Aircraft Lighting Market Size, Share, Trends and Forecast by Light Type, Aircraft Type, Aircraft Design, Installation Type, and Region, 2025-2033

Aircraft Lighting Market 2024, Size and Trends:

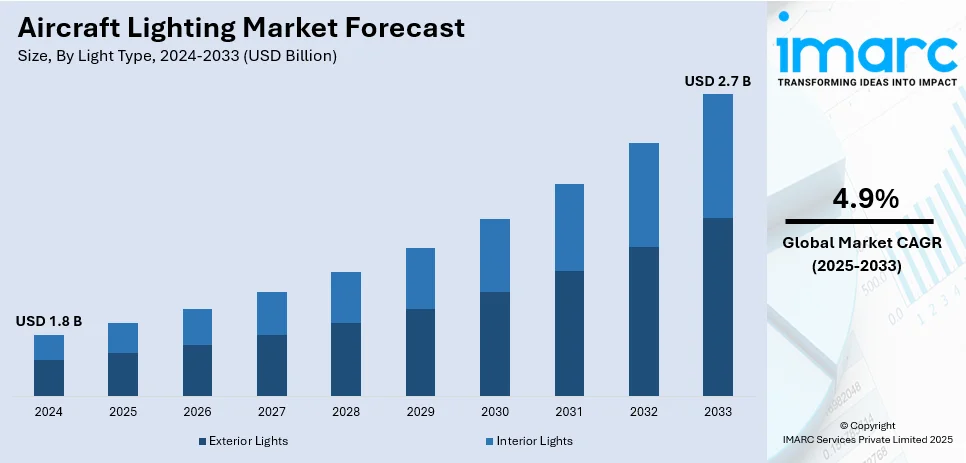

The global aircraft Lighting market size was valued at USD 1.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.7 Billion by 2033, exhibiting a CAGR of 4.9% during 2025-2033. Asia Pacific currently dominates the market, holding a significant aircraft lighting market share of over 35.8% in 2024. The market is fueled by increasing air travel, fleet expansion, the rising demand for energy-efficient technologies, passenger comfort enhancements, and regulatory safety standards.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.8 Billion |

|

Market Forecast in 2033

|

USD 2.7 Billion |

| Market Growth Rate (2025-2033) | 4.9% |

The aircraft lighting market is influenced by various factors, such as the growing demand for air travel, which has led to an increase in commercial and military aircraft production. Airlines are focusing on enhancing passenger experience with advanced lighting solutions like LED and mood lighting, catering to preferences for comfort and personalized environments. The push for energy-efficient technologies to reduce fuel consumption and carbon emissions is acting as another significant driver, with LEDs leading the shift. Fleet modernization and retrofitting older aircraft with advanced lighting systems also boost the aircraft lighting market growth. Additionally, stringent aviation regulations emphasizing safety and visibility further support the adoption of innovative lighting systems. Rising defense budgets and advancements in smart lighting technologies contribute to market expansion.

The aircraft lighting market in the United States is driven by the country’s robust aerospace industry, led by major manufacturers like Boeing, and the high demand for commercial and military aircraft. The increasing number of air travelers, coupled with the expansion of airline fleets fuel the adoption of advanced lighting systems, particularly energy-efficient LEDs, representing one of the key aircraft lighting market trends in the United States. For instance, in the Bureau of Transportation Statistics (BTS) in 2024 reported that 86.8 million passengers were transported by U.S. airlines on domestic and international scheduled service. Retrofitting older aircraft with modern lighting solutions to enhance efficiency and passenger comfort further drives market growth. The U.S. government’s high defense spending supports the development of advanced lighting technologies for military aircraft. Additionally, stringent FAA regulations emphasizing safety, visibility, and compliance with environmental standards encourage the adoption of innovative lighting solutions. The emphasis on sustainable aviation further accelerates the integration of efficient lighting systems.

