Agricultural Ventilation Fans Market Size, Share, Trends and Report by Product, Application, and Region, 2025-2033

Agricultural Ventilation Fans Market Size and Share:

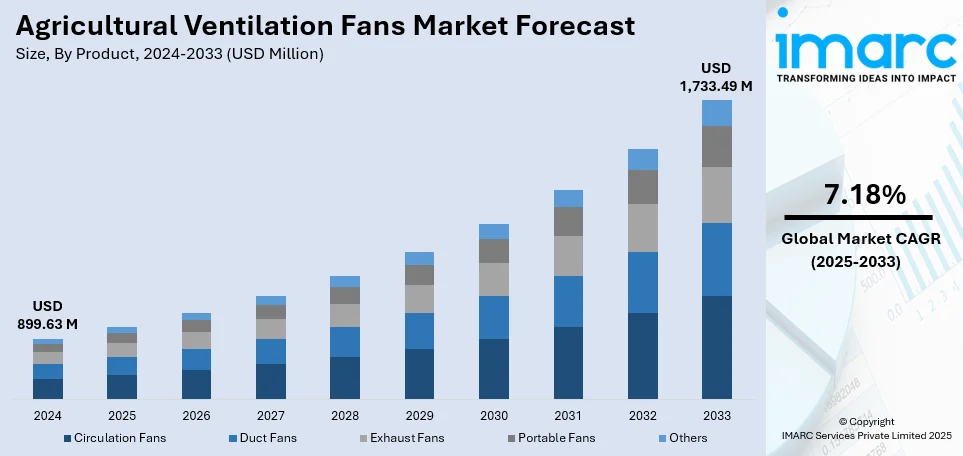

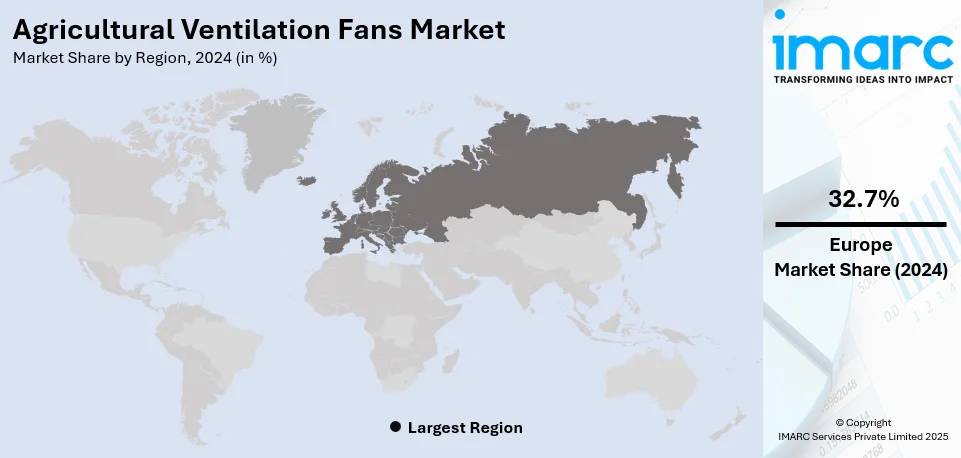

The global agricultural ventilation fans market size was valued at USD 899.63 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,733.49 Million by 2033, exhibiting a (CAGR) of 7.18% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 32.7% in 2024. The market is propelled by the widespread adoption of advanced farming technologies and stringent regulations on indoor farming environments. Government initiatives and subsidies also increasing the agricultural ventilation fans market share across the region, promoting sustainable agricultural practices and technological advancements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 899.63 Million |

|

Market Forecast in 2033

|

USD 1,733.49 Million |

| Market Growth Rate (2025-2033) | 7.18% |

Rising demand for efficient yet economic ventilation systems in agriculture benefits the market, as farmers strive for the optimization of livestock and crop environments. These demands are major drivers, with escalating energy costs and sustainability gaining traction. Climate change and erratic weather are also significant drivers since farmers need to maintain stable conditions for their undertakings. Furthermore, government regulations and incentives promoting energy-efficient and environmentally friendly practices support the growth of the market. Technological advances like IoT integration and automation in ventilation systems provide real-time monitoring and control that help transform operations to be more productive and efficient. These factors are collectively creating a positive agricultural ventilation fans market outlook .

