Agricultural Testing Market Size, Share, Trends, and Forecast by Sample, Technology, Application, and Region, 2025-2033

Agricultural Testing Market Size and Share:

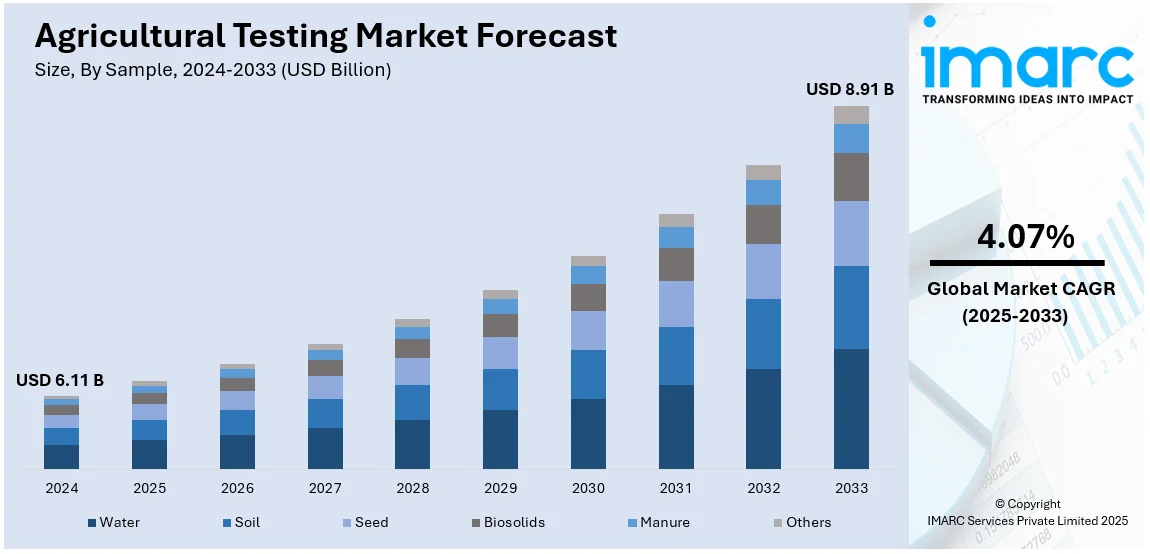

The global agricultural testing market size was valued at USD 6.11 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.91 Billion by 2033, exhibiting a CAGR of 4.07% during 2025-2033. North America currently dominates the market, holding a significant market share of over 45.0% in 2024. The market is driven by increasing demand for food safety, regulatory compliance, precision farming, and sustainable agricultural practices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.11 Billion |

|

Market Forecast in 2033

|

USD 8.91 Billion |

| Market Growth Rate (2025-2033) | 4.07% |

The agricultural testing market is driven by several factors, including the growing demand for food safety and quality assurance to meet stringent regulatory standards. Increasing concerns about pesticide residues, contaminants, and soil health propel the need for comprehensive testing to ensure product integrity. The rise in precision farming and sustainable agricultural practices also boosts demand for soil, water, and crop testing to optimize resource use and enhance yields. Additionally, advancements in testing technologies, such as DNA analysis and rapid testing methods, improve accuracy and efficiency. Consumer awareness about food safety and environmental impact is further driving growth. The expansion of global trade and stricter regulations on agricultural exports also increase the need for reliable testing to maintain compliance with international standards, contributing to the market’s expansion. The factors, collectively, are creating an agricultural testing market outlook across the globe.

In the United States, the agricultural testing market is driven by increasing concerns over food safety, regulatory compliance, and environmental sustainability. Stringent regulations by agencies like the FDA and EPA require thorough testing of soil, water, and crops for contaminants, pesticides, and harmful residues. The growth of precision farming technologies, which rely on soil and crop health data, fuels the demand for testing services to optimize yields and resource use. For instance, in January 2025, a leading digital agricultural company Farmers EdgeTM announced the release of FE Soils, a do-it-yourself grid soil sample software and nutrient management dashboard for American farmers and agronomists. FE Soils, formerly known as AgPhD Soils, is now entirely owned and run by Farmers Edge, and its US Laboratory in Grimes, Iowa, offers soil testing services. Additionally, the shift towards sustainable farming practices, including organic farming, intensifies the need for accurate testing to meet quality and safety standards. The consumer demand for high-quality, safe food also drives testing to maintain consumer trust and ensure compliance with market regulations. Furthermore, the widespread adoption of advanced testing technologies, such as rapid tests and DNA analysis, enhances the efficiency and accuracy of agricultural testing.

