Aerospace Composites Market Size, Share, Trends and Forecast by Fiber Type, Resin Type, Aircraft Type, Application, Manufacturing Process, and Region, 2025-2033

Aerospace Composites Market Size and Share:

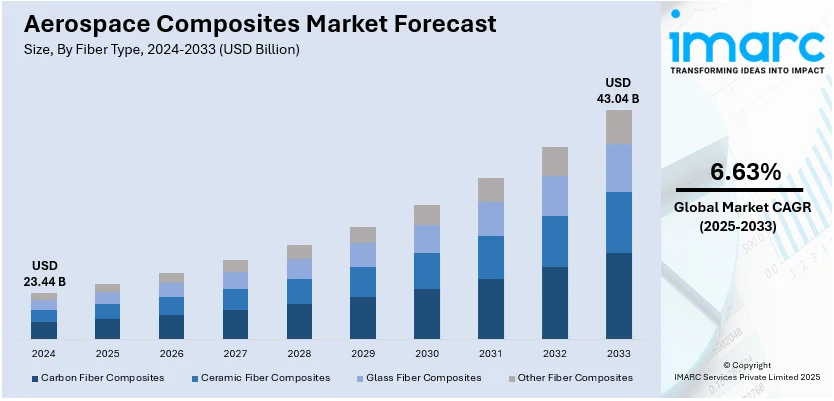

The global aerospace composites market size was valued at USD 23.44 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 43.04 Billion by 2033, exhibiting a CAGR of 6.63% from 2025-2033. North America currently dominates the market, holding a market share of over 34.2% in 2024. The aerospace composites market share in North America is increasing because of the growing aircraft production, rising space exploration activities, strong defense investments, advanced composite manufacturing capabilities, and a higher emphasis on fuel efficiency.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 23.44 Billion |

| Market Forecast in 2033 | USD 43.04 Billion |

| Market Growth Rate (2025-2033) | 6.63% |

The aerospace sector is transitioning to sustainable materials, such as bio-based resins and recycled carbon fiber, to achieve its environmental goals. Studies are concentrating on creating composites that lessen environmental effects while ensuring high efficiency for aerospace uses. Furthermore, advancements like automated fiber placement (AFP), resin transfer molding (RTM), and out-of-autoclave (OOA) curing are enhancing the efficiency of composite manufacturing. These methods shorten production time, decrease material waste, and cut costs, making aerospace composites more attainable for aircraft manufacturers. In addition, the increase in satellite launches, space tourism, and deep-space exploration is driving the need for lightweight, high-performance materials. Composites provide outstanding strength-to-weight ratios, thermal stability, and durability against extreme space conditions, establishing their importance for rockets, satellites, and components of space stations.

The United States is a crucial segment in the market, driven by the growing passenger traffic and increasing aircraft production require lighter and more fuel-efficient airframes. Airlines seek to optimize fuel consumption and operational costs by using composite materials, which offer excellent strength-to-weight ratios. This trend is driving aircraft manufacturers to incorporate more composite components into fuselages, wings, and interior structures. Additionally, federal investments in aerospace materials research support the development of advanced composites, enhancing manufacturing capabilities and promoting lightweight, fuel-efficient aircraft innovations. In 2025, Senators Patty Murray and Maria Cantwell announced a $48 million federal grant for the American Aerospace Materials Manufacturing Center (AAMMC) in Spokane. The funding will focus on developing advanced thermoplastic composite materials for lightweight, fuel-efficient aircraft.

Aerospace Composites Market Trends:

Growth in Air Travel

The rising number of air travelers globally has increased the demand for new aircraft. For instance, according to an industrial report, in 2023, worldwide air traffic passenger demand climbed by more than 36% over the previous year, when it increased by nearly 64.3%. This figure is expected to rise by about 12% in 2024. As airlines and manufacturers seek to meet this demand, they are turning to composites to build lighter, more efficient aircraft. Composite materials, particularly carbon fiber-reinforced polymers (CFRP) and glass fiber composites, are increasingly used in fuselage, wings, and interior components due to their superior strength-to-weight ratio and corrosion resistance. Major aircraft manufacturers such as Boeing and Airbus are incorporating higher percentages of composites in their latest models, including the Boeing 787 Dreamliner and Airbus A350. These materials not only enhance fuel efficiency and reduce emissions but also lower maintenance costs, making them essential for modern fleet expansion.

