Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Region, 2026-2034

Air Freight Market Size and Share:

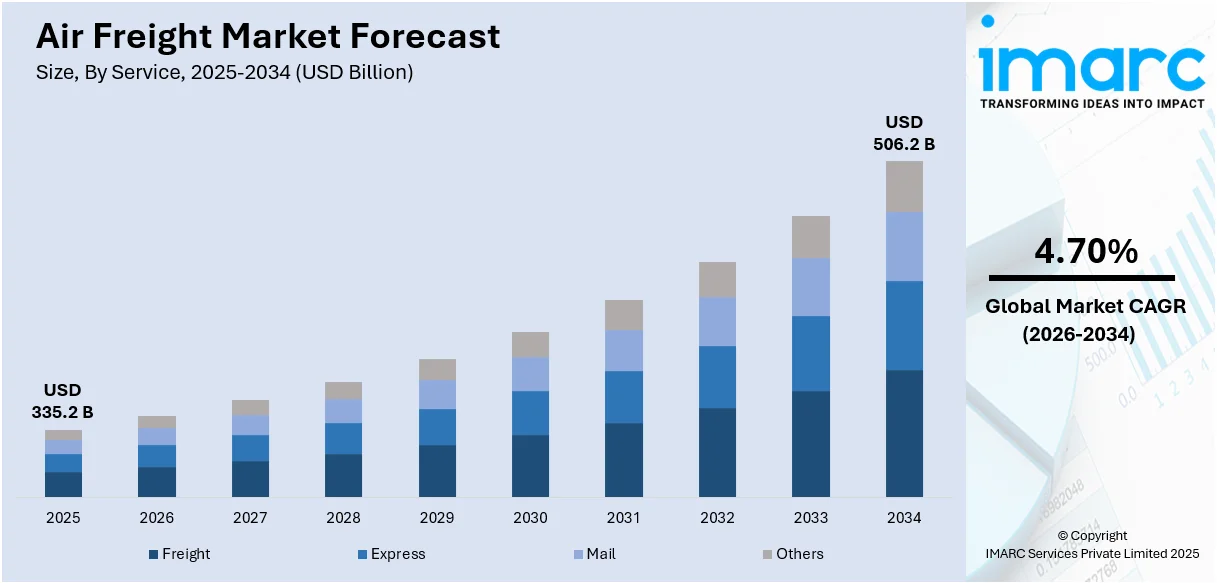

The global air freight market size was valued at USD 335.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 506.2 Billion by 2034, exhibiting a CAGR of 4.70% during 2026-2034. Asia Pacific dominated the market, holding a significant market share of 39.5% in 2025. The market is primarily driven by the escalating demand for fast and efficient transportation of goods across borders and the expanding e-commerce sector. Additionally, the increasing import and export of goods across countries globally and the continuous technological advancements are also favoring the air freight market 2025.

Key Insights:

- In terms of region, Asia Pacific held the leading position with a market share of 39.5% in 2025.

- Among services, freight generated the highest revenue with around 74.1% in 2025.

- The international segment was the top-performing destination with around 85.1% of market share in 2025.

