Aerosol Refrigerants Market Report by Product (HFC-143a, HFC-32, HFC-125, SF6, and Others), Container Type (Steel, Aluminum), End Use Sector (Residential, Commercial, Industrial), and Region 2025-2033

Global Aerosol Refrigerants Market:

The global aerosol refrigerants market size reached USD 1.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.7 Billion by 2033, exhibiting a growth rate (CAGR) of 3.6% during 2025-2033. The increasing emphasis on environmental sustainability, the rapid urbanization, the rising disposable incomes, the stringent regulations, technological advancements, growing e-commerce, and retrofitting requirements are few of the factors shaping the industry's trajectory.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.7 Billion |

| Market Growth Rate 2025-2033 | 3.6% |

Aerosol Refrigerants Market Analysis:

- Major Market Drivers: The market growth is driven by the escalating need for environmentally friendly solutions that have propelled the demand for low-global warming potential (GWP) refrigerants. Moreover, the surging demand for efficient cooling systems across various industries, such as automotive, food and beverage, and electronics, has spurred the adoption of aerosol refrigerants, which is accelerating the market growth.

- Key Market Trends: Rapid urbanization and increasing disposable incomes have led to a surge in the sales of consumer appliances, further bolstering the market growth. In line with this, stringent regulations and international agreements, aimed at phasing out high-GWP refrigerants, have compelled manufacturers to shift towards aerosol refrigerants, which is boosting the industry growth.

- Competitive Landscape: Some of the prominent companies in the market include A-Gas, Arkema S.A., Baltic Refrigeration Group, Daikin Industries Ltd., Dongyue Group, Fastenal Company, Groupe Gazechim, Honeywell International Inc., Navin Fluorine International Limited, Sinochem Corporation, SRF Limited (Kama Holdings Ltd.), Technical Chemical Company, and The Chemours Company, among many others.

- Geographical Trends: According to the aerosol refrigerants market dynamics, Asia Pacific exhibits a clear dominance in the market. Rapid industrialization and urbanization across countries like China, India, and other Southeast Asian nations drive the demand for aerosol refrigerants.

- Challenges and Opportunities: Rising safety concerns and high initial costs are hampering the market growth. However, continued innovation in aerosol refrigerant technologies, including improved efficiency, safety enhancements, and compatibility with existing equipment, presents opportunities for market expansion and product differentiation.

Aerosol Refrigerants Market Trends:

Regulatory Changes and Environmental Awareness

The surging global regulations to phase out ozone-depleting substances (ODS) and high-GWP (Global Warming Potential) refrigerants drive the demand for alternative, eco-friendly aerosol refrigerants. For instance, according to the International Forum for Environment, sustainability & technology, the phasedown of high global warming potential (GWP) hydrofluorocarbon (HFC) gases, India's third refrigerant transition, is set to start by the end of the decade with a freeze in 2028. At the same time, by 2030, hydrochlorofluorocarbons (HCFCs), which deplete the ozone layer, will be phased out. As a result, manufacturers are actively investing in research and development (R&D) to formulate innovative, environmentally friendly aerosol refrigerants that comply with regulatory standards and offer effective cooling performance. These factors are expected to drive the aerosol refrigerants market growth in the coming years.

Rising Demand for Air Conditioning Systems

The increasing demand for air conditioning systems significantly drives the growth of the aerosol refrigerants market. For instance, according to IMARC, the global air conditioning system market size reached US$ 118.0 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 193.0 Billion by 2032, exhibiting a growth rate (CAGR) of 5.4% during 2024-2032. As the demand for air conditioning systems rises globally, particularly in regions experiencing urbanization, industrialization, and warmer climates, there is a corresponding increase in the installation of HVAC (Heating, Ventilation, and Air Conditioning) systems. These systems require effective refrigerants for cooling purposes, further contributing to the aerosol refrigerating market share.

