Agriculture Equipment Market Size, Share, Trends and Forecast by Equipment Type, Application, Sales Channel, and Region, 2026-2034

Agriculture Equipment Market Size and Share:

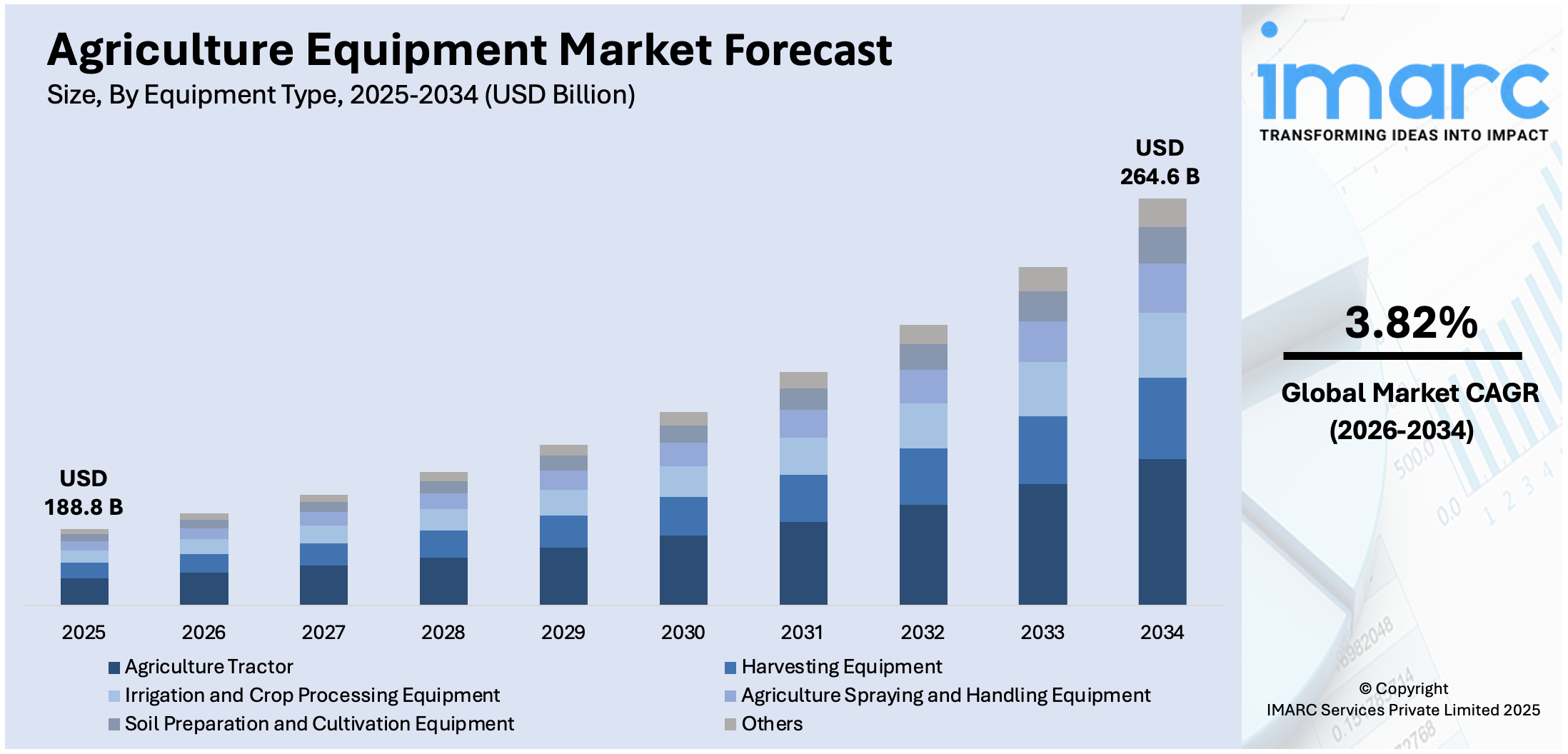

The global agriculture equipment market size was valued at USD 188.8 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 264.6 Billion by 2034, exhibiting a CAGR of 3.82% from 2026-2034. Asia Pacific currently dominates the market, holding a market share of over 36.8% in 2025. The market in the region is driven by rising mechanization, growing food demand due to population growth, government subsidies, and increasing adoption of advanced machinery.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 188.8 Billion |

