Agricultural and Forestry Machinery Market Size, Share, Trends and Forecast by Machinery Type, and Region, 2025-2033

Agricultural and Forestry Machinery Market Size and Share:

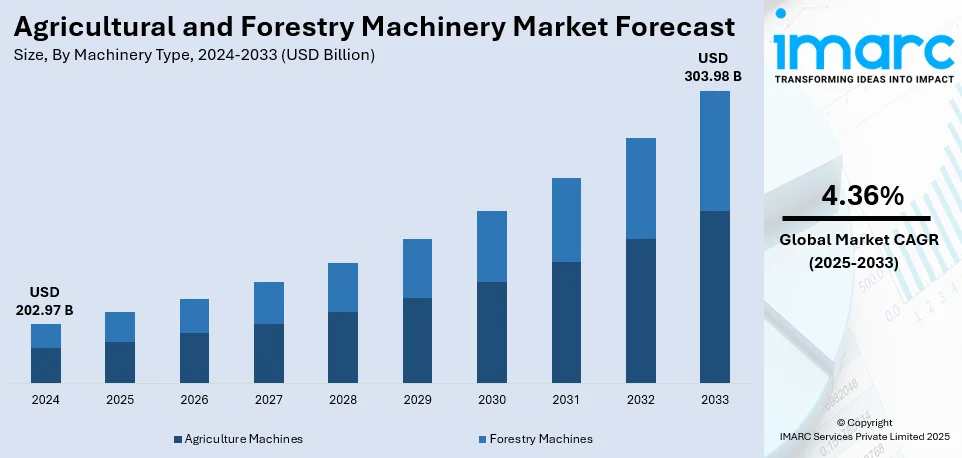

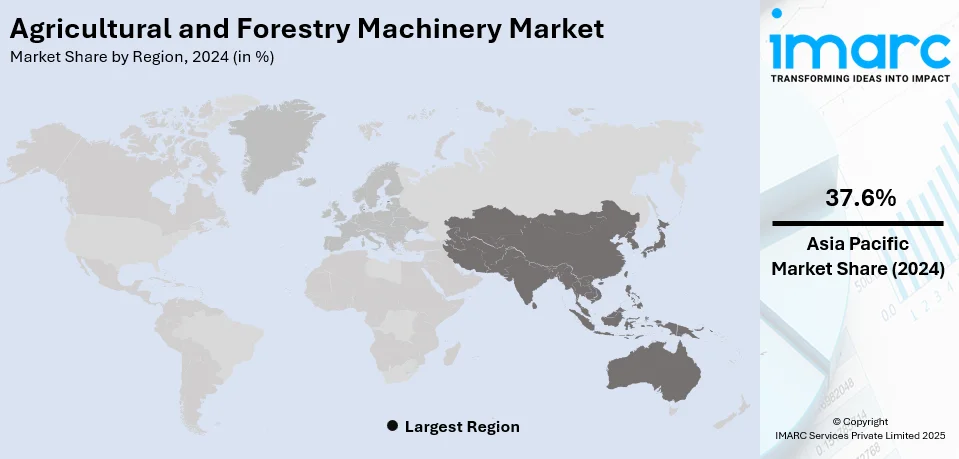

The global agricultural and forestry machinery market size was valued at USD 202.97 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 303.98 Billion by 2033, exhibiting a CAGR of 4.36% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 37.6% in 2024. The increasing mechanization, the surging food demand, ongoing technological advancements in machinery, growing government subsidies, increasing awareness of sustainable farming, precision agriculture, and efficient management, labor shortages in agriculture, and the rising need for productivity improvement are some of the crucial factors boosting the agricultural and forestry machinery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 202.97 Billion |

