Air Conditioning System Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Technology, End Use, and Region, 2026-2034

Air Conditioning System Market Size and Share:

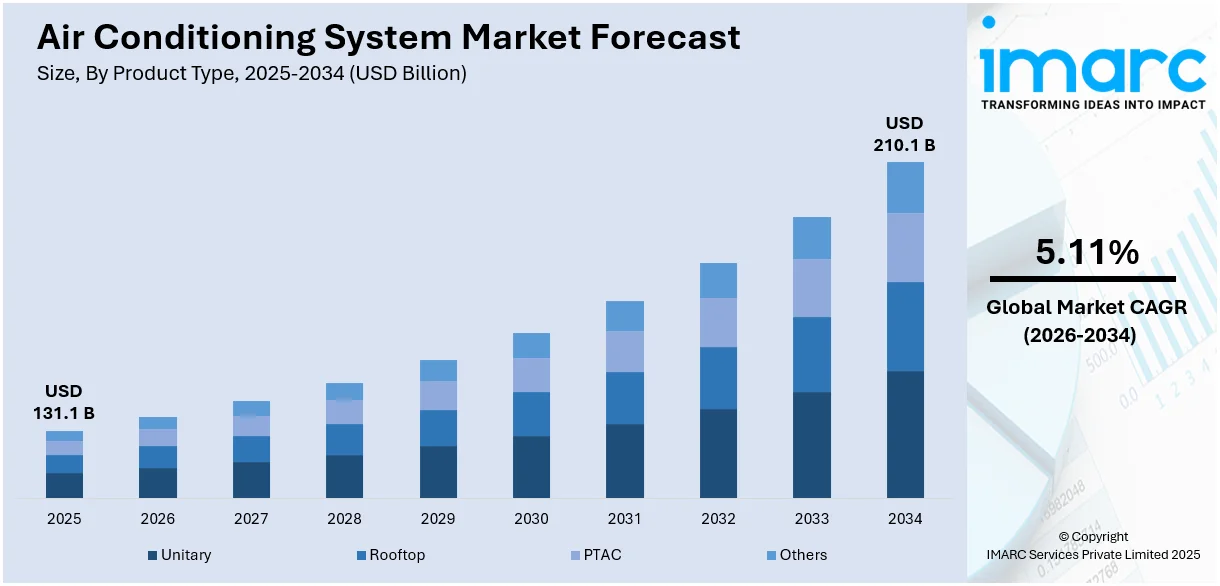

The global air conditioning system market size reached USD 131.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 210.1 Billion by 2034, exhibiting a growth rate (CAGR) of 5.11% during 2026-2034. Asia Pacific currently dominates the market, holding a market share of over 60.8% in 2025. The rapid urbanization, rising temperatures, stricter energy efficiency laws, notable technology advancements, and increasing levels of disposable income are some of the factors driving the market across Asia Pacific.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 131.1 Billion |

|

Market Forecast in 2034

|

USD 210.1 Billion |

| Market Growth Rate 2026-2034 | 5.11% |

A number of significant factors are driving the rapid growth of the global air conditioning market. In locations with harsh weather, the necessity for cooling systems has grown due to global temperature and climate change. Besides this, the rapid rise in the development of residential, commercial, and industrial buildings that need temperature control systems is another factor contributing to the air condition system market. Another critical factor is the rapid technological progress. With consumers and businesses adopting greener solutions, the market expands through energy-efficient and eco-friendly air conditioners. For instance, the utilization of inverter technology and Global Warming Potential (GWP) low refrigerants expands the market. In addition, developing countries such as China, India, and Brazil, with growing middle-class populations, have increased disposable incomes and more households can afford to travel by air. According to Oxford Economics, middle-class household numbers are projected to be twice that in the growth economies over the next decade-from 354 million households in 2024 to 687 million by 2034.

