Agribusiness Market Size, Share, Trends and Forecast by Product, and Region, 2026-2034

Agribusiness Market Size and Share:

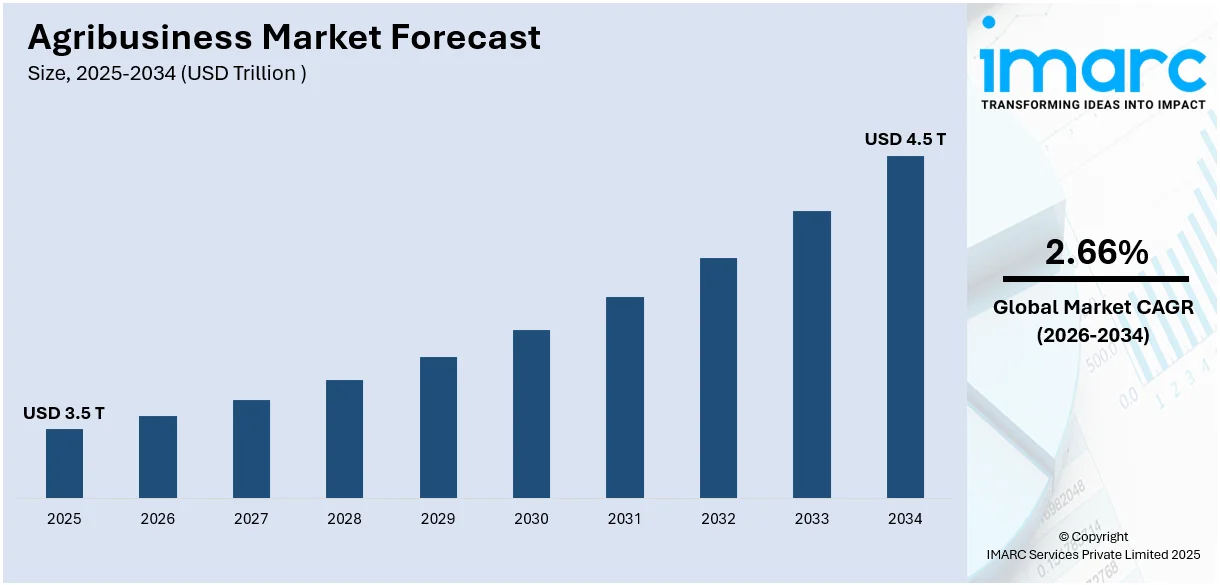

The global agribusiness market size was valued at USD 3.5 Trillion in 2025. Looking forward, IMARC Group estimates the market to reach USD 4.5 Trillion by 2034, exhibiting a CAGR of 2.66% from 2026-2034. North America currently dominates the market, holding a market share of over 41.3% in 2025. The changing dietary preferences, rising population, and growing environmental sustainability, government policies and regulatory framework, technological advancements in the agricultural sector represent some of the factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.5 Trillion |

| Market Forecast in 2034 | USD 4.5 Trillion |

| Market Growth Rate 2026-2034 | 2.66% |

One of the most prominent trends reshaping market is the adoption of precision agriculture and smart farming technologies. These advancements are enabling farmers to optimize productivity, lower resource wastage, and improve crop yields. Precision agriculture employees Global Positioning System (GPS) technology drones, and Internet of Things (IoT) devices to monitor field conditions in real time with access to accurate data farmers now can make informed decisions about irrigation, fertilization, and paste controls, which helps to minimize costs and environmental impacts. Agritech startups are playing a pivotal role in transforming the Agribusiness landscape. These companies are leveraging technology to address longstanding challenges in the agriculture sectors like supply chain inefficiencies, market access, and lack of financial services for farmers.

