Agricultural Micronutrients Market Report by Type (Zinc, Boron, Iron, Manganese, Molybdenum, and Others), Crop Type (Cereals, Pulses and Oilseeds, Fruits and Vegetables, and Others), Form (Chelated, Non-Chelated), Application (Soil, Foliar, Fertigation, and Others), and Region 2025-2033

Market Overview:

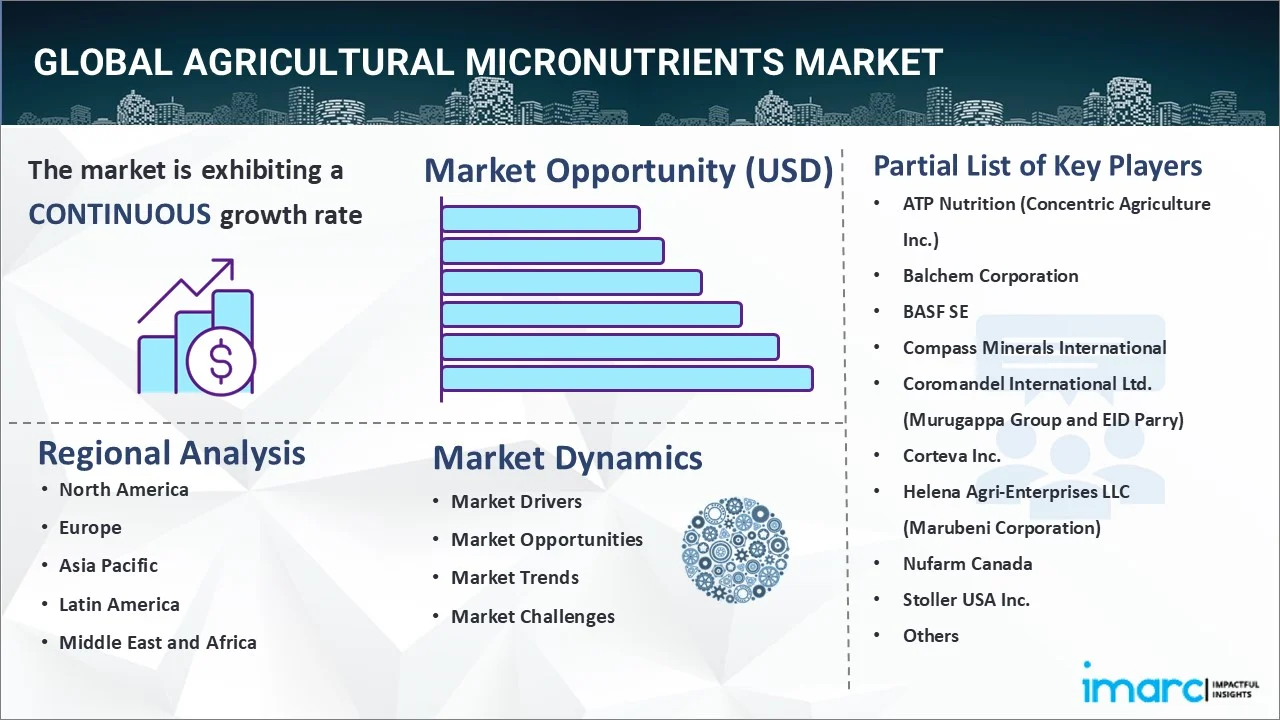

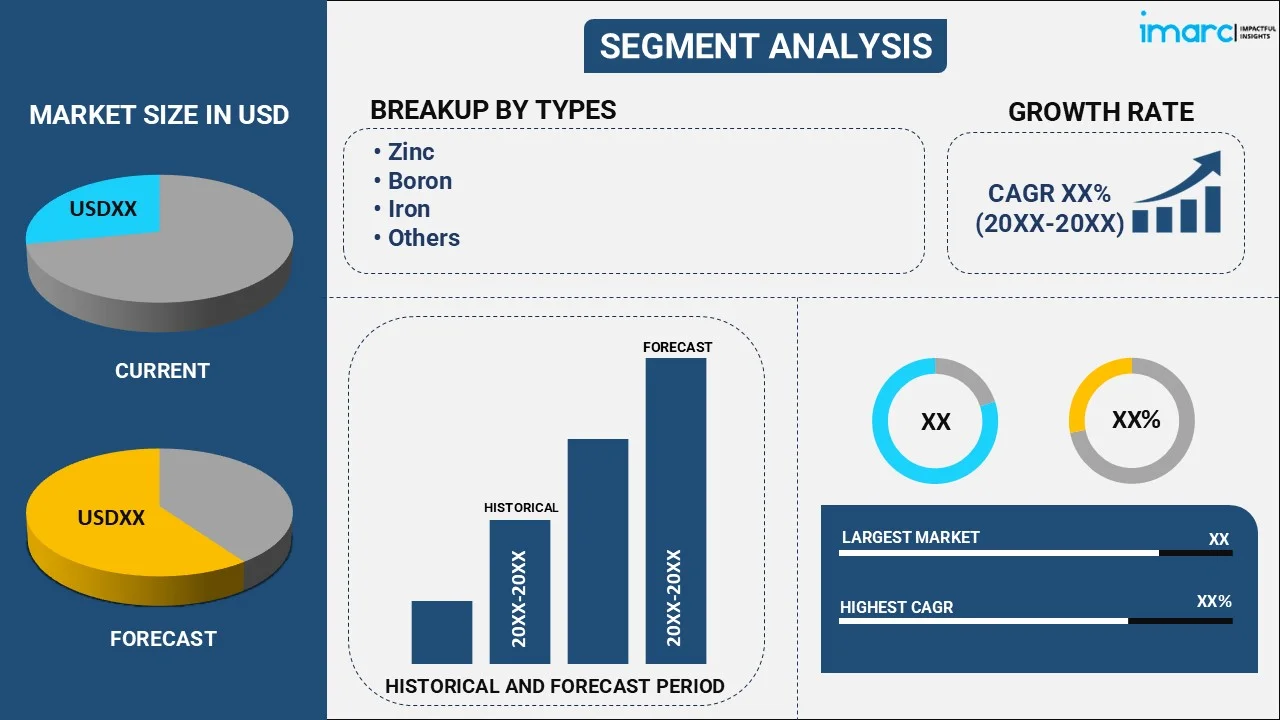

The global agricultural micronutrients market size reached USD 6.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.5 Billion by 2033, exhibiting a growth rate (CAGR) of 6.80% during 2025-2033. The growing awareness about micronutrient deficiencies in plants, rising advancements in agricultural technology, and increasing awareness about the beneficial aspects of micronutrients for facilitating chlorophyll synthesis are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.2 Billion |

|

Market Forecast in 2033

|

USD 11.5 Billion |

| Market Growth Rate (2025-2033) | 6.80% |

Agricultural micronutrients are essential minerals that plants need in relatively small quantities for their growth and development. They are typically categorized into several groups, including zinc (Zn), copper (Cu), manganese (Mn), molybdenum (Mo), iron (Fe), and boron (B). They can significantly increase crop yield and quality by correcting deficiencies and leading to more robust plants and better harvests. They also help plants take up and utilize macronutrients more effectively, reducing fertilizer wastage. They improve the ability of a plant to withstand environmental stresses, such as drought, disease, and extreme temperatures, thereby increasing overall resilience.