Aircraft Lighting Market Trends:

Integration of LED Technology

The aircraft lighting market witnesses significant transition towards the adoption of LED technology instead of traditional incandescent and halogen lights. LED lights have various benefits over the conventional lighting, including longer life, less power consumption, and more durability, which explains their excellent fit for the challenging aviation environment. LED lighting systems are more environmentally friendly than traditional lighting due to less heat output and lower power consumption, and thus lead to better fuel economy. LED lighting offers notable advantages, including a lifespan of up to 50,000 hours compared to the 2,000 hours offered by traditional incandescent lights. Additionally, LEDs consume up to 80% less power than halogen or incandescent bulbs, contributing to significant energy savings for airlines. In addition, they also allow aircraft designers to come up with more imaginative and pleasing environments inside the cabins by offering multi-color-changing capacities and improved illumination control. In fact, cabin lighting is only one part of the larger area of exterior lighting systems, from landing lights, navigation lights, and strobe lights. The industry reports that adoption of LED technology is expected to grow further in the future with airlines and manufacturers looking to upgrade their existing fleets in line with changing energy efficiency and sustainability standards.

Emergence of Smart Lighting Systems

In the aircraft cabin, smart lighting systems are becoming more commonly found as airlines and manufacturers look to improve the customer experience while using less energy. In these systems, passengers and crew members can easily make adjustments to brightness and color to match their individual preferences or the environment of the cabin, such as cabin mood lighting or natural daylight simulation. Operationally, smart lighting systems save energy. Airlines are taking up these systems because they not only improve the passenger experience but also reduce the operational costs of airlines. This is because with customizable settings, such as color-changing LED lights, and automated cabin occupancy-based adjustments, airlines can save up to 20% on energy consumption, as per reports. Such systems can be set to automatically change the lighting around, depending on the occupancy levels or flight schedules. Energy is, therefore, consumed only when it is necessary. For instance, lights can be dimmed or turned off in areas that are not occupied. In this manner, smart lighting systems improve interaction with other aircraft systems, for example, further enhancing control and automation. The trend toward smart lighting is poised to grow as airlines look to satisfy customers and align themselves with sustainability objectives, thereby contributing to the aircraft lighting market growth across the globe.

Increased Focus on Safety and Visibility

Safety and visibility are critical elements of aircraft operations, especially when flying in poor light or bad weather. This has led to the aircraft lighting market focusing on developing advanced lighting solutions that increase visibility and safety while adhering to strict regulations. It covers innovations in runway lights, navigation lights, anti-collision lighting, and landing lights-all crucial to enhancing situational awareness and preventing accidents. For instance, manufacturers are developing lights with increased luminosity and wider beam angles to enhance pilots' visibility when flying at night or in conditions of fog. Aircraft navigation lights, which previously had a luminous intensity of 3,000 candelas, now feature lighting systems offering up to 5,000 candelas, improving visibility for pilots during low-light operations. Next-generation lighting systems that are more resistant to environmental factors such as extreme temperatures, vibrations, and moisture are also being adopted more widely. All these developments will support the industry's efforts toward evolving safety standards and improvement in the overall flight experience for passengers and crew.

Aircraft Lighting Market Analysis:

The market for aircraft lighting is growing steadily with the development of aviation technology, along with a rising emphasis on passenger comfort and safety. Aircraft lighting is imperative to improve visibility, ensure safety in operation, and ensure a comfortable flying experience. Key market drivers include the rising demand for new aircraft, especially in the commercial and military sectors, and the need for efficient lighting systems that meet regulatory standards. Additionally, the trend toward energy-efficient LED lighting is gaining traction, as it offers longer lifespans and lower energy consumption compared to traditional systems. The adoption of smart lighting solutions used for in-cabin purposes, including ambient lighting and customizable settings, is also driving market growth further. In addition to this, there is a growing requirement for retrofit lighting solutions to modernize current aircraft fleets. As air travel expands and technology continues to evolve, the aircraft lighting market is likely to grow continuously.

Expansion of the Global Aviation Industry:

The worldwide aviation sector has undergone considerable growth over the past few decades, fueled by rising demand for both domestic and overseas travel. Growing disposable incomes, especially in the developing world, have increased affordability of air transport for a broader section of society. Improved technology has seen more efficient aircraft, lowering operating costs and allowing airlines to reduce ticket prices. In addition, the proliferation of low-cost airlines has brought aviation fares down, opening up more routes to underserved areas. Airports themselves have expanded significantly to cover increasing passenger traffic, investing in network infrastructure to increase capacity and upgrade passengers' experience. Global tourism growth, combined with international trade and business travel, has further spurred the international reach of aviation. Despite setbacks such as fuel costs and environmental issues, the sector remains vibrant, with forecasts for continued growth in the next few years.