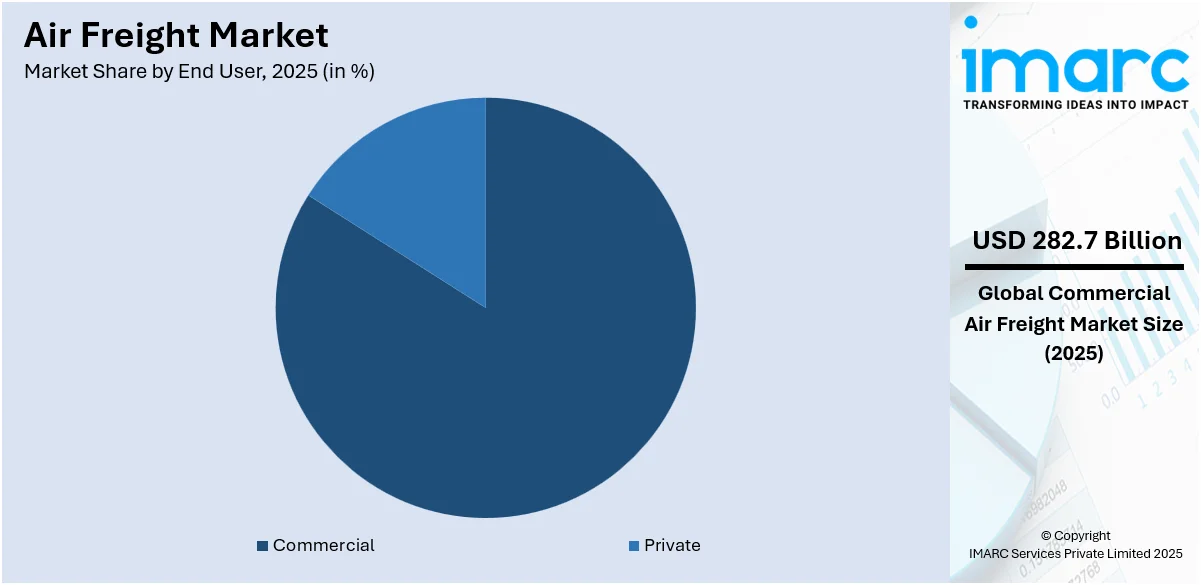

- Commercial emerged as the primary end user with around 88.5% of market share in 2025.

Market Size and Forecast:

- Market Size in 2025: USD 335.2 Billion

- Projected Market Size in 2034: USD 506.2 Billion

- CAGR (2026-2034): 4.70%

- Largest Market in 2025: Asia Pacific

The global air freight market is driven by the rapid growth of e-commerce, which demands faster delivery of goods. In India, the number of e-commerce users is projected to reach 501.6 million by the year 2029, with user penetration's more stable approach from 22.1% in 2024 to 34.0% as per industry research. The average revenue per user (ARPU) is predicted to be INR 14,121. The Government e-Marketplace (GeM) recorded its highest-ever gross merchandise value (GMV) of USD 201.1 Billion in the fiscal year 2022-23. Increasing globalization and cross-border trade also fuel demand for efficient air cargo services. Technological advancements, such as automation and digital tracking, enhance operational efficiency and reliability. Rising consumer expectations for quick deliveries, especially in industries such as pharmaceuticals and perishables, further enhance the market. Additionally, economic growth in emerging markets and the expansion of international supply chains contribute to the sector's growth. Moreover, the increasing innovation in sustainable aviation solutions is creating a positive air freight market outlook 2025.

To get more information on this market Request Sample

The United States stands out as a key regional market, primarily driven by the growing demand for rapid and efficient logistics solutions, particularly in industries including healthcare, where time-sensitive shipments of pharmaceuticals and medical supplies are critical. The expansion of cross-border trade and the need for streamlined supply chains further drive market growth. In 2022, payments associated with the use of intellectual property (IP) crossed USD 1 Trillion annually, with a solid 5.5% annual growth since 2010. Led by the United States, which amassed nearly USD 130 Billion in worldwide IP exports, changes to cross-border trade have opened the doors for the market to flow. The growth in IP transactions is also reflective of a growing global appetite for technology and knowledge that impacts U.S. air freight performance, given its integral role in the rapid movement of intellectual property and goods around the world. Besides this, technological advancements, such as AI and IoT, are enhancing operational efficiency and cargo tracking capabilities. Additionally, the rise of omnichannel retail and consumer expectations for faster deliveries are enhancing air freight demand. Infrastructure investments in airports and cargo facilities also play a key role in supporting the sector's development.

Air Freight Market Trends:

Increasing International Trade

The surge in global trade and the increasing need for fast and reliable transport of goods across international borders are major factors boosting demand for air freight services. In addition, growing procurement of parts, materials, and finished goods by companies from various countries and the frequent shipment of perishable and high-value items, including luxury goods, fresh food, flowers, electronics, pharmaceuticals, and more, are fueling the expansion of the air freight sector. For example, in August 2023, Shenzhen Bao’an International Airport in China recorded a twofold rise in cross-border e-commerce shipments from January to July, and further growth is anticipated in the remaining five months as freighter aircraft operations were introduced. The airport handled 93,000 tons of cross-border e-commerce cargo during that seven-month span, a 101% rise from the same period the year before. Alongside this, the growing need for storage space tied to airport freight traffic is expected to drive the development and use of SEZs, FTZs, and bonded warehouses.