At present, the increasing demand for agricultural micronutrients as micronutrient-rich crops contribute to better human and animal nutrition, addressing deficiencies that can lead to health issues is impelling the growth of the market. Besides this, the rising awareness about the beneficial aspects of micronutrients for facilitating chlorophyll synthesis, which is the pigment needed for capturing sunlight and converting it into energy during photosynthesis, is contributing to the growth of the market. In addition, the growing consumption of fresh fruits and green leafy vegetables to stay fit and prevent the occurrence of numerous chronic diseases is offering a favorable market outlook. Apart from this, increasing collaborations between key industry players, agricultural research institutions, and governing agencies of various countries to facilitate knowledge exchange, technology transfer, and the development of comprehensive micronutrient solutions are supporting the growth of the market.

Agricultural Micronutrients Market Trends/Drivers:

Growing awareness about micronutrient deficiencies in crops

The growing awareness about micronutrient deficiencies in crops is currently exerting a positive influence on the growth of the agricultural micronutrient market. Besides this, as farmers are increasingly realizing that deficiencies in essential micronutrients, such as zinc, iron, copper, manganese, and boron can significantly impair the health and yield potential of their crops, the demand for micronutrient-rich fertilizers and soil amendments that can address these deficiencies are rising. Furthermore, ongoing research and education campaigns are actively contributing to the momentum of the market. Agricultural extension services, academic institutions, and industry associations are currently disseminating information on micronutrient deficiencies, their adverse effects on crop growth, and the benefits of incorporating micronutrient supplements into farming practices. This continuous dissemination of knowledge is driving farmers to adopt micronutrient-enriched agricultural inputs.

