Advanced Suspension Control System Market Size, Share, Trends and Forecast by System Type, Component, Vehicle, Vehicle Type, Sales Channel, and Region, 2025-2033

Advanced Suspension Control System Market Size and Share:

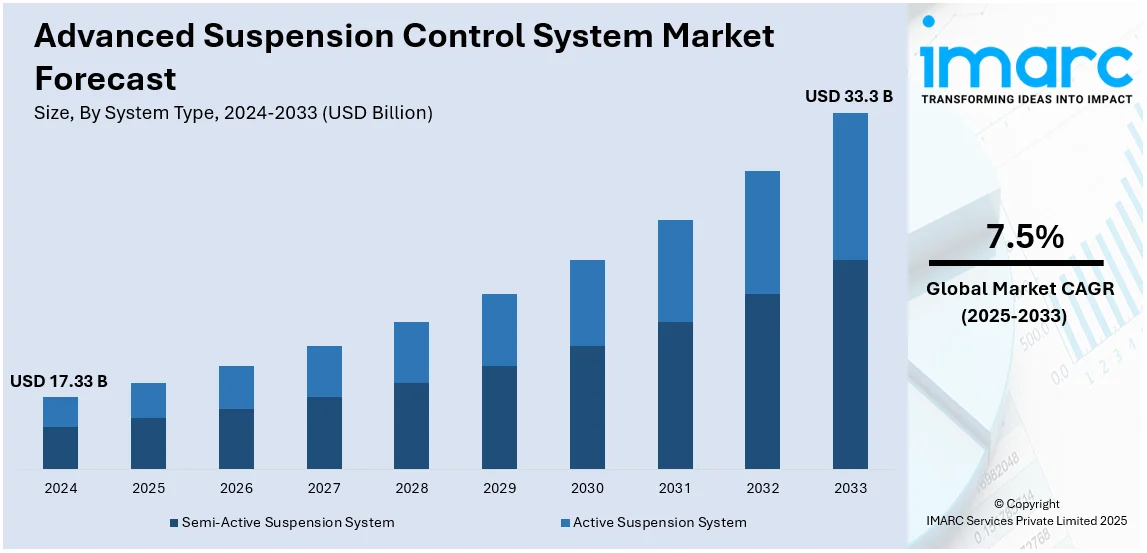

The global advanced suspension control system market size was valued at USD 17.33 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 33.3 Billion by 2033, exhibiting a CAGR of 7.5% from 2025-2033. Europe currently dominates the market, holding a market share of over 35% in 2024. The market is driven by stringent safety rules, widespread adoption of high luxury vehicles, and heavy investments in electric and autonomous mobility, propelling demand for advanced suspension control systems.

| Report Attribute | Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 17.33 Billion |

|

Market Forecast in 2033

|

USD 33.3 Billion |

| Market Growth Rate 2025-2033 | 7.5% |

The global market for advanced suspension control systems is growing with increased demand for high-performance and luxury cars. Consumers are giving high importance to ride comfort, stability, and dynamic handling, leading automakers to incorporate adaptive suspension technologies. Premium automobile manufacturers are investing in active and semi-active suspension systems to improve driving experience, enhance cornering ability, and minimize vibrations on different surfaces. Asia-Pacific emerging markets are also experiencing robust growth in sales of luxury vehicles, underpinned by rising disposable incomes and a desire for technologically equipped vehicles. Furthermore, electric vehicle makers are also adding advanced suspension solutions to balance battery weight distribution and enhance efficiency. For example, in October 2024, Foxconn introduced the MODEL D and MODEL U EVs during Hon Hai Tech Day, which come with pneumatic suspension, active height control (15-25 mm), and aerodynamic enhancements for improved stability, efficiency, and comfort of driving in electric mobility solutions. Moreover, the trend towards autonomous driving is also favoring innovation in predictive suspension systems powered by sensors and artificial intelligence to real-time adjust damping. These drivers are collectively propelling worldwide uptake of advanced suspension control technologies in high-end and mass-market vehicle applications.