To get more information on this market Request Sample

The United States had emerged as a key region in the agribusiness market because of the changing government policies and climate challenges. One of the defining trends in the US is the widespread adoption of precision agriculture technologies. Farmers across the country are employing tools like drones GPS guided machinery to optimize irrigation, check crop health at right times, and improve efficiency. These technologies have become essential for managing large scale farms, particularly in regions facing challenges like water scarcity or labor shortages. Data analytics and artificial intelligence (AI) are being increasingly integrated into agricultural operations foodstock advanced software solutions help farmers analyze soil composition, weather conditions, and market trends, allowing data-driven decision making. The IMARC Group further predicts that the US precision farming software market will reach US$ 1657.4 million in 2032.

Agribusiness Market Trends:

Technological Advancements in Agriculture

Technological innovations like robotics, precision agriculture, and biotechnology are impelling the market growth by increasing efficiency, productivity, and sustainability. Precision agriculture uses GPS-guided equipment, IoT sensors, and drones to provide real-time data on soil health, weather conditions, and crop performance. This allows farmers to optimize input usage, reduce waste, and increase yields. For instance, the adoption of automated irrigation systems, is helping farmers conserve water and boost productivity compared to traditional irrigation methods. In recent days, robotics and automation are also transforming farming operations. Companies are launching advanced autonomous tractors equipped with machine-learning (ML) algorithms to optimize planting and harvesting. The global agricultural robotics market is projected to grow at a compound annual growth rate (CAGR) of 15.4% from 2025 to 2033, further underlining the rapid adoption of these technologies.

Rising Demand for Sustainable and Organic Products

At present, the growing recognition of environmental and health issues is significantly driving demand for sustainable and organic agricultural products, thereby shaping agribusiness strategies. Apart from this, organic food sales are increasing worldwide. Consumers are increasingly prioritizing eco-friendly and ethically produced products, urging agribusinesses to shift toward regenerative farming, organic certifications, and sustainable supply chain practices.

Major corporations are aligning their operations with sustainability goals. For instance, Nestlé launched projects to reduce emissions in its cocoa supply chain to 20% by 2025. These initiatives not only cater to consumer preferences but also address global concerns about soil health, water scarcity, and carbon emissions. To meet rising demand, agribusinesses are also focusing on expanding their organic product portfolios. For example, Kate’s Real Food announced the launch of organic pumpkin spice snack bar in 2024. The product is made with high-quality components like organic oats, honey, and original fruits.

Increasing Global Food Demand Due to Population Growth

In recent years, the growing population requires an increase in food production, putting immense pressure on agribusinesses to scale operations while maintaining environmental sustainability. The demand for high-yield crops, advanced farming techniques, and efficient supply chains is higher than ever. In response, agribusinesses and governments are launching innovative solutions to meet these needs. For instance, in 2024, India’s prime minister Narendra Modi launched 109 high-yielding, climate resistant crop varieties. This step is aiming to help increase the income of farmers and boost sustainable farming procedures as well. Another area witnessing rapid growth is vertical farming, which addresses urban food demand by producing fresh vegetables and herbs in controlled indoor environments. Companies like are leading the way, with launching their advanced farming facility in 2024. These facilities boast yields much higher than traditional farming methods while using less water.

Agribusiness Industry Segmentation:

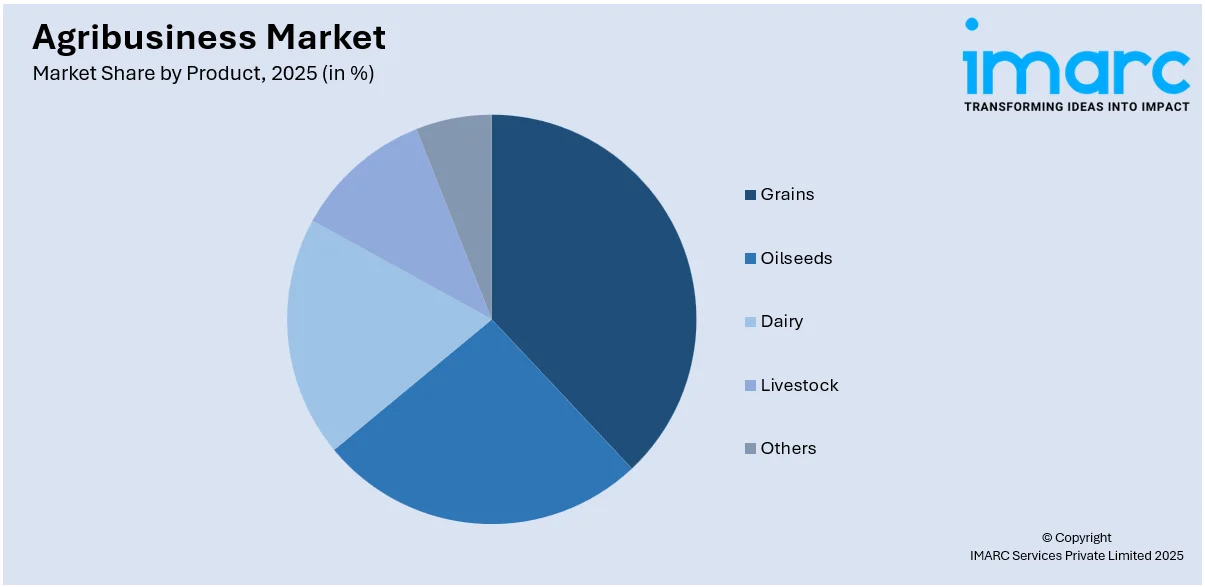

IMARC Group provides an analysis of the key trends in each segment of the global agribusiness market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on product.

Analysis by Product:

Access the comprehensive market breakdown Request Sample

- Grains

- Wheat

- Rice

- Coarse grains-ragi

- Sorghum

- Millets

- Oilseeds

- Wheat

- Rice

- Coarse grains-ragi

- Sorghum

- Dairy

- Liquid milk

- Milk powder

- Ghee

- Butter

- Ice-cream

- Cheese

- Others

- Livestock

- Pork

- Poultry

- Beef

- Sheep meat

- Others

Grains (wheat, rice, coarse grains-ragi, sorghum and millets) hold 36.9% of the market share. The global demand for grains is increasing at an unprecedented rate, driven by population growth, changing dietary patterns, and the expanding use of grains in non-food sectors such as biofuels and animal feed. Grains such as wheat, rice, corn, and soybeans form the backbone of global food security. The rising need for grains is driving significant investments in agricultural innovation, including the development of high-yield crop varieties, improved irrigation systems, and precision farming technologies. Agribusinesses are also focusing on optimizing supply chains to meet the growing global demand. As the need for grains continues to rise, the sector is poised for sustained growth, addressing both food security and energy challenges.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of 41.3%. The market in North America is undergoing significant transformation due to technological advancements, changing preferences, and a growing focus on sustainability. One of the most prominent trends in the North American market is the rapid adoption of agricultural technology (AgriTech). Farmers and agribusinesses across the region are leveraging technologies such as precision farming, robotics, and digital platforms to enhance efficiency, optimize inputs, and improve profitability. Precision farming, in particular, has become a cornerstone of modern agriculture in North America, allowing farmers to use data-driven insights to manage soil health, irrigation, fertilization, and pest control. Urban agriculture and vertical farming are emerging as viable solutions to address food security and reduce food miles in North America’s densely populated cities. Vertical farming technologies, which grow crops in controlled indoor environments using hydroponics and aeroponics, are gaining momentum in the U.S. and Canada. These methods allow year-round production of fresh produce with significantly reduced water and land usage compared to traditional farming. The IMARC Group stated that the US vertical farming market is project to experience a growth rate (CAGR) of 11.00% during 2024-2032.

