Agriculture Sprayers Market Size, Share, Trends and Forecast by Type, Source of Power, Usage, and Region, 2025-2033

Agriculture Sprayers Market Size and Share:

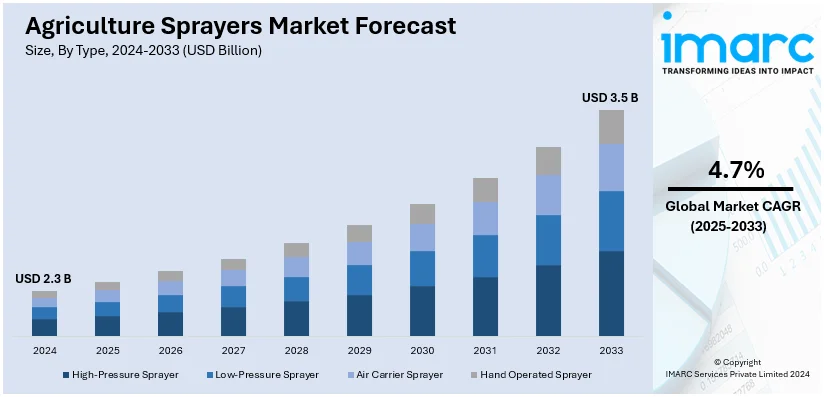

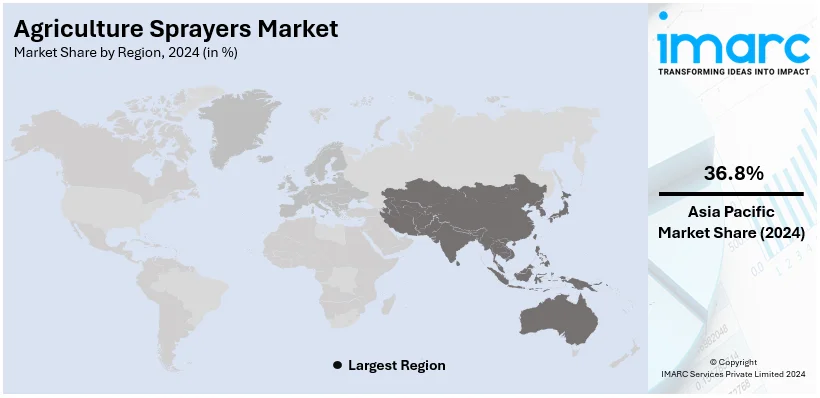

The global agriculture sprayers market size was valued at USD 2.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.5 Billion by 2033, exhibiting a CAGR of 4.7% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 36.8% in 2024. The Asia Pacific agriculture sprayers market is driven by the region's extensive agricultural activities, increasing adoption of mechanized farming, government subsidies, rising food demand due to population growth, and advancements in affordable sprayer technologies tailored for small and medium-scale farmers.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.3 Billion |

| Market Forecast in 2033 | USD 3.5 Billion |

| Market Growth Rate (2025-2033) | 4.7% |

The increasing use of advanced farming technologies to enhance efficiency and boost agricultural productivity serves as a key driver of the global agriculture sprayers market. The growing demand for food has driven the need for accurate crop protection methods, thereby increasing the requirement for advanced sprayers. Besides this, technological advancements feature drone-based sprayers and automated spraying systems that have enhanced efficiency and lowered labor expenses, driving the market to new levels. In line with this, government programs promoting sustainable farming practices and financial assistance for cutting-edge agricultural equipment further enhance market growth. Furthermore, growing awareness about environmental effects has led to a rise in the demand for equipment that reduces chemical usage and guarantees consistent application. Additionally, the expanding worldwide agricultural industry, particularly in developing nations, along with the rise of mechanized farming, are significantly driving the expansion of the agriculture sprayers market.