The US automotive sector is experiencing remarkable progress in suspension control systems with a market share of 87.40% because of strict safety and emissions regulations. The National Highway Traffic Safety Administration (NHTSA) and Environmental Protection Agency (EPA) are mandating greater stability and fuel efficiency, which has driven automakers to create lighter, electronically controlled suspension systems. Advanced suspension systems like air suspension and magnetorheological dampers help promote better vehicle stability, minimizing rollover probabilities and improving occupant protection. Moreover, regulation concerning auto emissions is propelling the uptake of active suspension technologies that maximize aerodynamics and reduce rolling resistance, helping to improve fuel efficiency. Growth in electric and hybrid cars in the US market also stimulates demand, as car manufacturers look for suspension systems that strike a balance between comfort and battery efficiency. For instance, in May of 2024, REE Automotive introduced the P7 EV chassis, complete with modular REEcorners suspension, marrying steering, brakes, and powertrain for tighter maneuverability, more cargo area, and level of autonomous-readiness, to aim at Class 3-5 electric truck applications. Additionally, with increasing investments in smart infrastructure and connected mobility, intelligent suspension control systems that combine artificial intelligence (AI) and Internet of Things (IoT) are becoming popular to address changing transportation standards.

Advanced Suspension Control System Market Trends:

Rising Demand for Luxury and High-Performance Vehicles

The growth in demand for luxury vehicles, SUVs, and high-performance vehicles is driving the need for advanced suspension control systems. Customers want greater ride comfort, stability, and dynamic handling, which induces manufacturers to incorporate adaptive suspension technologies that automatically adapt to road conditions. The international luxury vehicle market, worth USD 467.9 billion in 2024, is expected to expand at a 3.9% CAGR during 2025-2033, fueling investments in smart suspension technologies. Luxury vehicle manufacturers are integrating electronically controlled air suspension, adaptive dampers, and semi-active shock absorbers to provide enhanced driving dynamics. Further, high-end electric vehicle companies are also using these technologies to offset battery weight and enhance aerodynamics for smooth, efficient drives. With rising disposable incomes in emerging nations and enhanced consumer demands for high-performance ride quality, demand is accelerating for precision-tuned, electronically controlled suspension systems in both conventional and electric vehicle markets.

Technological Advancements in Energy-Efficient Suspension Systems

Pressure to become energy-efficient and sustainable is pushing the development of advanced suspension systems, especially for electric and low-emission vehicles. The focus is on electronically controlled air suspension systems that blend hydraulic and mechanical components to maximize oil flow and manage spring and damping forces. As private cars accounted for 10% of total energy-related CO₂ emissions in 2023, there is considerable focus on energy-efficient damping systems and lightweight materials to minimize fuel consumption and maximize vehicle performance. Low-friction shock absorbers and air suspensions that increase aerodynamic efficiency are being engineered by manufacturers to directly aid fuel economy. Moreover, self-leveling suspension systems also assist in optimizing weight distribution, especially in EVs with heavy battery packs, to improve range and ride comfort. Governments across the globe are implementing stringent emissions regulations, further driving the uptake of electronically controlled, fuel-efficient suspension solutions as manufacturers attempt to achieve sustainability targets and improve vehicle efficiency.

Integration of AI and Predictive Suspension Technologies

The push towards energy efficiency and sustainability is propelling innovation in advanced suspension systems, specifically for electric and low-emission vehicles. Car makers are converging on electronically controlled air suspension systems that combine hydraulic and mechanical components to ensure optimized oil flow and control of spring and damping forces. With private cars accounting for 10% of the world's energy-related CO₂ emissions in 2023, the focus must be on lightweight materials and low-energy damping technologies to improve vehicle performance while minimizing fuel usage. The automotive industry is working on low-friction dampers and air suspension that enhance aerodynamic efficiency, which has a direct impact on fuel economy. Besides that, self-levelling suspension systems assist in maximizing weight distribution, especially on EVs equipped with heavy batteries, improving both range and riding comfort. Governments across the globe are implementing severe emissions regulations, further pushing for the uptake of electronically controlled fuel-efficient suspension systems as manufacturers fight to achieve sustainability targets and make vehicles more efficient.

