Agricultural Fumigants Market Size, Share, Trends and Forecast by Type, Form, Crop Type, Application, Pest Control Method, and Region, 2025-2033

Agricultural Fumigants Market Size and Share:

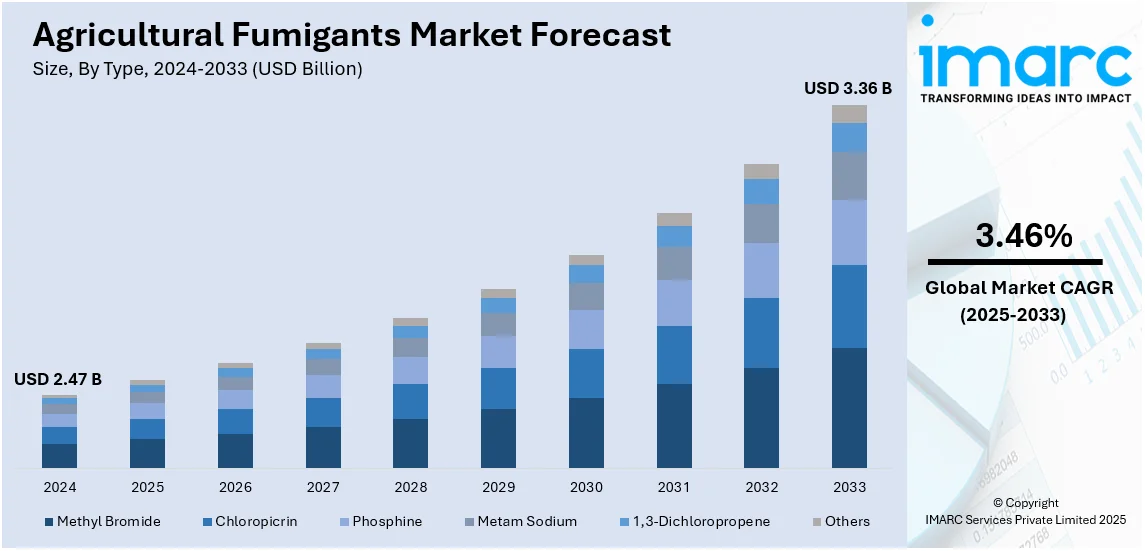

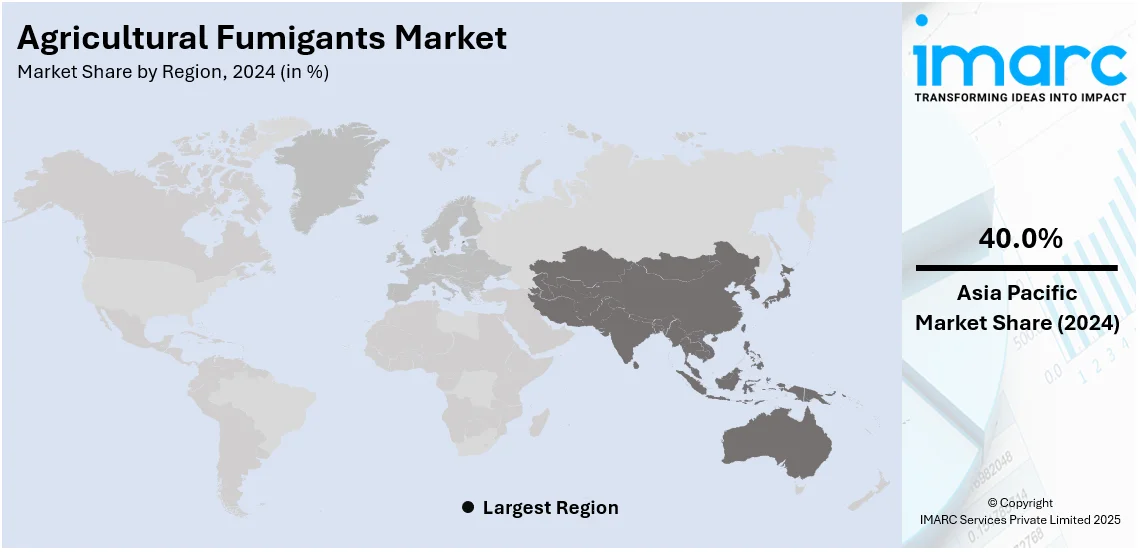

The global agricultural fumigants market size was valued at USD 2.47 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.36 Billion by 2033, exhibiting a CAGR of 3.46% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 40.0% in 2024. The market is driven by rising food demand, pest infestations, increased crop protection needs, and post-harvest loss prevention. Growth in commercial storage facilities, technological advancements, eco-friendly fumigants, and government support for sustainable farming further fuel the agricultural fumigants market share, ensuring higher yields and improved food security worldwide.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.47 Billion |