The United States stands out as a critical market disruptor, the increased usage of precision agriculture technologies further optimizes crop yields with less wastage of resources. Additionally labor shortages and high labor costs have motivated farmers to invest in advanced sprayers such as autonomous and drone-based systems, which assure efficiency and precision. Besides this, the growing awareness toward environmental issues and the necessity to use sustainable agriculture have fueled demand for chemical-reducing equipment and for targeted applications. In line with this, the government schemes and subsidy schemes for modern agricultural machinery fuel market growth. Increasing big commercial farms and the uptake of new techniques such as no-till farming and integrated pest management boost the demand for sophisticated sprayers. The increasing interest in specialty crops and the implementation of smart farming are also responsible for the increase in the agriculture sprayers market in the United States.

Agriculture Sprayers Market Trends:

Increasing popularity of pesticides

Pesticides play a significant role in maintaining crop health and enhancing farm productivity across the agricultural sector. With the growing global population and declining arable land, the focus has presently shifted toward the usage of modern agricultural approaches such as agricultural sprayers for improving crop productivity. According to the FAO, in 2022, agricultural land accounted for over one-third of the global land area, totaling 4,781 Million Hectares (ha). Of this, 33% (1,573 Million Ha) was cropland, while 67% (3,208 Million Ha) comprised permanent meadows and pastures. This significant reliance on agricultural land underscores the need for prudent resource use and sustainable agricultural practices to fulfil the fast-growing demand for food from around the world. Agricultural sprayers, being a part of modern agriculture, are crucial for the optimization of pesticide application, uniform coverage, and wastage minimization. The adoption of advanced sprayers, such as drone-mounted systems and precision spraying technologies, is gaining ground, since they offer higher accuracy, reduce labor dependency, and mitigate environmental impacts. Innovations are particularly crucial since farmers are trying to produce higher productivity on dwindling arable land.

Rising concerns about food security

The increasing worries about food security, combined with various initiatives by government agencies in multiple nations to encourage contemporary farming techniques, are playing a major role in market expansion. These efforts comprise grants for modern farming machinery, educational programs for farmers to implement precision agriculture methods, and regulations promoting sustainable agricultural practices. With the continuing rise in global population, the demand for greater yields from constrained arable land has intensified, prompting the embrace of innovative methods such as agricultural sprayers that improve efficiency and productivity. Moreover, government-supported research and development initiatives in agricultural tech are launching sophisticated sprayers equipped with capabilities such as GPS tracking, variable rate application, and automation that enhance input efficiency and lessen environmental effects. These initiatives tackle food security issues while also aligning with worldwide sustainability objectives, creating a conducive atmosphere for the growth of the agriculture sprayers market.

Increasing product utilization for treatment of livestock

The rising demand for the treatment of livestock through sprayers to eliminate ticks, combined with the growing consciousness among the public about food safety, has a positive effect on the market. Livestock producers are more and more utilizing sprayers to tackle the ticks, which pose considerable health problems in animals by inflicting anemia, lowered milk yield, and even causing diseases such as babesiosis and anaplasmosis. This has increased the need for efficient and accurate spraying solutions in the interest of animal health as well as the quality and safety of food products for consumption. More so, the strict policies and regulations of the United States about food safety and farming have increased the emphasis on hygiene in livestock management. Advancing sprayer technologies that promote better coverage and less application of chemical usage are also contributing factors to the use of sprayers for crops and also for livestock applications thus pushing the market scope.

Agriculture Sprayers Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global agriculture sprayers market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, source of power, and usage.

Analysis by Type:

- High-Pressure Sprayer

- Low-Pressure Sprayer

- Air Carrier Sprayer

- Hand Operated Sprayer

High-pressure sprayers spray chemicals at very high pressure to ensure deep penetration and effective coverage, especially when dealing with dense foliage and tall crops. They are used widely when the coverage area is enormous, such as in orchards, vineyards, or forestry, where the focus is on spraying in a way that is as precise and targeted as possible. High-pressure sprayers are also used to control pests in inaccessible areas or to clean equipment or facilities for livestock. These machines handle a liquid type of preparation, pesticide herbicide, disinfectants and more liquid formulations generally to their use on huge farms even if the more expensive kinds can consume considerable amounts of energy that place them relatively limited for smaller operations.

