Agricultural Harvester Market Size, Share, Trends and Forecast by Product Type, Drive Type, Application, and Region, 2025-2033

Agricultural Harvester Market Size and Share:

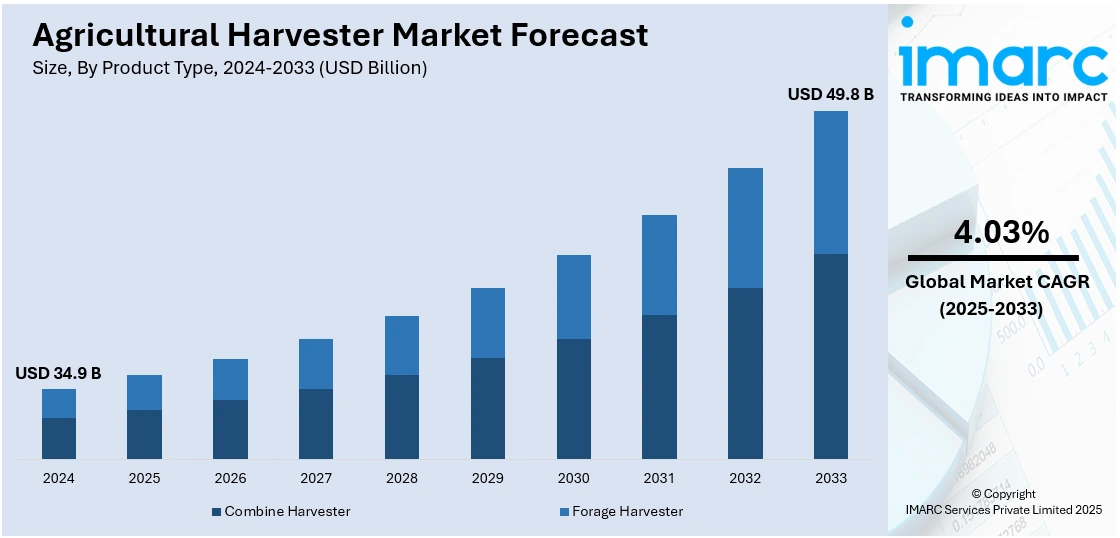

The global agricultural harvester market size was valued at USD 34.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 49.8 Billion by 2033, exhibiting a CAGR of 4.03% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 42.2% in 2024. The market is propelled by growing food demand, urbanization-induced labor shortages, and rising mechanization. Government subsidies and the advancement of smart farming technologies also fuel adoption, enhancing efficiency and productivity on both large-scale and smallholder farms.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 34.9 Billion |

|

Market Forecast in 2033

|

USD 49.8 Billion |

| Market Growth Rate 2025-2033 | 4.03% |

The market for agricultural harvesters is primarily driven by the requirement for increased farm productivity, scarcity of labor, and increasing demand for food worldwide. Urban migration and rural to urban migration have decreased the number of agricultural laborers available, and farmers have been forced to use mechanized solutions. Harvesters increase efficiency, lower harvest time, and reduce crop wastage, thus making them an investment worth every penny for both small and big farms. Advancements in technology, such as GPS-based systems, automation, and AI-based machinery, are also improving performance and accuracy in harvesting. Moreover, government support policies like subsidies, low-interest loans, and schemes for farm modernization are inducing machinery adoption, particularly in developing economies. Unpredictable climatic conditions and global warming are also making farmers invest in reliable and time-saving harvesting equipment. The rising trend of sustainable and precision agriculture is yet another factor driving the agricultural harvester market share forward, as contemporary harvesters optimize resource utilization and minimize environmental footprint while enhancing overall yield and profitability.

