Aesthetic Thread Market Size, Share, Trends and Forecast by Product, Application, and Region, 2026-2034

Aesthetic Thread Market Size and Trends:

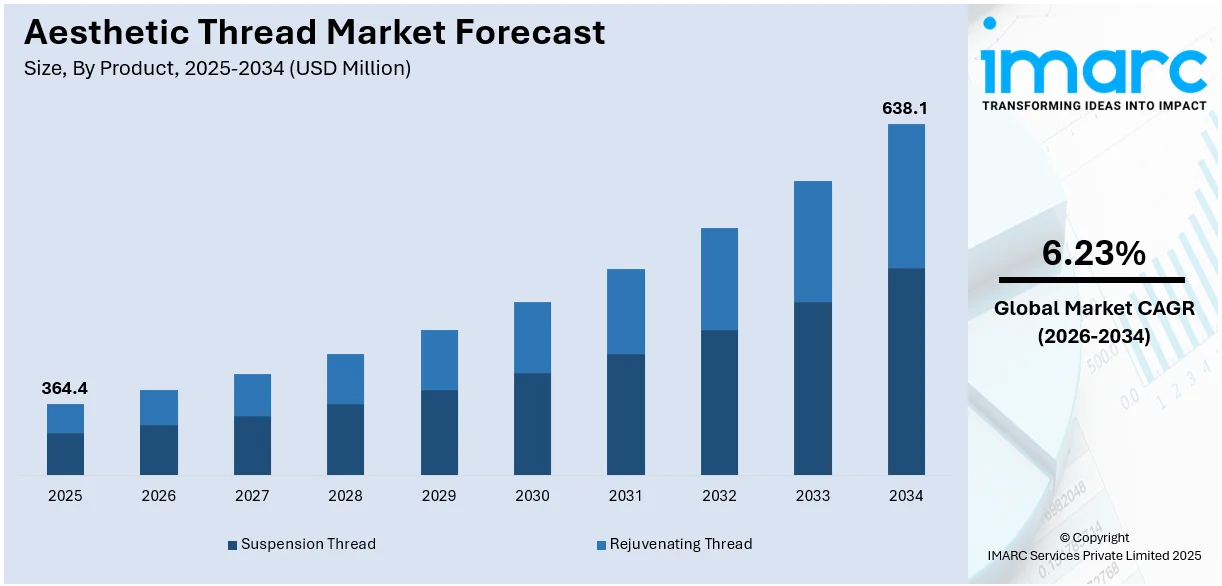

The global aesthetic thread market size was valued at USD 364.4 Million in 2025. Looking forward, the market is expected to reach USD 638.1 Million by 2034, exhibiting a CAGR of 6.23% during 2026-2034. North America currently dominates the market, holding a significant market share of 44.7% in 2025. The augmenting demand for minimally invasive aesthetic procedures, shifting consumer preference from expensive surgeries to comparatively inexpensive non-surgical alternatives, and the growing geriatric population seeking to address signs of aging represent some of the key factors driving the aesthetic thread market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 364.4 Million |

|

Market Forecast in 2034

|

USD 638.1 Million |

| Market Growth Rate 2026-2034 | 6.23% |

The market for aesthetic thread is driven by rising demand for minimally invasive cosmetic procedures offering natural results and reduced recovery time. An aging population with increasing disposable income further fuels adoption. Advancements in thread materials like PDO, PLLA, and PCL enhance durability and safety. Increased awareness through social media and influencer marketing boosts visibility, while growing availability of trained professionals and regulatory approvals enhances trust. Expansion of aesthetic clinics and greater affordability also contribute to market growth. Moreover, younger consumers are showing interest in preventive aging treatments. Combined, these factors are creating strong demand for aesthetic threads across facial contouring and skin-tightening applications, especially in emerging markets with improving healthcare infrastructure and beauty-conscious populations.