Agricultural Testing Market Trends:

Food Safety and Quality Assurance

Food safety concerns are a significant driver of the agricultural testing market. With increasing awareness about the potential risks of pesticides, contaminants, and pathogens, farmers and food producers are under pressure to ensure their products meet safety standards. Testing for pesticide residues, heavy metals, and microorganisms helps maintain product integrity and consumer health, which, in turn, is intensifying the agricultural testing market demand. Regulatory bodies like the FDA and EPA impose strict guidelines, which makes compliance a priority for the agriculture industry. This, in turn, drives the demand for testing services to verify that agricultural products are free from harmful substances and meet quality assurance requirements. For instance, in June 2024, TrinamiX and Eurofins Agro Testing Wageningen, a recognized laboratory that specializes in forage, feed, soil, water, manure, and compost analysis, established an international partnership to optimize forage tests without requiring samples to be sent to a laboratory.

Precision Agriculture

Precision agriculture, enabled by advanced technologies such as GPS, sensors, and data analytics, significantly represents one of the major agricultural testing market trends. By enabling farmers to monitor and manage crop health, soil conditions, and water use more effectively, precision farming practices enhance efficiency and sustainability. Testing services for soil, nutrients, and crop tissue allow farmers to optimize inputs, reduce waste, and increase yields. The integration of real-time data from sensors with testing results further enhances decision-making, leading to improved productivity and environmental impact. As precision farming continues to expand, the need for accurate and timely testing grows, fueling market demand. For instance, in December 2024, AgriCarm (Profile) declared the release of a mobile application in 2025 that will modernize farming methods and make precision agriculture instruments more widely available. The software, which was created for small and medium-sized farms, is a big step in the direction of democratizing agricultural technology.

Sustainability and Environmental Impact

The global emphasis on sustainability is a critical factor driving the agricultural testing market growth. With growing concerns about climate change, resource depletion, and environmental degradation, sustainable farming practices have become a priority. Testing helps ensure that agricultural practices maintain soil health, conserve water, and reduce the use of harmful chemicals. Soil and water testing, for instance, help farmers monitor nutrient levels and detect contaminants, enabling the adoption of eco-friendly practices. Additionally, testing plays a role in reducing carbon footprints by optimizing resource usage and improving crop productivity, which supports the growing trend of environmentally responsible farming. For instance, in January 2025, The Dr. Reddy's Foundation (DRF) and Dr. Reddy's Laboratories Limited (DRL) established a soil testing resource center (STRC) in Hyderabad that occupies 14,750 square feet. With an eye on increasing productivity and advancing sustainable agricultural practices, the center will offer farmers, agronomists, agricultural researchers, and institutions quick, accurate, and reasonably priced soil testing services.

Agricultural Testing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global agricultural testing market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on sample, technology, and application.

Analysis by Sample:

- Water

- Soil

- Seed

- Biosolids

- Manure

- Others

Soil stands as the largest component in 2024, holding around 40.0% of the market. Soil holds the largest share in the agricultural testing market since soil testing is essential to track crop health and optimize soil fertility. Soil testing gives farmers all essential information about nutrients, pH status, organic content and dangerous substances to support improved farming methods. Sustaining good farming practices becomes possible through soil testing which improves how resources are managed while keeping soil healthy and protecting the environment. The increasing focus of farmers on precision agriculture and better farm management is expected to influence the demand for soil testing services and products which represents the major industry segment.

