Air Cargo Security and Screening Systems Market Size, Share, Trends and Forecast by Technology, Size of Screening Systems, Application, and Region, 2026-2034

Air Cargo Security and Screening Systems Market Size and Share:

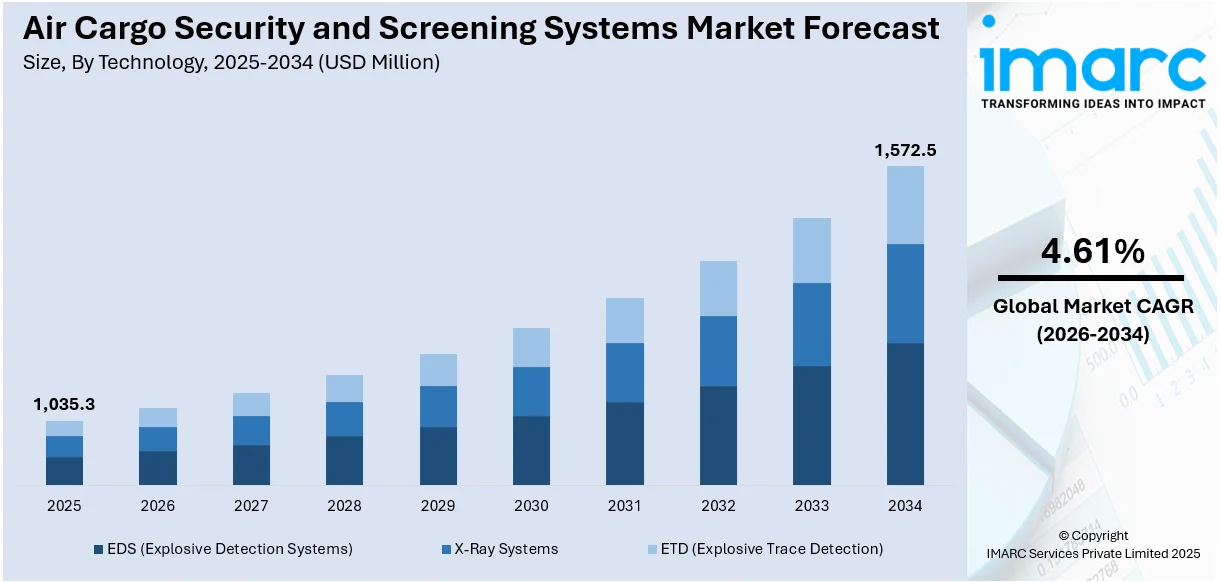

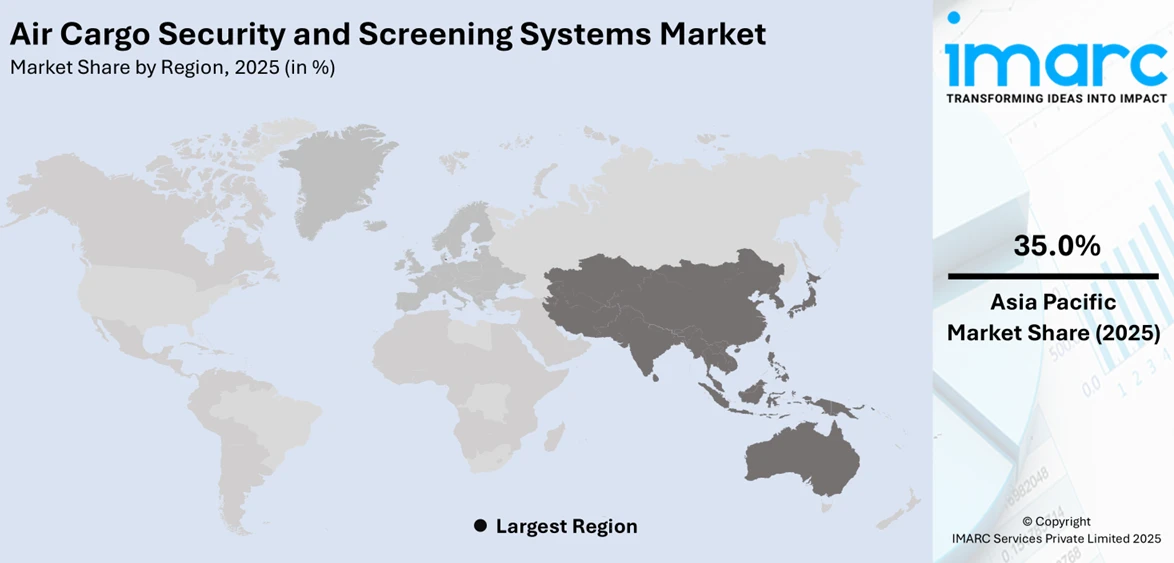

The global air cargo security and screening systems market size was valued at USD 1,035.3 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,572.5 Million by 2034, exhibiting a CAGR of 4.61% from 2026-2034. Asia Pacific currently dominates the market, holding a market share of over 35.0% in 2025. The market is driven due to investments by the region in infrastructure, growing attention to security in high-traffic air cargo hubs, and adoption of cutting-edge screening technologies in response to enhanced demand for secure global trade.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1,035.3 Million |

|

Market Forecast in 2034

|

USD 1,572.5 Million |

| Market Growth Rate 2026-2034 | 4.61% |

A key driver of the development of global air cargo security and screening mechanisms is the mounting level of worldwide trade and air travel. For instance, in December 2024, IATA initiated the Air Cargo Device Assessment Program to authenticate tracking devices, data loggers, and sensors according to industry safety standards, guaranteeing the integrity of valuable shipments. Furthermore, as international trade grows, air cargo is at the forefront of making the rapid transit of products around the world possible. The upsurge in air cargo activity requires more effective and advanced security systems to protect both goods and passengers. In addition, the increase in international terrorism and the risk of illegal activities, including the drug trade, armament, and explosives, compelled governments and authorities to implement tougher security measures. Organizations, such as the International Civil Aviation Organization (ICAO) have established global standards to enhance air cargo inspection, making the security technologies an internationally accepted best practice. This expansion in commerce, along with the demand for high security, represents a primary driving factor in the innovation and implementation of advanced air cargo screening technology globally.

To get more information on this market Request Sample

In the United States, holding a market share of 88.20% in 2024, a primary driver for the development of air cargo screening and security systems is the ongoing emphasis on national security. The creation of the Transportation Security Administration (TSA) saw the introduction of full-scale air cargo screening across the board for the purpose of keeping dangerous items from being moved. According to the sources, in August 2023, the Transportation Security Administration (TSA) enhanced its Certified Cargo Screening Program so more air cargo shippers could become part of the secure supply chain, streamlining