Air Quality Monitoring Market Report by Product Type (Indoor Monitors, Outdoor Monitors, Wearable Monitors), Pollutant (Chemical Pollutant, Physical Pollutant, Biological Pollutant), Sampling Method (Active/Continuous Monitoring, Passive Monitoring, Intermittent Monitoring, Stack Monitoring), End-User (Government Agencies and Academic Institutes, Commercial and Residential Users, Petrochemical Industry, Power Generation Plants, Pharmaceutical Industry, and Others), and Region 2026-2034

Air Quality Monitoring Market Size, Share & Trends:

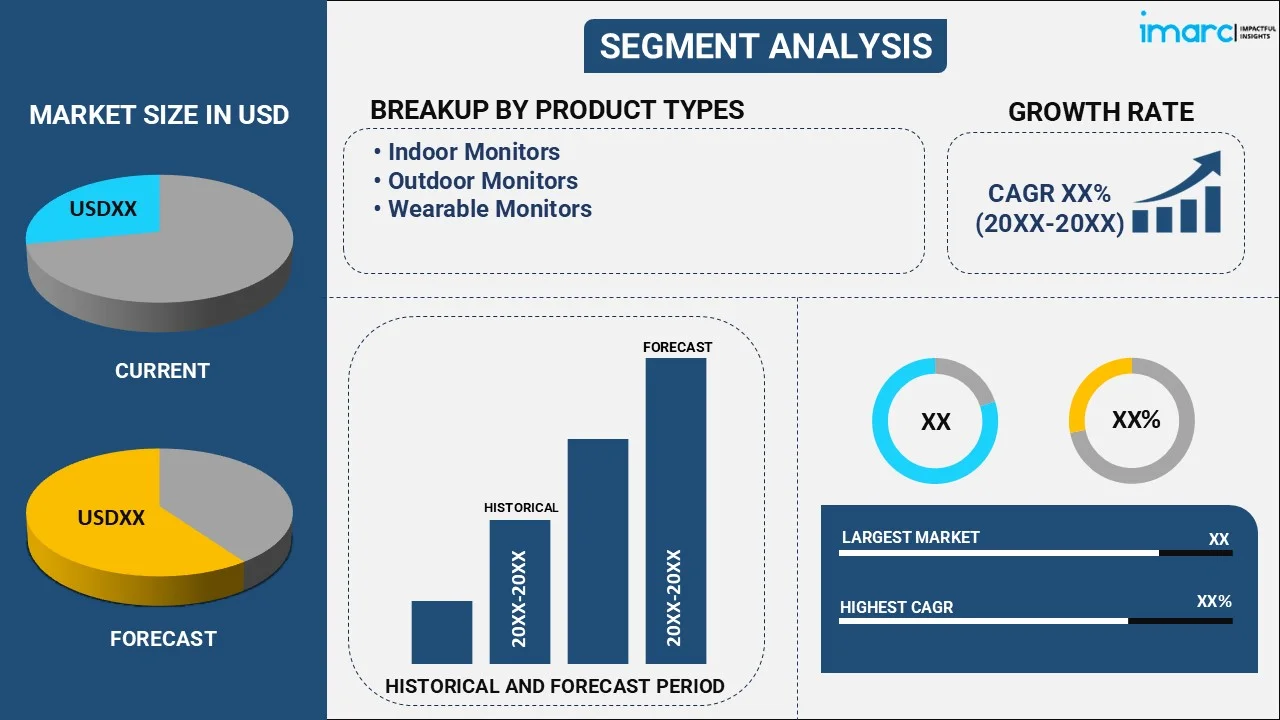

The global air quality monitoring market size reached USD 5.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 9.5 Billion by 2034, exhibiting a growth rate (CAGR) of 6.20% during 2026-2034. The growing pace of urbanization and industrialization, increasing public awareness about the harmful impacts of pollution on health, and incorporation of internet of things (IoT) and artificial intelligence (AI) in air monitoring systems to improve functionality are some of the factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 5.5 Billion |

|

Market Forecast in 2034

|

USD 9.5 Billion |

| Market Growth Rate (2026-2034) | 6.20% |

Air Quality Monitoring Market Analysis:

- Major Market Drivers: The market is experiencing moderate growth because of rising concerns about the effects of air pollution on health, increasing industrial activities, and the enforcement of strict air quality regulations by governments worldwide.

- Key Market Trends: The integration of the internet of things (IoT) and artificial intelligence (AI) in air quality monitoring systems for improving the process of collecting and analyzing real-time data is bolstering the market growth. Additionally, the increasing usage of portable and wearable devices for monitoring air quality, reflecting a shift towards personal and indoor air quality monitoring, is contributing to the market growth.