|

Market Forecast in 2033

|

USD 303.98 Billion |

| Market Growth Rate (2025-2033) | 4.36% |

The growth of the global agricultural and forestry machinery market is fueled by the rising need for food, biofuels, and timber, which is driven by the expanding global population and increasing urbanization. Advances in technology such as automation, precision farming, and IoT and AI in the machinery have been enhancing the operational efficiency of machinery while lowering labor costs, hence boosting the adoption. Apart from that, more incentives and policies by the governments towards sustainable farm activities and reformed forestry development are further influencing the growth of the market. Eco-friendly mechanization, encompassing electric, and low emissions equipment, portrays the trend shifting the industry focus toward sustainability, which is further impelling the agricultural and forestry machinery market growth. More mechanized development in less developed economies combined with an increased focus on higher farm productivity is significant to drive high mechanization across both sectors.

The United States is seeing a great deal of growth in the agricultural and forestry machinery market, due to several key factors. Precision farming technologies, including autonomous tractors and drones, are enhancing operational efficiency and crop yields. For example, John Deere introduced fully autonomous vehicles to address labor shortages and improve productivity in agriculture. Alongside, this merger of farms increased the scales to a larger operation scale, leading to the demand of highly capacity machineries, apart from it the government is taking incentives for sustaining farming practices with mechanization along with such supportive policies further widening the markets, and together contributing to increasing sales of advance machineries leading to U.S. growth of agricultural and forestry machinery markets.

Agricultural and Forestry Machinery Market Trends:

Increasing Mechanization

The need for higher productivity and efficiency in farming and forestry is pushing the adoption of modern machinery. Industry reports from 2023 suggested that reaching a mechanization level of 75–80% in India could take around 25 years. While existing initiatives like the Sub-Mission on Agricultural Mechanization (SMAM) are promoting the adoption of modern equipment in farming, India should prioritize mechanization initiatives aimed at small farms. As per the National Bank for Agriculture and Rural Development (NABARD), powered machinery contributes to around 40–45% of agricultural activities. Farm mechanization plays a key role in lowering cultivation costs and improving productivity by optimizing resource use, which is anticipated to further boost the agricultural and forestry machinery market demand.

Significant Technological Advancements

Efficiency and effectiveness of machines are being made better by the innovations in automation, precision farming, and smart technologies. Precision agriculture market across the globe reached USD 9.32 billion in 2024. In August 2024, Mahindra Farm Equipment Sector, the world’s largest tractor manufacturer, introduced cutting-edge rotavators designed to revolutionize land preparation for farmers in India. Rotavators are now developed for each soil and every crop type for the entire nation. Mahindra is a leading rotavator manufacturer in India, offering a complete range of rotavators produced at its state-of-the-art facility in Nabha, Punjab. These rotavators save time and labor to prepare a perfect seedbed. They also effectively kill weeds and residues while helping to retain moisture. These advancements are expected to create a positive agricultural and forestry machinery market outlook.

Rising Global Food Demand

With a growing population and limited arable land, there is increased pressure to maximize output, thereby driving the demand for advanced agricultural equipment. The recently released NITI Aayog's Working Group Report (WGR) titled "Crop Husbandry, Agriculture Inputs, Demand, and Supply" highlights the evolving trends in the agricultural sector, encompassing the yield, production, and consumption of different food commodities since the 1970s. The report also assesses the future demand and supply projections for different food commodities by 2047, when India’s population is expected to reach 1.6 billion. This study aims to evaluate the country's self-sufficiency and food security at that time. For example, the demand for fruits and vegetables, which are highly responsive to income changes, is likely to increase dramatically. In the BAU scenario, their demand for direct consumption is projected to rise at annual rates of 2.43% and 3.18%, respectively. Demand will be even higher in HIG scenarios. By 2047-48, India's vegetable demand is estimated to range between 263–302 million tonnes, while fruit demand could reach 62–75 million tonnes.

Agricultural and Forestry Machinery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global agricultural and forestry machinery market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on machinery type.