|

Market Forecast in 2034

|

USD 264.6 Billion |

| Market Growth Rate (2026-2034) | 3.82% |

The global agriculture equipment market is primarily driven by increasing awareness among farmers regarding the efficiency and productivity gains achieved through modern agricultural machinery. This trend is complemented by the rising global demand for high-quality, sustainably produced food, necessitating advanced farming solutions. A key driver reshaping the industry is the integration of cutting-edge technologies such as autonomous tractors, drones, and AI-powered robotics. These innovations enhance precision in farming operations and help reduce production costs, making them highly attractive to farmers.

To get more information on this market Request Sample

The United States remains one of the most prominent markets for agriculture equipment, driven by robust technological advancements and a strong focus on sustainability. Manufacturers in the United States are increasingly developing machinery and tools designed to reduce the environmental impact of farming practices, aligning with the growing emphasis on eco-friendly and efficient agricultural solutions. For instance, in November 2024, John Deere released an update for their Operations Center, a mobile and web-based management tool that helps farmers track equipment and crop data. The software enables farmers to track the rainfall received by each field, monitor seeding quality variation and productivity based on the used equipment, and analyze historical data to enhance crop management.

Agriculture Equipment Market Trends:

Low Availability of Skilled Labor

The declining arable land acreage, low availability of skilled labor, and increasing food demand globally are some of the key factors propelling the adoption of agricultural machinery for efficient farming operations. Moreover, with elevating levels of urbanization, urban areas are providing a plethora of job opportunities and attracting rural households to migrate. This shift is resulting in a shortage of farm labor in various regions. For instance, according to the survey by the Centre for Monitoring Indian Economy (CMIE), in India, the number of people employed in the agriculture sector dropped from 158.2 million in 2022 to 147.9 million in 2023. Looking ahead, the Indian Council of Food and Agriculture projects a 25.7% decline in the percentage of agriculture workers in India by 2050. In North America and Europe, the dependence on seasonal immigrant workers has emerged due to a decrease in domestic labor availability. This dependence has led to an increase in the cost of farm labor, prompting farmers to turn to cost-effective agricultural machinery as a cost-saving measure.

Emergence of Precision Agriculture

The rising adoption of precision agriculture practices is catalyzing the agriculture equipment market growth. Precision agriculture involves the use of GPS-guided tractors, drones, and sensors for monitoring soil health, moisture levels, and crop conditions. Moreover, various manufacturers are introducing technologically advanced equipment to improve agriculture practices. Furthermore, the adoption of smart agriculture equipment is increasing, particularly in emerging markets. In line with this, Deere & Co. joined forces with Sweden-based Delaval on the Milk Sustainability Center and Norway-based Yara to develop digital tools for precision agriculture in October 2023. The aim of the partnerships is to aid farmers monitor livestock and fertilizer information, enabling them to make smarter and eco-friendly business decisions.

Mechanization of Farms

The mechanization of farms plays a crucial role in sustainable agriculture. Agriculture equipment, including tractors, harvesters, and other cultivation equipment, assists in numerous farming activities. According to a 2022 report by PRS India, 47% of agricultural operations in India were mechanized. It is estimated that achieving 75–80% mechanization in India would take approximately 25 years. In other developing countries, including China and Brazil, agricultural operations were 60% and 75% mechanized, respectively. As a result, developing regions are emerging as key growth segments for manufacturers. Moreover, since farmers are gradually becoming tech-savvy, and the adoption of GPS software products and tractors equipped with telematics is anticipated to spur agriculture equipment sales.

Agriculture Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global agriculture equipment market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on equipment type, application, and sales channel.