- Geographical Trends: North America leads the market on account of the growing awareness about air pollution on health, the implementation of stringent regulations, and the presence of key players.

- Competitive Landscape: Some of the major market players in the industry include Thermo Fisher Scientific, Siemens Aktiengesellschaft, Teledyne Technologies, Emerson Electric, General Electric Company, 3M Company, Horiba, Merck KGaA, Aeroqual, TSI Incorporated, Testo India Pvt. Ltd., Honeywell International Inc., Agilent Technologies, TE Connectivity, Tisch Environmental, and Spectris plc.

- Challenges and Opportunities: Challenges like the expensive nature of air quality monitoring systems and the necessity of consistent upkeep and calibration are influencing the air quality monitoring market revenue. Nevertheless, the availability of affordable and easy-to-use monitoring options and market presence of leading companies in emerging economies are expected to overcome these challenges.

To get more information on this market Request Sample

Air Quality Monitoring Market Trends:

Rising Urbanization and Industrialization

The rate of urbanization for permanent residence tripled since 1982, reaching 66.2% in 2023, as per the “China in Numbers (2023)” report by the United Nations Development Programme (UNDP). The expansion of cities and the rise in industrial activities are resulting in increased air pollution levels, necessitating stringent monitoring and control measures. Urban areas are dealing with issues related to traffic emissions, construction dust, and industrial discharges, leading to a decline in air quality. Municipal authorities and private enterprises are using advanced air quality monitoring systems to deal with these problems by tracking pollution levels and implementing effective mitigation strategies. Industrial areas are required to consistently track emissions for adhering to environmental laws and reducing their impact on the environment.

Growing Environmental Awareness and Health Concerns

Individuals and governing bodies are actively working to address air pollution because of the growing evidence linking poor air quality to a range of health problems, such as respiratory illnesses and heart issues. Furthermore, increased media exposure and educational initiatives are raising public awareness about pollution origins and health dangers. This growing awareness is not only driving the demand for residential and commercial air quality monitors but also influencing policy changes that mandate stricter air quality standards and continuous monitoring. In June 2024, Agartala in Tripura, India, set up two real-time air quality monitoring systems that are linked to Central Pollution Control Board (CPCB) servers, allowing residents to track pollution levels through the Sameer app. This project aimed to tackle air quality problems worsened by urbanization and seasonal changes, enhancing transparency and public awareness.

Technological Advancements and Integration

The incorporation of the internet of things (IoT) and artificial intelligence (AI) in monitoring systems is transforming the way data is collected, analyzed, and reported. These technologies allow for immediate monitoring and offer precise and thorough data, which is critical for making decisions promptly and imposing efficient pollution control measures. Sophisticated sensors and advanced analytical instruments can identify even the smallest concentrations of pollutants, enhancing the accuracy of air quality evaluations. Furthermore, there is a rise in portable and wearable air quality monitors to meet the growing need for personal and indoor air quality control. These technological advancements enhance air quality monitoring devices by improving their functionality and user-friendliness and broadening their usage in different sectors, like industrial and residential settings. In 2023, Siemens Aktiengesellschaft introduced Connect Box, an IoT solution designed for overseeing small to medium-sized buildings, improving energy efficiency and offering air quality tracking with live updates on temperature and humidity. This new product in the Siemens Xcelerator lineup is designed to make building management easier and enhance the quality of indoor air.

Air Quality Monitoring Market Segmentation:

IMARC Group provides an analysis of the key air quality monitoring market trends in each segment, along with forecasts at the global and regional levels for 2026-2034. Our report has categorized the market based on product type, pollutant, sampling method, and end-user.

Breakup by Product Type:

To get detailed segment analysis of this market Request Sample

- Indoor Monitors

- Outdoor Monitors

- Wearable Monitors

Outdoor monitors account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product type. This includes indoor monitors, outdoor monitors, and wearable monitors. According to the report, outdoor monitors represented the largest segment.

Outdoor monitors account for the majority of the market share, driven by the essential requirement to evaluate and control air pollution in urban and industrial regions. These monitors are essential for examining pollutants found in outdoor settings. The growing use of these monitors is also supported by the progress in sensor technology, which is enhancing the precision, dependability, and cost-effectiveness of outdoor air quality monitoring options. Governing bodies and environmental organizations are making notable investments in monitoring systems for outdoor air quality to ensure adherence to air quality regulations and safeguard public well-being. In 2024, Vietnam aimed to set up 113 additional air quality monitoring stations across the country, which includes automatic stations that specifically monitor health alerts and regional evaluations. This project is focused on improving environmental monitoring and public health outcomes by collecting and analyzing data extensively.