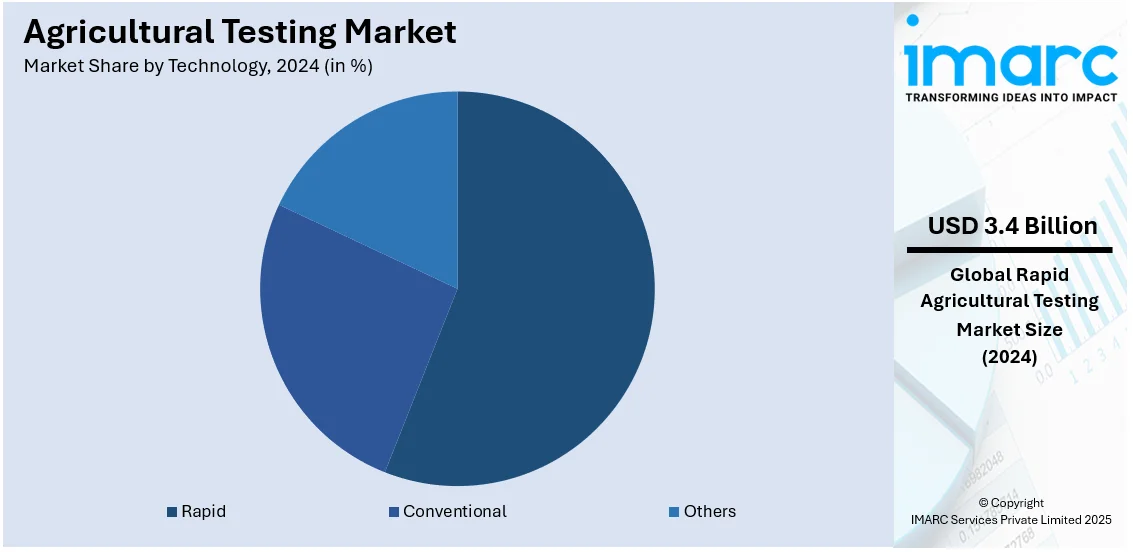

Analysis by Technology:

- Conventional

- Rapid

- Others

Rapid leads the market with around 55.6% of the market share in 2024. Rapid testing holds the largest share in the agricultural testing market due to its rapidness, affordability, and quick results which are essential for making quick decisions for farming. As farmers are increasingly asked to work with real-time data to optimize their crop production, monitor soil health, and ensure good control of quality, rapid testing methods enable farmers to make more informed decisions regarding how and when to fertilize, irrigate, and manage pests. As a result, new technologies, like portable devices, on-site analysis tools, and mobile apps have reduced the testing process from slow to fast. As the demand for precision agriculture grows, the adoption of rapid testing continues to rise, driving its dominance in the market.

Analysis by Application:

- Safety Testing

- Quality Assurance

- Others

Quality assurance holds the largest agricultural testing market share as it is essential for the safety, consistency, and compliance of agricultural products. Increasing consumer demand for safe, high-quality food necessitates agricultural businesses to ensure product integrity through quality assurance testing and consequently to meet regulatory standards. This also comprises contamination, pesticide use, and nutritional content. With crop losses, quality assurance aims to inspect and prevent crop losses, increase production efficiency, reduce waste, and build up consumer trust. With the rise in stringent food safety regulations globally, the demand for quality testing is increasing, making it the most dominating segment in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 45.0%. The demand for agricultural testing in North America grows as farmers need to comply with food regulations and use sustainable farming methods. The FDA and EPA food safety standards drive farmers and producers to check for dangerous substances including microbes in their products. Technology advances in precision agriculture and farming methods require soil crop and water testing to improve production success while protecting the environment. The focus on sustaining natural resources creates an increased need for checking soil vitality which increases testing industry demand. Moreover, the rising awareness of climate change and the importance of environmental conservation further boosts the need for agricultural testing to ensure long-term soil and resource health.

Key Regional Takeaways:

United States Agricultural Testing Market Analysis

In 2024, the United States accounted for the largest market share of over 80.00% in North America. The agricultural testing market in the United States is primarily driven by the growing need for improved agricultural productivity and sustainability. As the global population rises and the demand for food intensifies, farmers face mounting pressure to increase yields while minimizing their environmental footprint. This is leading to a greater adoption of advanced testing technologies for soil, water, and crop health, enabling farmers to make informed decisions. According to report, although 90% of farmers are aware of sustainable farming practices, holistic adoption remains limited, with only 68% adopting reduced- or no-till practices, around 50% utilizing variable-rate fertilizer applications, and 35% employing controlled-irrigation techniques. This gap between awareness and adoption is driving demand for testing solutions that support the effective implementation of these practices. Additionally, stringent government regulations on food safety and environmental sustainability are further propelling the market. The U.S. is also home to numerous agricultural research institutions that foster technological innovations in testing, promoting precision agriculture. Moreover, the rising shift towards organic farming and sustainable practices emphasizes the importance of testing for soil quality and pesticide residues. This creates a growing market for reliable and efficient agricultural testing solutions, with digital agriculture platforms incorporating testing data into farm management, enhancing market prospects.