Technological Advancements

Advances in air conditioning technology, including the development of more efficient systems and the integration of energy-saving features, increase the demand for aerosol refrigerants that can enhance system performance and efficiency. Manufacturers are developing air conditioners with energy-saving features, which is further propelling the demand for aerosol refrigerants. For instance, in April 2024, Haier introduced its new Heavy-Duty air conditioner line, which saves up to 65% on energy. These factors are contributing to the aerosol refrigerants market share.

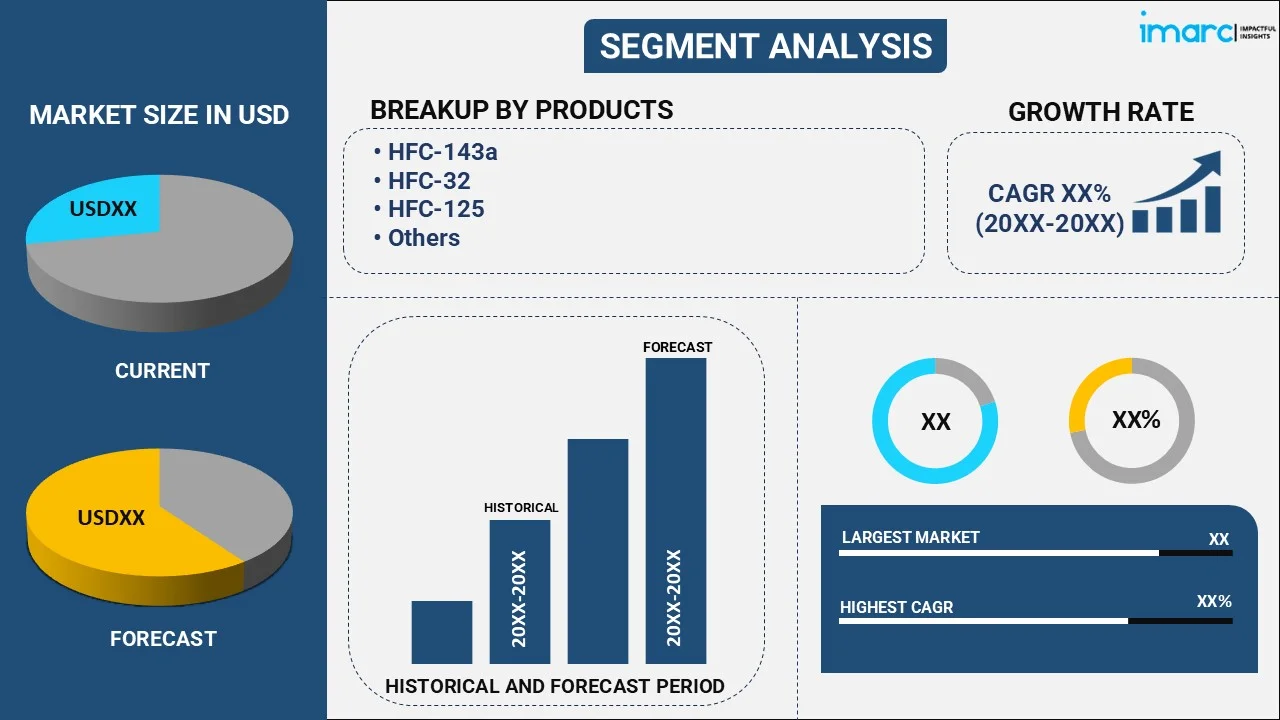

Global Aerosol Refrigerants Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global aerosol refrigerants market report, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on the product, container type, and end use sector.

Breakup by Product:

- HFC-143a

- HFC-32

- HFC-125

- SF6

- Others

HFC-143a dominates the market

The report has provided a detailed breakup and analysis of the market based on the product. This includes HFC-143a, HFC-32, HFC-125, SF6, and others. According to the report, HFC-143a represented the largest segment.