|

Market Forecast in 2033

|

USD 3.36 Billion |

| Market Growth Rate 2025-2033 | 3.46% |

The market for agricultural fumigants is driven by several key factors, including rising global food demand, the need for higher crop yields, and the increasing prevalence of pest infestations. As populations grow, farmers seek effective pest control solutions to protect stored grains and soil health, boosting fumigant adoption. The growth of commercial storage facilities as well as warehouses generated an increased demand for fumigants because they protect stored items from spoilage and contamination. Technological advancements in fumigation techniques, including eco-friendly and bio-based alternatives, are further driving market growth. Government regulations promoting sustainable farming practices, and the rising awareness of post-harvest loss prevention also play a crucial role in expanding the agricultural fumigants market worldwide.

The market for agricultural fumigants in the United States is driven by rising food demand, increased pest infestations, and the need for higher crop yields. According to industry reports, annually, pests cause a loss of 20% to 40% in global crop production. Every year, plant diseases result in approximately $220 billion in losses to the global economy, while invasive insects account for about $70 billion, as reported by the Food and Agriculture Organization of the United Nations. Weeds represent another major biological limitation on worldwide food production. The country’s large-scale grain storage and export industry requires effective fumigation to prevent spoilage and contamination. Stringent food safety regulations by the EPA and USDA further promote the use of advanced fumigation techniques. Additionally, technological advancements, including eco-friendly and bio-based fumigants, are gaining traction due to growing concerns over environmental impact. The increasing adoption of integrated pest management (IPM) practices and the need for soil fumigation in high-value crops also contribute to market growth.

Agricultural Fumigants Market Trends:

Growing Demand for Food Security and Post-Harvest Protection

With the increasing global population, food security is a pressing concern. The United Nations projects the worldwide population to increase from 8.2 Billion in 2024 to 10.3 Billion by the mid-2080s, marking continued demographic expansion over the next 50–60 years. Protecting stored grains, fruits, and vegetables from pest infestations is crucial in reducing post-harvest losses and maintaining food availability. Fumigants are widely used in warehouses, silos, and shipping containers to prevent spoilage during storage and transport. Increasing trade of agricultural commodities also drives demand for fumigation as an essential measure to meet global phytosanitary regulations. As governments and organizations push for improved food preservation techniques, the agricultural fumigants market is expected to expand.

Regulatory and Environmental Factors

Stringent government regulations on chemical pesticide use have driven innovation in the fumigants market. For instance, in March 2024, the governments of Ecuador, India, Kenya, Laos, Philippines, Uruguay, and Vietnam united to initiate a $379 million project to address pollution caused by plastics and pesticides in agriculture. Chemicals are essential in agriculture, as approximately 4 billion tons of pesticides and 12 billion kg of farming plastics are utilized annually. Many traditional fumigants, such as methyl bromide, have been banned or restricted due to their ozone-depleting properties and health concerns. This has led to the development of eco-friendly and bio-based fumigants, which comply with environmental standards while still offering effective pest control. Additionally, regulatory bodies like the EPA (U.S.), EFSA (Europe), and FAO (global) enforce stringent guidelines on fumigant residue levels and application methods, influencing market dynamics. Companies are increasingly investing in safer, sustainable alternatives to align with these evolving regulations.

Technological Advancements and Adoption of Bio-Based Fumigants

The rise of biological and precision fumigation technologies is creating a positive agricultural fumigants market outlook. Innovations in controlled-release fumigants, sensor-based application systems, and AI-driven pest monitoring are improving efficiency and reducing chemical usage. The demand for organic farming solutions has also driven the development of biofumigants, which use plant-based compounds and microbial solutions to control pests. Additionally, improved aeration and containment technologies in grain storage have enhanced fumigation efficiency, reducing chemical wastage. As farmers and agribusinesses seek cost-effective and sustainable solutions, the integration of advanced fumigation methods is expected to be a key market driver. For instance, in February 2024, The SAGROPIA project under Horizon Europe officially commenced, signaling the start of an exciting five-year partnership focused on research and innovation in sustainable crop protection. With a budget of €6 million, SAGROPIA, which includes Rovensa Next among its 10 partners, seeks to cut chemical pesticide usage by 50% in the cultivation of potatoes and sugar beets.

