Aerosol Paints Market Size, Share, Trends and Forecast by Raw Material, Technology, Application, and Region 2025-2033

Aerosol Paints Market Size and Share:

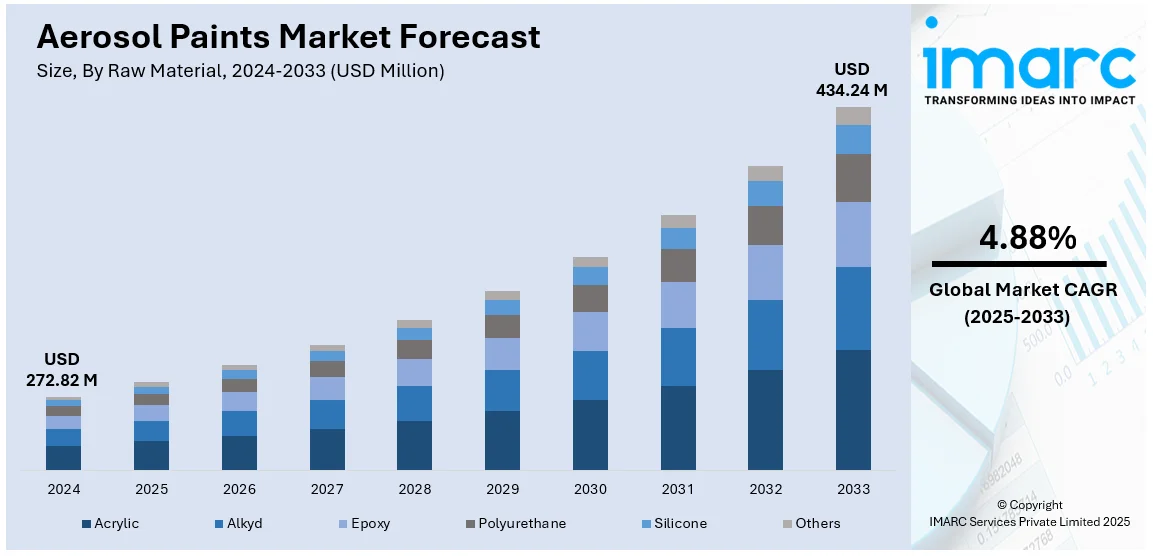

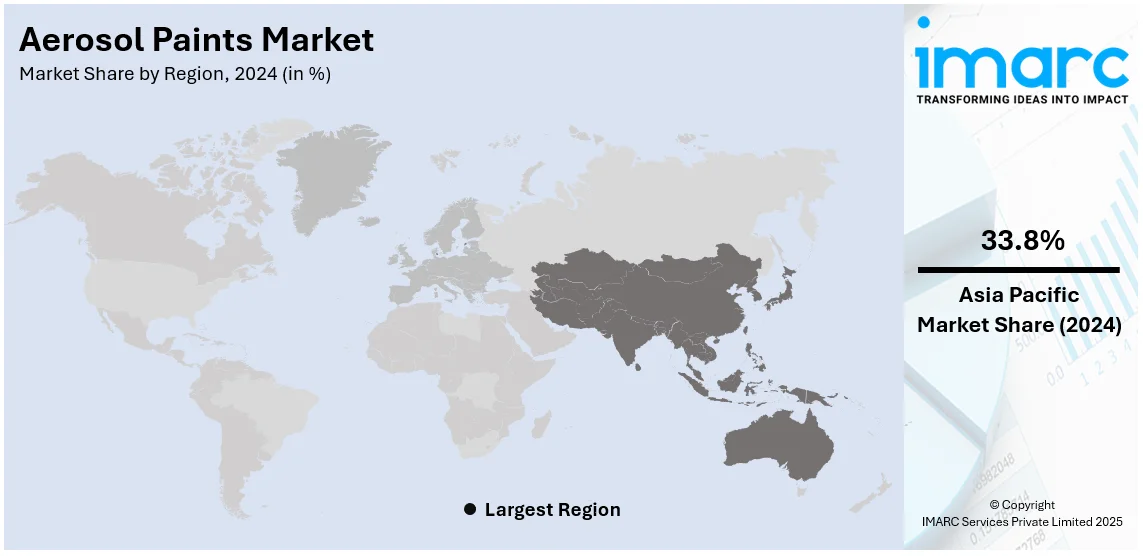

The global aerosol paints market size was valued at USD 272.82 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 434.24 Million by 2033, exhibiting a CAGR of 4.88% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 33.8% in 2024. The market is experiencing moderate growth driven by the convenience and versatility of aerosol paints, several technological advancements, such as the development of low-VOC (Volatile Organic Compounds) formulations, and the growing DIY culture. These factors are contributing significantly to increasing the aerosol paints market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 272.82 Million |

|

Market Forecast in 2033

|

USD 434.24 Million |

| Market Growth Rate 2025-2033 | 4.88% |

The product demand is rising in industries like automotive, construction, and DIY projects for aerosol paints. For instance, in the automobile industry, they are mainly used for touch-ups and personalization because they are easy to apply and dry up quickly. Construction industries mark and coat things using these paints. The market growth is also encouraged by consumers who are more interested in improving their homes and are creative about various DIY projects. Technological advancements, such as eco-friendly formulations and enhanced spray mechanisms, are attracting environmentally conscious consumers. Additionally, the growing popularity of graffiti art and urban street culture supports demand. Expanding retail and e-commerce platforms make aerosol paints more accessible, while their portability and convenience strengthen their appeal to both professionals and hobbyists. This, in turn, is contributing to the aerosol paints market growth.

The aerosol paints market in the United States is driven by the growing popularity of DIY home improvement projects and creative applications, including furniture refurbishing and craftwork. In addition to this, this industry is substantially driven by the automotive industry since aerosol paints are used in touch-ups and customizations because of their accuracy and ease of use. The increasing number of urban areas and construction increases demand for marking and coating applications. The main driver of innovation in low-VOC and eco-friendly aerosol formulations is environmental concerns, which appeals to sustainability-conscious consumers. Street art and graffiti culture are thriving and fueling the market, especially among younger generations, which also represents one of the key aerosol paints market