Analysis by Machinery Type:

- Agriculture Machines

- Combine and Forage Harvesters

- Field Sprayers

- Tractors

- Soil Cultivating Equipment

- Milking and Poultry Machines

- Haymaking Machines

- Others

- Forestry Machines

- Harvesters

- Forwarders

- Swing Machines

- Skidders

- Bunchers

- Loaders

- Others

The market growth of tractors is because they can easily serve for plowing, planting, and transporting goods. The growing demand for improved productivity in agriculture, labor shortages in rural areas, and government subsidies for agricultural mechanization all contribute to increased tractor usage, driving the expansion of the agricultural and forestry machinery market. Moreover, increasing efficiency and accuracy through GPS integration and automated systems make tractors unavoidable for modern agriculture. The pressure to increase sustainable agriculture encourages the demand for energy-efficient and eco-friendly tractor models.

Skidders are primarily used in forestry to haul logs from felling sites, which is why they increase in the market. The need for efficient timber extraction, particularly in rugged terrains, will also facilitate demand for skidders. An increase in global demand for wood products and timber propels further expansion of logging operations and thus generates a healthy market for skidders. Advancements in skidder design also include improved fuel efficiency and safety features, making them more appealing in modern forestry operations, thereby facilitating the demand for agricultural and forestry machinery.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The Asia Pacific leads the market with 37.6% market share. The increasing mechanization, driven by efficiency and productivity, due to the scarcity of labor and urbanization, is leading to this growth. The rising food demand due to a growing population requires efficient machinery to enhance output, thereby driving the growth of the agricultural and forestry machinery market. Support from the government through subsidies and modernization is also encouraging machinery adoption. Moreover, precision farming is picking up steam with technological advances in GPS and automation. EIMA Agrimach India 2024: In February 2024, the eighth edition of the international agricultural machinery exhibition took place in Bangalore at the GKVK University of Agricultural Sciences. This event was organized by FICCI in collaboration with FederUnacoma, and received support from the Ministry of Agriculture and the Indian Council for Agricultural Research. The event demonstrated live cutting-edge equipment and highlighted their efficiency and performance. It was a B2B, B2G, and B2C interaction platform, which provided the business and consumer with valuable networking opportunities, encouraged partnerships, and facilitated knowledge exchange. The event also included Kisan Training sessions to equip farmers with knowledge and skills to embrace new technologies and practices.

Key Regional Takeaways:

North America Agricultural and Forestry Machinery Market Analysis

The North American agricultural and forestry machinery market is growing based on several significant factors. Firstly, there is a trend towards precision agriculture technologies that involve autonomous tractors and drones. For instance, John Deere offers fully autonomous vehicles to the market with the goal of filling labor gaps in agriculture and ensuring productivity in agricultural production. Apart from that, farm concentration has led to increased operation scales and consequently higher demands for high-capacity machinery. Incentives towards sustainable farming and mechanization from the government boost the growth of the market. Together, these factors propel the demand for high-tech machinery and consequently push agricultural and forestry machinery in North America forward.

United States Agricultural and Forestry Machinery Market Analysis

The agricultural and forestry machinery market in the United States is driven by the integration of advanced technologies such as AI, IoT, and automation, aimed at enhancing productivity and reducing labor costs. The shift toward sustainable farming practices is also a key factor shaping the industry. While approximately 90% of farmers are aware of sustainable methods, full-scale adoption remains limited. For instance, over 68% have implemented reduced- or no-till practices, yet only about 50% utilize variable-rate fertilizer application, and just 35% employ controlled irrigation techniques. These figures indicate a gradual transition toward sustainability, fueling demand for advanced machinery that supports efficient and eco-friendly operations. Additionally, government incentives, including subsidies for modern farming equipment, encourage the adoption of sustainable solutions. As the need for increased productivity in agriculture and forestry grows, investments in high-performance, sustainable machinery are expected to rise.