The United States stands out as a key market disruptor, owing to innovation through the adoption of autonomous technologies, precision agriculture, and sustainable methods. Companies like John Deere have launched autonomous tractors and autonomous harvesters, solving labor shortages and improving operational efficiency. The use of GPS, IoT, and AI-based systems facilitates real-time data gathering and decision-making, maximizing crop yield and reducing wastage of resources. In addition, government support in the form of subsidies and research funding promotes faster development and deployment of advanced harvesting equipment, which becomes more affordable for farmers. This technology makes the US a world leader in farm machinery, driving market trends and establishing new efficiency and sustainability standards for agricultural practices.

Agricultural Harvester Market Trends:

Progress in Autonomous and Precision Harvesting Technologies

The market for agricultural harvesters is undergoing a great transformation toward automation and precision agriculture. Several regions across the globe are experiencing a shortage of labor force which has led farmers to make a shift toward mechanization. According to the International Labor Organization (ILO), the global labour force participation rate was only 60.8% in 2023. Hence, autonomous harvesters with GPS, sensors, and AI functions are being adopted to improve the efficiency of harvesting and minimize reliance on labor. These harvesters can work without human intervention, optimizing harvesting processes and eliminating the possibility of human error. Apart from this, precision agriculture technologies incorporated in harvesters allow real-time data acquisition and analysis, enabling farmers to make informed choices about crop management. This shift toward automation and precision is revolutionizing conventional farming practices, resulting in enhanced productivity and sustainability in farm operations.

Incorporation of Eco-Friendly and Sustainable Practices

Sustainability is emerging as a significant practice in the agricultural harvester market. Producers are designing environmentally friendly harvesters that run on electric and hybrid power systems to cut emissions and fuel usage. Such innovations are part of worldwide efforts to encourage sustainable agricultural practices. In addition, the use of sustainable harvesting techniques, including reduced tillage and effective crop residue management, is becoming increasingly popular. Such practices reduce environmental impact while also promoting soil health and long-term agricultural productivity. The introduction of environment-friendly features into harvesters indicates that the industry wants to contribute toward sustainable agriculture and help counteract environmental issues.

Customization and Regional Adaptation of Harvesting Equipment

With diversified farming practices in global agriculture, customers are increasingly asking for harvesting equipment that can be customized for the crop type, regional environments, and size of the farms. To address these needs, manufacturers are designing adjustable-setting harvesters with attachments designed for different kinds of agricultural operations. This flexibility allows farmers to maximize harvesting efficiency on various terrains and crops. Furthermore, vendors are consistently upgrading their equipment with telemetry and intelligent sensing technologies to enhance convenience and efficiency. Other new features such as GPS and navigation systems have also been incorporated in these harvesters to help in carrying out operations with more precision. As per a report by the IMARC Group, the global GPS tracking device market is projected to grow at a CAGR of 11.4% during 2024-2032. Apart from this, government programs and subsidies in countries such as Asia Pacific are making it easier for these tailored harvesting technologies to be adopted. By matching equipment design with local farming practices and environmental conditions, the industry is making modern harvesting solutions more effective and accessible.

Agricultural Harvester Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global agricultural harvester market, along with forecasts at the global and regional levels from 2025-2033. The market has been categorized based on product type, drive type, and application.

Analysis by Product Type:

- Combine Harvester

- Forage Harvester

Combine harvester stands as the largest component in 2024, holding around 65.2% of the market. The combine harvester is the most dominant product type in the agricultural harvester market outlook, owing to its effectiveness and applicability in reaping a broad variety of crops such as wheat, rice, corn, and barley. In 2023, combine harvesters represented more than 38% of total agricultural equipment sales worldwide, with models having less than 150 horsepower dominating smaller to medium-sized farms because they are affordable and adaptable to varying field conditions. These combine harvesters combine various harvesting activities—reaping, threshing, and winnowing—into one process, dramatically lowering the costs of labor and post-harvest losses. Their flexibility to handle different lands and crops makes them a must-have in contemporary agriculture, particularly in areas facing labor shortages or looking to increase productivity. More importantly, technological advancements have improved the performance of combine harvesters, with innovations such as GPS location, automation, and instant data analysis. These technologies enhance efficiency of operations and enable sustainable agriculture by maximizing resource utilization and reducing waste.