Increasing shift towards sustainable agriculture

At present, the increasing shift towards sustainable agriculture is propelling the demand for agricultural micronutrients. Besides this, farmers and agricultural stakeholders are embracing sustainable agriculture methods, which prioritize the efficient use of resources, reduction of environmental impacts, and enhancement of crop yields. This paradigm shift towards sustainability necessitates the utilization of agricultural micronutrients in various forms, such as zinc, iron, copper, manganese, and boron, among others. Moreover, the growing consumer preference for sustainably produced food products is spurring farmers to employ practices that enhance soil health and minimize the need for chemical fertilizers and pesticides. Micronutrients are integral to this transition, as they facilitate nutrient uptake by plants, improve soil structure, and reduce the overall environmental footprint of farming operations.

Rising advancements in agricultural technology

Presently, the continuous advancements in agricultural technology are contributing to the growth of the agricultural micronutrient market. Besides this, farmers are employing cutting-edge technologies, such as global positioning system (GPS)-guided machinery, drones, and satellite imagery to precisely monitor and manage their crops. This real-time data-driven approach allows for targeted and optimized application of micronutrients to address specific nutrient deficiencies in soil and crops. Moreover, it results in increased crop yields and improved product quality, stimulating the demand for micronutrient products. Furthermore, the research and development (R&D) activities in the field of agricultural technology are fostering the development of innovative micronutrient formulations and delivery systems. These state-of-the-art solutions are designed to enhance nutrient uptake by crops, minimize wastage, and maximize the efficiency of nutrient utilization.

Agricultural Micronutrients Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global agricultural micronutrients market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on type, crop type, form and application.

Breakup by Type:

- Zinc

- Boron

- Iron

- Manganese

- Molybdenum

- Others

Zinc dominates the market

The report has provided a detailed breakup and analysis of the market based on the type. This includes zinc, boron, iron, manganese, molybdenum, and others. According to the report, zinc represented the largest segment.

Zinc is employed as an essential micronutrient for plants and plays a crucial role in agriculture. It is involved in the uptake and transport of other essential nutrients in plants, such as phosphorus and iron. It aids in the synthesis of certain enzymes and proteins necessary for nutrient absorption, making it vital for overall plant health. It is a component of several enzymes involved in photosynthesis. Adequate zinc levels in plants can enhance photosynthetic efficiency, leading to increased crop yields. It is essential for respiration and various metabolic processes within plants. It plays a role in the synthesis of nucleic acids and proteins, which are fundamental for growth and development. Zinc plays a role in fruit development and maturation. It can impact the size, quality, and nutritional content of fruits, which is important for both commercial and subsistence farming.

Breakup by Crop Type:

- Cereals

- Pulses and Oilseeds

- Fruits and Vegetables

- Others

Cereals hold the largest share in the market

A detailed breakup and analysis of the market based on the crop type have also been provided in the report. This includes cereals, pulses and oilseeds, fruits and vegetables, and others. According to the report, cereals accounted for the largest market share.

Cereals, like other crops, require agricultural micronutrients to grow and develop properly. Besides this, micronutrients serve as cofactors for enzymes involved in numerous metabolic pathways within the plant. Micronutrients can influence the uptake and transport of other nutrients, including macronutrients like nitrogen (N), phosphorus (P), and potassium (K). Micronutrients like manganese (Mn) and magnesium (Mg) are involved in the photosynthesis process, helping to convert sunlight into energy and produce carbohydrates. When cereal crops do not receive an adequate supply of these micronutrients, they can exhibit various deficiency symptoms, such as stunted growth, yellowing of leaves, reduced yield, and increased susceptibility to diseases and environmental stressors. To address these issues and optimize crop production, farmers often use fertilizers containing micronutrients or amend soils with micronutrient-rich materials.

Breakup by Form:

- Chelated

- Non-Chelated

Chelated hold the biggest share in the market

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes chelated and non-chelated. According to the report, chelated accounted for the largest market share.