Advanced Suspension Control System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global advanced suspension control system market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on system type, component, vehicle, vehicle type, and sales channel.

Analysis by System Type:

- Semi-Active Suspension System

- Active Suspension System

Semi-active suspension systems stand as the largest component in 2024, holding around 57.4% of the market. These are becoming popular because of their potential to improve ride quality without losing cost-effectiveness as compared to complete active systems. The systems vary damping forces in real-time through electronically controlled shock absorbers, and they provide an optimal compromise between comfort and handling. Magnetorheological dampers and adaptive shock absorbers ensure vehicles dynamically respond to road conditions, minimize vibrations, and increase stability. Semi-active suspension systems are commonly used by sports and luxury car producers, especially in high-performance variants, to improve cornering and braking efficiency. Improved sensor and control algorithm technology also enhances responsiveness for semi-active solutions, with mid-range family cars becoming credible candidates for semi-active adoption. The demand for more fuel-efficient and electrified vehicles further favors the use of semi-active suspensions, where weight reduction and energy usage are improved. As car makers concentrate on advanced driver assistance systems (ADAS), semi-active suspension is likely to witness ongoing incorporation in contemporary cars.

Analysis by Component:

- Springs

- Shock Dampeners

- Struts

- Control Arms

- Ball Joints

- Others

Shock dampeners lead the market with around 42.8% of market share in 2024. Shock dampeners, or shock absorbers, are important components in advanced suspension control systems as they control vehicle motion and reduce road irregularity-induced vibration. New shock dampeners incorporate adaptive damping technology whereby the suspension systems can dynamically change stiffness depending on driving conditions. Magnetorheological fluid dampers and electronically controlled variable dampers are innovations that can allow for finely tuned suspension, enhancing ride comfort and vehicle stability. Manufacturers are increasingly relying on light shock absorbers in a bid to make vehicles lighter and more fuel-efficient. With boosted demand for hybrid and electric vehicles, innovations in shock dampeners have further gained momentum with companies creating energy-regenerative dampers that generate electrical energy from suspension movement. For high-performance and off-road cars, there are heavy-duty dampers featuring advanced hydraulic technology to deliver greater shock absorption to maintain durability despite the harsh operating conditions. As car safety and comfort start to become major differentiators, shock dampeners just keep improving, enabling better performance from new suspension technology.

Analysis by Vehicle:

- Passenger Cars

- Commercial Vehicles

- Others

Passenger cars lead the market with around 66.8% of market share in 2024. These cars are the most prominent segment for advanced suspension control systems due to increasing consumer demand for comfort, stability, and driving performance. Automotive manufacturers are incorporating adaptive and semi-active suspension technologies in upper-end and mid-range cars to improve ride comfort and vehicle response. The surge in the adoption of electric vehicles (EVs) has also fueled demand for high-performance suspension systems as manufacturers of EVs aim to achieve optimal weight distribution and better battery efficiency. Moreover, the proliferation of autonomous and connected cars is driving the growth of smart suspension systems that integrate with onboard sensors and artificial intelligence (AI) driven control units. Consumers of mature markets value automobiles with better ride comfort, and electronically controlled suspension systems are a prominent feature in premium models. As there is mounting regulatory interest in vehicle safety and emissions, passenger vehicles fitted with active and semi-active suspension solutions are turning into a standard fitment in leading automotive companies.