Low-pressure sprayers are the most widely used due to their cost-effectiveness, ease of operation, and compatibility with a variety of liquid applications. They operate at relatively low-pressure levels, making them suitable for the uniform application of chemicals over large areas without damaging crops. They are best suited for small and medium-scale farming operations, where precision is less critical. Low-pressure sprayers are more extensively used for applying fertilizers, herbicides, and pesticides on row crops and lawns because they are easy to design and have reduced operating costs. They also prove a good option for farmers in search of solutions with minimal cost, despite having reduced power for applying on dense vegetation or taller crops.

Air carrier sprayers, or mist blowers, rely on a strong air stream to carry droplets of chemicals over long distances for thorough coverage. These sprayers are ideal for orchards, vineyards, and high-density plantations, where air movement can help penetrate thick canopies. Air carrier sprayers decrease water usage and increase the efficiency of chemicals by forming fine, well-distributed droplets. This type is usually fitted with high features such as adjustable nozzles and air volume controls, which enhance the precision. However, air carrier sprayers require skilled operation and a higher initial investment, which may be a limitation to small-scale farmers.

Analysis by Source of Power:

- Manual

- Battery-operated

- Solar Sprayers

- Fuel-operated

Fuel operated leads the market with around 33.5% of market share in 2024, as they are dependable, powerful, and versatile, especially in large-scale farming operations. They usually operate through gasoline or diesel engines and offer efficiency and longer hours of operation compared to their battery or manually operated counterparts. These sprayers have the capability to cover large areas in less time and with efficiency, thus preferred by commercial farmers dealing with large fields or extensive orchards. Fuel-operated sprayers also offer the power required to tackle heavy-duty operations, such as spraying dense vegetation or managing high-pressure applications, which is one of the reasons they are so widely used in both conventional and mechanized farming systems.

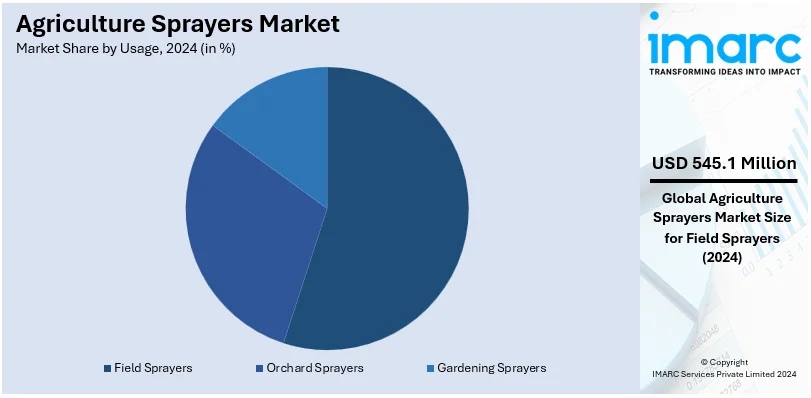

Analysis by Usage:

- Field Sprayers

- Orchard Sprayers

- Gardening Sprayers

Field sprayers leads the market with around 23.7% of market share in 2024, since they are used largely by large-scale farmlands for the fertilization of, herbicides, and pesticides throughout wide fields. Field sprayers are equipped with advanced technologies, such as GPS guidance and variable rate technology (VRT), which enables precise application and reduces chemical wastage. Moreover, their adaptability to different terrains and compatibility with various formulations further enhance their appeal, driving their dominance in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 36.8%, due to the vastness of agricultural lands in this region and due to their high dependence on farming for food security and economic stability. Large rural population countries such as China and India have rapidly accepted modern agricultural equipment to meet food demand rising from the increase in population. Government policies and subsidies for mechanized farming and increasing crop productivity increase the adoption of advanced sprayers. The small and medium-sized farms also promote the use of low-cost and efficient sprayers. The variety of crops and climatic conditions in the region also require specialized spraying solutions, which is further driving the market.