Agricultural Fumigants Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global agricultural fumigants market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, form, crop type, application, and pest control method.

Analysis by Type:

- Methyl Bromide

- Chloropicrin

- Phosphine

- Metam Sodium

- 1,3-Dichloropropene

- Others

Methyl bromide remains widely used due to its broad-spectrum efficacy against nematodes, fungi, weeds, and insects. It is particularly valuable for quarantine and pre-shipment (QPS) treatments in international trade, ensuring compliance with phytosanitary regulations. Despite environmental restrictions, exemptions for critical-use applications sustain its demand. Its ability to penetrate deeply into soil and commodities, combined with its rapid action, makes it an essential fumigant for high-value crops and stored products, securing its significant market share.

Chloropicrin is a versatile fumigant known for its effectiveness against soil-borne pathogens, nematodes, and insects. It is often used in combination with other fumigants to enhance pest control. Its deep penetration and volatility make it a preferred choice for pre-plant soil fumigation, especially in crops like strawberries and tomatoes. With increasing pest resistance and restrictions on alternative fumigants, Chloropicrin remains a key solution for ensuring soil health and high agricultural yields, sustaining its strong presence in the market.

Phosphine is the leading fumigant for stored grain protection, widely used in warehouses, silos, and bulk commodities. Its ability to effectively control insect infestations while leaving minimal residues makes it crucial for global food trade. Phosphine’s gas penetration properties allow it to reach pests in tightly packed storage, ensuring long-term preservation of grains and seeds. Additionally, its lower environmental impact and regulatory acceptance compared to Methyl Bromide drives its continued dominance in post-harvest pest control, securing its major share in the fumigants market.

Analysis by Form:

- Solid

- Liquid

- Gas

Liquid agricultural fumigants hold the largest market share due to their high efficacy, ease of application, and deep penetration into soil and storage structures. These fumigants, such as Chloropicrin and Metam Sodium, effectively control nematodes, fungi, insects, and weeds, making them ideal for pre-plant soil treatment and post-harvest pest control. Liquid fumigants can be applied through drip irrigation, shank injection, or chemigation, ensuring even distribution and long-lasting pest suppression. Additionally, their cost-effectiveness, reduced volatility, and compatibility with various crops make them a preferred choice among farmers. With increasing pest resistance and stringent regulations on alternatives, liquid fumigants remain essential in modern agriculture.

Analysis by Crop Type:

- Cereals and Grains

- Oilseeds and Pulses

- Fruits and Vegetables

- Others

Fruits and vegetables lead the market with around 47.8% of the market share in 2024. Fruits and vegetables hold the largest share in the agricultural fumigants market due to their high susceptibility to pests, fungi, and soil-borne diseases, which can significantly impact yield and quality. These crops require pre-plant soil fumigation to control nematodes, pathogens, and weeds, ensuring optimal growth conditions. Additionally, post-harvest fumigation is crucial for preventing spoilage, extending shelf life, and meeting phytosanitary regulations for international trade. With increasing consumer demand for fresh produce and stringent food safety standards, farmers rely on fumigants to maintain high-quality yields and reduce post-harvest losses, making fruits and vegetables the dominant segment in the agricultural fumigants market.

Analysis by Application:

- Soil

- Warehouse

Warehouses lead the market with around 55.0% of market share in 2024. Warehouses represent a major share in the agricultural fumigants market due to the need for post-harvest pest control in stored grains, seeds, and commodities. Stored products are vulnerable to insect infestations, mold, and decay, which can lead to significant economic losses. Fumigants like Phosphine and Methyl Bromide effectively penetrate storage structures, eliminating pests while maintaining food safety standards. With rising global food demand and stricter regulatory requirements, warehouse fumigation remains essential for long-term storage and trade protection, securing its strong market position.