Analysis by Vehicle Type:

- Conventional

- Gasoline-Based

- Diesel-Based

- Hybrid

- Electric

Conventional leads the market with around 65.0% of market share in 2024. Conventional vehicles, such as internal combustion engine (ICE) passenger cars, SUVs, and trucks, remain the dominant users of advanced suspension control systems. Electric and hybrid vehicles are highly popular, but ICE vehicles remain the best-selling vehicles globally and, as such, maintain a steady demand for high-performance suspension systems. Conventional vehicles, especially in the luxury and performance marketplaces, are becoming more frequently equipped with semi-active and adaptive suspension systems to refine ride quality, traction, and stability. Also, innovations in hydraulic and air suspension technologies enable automakers to provide increased comfort and load capacity on standard vehicle platforms. In commercial trucks and SUVs, heavy-duty suspension technology enables smoother riding over rough surfaces while minimizing driver fatigue. With global laws favoring improved fuel economy and lower emissions, lightweight and efficient suspension components are being incorporated into standard vehicles to enable overall improvements without sacrificing durability or cost-effectiveness.

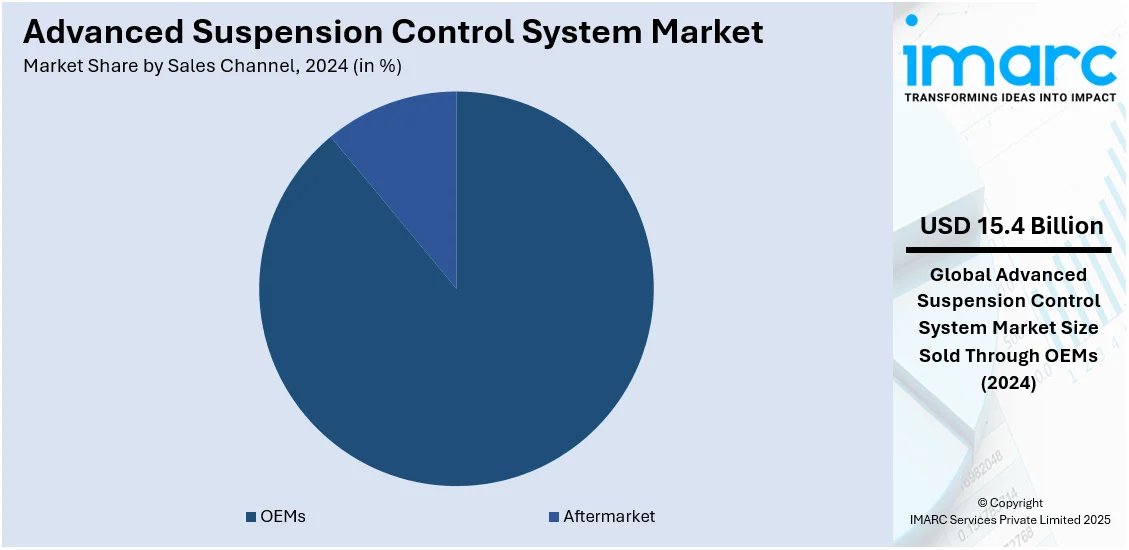

Analysis by Sales Channel:

- OEMs

- Aftermarket

OEMs leads the market with around 88.7% of market share in 2024. Original Equipment Manufacturers (OEMs) control the market of advanced suspension control systems due to automakers' focus on factory-fitted semi-active, active, and air suspension solutions to address increasing consumer expectations. Top automobile makers incorporate suspension technologies for improved safety, performance, and driving comfort, and top-end car makers equip their vehicles with electronically controlled suspension as an optional or standard fitment. Growing use of electric and self-driving cars is also fueling OEM demand for smart suspension systems that can communicate with ADAS and predictive road-mapping technology. OEMs are also using lightweight materials and smart damping technologies to comply with strict fuel efficiency and emissions standards. There is also growing demand for customizable suspension settings in high-performance cars, which has prompted OEMs to invest in modular and software-based suspension control systems. As automated manufacturing and artificial intelligence-powered testing keep pushing forward, OEMs keep setting the pace for next-generation suspension technologies across luxury and mass-market segments.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 35%. Europe is a prime market for advanced suspension control systems, supported by stringent safety regulations, premium vehicle demand, and robust automotive R&D spending. Top European automakers are incorporating semi-active and adaptive suspension technologies in luxury and premium vehicles to improve driving comfort on various road surfaces. The region's aggressive drive for electric mobility is also driving demand for lightweight and efficient suspension solutions. Nations like the UK, Germany, and France lead suspension technology innovation, and big auto firms are spending heavily in predictive suspension and AI-driven control systems. Vehicle emissions and safety standards for the European Union (Euro NCAP) further motivated auto firms to come up with smart and energy-saving suspension systems. An active aftermarket business and component makers also encourage continuous development and usage. While autonomous and connected technologies gain traction with every passing month, Europe stands as the keystone region for next-generation suspension technologies.

Key Regional Takeaways:

North America Advanced Suspension Control System Market Analysis

North American advanced suspension control system market is influenced by growing demand for better vehicle safety, comfort, and performance. Growth in consumer inclination towards premium and luxury vehicles that incorporate adaptive and semi-active suspension technology is driving adoption. The market is assisted by improvements in electronic control units (ECUs), sensors, and AI-based predictive systems that improve ride dynamics. Also, the increasing popularity of electric and autonomous cars is driving the demand for smart suspension solutions to enhance handling and efficiency. The commercial vehicle market is also seeing increased usage due to the emphasis on minimizing vibration and enhancing fuel efficiency. But high system prices and integration issues are challenges. The aftermarket market is growing as customers look for performance enhancements. With continued R&D on light-weight materials and intelligent actuators, the market is likely to grow steadily under the support of increasing demand for customized and high-performance driving experiences in North America.

United States Advanced Suspension Control System Market Analysis

The United States advanced suspension control system market growth is primarily driven by the increasing demand for high-performance vehicles, rising adoption of electric and autonomous cars, and advancements in adaptive suspension technologies. Automakers are integrating electronic and semi-active suspension systems to enhance ride comfort, stability, and handling, particularly in luxury and sports vehicles. Moreover, the shift toward electric vehicles (EVs) is further propelling market growth as automakers focus on lightweight, energy-efficient suspension systems to optimize battery performance and range. According to industry reports, by 2030, it is projected that there will be 26.4 Million electric vehicles on American roads, accounting for 10% of all automobiles. Additionally, the rise of autonomous driving technology is driving the development of intelligent suspension systems that adapt to real-time road conditions using sensors and AI-driven controls. Growing consumer preference for enhanced driving comfort, particularly in premium SUVs and high-end sedans, is boosting demand for active damping and air suspension technologies. Furthermore, government regulations on vehicle safety and emissions are also prompting manufacturers to adopt advanced suspension systems that improve fuel efficiency and reduce vibrations. Increasing investments in research and development (R&D), particularly in electro-hydraulic and magnetorheological suspension systems, are further driving innovations. Besides this, the presence of key automotive manufacturers and technology providers in the U.S. is fostering collaborations and technological advancements.

Asia Pacific Advanced Suspension Control System Market Analysis

The Asia Pacific advanced suspension control system market share is expanding due to increasing investments in automotive R&D, emergence of smart mobility solutions, and rising demand for fuel-efficient vehicles. The strong automotive manufacturing base in the region, particularly across China, Japan, and India, is also driving the adoption of electronically controlled suspension systems. As per the IBEF, a total of 27,73,039 passenger cars, quadricycles, two-wheelers, and three-wheelers were produced in India in September 2024. Additionally, governments are supporting the development of intelligent transportation infrastructure, which is boosting demand for vehicles equipped with adaptive suspension technologies. The popularity of hybrid and plug-in hybrid vehicles is further encouraging innovation in lightweight and energy-efficient suspension systems. Furthermore, the rise of ride-sharing and autonomous mobility solutions is encouraging the integration of AI-driven, real-time road adaptive suspension systems. Automakers are also focusing on enhancing vehicle dynamics and stability to meet consumer preferences for smoother and safer driving experiences.