Enhancing Supply Chain Resilience through Air Freight

The air freight market is playing a vital role in strengthening global supply chain resilience. In response to disruptions caused by geopolitical tensions, pandemics, and natural disasters, companies are increasingly turning to air cargo for its speed, reliability, and flexibility. Unlike ocean or land transport, air freight enables the rapid movement of critical goods, ensuring minimal downtime and helping businesses maintain inventory levels. This is especially important for industries like healthcare, electronics, and high-value manufacturing, where delays can lead to significant losses. Air freight also supports just-in-time delivery models, allowing companies to reduce warehousing needs and respond quickly to market changes. Logistics providers are investing in multi-modal transport networks, digital tracking, and cargo visibility tools to further reduce risk. With the rise of regional hubs and cross-border trade, air freight is becoming central to strategies that prioritize agility and risk mitigation in supply chain planning.

Escalating Demand for Fast-Delivery Services

Rising demand for quicker delivery services, like same-day or next-day shipping, driven by the growth of e-commerce and online retail, is helping to fuel the air freight market. The global e-commerce sector, which currently accounts for 16% of total air cargo activity, is expected to grow from USD 3.5 Trillion in 2022 to USD 7 Trillion by 2025. Along with this, there is growing pressure to deliver electronics, pharmaceuticals, fashion goods, and auto parts quickly, since many of these items are time-sensitive or have limited shelf life. According to the Association of Asia Pacific Airlines (AAPA), air cargo plays a key role in moving critical medical equipment and supplies. Forecasts also suggest that global e-commerce could hit USD 4.4 Trillion by 2026. Additionally, IATA highlights that 80% of global e-commerce shipments use air transport, making international purchases faster and more secure, and helping to improve efficiency, visibility, and reliability in cross-border logistics.

Rapid Innovations and Advancements

Ongoing tech improvements in air freight, like the adoption of smart tracking tools and the growing move toward automation and digital tools to boost transparency and efficiency, are supporting market expansion. Industry sources note that digital systems are projected to contribute to 70% of worldwide GDP growth over the next five years. The use of AI to optimize cargo handling, route planning, predictive maintenance, risk detection, and demand forecasting is also shaping air freight analysis. In April 2023, digital cargo platforms added new features allowing logistics providers handling imports to quickly schedule exports through agents based abroad. This update cuts out delays tied to getting quotes by phone or email. Lufthansa Cargo has also committed to digital upgrades, investing in an e-booking system and making their booking functions accessible through APIs so external users can view and book their inventory. In May 2023, FedEx launched FedEx Sustainability Insights, a cloud-based platform for tracking emissions. It uses near-real-time data from FedEx operations to estimate CO₂ output per tracking number and by FedEx.com account.

Air Freight Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global air freight market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on service, destination, and end user.

Analysis by Service:

- Freight

- Express

- Others

Freight leads the market with around 74.1% of market share in 2025. Freight is the most preferred service type, as it provides an efficient, reliable, and cost-effective transportation of goods internationally and domestically. Moreover, freight aids in ensuring the proper handling and packaging of the cargo, which includes appropriately protecting and securing the goods that are hazardous, fragile, or require special handling. For instance, Cargojet's bet on more aircraft led it to secure an expanded agreement with DHL Express. The pair announced a five-year cooperation agreement, with an option for another two years, for ACMI, CMI, charter, and dry leases. Canada's Cargojet already uses 12 aircraft for DHL, which is adding five 767Fs and next to handle 'expected cargo volume' DHL expanded its capacity in the Americas by 18% in the peak season and launched a weekly service from Vietnam to the US. Additionally, Cargojet recently signed purchase and conversion agreements for six more 777s, making eight more by 2026.

Analysis by Destination:

- Domestic

- International

International leads the market with around 85.1% of market share in 2025. International air freight offers the connectivity and speed required for moving goods between distant continents and countries, which makes it popular in the global supply chain. Besides this, the rising movement of high-value and perishable items, such as pharmaceuticals, luxury goods, electronics, and other time-critical products is also catalyzing the market growth in this segment. For instance, some global carriers are working to gain a more significant share of the door-to-door delivery market that online shopping giants such as Amazon, Alibaba, and JD.com dominate. Dubai-based Emirates launched Emirates Delivers, Lufthansa includes Heyday, and British Airways parent IAG includes Zenda. Moreover, according to the International Air Transport Association (IATA), in July 2023, the air cargo industry experienced a 20.7% increase from the previous month, maintaining steady growth since February 2023.