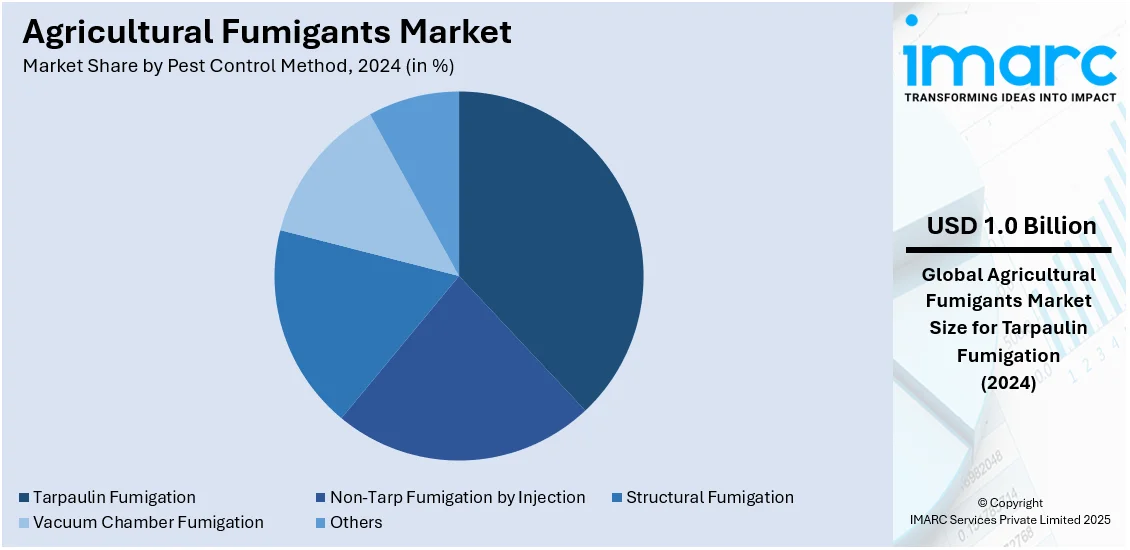

Analysis by Pest Control Method:

- Tarpaulin Fumigation

- Non-Tarp Fumigation by Injection

- Structural Fumigation

- Vacuum Chamber Fumigation

- Others

Tarpaulin fumigation leads the market with around 38.2% of the market share in 2024. Tarpaulin fumigation holds the largest share in the agricultural fumigants market due to its cost-effectiveness, efficiency, and versatility in pest control for stored grains, seeds, and commodities. This method involves covering infested products with gas-tight tarps, allowing fumigants like Phosphine and Methyl Bromide to effectively eliminate insects, mold, and pathogens. It is widely used in warehouses, silos, and temporary storage units due to its minimal infrastructure requirements and ability to maintain fumigant concentration for extended periods. Additionally, global trade regulations and food safety standards necessitate effective storage pest management, making tarpaulin fumigation a preferred choice for large-scale agricultural storage and protection.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 40.0%. The Asia Pacific agricultural fumigants market is witnessing growth driven by rapid population growth, rising food demand, and the need for effective post-harvest protection. According to FAO, 733 Million people face food insecurity globally, with 23% of Asia-Pacific’s population affected. World Food Day 2024 emphasizes the "Right to Foods" for better health and sustainability. The region plays a fundamental role in worldwide agrifood systems, employing 793 Million people to help feed 8 Billion worldwide. Similarly, China, India, Japan, and Australia lead the market, driven by large-scale grain production and export-oriented industries. Additionally, government initiatives promoting food security and reduced post-harvest losses are driving investments in advanced fumigation technologies, including aeration systems and smart monitoring. Sustainable alternatives like biological fumigants and modified atmosphere storage are gaining traction due to chemical residue concerns. Besides this, climate variability and pest outbreaks in rice, wheat, and soybean production further increase the demand for efficient fumigation solutions.

Key Regional Takeaways:

North America Agricultural Fumigants Market Analysis

The agricultural fumigants market in North America is driven by the growing demand for high crop yields and effective pest control solutions to combat soil-borne diseases, nematodes, and weeds. Stringent food safety regulations and phytosanitary requirements for exports necessitate fumigation to ensure compliance with international trade standards. Additionally, post-harvest storage protection is a major factor, as fumigants help prevent infestations in stored grains, fruits, and vegetables. Advancements in fumigation technology, such as eco-friendly alternatives and precision application methods, are also fueling market growth. Moreover, the expansion of large-scale commercial farming, rising concerns about post-harvest losses, and increased government initiatives for integrated pest management further drive the demand for fumigants in the region.