To get more information on this market Request Sample

The aesthetic thread market growth is also driven by the aging baby-boomer demographic seeking minimally invasive facial rejuvenation, strong adoption of non-surgical procedures, and rising disposable incomes fueling elective treatments. Significant technological advancements in thread materials like PDO, PLLA, and PCL improve safety and longevity. Robust FDA approvals and product launches, such as MINT and PDO Max’s bi-directional threads, have expanded availability. Additionally, extensive practitioner training and clinic specialization ensure high-quality outcomes. Finally, heightened awareness driven by social media, celebrity influence, and burgeoning cosmetic tourism further amplifies consumer adoption of thread lift procedures. For instance, in January 2024, Novaestiq Corp., a company dedicated to advancing aesthetic and medical dermatology through innovative and growth-driven solutions, announced a finalized agreement with Croma-Pharma GmbH to serve as the exclusive distributor of the Saypha® dermal filler range in the United States. This strategic alliance expands upon their ongoing collaboration to co-develop cutting-edge, next-generation dermal fillers featuring advanced cross-linking technology aimed at enhancing product performance and patient outcomes.

Aesthetic Thread Market Trends:

Rising Demand for Minimally Invasive Aesthetic Treatments

The aesthetic thread market is primarily driven by a growing preference for non-surgical, minimally invasive procedures. Consumers increasingly seek cosmetic enhancements that avoid the recovery time, risks, and high costs associated with traditional surgeries. Aesthetic thread lifts, which offer natural-looking skin tightening and contouring with minimal downtime, appeal to individuals looking for subtle enhancements without the need for hospitalization. According to a recent report, the global medical aesthetics market is projected to expand to USD 146.5 Billion by 2028, underlining the extensive and growing consumer interest in such procedures. In addition to this, advancements in thread composition and design have improved safety and results, boosting patient confidence, thereby creating a positive aesthetic thread market outlook. The trend toward quick and effective treatments, alongside a shift in social acceptance of cosmetic procedures, has significantly expanded the aesthetic thread market’s consumer base.

Technological Advancements in Thread Materials and Techniques

Innovations in the materials used for aesthetic threads, such as biodegradable, biocompatible polymers like polydioxanone (PDO) and polylactic acid (PLA), have contributed to enhanced results and durability. These materials stimulate collagen production, resulting in firmer skin over time. Improvements in application techniques have also allowed practitioners to achieve more precise results, addressing specific areas of concern with greater ease. According to the aesthetic thread market analysis, technological advancements have minimized risks associated with thread procedures, such as swelling and infection, further enhancing patient outcomes and satisfaction. These advancements have made aesthetic thread treatments a more viable and appealing option for both patients and professionals, thereby driving the market growth.

Growing Awareness and Accessibility

The awareness of aesthetic treatments is growing rapidly due to digital platforms, influencer marketing, and educational campaigns by dermatologists and aesthetic professionals, which are driving the aesthetic thread market trends. Social media has particularly amplified the visibility of aesthetic procedures, making them more mainstream and accepted across diverse demographics. YouTube leads with 73% of adults using it, followed by Facebook (69%), Instagram (37%), and Snapchat (24%). As awareness spreads, more clinics and practitioners are adding aesthetic threading to their service offerings, often at competitive prices. This increased accessibility, coupled with broader acceptance of cosmetic treatments across different age groups, especially millennials and Gen Z, has broadened the potential client base. As more consumers recognize the benefits and see realistic results of aesthetic threads, the demand is rising, thus fueling market expansion across the globe.

Aesthetic Thread Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global aesthetic thread market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on product and application.

Analysis by Product:

- Suspension Thread

- Rejuvenating Thread

Suspension thread stands as the largest product in 2025, holding 60.3% of the market due to their superior lifting capacity and long-lasting results compared to smooth or mono threads. These threads, often made from materials like PDO, PLLA, or PCL, are equipped with barbs or cones that anchor into the skin, allowing for effective repositioning of sagging tissue. They are widely used in mid-face, jawline, and neck lifts, offering a minimally invasive alternative to surgical facelifts. High demand among aging populations seeking non-surgical rejuvenation, combined with growing practitioner expertise and patient satisfaction, drives their popularity. Additionally, strong regulatory approvals and clinical backing have further boosted adoption in both developed and emerging aesthetic markets.