trends. Increased retail and e-commerce channels increase the availability of products, while innovations in spray technology, such as nozzle designs and durability, make aerosol paints more attractive and versatile. For example, in April 2023, the introduction of Custom Spray 5-in-1 was announced by the industry leader Rust-Oleum, which is the new advancement in the spray paint technology that helps painters easily change spray patterns using one click of a dial.

Aerosol Paints Market Trends

Convenience and Ease of Use

Aerosol paints offer convenience and ease of use, which is a significant driving force behind their global market growth. Unlike traditional brush and roller methods, aerosol cans are ready-to-use and require minimal preparation. Industry reports indicate that global construction spending will reach around USD 17.5 trillion by 2030, led by China, the US, and India. This is expected to increase construction activity substantially, spurring big demand for efficient and easy-to-use painting solutions such as aerosol paints. Consumers appreciate the simplicity of spraying paint directly onto surfaces without the need for brushes, rollers, or other tools. This convenience is particularly valued in DIY projects and quick touch-up jobs. Moreover, aerosol paints provide a consistent and even application, reducing the chances of streaks or uneven coatings. As a result, the ease of use associated with aerosol paints has made them a popular choice among both professionals and non-professional users, thereby intensifying the aerosol paints market demand.

Versatility and Wide Range of Colors

Another factor propelling the aerosol paints market is the wide range of available colors and finishes. Aerosol paint manufacturers offer an extensive palette of colors and finishes, including matte, gloss, metallic, and more. This diversity enables consumers to find the perfect shade and texture for their specific projects, whether it is automotive touch-ups, home décor, or artistic creations. Additionally, aerosol paints are known for their compatibility with various surfaces, including metal, wood, plastic, and more. This versatility makes aerosol paints a versatile choice for a multitude of applications, further boosting market demand. In June 2022, BEHR Process Corporation launched BEHR PREMIUM Spray Paint, offering 51 color options, including newly introduced metallic and textured finishes. These spray paints feature an enhanced formula that combines both primer and paint in a single aerosol can. This innovation leads to a high-quality, long-lasting finish, which allows furniture and décor items to be revitalized indoors and outdoors. This, in turn, is creating a positive aerosol spray paints market outlook.

