Africa Microinsurance Market Report by Product Type (Property Insurance, Health Insurance, Life Insurance, Index Insurance, Accidental Death and Disability Insurance, and Others), Provider (Microinsurance (Commercially Viable), Microinsurance Through Aid/Government Support), Model Type (Partner Agent Model, Full-Service Model, Provider Driven Model, Community-Based/Mutual Model, and Others), and Country 2025-2033

Market Overview:

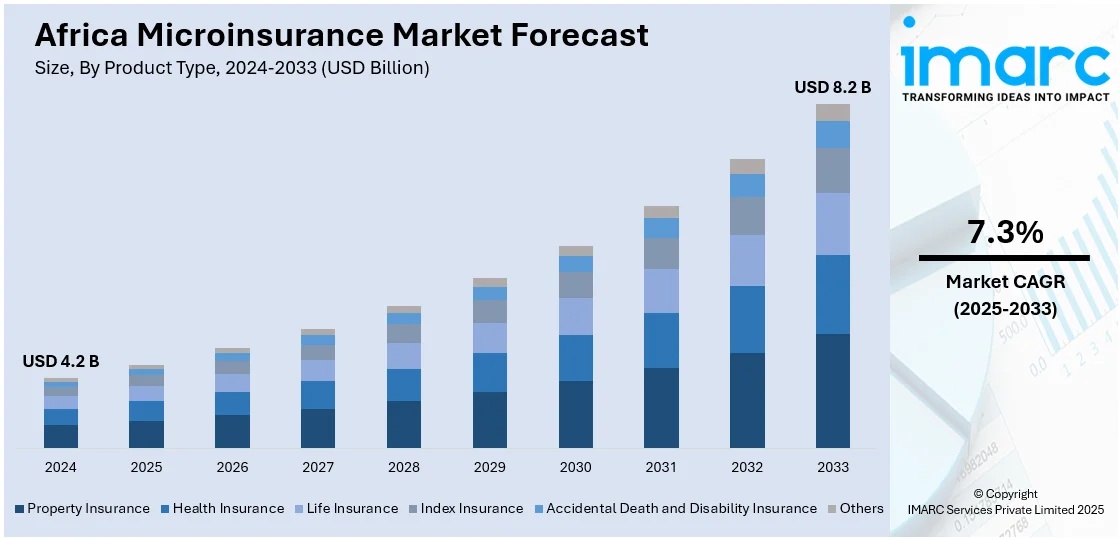

The Africa microinsurance market size reached USD 4.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.2 Billion by 2033, exhibiting a growth rate (CAGR) of 7.3% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.2 Billion |

|

Market Forecast in 2033

|

USD 8.2 Billion |

| Market Growth Rate 2025-2033 | 7.3% |

Microinsurance is a component of microfinance that provides low-premium insurance plans to the low-income section of society. It offers various insurance, insurance-like, and similar products and services that help the weaker section of the society while providing risk protection and relief in case of distress, misfortune and contingent events. Microinsurance merges various small financial units into a large structure and provides a cushion against unexpected loss and exorbitant interest rates charged by unorganized money lenders.

Africa represents one of the leading microinsurance markets. It is primarily driven by the presence of a large low-income population, coupled with the positive economic growth in the region. In sub-Saharan Africa, many mutualized health insurance schemes have also been created based on voluntary membership. In exchange for the premiums they send to a fund, policyholders are entitled to certain benefits. Besides this, there has been an increase in the delivery of the microinsurance products to the target users through various institutional channels. These include licensed insurers, healthcare providers, microfinance institutions, community-based organizations, and non-governmental organizations (NGOs), which is propelling the market growth. For instance, in West Africa, a French NGO called Centre International de Développement et de Recherche (CIDR) has also developed a maternity cover health insurance product. The product is sold at the village level, with all inhabitants paying an annual fee to cover all pregnant women.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Africa microinsurance market report, along with forecasts at the regional and country level from 2025-2033. Our report has categorized the market based on product type, provider and model type.

