Aesthetic Lasers and Energy Devices Market Size, Share, Trends and Forecast by Product Type, Application, Technology, End User, and Region, 2025-2033

Aesthetic Lasers and Energy Devices Market Size and Share:

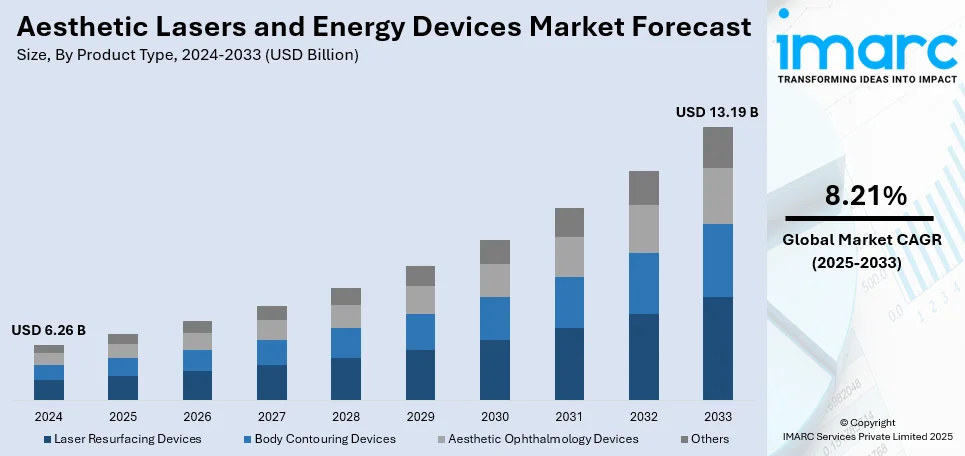

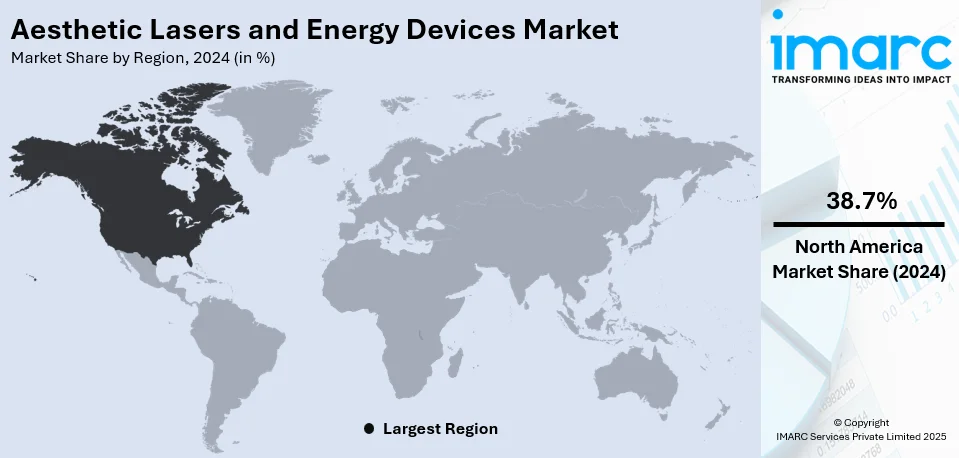

The global aesthetic lasers and energy devices market size was valued at USD 6.26 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 13.19 Billion by 2033, exhibiting a CAGR of 8.21% during 2025-2033. North America currently dominates the market, holding a significant market share of over 38.7% in 2024. The market is experiencing significant growth mainly driven by the rising demand for non-invasive cosmetic treatments. Technological advancements, increasing consumer interest in skin rejuvenation, and anti-aging solutions are also contributing positively to the aesthetic lasers and energy devices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.26 Billion |