Asia Pacific Agricultural Testing Market Analysis

The agricultural testing market in the Asia Pacific region is experiencing substantial growth, fueled by the demand for increased agricultural productivity amid rising populations. In 2021, it has been reported that 563 Million people were employed in agriculture across this region, underscoring its critical role in food security. Governments are increasingly investing in agricultural technologies to boost productivity and sustainability, including precision farming solutions that rely heavily on soil, water, and crop testing. Countries like China and India are at the forefront of these efforts, leveraging testing technologies to improve yields and ensure environmental protection. Additionally, growing awareness of food safety and environmental sustainability is driving demand for testing services to monitor chemical levels and residues. The region's focus on improving water management and soil health is further supporting market growth, as testing helps optimize irrigation practices and reduce water wastage. As advancements in testing technologies continue, the Asia Pacific market is expected to remain a key area of growth for agricultural testing services.

Europe Agricultural Testing Market Analysis

Europe's agricultural testing market is significantly influenced by the region's emphasis on sustainable farming practices, food safety, and environmental protection. The European Union (EU) enforces stringent regulations on pesticide residues, soil health, and water quality, which has driven the widespread adoption of agricultural testing solutions. The increasing trend of organic farming also adds to this demand. According to IFOAM Organics Europe, the EU's total area of farmland under organic production grew to 16.9 Million Hectares in 2022, reflecting the growing need for testing services to ensure compliance with organic standards. Moreover, the rising adoption of precision agriculture in countries like Germany, France, and the UK requires reliable testing to monitor soil quality, crop health, and water usage. Environmental concerns, such as the impact of climate change on farming, further drive the adoption of testing practices to optimize agricultural inputs and minimize ecological footprints. Research and innovation in testing technologies are advancing rapidly across the region, with companies and institutions focused on developing cost-effective and accurate solutions. These factors, combined with increasing consumer demand for sustainably produced food, are expected to continue fueling the growth of the agricultural testing market in Europe.

Latin America Agricultural Testing Market Analysis

The agricultural testing market in Latin America is driven by the growing need for improved productivity and sustainable farming practices. Agriculture plays a crucial role in the region, with Brazil, for instance, utilizing 41% of its land area for agricultural purposes, as indicated by the Brazilian Institute of Geography and Statistics (IBGE) Agricultural Census 2017. This extensive agricultural land necessitates reliable testing solutions to monitor soil health, water quality, and crop conditions. Additionally, increasing awareness of food safety and environmental sustainability is pushing demand for efficient testing methods to optimize agricultural inputs and reduce ecological impacts.

Middle East and Africa Agricultural Testing Market Analysis

The agricultural testing market in the Middle East is growing, driven by the need for sustainable practices amid challenges like water scarcity and soil degradation. As precision agriculture becomes increasingly popular in the region, the adoption of agricultural testing technologies is essential for improving productivity and resource management. According to reports, precision agriculture technologies have led to up to a 30% increase in crop yields on Middle Eastern farms. This illustrates the potential for testing technologies to optimize farming practices, enhance crop health, and promote sustainability, further driving market growth in the region.

Competitive Landscape:

The agricultural testing market is competitive, with key players such as SGS SA, Eurofins Scientific, Intertek Group, and Bureau Veritas dominating the industry. These testing companies serve all agricultural product types and testing elements using state-of-the-art techniques including DNA analysis and advanced analysis tools. They develop their service lines by acquiring companies and joining forces with others while strengthening their research and development teams in food safety evaluation and pesticide detection. Regional testing service providers develop testing methods that match farm requirements in specific regions. The demand for sustainable farming regulations and precision agriculture elevates market competition among testing businesses aiming to develop exceptional measurement tools for farmers and authorities.

