Agriculture Drones Market Size, Share, Trends and Forecast by Offering, Component, Farming Environment, Application, and Region, 2025-2033

Agriculture Drones Market Size and Share:

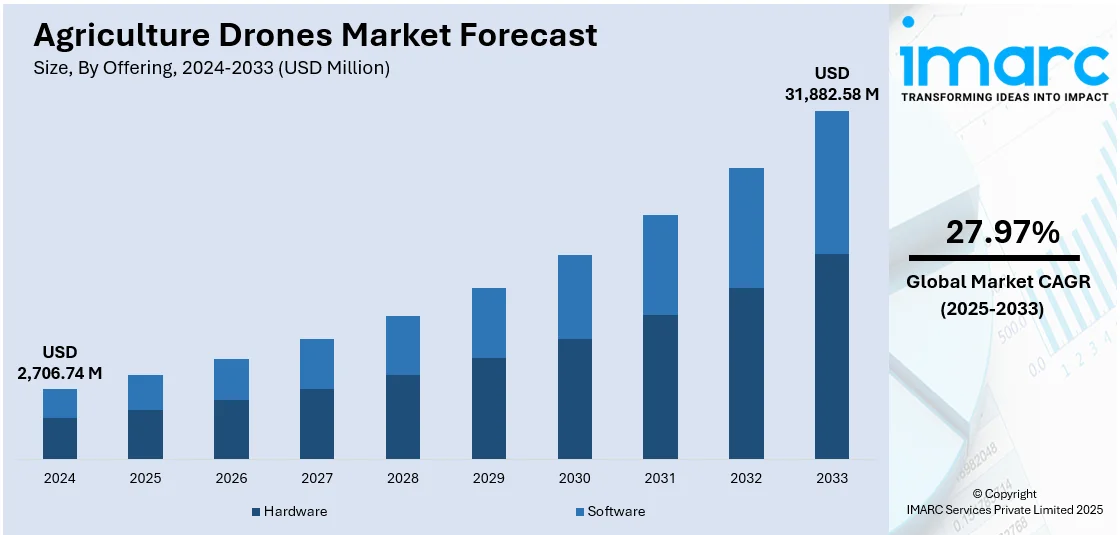

The global agriculture drones market size was valued at USD 2,706.74 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 31,882.58 Million by 2033, exhibiting a CAGR of 27.97% during 2025-2033. North America currently dominates the market, holding a significant market share of over 33.2% in 2024. The continual technological advancements, rising labor shortage across the globe, escalating environmental consciousness among the masses, implementation of various government initiatives, escalating consumer expectation for better-quality, and increasing unpredictability of weather patterns are some of the major factors propelling the agriculture drones market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,706.74 Million |

| Market Forecast in 2033 | USD 31,882.58 Million |

| Market Growth Rate 2025-2033 | 27.97% |

The market is primarily driven by the expansion of precision livestock monitoring and disease detection applications, which is increasing the adoption rate. These technologies are enabling farmers to optimize resources, reduce livestock losses, and improve overall productivity. According to an industry report, agricultural drones were deployed across more than 500 Million hectares of farmland globally by the end of June 2024. This widespread utilization reflects their growing importance in large-scale operations. Their operational efficiency has resulted in significant resource conservation, saving approximately 210 Million Metric Tons of water and reducing pesticide use by nearly 47,000 Metric Tons worldwide. These benefits continue to fuel their rising demand across regions. Furthermore, increased investments by private firms and research institutions in drone-assisted smart farming trials are encouraging broader use across diverse climatic zones. In addition to this, supportive legal frameworks in emerging economies are also lowering entry barriers for drone service providers, which is providing an impetus to the market.

The market in the United States is significantly expanding, propelled by the presence of a well-established digital infrastructure, which enables seamless integration of drone-collected data into farm management systems. Moreover, the surge in organic farming and demand for pesticide efficiency is driving the adoption of drones, which is an emerging agriculture drone market trend. Also, strategic collaborations between drone manufacturers, resulting in highly tailored drone platforms that cater to the specific needs of U.S. growers. For instance, on December 10, 2024, Agri Spray Drones announced a strategic partnership with EAVision to enhance its agricultural drone offerings in the United States. This collaboration introduces EAVision's J100 drone, featuring integrated lidar technology and advanced mist nozzles aimed at improving precision spraying for diverse crop types. Apart from this, increased funding through USDA innovation grants and state-level pilot programs is encouraging small and mid-sized farms to implement UAV technologies.