The United States stands out as a key market disruptor, driven by the advanced agricultural practices of the country and adoption of modern technology which fuel the demand for high-efficiency ventilation systems. As the U.S. embraces sustainable farming and seeks to optimize livestock and crop environments, the need for energy-efficient, durable, and smart ventilation solutions has grown. Government incentives and policies promoting sustainability further accelerate market disruption by encouraging the development of eco-friendly fan systems. Additionally, U.S. companies lead in research and development, introducing state-of-the-art fans with advanced automation, IoT integration, and better airflow control, making it a key player in transforming the global agricultural ventilation landscape.

Agricultural Ventilation Fans Market Trends:

Rise in indoor and vertical farming

The increasing adoption of indoor and vertical farming practices is significantly driving the demand for agricultural ventilation fans. The global vertical farming market size reached USD 6.8 Billion in 2024. These fans are crucial for maintaining optimal temperature and humidity levels in controlled environment agriculture (CEA), which enhances crop yield and quality. In Japan, more than half of agricultural producers have received financial assistance to establish indoor farming operations, highlighting the role of supportive government policies in this growth. For instance, various grant programs and initiatives by Japan's Ministry of Agriculture, Forestry, and Fisheries (MAFF) have been instrumental in promoting indoor farming, resulting in the widespread adoption of advanced agricultural practices. This governmental support, combined with technological advancements, underscores the critical role of ventilation systems in modern agriculture, ensuring that crops can thrive in optimized conditions year-round, further increasing the agricultural ventilation fans market demand.

Technological advancements in fan systems

Innovations in fan technology, such as the development of energy-efficient and smart ventilation systems, are becoming a prominent trend. Companies are focusing on enhancing the efficiency and sustainability of their products. According to reports, over 80% of consumers are ready to pay a higher price for sustainable products, despite rising cost of living pressures. These fans improve animal health by ensuring adequate air exchange and contribute to preventing the spread of diseases, making them indispensable in modern agricultural practices. These advancements are significantly influencing the market growth. These technological advancements and the push for more sustainable agricultural practices are key drivers in the agricultural ventilation fans market, reflecting a broader trend toward energy efficiency and improved animal welfare in farming operations. According to the National Institute of Food and Agriculture (NIFA) and the U.S. Government Accountability Office (GAO), such innovations are essential for the future of farming, offering significant environmental benefits and operational efficiencies, leading to a higher agricultural ventilation fans market growth.

Supportive government initiatives

Government programs and financial support are essential in encouraging the use of modern agricultural ventilation systems. Initiatives like the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) in India aim to enhance irrigation and farming tools, subsequently increasing the demand for agricultural ventilation fans. Additionally, the International Fund for Agricultural Development (IFAD) and the Government of India have joined forces to support smallholder agriculture, improving farmers' ability to embrace new technologies. In 2023, India's national cattle herd inventory was estimated at 307.4 Million, indicating a substantial market for ventilation systems to maintain animal health and productivity.

Agricultural Ventilation Fans Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global agricultural ventilation fans market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and application.

Analysis by Product:

- Circulation Fans

- Duct Fans

- Exhaust Fans

- Portable Fans

- Others

Circulation fans stand as the largest component in 2024, holding around 33.2% of the market. Circulation fans are the greatest contributor to market growth in agricultural ventilation fans market, as they are capable in cooling and ventilating spaces efficiently. These fans are instrumental in maintaining temperature and distributing warm air from overhead heating units during colder months to ensure ideal growing conditions. High volumes of air can be moved at low pressure for temperature equilibrium, making them increasingly significant in modern farming. For the livestock sector, circulation fans provide ventilation that helps relieve heat stress, an important consideration in animal welfare and productivity. Animals in well-ventilated surroundings show better growth rates, milk production, and reproductive performance.