Key Regional Takeaways:

United States Agribusiness Market Analysis

The Unites States hold 85.90% of the market share in North America. The US agribusiness market has support factors in terms of strong economic performance and high levels of innovation. The biggest US agribusiness cooperative, CHS Inc., reported consolidated revenue of USD 39.3 Billion for fiscal year 2024 against USD 45.6 Billion in 2023, which showed that the market could stand firm even against the fluctuating margins of global grain exports and agricultural conditions. As of 2024, the agricultural segment of CHS had reported pre-tax profit of USD 342.7 million with the pressures caused by weaker crush margins. Despite this, CHS is targeting to return USD 600 million to its members in fiscal 2025, which in turn gives proof of its commitment towards growth and stability. The U.S. market remains the largest globally due to technological advancements, government support for sustainable farming, and the increasing application of automation and data analytics to improve crop yields and efficiency.

Europe Agribusiness Market Analysis

Europe's agriculture business thrives from high technologies, sustainable production, and harvesting practices. The CAP, established by the European Union, maintains a substantial role in agribusiness as a contributor to all farmers; as estimated today, each year an amount of Euro 58 billion (USD 61.38 Billion) is used to finance every farmer of the EU. According to European Commission, agribusiness trade in 2024 hit Euro 18.4 Billion (USD 19.47 Billion), having seen an upward trend from the past by an impressive 3.5%. This region focuses on innovation. The investment by countries like Germany in digital agriculture technologies, including AI-driven crop monitoring systems, has the ability to enhance productivity in their regions. Increased demand for plant-based food products and organic farming also help increase Europe's market, thus creating opportunities for growth and investment.

Asia Pacific Agribusiness Market Analysis

Asia Pacific's market is growing quite briskly. The market is seeing key players such as Wilmar International post a 5% increase in core net profit to USD 606 Million for the first half of 2024. The region is witnessing growth due to increased demand for food products and feed & industrial products. Wilmar's revenues declined 5% y-o-y to USD 30.93 billion in 1H2024, dragged by a decline in commodity prices, however, its Food Products division reported strong growth of 77% in pre-tax profits, driven by higher sales volumes and lower raw material costs. The Asia Pacific market is driving growth by expansion of the population, urbanization, and rising income of the middle class to purchase agricultural products. Other governments in China, India, and Southeast Asia are likewise spending on modern agricultural practices and technologies to enhance regional food security.

Latin America Agribusiness Market Analysis

Strong agribusiness exports drive the market of Latin America with Brazil and Argentina in an exceptional position. According to Government of Brazil, agribusiness exports from Brazil accounted for a record-breaking high at USD 166.19 Billion in 2024, with major areas of soybeans, meat, and sugar. Other segments being defense and security sectors were affected positively due to agribusiness sector, as the firm leading Brazil with an outstanding position in ammunition production is CBC from Brazil. The Brazilian agribusiness sector registered a 6% growth in revenue, with support from favorable climatic conditions and strong international demand, during 2024. International investments in the agribusiness sector of Latin America have continued to fuel the growth of this sector as well.

Middle East and Africa Agribusiness Market Analysis

Agribusiness in the Middle East is growing at a rate as the food production sector experiences immense investments. Riyadh is capital in a USD 1.108 Trillion economy and leads the way within the Middle East and Africa region. The latest reports state that the investments towards agricultural have soared from USD 44 Billion in 2016 to approximately USD 70 Billion by 2030. Agribusiness in Saudi Arabia: The country's agricultural GDP rose by more than 38 per cent to USD 26.6 Billion in 2022, primarily due to population growth, lifestyle modifications, and government-supported programs. Focus areas for food manufacturing and processing with conducive agreements are building the agribusiness ecosystem in the region. Moreover, investments in modern farming practices and sustainable farming technologies aim to upgrade local food production capabilities. These efforts position Saudi Arabia as a vital actor in regional agribusiness, while innovatively mitigating challenges like water scarcity and climate change.