Agriculture Drones Market Trends:

The rising labor shortage across the globe

The agricultural sector is facing a growing labor shortage problem, which is driving the need for automated solutions, such as drones, which is positively impacting agriculture drones market outlook. Additionally, the rising geriatric population in many developed countries and younger generations increasingly moving towards urban areas for employment opportunities are causing a shortage of skilled labor for farming activities. According to the United Nations, 55% of the world’s population currently resides in urban areas, a figure projected to rise to 68% by 2050. Besides this, manual labor is not only hard to find but can also be expensive and seasonal, adding to the inconsistency in workforce availability. Drones provide a solution to this labor gap by automating many tasks, such as crop monitoring, that would otherwise require significant human effort. In addition, they can also apply fertilizers and pesticides in a targeted manner, thus reducing the need for manpower. As a result, drones allow agricultural enterprises to maintain or even increase productivity despite labor shortages.

The escalating environmental consciousness among the masses

The growing environmental consciousness is a crucial factor driving agriculture drones market demand. Traditional farming practices involve the indiscriminate use of resources, such as water and fertilizers, which cause soil degradation and water pollution. The United Nations Environment Programme highlights the severity of this issue, reporting that 11,000 people die annually due to the toxic effects of pesticides, while chemical residues degrade ecosystems, diminish soil health, and reduce farmers’ resilience to climate change. Drones, with their precision agriculture capabilities, address these concerns effectively by enabling targeted application of fertilizers and pesticides, thereby reducing wastage and minimizing environmental impact. In addition, drones can generate detailed maps of farmland, highlighting areas that may require special attention, such as those with poor drainage or soil conditions. This data aids in the optimal utilization of resources, thus preserving the environment, saving costs, and promoting eco-friendly practices. The agriculture drones market revenue is projected to increase due to widespread adoption of precision farming techniques worldwide. Moreover, the agriculture drones market forecast anticipates growth driven by the demand for precision farming solutions.

Significant technological advancements

Continual technological advancement in drone capabilities is a key driver influencing the agriculture drones market value. Drones are becoming more specialized and equipped with advanced features tailored to agricultural needs. In line with this, the integration of sophisticated sensors, such as multispectral, hyperspectral, and thermal cameras, has enabled the collection of highly accurate data, which can be analyzed in real-time for informed decision-making. Furthermore, the incorporation of advanced global positioning systems (GPS) and geographic information systems (GIS) to offer precise location tracking and data mapping is positively impacting the market. This trend aligns with the broader expansion of the global GIS market, which reached USD 14.4 Billion in 2024 and is projected to grow to USD 37.1 Billion by 2033 at a CAGR of 11.1% (2025-2033). Apart from this, the advancements in artificial intelligence (AI) and machine learning (ML) algorithms that are revolutionizing data analytics and providing actionable insights into crop health, soil conditions, and irrigation needs are contributing to the agriculture drones market growth.

Agriculture Drones Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global agriculture drones market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on offering, component, farming environment, and application.

Analysis by Offering:

- Hardware

- Fixed Wing

- Rotary Wing

- Hybrid Wing

- Software

- Data Management Software

- Imaging Software

- Data Analytics Software

- Others

Hardware (fixed wing) leads the market with around 62.1% of market share in 2024. It offers longer flight times compared to its rotary-wing counterparts, allowing for the surveying of larger agricultural fields in a single flight. Furthermore, it is generally faster, covering more ground in less time, which enhances its suitability for large-scale agricultural applications, such as crop monitoring, soil analysis, and mapping. Moreover, fixed-wing drones are more energy-efficient, as they require less power to stay aloft, which makes them highly cost-effective in the long run, lowering operational cost for farmers and agricultural companies. Additionally, their designs enable them to carry heavier payloads, including advanced imaging technologies and larger batteries. This capacity allows for more sophisticated data collection, which is crucial for modern, data-driven agricultural practices.

