acquisition. Growing aviation demand and State-sponsored R&D support further help the market scale up.

Latin America Aircraft Transparencies Market Analysis

The market in Latin America is growing due to the increasing defense investments and commercial aviation growth. An industrial report has stated that Brazil's defense budget was USD 21.8 billion in 2022, which focused on modernizing military aircraft. Demand for civilian aviation is also growing as airlines are expanding their fleets due to growing air travel. Embraer, the leading regional aircraft manufacturer, is one of the major players in the advancement of aircraft transparency technologies. Countries like Mexico and Colombia will invest in space infrastructure, pushing local manufacturing of innovation. It is the main driver for doing research on sustainability in lightweight transparencies that are resilient to impact; this will greatly improve fuel consumption. Government-run programs and cross-border partnerships increase the region's aerospace capabilities; Latin America positions itself as the emerging player within the aircraft transparency market.

Middle East and Africa Aircraft Transparencies Market Analysis

Defense modernization and aviation expansion have been driving the market in the Middle East and Africa. For 2025, Saudi Arabia's defense budget was allocated at USD 78 billion, which translates to 21% of the country's total government spending, as per reports. Such investments in advanced military aircraft boost demand for high-performance transparencies, and the same is expected from the future expansion of the air forces in the UAE and Qatar. Africa is advancing in aerospace industry. South Africa's Denel manufactures aircraft components, including transparencies, for both military and commercial use. Impact-resistant materials and UV-protective coatings further improve operational efficiency in extreme climates. Investments by the government, combined with strategic partnerships with key players globally, enhance regional capabilities, facilitating continued growth in market spaces.

Competitive Landscape:

A major strategy employed by key market players in the market is significant investment in research and development (R&D). The need for advanced materials and innovative technologies is driving companies to explore new possibilities in transparency products. Research efforts are largely focused on developing lighter, stronger, and more durable materials that improve the overall performance and safety of aircraft transparencies. In addition to material improvements, R&D investments are also directed toward the development of smart transparency technologies, such as electrochromic windows, which automatically adjust their tint based on ambient lighting conditions. For instance, in November 2023, the airline Emirates, based in Dubai, became the first customer for the aerBlade window shade produced by Aerospace Technologies Group (ATG). The airline’s upcoming fleet of Airbus A350 and Boeing 777X featured the installation of the blind systems. As the demand for high-quality aircraft transparencies grows, especially with the expansion of global fleets, companies are scaling up their production capabilities to meet this demand. Leading players in the market are investing in expanding manufacturing facilities, improving automation, and streamlining production processes to enhance efficiency and output.

The report provides a comprehensive analysis of the competitive landscape in the aircraft transparencies market with detailed profiles of all major companies, including:

- Aeropair Ltd.

- Aviation Glass

- Control Logistics Inc.

- GKN Aerospace Services Limited

- Lee Aerospace

- Llamas Plastics Inc.

- MECAPLEX Ltd.

- Micro-Surface Finishing Products Inc.

- PPG Industries Inc.

- Saint-Gobain Aerospace

- Spartech LLC

- The NORDAM Group LLC

Latest News and Developments:

- September 2024: IATA announced the launch of the Sustainable Aviation Fuel (SAF) Matchmaker platform, aimed at connecting airlines with SAF suppliers, which improves transparency and efficiency.

- September 2024: Anisos Capital Group introduced the world's first tokenized aviation finance fund through EVIDENT's platform, which supports aircraft leasing, enhancing transparency in financial operations.

- June 2024: GKN Aerospace stated proposals to double F-35 canopy production at its Garden Grove, California, site, backed by up to USD 150M in customer investment. The expansion, completing by January 2027, will create 100+ jobs, supporting rising OE and aftermarket demand for F-35 transparencies worldwide.

- June 2024: Lee Aerospace has acquired Llamas Plastics, Inc., expanding into the military aerospace transparency market. Facilitated by Keystone Business Advisors, the deal enhances Lee Aerospace’s product portfolio and capacity. Both companies aim to integrate technology and expertise for advanced aerospace solutions. Llamas Plastics’ leadership expresses confidence in the partnership’s future.

- April 2024: Satair, an Airbus Services company, launched a campaign at MRO Americas. This initiative emphasizes Satair's proactive approach, focusing on meeting evolving customer demands, including delivering aircraft transparencies and spare parts for the aviation aftermarket with strategic precision.

Aircraft Transparencies Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Aircraft Types Covered | Helicopters, Commercial Aviation, Military Aviation, Others |

| Materials Covered | Acrylic, Glass, Polycarbonate |

| Applications Covered | Windows, Windshield, Cabin Interiors, Landing Lights and Wingtip Lenses, Canopies, Chin Bubbles, Others |

| End Uses Covered | Original Equipment Manufacturers (OEM), Aftermarket |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aeropair Ltd., Aviation Glass, Control Logistics Inc., GKN Aerospace Services Limited, Lee Aerospace, Llamas Plastics Inc., MECAPLEX Ltd., Micro-Surface Finishing Products Inc., PPG Industries Inc., Saint-Gobain Aerospace, Spartech LLC, The NORDAM Group LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the aircraft transparencies market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global aircraft transparencies market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the aircraft transparencies industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global aircraft transparencies market was valued at USD 1.58 Billion in 2024.

The aircraft transparencies market is projected to exhibit a CAGR of 5.62% during 2025-2033, reaching a value of USD 2.58 Billion by 2033.

The aircraft transparencies market is driven by multiple factors, including the expansion of global air travel, increasing demand for modern aircraft, heightened safety and performance requirements, technological advancements in transparency materials, and growing emphasis on passenger comfort.

Asia Pacific currently dominates the aircraft transparencies market, accounting for over 30.0% of the market share in 2024. The region's growth is fueled by rising disposable incomes, expanding middle classes, increasing demand for air travel, and substantial investments in both commercial and military aircraft fleets.

Some of the major players in the aircraft transparencies market include Aeropair Ltd., Aviation Glass, Control Logistics Inc., GKN Aerospace Services Limited, Lee Aerospace, Llamas Plastics Inc., MECAPLEX Ltd., Micro-Surface Finishing Products Inc., PPG Industries Inc., Saint-Gobain Aerospace, Spartech LLC, The NORDAM Group LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)