Rapid Drying and Time Efficiency

Speed is crucial in many painting projects, and aerosol paints excel in this regard. These paints are designed to dry rapidly, allowing for quick project completion. This is particularly valuable in industrial and commercial settings, where downtime can be costly. The fast-drying nature of aerosol paints minimizes the risk of dust or debris settling on wet surfaces, ensuring a smoother finish. Moreover, it allows for multiple coats to be applied in a shorter timeframe, enhancing productivity. Whether it is for touch-up jobs in the automotive industry or large-scale construction projects, the time efficiency offered by aerosol paints is a significant driver of their market growth. In 2022, 85.4 million motor vehicles were produced globally, marking an increase of 5.7% compared to 2021, according to ACEA. This surge in automotive production underscores the growing demand for aerosol paints in the automotive sector, where quick touch-ups and high-quality finishes are essential.

Technological Advancements

Technological advancements in aerosol paint formulations have played a pivotal role in driving market growth. Manufacturers have focused on improving the quality, durability, and environmental sustainability of aerosol paints. For instance, low-VOC (Volatile Organic Compounds) formulations have gained popularity, aligning with global efforts to reduce environmental impact. Advanced spraying mechanisms and nozzles have been developed to provide better control and minimize overspray. These innovations have enhanced the performance of aerosol paints and have also attracted environmentally conscious consumers, contributing to market expansion. In April 2023, Rust-Oleum unveiled the Custom Spray 5-in-1, marking the latest innovation in spray paint technology. The new product allows craftsmen to switch between five spray patterns easily with just a click of a dial. This kind of development not only makes it convenient for users but also reflects how the aerosol paint industry continues to evolve in terms of technology, which accelerates its growth.

Growing DIY Culture

The global do-it-yourself (DIY) culture has experienced significant growth, and aerosol paints have found a natural fit within this trend. DIY enthusiasts and homeowners prefer aerosol paints due to their user-friendly nature, allowing individuals to tackle various projects without professional assistance. Whether it is repainting furniture, sprucing up outdoor spaces, or customizing personal belongings, aerosol paints offer a straightforward solution. In April 2022, Akzo Nobel N.V. debuted the Dulux Simply Refresh spray paint range, catering to the DIY paint sector. This product is unique, with low splatter and low drip technology, embedded in a ready-to-use interior washable paint. This way, consumers will be able to complete their DIY projects more efficiently, enjoying a cleaner process with less waste. The accessibility of aerosol paints in hardware stores and online marketplaces has further fueled their popularity among DIY enthusiasts. As the DIY culture continues to thrive, the demand for aerosol paints is expected to rise, driving market growth.

Aerosol Paints Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on raw material, technology, and application.

Analysis by Raw Material:

- Acrylic

- Alkyd

- Epoxy

- Polyurethane

- Silicone

- Others

Acrylic leads the market with around 38.7% of market share in 2024. Acrylic aerosol paints hold the largest share in the market due to their versatility, quick drying time, and ease of application. They have outstanding adhesion to a variety of materials, including plastic, metal, and wood, which makes them perfect for a range of uses in craft, home remodeling, and automotive applications. Acrylic paints ensure long-lasting finishes by offering brilliant color, durability, and resistance to fading. They are also weatherproof and water-resistant. They are also more eco-friendly than solvent-borne alternatives since they have fewer volatile organic compounds (VOCs), which appeals to customers who care about the environment.

Analysis by Technology:

- Solvent-Borne

- Water-Borne

Solvent-borne leads the market with around 55.8% of the market share in 2024. Solvent-borne aerosol paints hold the largest share in the market because of their optimal performance and properties. Due to their high-performance features such as good adhesion, ease of application, and quick drying to the touch, these paints can be used in automotive refinishing, industrial, and construction. The formulations of solvents give adhesion strength, weather resistance, and durability of the finishing which is important for internal as well as external use. Solvent-borne paints provide cost-efficient solutions with the right level of thickness and density, especially where the quality of the superstrate matters. However, innovations to suppress the nuisance of volatile organic compounds (VOCs) have also been responsible for sustaining the aerosol paints market.