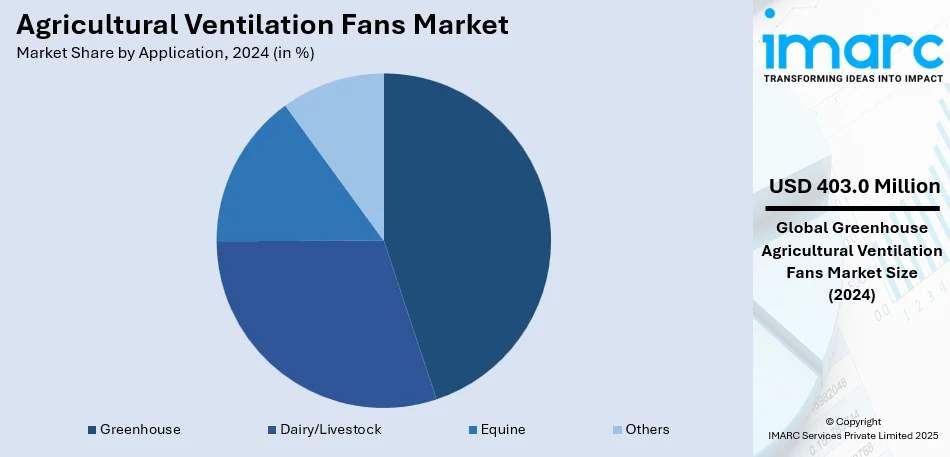

Analysis by Application:

- Dairy/Livestock

- Equine

- Greenhouse

- Others

Greenhouse leads the market with around 44.8% of market share in 2024. Based on forecasts for the agricultural ventilation fan market, the greenhouse construction segment is said to account for the largest share due to its significance in controlled environment agriculture, thereby enhancing productivity and quality of produce. These fans regulate temperature, humidity, and airflow: all essentials for optimal plant growth. In summer, ventilation fans can replace hot air in the greenhouse with cooler air drawn from the outside to help cultivate crops, presenting a strong case for their importance in greenhouse operations. The incorporation of smart and automated technologies has placed further demand for sophisticated ventilation systems. Automatic fan systems by real-time climate data ensure instantaneous control of the greenhouse environment. All these developments and upgrades make a ventilation system including fans an integral component of modern greenhouse management.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 32.7%. Europe is the largest segment in the Agricultural Ventilation Fans Market due to the widespread adoption of advanced farming technologies and stringent regulations on indoor farming environments. The region accounted for 31.3% of global revenue in 2022, driven by the growing trend of controlled environment agriculture (CEA) and greenhouse cultivation. Government initiatives and subsidies support this growth, promoting sustainable agricultural practices and technological advancements. According to the Council Foreign Relations, countries such as the UK have embraced U.S.-style greenhouse systems, further boosting the demand for ventilation fans to maintain optimal conditions for crop and livestock production.

Key Regional Takeaways:

United States Agricultural Ventilation Fans Market Analysis

The U.S. market for agricultural ventilation fans continues to thrive with the rise of CEA or controlled environment agriculture and advancements in the automation of farming. Though about 90% of farmers are aware of such practices, they are yet to invest largely in their use. Reports indicate that more than 68% of the farmers are adopting reduced or no-till practices, but only about half of these farmers make use of variable-rate fertilizer applications, while only 35% have adopted controlled-irrigation techniques. This points toward the need for better climate control solutions in support of more sustainable farming practices. Additionally, the realization that livestock suffers from heat stress is driving a greater demand for advanced systems to ventilate their surroundings to optimize animal health. Incentives from governments that favor energy-efficient solutions alongside goals for sustainability are propelling the growth of the market by prompting investment in green technologies within the agriculture sector. Indoor farming, especially of high value crops like cannabis, has propelled investments in sophisticated air circulation systems aimed at optimizing growing conditions. According to the USDA, rampant demand for organic and locally grown produce has further led to the adoption of modern agricultural infrastructure, that is, effective ventilation to be used in growing structures. Technological developments in the sector, such as those with IoT integrations and VFD venting systems, continue to promote energy efficiency and further catalyze adoption of climate- control technologies into agriculture.