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Private

- Commercial

Commercial leads the market with around 88.5% of market share in 2025. The extensive utilization of air freight by commercial end users, such as manufacturers, retailers, wholesalers, and other industries to transport their goods efficiently is propelling the market growth. For instance, ATA's e-commerce monitor revealed that 18% of air cargo comprised e-commerce shipments—a figure expected to rise as consumer behaviors transform. The air cargo industry, boasting global networks, adaptable capacity, and digitalization initiatives, stands well-equipped to bolster e-commerce growth. These initiatives promise to augment operational efficiency and shipment visibility throughout transit.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia-Pacific accounted for the largest market share of over 39.5%. Besides this, the inflating investments by government bodies and the leading players in modernizing airport infrastructure and building new networks are also propelling the growth of the air freight market in this region. For instance, many Asia-Pacific countries encouraged airlines to modify their passenger aircraft for air freight transport temporarily. While a standard passenger ATR72-600 can only carry 1.7 metric tons of cargo, its freighter-modified model can carry up to 8 metric tons, making it suitable for Pacific Island countries, given the region's demand and operating conditions. Furthermore, as Korean Air continues to position itself for high cargo demand, it is considering a move for the new wide-body freighters released by Airbus and Boeing in recent months. Long-term strong cargo demand also prompted Airbus to launch its A350 freighter and Boeing its 777X freighter.

Key Regional Takeaways:

United States Air Freight Market Analysis

The US accounted for around 84.10% of the total North America air freight market in 2025. The United States air freight market is primarily driven by the increasing demand for fast and efficient delivery of goods, particularly time-sensitive products such as electronics, pharmaceuticals, and perishable goods. The rise of e-commerce has also played a significant role, as consumers expect quick delivery times, propelling retailers and logistics companies to adopt air freight for faster fulfillment. According to the IMARC Group, the United States e-commerce market reached USD 1,087.54 Billion in 2024 and is expected to grow at a CAGR of 6.80% during 2025-2033. Additionally, the expansion of global supply chains has led to a greater need for reliable and secure transportation of goods across international borders, with air freight offering the fastest and most efficient solution. The growing emphasis on just-in-time inventory and the need for rapid replenishment of stock further fuels air freight market demand. Moreover, advancements in technology, such as automation, real-time tracking, and AI-powered logistics, have enhanced the efficiency and reliability of air freight services, making them more attractive to businesses. The ongoing recovery of the global economy, particularly post-pandemic, has also contributed to an increase in trade volumes, thereby enhancing air cargo demand. Besides this, partnerships between airlines and freight forwarders, along with investments in airport infrastructure and cargo handling facilities, continue to improve the capacity and competitiveness of the U.S. air freight market.

Asia Pacific Air Freight Market Analysis

The Asia Pacific air freight market is expanding due to the region’s growing integration into global trade networks and its strategic position as a manufacturing powerhouse. Rising demand for high-value, time-sensitive goods, such as electronics, luxury items, and medical supplies, has increased the reliance on air freight for quick deliveries. The escalating adoption of cold chain logistics, particularly for perishable goods such as food and pharmaceuticals, has further fueled air freight needs. As per recent industry reports, the Asia Pacific cold chain market size is growing at a CAGR of 11.52% and is expected to reach USD 496.9 Billion by 2033. Additionally, the rapid development of regional trade agreements, such as the Regional Comprehensive Economic Partnership (RCEP), has facilitated smoother cross-border movement of goods, bolstering air cargo demand. The ongoing expansion of low-cost carriers in the region also supports market growth, offering more flexible air freight solutions, while the rise of digital platforms for logistics management is optimizing air cargo processes.