To get more information on this market Request Sample

The United States has emerged as a key regional market for air conditioning system. One major factors driving the United States air conditioning market is the heightened demand for cooling solutions owing to the increasing temperatures across the nation and more frequent occurrences of heatwaves, as influenced by climate change. On account of this, more individuals demand air-conditioning systems for use at home and offices. Another factor is the rapid population growth and urbanization. This makes energy-efficient air conditioning a need as cities expand in size and new housing complexes increase. Moreover, manufacturers are encouraged by government programs and energy efficiency rules to develop environment- friendly and energy-efficient air conditioning systems that aim a reduction in carbon emissions. The use of energy-efficient appliances is also promoted by incentives and rebates.

Air Conditioning System Market Trends:

Rising Global Temperatures

The increasing global temperatures due to climate change are significantly driving the air conditioning system market. The January–September 2024 global mean surface air temperature was 1.54 °C (with a margin of uncertainty of ±0.13°C) above the pre-industrial average, boosted by a warming El Niño event, according to an analysis of six international datasets used by WMO. As average temperatures continue to rise, especially in regions such as the Middle East, Asia-Pacific, and North America, the demand for cooling solutions has increased. For instance, climate change has an unrelenting effect in India. During summer, in the northern regions of the country, temperatures pass the 50 degrees Celsius mark. Temperatures in the Indian summer over the last decade or so have repeatedly broken heat records, and there is no sign of respite from heat waves in the foreseeable future, making air conditioning an increasingly important fixture in Indian homes. Similarly, Middle East warming is almost two times faster than other inhabited parts of the world. Moreover, extreme heatwaves have become more frequent, prompting governments and individuals to invest in cooling solutions for both residential and commercial spaces.

Increasing Demand for Energy-efficient Air Conditioners

The increasing demand for energy-efficient air conditioning (AC) systems is driven by environmental concerns and the desire to reduce energy consumption and utility costs. As incomes rise and populations grow, especially in the world’s hotter regions, the use of air conditioners is becoming increasingly common. In fact, the use of air conditioners and electric fans already accounts for about a fifth of the total electricity in buildings around the world or 10% of all global electricity consumption. In response to this, various key market players are introducing ACs that are highly energy-efficient and sustainable. For instance, in April 2024, LG Electronics India celebrated their record-breaking sales in Q1 by introducing their flagship feature range, which includes the Energy Manager and ArtCool Air Conditioners. The introduction of the Energy Manager feature marks a significant milestone in LG’s commitment to sustainability and consumer empowerment. This cutting-edge feature allows users to define their energy usage preferences and periods, leveraging Wi-Fi connectivity to optimize compressor usage and minimize energy consumption effortlessly. Besides this, the governments of various countries are focusing on efficient air conditioning, which is positively impacting the air conditioning system market outlook. For instance, Energy Efficiency Services Limited (EESL), a joint venture of four Public Sector Enterprises under the administrative control of the Ministry of Power, Government of India, announced the launch of the Super-Efficient Air Conditioning program. The program is aimed at promoting the use of energy-efficient technologies and bringing about a reduction in energy consumption.

Rapid Urbanization and Infrastructure Development

The increasing construction of both residential and commercial establishments and the elevating levels of urbanization are further catalyzing the air conditioning system industry. Furthermore, the rising population, which is anticipated to positively influence the residential and commercial constructions is also expected to increase demand for air conditioning systems. For instance, the rising population in Gulf countries is expected to contribute significantly to construction spending. The regional population is estimated to reach over 600 Million by 2050, from 350 Million in 2015. This is likely to propel growth in construction activities in the infrastructure and building sector, particularly education, housing, and healthcare infrastructure. Moreover, according to a data report, 44% of the world lived in cities, 43% in towns and suburbs, and 13% in rural areas in 2020. The rise in infrastructure development is projected to propel the air conditioning system market size in the coming years.

Air Conditioning System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on product type, distribution channel, technology, and end use.