shipment speed and security, and decreasing requirements for additional screening. Moreover, since an accelerating amount of air cargo is being transported currently, especially considering the speedy increase in e-commerce, there arises a greater urgency for stronger security protocols to help keep shipments secure and avoid creating potential threats. The US administration has given its top priority to the implementation of advanced screening techniques, including bomb detection systems as well as X-ray machines, to deal with the amplifying mass of goods going by air. Protecting the security of cargo shipments is critical not only for the nation's safety but also for the continued efficiency and reliability of the nation's critical air cargo infrastructure.

Air Cargo Security and Screening Systems Market Trends:

Rising Security Threats Driving Air Cargo Screening Demand

Increase in worldwide air freight traffic has introduced with it greater concern regarding threats to security. As the experience of the 1000 hoax explosive threats presented to Indian carriers in 2024 illustrates, the potential for malevolent use, such as smuggling explosives, weapons, and drugs, has mounted. Such threats have fueled the need for advanced security and screening technology capable of effectively identifying concealed prohibited articles. Latest technologies in air cargo security, including advanced scanners and x-ray machines, can now efficiently and precisely identify such threats quickly, making the lives of passengers and freight safe. As security issues rose, these systems are an integral part of the air cargo sector now, doing a lot to decrease the potential for attacks. As the global transportation network grows, so is the industry's dependence on such technologies, which will drive the need for ongoing innovation in detection capabilities.

Managing Increased Cargo Volumes with Advanced Security Solutions

As international air cargo traffic grows at a fast rate, effective security systems are important to controlling the movement of products while maintaining safety. Air cargo demand rose by 11.3% in 2024, much higher than the numbers in the previous year, the International Air Transport Association (IATA) has reported. This demand has put an enormous pressure on airports and cargo handlers to implement solutions that can screen high numbers of shipments at a fast pace without sacrificing security. Physical inspection, which was good enough while traffic was low, is not good enough with the outbidding increase in shipments. Advanced and automated solutions are needed. Air cargo security systems now have to balance the need for thoroughness with efficiency, speeding through cargo while scanning carefully for danger or contraband. Innovations in automated scanning technologies, AI-driven threat detection, and imaging technologies are key to addressing these challenges while maintaining air cargo routes' safety.