|

Market Forecast in 2033

|

USD 13.19 Billion |

| Market Growth Rate (2025-2033) | 8.21% |

The global aesthetic lasers and energy devices market is driven by the increasing demand for non-invasive cosmetic procedures, advancements in laser and energy-based technologies, and rising awareness of aesthetic treatments. The growing aging population seeking anti-aging solutions, coupled with the influence of social media and beauty standards, further fuels the market expansion. Additionally, the rise in disposable incomes and the availability of minimally invasive procedures with shorter recovery times contribute to the market growth. Technological innovations, such as improved safety and efficacy of devices, alongside expanding applications in skin rejuvenation, hair removal, and body contouring, are key factors propelling the aesthetic lasers and energy devices market demand. On 1st October 2024, Cynosure Lutronic introduced Mosaic 3D, a 1550nm Erbium Glass fractional non-ablative laser designed for skin rejuvenation. This innovative platform incorporates 3D Controlled Chaos Technology and an integrated air cooling system, effectively targeting both superficial and mid-dermal layers. It provides customizable treatment options with minimal downtime.

The United States stands out as a key regional market, primarily driven by high consumer demand for cosmetic enhancements and technological advancements in medical aesthetics. In 2023, the United States witnessed 25.4 million minimally invasive treatments, with neuromodulator injections accounting for 9.48 million (up 9%), and approximately 1.6 million cosmetic surgical procedures, with liposuction topping at 347K (up 7%). The increasing demand for cosmetic and reconstructive improvements is reflected in the 1.02 million reconstructive surgeries performed, with tumor removal reaching a peak of 351K (up 2%). The industry is aided by a high emphasis on personal appearance, a well-established healthcare infrastructure, and the growing popularity of less invasive treatments. The market is developing as a result of rising disposable incomes and a growing need for non-surgical procedures including body sculpting, hair removal, and skin resurfacing. Additionally, the existence of important industry players and regulatory approvals for novel devices support the market's growth, establishing the United States as a global leader in aesthetic technology.

Aesthetic Lasers and Energy Devices Market Trends:

Technological Advancements

Market technological developments are resulting in the development of multipurpose platforms that can carry out many treatments, such as scar reduction, hair removal, and skin rejuvenation, all inside a single system. According to reports, women spend an average of 22.4 minutes a day on skincare. These developments meet the increasing need for effective, adaptable, and non-invasive treatments. Many wavelengths and energy sources, including radiofrequency and ultrasound, are now included into devices, enabling professionals to tailor therapies to the demands of their patients. This not only improves clinical outcomes but also reduces treatment time and recovery periods, making these devices appealing to both healthcare professionals and patients looking for quicker, more convenient options, which, in turn, is contributing positively to the aesthetic lasers and energy devices market growth. For example, Karma, a state-of-the-art cosmetic therapy tool with four emission modalities and sophisticated dual-wavelength technology, was introduced by Reveal Lasers LLC in March 2024. Karma's accuracy and adaptability make it ideal for tattoo removal, benign pigmented lesion removal, scar treatments, and skin rejuvenation. The device's creative design offers versatility and great power by including several focus lenses and spot sizes. Karma's exclusive pulse technology strives to produce remarkable outcomes while reducing negative responses.

Growing Popularity of Non-Invasive Treatments

The aesthetic industry is shifting toward non-invasive and minimally invasive cosmetic procedures due to consumer desire for safer, less painful, and faster recovery options. The minimally invasive surgery industry was estimated to be worth USD 56.1 Billion globally in 2024. More and more individuals are using devices that provide non-surgical ways to reduce fat, minimize wrinkles, and tighten the skin. To get the desired outcomes with little to no recovery time, these treatments employ contemporary technology such as laser, radiofrequency, and ultrasound. These therapies appeal to a larger spectrum of individuals as they may produce realistic, useful results without the risks connected with conventional surgical procedures. For instance, in April 2024, Cartessa Aesthetics introduced PHYSIQ 360, a cutting-edge non-invasive body sculpting technique. The device offers a comprehensive strategy for fat reduction and muscle activation, utilizing state-of-the-art technology to meet industry standards. PHYSIQ 360 uses customized treatment plans to address the challenges of achieving desired body goals. This innovation comes as a response to the increasing popularity of weight loss medications, offering a sustainable approach to total body wellness.