Analysis by Equipment Type:

- Agriculture Tractor

- Harvesting Equipment

- Irrigation and Crop Processing Equipment

- Agriculture Spraying and Handling Equipment

- Soil Preparation and Cultivation Equipment

- Others

Agriculture tractors account for 35.9% of the global market share, representing the leading equipment type. Tractors play a crucial role in agriculture, serving as the backbone of modern farming operations. Moreover, various key market players are increasingly investing in research and development activities to launch technologically advanced tractors in the market. For instance, in June 2023, Mahindra & Mahindra Ltd launched India's new Sarpanch Plus Tractor series, which offers a higher maximum torque, a 2 HP (1.49 kW) increase in power, and back-up torque to cover more ground quickly. Similarly, Sonalika Tractors has launched Tiger Electric, a field-ready electric tractor for the domestic market.

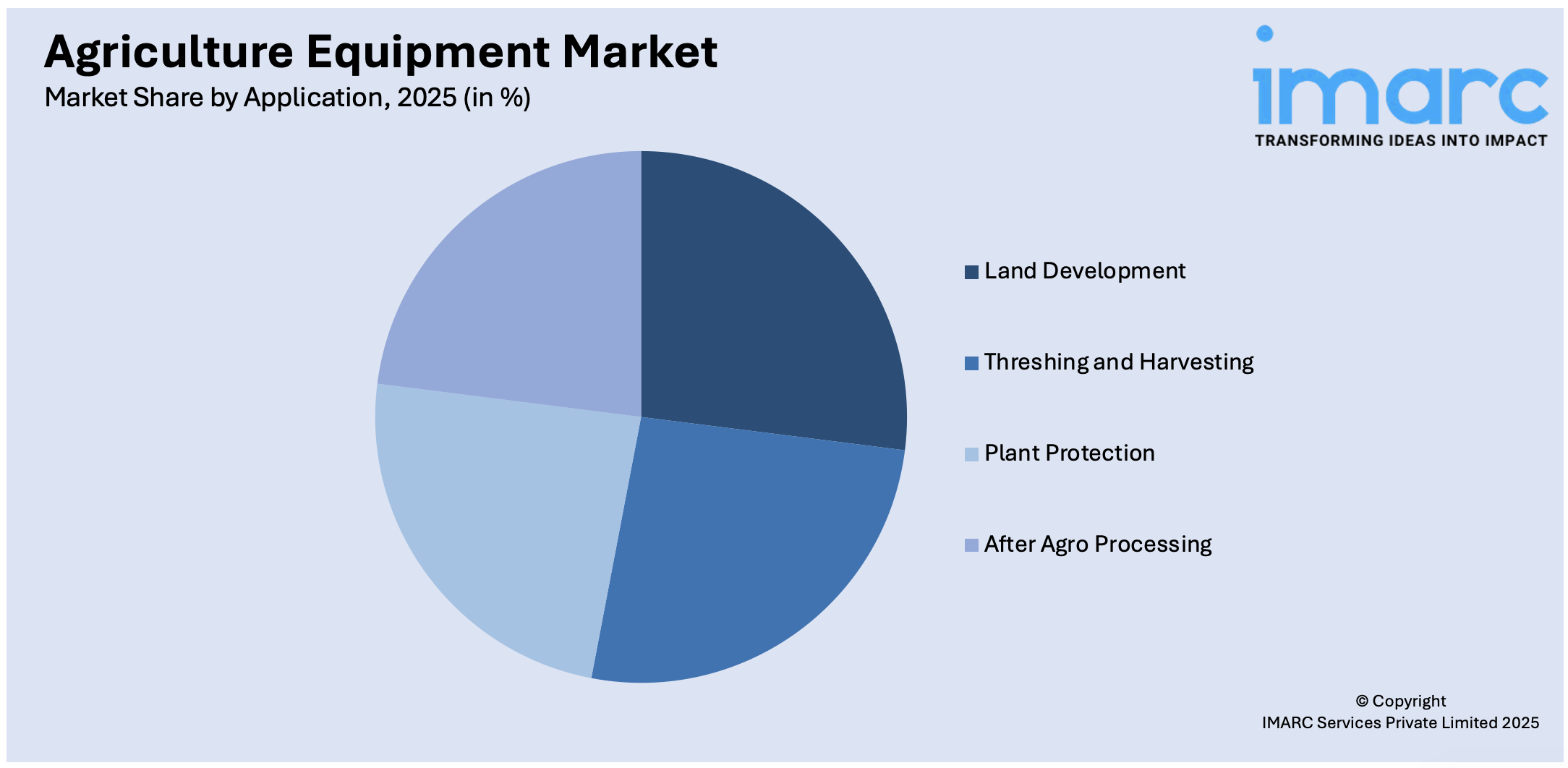

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Land Development

- Threshing and Harvesting

- Plant Protection

- After Agro Processing

Land development currently exhibits a clear dominance in the market, holding a share of 26.7%. As per data by the Food and Agriculture Organization, the total area under agricultural land was 4,781 million hectares globally. This represents more than 33% of the available land area worldwide. Consequently, land development has a critical role in preparing soil for cultivation, leveling fields, and enhancing overall agricultural efficiency. This segment benefits from the growing adoption of advanced machinery, such as tractors and tillers, to improve land productivity. Additionally, increasing mechanization in emerging economies further drives demand for land development equipment.

Analysis by Sales Channel:

- Original Equipment Manufacturers (OEM)

- Aftermarket

Original equipment manufacturers (OEM) hold the largest market share. OEMs provide high-quality, reliable machinery and components directly to farmers and agricultural businesses. OEMs are responsible for designing and manufacturing equipment that meets specific quality standards. Farmers are heavily dependent on this equipment for their daily operations, so durability, reliability, and efficiency are crucial. As a result, various key market players are involved in merger and acquisition activities to expand and offer improved agricultural machinery and equipment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific currently dominates the global market, with a significant 36.8% share of the global market. China is one of the leading producers of farming equipment and holds a major share of the market in the Asia Pacific. According to the National Bureau of Statistics of China, the country produced 5,253,595 large and medium-sized tractors in 2022. Moreover, the shortage of skilled labor, rising agricultural labor costs, and