Aircraft Modernization:

Aircraft modernization is a process of replacing older aircraft with new technology to enhance performance, extend service, and increase operational efficiency. Updating avionics, engines, and systems to current standards, improving fuel efficiency, safety, and reliability is part of this process. Modernization may also focus on enhancing communications, navigation, and surveillance systems, making aircraft more adaptable to new regulations and technological advancements. For military aircraft, it can also involve upgrading weapons systems and defensive capabilities. The goal is to maintain competitiveness in a rapidly evolving aerospace environment without the cost of purchasing entirely new aircraft. Through modernization, airlines and military can reduce new aircraft acquisition costs and mitigate downtime. While balancing upgrades' cost and remaining life of the aircraft is required in making smart financial choices.

Aircraft Lighting Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global aircraft lighting market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on light type, technology, aircraft type, aircraft design, and installation type.

Analysis by Light Type:

- Exterior Lights

- Interior Lights

Interior lights leads the market with around 55.8% of the total aircraft lighting market share in 2024. Interior lights hold the largest share in the aircraft lighting market due to their critical role in increasing passenger experience and operational efficiency. These lights, including cabin, reading, and mood lighting, are essential for creating a comfortable and appealing in-flight environment. Airlines increasingly focus on advanced LED systems to reduce energy consumption, minimize maintenance costs, and provide customizable lighting for branding and passenger comfort. Rising demand for premium services, especially in long-haul flights, drives investments in innovative interior lighting. Additionally, stringent safety regulations and retrofitting older fleets with modern lighting systems contribute to their dominance in the aircraft lighting market.

Analysis by Technology:

- LED

- Fluorescent

- Others

LED technology dominates the market as the largest share due to its superior efficiency, durability, and cost-effectiveness. LEDs consume significantly less energy compared to traditional lighting systems, contributing to fuel savings and reduced carbon emissions. Their long lifespan minimizes maintenance costs and downtime, making them highly attractive to airlines. Additionally, LEDs offer enhanced design flexibility, enabling features like mood lighting and customizable color schemes that improve passenger experience. The growing focus on sustainability and compliance with aviation regulations further drives the adoption of LED systems. Their widespread use across interior, cockpit, and exterior applications solidifies their market dominance.

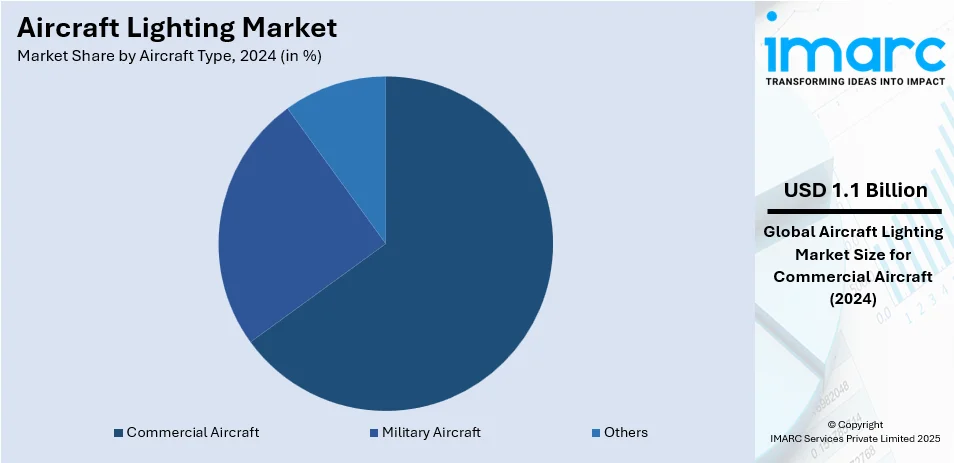

Analysis by Aircraft Type:

- Commercial Aircraft

- Military Aircraft

- Others

Commercial aircraft leads the market with around 65.0% of the market share in 2024. Commercial aircraft hold the largest share of the aircraft lighting market due to the significant global demand for air travel, which drives the production and operation of passenger aircraft. Airlines prioritize advanced lighting systems, such as LED cabin and mood lighting, to enhance passenger comfort and create a distinctive in-flight experience. The rise in fleet modernization and retrofitting initiatives also boosts demand for energy-efficient lighting solutions. Additionally, the growing adoption of long-haul flights and premium services amplifies the need for innovative interior lighting. Commercial aviation dominates the aircraft lighting market demand with a larger fleet size and higher passenger volumes than other aircraft segments.

Analysis by Aircraft Design:

- Fixed Wing

- Rotary Wing

Fixed-wing aircraft hold the largest share of the aircraft lighting market due to their extensive use in commercial, military, and general aviation. These aircraft dominate air transportation, serving the growing demand for passenger and cargo travel worldwide. The high production volume of fixed-wing aircraft drives significant demand for advanced lighting systems, including cockpit, cabin, and exterior lighting. Their long operational range and diverse applications necessitate energy-efficient and durable lighting solutions, such as LEDs. Additionally, continuous advancements in aircraft design and retrofitting programs for older fleets contribute to the adoption of innovative lighting technologies, reinforcing the dominance of fixed-wing aircraft in the market.

Analysis by Installation Type:

- Line-Fit

- Retrofit

Based on the aircraft lighting market forecast, line-fit holds the largest share in the aircraft lighting market because it is the default method for integrating lighting systems into newly manufactured aircraft. Aircraft manufacturers collaborate closely with lighting suppliers to install advanced lighting solutions during production, ensuring compliance with safety regulations and meeting customer preferences for energy efficiency and passenger comfort. The growing demand for new aircraft, driven by increasing air travel and fleet expansions, further fuels this segment. Line-fit installations also reduce retrofit costs and minimize operational disruptions, making them more attractive to airlines. The dominance of new aircraft production solidifies line-fit's leading position in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 35.8%. Robust growth is expected from the Asia Pacific aircraft lighting market, influenced by rising air travel and defense expenditure. The civil aviation sector of China accounted for around 620 million air passenger trips in 2023; this increased to 146.1% when compared with that of 2022, as per reports. Such an upward trajectory reflects increasing demands for superior-quality aircraft lighting. For the fiscal year 2024-2025, India's Ministry of Defence has been allocated ₹6,21,941 crore (approximately USD 75 billion), marking an 18.43% increase from the previous fiscal year, with significant investments in military aviation. These developments reflect the region's focus on modernizing aviation infrastructure and enhancing operational safety. Key players are leveraging innovation in cabin and exterior lighting to meet the rising demand. Support for growth in the market is provided by government initiatives such as China's civil aviation expansion and India's "Make in India" program. Technology transfers and innovation through partnerships with global firms sustain a positive aircraft lighting market outlook.

Key Regional Takeaways:

North America Aircraft Lighting Market Analysis

The aircraft lighting market in North America is driven by several key factors, including the region's robust aerospace industry and high air travel demand. The increasing production of commercial and military aircraft by manufacturers like Boeing and Lockheed Martin supports the demand for advanced lighting systems. Rising investments in next-generation aircraft with energy-efficient technologies, such as LED and OLED lighting, are pivotal. Regulations mandating safety and visibility standards fuel the adoption of innovative cockpit, cabin, and exterior lighting solutions. Growing passenger expectations for enhanced in-flight experiences, such as mood lighting and personalized illumination, further drive market growth. Additionally, the surge in retrofitting older aircraft fleets with modern lighting systems and advancements in lightweight materials align with the industry's focus on fuel efficiency. Strong defense budgets and the demand for tactical aircraft with advanced lighting capabilities also contribute to market expansion in North America.