Technological Advancements Enhancing Screening and Surveillance

With increasing demand for air cargo services, there is a corresponding demand for advanced security screening technologies. Contemporary systems employ cutting-edge imaging methods, including 3D scanners, AI-powered threat detection algorithms, and multi-spectral scanners, to offer greater insights into cargo without manual inspection. These technologies are created to screen large quantities of cargo quickly and detect potential threats that might not be discovered through conventional security measures. The implementation of automation has enabled airports to process larger shipments more accurately and efficiently, allowing more cargo to be handled with less resource. Additionally, real-time monitoring systems are playing an important role in tracing and monitoring cargo shipments along the way. This degree of monitoring improves the security of the overall air cargo supply chain, making it more difficult for illegal commodities to be shipped under the radar and supporting international measures against security threats in air cargo.

Air Cargo Security and Screening Systems Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global air cargo security and screening systems market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on technology, size of screening systems, and application.

Analysis by Technology:

- X-Ray Systems

- ETD (Explosive Trace Detection)

- EDS (Explosive Detection Systems)

Explosive Detection Systems (EDS) has captured the air cargo security market with an estimated market share of 45.7% in 2025. Increased terrorism threats and illicit trafficking have seen the demand for effective explosive detection systems more urgent than ever. EDS technology identifies explosives in cargo shipments to guarantee safety and adhere to international regulations. These systems use advanced imaging methods, including computed tomography (CT) and other advanced detection technologies, to detect suspect materials with great accuracy and speed. Rising utilization of EDS by airports and cargo terminals globally is prompted by regulatory requirements and the exigency of improved security in air transport. With increasing volumes of global trade, the need for fast, accurate, and dependable screening solutions, such as EDS will boost, and it will become a leading technology in securing air cargo operations.

Analysis by Size of Screening Systems:

Access the comprehensive market breakdown Request Sample

- For Small Cargo

- For Break and Pallet Cargo

- For Oversized Cargo

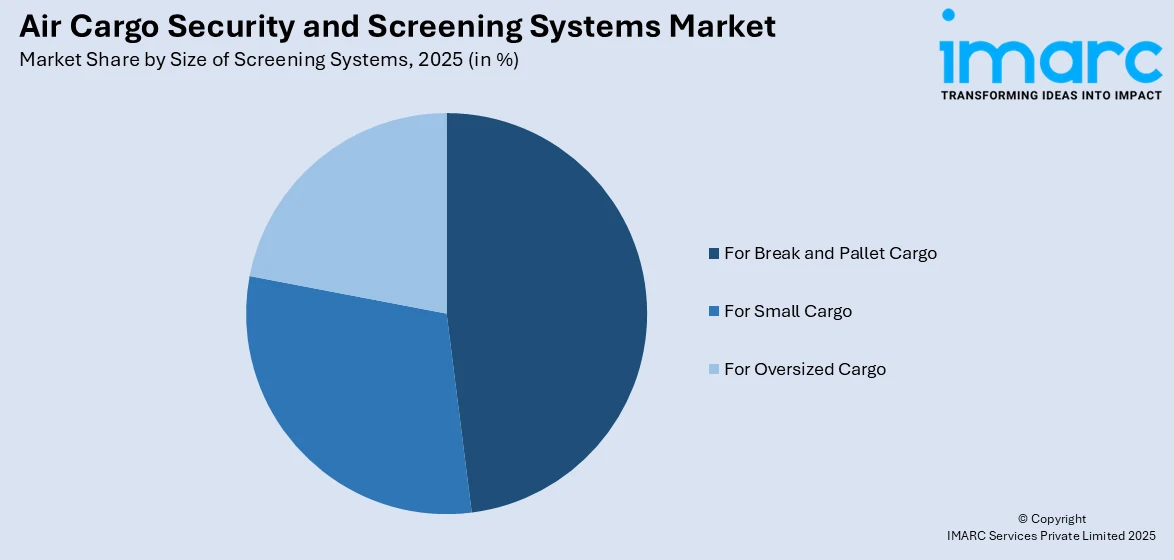

In 2025, the screening system market for break and pallet cargo is expected to account for a market share of 47.9%. Break and pallet cargo tends to consist of bulkier shipments and poses specific security screening challenges in terms of high volume and diverse sizes of goods. Screening equipment for break and pallet cargo consists of state-of-the-art technologies like X-ray scanners, explosive detection systems, and automated systems that guarantee efficiency while adhering to high security standards. With increasing international trade, particularly with the rise in e-commerce, the need for efficient screening solutions capable of handling large-scale cargo shipments is gaining momentum. These screening systems ensure rapid, accurate detection of explosives, contraband and other threats enabling smooth transit through cargo hubs. Growing volume of break and pallet cargo, backed by stringent security regulations, creates growth opportunities in this segment, commanding substantial market share in 2024.

Analysis by Application:

- Narcotics Detection

- Explosive Detection

- Metal and Contraband Detection

Explosive detection remains one of the most important applications in air cargo security, with a forecasted market share of 44.2% in 2025. With growing global security threats, the demand for effective explosive detection systems to protect air cargo is gaining importance. These systems employ diverse technologies, ranging from X-ray screening to computed tomography (CT) and explosive trace detection (ETD), to detect and neutralize possible threats prior to their reaching their destinations. Explosive detection is not just critical for avert terrorist attacks but also necessary for adhering to strict international regulations by agencies like the International Civil Aviation Organization (ICAO). The growing air cargo volume, especially in the aftermath of explosive e-commerce expansion, requires the extensive use of efficient explosive detection solutions in airports and cargo centers. Consequently, the explosive detection application is likely to hold a significant market share, securing the safety and security of air cargo shipments worldwide.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- Asia Pacific

- Europe

- Middle East and Africa

- Latin America

Asia Pacific is leading with a share of 35.0% in the air cargo security and screening systems market in 2025. Increased economic growth in the region, growing trade relationships, and soaring air cargo flows are propelling the demand for advanced security tools. China, India, and Japan, these key economies within the region, are bolstering their security structure to combat higher fears of terror, smuggling, and illegal business. This accelerating demand for security systems is driven by the rising traffic of cargo handled in Asia Pacific's congested airports and freight centers. Region governments are also following more stringent security regulations in order to conform to international requirements. As the Asia Pacific continues to emerge as a major global trade and logistics hub, demand for advanced air cargo screening systems, especially those designed for explosive detection, narcotics, and contraband, will amplify and drive the market share in 2024 significantly.

Key Regional Takeaways:

North America Air Cargo Security and Screening Systems Market Analysis

The North America air cargo screening and security systems market is witnessing strong growth, influenced by increased security needs and regulatory obligations. The region's extensive air cargo infrastructure comprising large airports and global trade centers demands strong screening solutions to support the safe and efficient shipment of products. Growing terrorist threats, illegal commerce, and the risk of harmful material transported through air cargo have led governments to impose stringent security standards. Regulatory agencies like the Transportation Security Administration (TSA) have put into place mandatory screening procedures that necessitate advanced technology, including X-ray machines, explosive detection systems (EDS), and explosive trace detection (ETD) systems. The spurring amount of e-commerce and growing size of air cargo shipments only underpin the urgency for quality security solutions. Subsequently, North America is slated to expand its market even more, with its focus now laying more heavily on innovation, productivity, and aligning itself internationally with security guidelines.

United States Air Cargo Security and Screening Systems Market Analysis

The United States air cargo screening and security systems market is led mainly by increased security concerns, technological advancements, and growth in air cargo volumes. The rising threat of terrorism and the imperative to protect the global supply chain have necessitated strict security regulations, which has driven the demand for more advanced cargo screening systems. Based on recent industry reports, in 2023, 76% of fatalities resulting from terrorism in the West took place in the United States. Furthermore, the ongoing advancement of new technologies, including automation, artificial intelligence, and machine learning, improves the speed and precision of screening operations, making them more effective at detecting banned items. Regulatory codes, like the U.S. Transportation Security Administration's (TSA) regulations, also influence the market significantly by compelling carriers and logistics companies to adopt advanced screening technologies to ensure security. Additionally, a growth in international trade, e-commerce, and air freight volumes has raised demand for robust and secure security solutions to manage increasing cargo shipments. Apart from this, the market is also driven by the demand for rapid cargo processing, which harmonizes security needs with operational effectiveness. With these forces combining, they continue to propel investment and innovation in air cargo security and screening equipment to safeguard people and commodities during transit.