Europe Agricultural and Forestry Machinery Market Analysis

In Europe, the agricultural and forestry machinery market is defined by the integration of automation and robotics, which aim to enhance efficiency and promote sustainability. A fuel-efficient, eco-friendly green deal from Europe, including regulations on climate policies, continues to push up the demand for machines. This encourages the development and adoption of more modern agriculture-related technologies by providing government subsidies and financial incentives for their deployment in the markets, thereby pushing market growth ahead. As the European farming population grows older, automation becomes a necessary measure to combat labor shortages and improve productivity. Commitment to sustainability has also increased organic farming in the region. According to IFOAM Organics Europe, the EU's organic farming will total 16.9 million hectares in 2022. The shift to sustainable agriculture has resulted in an increase in demand for organic farming and land management equipment. Among these industries, the forestry industry has shown a high demand for modern machinery, mostly aimed to decrease environmental effect while boosting responsible timber production and good forestry management. Digitalization, which includes the integration of IoT, big data, and AI into farming equipment, is likewise transforming European agriculture by increasing efficiency and productivity.

Asia Pacific Agricultural and Forestry Machinery Market Analysis

In the Asia-Pacific (APAC) region, the agricultural and forestry machinery market is driven by the demand for increasing productivity and meeting growing food requirements. According to the International Labour Organization, in 2021, there were 563 million people involved in agriculture in this region. Major countries such as China, India, and Japan have been introducing subsidies and incentives encouraging the use of modern farming equipment. Precision farming is gaining steam, especially among large commercial farm concerns seeking efficiency. Sustainable agriculture practices continue to rise; with growth spreading in the EU area of organic farming, which now covers 16.9 million hectares in 2022. There is an urgency for mechanization as labor shortages increasingly threaten food security in regions where population is rising and arable land is dwindling. In addition, the adoption of AI and IoT in farming technologies has increased and hastened the growth of the market across the region.

Latin America Agricultural and Forestry Machinery Market Analysis

The agricultural and forestry machinery market in Latin America is driven by the region’s robust agricultural sector, with Brazil and Argentina being key crop producers. The Brazilian Institute of Geography and Statistics (IBGE) Agricultural Census 2017 reveals that agriculture occupied 41% of Brazil's land area, highlighting its significant role in the country. To meet the growing demand for higher productivity, farmers are increasingly adopting advanced machinery to enhance yields. Government initiatives promoting mechanization further support market expansion. Additionally, the rise of sustainable farming practices and precision agriculture technologies is fueling demand for efficient and eco-friendly equipment across the region.

Middle East and Africa Agricultural and Forestry Machinery Market Analysis

The Middle East and Africa agricultural and forestry machinery market is primarily driven by the need for food security as well as optimizing land use in arid environments. In the Middle East region, as precision agriculture technologies gain popularity, yield improvements have been drastic, bringing to the fore the shift of focus toward tech-driven farm solutions. Further boost to productivity and sustainability is being proffered in agricultural equipment by the increasing integration of AI, IoT, and automation. Mechanization is an important factor in improving yields for both large-scale and smallholder farms in Africa. Rapid urbanization and infrastructure expansion are also creating demand for forestry machinery across the region.

Competitive Landscape:

The global market for agriculture and forestry machinery is highly competitive, with top players emphasizing technical innovation, product diversity, and regional growth. Some of the market's leading competitors dominate both sectors, notably machinery options, where they spend continuously in automation, precision farming technologies, and sustainable equipment solutions to meet the growing need for high-efficiency machinery. For example, John Deere is pioneering self-driving tractors and AI-enabled technology to increase production. The market also sees a slew of mergers and acquisitions as corporations seek to consolidate their positions and expand their portfolios. Regional firms compete for low-cost solutions adapted to the demands of their own markets, particularly in emerging economies. Strong research and development activities and government backing for sustainable practices boost competitiveness.

The report provides a comprehensive analysis of the competitive landscape in the agricultural and forestry machinery market with detailed profiles of all major companies, including:

- AGCO Corporation

- Caterpillar Inc.