Analysis by Product Type:

- Unitary

- Rooftop

- PTAC

- Others

Unitary air conditioning system leads the market with around 41.0% of market share in 2025. These systems, often referred to as split or ducted systems, are widely used in both residential and commercial applications. They are known for their versatility, as they can be installed in single rooms or multiple zones, offering individualized temperature control. In the residential sector, unitary systems are favored for their quiet operation, energy efficiency, and ease of installation. In commercial applications, they are commonly used in small to medium-sized offices, retail spaces, and restaurants. The rise in the number of residential construction projects and expanding food and restaurant chains across the globe are anticipated to propel the air conditioning system market share in the coming years. For instance, home sales volume in seven major Indian cities accelerated by 113% year-on-year in the third quarter of 2021.

Analysis by Distribution Channel:

- Specialty Stores

- Supermarkets and Hypermarkets

- Online

- Others

Specialty stores lead the market in 2025. These stores have been a vital supply chain of distribution for air conditioning systems. These stores focus on home appliances and HVAC products, providing consumers with a variety of air conditioning units. Specialty stores possess an advantage with their knowledgeable staff who offer expertise to help consumers choose the appropriate system for their needs. Consumers frequently go to these stores for personalized guidance, installation help, or product demonstrations. Specialty stores also offer a showroom experience for customers to examine and try out air conditioning units before buying them. This practical experience can be essential when purchasing a major household appliance like an air conditioner.

Analysis by Technology:

- Inverter

- Non-inverter

Inverter technology lead the market with around 67.5% of market share in 2025. Inverter technology has been a game-changer in the air conditioning industry, revolutionizing the way cooling systems operate. Inverter air conditioning systems use variable-speed compressors that can adjust their speed based on the cooling load rather than cycling on and off, such as traditional non-inverter systems. This results in several advantages that have driven the adoption of inverter technology. Moreover, inverter air conditioners are highly energy efficient. As a result, various key market players are increasingly developing and introducing new and improved variants of inverter air conditioners. For instance, in February 2024, Elista introduced a new range of air conditioners in India, offering an impressive indoor cooling experience with the 4-in-1 convertible, Inverter AC, & Fixed speed AC range. This range is equipped with Turbo Cool Power Chill mode, advanced Blue Fin Technology, 100% copper-made condensers, C-shaped evaporator design, Inverter Technology, stabilizer-free operation, and an ultra-modern chipset.

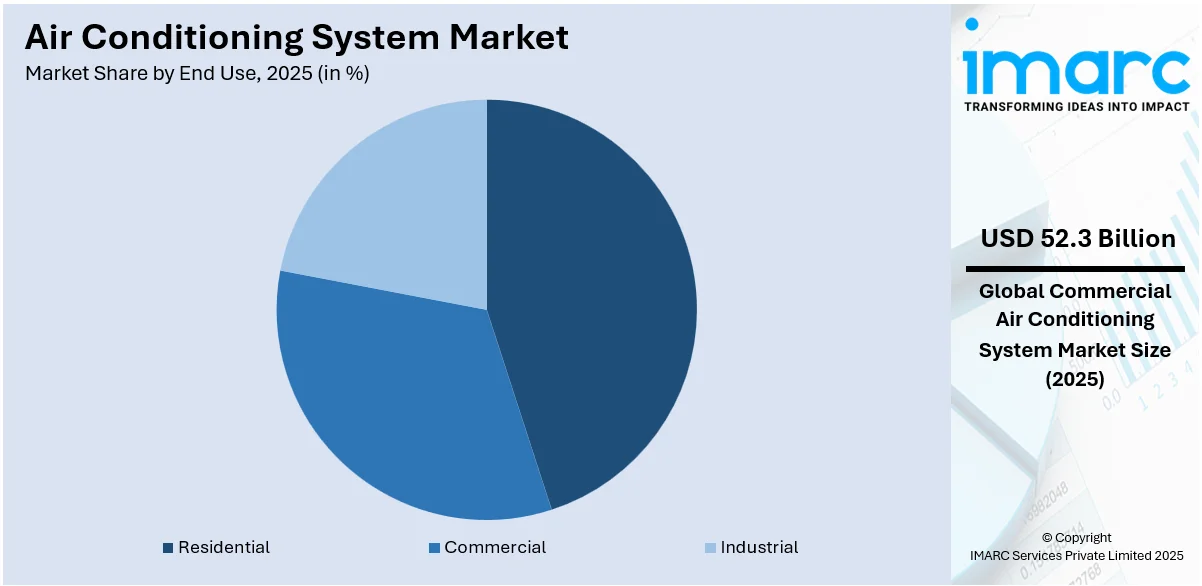

Analysis by End Use:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Industrial