Chelated agricultural micronutrients are an important component of modern farming practices. Chelation enhances the solubility and availability of micronutrients, ensuring that plants can absorb them more easily. Apart from this, chelated micronutrients are less likely to react with other elements in the soil, reducing the risk of nutrient deficiencies. They can be applied effortlessly to plant leaves, which is an effective way to address micronutrient deficiencies quickly. Chelated micronutrients are available in various forms, including chelated iron, chelated zinc, chelated manganese, and chelated copper, which can be applied to the soil (as soil amendments) or directly to plants (foliar sprays). The choice of application method relies on the specific nutrient deficiency, the crop, and the stage of growth.

Breakup by Application:

- Soil

- Foliar

- Fertigation

- Others

Soil holds the maximum share in the market

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes soil, foliar, fertigation, and others. According to the report, soil accounted for the largest market share.

Soils require agricultural micronutrients, such as iron (Fe), zinc (Zn), manganese (Mn), copper (Cu), boron (B), and molybdenum (Mo) to promote healthier and more productive crops. In some cases, soil may contain excessive levels of certain micronutrients, which can be harmful to plants. Proper micronutrient management helps maintain optimal levels, preventing toxic conditions. Moreover, ensuring that micronutrients are available in the soil in the right quantities helps plants make more efficient use of macronutrients like nitrogen and phosphorus. This can reduce the overall fertilizer requirements and minimize nutrient runoff, which can be environmentally harmful. Micronutrients are often referred to as "nutrient catalysts" because they facilitate the uptake and utilization of other nutrients. Their presence in the soil can help balance nutrient uptake, ensuring that plants have access to all the essential elements they need for growth.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

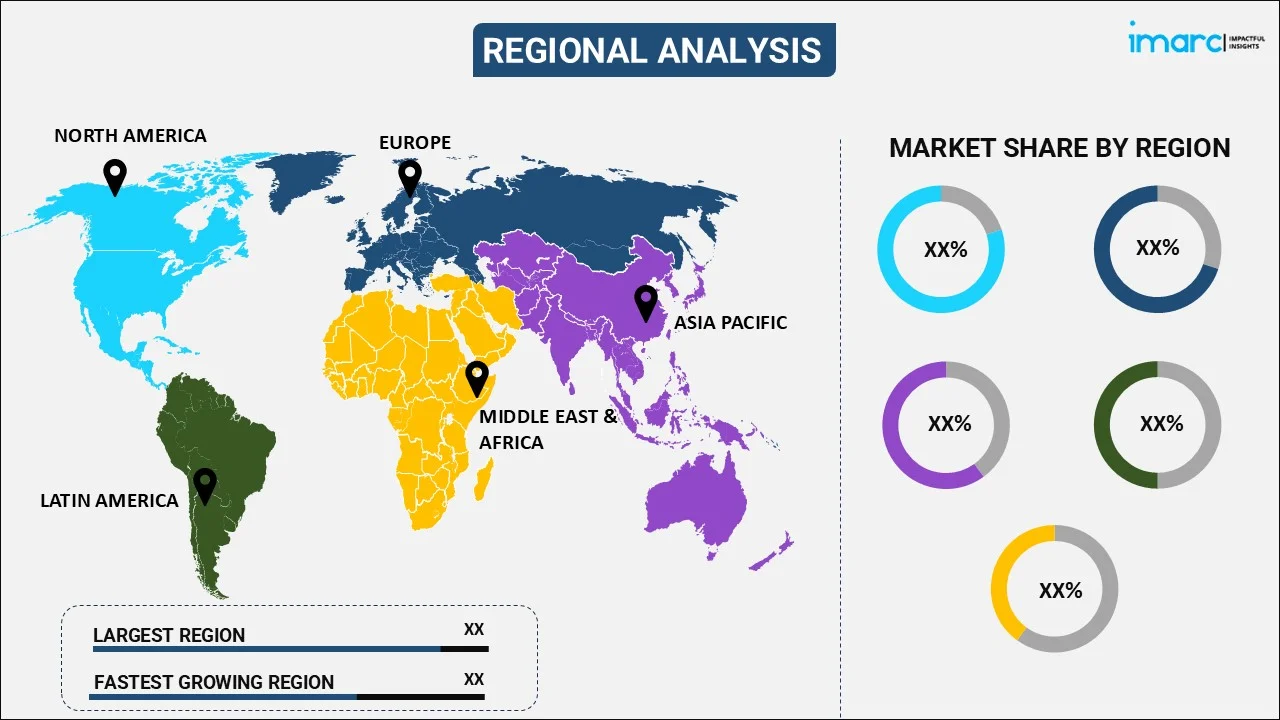

Asia Pacific exhibits a clear dominance, accounting for the largest agricultural micronutrients market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.