government initiatives for farm mechanization are projected to drive market expansion in the long run in the country. In recent years, Japan has also faced challenges related to the increasing area of abandoned farmland. Therefore, mechanization of agriculture is becoming essential for Japan to overcome the shortage of farm labor. Besides this, India produces a massive volume of tractors and exports tractors globally. Also, the production and sales volume of key players in the Indian market are growing, which indicates that the tractor market in India is growing.

Key Regional Takeaways:

North America Agriculture Equipment Market Analysis

The agriculture equipment market in North America is primarily driven by the increasing adoption of advanced technologies such as precision farming, GPS-enabled equipment, and automation to enhance productivity and efficiency. For instance, according to the USDA, over the past 20 years, U.S. farms have substantially increased their adoption of precision agriculture, and numerous precision technologies are now widespread. For instance, guidance autosteering systems on tractors, harvesters, and other equipment were used by 52% of midsize farms and 70% of large-scale crop-producing farms in 2023—up from adoption rates in the single digits in the early 2000s. Rising demand for high-yield crops, driven by a growing population and expanding food consumption, has fueled investments in modern farming machinery. Additionally, government subsidies and financial support programs for agricultural mechanization encourage farmers to upgrade their equipment. The region's focus on sustainable farming practices and the integration of energy-efficient machinery also play a crucial role in propelling market growth.

United States Agriculture Equipment Market Analysis

The United States accounted for 77.80% share of the agriculture equipment market in North America during 2024. The US agriculture machinery market has seen upward movement and continues to rise further on grounds of technology advancement, higher demand for crop production, and favorable government policies. According to USDA 2024 data, total expenditures by U.S. farms (not including Alaska and Hawaii) were USD 481.9 billion in 2023, up 6.5% from USD 452.5 billion in 2022. This increase in expenditure can be attributed to the integration of precision farming technologies, including GPS-guided systems and autonomous machinery, which enhance efficiency in operations. Companies like John Deere and AGCO are market leaders, heavily investing in innovative products that meet the diverse needs of modern farming. These factors also contribute to the dynamics within the market as it transitions to sustainable farming practices and obtains government support for green technology. Export opportunities for U.S. manufacturers place the nation among the leaders for the production of agricultural equipment worldwide.