Analysis by Component:

- Controller Systems

- Propulsion Systems

- Cameras

- Batteries

- Navigation Systems

- Others

Camera leads the market in 2024. Cameras provide high-resolution imaging, which allows detailed crop monitoring, soil assessment, and mapping, enabling farmers to make informed decisions. Additionally, the recent advancements in camera technology, which have led to the development of specialized cameras capable of multispectral, hyperspectral, and thermal imaging, are contributing to the market growth. Besides this, cameras are becoming increasingly cost-effective, making them an accessible option for even smaller agricultural operations. Furthermore, the cost-effectiveness and wider affordability has accelerated the adoption of camera-equipped drones across the agricultural sector. Moreover, the ease of integrating cameras with drone hardware and data analytics platforms facilitates efficient data processing and interpretation, which is crucial for modern agriculture practices that rely on real-time information.

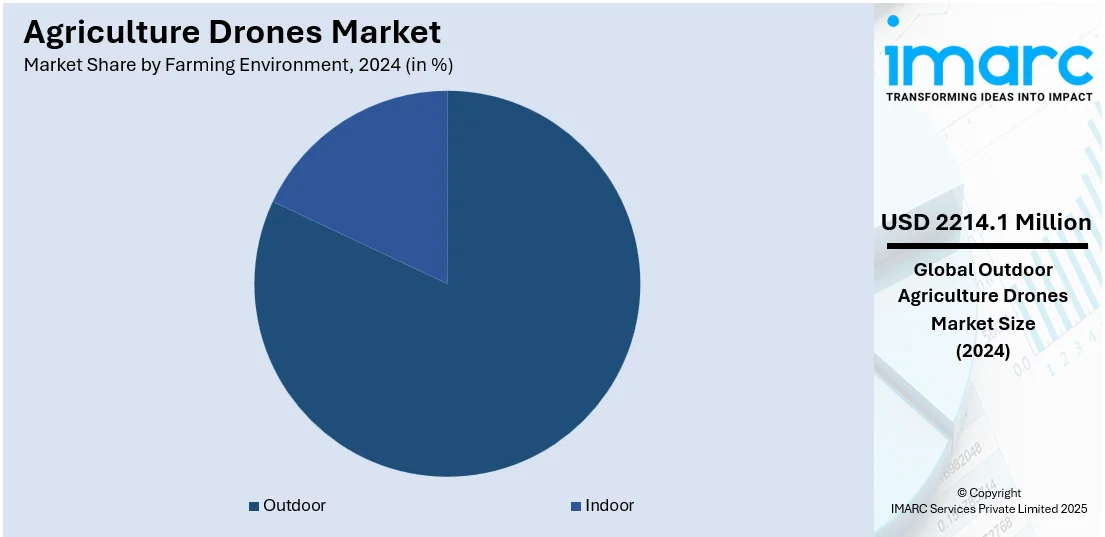

Analysis by Farming Environment:

- Indoor

- Outdoor

Outdoor leads the market with around 81.8% of market share in 2024. Outdoor farming environments, such as large farms and plantations, cover vast areas that are difficult to monitor manually. Drones offer an efficient, scalable solution to survey these large tracts of land, making them highly suitable for outdoor applications. Furthermore, agricultural drones are primarily used for field mapping, crop monitoring, and soil analysis, tasks that are predominantly relevant to outdoor farming practices. Additionally, outdoor farming often involves varied terrains and ecological conditions, which can be challenging to navigate through ground-based methods. In line with this, drones offer the flexibility to easily adapt to different outdoor conditions, thus offering more reliable and efficient data collection. Moreover, the outdoor environment provides more opportunities for the deployment of advanced drone technologies, such as multispectral imaging and LIDAR.