- Changzhou Dongfeng Agricultural Machinery Group Co. Ltd.

- China National Machinery Industry Corporation

- Claas KGaA mbH

- CNH Industrial N.V.

- Deere & Company

- Komatsu Ltd.

- Kubota Corporation

- Mahindra & Mahindra Limited

- SDF Group

Latest News and Developments:

- November 2024: CEAT Specialty showcased its latest agricultural and forestry tyres at EIMA 2024, held in Italy from November 6 to 10. The new products, including the Farmax R65 X3, Logger XL, Agricultural Tracks, and Sustainmax, were designed to improve productivity, sustainability, and durability in agricultural and forestry operations. The Farmax R65 X3 provides enhanced traction and stability across various terrains, while the Logger XL is built for rugged forestry work with reinforced tread and self-cleaning features.

- August 2024: AGCO Corporation, a global leader in agricultural machinery design, manufacturing, and precision AG technology, unveiled new products and showcased its farmer-centric solutions at the 2024 Farm Progress Show in Boone, Iowa, held from August 27-29. The exhibition featured new tractors from its Fendt® and Massey Ferguson® brands, along with displays from PTx Trimble™, Precision Planting®, FarmerCore™, and a variety of engaging events throughout the show.

- April 2024: John Deere unveiled its H Series harvesters and forwarders in Helsinki, showcasing advanced technology for timber harvesting and forwarding. The new models, including the 1270H and 1470H harvesters, and the 2010H and 2510H forwarders, offer improved efficiency, reduced fuel consumption, and enhanced stability. The forwarders now feature 20-ton and 25-ton capacity options.

- December 2023: Erisha Agritech, an Indian agri-tech firm, has entered into a memorandum of understanding (MoU) with Hyundai Agricultural Machinery, a Korea-based company specializing in agricultural machinery research and development. This collaboration is focused on introducing advanced harvesting solutions for key crops such as onions, potatoes, ginger, garlic, and cabbage in India through a joint venture manufacturing initiative.

- September 2023: John Deere and Yara have formed a strategic partnership, combining Yara’s agronomic knowledge with John Deere’s cutting-edge precision technology and machinery. This collaboration is designed to enhance crop yields and improve fertilizer efficiency, aligning with the European Union's Farm to Fork Strategy objectives.

Agricultural and Forestry Machinery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Machinery Types Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AGCO Corporation, Caterpillar Inc., Changzhou Dongfeng Agricultural Machinery Group Co. Ltd., China National Machinery Industry Corporation, Claas KGaA mbH, CNH Industrial N.V., Deere & Company, Komatsu Ltd., Kubota Corporation, Mahindra & Mahindra Limited, SDF Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the agricultural and forestry machinery market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global agricultural and forestry machinery market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the agricultural and forestry machinery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The agricultural and forestry machinery market was valued at USD 202.97 Billion in 2024.

IMARC Group estimates the market to reach USD 303.98 Billion by 2033, exhibiting a CAGR of 4.36% from 2025-2033.

Key factors driving the agricultural and forestry machinery market include advancements in automation and precision farming technologies, increasing demand for food production, labor shortages, government incentives for sustainable farming practices, and the growing adoption of eco-friendly machinery to address environmental concerns.

Asia Pacific currently dominates the agricultural and forestry machinery market owing to the large-scale agricultural operations in countries like China and India, increasing mechanization, and the adoption of modern farming technologies. The region also benefits from government support for agricultural growth and improving productivity.

Some of the major players in the agricultural and forestry machinery market include AGCO Corporation, Caterpillar Inc., Changzhou Dongfeng Agricultural Machinery Group Co. Ltd., China National Machinery Industry Corporation, Claas KGaA mbH, CNH Industrial N.V., Deere & Company, Komatsu Ltd., Kubota Corporation, Mahindra & Mahindra Limited, SDF Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)