Commercial end use leads the market with around 42.0% of market share in 2025. The commercial segment of the air conditioning system market caters to various non-residential spaces, including offices, retail stores, hotels, restaurants, educational institutions, and healthcare facilities. The air conditioning system market research report by IMARC indicates that the increasing number of commercial properties is primarily driving the market for this segment. For instance, in March 2022, 144.7 million square feet of office space were under construction in the United States, accounting for 2.2% of total stock. Furthermore, 93% of the space is Class A or A+, indicating that businesses are continuing to prioritize high-quality projects to retain their workforce. As businesses continue to adapt to evolving consumer preferences and regulations concerning indoor air quality, the commercial segment of the air conditioning market is poised for moderate growth.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia Pacific accounted for the largest market share of over 60.8%. It is the dominant force in the global air conditioning system market. This dynamic market is characterized by rapid urbanization, rising temperatures, and a growing middle-class population with increasing disposable incomes. Countries, such as China and India, are witnessing a rise in demand for air conditioning systems in residential spaces and also in commercial and industrial sectors. Furthermore, the elevating temperatures in some countries of the APAC region are increasing the demand for cooling solutions like air conditioning systems. For instance, climate change has an unrelenting effect in India. During summer, in the northern regions of the country, temperatures pass the 50 degrees Celsius mark. Temperatures in the Indian summer over the last decade or so have repeatedly broken heat records, and there is no sign of respite from heat waves in the foreseeable future, making air conditioning an increasingly important fixture in Indian homes.

Key Regional Takeaways:

United States Air Conditioning System Market Analysis

In 2025, the United States accounts for over 72.7% of air conditioning system market in North America. Rising temperatures, growing urbanization, and an emphasis on energy-efficient cooling technology are driving the market for air conditioning systems in the US. According to the U.S. Energy Information Administration, strong penetration rates are demonstrated by the fact that more than 88% of American homes had air conditioning in 2020. With many U.S. states experiencing one of the hottest summers on record in 2023, the need for cooling solutions has increased due to rising heatwaves and climate change. According to data analytics platform Jungle Scout, Amazon sales of air conditioners increased 248% during the month of June-July compared to the same period last year, with sales of portable AC units increasing 208%. Pet cooling gel patches and pads saw increases in sales of 226% and 365%, respectively. The need for HVAC systems has also grown because of a rise in construction activity, especially in residential and commercial real estate.

High-efficiency systems are encouraged to be adopted by consumers and companies by energy efficiency rules like the SEER (Seasonal Energy Efficiency Ratio) criteria set forth by the U.S. Department of Energy. Smart air conditioning systems are also becoming more and more popular in the U.S. market, as IoT-enabled gadgets become more well-liked. For example, the demand for smart thermostats has increased by and it is nearly reaching 20% penetration in the country, according to industrial reports. The adoption of air purifiers linked with HVAC systems has been further stimulated by growing consumer awareness of indoor air quality.