According to the aerosol refrigerants market outlook, the growth of the HFC-143a segment is primarily driven by several key factors, such as its relatively low ozone depletion potential (ODP) and moderate global warming potential (GWP) compared to other refrigerants. In line with this, its excellent thermodynamic properties and compatibility with existing equipment further enhance its appeal. Moreover, regulatory frameworks mandating the phase-out of high-GWP refrigerants in certain regions have prompted industries to transition to HFC-143a due to its compliance with current environmental standards, thereby favoring the industry growth. For instance, the Environmental Protection Agency (EPA) proposed a rule under the American Innovation and Manufacturing Act (AIM) to advance the transition to more efficient heating, air conditioning, and refrigeration technologies by banning the use of high GWP super-polluting hydrofluorocarbon (HFC) refrigerants. The robust demand for automotive vehicles, coupled with the increasing need for efficient and eco-friendly cooling solutions, has also fueled the growth of the HFC-143a segment. As industries continue to balance performance and sustainability, HFC-143a's attributes align closely with the evolving market requirements, substantiating its positive growth trajectory.

Breakup by Container Type:

- Steel

- Aluminum

Aluminum dominates the market

The report has provided a detailed breakup and analysis of the market based on the container type. This includes steel and aluminum. According to the report, aluminum represented the largest segment.

According to the aerosol refrigerants market overview, the growth of the aluminum segment is underpinned by several key factors, such as the expanding construction and infrastructure sector globally. Aluminum's lightweight yet robust properties make it an ideal choice for various structural components. Additionally, the automotive industry's increasing shift towards lightweight materials to improve fuel efficiency has boosted demand for aluminum in vehicle manufacturing. The soaring demand for consumer electronics has also propelled the use of aluminum in casings and components due to its favorable attributes of conductivity and malleability. Moreover, aluminum's eco-friendly nature, as it is recyclable and energy-efficient to produce, aligns with the growing sustainability drive across industries. In line with this, advancements in aluminum processing technologies are enhancing its range of applications and further driving its segment growth.

Breakup by End Use Sector:

- Residential

- Commercial

- Industrial

Residential dominates the market

The report has provided a detailed breakup and analysis of the market based on the end use sector. This includes residential, commercial, and industrial. According to the report, residential represented the largest segment.

The growth of the residential segment in the aerosol refrigerants industry is driven by escalating global urbanization rates, leading to increased demand for residential spaces and the need for efficient and eco-friendly cooling solutions. Rising urban populations have intensified the requirement for air conditioning and refrigeration systems, promoting the adoption of aerosol refrigerants compliant with environmental regulations. For example, in 2022, 24% of Indian households owned air conditioners or coolers as compared to 18% in 2015-2016. Consumer awareness of sustainable living practices is fostering a preference for eco-friendly alternatives, including low-global warming potential aerosol refrigerants. This shift towards environmentally responsible solutions, coupled with government regulations and incentives targeting high-GWP refrigerants in homes, is propelling the residential segment's expansion in the aerosol refrigerants market.

Breakup by Region:

.webp)

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest aerosol refrigerants market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.

According to the aerosol refrigerants market statistics, the Asia Pacific region is witnessing significant growth in the aerosol refrigerants market due to rapid urbanization and industrialization, driving the demand for cooling solutions across the manufacturing, construction, and consumer sectors. Increasing population and higher living standards are amplifying the need for air conditioning, refrigeration, and cold storage facilities, leading to the adoption of aerosol refrigerants. Stringent environmental regulations and agreements like the Kigali Amendment are compelling Asia Pacific governments and industries to transition to low-global warming potential (GWP) refrigerants, aligning with emission reduction goals. The rising middle-class population in countries like China, India, and Southeast Asian nations is further boosting the demand for consumer appliances, solidifying the region's role as a key growth hub in the aerosol refrigerants market. For instance, India's middle class is expected to increase from 31% in 2020–21 to 61% of the country's total population by 2047.

Competitive Landscape:

The aerosol refrigerants market is witnessing substantial growth driven by a convergence of factors. The increasing global focus on sustainable practices and environmental conservation has prompted a shift towards low-global warming potential (GWP) refrigerants, propelling the demand for aerosol refrigerants. As industries and consumers alike seek energy-efficient and eco-friendly cooling solutions, the market experiences a surge in demand across sectors such as automotive, food and beverage, electronics, and healthcare.