The report has also analysed the competitive landscape of the market with some of the key players being:

- Agilent Technologies Inc.

- ALS Limited

- bioMérieux SA

- Bureau Veritas SA

- Element Materials Technology

- Eurofins Scientific

- Intertek Group PLC

- Merck KGaA

- R J Hill Laboratories Limited

- Scientific Certification Systems Inc.

- SGS S.A.

- TUV Nord Group

Latest News and Developments:

- October 2024: Safex Chemicals-backed AgCare Technologies has launched "Golden Farms," an online marketplace to digitize India’s agricultural input supply chain. Covering over 16,000 PIN codes, the app allows customers to directly procure agrochemicals from manufacturers, ensuring better pricing and quality. It currently offers 22 products, with herbicides and insecticides making up 35% and 45% of the portfolio. The platform aims to simplify and improve accessibility to agricultural inputs across rural India.

- July 2024: Biome Makers has launched BeCrop® Farm, a digital platform that evaluates over 1,000 parameters to provide precise recommendations on soil health, disease risk, and management practices. Leveraging the company’s extensive soil microbe database, BeCrop® Farm offers actionable insights to help farmers and retailers make informed decisions, optimize product selection, and improve soil health, leading to better performance and ROI.

- June 2024: ExcelAg Corp, USA, has partnered with Arboint International, a subsidiary of Shakti Vardhak Hybrid Seeds, to introduce advanced agricultural solutions in India. The collaboration focuses on improving crop establishment and quality using ExcelAg’s Microencapsulation Technology (MET) for seed and plant nutrition. This partnership aims to provide innovative solutions for crops such as paddy, wheat, and maize, supporting sustainable and productive farming practices.

- March 2024: UPM Biochemicals launched UPM Solargo™, a bio-based plant stimulant range, marking its entry into the agrochemicals market. The biostimulants provided a sustainable alternative to fossil-based products, enhancing plant growth by improving soil microbiome quality and increasing water retention. They offered proven benefits for various crops, with a reduced environmental footprint compared to traditional solutions.

- March 2023: Mahindra launched the Krish-e Smart Kit, offering GPS-enabled tracking and remote monitoring for tractors and farm equipment. Developed by Carnot Technologies, it helps improve fleet performance, reduce downtime, and prevent unauthorized use. The brand-agnostic kit is compatible with various equipment and is paired with the Krish-e Rental Partner App, providing access to high-end machinery on a pay-per-use basis. With over 25,000 active users, the kit aims to support farmers and institutions in digitizing agricultural activities.

Agricultural Testing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Samples Covered | Water, Soil, Seed, Biosolids, Manure, Others |

| Technologies Covered | Conventional, Rapid, Others |

| Applications Covered | Safety Testing, Quality Assurance, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agilent Technologies Inc., ALS Limited, bioMérieux SA, Bureau Veritas SA, Element Materials Technology, Eurofins Scientific, Intertek Group PLC, Merck KGaA, R J Hill Laboratories Limited, Scientific Certification Systems Inc., SGS S.A. and TUV Nord Group. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the agricultural testing market from 2019-2033.

- The agricultural testing market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the agricultural testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The agricultural testing market was valued at USD 6.11 Billion in 2024.

The agricultural testing market is projected to exhibit a CAGR of 4.07% during 2025-2033, reaching a value of USD 8.91 Billion by 2033.

Key factors driving the agricultural testing market include growing concerns over food safety, regulatory compliance, and sustainability. Precision farming technologies, advancements in testing methods, and increasing demand for quality assurance in crops, soil, and water also contribute to the market’s growth, helping optimize agricultural productivity and environmental impact.

North America currently dominates the composite preforms market, accounting for a share of 45.0%. In North America, factors driving the agricultural testing market include food safety regulations, precision farming, sustainability practices, and technological advancements. These factors, collectively, are creating a positive agricultural testing market outlook across the region.

Some of the major players in the global agricultural testing market include Broadcom Inc., Infineon Technologies AG, Murata Manufacturing Co. Ltd., NXP Semiconductors N.V., Qorvo Inc., Skyworks Solutions Inc., STMicroelectronics N.V., Taiyo Yuden Co. Ltd., TDK Corporation, Teradyne Inc., Texas Instruments Incorporated, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)