Growing Space Exploration Activities

The expanding space industry, including satellite manufacturing and space tourism, is driving the demand for advanced composite materials. For instance, in August 2024, ISRO launched the SSLV-D3 mission, which was the third and final developmental flight for the Small Satellite Launch Vehicle (SSLV). Spacecraft and satellites require materials that are both lightweight and durable to withstand the harsh conditions of space, including extreme temperatures, radiation, and the vacuum of space. Composites are ideal for these requirements due to their excellent strength-to-weight ratios and resistance to environmental stresses. Additionally, the growing adoption of carbon fiber-reinforced polymers (CFRP) in space structures enhances mission efficiency by reducing fuel consumption and launch costs. Private space ventures, including those led by SpaceX, Blue Origin, and Rocket Lab, are also investing in novel composite materials to improve spacecraft reusability and thermal protection. These factors further positively influence the aerospace composites market forecast.

Technological Innovations

Innovations in composite materials and manufacturing techniques have improved the performance, durability, and cost-effectiveness of aerospace composites. Advances such as improved resin systems, better fiber materials, and more efficient production methods have expanded their applications. For instance, in April 2024, TCR Composites Inc. introduced TR1116, a room-temperature stable, snap-cure epoxy prepreg resin solution designed for press-cure applications, as its newest composites manufacturing innovation. TR1116 provides excellent curing speed, with composite parts curing in two minutes at 177°C and de-molded hot for speedy processing, thereby boosting the aerospace composites market revenue. Additionally, advancements in automated fiber placement (AFP) and out-of-autoclave (OOA) curing technologies have further enhanced production efficiency and reduced costs. Companies are increasingly focusing on sustainable composite solutions, such as bio-based resins and recycled carbon fiber, to meet regulatory and environmental demands. The rising use of thermoplastic composites in aircraft structures due to their superior toughness and reprocessability is also driving market expansion.

Aerospace Composites Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global aerospace composites market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on fiber type, resin type, aircraft type, application, and manufacturing process.

Analysis by Fiber Type:

- Carbon Fiber Composites

- Ceramic Fiber Composites

- Glass Fiber Composites

- Other Fiber Composites

Carbon fiber composites hold the biggest market share of 67.9% in 2024. According to the aerospace composites market outlook, carbon fiber composites are renowned for their superior strength-to-weight ratio, durability, and performance in aerospace applications. These composites provide high tensile strength and stiffness while significantly reducing aircraft weight, leading to improved fuel efficiency and lower operational costs. Their exceptional fatigue and corrosion resistance enhance the longevity of aircraft structures, reducing maintenance requirements. Carbon fiber composites are widely used in fuselages, wings, empennages, and interior components, ensuring optimal performance under extreme aerodynamic and mechanical stresses. Additionally, ongoing research in next-generation carbon fiber composites, including thermoplastic variants, enhances processability and recyclability, aligning with industry sustainability goals. As aerospace manufacturers prioritize lightweight, high-strength materials for fuel savings and emission reductions, carbon fiber composites continue to dominate the aerospace composites market with growing adoption in commercial and military aircraft.

Analysis by Resin Type:

- Epoxy

- Phenolic

- Polyester

- Polyimides

- Thermoplastics

- Ceramic and Metal Matrix

- Others

In 2024, epoxy dominated the market with 70.1% of market share. According to the aerospace composites market overview, epoxy resins provide excellent mechanical properties, including high tensile strength, compressive strength, and toughness. Epoxy resins provide high tensile and compressive strength, ensuring durability and reliability in aircraft structures subjected to extreme operational stresses. Their excellent adhesion to various substrates enhances the bonding of reinforcement fibers, improving load distribution and impact resistance. Epoxies also exhibit exceptional resistance to environmental factors such as moisture, chemicals, and temperature fluctuations, making them ideal for both interior and exterior aerospace applications. Additionally, advancements in epoxy formulations, including enhanced thermal stability and reduced curing times, improve production efficiency while maintaining high-performance standards. As aircraft manufacturers seek lightweight, high-strength materials for fuel efficiency and emission reduction, epoxy resins continue to be the preferred choice for aerospace composites.