Expanding Applications

In dermatological treatments for problems including acne, pigmentation disorders, and scar removal, aesthetic lasers and energy devices are becoming increasingly important. More than 1 million individuals have reportedly had dermal filler procedures, according to industry reports. These devices treat deeper layers of the skin using energy-based technologies or focused lasers, treating problems including inflammation, hyperpigmentation, and uneven skin texture. Their expanded range of use increases their worth in the healthcare industry by providing therapeutic and cosmetic solutions of the highest caliber. Dermatologists greatly value these devices' adaptability since they provide non-invasive options for treating a range of skin diseases and enhancing skin health in general. For instance, in March 2023, Doctors Aesthetics Centre introduced Picocare 250 Majesty, the first 250 Picosecond Nd: YAG laser in South India. This USA FDA-approved laser from Wontech, South Korea, aims to redefine skincare in India. It addresses various skin concerns such as multi-colored tattoos, pigmented lesions, and skin rejuvenation. The launch marks a new milestone in DAC's journey of providing advanced medical and cosmetic procedures.

Aesthetic Lasers and Energy Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global aesthetic lasers and energy devices market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, application, technology, and end user.

Analysis by Product Type:

- Laser Resurfacing Devices

- Body Contouring Devices

- Aesthetic Ophthalmology Devices

- Others

Laser resurfacing devices stand as the largest component in 2024, holding around 37.6% of the market. These devices' remarkable effectiveness in pigmentation correction, wrinkle reduction, scar removal, and skin rejuvenation is what drives their appeal. The non-invasive characteristics of laser treatments and advancements in technology have increased patient demand for them. Growing desire for anti-aging solutions and more awareness of aesthetic procedures have also contributed to the market dominance of laser resurfacing equipment, making it a popular choice in both clinical and cosmetic settings. For instance, in March 2024, Rohrer Aesthetics introduced Pix:E, a cutting-edge device that combines 4 MHz RF microneedling with Erbium skin resurfacing. With increased efficacy, more customization options, better patient comfort, and quicker treatment durations, this FDA-approved device seeks to address a variety of skin issues.

Analysis by Application:

- Hair Removal

- Skin Resurfacing

- Skin Rejuvenation

- Body Shaping and Skin Tightening

- Others

Body shaping and skin tightening leads the market in 2024. A major contributing element to this rise is the rising desire for minimally invasive and non-invasive procedures meant to improve body shape and lessen sagging skin. Cosmetic procedures are becoming more and more popular due to advancements in laser technology and increased customer interest in them. The market's attractiveness in this sector is also being driven by the rising knowledge of cosmetic choices and a notable need for anti-aging therapies.

Analysis by Technology:

- Laser Based Technology

- Light Based Technology

- Energy Based Technology

Energy based technology leads the market with around 45.0% of market share in 2024 due to its versatility and effectiveness in various cosmetic treatments. For body contouring, skin rejuvenation, hair removal, and acne treatment, a variety of technologies, including laser, radiofrequency, and ultrasound, are widely used. They are appealing as they provide minimally invasive or non-invasive alternatives that take less time to recover from than traditional methods. Demand has been fueled by ongoing developments in energy-based devices, which improve efficacy and safety, positioning this industry at the forefront of the market for cosmetic devices. These advancements in energy-based technologies, coupled with increasing consumer demand for non-invasive aesthetic procedures, shorter recovery times, and ongoing innovation in device safety and effectiveness, are creating a positive aesthetic lasers and energy devices market outlook. The expansion of applications such as body contouring, skin tightening, and rejuvenation further strengthens the market's growth trajectory, as more individuals seek personalized and efficient cosmetic treatments.