Key Regional Takeaways:

United States Agriculture Sprayers Market Analysis

In 2024, the United States accounts for over 86.20% of the agriculture sprayers market in North America. In the United States, the agriculture sprayers market is largely driven by the growing usage of precision farming techniques and upgradations in agricultural technology. While 90% of farmers are aware of sustainable farming practices, holistic adoption remains limited. According to McKinsey, while over 68% of farmers have implemented reduced- or no-till practices, only around half are utilizing variable-rate fertilizer applications, and just 35% are using controlled-irrigation practices. This indicates that while awareness is widespread, the integration of advanced, sustainable practices is still evolving. The rising need for efficient resource use, coupled with the growing concern for environmental sustainability, has spurred demand for advanced sprayers that offer precision application, reducing chemical waste and improving crop yield. Additionally, large-scale farming operations are increasingly relying on automated and GPS-enabled sprayers to ensure uniform application of fertilizers, pesticides, and herbicides. Government incentives for adopting cutting-edge farming technology also play a crucial role in driving market growth. As farmers continue to embrace technology for better crop management, the market for advanced sprayers in the U.S. is expected to grow significantly in the coming years.

Asia Pacific Agriculture Sprayers Market Analysis

In the Asia-Pacific region, the agriculture sprayers market is primarily driven by the expanding agricultural sector and the rising demand for food production due to population growth. According to the International Labour Organization (ILO), in 2021, a total of 563 Million individuals were employed in agriculture in this region, highlighting the significant role of the sector in the economy. Small and medium-scale farmers are increasingly adopting affordable and efficient sprayers to enhance productivity and manage pest control. Government initiatives and subsidies supporting mechanization, particularly in developing countries such as India and China, further fuel market growth. Moreover, the growing awareness about precision farming techniques and sustainable agricultural practices is encouraging farmers to invest in advanced spraying equipment. The emergence of lightweight and cost-effective sprayers, suitable for fragmented landholdings, coupled with the availability of local manufacturing, boosts adoption across the region.

Europe Agriculture Sprayers Market Analysis

In Europe, the agriculture sprayers market is largely driven by stringent regulations promoting sustainable farming and environmentally friendly practices. The European Union’s directives on pesticide usage and emissions are pushing farmers to adopt advanced sprayers that reduce environmental impact. Moreover, the rising demand for organic produce further boosts the market, as consumers increasingly prioritize quality and sustainability. According to IFOAM Organics Europe, the EU's total area of farmland under organic production grew to 16.9 Million hectares in 2022, reflecting the growing trend toward organic farming across the region. This shift is driving the need for specialized spraying equipment tailored to organic farming practices, which often require more precise application techniques. The adoption of precision agriculture technologies, such as GPS-enabled and automated sprayers, is also increasing as farmers seek to optimize field operations and reduce costs. With a strong regulatory framework and consumer demand for high-quality, sustainable products, the agriculture sprayers market in Europe is attaining continued growth.

Latin America Agriculture Sprayers Market Analysis

In Latin America, the agriculture sprayers market is driven by large-scale farming operations and the growing demand for high crop productivity. According to the Brazilian Institute of Geography and Statistics (IBGE) Agricultural Census 2017, agriculture occupies 41% of Brazil's land area, underscoring the sector's significant role in the region. Countries such as Brazil and Argentina are increasingly adopting advanced sprayers to optimize resource utilization and ensure uniform agrochemical application. Government subsidies for agricultural machinery, along with the presence of multinational manufacturers offering affordable solutions, further support market growth, fueling the adoption of modern spraying technologies.

Middle East and Africa Agriculture Sprayers Market Analysis

In the Middle East, the agriculture sprayers market is driven by the need for efficient irrigation and pest control solutions in arid and semi-arid climates. As farmers seek to address water scarcity and pest outbreaks, the demand for advanced sprayers is growing. According to an article published on Farmonaut, the company's precision agriculture technologies have increased crop yields by up to 30% in Middle Eastern farms, highlighting the region's shift toward more efficient farming practices. Government initiatives and subsidies are further promoting mechanization, while the adoption of modern sprayers continues to rise, enhancing productivity and sustainability.