Asia Pacific Agricultural Ventilation Fans Market Analysis

The Asia-Pacific agricultural ventilation fans market is driven by rapid urbanization, climate change challenges, and increasing labor dependency. According to the International Labour Organization (ILO), agriculture employed approximately 563 Million people in the region in 2021, emphasizing the need for efficiency-enhancing technologies. Expanding greenhouse farming, hydroponics, and vertical agriculture, particularly in China, India, and Japan, is boosting demand for climate-controlled ventilation solutions. Rising temperatures and unpredictable weather patterns further push farmers to adopt modern air circulation systems to optimize crop and livestock productivity. Government initiatives promoting precision agriculture and automation are accelerating market growth. According to the Indian Ministry of Agriculture, IoT-enabled smart ventilation systems enhance operational efficiency, reducing energy consumption and costs. The expansion of commercial poultry and dairy farming industries, particularly in Southeast Asia, further fuels demand for advanced ventilation solutions, ensuring optimal environmental conditions for livestock.

Europe Agricultural Ventilation Fans Market Analysis

The European agricultural ventilation fans market is driven by a strong focus on sustainable and energy-efficient farming practices. According to IFOAM Organics Europe, in 2022, the total area of organic farmland in the EU increased to 16.9 million hectares. , reflecting a growing commitment to sustainable agriculture. The expansion of greenhouse farming, fueled by rising demand for organic and locally sourced produce, is increasing the need for advanced climate control solutions. Strict government regulations on animal welfare and environmental emissions are compelling farmers to adopt modern ventilation technologies to ensure compliance. Additionally, vertical farming is expanding in urban areas, driving investments in high-performance air circulation systems. Europe’s emphasis on renewable energy integration in agriculture is further influencing market trends, with increased adoption of solar-powered and energy-efficient ventilation fans. Technological advancements, such as IoT-enabled monitoring and automated ventilation, are improving efficiency and reducing operational costs. According to Eurostat, the demand for improved air circulation systems in poultry, dairy, and swine farms continues to accelerate. Maintaining optimal temperature and humidity levels is crucial for livestock and crop productivity, contributing to the growing adoption of smart ventilation solutions across the continent.

Latin America Agricultural Ventilation Fans Market Analysis

The Latin American agricultural ventilation fans market is driven by expanding livestock and poultry farming, particularly in Brazil, Argentina, and Mexico. According to the Brazilian Institute of Geography and Statistics (IBGE) Agricultural Census, agriculture occupies 41% of Brazil’s land area, highlighting the industry’s importance. Rising temperatures and climate-related challenges are increasing the demand for effective ventilation systems to enhance farm productivity. The adoption of greenhouse farming, supported by government initiatives promoting sustainable agriculture, is fueling market growth. Additionally, foreign investments in modern farming infrastructure and smart agriculture technologies are driving demand. Cost-effective, energy-efficient ventilation solutions are gaining traction, ensuring better crop yields and animal welfare.

Middle East and Africa Agricultural Ventilation Fans Market Analysis

The Middle East and Africa agricultural ventilation fans market is expanding due to rising investments in greenhouse farming, particularly in arid regions, to address food security challenges. The adoption of advanced ventilation systems is increasing to support controlled-environment agriculture. According to an article published on Farmonaut, Farmonaut’s precision agriculture technologies have increased crop yields by up to 30% in Middle Eastern farms, further driving demand for climate control solutions. Expanding poultry and livestock industries, especially in Saudi Arabia and South Africa, are fueling adoption. Government programs that promote sustainable agriculture and the increasing need for solar-powered ventilation systems are driving market expansion in the area.