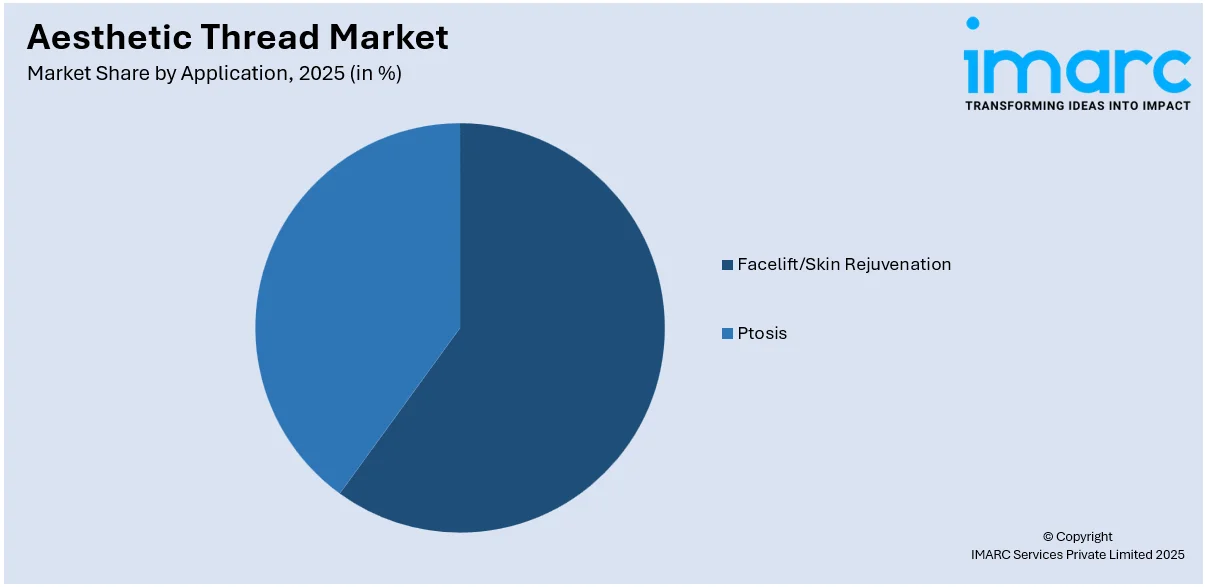

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Facelift/Skin Rejuvenation

- Ptosis

Facelift/skin rejuvenation leads the market with 48.8% of market share in 2025 due to rising demand for minimally invasive procedures that offer visible anti-aging results with minimal downtime. As facial sagging, wrinkles, and volume loss become common concerns with age, patients increasingly seek thread lifts for natural-looking rejuvenation without surgery. Suspension threads with barbs or cones are widely used to lift and tighten the skin, particularly in the mid-face, jawline, and neck. According to the aesthetic thread market forecast, growing awareness, social media influence, and preference for non-surgical aesthetic solutions have fueled adoption. The increasing availability of trained professionals and technological advancements in thread materials further support the widespread use of aesthetic threads in facelift procedures.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of over 44.7%. The aesthetic thread market demand in North America is driven by a rising preference for minimally invasive cosmetic procedures that deliver effective, natural-looking results with reduced recovery time. An aging population seeking non-surgical facial rejuvenation, along with growing disposable incomes, fuels demand for thread lifts. Technological advancements in thread materials such as PDO, PLLA, and PCL enhance safety, biocompatibility, and longevity, encouraging wider adoption. Increasing awareness through social media, celebrity endorsements, and online platforms has made aesthetic procedures more mainstream. Additionally, strong regulatory support, including FDA clearances, and a high concentration of trained practitioners and specialized aesthetic clinics ensure access to quality treatments. Expanding interest from younger demographics in preventive aging further boosts market growth across the region.