Analysis by Application:

- Field Mapping

- Variable Rate Application

- Crop Scouting

- Others

Field mapping is dominating the market in 2024, as it provides critical data that helps farmers understand the variability in their fields, allowing them to make informed decisions about irrigation, fertilization, and pest control. Furthermore, the advancements in drone technology, which have enabled high-resolution imaging capabilities, making field mapping more precise and accurate, are offering a favorable agriculture drones market outlook. Additionally, the advent of precision agriculture, which depends heavily on accurate field maps, is acting as another growth-inducing factor. Moreover, field mapping with drones is significantly faster and provides the ability to quickly gather data, which allows timely interventions, such as planting adjustments, irrigation modifications, or pest treatments. Along with this, the imposition of favorable policies by governments to encourage the use of drones for non-intrusive applications like field mapping is catalyzing the agriculture drones market demand.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 33.2%. North America has a strong technological infrastructure that readily supports advancements in drone technology. Along with this, the region hosts some of the world's leading tech companies specializing in drone manufacturing. Furthermore, North America benefits from robust regulatory frameworks that facilitate easier implementation of drone technology in agriculture, including clear guidelines and quicker approvals for drone operations. Besides this, the regional farmers possess the capital required to invest in sophisticated drone systems, making it a lucrative market for agriculture drone companies. Additionally, the agricultural sector in the region is more industrialized and open to adopting new technologies to improve efficiency and yield. Moreover, North America has a vast expanse of arable land, which necessitates more effective and scalable solutions, such as drones, for crop monitoring, soil assessment, and yield prediction.

Key Regional Takeaways:

United States Agriculture Drones Market Analysis

The United States holds a substantial share of the North America agriculture drones market with 76.80% in 2024. The market in the United States is witnessing significant growth, driven by advancements in precision farming and the increasing adoption of automation in agriculture. Farmers are leveraging drones for crop monitoring, field mapping, and yield estimation, leading to improved productivity and resource efficiency. The integration of artificial intelligence and data analytics further enhances decision-making, optimizing input usage and reducing operational costs. Government initiatives supporting precision agriculture and the rising demand for sustainable farming practices are propelling market expansion. Notably, USDA climate-smart agriculture investments, initiated during the Biden-Harris Administration, are projected to support over 180,000 farms and 225 Million acres within five years, further encouraging the adoption of smart technologies, including agricultural drones. Additionally, the inclusion of high-resolution imaging and multispectral sensors is improving data accuracy, contributing to enhanced farm management. The market is also benefiting from the rapid development of autonomous drone technologies, reducing manual labor dependency. Drones are gaining importance in agriculture due to labor shortages and climate variability, enhancing efficiency and sustainability in pesticide and fertilizer spraying, thereby expanding the sector.

Europe Agriculture Drones Market Analysis

The European agriculture drone market is growing due to demand for precision farming solutions and sustainable practices. Drones are used for real-time crop health monitoring, field surveying, and irrigation management, optimizing resources, and increasing yields. Advanced imaging technologies and AI-driven analytics enhance decision-making. Regulations supporting drone usage in agriculture contribute to market expansion. Automation in farming is gaining traction, leading to increased integration of drones with other digital solutions. Targeted pesticide spraying enhances productivity while minimizing environmental impact. Climate-resilient farming techniques are also accelerating adoption. Market growth is also supported by research and innovation in drone-based analytics, enabling farmers to improve efficiency. According to IMARC Group, the Europe agricultural robot market size reached USD 2.8 Billion in 2024 and is expected to grow at a CAGR of 12.4%, reaching USD 8.1 Billion by 2033. This rising adoption of agricultural automation further strengthens the demand for drones, as they play a crucial role in enhancing farm productivity.

Asia Pacific Agriculture Drones Market Analysis

The Asia Pacific agriculture drone market is expanding rapidly due to smart farming technologies and automation. Drones are used for field monitoring, crop assessment, and precision spraying, improving productivity and resource management. The integration of AI and remote sensing enhances efficiency, enabling real-time decision-making. Growing awareness about modern farming techniques encourages widespread drone adoption, particularly in large-scale farming. Technological advancements like multispectral imaging and GPS-enabled drones drive further market growth. Additionally, the use of drones for pesticide and fertilizer application is gaining popularity, reducing manual labor and optimizing input usage. Investments in digital agriculture are further accelerating market expansion. According to Agro Spectrum India, the Indian government's commitment to digital agriculture was reinforced in the Interim Budget 2024, which allocated INR 600 Crore for the development of technology in the agriculture sector and INR 450 Crore for the Digital Agriculture Mission. Such initiatives highlight the growing emphasis on integrating cutting-edge technology in farming operations.