Competitive Landscape:

One of the most prominent strategies among agribusiness leaders is the adoption of advanced technology to improve efficiency and productivity. Companies are investing heavily in precision agriculture tools, robotics, artificial intelligence (AI), and blockchain to modernize farming operations and supply chain management. Blockchain technology is also being used to improve transparency and traceability in the agribusiness supply chain. Companies are implementing blockchain to trace food products from farm to table, ensuring food safety, reducing fraud, and meeting consumer demand for transparency. Sustainability has become a cornerstone of the strategies employed by key agribusiness players as they respond to growing consumer demand for eco-friendly and ethically sourced products. Companies are integrating sustainable farming practices, adopting renewable energy sources, and working toward reducing greenhouse gas emissions across their operations. For instance, in 2024 Bayer AG launched its initiative “Bayer ForwardFarming” in India which provides sustainable farming procedures, presenting a platform for farmers, stakeholders, and researchers to connect and share knowledge.

The report provides a comprehensive analysis of the competitive landscape in the agribusiness market with detailed profiles of all major companies, including:

- ABP Food Group

- Archer-Daniels-Midland Company

- Associated British Foods plc

- BASF SE

- Bayer AG

- Bunge Limited

- Cargill Incorporated

- CHS Inc.

- Nippon Soda Co. Ltd.

- Nutrien Ltd.

- Syngenta AG (China National Chemical Corporation)

- Wilmar International Limited

Latest News and Developments:

- October 2024: According to ADM, the regenerative agriculture program in the UK exceeded initial goals, enrolling over 260 farmers in its first year. As enrollment opens for the 2025 season, the program supports soil health, biodiversity, and carbon emission reduction.

- October 2024: According to ABP and Sysco, the two companies launched a five-year regenerative farming initiative in Ireland. The project promotes sustainable practices, enhances biodiversity, and combats climate change while maintaining high-quality beef production. The project will also share insights with the wider farming industry.

- June 2024: Trelleborg Tires partnered with ABP Food Group to enhance agricultural fuel efficiency through improved tire selection. The initiative supports ABP’s PRISM 2030 sustainability program, helping farmers reduce carbon emissions and improve production efficiency through better tire performance and maintenance.

- June 2024: Nutrien Ag Solutions acquired Suncor Energy’s AgroScience assets on June 17, gaining biocontrol technology with chlorin-based photosensitizers for integrated pest management. This technology, set for global launch by 2025, aims to enhance resistance management and sustainability in agriculture.

Agribusiness Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Trillion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Grains, Oilseeds, Dairy, LiveStock, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABP Food Group, Archer-Daniels-Midland Company, Associated British Foods Plc, BASF SE, Bayer AG, Bunge Limited, Cargill Incorporated, CHS Inc., Nippon Soda Co. Ltd., Nutrien Ltd., Syngenta AG (China National Chemical Corporation), Wilmar International Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the agribusiness market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global agribusiness market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the agribusiness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Agribusiness encompasses all economic activities related to farming and agricultural production, including the supply chain of food, fiber, and biofuels. It integrates farming, processing, distribution, and retail, along with agricultural technology, to optimize production efficiency and meet global food demand sustainably.

The agribusiness market was valued at USD 3.5 Trillion in 2025.

IMARC estimates the global agribusiness market to exhibit a CAGR of 2.66% during 2026-2034.

The global agribusiness market is driven by technological advancements such as precision agriculture, rising population, changing dietary preferences, growing demand for sustainability, and favorable government policies. These factors collectively enhance productivity, improve resource efficiency, and address food security concerns.

In 2025, grains represented the largest segment by product, holding 36.9% of the market share, driven by the rising demand for food, animal feed, and biofuels globally.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global agribusiness market include ABP Food Group, Archer-Daniels-Midland Company, Associated British Foods Plc, BASF SE, Bayer AG, Bunge Limited, Cargill Incorporated, CHS Inc., Nippon Soda Co. Ltd., Nutrien Ltd., Syngenta AG (China National Chemical Corporation), Wilmar International Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)