Key Regional Takeaways:

United States Aesthetic Thread Market Analysis

In 2025, the United States accounted for 86.30% of the aesthetic thread market in North America. The aesthetic thread market in the United States is experiencing steady growth, driven by increasing consumer demand for minimally invasive cosmetic procedures. A growing preference for non-surgical facial rejuvenation among aging demographics, coupled with rising awareness about thread lifting techniques, is fueling market expansion. Technological advancements in thread materials and techniques are enhancing procedure efficacy and safety, boosting consumer confidence. The popularity of personalized aesthetics among individuals is also contributing to higher procedural uptake. A report states that in Miami, recent studies reveal that 82% of patients prefer personalized aesthetic treatments that consider their unique features, underscoring the market’s shift toward customized solutions. In addition, the presence of a well-developed aesthetic services ecosystem supports widespread adoption across urban and suburban settings. Influencer-driven beauty trends and social media visibility encourage aesthetic experimentation and normalization of thread-based treatments. Medical training institutions increasingly offering specialized courses in aesthetic procedures are expanding the pool of qualified professionals.

Europe Aesthetic Thread Market Analysis

Europe’s aesthetic thread market is witnessing a surge in demand, primarily supported by growing interest in age-defying treatments that offer natural-looking results. Cultural emphasis on subtle enhancements and a refined appearance aligns well with thread-based procedures that deliver gradual, noticeable changes. Increasing demand for non-invasive treatments within wellness tourism destinations is contributing to market penetration across both Western and Eastern Europe. A mature regulatory environment fostering standardization of practices and ensuring consumer trust in emerging thread technologies. According to the report, the UK aesthetics sector is supported by 7,892 licensed aesthetics practitioners, reflecting a well-established professional network that strengthens market confidence and service availability. Advancements in resorbable thread composition and techniques for varying skin types enhance procedural versatility and appeal. The rise of specialized aesthetic training institutions and congresses accelerates practitioner adoption of thread-lifting solutions, integrating aesthetic threads into comprehensive treatment plans and creating recurring demand among experienced aesthetic consumers.

Asia Pacific Aesthetic Thread Market Analysis

The aesthetic thread market in Asia Pacific is expanding rapidly, fueled by a cultural inclination toward youthful appearances and preventive aesthetics. Increasing urbanization and exposure to global beauty standards are driving awareness about innovative non-surgical treatments. Rising middle-class income levels and the growing influence of beauty influencers are creating a receptive consumer base for aesthetic advancements. It is expected that by 2029, two in every three middle-class consumers are to be from Asia. Technological integration into skincare and aesthetics, such as AI-based consultations, is encouraging patient-specific thread treatments. The emergence of beauty-focused medical tourism hubs across the region is further promoting adoption of aesthetic threads, especially among international and domestic clientele seeking affordable, high-quality treatments.

Latin America Aesthetic Thread Market Analysis

Latin America's aesthetic thread market is growing steadily, driven by increasing interest in body contouring and non-invasive facial enhancements. Aesthetic consciousness among younger populations and expanding access to aesthetic clinics are making thread procedures more mainstream. According to the 2021 International Survey on Aesthetic/Cosmetic Procedures by the International Society of Aesthetic Plastic Surgery, Brazil, Mexico, Argentina, and Colombia were among the top 10 countries globally in terms of total aesthetic procedures performed. Brazil held the second position worldwide for the combined number of surgical and non-surgical procedures. The integration of aesthetic services into wellness and lifestyle offerings enhances visibility and acceptance. Local innovation in aesthetic procedure customization enables better results for a diverse range of skin types and facial structures. Moreover, social trends emphasizing physical self-care are making aesthetic thread treatments a desirable option within broader beauty regimens.

Middle East and Africa Aesthetic Thread Market Analysis

The aesthetic thread market in the Middle East and Africa is gaining momentum, supported by rising demand for quick-recovery cosmetic procedures. A strong cultural focus on personal grooming and physical appearance is encouraging the uptake of thread-based treatments. Growth in luxury wellness centers and aesthetic clinics is making advanced procedures more accessible. According to a recent report, 86.51% of respondents in Riyadh were aware about the consequences of cosmetic procedures, with social media influencing 60% of decision-making, highlighting the digital sphere’s growing role in shaping aesthetic preferences. A younger population with increasing disposable income is showing high interest in modern aesthetic solutions. Additionally, the influence of digital platforms enhances awareness and acceptance of non-surgical rejuvenation options across the region.