Latin America Agriculture Drones Market Analysis

The Latin American agriculture drone market is expanding due to improved farming efficiency and yield optimization. Farmers use drones for precision spraying, crop health monitoring, and land assessment. Automation reduces labor dependency and improves operational efficiency. Advanced technologies like multispectral imaging and AI-based analytics enhance decision-making. The integration of drones with digital agriculture solutions contributes to market growth. According to the Presidency of the Republic, Private investments in the agro-industrial sector are anticipated to reach BRL 296.3 Billion by 2029, highlighting the region’s commitment to modernizing agriculture. This growing investment landscape is likely to accelerate the adoption of drone technology, enabling farmers to optimize resources and enhance productivity. As agricultural activities continue to modernize, drones are expected to play a vital role in optimizing farming operations, improving efficiency, and supporting the region’s push toward precision agriculture.

Middle East and Africa Agriculture Drones Market Analysis

The Middle East and Africa's agriculture drone market is growing due to smart farming technologies, including crop monitoring, irrigation management, and precision spraying. AI and remote sensing integration improves decision-making, while advanced imaging and data analytics optimize crop management. Automation in agriculture is gaining traction for large-scale farming. Additionally, the growing focus on sustainable farming solutions is increasing market demand. According to the World Bank Group, in a major step toward developing climate-smart agriculture solutions, the World Bank has granted USD 40 Million in IDA loans for the Accelerating Impacts of Climate Research for Africa project. Investment in precision farming tools, including drones, is expected to boost agricultural resilience, efficiency, productivity, and sustainability, contributing to the advancement of agricultural modernization.

Competitive Landscape:

The leading players are focusing on technological innovations to provide drones with advanced features, such as enhanced imaging capabilities, machine learning (ML) algorithms for crop analysis, and improved battery life for extended flight times. Besides this, various companies are entering into partnerships and collaborations with agricultural tech firms and research institutions to develop drones with specialized functionalities. Furthermore, they are participating in agricultural exhibitions, hosting webinars, and publishing case studies to demonstrate the effectiveness of drone technology in modern agriculture. Additionally, several product manufacturers are actively working with governmental bodies to help define regulations that are conducive to the agricultural drone industry, ensuring safety and compliance. Moreover, they are exploring various pricing models, including leasing options, to make drone technology accessible to small and medium-sized farms, thus broadening the consumer base.

The report provides a comprehensive analysis of the competitive landscape in the agriculture drones market with detailed profiles of all major companies, including:

- 3D Robotics Inc.

- AeroVironment Inc.

- AGCO Corporation

- AgEagle Aerial Systems Inc.

- American Robotics Inc. (Ondas Holdings Inc.)

- DJI

- DroneDeploy

- Parrot Drone SAS

- PrecisionHawk

- Trimble Inc.

- Yamaha Motor Co. Ltd.

Latest News and Developments:

- January 2025: General Aeronautics, a Bangalore-based drone technology firm, closed its Series A+ funding round led by Fowler Westrup India to accelerate precision agriculture. The investment will expand production, strengthen distribution, and introduce affordable drone models for microentrepreneurs, making advanced farming solutions accessible to more farmers. GA’s DGCA-certified drones are already used by major agrochemical companies, reflecting industry trust. The funding aims to boost operational scale, R&D, and supply chain efficiency, supporting sustainable, efficient, and innovative agricultural practices in India.

- January 2025: Drone Nerds partnered with ABZ Innovation to offer American farmers multifunctional agricultural drones. The partnership aims to provide alternative solutions to the North American farming industry due to changes and challenges in federal drone regulations. ABZ Innovation's agricultural UAVs include the L30, for medium and large farms, and the L10 PRO, designed for smaller farms.