The urbanization trend, particularly prominent in emerging economies, contributes significantly to market expansion. Urban populations' rising disposable incomes drive the adoption of consumer appliances like air conditioners and refrigerators, further amplifying the demand for aerosol refrigerants.

Stringent regulatory frameworks and international agreements aimed at reducing high-GWP refrigerants' usage drive manufacturers to innovate and develop environmentally compliant solutions. The market's growth trajectory is also shaped by technological advancements, such as smart refrigeration systems, enhancing efficiency and convenience. These combined factors position the aerosol refrigerants market for continued growth and evolution across the global landscape.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- A-Gas

- Arkema S.A.

- Baltic Refrigeration Group

- Daikin Industries Ltd.

- Dongyue Group

- Fastenal Company

- Groupe Gazechim

- Honeywell International Inc.

- Navin Fluorine International Limited

- Sinochem Corporation

- SRF Limited (Kama Holdings Ltd.)

- Technical Chemical Company

- The Chemours Company

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Aerosol Refrigerants Market Recent Developments:

- July 2024: Honeywell acquired the LNG process technology and equipment business from industrial gases supplier Air Products for $1.81bn.

- July 2024: Actrol announced that it would utilize Honeywell's energy-efficient and low global warming potential (GWP) refrigerant Solstice L40X (R-455A) for its condensing units.

- May 2024: Lennox, a developer of creative climate solutions, launched a low global warming potential (GWP) light commercial and ducted residential HVAC equipment to comply with the 2025 low GWP refrigerant rules.

- April 2024: Daikin Europe, a part of Japanese manufacturer Daikin Industries, unveiled the Altherma 4 HS-S+ series, its first propane (R290) air-to-water residential heat pump.

Aerosol Refrigerants Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | HFC-143a, HFC-32, HFC-125, SF6, Others |

| Container Types Covered | Steel, Aluminum |

| End Use Sectors Covered | Residential, Commercial, Industrial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | A-Gas, Arkema S.A., Baltic Refrigeration Group, Daikin Industries Ltd., Dongyue Group, Fastenal Company, Groupe Gazechim, Honeywell International Inc., Navin Fluorine International Limited, Sinochem Corporation, SRF Limited (Kama Holdings Ltd.), Technical Chemical Company, The Chemours Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the aerosol refrigerants market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global aerosol refrigerants market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the aerosol refrigerants industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global aerosol refrigerants market was valued at USD 1.2 Billion in 2024.

We expect the global aerosol refrigerants market to exhibit a CAGR of 3.6% during 2025-2033.

The rising applications of aerosol refrigerants as cooling agent in refrigerators, air conditioning systems, chillers, etc., to maintain optimum temperature and minimize energy consumption are primarily driving the global aerosol refrigerants market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous manufacturing units for aerosol refrigerants.

Based on the product, the global aerosol refrigerants market can be categorized into HFC-143a, HFC-32, HFC-125, SF6, and others. Currently, HFC-143a exhibits clear dominance in the market.

Based on the container type, the global aerosol refrigerants market has been segmented into steel and aluminum, where aluminum represents the largest market share.

Based on the end-use sector, the global aerosol refrigerants market can be bifurcated into residential, commercial, and industrial. Among these, the residential sector accounts for the majority of the total market share.

On a regional level, the market has been classified into North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America, where Asia-Pacific currently dominates the global market.

Some of the major players in the global aerosol refrigerants market include A-Gas, Arkema S.A., Baltic Refrigeration Group, Daikin Industries Ltd., Dongyue Group, Fastenal Company, Groupe Gazechim, Honeywell International Inc., Navin Fluorine International Limited, Sinochem Corporation, SRF Limited (Kama Holdings Ltd.), Technical Chemical Company, and The Chemours Company.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)