Breakup by Product Type:

- Property Insurance

- Health Insurance

- Life Insurance

- Index Insurance

- Accidental Death and Disability Insurance

- Others

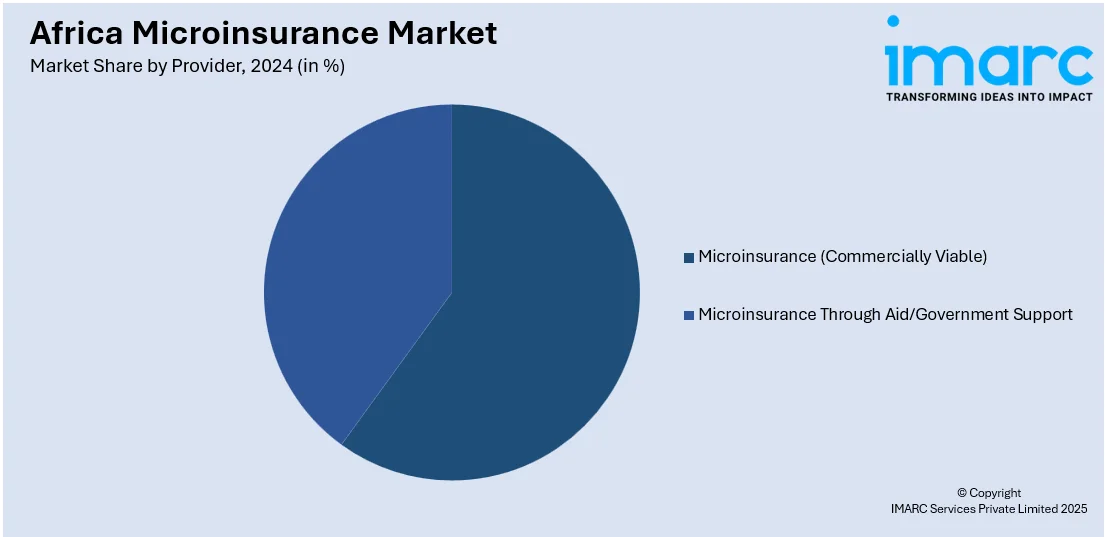

Breakup by Provider:

- Microinsurance (Commercially Viable)

- Microinsurance Through Aid/Government Support

Breakup by Model Type:

- Partner Agent Model

- Full-Service Model

- Provider Driven Model

- Community-Based/Mutual Model

- Others

Breakup by Country:

- South Africa

- Morocco

- Nigeria

- Egypt

- Kenya

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Product Type, Provider, Model Type, Country |

| Countries Covered | South Africa, Morocco, Nigeria, Egypt, Kenya, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Africa microinsurance market was valued at USD 4.2 Billion in 2024.

We expect the Africa microinsurance market to exhibit a CAGR of 7.3% during 2025-2033.

The growing adoption of microinsurance, as it helps individuals belonging to the financially weaker section of society by formulating a tailored plan with low premiums and provides compensation for illness, injury, disabilities, death, etc., is primarily driving the Africa microinsurance market.

The sudden outbreak of the COVID-19 pandemic has led to the rising utilization of microinsurance by numerous organizations across several African nations to provide cover for medical expenses incurred during the treatment of the coronavirus infection.

Based on the product type, the Africa microinsurance market can be segmented into property insurance, health insurance, life insurance, index insurance, accidental death and disability insurance, and others. Among these, life insurance currently holds the majority of the total market share.

Based on the provider, the Africa microinsurance market has been divided into microinsurance (commercially viable) and microinsurance through aid/government support. Currently, microinsurance (commercially viable) exhibits a clear dominance in the market.

Based on the model type, the Africa microinsurance market can be bifurcated into partner agent model, full-service model, provider driven model, community-based/mutual model, and others. Among these, partner agent model accounts for the largest market share.

On a regional level, the market has been classified into South Africa, Morocco, Nigeria, Egypt, Kenya, and others, where South Africa currently dominates the Africa microinsurance market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)