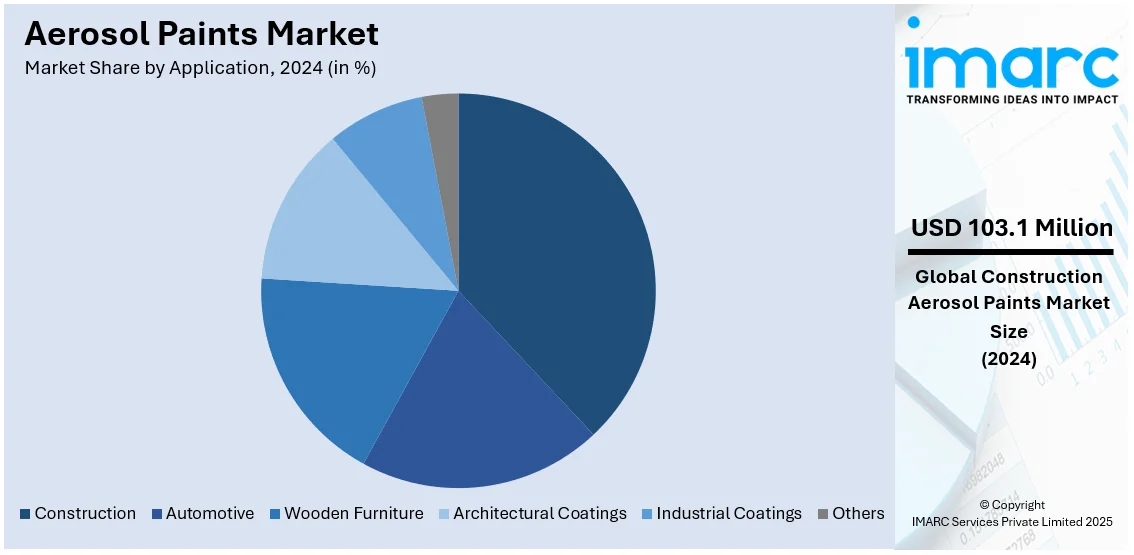

Analysis by Application:

- Construction

- Automotive

- Wooden Furniture

- Architectural Coatings

- Industrial Coatings

- Others

Construction leads the market with around 37.8% of market share in 2024. Construction holds the largest share in the aerosol paints market due to its extensive use in marking, coating, and finishing applications. Aerosol paints are valued for their ease of application, fast drying time, and ability to adhere to various surfaces like concrete, metal, and wood. It is used liberally in marking the layout, in identifying the utilities, and even in the demarcation of construction color codes. Mobility and a high degree of measurement accuracy make them applicable to on-site contexts, which ultimately decreases labor expenses and working time. Aerosol paints also grant protection from rust, various weather, and wear, thus making them suitable for infrastructural applications. The increase in construction activities especially in residential and commercial buildings enhances the demand continuously making the segment dominant in the aerosol paints market.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 33.8%. The Asia Pacific aerosol paints market is developing significantly as developments in both automotive and construction are sound. During 2023, the Chinese automotive industry had seen significant sales increases as the sale of passenger cars stood at more than 26 million units that is above a 10% rise in the sale for 2022, as per reports. Vehicle production as well as customisation in vehicles, continue to contribute to a demand in the automobile sector for aerosol paints. In addition, the commercial vehicle market increased at 22%. This is a further stimulus to increase the demand for high-quality coatings that are efficient. Construction also adds input to the growth of the market, especially in Japan where several high-end residential complexes are underway. Mitsubishi State's construction of Japan's tallest building with 50 luxury apartments is one example of a development leading toward higher-end real estate. This raises the demand for premium paints, which can be used to give the paint durability and aesthetic appeal. The demand for aerosol paints in the Asia Pacific region is driven by the combination of expanding automotive production and rising construction activities.