Europe Air Freight Market Analysis

The Europe air freight market is experiencing significant growth, fueled by several key factors. The rise in global e-commerce has significantly impacted air freight demand, as businesses and consumers increasingly expect fast, reliable delivery of goods. This rise in online shopping is propelling logistics companies to adopt air freight as a faster option to meet tight delivery windows. According to a survey by the European Commission, 77% of respondents between the ages of 16 and 74 reported having purchased or ordered products or services online in 2024. Moreover, 46% of individuals using the Internet purchased or ordered clothing, accessories, and shoes in the same year. Additionally, the growth of global supply chains, combined with the need for efficient cross-border trade, has heightened the demand for air freight services. The strategic location of Europe as a hub for international trade and its strong manufacturing sectors, particularly in automotive, technology, and pharmaceuticals, further contribute to air freight growth. The region’s robust infrastructure, with major airports such as Frankfurt, Paris Charles de Gaulle, and Amsterdam Schiphol, also supports the smooth handling and movement of cargo. Besides this, the focus of the European Union on environmental sustainability has encouraged the adoption of fuel-efficient aircraft and eco-friendly logistics practices.

Latin America Air Freight Market Analysis

The Latin America air freight market is growing as a result of the increasing demand for fast and reliable delivery services, particularly for high-value and time-sensitive goods such as pharmaceuticals and perishables. Moreover, e-commerce growth in countries, such as Brazil and Mexico, is significantly improving air freight volumes as consumers expect quicker delivery times. As per the International Trade Administration (ITA), the e-commerce sector of Brazil is experiencing a growth of 14.3% and is expected to reach USD 200 Billion by 2026. Additionally, the position of Latin America as an exporter of commodities, such as agricultural products, is fostering demand for air cargo to transport goods globally. Furthermore, regional trade agreements and a focus on improving supply chain resilience are encouraging greater use of air freight services to meet international trade demands, contributing to overall industry expansion.

Middle East and Africa Air Freight Market Analysis

The Middle East and Africa air freight market is propelled by the rising government focus on the non-oil sector in the region. For instance, Saudi Arabia's trade surplus was SR 41.4 Billion (USD 11.04 Billion) in April 2024, with non-oil exports rising by 36%. Moreover, the expansion of the region's logistics and supply chain networks, driven by the establishment of free trade zones and logistics hubs, also contributes to market growth. Additionally, the focus of the region on diversifying its economy, with an emphasis on industries such as healthcare, technology, and manufacturing, increases the need for air freight solutions.

Competitive Landscape:

The global air freight market is highly competitive, with key players focusing on expanding their networks, enhancing operational efficiency, and adopting advanced technologies. Many are investing in digital platforms to improve cargo tracking, optimize routes, and streamline supply chain management. Sustainability is also a priority, with efforts to reduce carbon emissions through fuel-efficient aircraft and alternative energy solutions. To meet rising demand, particularly from e-commerce and time-sensitive industries, companies are increasing fleet capacities and forming strategic alliances. Additionally, they are prioritizing customer-centric services, such as faster delivery options and tailored logistics solutions, to strengthen their market position and cater to changing industry demands.

The report provides a comprehensive analysis of the competitive landscape in the air freight market with detailed profiles of all major companies, including:

- American Airlines Inc.

- ANA Cargo Inc.

- Bolloré Logistics

- Cargolux Airlines International S.A.

- Delta Air Lines Inc.

- Deutsche Bahn AG

- Deutsche Post AG

- DSV A/S

- Expeditors International of Washington Inc.

- FedEx Corporation

- Hellmann Worldwide Logistics SE & Co. KG

- Kuehne + Nagel International AG

- Nippon Express Co. Ltd.

- Qatar Airways

- United Parcel Service Inc.

Air Freight Market News:

- February 2025: Nippon Express Co. Ltd., an affiliate business of NIPPON EXPRESS HOLDINGS, INC., entered into a partnership with Nikon Corporation for the supply of SAF-enabled air freight transportation services. As part of this collaboration, Nippon Express will provide Nikon with CO2 reduction certificates based on the amount of SAF utilized in the transportation of its air freight. As Nikon continues to grow internationally, Nippon Express will also keep supporting its green efforts in relation to air freight shipping.

- February 2025: JAS, a leading international provider of operations and supply chain services, successfully acquired International Airfreight Associates B.V. (IAA), an established supplier of air, ocean, and road freight solutions based in the Netherlands. This acquisition significantly supports the international shipping network of JAS and improves the company’s access to important markets, especially in the time-sensitive perishable products industry.