Asia Pacific Air Cargo Security and Screening Systems Market Analysis

The Asia Pacific air cargo security and screening systems market is growing as a result of growing volumes of air cargo and the need for hassle-free, high-speed cargo handling. According to the International Air Transport Association (IATA), airlines in Asia Pacific witnessed the largest year-over-year increase in global air freight demand in 2024 at 14.5%. In addition, air freight capacity increased by 11.3%. With Asia Pacific emerging as the hub of world trade, driven by the increased prominence of China and India as economic powers, the demand for effective and secure handling of cargo has grown in intensity. Furthermore, the escalation of international laws and regulations that govern air cargo security, with strict screening requirements, has pushed investments in contemporary screening technologies to the forefront. Moreover, increased concern regarding the integrity of the supply chain and protection of merchandise from tampering or smuggling have prompted investments in secure infrastructure, rendering air cargo screening a necessary component of logistics business in the region.

Europe Air Cargo Security and Screening Systems Market Analysis

The Europe air cargo security and screening systems market is expanding with the rising emphasis on global trade, changing security threats, and the adoption of advanced screening technologies. The European Union accounts for about 14% of international commerce trade, as per Eurostat. Since Europe continues to be a major center of global commerce, the growth in international shipments and development of air cargo infrastructure has created increased focus on securing goods during transit. Increased air freight demand, fueled by global supply chains and burgeoning e-commerce activity, is spurring demand for advanced screening solutions that will protect safely without detracting from efficiency. For example, in 2024, demand for air freight rose by 11.2% per year in Europe. In addition, the region is confronted with varied and changing security threats, including the rising threat of organized crime and cyber-attacks against air cargo systems, necessitating enhanced and more advanced screening measures. The European Commission's commitment to improving aviation security as well as unifying screening standards among member countries also drives air cargo security and screening systems market growth, with higher investments being made in automated screening equipment, including explosive trace detection and high-end X-ray equipment. Apart from this, the intensifying need for quicker and cheaper screening procedures to deal with large volumes of cargo also drives the industry's growth.

Latin America Air Cargo Security and Screening Systems Market Analysis

The Latin America air cargo security and screening systems market is gaining a lot from expanding trade activities, rising air freight volumes, and the requirement for higher security standards. According to the International Air Transport Association (IATA), air freight demand rose by 12.6% year on year in Latin America during 2024. Additionally, air cargo capacity expanded by 7.9% per annum. With increased regional trade, especially with the development of global logistics, there is an increased need for advanced cargo screening systems that will guarantee security without interfering with the movement of goods. Furthermore, the increase in international trade agreements and integration of the region into global value chains is driving the demand for more efficient and effective cargo screening procedures. Additionally, increased alliances with global agencies and compliance with international security standards promote market expansion and technology uptake.

Middle East and Africa Air Cargo Security and Screening Systems Market Analysis

The Middle East and Africa air cargo screening and security systems market is being pushed more and more by the growing rate of air cargo traffic. As per latest industry reports, in 2024, demand for air freight grew by 13% each year in the Middle East. Since the region is a major transit point for international commerce, there is an increasing requirement for advanced security systems to allow the safe and smooth passage of goods. Increasing e-commerce in the Middle East is also boosting air cargo traffic, and hence demand for advanced security and screening solutions. Accordingly, the Middle East e-commerce market hit USD 1,888 Billion in 2024 and will grow at a CAGR of 21.58% between 2025-2033. Apart from this, the construction of new airport facilities and modernization projects in major regions, including the Gulf countries, is driving the demand for advanced screening technologies, aiding the growth of the industry.

Competitive Landscape:

The market for air cargo security and screening systems is highly competitive with a number of major players providing a broad portfolio of advanced technologies. The players emphasize innovation to create effective and reliable screening solutions such as X-ray systems, explosive detection systems (EDS), and explosive trace detection (ETD) systems. Firms are using advanced technology like computed tomography (CT) and automation-based detection systems to increase accuracy and capacity and remain in alignment with global security standards. Firms compete depending on factors that include technological prowess, reliability of systems, regulations compliance, as well as the support of the customers. Strategic alliances and collaborations with airport authorities and logistics companies are prevalent, enabling companies to boost their coverage and the functionality of their security systems. In addition, regional market conditions, including differences in security needs and economic growth, shape competition, with companies focusing on regional needs to stay competitive.