Key Regional Takeaways:

North America Aerosol Paints Market Analysis

The aerosol paints market in North America is driven by the increasing demand for DIY home improvement and craft projects, where ease of use and precision are prioritized. The automotive sector also contributes significantly, with aerosol paints used for vehicle touch-ups and customizations. Urbanization and construction activity boost demand for marking and coating applications. Rising interest in street art and graffiti culture supports market growth among creative users. Technological advancements, such as eco-friendly formulations and customizable spray patterns, cater to environmentally conscious consumers and enhance product versatility. Expanding e-commerce platforms and retail networks improve accessibility, while growing consumer awareness of time-saving, high-performance products strengthens the appeal of aerosol paints across various professional and personal applications.

United States Aerosol Paints Market Analysis

In 2024, the United States accounted for the largest market share of over 86.50% in North America. The United States aerosol paints market is growing rapidly due to the rapid growth of construction and the housing sectors. According to the United States Census Bureau, construction value in the country reached USD 1,978.7 billion in 2023, which is above 7% growth from the previous year, 2022. This growth can be attributed to the demand for infrastructure development and renovation projects. Furthermore, privately owned housing units authorized by building permits grew to 1,518,000 units, which were up 2.4% compared with February 2023, for February 2024.

With an increased level of construction activities coupled with an increase in aesthetic as well as protective coatings, demand for aerosol paints is likely to have surged. The convenience, easy applicability, and fast delivery make aerosol paints handy not only for professionals but also for a do-it-yourself enthusiast carrying out construction activities. The United States housing boom along with its infrastructural developments will continue to push the aerosol paint market upward.

Europe Aerosol Paints Market Analysis

The Europe aerosol paints market is expected to grow, supported by the high performance of the automotive industry in the region. The European Union has 255 automotive plants involved in vehicle assembly, battery production, and engine manufacturing. In 2023, the EU produced 14.8 million vehicles, which included 12.2 million cars, according to the European Commission. This has resulted in a high demand for high-quality coatings, especially aerosol paints, used in manufacturing and touch-ups of vehicles.

Aerosol paints are most favoured in the automobile industry, with their ready and easy applicability, smoothing effect, and faster drying rates. With car modification and repair business booming more nowadays, aerosol paints make easy and handy paints for those into car fixing business and restoration as well. In this way, the prospects for the future expansion of aerosol paints can be seen growing through the expanding automobile industry of Europe.

Latin America Aerosol Paints Market Analysis

The Latin American aerosol paints market is well poised for growth, as this is expected in Brazil's automobile production. This is according to estimates from Anfavea, the auto manufacturers association of Brazil, whose projections indicate a 6.8% rise in auto production in 2025 to an estimated 2.75 million units. There is an expectation of increased vehicle manufacture, which increases the demand for aerosol paints, especially on automotive coatings and finishes. With increased car production, manufacturers will need painting solutions that are of high quality, efficient, and cost-effective. Aerosol paints will provide convenience and precision.

Besides the automotive industry, the increasing construction and DIY activities in the region are also driving the demand for aerosol paints. Aerosol paints being a favorite for professional as well as DIY applications due to their convenience, the growing automotive industry in Brazil, coupled with the construction boom, places aerosol paints at the forefront of the Latin American market expansion.

Middle East and Africa Aerosol Paints Market Analysis

The Middle East and Africa aerosol paints market is likely to gain significant growth with the increase in construction spending in Dubai. In 2025, Dubai has allocated an additional USD 1.6 billion for construction and infrastructure, marking an 18% increase in the city's construction budget compared to 2024, as per an industry report. This surge in investment will stimulate demand for aerosol paints, particularly in the construction and renovation sectors, as they are widely used for various applications, including surface finishes, coatings, and quick touch-ups in large-scale projects. Moreover, the thriving infrastructure development, including luxury buildings, commercial spaces, and residential complexes, will demand efficient and high-quality painting solutions that aerosol paints can provide. Given the region's continued investment in large-scale construction and renovation projects, the demand for aerosol paints in both the commercial and residential segments is expected to increase even further, leading to increased growth of the Middle East and Africa aerosol paints market.