Breakup by Pollutant:

- Chemical Pollutant

- Physical Pollutant

- Biological Pollutant

Chemical pollutant holds the largest share of the industry

A detailed breakup and analysis of the market based on the pollutant have also been provided in the report. This includes chemical pollutant, physical pollutant, and biological pollutant. According to the report, chemical pollutant accounted for the largest market share.

Chemical pollutants like nitrogen oxides (NOX), sulfur dioxide (SO2), carbon monoxide (CO), ozone (O3), and volatile organic compounds (VOCs) play a significant role in air pollution, particularly in industrialized and urban regions. Moreover, there is a demand for robust air quality monitoring system because of increasing public awareness and emphasis on early identification and mitigation of the harmful impacts of chemical pollutants. Governing bodies in many countries are implementing strict regulations to manage the release of these dangerous chemicals, driving the need for advanced systems that monitor chemical pollutants. In December 2023, Mumbai's BMC revealed their intention to work with IIT Kanpur to put up 250 sensors for monitoring air quality at a detailed level. These systems, which run on solar energy, were created to monitor PM 2.5, PM 10, temperature, humidity, CO, and NOX, giving immediate information for specific pollution control measures.

Breakup by Sampling Method:

- Active/Continuous Monitoring

- Passive Monitoring

- Intermittent Monitoring

- Stack Monitoring

Active/continuous monitoring represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the sampling method. This includes active/continuous monitoring, passive monitoring, intermittent monitoring, and stack monitoring. According to the report, active/continuous monitoring represented the largest segment.

Active/continuous monitoring holds the biggest market share as per the air quality monitoring market outlook, driven by the growing demand for immediate and accurate information to handle and reduce air pollution efficiently. Continuous monitoring provides automated and ongoing gathering and assessment of air quality information, playing a crucial role in tracking pollutant concentrations in dynamic and high-risk settings like industrial locations, urban regions, and areas with heavy traffic. Technological advancements like the integration of IoT and advanced sensor technologies are also encouraging the adoption of active/continuous monitoring, improving data accuracy, reliability, and connectivity. Furthermore, the increasing focus on public health and environmental sustainability highlights the importance of ongoing air quality monitoring, leading to extensive adoption of active/continuous monitoring in different industries.

Breakup by End-User:

- Government Agencies and Academic Institutes

- Commercial and Residential Users

- Petrochemical Industry

- Power Generation Plants

- Pharmaceutical Industry

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes government agencies and academic institutes, commercial and residential users, petrochemical industry, power generation plants, pharmaceutical industry, and other.

Government agencies and academic institutions are mainly dedicated to conducting research, creating policies, and guaranteeing adherence to air quality regulations. Government organizations utilize extensive air quality monitoring systems to gather information, evaluate pollution levels, and enforce regulations to safeguard public well-being. Academic institutions utilize these monitoring systems for environmental research.

Commercial and residential users are driving the air quality monitoring market demand due to the growing awareness about the adverse health effects of air pollution on the masses. Businesses, such as office buildings, shopping malls, and hotels, purchase air quality monitors to guarantee a safe and healthy atmosphere for both employees and clients. Residents use these systems to oversee and enhance the air quality in their residences, motivated by concerns about allergens, VOCs, and other pollutants found indoors. In 2024, Bosch Sensortec introduced the BME690, a durable 4-in-1 MEMS air quality sensor designed for indoor spaces, with up to 50% less power usage than its previous model. It provides accurate tracking of gases, humidity, temperature, and barometric pressure, adhering to WELL and RESET® Air criteria for effective management of indoor air quality.

Petrochemical industry relies on air quality monitoring systems as they can emit dangerous pollutants during different operations. This sector depends on sophisticated monitoring solutions to check the release of chemical pollutants, including VOCs, sulfur compounds, and particulate matter. Additionally, real-time data from these systems aids in maintaining safety standards and preventing accidents caused by toxic gas leaks, thereby safeguarding both workers and the surrounding communities.

Breakup by Region:

To get more information on the regional analysis of this market Request Sample

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

North America leads the market, accounting for the largest air quality monitoring market share

The report has also provided a comprehensive analysis of all the major regional markets, which include Europe, North America, Asia Pacific, the Middle East and Africa, and Latin America. According to the report, North America represents the largest regional market for air quality monitoring.

North America leads the market due to strict environmental regulations, advanced technology, and rising awareness about air pollution on health. The proactive approach of the region towards environmental conservation and the growing investments in monitoring technologies are enabling the widespread implementation of air quality monitoring systems in urban and industrial areas. Furthermore, partnerships between public agencies and private companies, along with the adoption of smart city initiatives, are contributing to the air quality monitoring market growth. Additionally, the presence of numerous key players in the industry is fostering innovation and the development of state-of-the-art monitoring technologies. The focus of the region on sustainability and public health is further encouraging the adoption of air quality monitoring solutions, ensuring a proactive approach to managing and mitigating air pollution. In 2023, the Environmental Protection Agency (EPA) renewed its Cooperative Research and Development Agreement (CRADA) with Aeroqual for an additional three years to continue advancing cost-effective air sensor technologies for air quality monitoring. This expansion aimed to improve the precision, alignment, and use of these sensors, expanding on their original five-year partnership.