The report provides a comprehensive analysis of the competitive landscape in the air cargo security and screening systems market with detailed profiles of all major companies, including:

- 3DX-RAY

- American Science and Engineering

- L-3 Communications Security and Detection Systems, Inc

- Morpho Detection, LLC

- Rapiscan Systems

- Armstrong Monitoring

- Astrophysics, Inc.

- CEIA

- Autoclear LLC

- Gilardoni

Latest News and Developments:

- October 2024: The International Air Transport Association (IATA) introduced the IATA Security Management System (SeMS) to improve aviation safety for airports, air cargo management facilities, and airlines, among many others. SeMS gives organizations an established set of operating rules and regulations that allow them to improve security efficiency by actively handling risks, dangers, and sectors with gaps and problems.

- April 2024: Smiths Detection, a leading provider of threat identification and safety screening solutions, launched the SDX 10060 XDi, a revolutionary X-ray diffraction (XRD) technology scanner for the detection of illicit drugs. XRD provides extremely precise contraband detection by examining the chemical composition of the item. By detecting drugs without the need to open packages or mail, the SDX 10060 XDi will greatly increase the rate of detection and decrease the amount of time spent manually inspecting hold luggage at customs screening stations, arriving at airports, and in air cargo transit.

- January 2024: OSI Systems Inc. reported that a major international provider of air cargo logistics placed an order for nearly USD 4 Million to supply cutting-edge security screening devices. Among these are the Rapiscan Orion® 927DX and 935DX for screening large packages, the Rapiscan Orion 920CX for screening small packages, and the Rapiscan RTT®110 CT-based explosives identification device.

- November 2023: GMR Hyderabad Air Cargo opened a new import shipment facility in order to expedite the inspection and customs clearance of import cargo. The 300-square-meter, round-the-clock import processing complex is situated on the grounds of the GHAC terminal and is furnished with cutting-edge logistics machinery and superior safety screening technologies.

- March 2023: Rapiscan Systems, an internal leader in security screening solutions, introduced the 935DX, the newest model in its expanding series of ORION X-ray screening equipment. The 935DX is one of the biggest tunneled conveyor systems and is primarily developed for pallet and air cargo screening.

Air Cargo Security and Screening Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | X-Ray Systems, ETD (Explosive Trace Detection), EDS (Explosive Detection Systems) |

| Size of Screening Systems Covered | For Small Cargo, For Break and Pallet Cargo, For Oversized Cargo |

| Applications Coverage | Narcotics Detection, Explosive Detection, Metal and Contraband Detection |

| Regions Covered | North America, Asia Pacific, Europe, Middle East and Africa, Latin America |

| Companies Covered | 3DX-RAY, American Science and Engineering, L-3 Communications Security and Detection Systems, Inc, Morpho Detection, LLC, Rapiscan Systems, Armstrong Monitoring, Astrophysics, Inc., CEIA, Autoclear LLC, Gilardoni, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the air cargo security and screening systems market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global air cargo security and screening systems market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the air cargo security and screening systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The air cargo security and screening systems market was valued at USD 1,035.3 Million in 2025.

The air cargo security and screening systems market is projected to exhibit a CAGR of 4.61% during 2026-2034, reaching a value of USD 1,572.5 Million by 2034.

Major drivers of the air cargo security and screening systems market are increased global security threats, strict regulatory environments, higher volumes of international trade, fast-paced expansion in e-commerce, and advances in screening technologies. These trends require more effective, dependable, and compliant air cargo security solutions.

Asia Pacific currently dominates the air cargo security and screening systems market, accounting for a share of 35.0%. The market is driven due to rapid economic growth, increasing international trade, growing air cargo volumes, stringent regulatory standards, and an increasing demand for innovative security technologies to protect air transport.

Some of the major players in the air cargo security and screening systems market include 3DX-RAY, American Science and Engineering, L-3 Communications Security and Detection Systems, Inc, Morpho Detection, LLC, Rapiscan Systems, Armstrong Monitoring, Astrophysics, Inc., CEIA, Autoclear LLC, Gilardoni, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)