Competitive Landscape:

The key players in the market are actively engaging in several strategic initiatives to maintain their competitive edge and cater to evolving consumer preferences. These initiatives include research and development efforts focused on formulating low-VOC and environmentally friendly aerosol paints, aligning with increasing sustainability concerns. Additionally, these companies are investing in technological advancements to improve the performance and durability of aerosol paint products. Collaboration and partnerships with suppliers and distributors are also common strategies to expand their reach and product portfolios. Furthermore, market leaders are emphasizing branding and marketing campaigns to create brand awareness and establish themselves as reliable sources of high-quality aerosol paint solutions. These efforts collectively demonstrate their commitment to innovation and market leadership.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Aeroaids Corporation

- Kobra Spray Paint

- LA-CO Industries Inc.

- Masco Corporation

- Montana Colors S.L.

- Nippon Paint Holdings Co. Ltd.

- PPG Industries Inc.

- Rust-Oleum (RPM International Inc.)

- Southfield Paints Ltd.

- The Sherwin-Williams Company

- Valspar Corporation

Recent Developments:

- February 2024: The strategic alliance of Nippon Paint India, the Indian subsidiary of Nippon Paint Holdings Co. Ltd., with Snapdeal, a well-known e-commerce site, resulted in Nippon Paint India's complete product portfolio of aerosol spray paints, with its Pylac 1000 Rainbow range, now going to be offered exclusively on Snapdeal for direct and convenient buys by the consumers.

- February 2024: Krylon aerosol paint producer launched its product line called Fusion All-In-One EcoBlend. This new series is the outcome of the commitment of the company to environmentalism and stewardship, which, in turn, is manifested by low-VOC technology and recyclable barrels as packaging. In this way, the new series of EcoBlend will meet not only the demand of the industrial users but also the growing DIY market.

- April 2023: PPG Industries announced a new name, PPG OPTIGUARD™ series (formerly LineGuard) for its advanced coatings solutions developed to help automotive original equipment manufacturers (OEM), tier suppliers and industrial customers reduce the time, cost, risk and environmental impact associated with cleaning paint shop equipment. The new name aligns the offering with the global PPG OPTIMA SOLUTIONS product and service portfolio.

- July 2021: Nippon Paint Holdings Co. Ltd. has launched PROTECTON BARRIERX SPRAY, incorporating visible light-responsive photocatalyst technology. This product includes a substantial alcohol content, ensuring swift eradication of viruses and bacteria on various surfaces. The photocatalysts within this innovative solution react to visible light, even in dimly lit indoor environments.

Aerosol Paints Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Acrylic, Alkyd, Epoxy, Polyurethane, Silicone, Others |

| Technologies Covered | Solvent-Borne, Water-Borne |

| Applications Covered | Construction, Automotive, Wooden Furniture, Architectural Coatings, Industrial Coatings, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aeroaids Corporation, Kobra Spray Paint, LA-CO Industries Inc., Masco Corporation, Montana Colors S.L., Nippon Paint Holdings Co. Ltd., PPG Industries Inc., Rust-Oleum (RPM International Inc.), Southfield Paints Ltd., The Sherwin-Williams Company, Valspar Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the aerosol paints market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global aerosol paints market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the aerosol paints industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The aerosol paints market was valued at USD 272.82 Million in 2024.

IMARC estimates the aerosol paints market to reach USD 434.24 Million by 2033, exhibiting a growth rate (CAGR) of 4.88% during 2025-2033.

The aerosol paints market is driven by its ease of use, quick-drying properties, and versatility across surfaces. Growing DIY trends, automotive touch-up applications, and urbanization boost demand. Technological advancements in eco-friendly formulations and spray mechanisms, coupled with rising construction and creative projects, further fuel the market's expansion globally.

Asia Pacific currently dominates the aerosol paints market, accounting for a share of 33.8%. The market in the Asia Pacific region is driven by the expansion in the automotive and construction industries. In line with this, increasing vehicle production and the demand for customisation of vehicles, along with rising popularity of premium paints drive the market for aerosol paints further across the region.

Some of the major players in the global aerosol paints market include Aeroaids Corporation, Kobra Spray Paint, LA-CO Industries Inc., Masco Corporation, Montana Colors S.L., Nippon Paint Holdings Co. Ltd., PPG Industries Inc., Rust-Oleum (RPM International Inc.), Southfield Paints Ltd., The Sherwin-Williams Company, Valspar Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)