United States Agricultural Fumigants Market Analysis

In 2024, the United States accounted for over 86.50% of the agricultural fumigants market in North America. The United States agricultural fumigants market is expanding due to large-scale commercial farming, stringent pest control regulations, and advanced storage infrastructure. As a leading producer and exporter of grains, fruits, and vegetables, the country relies on effective fumigation techniques to maintain crop quality and post-harvest protection. According to a 2024 USDA report, in 2022, California led U.S. agricultural exports with USD 24.7 Billion, specializing in fruits, vegetables, wine, and tree nuts. Iowa, Illinois, and Minnesota, some of the major corn and soybean producers, exported a combined USD 40.2 Billion, leveraging the Mississippi River trade corridor. Other key regions contribute exports of wheat, cotton, poultry, potatoes, and manufactured foods, reinforcing the U.S. role in global food security. The USDA and EPA regulate fumigants, enforcing buffer zones and safety protocols to minimize environmental and health risks. Furthermore, growing concerns over residue levels and worker safety are driving a shift toward bio-based fumigants and integrated pest management (IPM) practices. Additionally, numerous technological advancements in soil fumigation methods, such as precision application techniques, are enhancing fumigant efficacy while reducing chemical exposure. Besides this, stringent regulations, sustainability initiatives, and increasing demand for organic produce continue to shape the market.

Europe Agricultural Fumigants Market Analysis

The expansion of high-value crop cultivation has driven an increase in the demand for fumigants as an essential pest control solution. According to FAOSTAT, the harvested area for tomatoes in Europe grew from 374.9 Thousand Hectares in 2022 to 395.5 Thousand Hectares in 2023, while blueberry cultivation expanded from 30.5 Thousand Hectares to 32.6 Thousand Hectares during the same period. These crops require effective pest management strategies to preserve their quality and ensure compliance with global export regulations. Fumigation plays a critical role in safeguarding crops against pests, maintaining market suitability, and meeting international trade standards. However, stringent European Commission regulations have led to the ban or restriction of synthetic fumigants like methyl bromide, shifting the industry toward phosphine, sulfuryl fluoride, and bio-based alternatives. Market players invest in nanotechnology-based fumigants, eco-friendly soil treatments, and advanced pest control to meet sustainability goals while ensuring post-harvest storage and soil health. The market balances crop protection and environmental safety, driving innovation in fumigation solutions.

Latin America Agricultural Fumigants Market Analysis

The Latin American market is expanding, propelled by agribusiness growth, high pest pressure, and large-scale exports. According to reports, Brazil, Argentina, Mexico, Colombia, Chile, Costa Rica, and Peru lead global trade in cereals, oilseeds, fruits, vegetables, and coffee. Agriculture employs 14% of the workforce, rising to 18.42% across 20 Latin American countries, encouraging socioeconomic development. In addition to this, growing concerns over soil degradation and chemical residues drive government regulations promoting biological fumigants and ozone-based treatments, thereby positively influencing the market. Moreover, export markets align with international food safety standards, increasing adoption of fumigation monitoring and controlled atmosphere storage, while eco-friendly soil disinfection methods are shaping the future of the market.

Middle East and Africa Agricultural Fumigants Market Analysis

The Middle East and Africa (MEA) agricultural fumigants market is expanding due to rising agricultural production, food security initiatives, and post-harvest pest management. In 2023, Saudi Arabia produced 1.75 Million tons of grain crops across 331,000 hectares, with 323,000 hectares harvested. Wheat dominated with 63.4% of planted area, yielding 1.31 Million tons. Organic crop production reached 95.3K tons, while perennial trees made up 70.9% of total output. South Africa, Egypt, and Saudi Arabia are key markets where fumigation is essential for grain storage and fresh produce exports. Apart from this, governments are investing in pest management programs to address insect infestations and mycotoxin contamination in cereals, nuts, and dried fruits. The market is shifting toward sustainable fumigation techniques to enhance crop protection while meeting environmental standards.