Analysis by Aircraft Type:

- Commercial Aircraft

- Business Aviation

- Civil Helicopters

- Military Aircraft & Helicopters

- Others

Commercial aircraft stands as the largest component, holding 43.7% of the market share in 2024. This can be accredited to the increasing demand for fuel-efficient, lightweight aircraft to support growing air travel. Airlines are prioritizing fuel savings and lowering operating costs for driving the adoption of composite materials in fuselages, wings, and other structural components. Stringent environmental regulations further encourage manufacturers to integrate lightweight composites, reducing emissions and improving fuel economy. The rising production rates of next-generation aircraft, coupled with the expansion of airline fleets, contribute to higher composite consumption. Progress in composite production technologies, including automated fiber placement (AFP) and out-of-autoclave processes, enhance production efficiency, making composites more viable for large-scale commercial aircraft manufacturing. Additionally, the increasing replacement of aging fleets with modern, lightweight aircraft further contribute to the market growth.

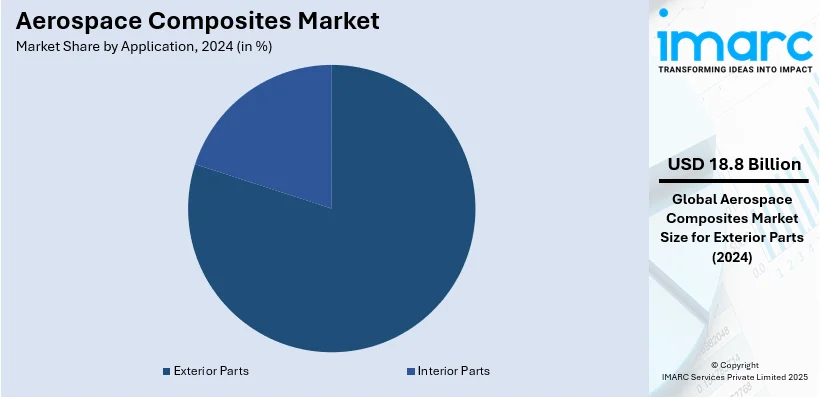

Analysis by Application:

- Interior Parts

- Exterior Parts

Exterior parts represent the largest segment, accounting 80.0% of market share in 2024. Exterior parts lead the market due to their critical role in enhancing aircraft performance, fuel efficiency, and structural integrity. The increasing demand for lightweight, high-strength materials to improve aerodynamics and reduce fuel consumption is leading to the adoption of composites in fuselages, wings, nacelles, and empennage structures. Composite materials provide enhanced durability against environmental conditions like ultraviolet (UV) radiation, extreme temperatures, and corrosion, extending aircraft lifespan while minimizing maintenance costs. Additionally, regulatory requirements for lower emissions and noise reduction encourage the use of advanced composites in exterior components. The growing production of next-generation commercial and military aircraft further accelerates the demand for composite-based exterior structures. As aircraft manufacturers prioritize lightweight, durable, and sustainable materials, exterior components continue to dominate the aerospace composites market.

Analysis by Manufacturing Process:

- AFP/ATL

- Layup

- RTM/VARTM

- Filament Winding

- Others

AFP/ATL holds the largest share of 43.9% in 2024. Automated fiber placement (AFP) and automated tape laying (ATL) is a crucial segment in the market due to their ability to enhance precision, efficiency, and material optimization. These automated techniques enable the rapid deposition of composite materials with minimal waste, reducing overall production costs and improving structural performance. Their high degree of automation ensures consistent quality, eliminating defects associated with manual layup processes. AFP/ATL supports the manufacturing of complex, lightweight structures with exceptional strength-to-weight proportions, essential for modern aerospace applications. The growing demand for high-performance aircraft, including commercial, military, and space vehicles, is further driving the adoption of these advanced manufacturing methods. Additionally, AFP/ATL aligns with industry sustainability goals by minimizing material waste and energy consumption. Ongoing advancements in robotic automation, software integration, and in-situ monitoring are further optimizing AFP/ATL processes, making them the preferred choice for next-generation aerospace composite manufacturing.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 34.2%, driven by strong aerospace manufacturing capabilities, high defense spending, and continuous advancements in composite technologies. The region benefits from extensive research initiatives focused on enhancing composite strength, durability, and fuel efficiency. Increasing demand for lightweight materials in commercial and military aircraft further supports the market growth. Government investments in aerospace innovation, coupled with the presence of established manufacturers and suppliers, strengthen the regional market. Additionally, innovations in recyclable composite materials are driving the market, with companies developing advanced resins that enhance sustainability and circularity. These materials reduce manufacturing waste, improve durability, and support regulatory compliance, strengthening North America's position as a leader in aerospace composite technology. In 2025, Mallinda Inc. launched its Vitrimax VHM resin, designed to offer infinite recyclability, self-healing properties, and tunable characteristics for high-performance industries. This resin supports the aerospace, automotive, and wind energy sectors by reducing manufacturing waste and improving sustainability. Vitrimax VHM enables circularity by allowing economic recycling of production scrap and parts in the USA.