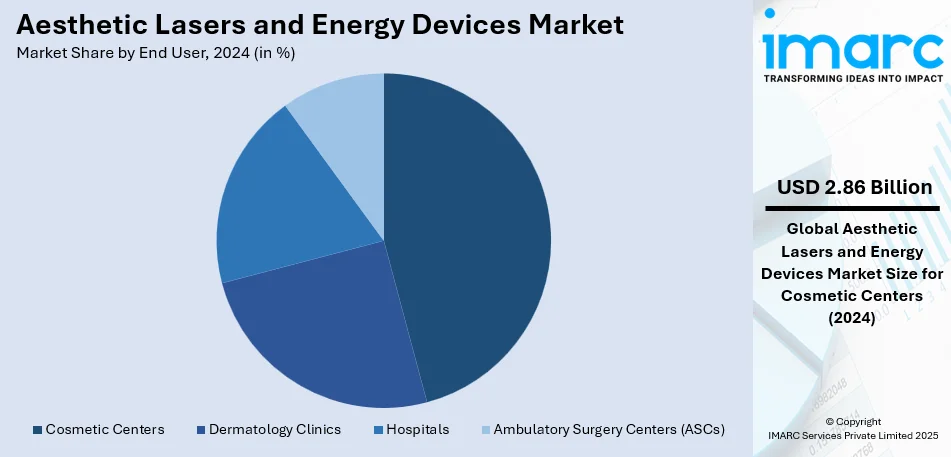

Analysis by End User:

- Cosmetic Centers

- Dermatology Clinics

- Hospitals

- Ambulatory Surgery Centers (ASCs)

Cosmetic centers leads the market with around 45.7% of market share in 2024 due to the growing demand for non-invasive beauty treatments. These clinics use cutting-edge laser and energy-based technology to offer a range of treatments, such as body shaping, skin rejuvenation, and hair removal. A wide range of clientele are drawn to their capacity to provide individualized therapy using the most modern technological developments. Their dominance in this sector is further cemented by the expanding number of cosmetic clinics throughout the globe, which is being driven by more awareness and easier access to aesthetic procedures.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

In 2024, North America accounted for the largest market share of over 38.7%, due to high consumer demand for cosmetic procedures, driven by rising disposable incomes and increasing awareness of non-invasive treatments. The region's advanced healthcare infrastructure supports the adoption of innovative technologies including lasers, radiofrequency, and ultrasound for body contouring, skin rejuvenation, and hair removal. Furthermore, the presence of key industry players and a growing number of cosmetic centers offering these treatments contribute to North America's dominant market position. For instance, in March 2024, Reveal Lasers LLC unveiled the AlloraPro Laser Workstation, a cutting-edge device designed for permanent hair reduction and skin rejuvenation treatments. With its advanced features and customizable options, including a larger spot size and versatile handpieces, the AlloraPro aims to meet the increasing demand for faster and more effective laser hair removal solutions.

Key Regional Takeaways:

United States Aesthetic Lasers and Energy Devices Market Analysis

In 2024, the US accounted for around 86.80% of the total North America aesthetic lasers and energy devices market. The aesthetic laser and energy device market in the United States is significantly driven by an increasing inclination towards minimally invasive cosmetic procedures. This trend is further enhanced by rising disposable incomes and the pervasive influence of social media. Acne, identified as the most common skin condition in the U.S., affects around 50 million individuals annually, according to the American Academy of Dermatology (AAD), thereby fueling the demand for laser treatments aimed at acne. Additionally, concerns regarding skin aging, including wrinkles and pigmentation issues, are propelling the uptake of advanced laser technologies. Continuous innovations, such as picosecond and fractional lasers, are enhancing treatment efficacy while reducing recovery periods. A strong regulatory framework and the presence of prominent manufacturers also play a vital role in the expansion of this market. The rising trend of combination therapies, which merge lasers with radiofrequency and ultrasound, enhances overall treatment results. An increase in male engagement in aesthetic procedures and a heightened interest in body contouring are additional factors supporting market expansion. Moreover, the rise of medical tourism and accessible financing options further facilitate consumer access. Although stringent FDA regulations and high equipment costs present challenges, the market continues to thrive, driven by shifting consumer preferences towards non-surgical aesthetic options.