- January 2025: Freightos, a global leader in the international freight sector, announced that in partnership with the Dutch GSA Euro Cargo Aviation (ECA), Norwegian Cargo, the transportation unit of Norwegian Air UK, officially joined WebCargo by Freightos, the largest air freight booking platform in the world. Through this partnership, Norwegian Cargo will integrate its first digital booking tool, giving shipping companies access to its vast network and enabling eBooking in real-time.

- January 2025: Finnair Cargo, a renowned international air freight operator that specializes in quick and excellent transportation between North America, Europe, and Asia, joined the Cargo Portal Services (CPS) platform of Unisys. CPS increases operational effectiveness by providing international carriers with access to a reliable multi-carrier air freight booking gateway. With this partnership, Finnair's freight locations and routes will be more easily accessible and visible.

- December 2024: China Airlines (CI), the premier airline in Taiwan, successfully integrated the iCargo solution from IBS Software into its air freight administration infrastructure. China Airlines has made significant progress in its digitalization path by integrating this premier digital technology service into its organizational structure, making it one of the top 15 air freight providers in the world.

- May 2024: Maersk opened a 90,000-square-foot air freight gateway in Miami to strengthen cargo flow from Europe and Asia to Latin America. Fully staffed and certified as a bonded Container Freight Station and Cargo Screening Facility, the site enhances connectivity with competitive options via freighter and passenger aircraft. The Miami hub mirrors existing Maersk operations in Atlanta, Chicago, and Los Angeles.

Air Freight Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Freight, Express, Mail, Others |

| Destinations Covered | Domestic, International |

| End Users Covered | Private, Commercial |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | American Airlines Inc., ANA Cargo Inc., Bolloré Logistics, Cargolux Airlines International S.A., Delta Air Lines Inc., Deutsche Bahn AG, Deutsche Post AG, DSV A/S, Expeditors International of Washington Inc., FedEx Corporation, Hellmann Worldwide Logistics SE & Co. KG, Kuehne + Nagel International AG, Nippon Express Co. Ltd., Qatar Airways, United Parcel Service Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the air freight market from 2020-2034.

- The air freight market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the air freight industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The air freight market involves transporting goods by aircraft, offering fast delivery over long distances. It serves industries needing quick shipping, like electronics, pharmaceuticals, and perishables. Airlines, freight forwarders, and logistics firms manage these operations across domestic and international routes, supporting global trade and time-sensitive supply chain demands.

The air freight market was valued at USD 335.2 Billion in 2025.

IMARC estimates the air freight market to exhibit a CAGR of 4.70% during 2026-2034, reaching a value of USD 506.2 Billion by 2034. Growth is fueled by rising cross-border e-commerce, time-sensitive shipments, and increased demand for fast, reliable logistics. Industries like electronics, pharmaceuticals, and perishables continue to rely heavily on air transport solutions.

The key drivers of the air freight market include the rapid growth of e-commerce, increasing demand for fast and efficient transportation across borders, expanding globalization, and the rising import/export activities. Technological advancements, such as digital tracking and automation, also enhance operational efficiency and reliability, contributing to market growth.

The air freight market is shifting toward e-commerce-driven demand, increased use of digital logistics platforms, and greater reliance on integrated air-sea transport solutions. Sustainability efforts, such as carbon offset programs and fuel-efficient aircraft, are also gaining ground. Capacity management and regional connectivity are shaping strategies amid fluctuating global trade volumes.

Asia Pacific dominated the air freight market, accounting for a share exceeding 39.5%. This dominance is fueled by robust infrastructure investments, the rising demand for cross-border trade, and rapid economic growth in the region.

Some of the major players in the air freight market include American Airlines Inc., ANA Cargo Inc., Bolloré Logistics, Cargolux Airlines International S.A., Delta Air Lines Inc., Deutsche Bahn AG, Deutsche Post AG, DSV A/S, Expeditors International of Washington Inc., FedEx Corporation, Hellmann Worldwide Logistics SE & Co. KG, Kuehne + Nagel International AG, Nippon Express Co. Ltd., Qatar Airways, and United Parcel Service Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)