Europe Air Conditioning System Market Analysis

Urbanization, climate change resulting in warmer summers, and energy efficiency rules are the main factors driving the market for air conditioning systems in Europe. Though historically less common than in the United States, air conditioning is becoming more and more popular in Europe, particularly in nations like Italy, Spain, and France that hold a significant portion of the market. According to the trade association BSRIA, the European market for air conditioning systems expanded by over 6% in 2023 over the prior year. Residential air conditioning systems increased by 9.4% because of this rise 4.6% of cooling technologies were sold commercially. The EU F-Gas law, which restricts the use of hydrofluorocarbons (HFCs), is one example of a strict environmental law that is pushing manufacturers to develop environmentally friendly refrigerants like R32 and R290. The market is expanding due to the trend toward HVAC systems that run on renewable energy, such as solar and hybrid air conditioners. Furthermore, smart cooling systems are becoming more and more popular thanks to the European Green Deal's emphasis on energy efficiency. Heatwaves throughout Central and Southern Europe during the summer of 2023 caused a spike in demand for portable air conditioners.

Asia Pacific Air Conditioning System Market Analysis

Rapid urbanization, rising disposable incomes, and rising temperatures in densely populated nations like China, India, and Japan are driving the Asia-Pacific market for air conditioning systems. According to industry reports, APAC region holds the dominant market position in 2023 with over 60% of global air conditioner sales. The need for home air conditioning has increased due to housing development and population growth, especially in emerging economies.

With an emphasis on energy-efficient systems to satisfy sustainability goals, the commercial sector—which includes offices, retail establishments, and industrial facilities—is also driving market expansion. The adoption of sustainable cooling solutions is being promoted by governments around the area, such as China's incentives for energy-efficient appliances and India's National Cooling Action Plan (NCAP). Japan, a pioneer in HVAC technology, keeps coming up with new ideas using products that use low global warming potential (GWP) refrigerants.

Latin America Air Conditioning System Market Analysis

Rising urbanization, rising temperatures, and the expansion of the middle class are the main factors driving the market for air conditioning systems in Latin America. Leading markets include nations like Brazil and Mexico. As per industrial analysis report, in 2023, sales volumes of packaged and central plant air conditioning systems were 5.1 Million, 1.9 Million, and 1 Million, respectively, in Brazil, Mexico, and Argentina. The residential sector is in control, and adoption is being driven by growing housing developments and greater knowledge of indoor climate management. The need for air conditioning in hotels and resorts has increased dramatically due to the region's tropical and subtropical climate and the expanding tourism sector. Energy-efficient cooling innovations in inverter technology are becoming more popular, particularly in areas with high electricity prices.

Middle East and Africa Air Conditioning System Market Analysis

The Middle East and Africa (MEA) market for air conditioning systems is driven by the region's harsh climate, increasing urbanization, and expanding construction industry. With some of the highest temperatures in the world, air conditioning is more of a need than a luxury in this area. The region's energy demand is predicted to rise by 50% by 2040 due to the increased demand for cooling, unless climate change mitigation measures are taken, according to the Cool Up Program's MENA Region Cooling Status Report. Growing energy prices and government programs like Saudi Arabia's Vision 2030, which prioritizes sustainable building technology, have led to an increase in the use of smart and energy-efficient air conditioning systems. Growing urbanization and middle-class incomes in Africa are driving the expansion of the market for residential air conditioning.

Competitive Landscape:

Key players in air conditioning system market aim to focus on innovation, sustainability, and expansion to retain competitive strength. Companies such as Daikin, Carrier, and Trane Technologies focus on research and development (R&D) so that energy efficiency and green systems are offered to end-users, thus including leading-edge technologies, such as variable refrigerant flow and Internet-of-things-enabled smart controls, with their offerings. Besides this, key players are also engaging into strategic partnership, mergers and acquisitions to reinforce the presence in the market as well as broaden their products in a given market space. Many are also focusing on after-sales services, such as maintenance and repair, to increase customer satisfaction and retention. Regional expansions, especially in emerging markets, and localized production facilities are helping companies reduce costs and cater to specific market needs effectively.

The report provides a comprehensive analysis of the competitive landscape in the air conditioning system market with detailed profiles of all major companies, including:

- Carrier Global Corporation

- Daikin Industries, Ltd.

- Electrolux AB

- Haier Group Corporation

- Johnson Controls-Hitachi Air Conditioning India Ltd.