Analysis by Drive Type:

- Four-Wheel Drive Harvester

- Two-Wheel Drive Harvester

Four-Wheel drive harvester leads the market with around 58.3% of market share in 2024. Four-wheel drive (4WD) harvesters have become the dominant drive type segment in the agricultural harvester industry because of their higher performance, flexibility, and responsiveness to different terrain conditions. The machines offer improved traction and stability, which is suitable for operation in difficult field conditions like muddy, uneven, or sloping farmland. The 4WD feature ensures equal power distribution to all wheels, enhancing maneuverability and minimizing chances of getting stuck, particularly under poor weather conditions or in heavy-duty harvesting operations. Farmers appreciate 4WD harvesters as they can improve productivity and decrease downtime, thus directly impacting improved efficiency during peak harvesting seasons. Furthermore, improvements in technology and ergonomic design of current 4WD harvesters provide better comfort and accuracy for the operator. Their versatility in withstanding rough use and facilitating mass production render them a favorite among industrial-scale and commercial farmers, supporting their supremacy in the agricultural harvester drive type segment.

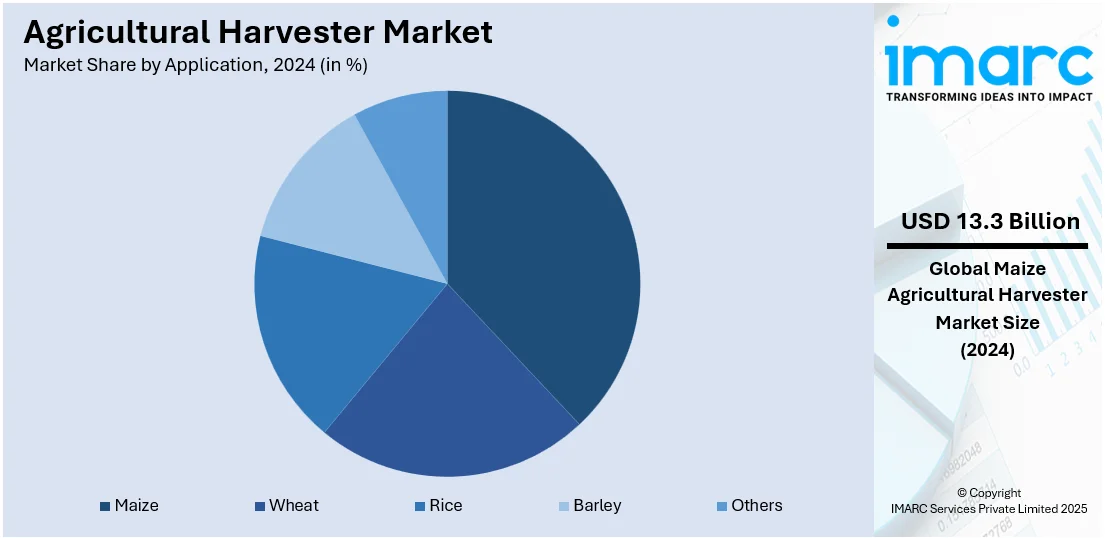

Analysis by Application:

- Wheat

- Rice

- Maize

- Barley

- Others

Maize leads the market with around 38.0% of market share in 2024. Maize, or corn, is the leading application segment within the agricultural harvester market due to its extensive cultivation and broad applications in food, feed, and industrial usage. The rising global demand for maize, fueled by growing populations and higher consumption of processed food, requires effective harvesting solutions to sustain production goals. Combine harvesters, especially those with less than 150 horsepower, are widely utilized for maize harvesting, providing versatility and affordability appropriate for different farm sizes. These harvesters simplify the harvesting process by combining reaping, threshing, and winnowing functions, thus lowering labor costs and reducing crop losses. The maize harvesting industry also enjoys technological innovation, including GPS guidance systems and automated controls, improving precision and operational efficiency. These technologies allow farmers to better manage harvest time and minimize wastage, resulting in higher yield quality. In addition, subsidies and incentives by governments of major maize-producing nations for the adoption of new harvesting machinery propel the market in this segment further.