Competitive Landscape:

Key players in the agriculture sprayers market drive the growth by constant innovation, strategic partnerships, and expansion in portfolios. The companies heavily invest in research and development processes for the introduction of advance technologies such as GPS-enabled sprayers, automated systems, and drone-based spraying solutions for higher efficiency and accuracy in operation. Mechanized farming through collaboration with agricultural organizations and governments strengthens their market positions even more. In response to ever-increasing demand for sustainable farming, multiple players are shifting their focus on developing eco-friendly sprayers that minimize the usage of chemicals and their subsequent influence on the environment. Improving manufacturing capacity and ensuring distribution networks in growth countries such as Asia Pacific and Latin America are also strategic avenues to capture a wider market area.

The report provides a comprehensive analysis of the competitive landscape in the agriculture sprayers market with detailed profiles of all major companies, including:

- AGCO Corporation

- ASPEE

- Bucher Industries AG

- Buhler Industries Inc. (Rostselmash)

- CNH Industrial N.V.

- Deere & Company

- Exel Industries

- Jacto Inc.

- KUBOTA Corporation

- Mahindra & Mahindra Limited

- RSR AGRO-Hymatic (RSR Retail Pvt. Ltd.)

- Stihl

- Yamaha Motor Co. Ltd.

Latest News and Developments:

- August 2024: MasterBrain Agro Industries Pvt Ltd, a startup supported by the Punjab Agri Business Incubator at Punjab Agricultural University (PAU), has registered its innovative agriculture spray machine design under design number 410796-001, classified as 15-03. The machine aims to enhance efficiency and productivity in farming practices.

- May 2024: Stara introduced the Imperador 4000 Eco Spray, the first crop protection sprayer in Latin America with precision weed management technology. Presented at Agrishow in Ribeirao Preto, Brazil, the sprayer utilizes camera-based AI for targeted herbicide application, aiming to enhance efficiency and reduce environmental.

Agriculture Sprayers Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | High-Pressure Sprayer, Low-Pressure Sprayer, Air Carrier Sprayer, Hand Operated Sprayer |

| Sources of Power Covered | Manual, Battery-Operated, Solar Sprayers, Fuel-Operated |

| Usages Covered | Field Sprayers, Orchard Sprayers, Gardening Sprayers |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AGCO Corporation, ASPEE, Bucher Industries AG, Buhler Industries Inc. (Rostselmash), CNH Industrial N.V., Deere & Company, Exel Industries, Jacto Inc., KUBOTA Corporation, Mahindra & Mahindra Limited, RSR AGRO-Hymatic (RSR Retail Pvt. Ltd.), Stihl and Yamaha Motor Co. Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the agriculture sprayers market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global agriculture sprayers market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the agriculture sprayers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Agricultural sprayers are farm appliances invented to apply liquid agents that include pesticides, herbicides, fertilizers, among others, to crops or on the soil for enhancing the growth and fighting pest or diseases.

The agriculture sprayers market was valued at USD 2.3 Billion in 2024.

IMARC estimates the global agriculture sprayers market to exhibit a CAGR of 4.7% during 2025-2033.

Some of the factors driving the global agricultural sprayers market include the rising adoption of precision farming technologies, increased demand for food due to population growth, advanced technology in sprayers, support from the government in favor of modern farming equipment, and sustainable crop protection solutions that are efficient.

According to the report, fuel-operated represented the largest segment by source of power, driven by their high-power output, durability, and ability to operate efficiently in large-scale farming and remote areas without reliance on electricity.

Field sprayers represent the most significant portion of the market in terms of usage because of their adaptability, effectiveness in covering extensive agricultural land, and common use in row crops, cereals, and other large farming practices.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global agriculture sprayers market include AGCO Corporation, ASPEE, Bucher Industries AG, Buhler Industries Inc. (Rostselmash), CNH Industrial N.V., Deere & Company, Exel Industries, Jacto Inc., KUBOTA Corporation, Mahindra & Mahindra Limited, RSR AGRO-Hymatic (RSR Retail Pvt. Ltd.), Stihl and Yamaha Motor Co. Ltd, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)