Competitive Landscape:

Major participants in the agricultural ventilation fans market are concentrating on product innovation, strategic alliances, and technological progress to improve efficiency and sustainability. Businesses are adopting IoT-enabled intelligent ventilation systems for real-time oversight and automated climate management in farming environments. Energy-saving fans equipped with variable speed settings are being launched to lower energy usage and operational expenses. Leading producers are broadening their distribution channels and investing in research and development to satisfy the increasing need for controlled environment agriculture. Moreover, partnerships with agricultural research organizations and government programs advocating for sustainable farming methods are bolstering market expansion. The growing popularity of vertical farming and greenhouse cultivation is boosting investments in high-efficiency ventilation systems to maintain ideal airflow and humidity levels.

The report provides a comprehensive analysis of the competitive landscape in the agricultural ventilation fans market with detailed profiles of all major companies, including:

- AirMax Fans

- American Coolair

- B&B AgriSystems

- Bigass Fans (Delta T LLC)

- Breeza Industrial

- ebm-papst

- Markair Inc.

- Multi-Wing America Inc.

- New York Blower Company

- QC Supply

- Schaefer Systems International Pvt Ltd.

- Vostermans Ventilation B.V.

Latest News and Developments:

- November 2024: Termotecnica Pericoli introduced the EOD fan, a modular agricultural ventilation solution. It offers flexible configurations for exhaust and air circulation, with a direct-drive propeller for reduced maintenance. Powered by an efficient AC IE3 motor, the fan supports energy savings and meets ErP 2026 standards. Durable and adaptable, the EOD fan is perfect for upgrading or installing ventilation systems in agricultural settings.

- November 2023: Munters Corporation, which produces ventilation and climate control systems for farmers, introduced the CX 74 circulation fan featuring Munters Drive G2 MAX, the latest advancement in EC motor technology. The CX 74 is crafted and built specifically for the rigorous requirements of a contemporary dairy business.

- September 2022: DENSO Corporation has developed semi-closed greenhouses with active ventilation, replacing roof windows with automated gable wall fans. This system ensures stable crop cultivation, independent of weather conditions, by utilizing advanced air conditioning and software-based technologies.

Agricultural Ventilation Fans Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Circulation Fans, Duct Fans, Exhaust Fans, Portable Fans, Others |

| Applications Covered | Dairy/Livestock, Equine, Greenhouse, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AirMax Fans, American Coolair, B&B AgriSystems, Bigass Fans (Delta T LLC), Breeza Industrial, ebm-papst, Markair Inc., Multi-Wing America Inc., New York Blower Company, QC Supply, Schaefer Systems International Pvt Ltd., Vostermans Ventilation B.V., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the agricultural ventilation fans market from 2019-2033.

- The agricultural ventilation fans market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the agricultural ventilation fans industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The agricultural ventilation fans market was valued at USD 899.63 Million in 2024.

The agricultural ventilation fans market is projected to exhibit a CAGR of 7.18% during 2025-2033.

The agricultural ventilation fans market is driven by factors such as increasing demand for efficient livestock farming, rising awareness of climate control in greenhouses, and the need to enhance crop production. Technological advancements in energy-efficient fan systems and the growth of the agricultural sector also contribute significantly to market growth.

Europe currently dominates the market, driven by the widespread adoption of advanced farming technologies and stringent regulations on indoor farming environments.

Some of the major players in the agricultural ventilation fans market include AirMax Fans, American Coolair, B&B AgriSystems, Bigass Fans (Delta T LLC), Breeza Industrial, ebm-papst, Markair Inc., Multi-Wing America Inc., New York Blower Company, QC Supply, Schaefer Systems International Pvt Ltd. and Vostermans Ventilation B.V., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)