- Lennox International Inc.

- LG Electronics Inc.

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Samsung Electronics Co. Ltd.

- Trane Technologies plc

- Voltas Limited

- Whirlpool Of India

Latest News and Developments:

- September 2024: Daikin Industries Ltd., the world's largest air conditioner manufacturer, is expanding its operations in India by acquiring an additional 33 acres to build a new plant, responding to a market where approximately 93% of the population still does not own air conditioners. The company sold about 700,000 units in the first quarter of 2024, with sales up 40% year-on-year, and expects to double sales by 2025 while aiming to grow its commercial refrigeration business to around INR 1,000 crore (USD 119.1 Million) annually by 2030.

- April 2024: Haier Appliances India announced the launch of its latest range of “super heavy-duty” air conditioners. The new range comes with the company’s Hexa Inverter and Supersonic cooling technologies.

- February 2024: Elista introduced a new range of air conditioners in India, offering an impressive indoor cooling experience with the 4-in-1 convertible, Inverter AC & Fixed speed AC range. This range is equipped with Turbo Cool Power Chill mode, advanced Blue Fin Technology, 100% copper made condensers, C-Shaped evaporator design, Inverter Technology, stabilizer-free operation, and ultra-modern chipset.

- December 2023: Panasonic Life Solutions India (PLSIND) introduced India's First Matter-enabled room air conditioners. Matter is an open-source connectivity standard that facilitates smooth interoperability among smart devices.

Global Air Conditioning System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Unitary, Rooftop, PTAC, Others |

| Distribution Channels Covered | Specialty Stores, Supermarkets and Hypermarkets, Online, Others |

| Technologies Covered | Inverter, Non-Inverter |

| End Uses Covered | Residential, Commercial, Industrial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Carrier Global Corporation, Daikin Industries, Ltd., Electrolux AB, Haier Group Corporation, Johnson Controls-Hitachi Air Conditioning India Ltd., Lennox International Inc., LG Electronics Inc., Mitsubishi Electric Corporation, Panasonic Corporation, Samsung Electronics Co. Ltd., Trane Technologies plc, Voltas Limited, Whirlpool Of India, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, air conditioning system market forecast, and dynamics of the market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global air conditioning system market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the air conditioning system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

An air conditioning system is a mechanical system used for managing temperature, humidity levels and indoor air quality. It cools and dehumidifies air to provide a comfortable environment, typically using components like compressors, evaporators, condensers, and refrigerants. AC systems are commonly used in residential, commercial, and industrial spaces.

The global air conditioning system market was valued at USD 131.1 Billion in 2025.

IMARC estimates the global air conditioning system market to exhibit a CAGR of 5.11% during 2026-2034.

The increasing global temperatures and climate change, rapid urbanization and growing construction activities, rising demand for energy-efficient and eco-friendly systems are some of the key factors driving the global air conditioning system market.

According to the report, unitary air conditioning represented the largest segment by product type, driven by its widespread use in residential and light commercial applications, offering easy installation, energy efficiency, and cost-effectiveness.

Specialty stores leads the market by distribution channel as they offer a wide range of air conditioning products, expert guidance, and personalized services, attracting both residential and commercial buyers.

Inverter is the leading segment by industry vertical, driven by its superior energy efficiency, ability to adjust compressor speed based on cooling demand, and lower operational costs compared to traditional fixed-speed systems.

Commercial is the leading segment by end use, driven by the high demand for air conditioning in offices, retail spaces, hospitals, and hospitality sectors, driven by the need for occupant comfort, productivity, and regulatory compliance.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global Air Conditioning System market include Carrier Global Corporation, Daikin Industries, Ltd., Electrolux AB, Haier Group Corporation, Johnson Controls-Hitachi Air Conditioning India Ltd., Lennox International Inc., LG Electronics Inc., Mitsubishi Electric Corporation, Panasonic Corporation, Samsung Electronics Co. Ltd., Trane Technologies plc, Voltas Limited, Whirlpool Of India, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)