- October 2024: Amber Wings launched the Vihaa agricultural drone to enhance farming efficiency in India. Certified by DGCA, the 28 kg drone features a 10-liter spraying tank and covers 30 acres daily.

- August 2024: Rotor Technologies, Inc. launched the Sprayhawk, an automated crop-dusting UAV based on the Robinson R44 helicopter that can carry 110 gallons and spray over 240 acres per hour. The Sprayhawk is the largest agricultural drone available, operated by a ground crew of two. It features a 120-gallon spray tank with 33-foot spray booms, autonomous spray path and terrain following algorithms, and sensors for obstacle avoidance.

- May 2024: AITMC Ventures Ltd.'s VIRAJ agriculture drone received type certification from the Directorate General of Civil Aviation (DGCA). This certification enhances the company's credibility and opens new opportunities in the growing Indian drone market. The VIRAJ UAS drones are designed for seed broadcasting, agrochemical spraying, and remote pilot training.

- May 2024: Marut Dronetech and the Indian Farmers Fertilizer Cooperative Limited (Iffco) partnered to implement drone-as-a-service (DAAS) operations across five lakh acres, with the goal of creating rural entrepreneurs, increasing agricultural productivity, and introducing drone technology to Telangana and Andhra Pradesh. Marut Dronetech will use its drone technology to administer agricultural inputs developed by IFFCO Agri-products, which will optimize crop yields while minimizing environmental impact and promoting sustainable agricultural practices.

- April 2024: DJI introduced the Agras T50 and T25 agricultural drones. The T50 is tailored for large-scale farming with a 40 kg spraying capacity, while the compact T25 suits smaller fields with a 20 kg capacity. Both models feature dual atomization spraying systems, advanced obstacle sensing, and integrate with the upgraded SmartFarm app for enhanced aerial application management.

- February 2024: Trimble and DroneDeploy integrated the Applanix POSPac Cloud PPK GNSS positioning service with DroneDeploy’s reality capture platform, delivering centimeter-level accuracy for drone mapping. This collaboration eliminates the need for base stations, streamlining workflows and enabling high-accuracy reality capture for industries like construction, energy, and agriculture.

Agriculture Drones Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Offerings Covered |

|

| Components Covered | Controller Systems, Propulsion Systems, Cameras, Batteries, Navigation Systems, Others |

| Farming Environments Covered | Indoor, Outdoor |

| Applications Covered | Field Mapping, Variable Rate Application, Crop Scouting, Others |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | 3D Robotics Inc., AeroVironment Inc., AGCO Corporation, AgEagle Aerial Systems Inc., American Robotics Inc. (Ondas Holdings Inc.), DJI, DroneDeploy, Parrot Drone SAS, PrecisionHawk, Trimble Inc., Yamaha Motor Co. Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the agriculture drones market from 2019-2033.

- The agriculture drones market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the agriculture drones industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The agriculture drones market was valued at USD 2,706.74 Million in 2024.

The agriculture drones market is projected to exhibit a CAGR of 27.97% during 2025-2033, reaching a value of USD 31,882.58 Million by 2033.

The market is driven by rising demand for precision farming, the need to increase crop yields, and growing labor shortages in agriculture. Drones help farmers collect real-time data on crop health, soil conditions, and field variability, leading to improved resource efficiency. Technological advancements in GPS, imaging sensors, and AI analytics are also accelerating drone adoption in modern agriculture.

North America currently dominates the agriculture drones market, accounting for a share of 33.2% in 2024. The dominance is fueled by widespread adoption of precision agriculture practices, strong government support for drone usage, and high investment in agri-tech solutions. Presence of leading drone manufacturers and favorable regulatory policies further support market expansion across the United States and Canada.

Some of the major players in the agriculture drones market include 3D Robotics Inc., AeroVironment Inc., AGCO Corporation, AgEagle Aerial Systems Inc., American Robotics Inc. (Ondas Holdings Inc.), DJI, DroneDeploy, Parrot Drone SAS, PrecisionHawk, Trimble Inc., and Yamaha Motor Co. Ltd, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)