Asia Pacific Aesthetic Lasers and Energy Devices Market Analysis

The Asia-Pacific market for aesthetic lasers and energy devices is expanding significantly due to rising disposable incomes, rapid urbanization, and a greater appreciation of beauty, particularly in nations such as China, Japan, South Korea, and India. With an annual urbanization rate of 3%, East Asia and the Pacific is the region with the highest pace of urbanization worldwide, according to the World Bank. This increases access to high-end cosmetic procedures. An increase in the population of the older generation coupled with a social preference for keeping skin young is propelling demand for laser anti-aging therapies. Technological advancements, notably AI-driven personalization, are improving the precision of these therapies, and medical tourism is propelling industry growth. The rapid growth in the number of dermatology clinics and medical spas is an enabler for the adoption of these solutions. However, the inherent challenges are with ambiguous regulations and lack of defined safety protocols. With conflicting situation notwithstanding, the Asia Pacific region is still among one of the fastest-growing markets for aesthetic energy devices propelled by changing customer preferences and increasing knowledge of minimally invasive alternatives.

Europe Aesthetic Lasers and Energy Devices Market Analysis

An increasing need for less intrusive cosmetic operations is the reason for the market's significant growth in Europe for aesthetic lasers and energy devices. An aging society and increased emphasis on physical attractiveness are the two primary impetus behind this trend. There is now a greater demand for anti-aging laser therapy as of January 1, 2023, with 448.8 million individuals living in the EU, 21.3% of whom are over the age of 65. Another factor enhancing the growth of this market will be technological advancements in non-ablative lasers, which are employed for pigmentation correction and skin rejuvenation. Strong regulations help ensure product safety, which enhances customer confidence. Higher disposable earnings also make it easier for individuals to adopt expensive cosmetic operations, particularly in Western Europe. The increasing number of aesthetic clinics and dermatology centers also improves accessibility for consumers. Additionally, social media influence and celebrity endorsements accelerate consumer interest. The market is also supported by government initiatives promoting innovation in medical aesthetics. However, stringent regulatory approval processes and high device costs remain challenges. Despite this, changing consumer preferences and continuous advancements make Europe a key market for aesthetic laser solutions.

Latin America Aesthetic Lasers and Energy Devices Market Analysis

The significant growth in the Latin American market for aesthetic lasers and energy devices is mostly due to the rising demand for cosmetic procedures. This demand is mostly driven by rising medical tourism, particularly in Brazil and Mexico, and rising disposable incomes. Reports state that the rate of urbanization in Latin America is around 80%, greater than in many other areas. In urban locations, this raises the demand for and accessibility of cutting-edge cosmetic procedures. Furthermore, a high emphasis on beauty in society promotes the use of laser treatments for skin renewal and body contouring. Although the region faces challenges such as economic instability and regulatory inconsistencies, advancements in technology and an increasing awareness of non-invasive treatment options are propelling market expansion, rendering the region more appealing for aesthetic energy devices.

Middle East and Africa Aesthetic Lasers and Energy Devices Market Analysis

Growing disposable incomes, a greater consciousness of beauty, and the expansion of medical tourism, particularly in the United Arab Emirates and Saudi Arabia, are driving the market for cosmetic lasers and energy devices throughout the Middle East and Africa. According to reports, Lebanon, a country of 6 million individuals, performs over 1.5 million cosmetic treatments annually, demonstrating a strong demand in spite of the country's current economic challenges. The region’s 64% urbanization rate further supports accessibility to advanced aesthetic treatments. Expanding specialized clinics and technological advancements enhance market growth. While regulatory hurdles and high treatment costs pose challenges, increasing awareness and infrastructure development continue to drive market expansion across the Middle East and Africa.

Competitive Landscape:

An increasing trend of non-invasive cosmetic procedures is generating intense competition within the industry. Making use of modern innovations such as lasers, radio frequency, and ultrasound for multiple applications such as body contouring, hair removal, and skin rejuvenation, companies focus on bringing forth what is newest. Theres competition among the industry players for sourcing new devices which provide safety and comfort for the patients and other effectiveness. To maintain a competitive edge in the market, competitive pricing, strategic alliances and consumer satisfaction are required. Further, technology innovations along with regulations focusing on improving clinical outcomes, are a major component of the competitive environment.

The report provides a comprehensive analysis of the competitive landscape in the aesthetic lasers and energy devices market with detailed profiles of all major companies, including:

- Allergan Plc.

- Bausch Health Companies Inc.