Regional Analysis:

- North America

- Asia Pacific

- Europe

- Middle East and Africa

- Latin America

In 2024, Asia-Pacific accounted for the largest market share of over 42.2%. Asia Pacific is the dominant regional segment of the agricultural harvester industry due to its large agricultural geography, increasing food requirements, and fierce drive toward modernization. India, China, and Indonesia are rapidly transforming their agricultural sectors, as farmers switch from conventional farming to mechanized production. With enhanced rural-urban migration and farm labor shortages in main crop-growing areas, demand for effective harvesting machines keeps on escalating. Governments in the region are working actively to support mechanization using subsidies and promotional programs to enhance food security as well as farmers' productivity. Furthermore, growing awareness among farmers regarding the utility of modern harvesters, such as time reduction and lower post-harvest losses, is also leading to their increased uptake. Domestic and international manufacturers are increasing their presence in the area, providing a broad array of harvester models suited to different crops and soil conditions.

Agricultural Harvester Market Key Takeaways:

United States Agricultural Harvester Market Analysis

In 2024, the United States accounted for 85.30% of the agricultural harvester market in North America. The United States agricultural harvester market dynamics are primarily driven by advancements in agricultural technology, the need for increased efficiency, and rising demand for food production. With the growing population and the need for sustainable farming practices, farmers are increasingly turning to advanced harvesting equipment that can boost productivity while minimizing labor costs. Innovations in automation, such as autonomous harvesters and smart technologies that offer real-time data and precision agriculture are significantly improving operational efficiency and reducing human intervention. Additionally, the expanding global trade of agricultural products, particularly in grains and other staple crops, has also fueled the demand for high-performance harvesters to meet both domestic and international market needs. According to industry reports, in 2023, U.S. agricultural product exports amounted to USD 174.9 Billion. Besides this, the trend toward larger-scale farming operations, driven by the desire for higher output, is propelling the adoption of sophisticated and powerful harvesters capable of handling larger fields. The availability of government incentives and subsidies for modernizing agricultural machinery further encourages the purchase of advanced harvesters.

Asia Pacific Agricultural Harvester Market Analysis

The Asia Pacific agricultural harvester market scope is witnessing expansion due to rapid urbanization, a growing need for food production, and advancements in farming technology. As per industry estimates, 53.6% of the population in Asia lived in urban areas in 2025, equating to 2,545,230,547 individuals. As the region’s population increases, particularly in countries such as China and India, there is a rising demand for more efficient agricultural practices to ensure food security. The population of Asia accounts for 58.74% of the total population of the world, with a yearly growth rate of 0.59%. Moreover, with labor shortages in rural areas, there is a shift toward automation and the adoption of advanced harvesting machinery to reduce the reliance on manual labor. The development of smart, GPS-guided harvesters, which increase operational efficiency and reduce waste, is also fueling market growth. Government support and subsidies for agricultural mechanization in countries such as China and Japan are also encouraging farmers to upgrade to modern equipment, supporting overall industry expansion.