Key Regional Takeaways:

United States Aerospace Composites Market Analysis

In North America, the market portion held by the United States was 85.10% of the overall total. Foreign direct investment (FDI) is driving the U.S. aerospace composites market's growth. At the end of 2023, FDI into the sector crossed USD 20 Billion, reflecting international demand for U.S. aerospace experience, according to industry reports. Investment has spurred innovation, particularly towards the development of high-strength and lightweight composite materials. Foreign-owned U.S. aerospace firms also helped to sustain more than 40,000 jobs in 2022, making the industry even stronger. The investments have also begun novel, state-of-the-art manufacturing methods, including automated fiber placement and 3D printing, necessary for future aerospace composite manufacturing. With domestic as well as international investment ongoing in the industry, demand will be increasing for advanced composites, primarily for the future of aircraft. With consistent growth, the U.S. is spearheading the aerospace composites industry globally, and it remains in the leadership position in the industry.

Europe Aerospace Composites Market Analysis

In 2023, Europe's aerospace and defense sector registered a stunning year-on-year growth of 10.1%, with a turnover of Euro 290.4 Billion (USD 303.6 Billion), as per ASD Europe. The growth trend, after a growth of 10.5% in 2022, is a major stimulant for the aerospace composites market in Europe. While the aerospace and defense industry keep on expanding, more demand is felt for new-generation advanced composite materials with light weight, high strength, and fuel-efficient solutions suitable for aircraft as well as defense uses. Demand is being led by rising investments in next-generation aircraft as well as modernization and expansion of defense fleets. In addition, Europe's focus on reducing emissions and developing a more sustainable aviation industry is also in keeping with the direction towards increased use of composite materials to render aviation more fuel-efficient and reduce its environmental impact. As there is continued expansion in aerospace production and advancing technologies, Europe's aerospace composites market will likely expand further over the next several years.

Asia Pacific Aerospace Composites Market Analysis

The expansion in the Asia-Pacific aerospace composites market is majorly propelled by rising defense and military modernization initiatives within the region. An important case is the Tata-Airbus collaboration, which, in October 2022, commenced building a manufacturing plant for the C-295 medium transport aircraft, targeted at upgrading the Indian Air Force's transport fleet. This step also reflects a strengthening need for higher-performance materials like aerospace composites, critical for enhancing aircraft performance, strength, and weight-to-strength ratios. On the other hand, increasing investment in military planes and growth in defense budgets among nations like China, India, and Japan is further driving demand for high-performance composites for aerospace applications. Additionally, local producers are becoming more concentrated on using composites in their efforts to increase the lifespan and fuel economy of military as well as civilian planes. Increased indigenization along with a strong government patronage of the aerospace industry supports an enabling market scenario for growth of the aerospace composites industry within the Asia-Pacific region.

Latin America Aerospace Composites Market Analysis

Latin America had 47.6 million air passengers in 2023, down marginally from 48.2 million in 2022, according to sector reports. This modest drop notwithstanding, Chile, Colombia, and Argentina are witnessing an unprecedented expansion in their airline services following an increased demand for air transport, modernized fleets, and new aeronautical infrastructure. This expansion fuels the adoption of composite aerostructures, as regional airlines and aircraft manufacturers desire to fuel-efficient, lightweight, and more efficient aircraft. The use of lightweight composite materials is essential for commercial as well as military aircraft use, providing advantages such as increased durability and lower maintenance costs. Also, as the Latin American aviation industry upgrades its fleet, there is an increasing need for advanced composite materials in the manufacture of aircraft parts like fuselages, wings, and interior structures. These trends set the Latin American aerospace composites market for consistent growth in the future.

Middle East and Africa Aerospace Composites Market Analysis

Saudi Arabia's Vision 2030 is among the key drivers of the Middle East aerospace sector, with the nation having aimed to increase local production of military hardware to 50% by 2030, as per reports. The same is expected to result in increased demand for high-quality materials like aerospace composites, particularly for defense and aviation sectors. Africa's aerospace industry, meanwhile, is expanding robustly with global air travel increasing 39.3% in 2023, IATA reported. Such growth in air travel has spurred airlines to prioritize fleet modernization and fuel efficiencies, adding to the demand for weight-saving, high-strength aerospace composites. Each region is actively seeking to enhance its aircraft self-sufficiency, and with air passenger travel continuing to climb, there will be increasing use of advanced composites to make lighter, more efficient aircraft. As the Middle East and Africa expand their aerospace sectors, aerospace composites will have a key role to play in facilitating growth and achieving sustainability objectives.