- Candela Medical

- Cutera Palomar Medical Technologies

- Cynosure Inc.

- Fotona Inc.

- Lumenis Ltd.

- Lutronic Inc.

- Sciton Inc.

Latest News and Developments:

- September 2024: Alma Lasers, a world leader in energy-based medical and cosmetic solutions, plans to add skincare products, injectables, and new platforms to its line of goods in India. For the aesthetics, surgical, and beauty industries, the Israeli firm specializes in medical lasers, light-based, radiofrequency, and ultrasound platforms. Alma operates directly through subsidiaries and has a significant presence throughout Asia, especially in China, Korea, Japan, India, and Australia.

- April 2024: Cartessa Aesthetics has launched PHYSIQ 360, an advanced non-invasive body contouring technology developed in collaboration with DEKA. This next-generation solution builds on the success of the award-winning PHYSIQ, offering enhanced fat reduction and muscle stimulation through customizable treatments suitable for various body and skin types. PHYSIQ 360 combines laser energy (LZR) and electrical muscle stimulation (EMS), administered either separately or sequentially, using exclusive Sequential Thermal & Electrical Pulse (STEP) technology.

- March 2024: Beagle Lasers, a medical aesthetics brand based in Surat, announced its plans to expand its operations to over 50 cities, aiming to bridge the gap between manufacturers and end-users by offering a wide range of high-quality laser products. This expansion will involve significant investment in infrastructure, including new factories and production facilities, with the goal of increasing accessibility to advanced medical equipment and technologies. The company's vision is to bring innovative solutions closer to medical practitioners and healthcare institutions.

- November 2023: The Laser Center of Marin ("TLC"), a well-known cosmetic and laser treatment facility in Northern California, has announced a strategic relationship with Alpha Aesthetics Partners, a leading medical aesthetics platform. The goal of this partnership is to use the resources of both companies to improve the standard of aesthetic treatments and the patient experience. In addition to advancing their growth in the medical aesthetics sector, the alliance demonstrates Alpha Aesthetics Partners' dedication to cultivating a collaborative culture and offering broad industry contacts.

Aesthetic Lasers and Energy Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Laser Resurfacing Devices, Body Contouring Devices, Aesthetic Ophthalmology Devices, Others |

| Applications Covered | Hair Removal, Skin Resurfacing, Skin Rejuvenation, Body Shaping and Skin Tightening, Others |

| Technologies Covered | Laser Based Technology, Light Based Technology, Energy Based Technology |

| End Users Covered | Cosmetic Centers, Dermatology Clinics, Hospitals, Ambulatory Surgery Centers (ASCs) |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Argentina, Colombia, Chile, Peru, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Companies Covered | Allergan Plc., Bausch Health Companies Inc., Candela Medical, Cutera Palomar Medical Technologies, Cynosure Inc., Fotona Inc., Lumenis Ltd., Lutronic Inc., Sciton Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the aesthetic lasers and energy devices market from 2019-2033.

- The aesthetic lasers and energy devices market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the aesthetic lasers and energy devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The aesthetic lasers and energy devices market was valued at USD 6.26 Billion in 2024.

IMARC estimates the aesthetic lasers and energy devices market to exhibit a CAGR of 8.21% during 2025-2033, reaching a value of USD 13.19 Billion by 2033.

The market is driven by increasing demand for non-invasive cosmetic procedures, advancements in laser and energy-based technologies, rising awareness of aesthetic treatments, growing aging population seeking anti-aging solutions, and the influence of social media and beauty standards. Additionally, rising disposable incomes and the availability of minimally invasive procedures with shorter recovery times contribute to the market growth.

North America currently dominates the aesthetic lasers and energy devices market, accounting for a share exceeding 38.7%. This dominance is fueled by high consumer demand for cosmetic procedures, advanced healthcare infrastructure, rising disposable incomes, and the presence of key industry players.

Some of the major players in the aesthetic lasers and energy devices market include Allergan Plc., Bausch Health Companies Inc., Candela Medical, Cutera Palomar Medical Technologies, Cynosure Inc., Fotona Inc., Lumenis Ltd., Lutronic Inc., and Sciton Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)