United States Aircraft Lighting Market Analysis

In 2024, the United States accounted for the largest market share of over 87.80% in North America. The U.S. market for aircraft lighting is increasing owing to increased commercial air traffic and advanced military aviation requirements. As estimated by the Federal Aviation Administration (FAA), in 2023 alone, over 16 million scheduled commercial flights in the United States reflected healthy demand for efficient lighting solutions. Besides, the Department of Defense allocated a defense budget of USD 820.3 billion in 2023, where advanced avionics have been significantly invested, including lighting technologies. The industry players, such as Honeywell and Collins Aerospace, innovate with smart lighting systems that improve energy efficiency and operational safety. The market also benefits from strict FAA regulations mandating advanced lighting systems for improved safety and compliance. Additional advancements in technological components such as export growth for LED and OLED lighting solidify further the leadership status of the United States aircraft lighting market.

Europe Aircraft Lighting Market Analysis

Europe is growing its steady aircraft lighting market, based on increasing airline traffic and modernization programs. EUROCONTROL said that during 2023, Europe recorded 10.2 million flights, registering an increase of 10 percent compared with 2022, and these are already at 92 percent of the 2019 pre-COVID levels. Moreover, European Union Aviation Safety Agency (EASA) noted that the total number of arrivals and departures at EU27+EFTA airports increased to 8.35 million in 2023, still 10% lower than in 2019 before the COVID pandemic. Military spending in Germany was about USD 55.8 billion in 2022, with a considerable portion for military aviation modernization, supporting market growth. Sustainability-focused regulations spur the adoption of green lighting solutions. The market leaders are Safran and Lufthansa Technik, both of which produce state-of-the-art lighting technology for commercial as well as military aircraft, encompassing dynamic cabin lighting and exterior illumination.

Latin America Aircraft Lighting Market Analysis

The Latin American aircraft lighting market is growing, as air traffic and regional economic growth increase. Data from the National Civil Aviation Agency (ANAC) indicate that Brazil's airports handled around 112.7 million passengers in 2023, which is a marked increase from 97.7 million in 2022. This growth shows the recovery and growth of Brazil's aviation sector, the largest in the region. Investing in modern lighting solutions, airlines work to enhance both passenger experience and operational efficiency. Government initiatives focusing on the strengthening of aviation infrastructure, coupled with growing middle-class travel demand, are further complementing the momentum of the market. The advanced lighting technologies found in aircraft under development by top players such as Embraer are designed according to international requirements. Other drivers of innovation in aircraft lighting include collaboration with global manufacturers and focus on sustainability. This is bound to make Latin America competitive in the global aviation industry.

Middle East and Africa Aircraft Lighting Market Analysis

The market for Middle East and Africa aircraft lighting is growing as a result of high air traffic and defense spending. According to the International Air Transport Association, IATA, Middle Eastern air traffic increased by 33.3% in 2023 compared to the previous year. This is strong growth in tourism and business activities. Saudi Arabia has spent USD 75.01 billion on its defense budget in the year 2022, raising it by 18.7 percent from the figure in 2021. With a focus on modernizing the military aviation infrastructures, more advanced lighting systems have been required to be installed on the commercial and military aircraft. On the other hand, growth also comes from a rise in demand for airport development and expansion and aviation services for key markets including the UAE and Qatar. Manufacturers are paying attention to energy-efficient and durable lighting solutions as the demand for safe and reliable air travel increases.

Competitive Landscape:

The aircraft lighting market is highly competitive, driven by advancements in LED technology and the growing demand for energy-efficient solutions. Key players include Astronics Corporation, Honeywell International, Cobham Aerospace, and Collins Aerospace, focusing on innovative cabin, cockpit, and exterior lighting systems. Emerging companies are leveraging lightweight designs and smart lighting to gain traction. The market is propelled by increasing air travel, fleet expansion, and the push for sustainability. Intense rivalry exists among OEMs and aftermarket suppliers, with partnerships and R&D investments shaping the landscape. Regional players in Asia-Pacific and Europe are strengthening their foothold, targeting the lucrative aviation sector.

The report provides a comprehensive analysis of the competitive landscape in the aircraft lighting market with detailed profiles of all major companies, including:

- Astronics Corporation

- Bruce Aerospace (TransDigm Group Inc.)

- Cobham Plc.

- Diehl Stiftung & Co. KG

- Honeywell International Inc.