Europe Agriculture Equipment Market Analysis

Europe's agricultural machinery market is growing steadily through the EU's Common Agricultural Policy and demand for far more efficient farming technologies. The European Commission report shows that the value of EU agricultural production was EUR 223.9 Billion (USD 236.81 Billion) in 2023, thus driving up demand for advanced equipment. Key markets in the region include Germany, France, and the UK. Increasing adoption of precision agriculture technologies, like drone-assisted farming and automated machinery, is another factor driving the market expansion. The strict environmental policies of the EU force manufacturers to develop environment-friendly machinery like low-emission variants and energy-efficient systems. The leading companies in the manufacture of agricultural equipment include CLAAS and CNH Industrial, focusing on innovating through technology with sustainable inputs. Besides this, government support, R&D activities and regional cooperation encourage innovation, making Europe a significant market globally for the farming equipment sector.

Asia Pacific Agriculture Equipment Market Analysis

Agriculture in the Asia Pacific region is fast-growing and expected to boom further due to rising food demand, increasing mechanization in agriculture, and support by governments for rural development. In India, agricultural output in 2021-22 stood at USD 50.2 Billion with emphasis on mechanization enhancing the country's farm productivity. Japan, South Korea, and Australia have also invested in modernized equipment like drones and automatic tractors. Precision farming technologies that include satellite navigation and sensors are becoming popular; this boosts the market. Partnerships between local and international players, such as Mahindra & Mahindra with SANY, lead to innovation and an extensive market. The Asia-Pacific region will become a notable production and sales hub for farm equipment with increasing disposable incomes as well as export opportunities in the region.

Latin America Agriculture Equipment Market Analysis

Latin America's agricultural equipment market is growing due to improved agricultural output, increased farm mechanization, and government incentives in modernizing the agriculture sector. According to the Inter-American Development Bank (IDB), Latin America's agricultural exports rose 18.8% in 2022, mainly driven by higher commodity prices. The biggest agricultural economies in the region have been heavily investing in the mechanization of agriculture and making it more productive and less labor intensive. The ministry of agriculture in Brazil made allocation of USD 9.2 billion during 2023 to accelerate modernization of agriculture which entails the usage of tractors as well as harvesters. Other vital markets are Argentina, Chile, and Mexico, which are also implementing machinery for the production of food items. The region is seeing more interest in sustainable farming practices, with government programs supporting the development of eco-friendly machinery. Major manufacturers such as Kubota and AGCO dominate the market, while local players such as Semeato are expanding their reach. Latin America's growing agricultural exports further strengthen the demand for agricultural equipment.

Middle East and Africa Agriculture Equipment Market Analysis

The agricultural equipment market in the Middle East and Africa is growing since countries are looking to modernize their farming sectors and combat food security challenges. According to data from the African Development Bank, approximately 60% of the working population in Africa is engaged in agriculture. Countries like South Africa, Kenya, and Egypt are experiencing acceleration in the adoption of mechanization. Tractors and irrigation systems are in high demand in the market. Water management and precision agriculture technologies have become necessary in North Africa and thus boost the market growth. International and local producers have also increased market access through partnerships, as represented by John Deere, who collaborated with local African distributors to make more high-end technologies accessible. The agricultural machinery market in the Middle East and Africa is growing with good government support, investments in countryside infrastructure, and rising demand for highly efficient farming solutions.

Competitive Landscape:

Key players in the market, such as Deere & Company, CNH Industrial N.V., AGCO Corporation, and Mahindra & Mahindra Ltd., are focusing on technological advancements, product diversification, and strategic partnerships to strengthen their market position. They are heavily investing in precision agriculture technologies, including GPS-enabled machinery, autonomous tractors, and smart farming solutions, to address the growing demand for efficiency and sustainability in farming practices. Additionally, these companies are expanding their regional footprints through acquisitions and collaborations to tap into emerging markets. Emphasis on electric and hybrid machinery is also gaining momentum.

The report provides a comprehensive analysis of the competitive landscape in the agriculture equipment market with detailed profiles of all major companies, including:

- AGCO Corporation

- Agromaster Agricultural Machinery

- Argo Tractors S.p.A.