Competitive Landscape:

- The air quality monitoring market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the industry include Thermo Fisher Scientific, Siemens Aktiengesellschaft, Teledyne Technologies, Emerson Electric, General Electric Company, 3M Company, Horiba, Merck KGaA, Aeroqual, TSI Incorporated, Testo India Pvt. Ltd., Honeywell International Inc., Agilent Technologies, TE Connectivity, Tisch Environmental, Spectris plc, etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Key players in the industry are prioritizing strategic efforts to enhance their market standing and promote innovation. They are making notable investments in research operations to improve the precision, dependability, and connectivity of their monitoring systems. Efforts are being made to extend their reach and impact by forming partnerships and collaborations with governmental agencies, academic institutions, and other industries. These companies are also concentrating on broadening their product offerings by incorporating sophisticated technologies like IoT, AI, and cloud-based data analytics. Moreover, major air quality monitoring companies are focusing on improving the functionalities of their products. In 2024, Oizom launched AQBot, an affordable, industrial-grade air quality monitor designed to detect specific pollutants and particulate matter in real time for various industries. AQBot, available in 14 variants, offered robust data storage and versatile communication options and was compatible with Industry 4.0 requirements, enhancing safety and environmental monitoring.

Air Quality Monitoring Market News:

- May 2024: Thermo Fisher Scientific started producing air quality monitoring system (AQMS) analyzers in Nasik, India, to assist nearby industries in monitoring and regulating air pollution. This action was taken to improve the precision and accessibility of air quality information important for India's environmental efforts.

- May 2024: Wayne County partnered with JustAir Solutions to place 100 air quality monitors in 43 communities for residents to access real-time pollution data and alerts. This project was designed to improve visibility on environmental issues and promote public health by distributing 500 mobile monitors later in the year.

Air Quality Monitoring Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Indoor Monitors, Outdoor Monitors, Wearable Monitors |

| Pollutants Covered | Chemical Pollutant, Physical Pollutant, Biological Pollutant |

| Sampling Methods Covered | Active/Continuous Monitoring, Passive Monitoring, Intermittent Monitoring, Stack Monitoring |

| End-Users Covered | Government Agencies and Academic Institutes, Commercial and Residential Users, Petrochemical Industry, Power Generation Plants, Pharmaceutical Industry, Other |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Thermo Fisher Scientific, Siemens Aktiengesellschaft, Teledyne Technologies, Emerson Electric, General Electric Company, 3M Company, Horiba, Merck KGaA, Aeroqual, TSI Incorporated, Testo India Pvt. Ltd., Honeywell International Inc., Agilent Technologies, TE Connectivity, Tisch Environmental, Spectris plc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, air quality monitoring market forecast, and dynamics of the market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the market and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the air quality monitoring industry.

Key Questions Answered in This Report

The global air quality monitoring market was valued at USD 5.5 Billion in 2025.

We expect the global air quality monitoring market to exhibit a CAGR of 6.20% during 2026-2034.

The rising adoption of air quality monitoring system to examine dispersion, dry deposition, and chemical transformation and monitor deviation from the air quality standards is primarily driving the global air quality monitoring market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous manufacturing units for air quality monitoring systems.

Based on the product type, the global air quality monitoring market can be categorized into indoor monitors, outdoor monitors, and wearable monitors. Currently, outdoor monitors account for the majority of the global market share.

Based on the pollutant, the global air quality monitoring market has been segregated into chemical pollutant, physical pollutant, and biological pollutant. Among these, chemical pollutant currently holds the largest market share.

Based on the sampling method, the global air quality monitoring market can be bifurcated into active/continuous monitoring, passive monitoring, intermittent monitoring, and stack monitoring. Currently, active/continuous monitoring exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Europe, Asia Pacific, Middle East and Africa, and Latin America, where North America currently dominates the global market.

Some of the major players in the global air quality monitoring market include Thermo Fisher Scientific, Siemens Aktiengesellschaft, Teledyne Technologies, Emerson Electric, General Electric Company, 3M Company, Horiba, Merck KGaA, Aeroqual, TSI Incorporated, Testo India Pvt. Ltd., Honeywell International Inc., Agilent Technologies, TE Connectivity, Tisch Environmental, Spectris plc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)