Competitive Landscape:

Major participants in the aerospace composites sector are concentrating on increasing production capacities and putting resources into research operations, and enhancing composite material performance to meet evolving industry requirements. They are adopting latest production methods like automated fiber placement and out-of-autoclave processing to improve efficiency and reduce production costs. Strategic collaborations with aircraft manufacturers and defense organizations are strengthening their market presence. Companies are also optimizing supply chains and establishing regional manufacturing hubs to ensure consistent material availability. Additionally, they are working on enhancing composite durability, thermal resistance, and mechanical strength to support next-generation aircraft designs, space exploration, and urban air mobility solutions. Sustainability initiatives, including the development of recyclable and bio-based composites, are becoming more popular for addressing ecological concerns. For example, the PLEIADES project, launched in 2025, aims to advance composite aerostructures in aviation through new materials, induction welding automation, and integrated sensing technologies. It focuses on sustainability, circularity, and high-volume manufacturing. The project, funded by Horizon Europe, will run for 36 months.

The report provides a comprehensive analysis of the competitive landscape in the aerospace composites market with detailed profiles of all major companies, including:

- Bally Ribbon Mills

- Hexcel Corporation

- Materion Corporation

- Mitsubishi Chemical Holding Corporation

- Renegade Materials Corporation

- Koninklijke Ten Cate B.V.

- SGL Carbon SE

- Solvay

- Teijin Limited

- Toray Industries Inc.

Latest News and Developments:

- August 2024: Rocket Lab USA, Inc. began the installation of automated fiber placement (AFP) equipment of its kind in the company's Neutron rocket production line in Middle River, MD. The AFP machine will allow Rocket Lab to automate the manufacturing of the largest carbon composite rocket structures.

- April 2024: TCR Composites Inc. introduced TR1116, a room-temperature stable, snap-cure epoxy prepreg resin solution designed for press-cure applications, as its newest composites manufacturing innovation.

- March 2024: Hexcel Corp launched a new HexTow continuous carbon fiber, IM9 24K, at JEC World in Paris. HexTow IM9 24K is a lightweight, robust, and durable carbon fiber for aerospace composite applications.

Aerospace Composites Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fiber Types Covered | Carbon Fiber Composites, Ceramic Fiber Composites, Glass Fiber Composites, Other Fiber Composites |

| Resin Types Covered | Epoxy, Phenolic, Polyester, Polyimides, Thermoplastics, Ceramic and Metal Matrix, Others |

| Aircraft Types Covered | Commercial Aircraft, Business Aviation, Civil Helicopters, Military Aircraft & Helicopters, Others |

| Applications Covered | Interior Parts, Exterior Parts |

| Manufacturing Processes Covered | AFP/ATL, Layup, RTM/VARTM, Filament Winding, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bally Ribbon Mills, Hexcel Corporation, Materion Corporation, Mitsubishi Chemical Holding Corporation, Renegade Materials Corporation, Koninklijke Ten Cate B.V., SGL Carbon SE, Solvay, Teijin Limited Toray Industries Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the aerospace composites market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global aerospace composites market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the aerospace composites industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The aerospace composites market was valued at USD 23.44 Billion in 2024.

The aerospace composites market is projected to exhibit a CAGR of 6.63% during 2025-2033, reaching a value of USD 43.04 Billion by 2033.

The aerospace composites market is growing due to increasing demand for lightweight, fuel-efficient aircraft, advancements in composite manufacturing technologies, rising use in commercial and military aviation, and stringent environmental regulations promoting reduced emissions. Enhanced strength-to-weight ratios and corrosion resistance further drive adoption across the industry.

North America currently dominates the aerospace composites market, accounting for a share of 34.2%. The dominance of the region is because of high aircraft manufacturing, increasing defense spending, technological advancements, and rising demand for lightweight, high-performance materials in commercial and military applications.

Some of the major players in the aerospace composites market include Bally Ribbon Mills, Hexcel Corporation, Materion Corporation, Mitsubishi Chemical Holding Corporation, Renegade Materials Corporation, Koninklijke Ten Cate B.V., SGL Carbon SE, Solvay, Teijin Limited Toray Industries Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)