- Bellota Agrisolutions

- China National Machinery Industry Corporation

- CLAAS KGaA mbH

- CNH Industrial N.V.

- Deere & Company

- Escorts Kubota Limited

- Iseki & Co. Ltd.

- JC Bamford Excavators Ltd

- Mahindra & Mahindra Ltd.

- SDF Group

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- December 2024: CropX announced integration with CLAAS, whereby CLAAS equipment users can upload machine data into the CropX agronomy platform to visualize and analyze various variable rate application tasks. According to CropX, such a connection improves interoperability, with farmers receiving sharper insights of field conditions, irrigation, nitrogen leaching, and crop protection to make better gains in productivity.

- May 2024: Escorts Kubota plans to invest up to Rs 4,500 crore in a new plant over the next 3-4 years. This investment will support the company's growth in the agriculture equipment sector. The initiative aims to expand manufacturing capacity and enhance production capabilities.

- February 2024: Mahindra USA introduced two new tractors – subcompact, 1100 models with 20-26 hp engines and compact, 2100 models, mounting 23-26 hp engines. These tractors are constructed on two different chassis and offer enhanced comfort and accessibility to buyers, including features such as telematics, leather seats, and USB charging ports.

- November 2023: The Bihar Government in India launched Krishi Yantrikaran Yojna to provide subsidized agricultural equipment to farmers. The scheme covers 108 types of agricultural equipment, from trowels, spades, and sickles to pump sets, plows, harvesters, and more.

- February 2023: Massey Ferguson tractors launched its brand-new DYNATRACK Series, an innovative line of tractors that combine potent power with dynamic performance, smart technology, unrivaled usefulness, and versatility.

Agriculture Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Agriculture Tractor, Harvesting Equipment, Irrigation and Crop Processing Equipment, Agriculture Spraying and Handling Equipment, Soil Preparation and Cultivation Equipment, and Others |

| Applications Covered | Land Development, Threshing and Harvesting, Plant Protection, After Agro Processing |

| Sales Channels Covered | Original Equipment Manufacturers (OEM), Aftermarket |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AGCO Corporation, Agromaster Agricultural Machinery, Argo Tractors S.p.A., Bellota Agrisolutions, China National Machinery Industry Corporation, CLAAS KGaA mbH, CNH Industrial N.V., Deere & Company, Escorts Kubota Limited, Iseki & Co. Ltd., JC Bamford Excavators Ltd, Mahindra & Mahindra Ltd., SDF Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the agriculture equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global agriculture equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the agriculture equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Agriculture equipment refers to machinery, tools, and devices used in farming to perform tasks such as plowing, planting, harvesting, irrigation, and soil maintenance. Examples include tractors, combines, seed drills, sprayers, and irrigation systems. These technologies enhance efficiency, productivity, and sustainability in agricultural operations across various scales.

The agriculture equipment market was valued at USD 188.8 Billion in 2025.

IMARC estimates the global agriculture equipment market to exhibit a CAGR of 3.82% during 2026-2034.

The global agriculture equipment market is driven by increasing mechanization, rising demand for food due to population growth, and technological advancements like precision farming. Government subsidies, favorable financing options, and growing adoption of sustainable farming practices further support the market's expansion, particularly in developing regions.

In 2025, agriculture tractors represented the largest segment by equipment type, driven by their crucial role in farm management and operations, along with the introduction of technologically advanced products by manufacturers.

Land development leads the market by application due to its role in soil preparation and growing adoption of tractors and tillers, particularly in mechanizing emerging agricultural markets.

The OEM is the leading segment by sales channel as they offer high product quality, warranties, customization, and robust dealer networks, making them the preferred choice for large-scale farmers globally.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global agriculture equipment market include AGCO Corporation, Agromaster Agricultural Machinery, Argo Tractors S.p.A., Bellota Agrisolutions, China National Machinery Industry Corporation, CLAAS KGaA mbH, CNH Industrial N.V., Deere & Company, Escorts Kubota Limited, Iseki & Co. Ltd., JC Bamford Excavators Ltd, Mahindra & Mahindra Ltd., SDF Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)