Competitive Landscape:

The agricultural fumigants market is highly competitive, with key players focusing on product innovation, strategic partnerships, and geographical expansion to strengthen their market position. Major companies such as BASF SE, Syngenta AG, Corteva Agriscience, UPL Limited, and AMVAC Chemical Corporation dominate the industry by offering a diverse range of fumigants for pre-plant soil treatment and post-harvest storage protection. Increasing regulatory restrictions on certain fumigants have driven companies to develop eco-friendly and bio-based alternatives. Additionally, firms invest in advanced application technologies to enhance efficiency and safety. The market also sees strong competition from regional players catering to localized agricultural needs, creating a dynamic landscape shaped by technological advancements, mergers, acquisitions, and evolving environmental regulations.

The report provides a comprehensive analysis of the competitive landscape in the agricultural fumigants market with detailed profiles of all major companies, including:

- AMVAC Chemical Corporation

- Arkema

- BASF SE

- Corteva Inc.

- Detia Degesch GmbH

- FMC Corporation

- Lanxess AG

- Nippon Chemical Industrial Co. Ltd.

- Nufarm

- SGS SA

- Syngenta AG (China National Chemical Corporation)

- Trinity Manufacturing Inc.

- UPL Limited

Latest News and Developments:

- February 2025: The Miller Research Potato Pest Management Seminar was announced in February in Rupert, Idaho. Discussions will focus on alternatives to Metam sodium fumigation, compost and green manure trials, and disease management. Research covers Verticillium wilt, aerial stem rot, and Black Dot fungicide treatments.

- September 2024: Australia announced an updated Methyl Bromide Fumigation Methodology (v3.0), effective May 2025. Changes clarify requirements without altering fumigation success criteria. As a Montreal Protocol signatory, Australia aims to reduce ozone depletion while ensuring biosecurity compliance. The methodology is internationally recognized and ICCBA-endorsed.

- June 2024: INTRESO Group urged the EU Commission to consider sustainable fumigation alternatives to sulfuryl fluoride. BLUEFUME™ and EDN™ are effective drop-in fumigation replacements, with EDN™ having 4400x lower GWP. The EU F-Gas Regulation enforces new fumigation monitoring and recapture rules.

- April 2024: Draslovka rebranded its Agricultural Solutions division as INTRESO Group, a stand-alone entity offering sustainable fumigation and biocide solutions. INTRESO integrates EDN, BLUEFUME, and eFUME, expanding environmentally friendly alternatives for agriculture and forestry while accelerating global commercialization and partnerships to reduce fumigation emissions.

Agricultural Fumigants Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Methyl Bromide, Chloropicrin, Phosphine, Metam Sodium, 1,3-Dichloropropene, Others |

| Forms Covered | Solid, Liquid, Gas |

| Crop Types Covered | Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Others |

| Applications Covered | Soil, Warehouse |

| Pest Control Methods Covered | Tarpaulin Fumigation, Non-Tarp Fumigation by Injection, Structural Fumigation, Vacuum Chamber Fumigation, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AMVAC Chemical Corporation, Arkema, BASF SE, Corteva Inc., Detia Degesch GmbH, FMC Corporation, Lanxess AG, Nippon Chemical Industrial Co. Ltd., Nufarm, SGS SA, Syngenta AG (China National Chemical Corporation), Trinity Manufacturing Inc., UPL Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the agricultural fumigants market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global agricultural fumigants market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the agricultural fumigants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The agricultural fumigants market was valued at USD 2.47 Billion in 2024.

The agricultural fumigants market is projected to exhibit a CAGR of 3.46% during 2025-2033, reaching a value of USD 3.36 Billion by 2033.

The market is driven by rising demand for high crop yields, post-harvest storage protection, stringent food safety regulations, increasing global trade of agricultural products, advancements in fumigation technology, growing concerns about pest infestations, expansion of commercial farming, and government initiatives promoting integrated pest management solutions.

Asia Pacific currently dominates the agricultural fumigants market due to rising crop yields demand, strict regulations, post-harvest protection, technological advancements, commercial farming expansion, and integrated pest management initiatives.

Some of the major players in the agricultural fumigants market include AMVAC Chemical Corporation, Arkema, BASF SE, Corteva Inc., Detia Degesch GmbH, FMC Corporation, Lanxess AG, Nippon Chemical Industrial Co. Ltd., Nufarm, SGS SA, Syngenta AG (China National Chemical Corporation), Trinity Manufacturing Inc., UPL Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)