Europe Agricultural Harvester Market Analysis

The Europe agricultural harvester market is significantly influenced by the increasing demand for high-efficiency farming, changing farming practices, and growing market access. With the strong agricultural export sector in Europe, there is a growing need for advanced harvesting equipment to maintain competitiveness in global markets. According to the European Commission, in October 2024, exports of agricultural foods in the European Union hit a record €21.7 billion, increasing by 10% in comparison to September 2024 and 8% in comparison to October 2023. Moreover, the shift toward precision farming, driven by the need for cost-efficiency and minimal environmental impact, has led to the adoption of harvesters equipped with advanced sensors, automation, and IoT technologies. These innovations allow farmers to collect crops efficiently while optimizing input use and reducing wastage. Additionally, the growing awareness about soil health and sustainable farming practices is propelling the demand for harvesters that minimize soil compaction and preserve crop quality. Furthermore, the focus of the EU on meeting carbon-neutral targets and reducing greenhouse gas emissions has led to the development of energy-efficient harvesters. Other than this, as farming operations continue to consolidate and expand, larger-scale harvesting solutions are becoming essential, driving further growth in the market for high-capacity, multi-crop harvesters designed to handle diverse crop types in a variety of environments.

Latin America Agricultural Harvester Market Analysis

The agricultural harvester market in Latin America is growing, fueled by the need for increased crop yields, growing demand for food exports, and advancements in farming technology. As countries in the region, such as Brazil and Argentina, become major players in global agricultural trade, there is a rising need for efficient and high-capacity harvesting equipment to maintain competitiveness. As per estimations by the IMARC Group, the Brazil agriculture market is expected to reach USD 168.9 Billion by 2032, growing at a CAGR of 3.60% during 2024-2032. Additionally, rising consumer demand for organic and high-quality produce is prompting farmers to invest in equipment that ensures minimal damage during harvesting. The expansion of agricultural export markets, particularly for crops such as soybeans, corn, and coffee, is also increasing the adoption of advanced harvesting equipment to meet international standards and increase productivity across the region.

Middle East and Africa Agricultural Harvester Market Analysis

The Middle East and Africa agricultural harvester market is being increasingly propelled by the need for efficient food production due to the region's growing population and limited arable land. For instance, according to recent industry reports, the population of Africa was estimated to be growing at a yearly rate of 2.29% in 2025. With an increasing demand for food security, there is a rising emphasis on advanced harvesting technologies to maximize crop yield and minimize losses. Additionally, the increasing focus on crop diversification and the need for versatile equipment to handle various crops, such as cereals, fruits, and vegetables, is propelling industry expansion. Furthermore, regional climate challenges are also motivating the adoption of machinery that can efficiently handle different environmental conditions.

Competitive Landscape:

Leading players in the farm harvester industry are making considerable efforts to propel innovation, efficiency, and sustainability in the sector. Top manufacturers are investing significantly in research and development to launch technologically superior harvesters with better precision, lower operational costs, and increased productivity. The companies are emphasizing incorporating automation, GPS technology, and AI-based analytics into their equipment, making farming operations smarter and efficient. Several among them are also partnering with agri-tech startups and software companies to increase the digital sophistication of their harvesters, offering farmers real-time insights on crop yield, machine performance, and the best harvest times. Sustainability is also high on their agenda, with the industry leaders focusing on lessening the environmental footprint of their machines through cleaner engine technology and energy-efficient designs. Besides, firms are growing their international footprint by opening local manufacturing units, after-sales support networks, and training centers to enhance availability and support for farmers in emerging markets. Strategic collaborations with governments and agricultural bodies also assist in advancing mechanization through subsidies and funding options. These combined efforts not only consolidate their market position but also enable farmers to embrace advanced equipment, raise productivity, and achieve long-term agricultural sustainability in the face of changing global challenges.

The report provides a comprehensive analysis of the competitive landscape in the agricultural harvester market with detailed profiles of all major companies, including:

- Deere & Company

- CNH Industrial N.V.

- AGCO Corporation

- CLAAS KGaA mbH

- Mahindra & Mahindra Ltd.

- Maschinenfabrik Bernard Krone GmbH

- Yanmar Holdings Co., Ltd.

- PÖTTINGER Landtechnik GmbH

- Dewulf BV

- Lovol Heavy Industry CO., LTD

- Lely International N.V.

- Ploeger Machines BV

- PREET AGRO Industries (P) Limited

- SDF S.p.A.