Asia Pacific held the biggest market share due to the increasing demand for sustainably grown crops among the masses. Besides this, the rising focus on the adoption of eco-friendly agricultural practices to reduce wastage and carbon footprint is contributing to the market growth. Apart from this, increasing concerns of soil depletion due to the over-cultivation of crops over a certain area of land are supporting the growth of the market. Additionally, the rising intensification of crops to produce more in limited arable land is strengthening the growth of the market.

North America is estimated to expand further in this domain due to the rising consumption of plant-based diets among the masses. Moreover, the increasing focus on crop quality improvement by incorporating higher nutritional content and better resistance to diseases and pests in various crop varieties is bolstering the growth of the market.

Competitive Landscape:

Key market players are investing in research operations to develop new micronutrient products that are more effective and environmentally friendly. They are also developing micronutrient formulations with improved nutrient availability and efficiency. Top companies are expanding their product portfolios to offer a wider range of micronutrient solutions to cater to different crops, soil types, and regions, thereby increasing their market share. They are also focusing on expanding their presence in new geographic regions or strengthening their existing distribution networks to reach more farmers. Leading companies are working on developing micronutrient products that have a limited environmental impact, such as those with lower application rates or products that minimize nutrient runoff. They are also organizing training programs and workshops to increase awareness among farmers about the importance of micronutrients for crop health and yield.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- ATP Nutrition (Concentric Agriculture Inc.)

- Balchem Corporation

- BASF SE

- Compass Minerals International

- Coromandel International Ltd. (Murugappa Group and EID Parry)

- Corteva Inc.

- Helena Agri-Enterprises LLC (Marubeni Corporation)

- Nufarm Canada

- Stoller USA Inc.

- The Mosaic Company

- Valagro SpA (Syngenta Crop Protection AG)

- Yara International ASA

- Zuari Agro Chemicals LTD

Recent Developments:

- In 2021, ATP Nutrition and Marrone Bio Innovations entered into a partnership to distribute Stargus Biofungicide on Canadian broad-acre crops, including canola, dry beans, peas, soybeans, and sunflower.

- In March 2021, The Mosaic Company and AgBiome announced a strategic collaboration to discover, manufacture, and launch novel biological approaches for enhancing soil fertility and increasing nutrient use efficiency.

- In 2023, Corteva Inc. announced a new collaboration with the U.S. Agency for International Development (USAID) to support Ukrainian farmers by increasing farmer access to crop inputs, financing, and post-harvest storage.

Agricultural Micronutrients Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Zinc, Boron, Iron, Manganese, Molybdenum, Others |

| Crop Types Covered | Cereals, Pulses and Oilseeds, Fruits and Vegetables, Others |

| Forms Covered | Chelated, Non-Chelated |

| Applications Covered | Soil, Foliar, Fertigation, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ATP Nutrition (Concentric Agriculture Inc.), Balchem Corporation, BASF SE, Compass Minerals International, Coromandel International Ltd. (Murugappa Group and EID Parry), Corteva Inc., Helena Agri-Enterprises LLC (Marubeni Corporation), Nufarm Canada, Stoller USA Inc., The Mosaic Company, Valagro SpA (Syngenta Crop Protection AG), Yara International ASA, Zuari Agro Chemicals Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global agricultural micronutrients market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global agricultural micronutrients market?

- What is the impact of each driver, restraint, and opportunity on the global agricultural micronutrients market?

- What are the key regional markets?

- Which countries represent the most attractive agricultural micronutrients market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the agricultural micronutrients market?

- What is the breakup of the market based on the crop type?

- Which is the most attractive crop type in the agricultural micronutrients market?

- What is the breakup of the market based on the form?

- Which is the most attractive form in the agricultural micronutrients market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the agricultural micronutrients market?

- What is the competitive structure of the global agricultural micronutrients market?

- Who are the key players/companies in the global agricultural micronutrients market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the agricultural micronutrients market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global agricultural micronutrients market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the agricultural micronutrients industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)