- Luminator Technology Group

- Oxley Group

- Safran S.A.

- Soderberg Manufacturing Co. Inc.

- STG Aerospace Ltd.

Recent Developments:

- In December 2024: PJ Aviation unveiled its upgraded Radio Activated Lighting Controller, replacing the Mark I model that has been in use for 20 years. The new version, launched at the Africa Aerospace and Defence (AAD) 2024 exhibition, features additional functions and a lower price due to reduced component costs. It allows pilots to activate runway lighting by pressing the push-to-talk button, saving energy, reducing light pollution, and improving security in conflict zones. The product targets both aviation and marine markets.

- December 2024: Honeywell Aerospace and Bombardier announced signing of an agreement to develop cutting-edge aviation innovations, such as next-generation avionics, like Honeywell's Anthem, into Bombardier aircraft, as well as enhanced satellite communications. The endeavor intends to pave in major new developments, namely JetWave X on Global and Challenger.

- April 2024: Cobham Aerospace is now integrated into Thales. All Audio/Radio Satcom, Antennas Lighting, Clock, and IHM solutions are covered under Thales and are open for purchase and maintenance. Brand names like Air Précision, Thrane & Thrane Aero, Comant Industries-are all included under Thales.

- In February 2024: Air India discovered a lighting malfunction in the economy class section of its Boeing 777 aircraft, affecting the cabin's illumination. This issue could impact passenger comfort and the overall in-flight experience. The airline is actively working to resolve the problem to ensure the lighting system meets the necessary standards for passenger safety and comfort.

- In January 2024: SoFly launched "Aircraft Lighting Pro" for Microsoft Flight Simulator (MSFS), a new add-on designed to enhance the visual realism of aircraft lighting. This update offers more accurate and immersive lighting effects for a variety of aircraft, aiming to elevate the flight simulation experience . With detailed and dynamic lighting solutions that replicate real-world aircraft lighting conditions, the release caters to both casual players and dedicated flight simulation enthusiasts.

Aircraft Lighting Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Light Types Covered | Exterior Lights, Interior Lights |

| Technologies Covered | LED, Fluorescent, Others |

| Aircraft Types Covered | Commercial Aircraft, Military Aircraft, Others |

| Aircraft Designs Covered | Fixed Wing, Rotary Wing |

| Installation Types Covered | Line-Fit, Retrofit |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Astronics Corporation, Bruce Aerospace (TransDigm Group Inc.), Cobham Plc., Diehl Stiftung & Co. KG, Honeywell International Inc., Luminator Technology Group, Oxley Group, Safran S.A., Soderberg Manufacturing Co. Inc. and STG Aerospace Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the aircraft lighting market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global aircraft lighting market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the aircraft lighting industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The aircraft lighting market was valued at USD 1.8 Billion in 2024.

The aircraft lighting market is projected to exhibit a CAGR of 4.9% during 2025-2033, reaching a value of USD 2.7 Billion by 2033.

Key market trends driving the aircraft lighting market include increasing air travel, fleet expansion, the demand for energy-efficient solutions like LEDs, enhanced passenger comfort, and strict safety regulations. Additionally, retrofitting older aircraft, advancements in lighting technologies, and rising defense spending further contribute to market growth.

Asia Pacific currently dominates the aircraft lighting market, accounting for a share of 35.8%. The aircraft lighting market in Asia Pacific is driven by increasing air travel, fleet modernization, rising disposable incomes, and growing investments in energy-efficient lighting technologies. These factors, collectively, are creating a positive aircraft lighting market outlook across the region.

Some of the major players in the aircraft lighting market include Astronics Corporation, Bruce Aerospace (TransDigm Group Inc.), Cobham Plc., Diehl Stiftung & Co. KG, Honeywell International Inc., Luminator Technology Group, Oxley Group, Safran S.A., Soderberg Manufacturing Co. Inc. and STG Aerospace Ltd.

The fastest-growing segment in the market is expected to be commercial aircraft, which currently leads with approximately 65.0% of the market share in 2024. As demand for air travel and technological advancements continue to rise, commercial aircraft will maintain its strong growth trajectory.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)