- Sampo Rosenlew Ltd.

Recent Developments:

- September 2024: AGCO Corporation, a leading provider of agricultural and precision farming technologies, entered into an exclusive distribution agreement with Ziegler Ag Equipment, a long-standing AGCO-affiliated dealership. With this agreement, Ziegler will be the sole distributor of AGCO’s Fendt and Gleaner combine agricultural harvesters throughout Minnesota, Iowa, and northwest Missouri.

- September 2024: Case IH launched the Axial-Flow 160 and 260 Series, its new and improved combine agricultural harvester models, which will be available for the 2025 harvesting season. The Axial-Flow 160 line is equipped with Harvest Command automation, boasting full connectivity features and providing consistent harvesting outcomes.

- August 2024: CLAAS India, an Indian agricultural machinery manufacturer, was successfully acquired by Yanmar Holdings Co. Ltd. With this acquisition, Yanmar will be able to expand its Agribusiness in India by adding the superior infrastructure of CLAAS India and its established history of manufacturing long-lasting, superior combine agricultural harvesters to its portfolio.

- June 2024: New Holland, a leading international agricultural machinery manufacturer, launched the new CR10 and CR11 combine agricultural harvesters. Both harvesters are equipped with cutting-edge technologies intended to assist farming companies in increasing yield, minimizing losses, and lowering harvesting costs overall.

- February 2024: John Deere launched the new S7 Series combine harvesters equipped with innovative new features for improved performance. The various upgrades in the S7 Series include improved operator comfort, the Integrated StarFire 7500 receiver, the G5PLUS CommandCenter, the JDLink modem, and a redesigned corner post monitor, opening the door for potential automation amenities and capabilities in the future.

Agricultural Harvester Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Combine Harvester, Forage Harvester |

| Drive Types Covered | Four-Wheel Drive Harvester, Two-Wheel Drive Harvester |

| Applications Covered | Wheat, Rice, Maize, Barley, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Deere & Company, CNH Industrial N.V., AGCO Corporation, CLAAS KGaA mbH, Mahindra & Mahindra Ltd., Maschinenfabrik Bernard Krone GmbH, Yanmar Holdings Co., Ltd., PÖTTINGER Landtechnik GmbH, Dewulf BV, Lovol Heavy Industry CO., LTD, Lely International N.V., Ploeger Machines BV, PREET AGRO Industries (P) Limited, SDF S.p.A., and Sampo Rosenlew Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the agricultural harvester market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global agricultural harvester market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the agricultural harvester industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The agricultural harvester market was valued at USD 34.9 Billion in 2024.

The agricultural harvester market is projected to exhibit a CAGR of 4.03% during 2025-2033, reaching a value of USD 49.8 Billion by 2033.

The agricultural harvester market is driven by rising food demand, labor shortages, and the push for farm mechanization. Technological advancements, government subsidies, and the need for efficient, time-saving harvesting methods further boost adoption, especially in emerging economies aiming to enhance productivity and reduce post-harvest losses.

Asia Pacific currently dominates the agricultural harvester market, propelled by rapid population growth, urbanization, and labor shortages. Technological advancements, such as GPS, sensors, and automation, are enhancing the efficiency and accuracy of farming operations. Additionally, the rising trend of mechanization is helping farmers minimize labor costs, increase productivity, and reduce post-harvest losses.

Some of the major players in the agricultural harvester market include Deere & Company, CNH Industrial N.V., AGCO Corporation, CLAAS KGaA mbH, Mahindra & Mahindra Ltd., Maschinenfabrik Bernard Krone GmbH, Yanmar Holdings Co., Ltd., PÖTTINGER Landtechnik GmbH, Dewulf BV, Lovol Heavy Industry CO., LTD, Lely International N.V., Ploeger Machines BV, PREET AGRO Industries (P) Limited, SDF S.p.A., and Sampo Rosenlew Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)