Competitive Landscape:

The aesthetic thread industry is marked by intense competition, with leading companies prioritizing innovation, new product launches, and strategic collaborations as core strategies to strengthen their market presence and expand their share. Companies such as Aptos, Sinclair Pharma, Croma-Pharma GmbH, and Hansbiomed Co., Ltd. are leading the market with advanced thread technologies using materials like PDO, PLLA, and PCL. These firms emphasize clinical efficacy, safety, and regulatory approvals to strengthen credibility. Mergers, acquisitions, and regional expansions are common strategies to tap into emerging markets. Additionally, local players are gaining traction by offering cost-effective, high-quality solutions. The market is also witnessing increased investments in practitioner training and digital marketing, intensifying competition, and encouraging continuous product and procedural innovation to meet evolving consumer demands.

The report provides a comprehensive analysis of the competitive landscape in the aesthetic thread market with detailed profiles of all major companies, including:

- Aptos LLC

- Croma-Pharma GmbH

- Intraline

- Medical Aesthetic Group

- Menarini Group

- Metro Korea Co. Ltd.

- N-Finders

- OXXOT S.r.l.

- Sinclair Pharma PLC (Huadong Medicine Co. Ltd.)

Latest News and Developments:

- May 2025: The Laser Lounge Spa in Sarasota launched advanced medical-grade aesthetic treatments, including MIRACU PDO threads, to meet the rising demand for non-surgical beauty solutions. The minimally invasive threads lifted and firmed skin while boosting collagen production, aligning with their commitment to personalized, clinically supervised skin care for rejuvenation and facial enhancement.

- March 2025: SBC Medical expanded its multi-brand strategy by launching “SBC NEO Skin Clinic” in Tokyo, focusing on non-invasive dermatological treatments. The clinic offered advanced laser and skincare solutions inspired by South Korean standards, aligning with the growing demand for aesthetic innovation and broadening SBC’s market reach beyond surgical procedures to include thread-based rejuvenation therapies.

- January 2025: Merz Aesthetics launched Ultherapy PRIME® in the EMEA region, showcasing advancements in non-invasive skin lifting. The device supports regenerative aesthetics through micro-focused ultrasound, complementing thread-based treatments by enhancing collagen stimulation, skin quality, and long-term lifting effects without surgery, reinforcing Merz’s innovation leadership.

- January 2025: Cytrellis Biosystems launched ellacor® 2.0, an upgraded minimally invasive skin removal device that enhanced procedure speed by 35% and reduced healing time by 60%. Backed by new leadership and funding, the system offers an effective non-surgical alternative to traditional threads, addressing wrinkles and sagging with improved consistency and patient satisfaction.

Aesthetic Thread Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Suspension Thread, Rejuvenating Thread |

| Applications Covered | Facelift/Skin Rejuvenation, Ptosis |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aptos LLC, Croma-Pharma GmbH, Intraline, Medical Aesthetic Group, Menarini Group, Metro Korea Co. Ltd., N-Finders, OXXOT S.r.l., Sinclair Pharma PLC (Huadong Medicine Co. Ltd.), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the aesthetic thread market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global aesthetic thread market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the aesthetic thread industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The aesthetic thread market was valued at USD 364.4 Million in 2025.

The aesthetic thread market is projected to exhibit a CAGR of 6.23% during 2026-2034, reaching a value of USD 638.1 Million by 2034.

Key drivers of the aesthetic thread market include rising demand in fashion and sportswear, growing cosmetic surgery and medical applications, higher consumer spending on appearance, and innovations in thread materials and finishes. Social media influence and brand-driven trends also play a major role in market growth.

North America dominated the aesthetic thread market in 2025 due to high demand for non-surgical cosmetic procedures, advanced healthcare infrastructure, rising beauty consciousness, and the strong presence of key market players.

Some of the major players in the aesthetic thread market include Aptos LLC, Croma-Pharma GmbH, Intraline, Medical Aesthetic Group, Menarini Group, Metro Korea Co. Ltd., N-Finders, OXXOT S.r.l., Sinclair Pharma PLC (Huadong Medicine Co. Ltd.), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)