Europe Advanced Suspension Control System Market Analysis

The Europe advanced suspension control system market is growing, fueled by the increasing adoption of luxury and electric vehicles. Leading automakers in Germany, the UK, and France are integrating adaptive and semi-active suspension technologies to enhance driving comfort, stability, and fuel efficiency. Moreover, the rapid expansion of the electric vehicle market is propelling manufacturers to develop lightweight, energy-efficient suspension systems that optimize battery performance and range. According to industry reports, in 2022, 80% of all passenger car sales in Norway were electric, while in Iceland, electric cars made up 41% of all passenger vehicle sales. Overall, in the European Union, electric vehicle sales accounted for 12% of total automobile sales in 2022. Autonomous driving advancements are further increasing the demand for smart suspension systems that use sensors, AI, and real-time road condition analysis to improve ride quality. Additionally, the European Union's strict regulations on vehicle emissions and safety are encouraging automakers to invest in advanced suspension solutions that reduce road vibrations and enhance energy efficiency. Furthermore, consumer preference for smooth, high-performance driving experiences, particularly in premium sedans and SUVs, is fueling the adoption of air suspension and magnetorheological dampers. Besides this, the wide presence of key luxury car manufacturers, including BMW, Mercedes-Benz, and Audi, is further boosting market growth as they continue to integrate cutting-edge suspension technologies into their vehicle models.

Latin America Advanced Suspension Control System Market Analysis

The Latin America advanced suspension control system market is propelled by increasing vehicle production, rising demand for premium and electric vehicles, and advancements in road infrastructure. For instance, as per a report by the IMARC Group, the electric vehicle market size in Brazil is expected to reach 735.67 Thousand Units by 2032, growing at a CAGR of 23.60% during 2024-2032. Moreover, countries such as Brazil, Mexico, and Argentina are witnessing higher adoption of electronically controlled suspension systems as automakers enhance vehicle performance and safety features. The expansion of the middle class and increasing disposable income are further fueling demand for luxury SUVs and high-performance cars, which require advanced suspension technologies. Additionally, improving road networks and expanding urban mobility initiatives are driving interest in adaptive suspension systems that enhance ride comfort and stability, supporting overall industry expansion.

Middle East and Africa Advanced Suspension Control System Market Analysis

The Middle East and Africa advanced suspension control system market is being increasingly driven by the rise in automotive manufacturing, growing off-road vehicle demand, and government policies promoting vehicle safety. Countries such as South Africa, Egypt, and Morocco are strengthening their automotive sectors, driving the integration of electronically controlled suspension systems. Growth in luxury tourism, particularly in the UAE and Saudi Arabia, is further increasing the demand for high-end vehicles with superior ride comfort. According to the Saudi Arabia Ministry of Tourism, between January and July 2024, the Kingdom witnessed 17.5 Million international tourists, recording a 10% rise in comparison to the corresponding period in 2023. Moreover, there was a notable 656% rise in tourists visiting for vacation and recreational purposes alone. Additionally, the emphasis on sustainable transportation, including hybrid and electric vehicles, is encouraging automakers to develop lightweight, energy-efficient suspension solutions, supporting market growth across the region.

Competitive Landscape:

The market for advanced suspension control is extremely competitive based on ongoing advancements in semi-active, active, and air suspension technologies. Industry players are looking to achieve the use of lighter materials, artificial intelligence-driven control systems, and real-time adjustments in damping for improved stability and comfort for the vehicle. Partnerships among the automakers and component providers are strong and serve to seamlessly integrate next-generation suspension technologies. Firms are investing in predictive suspension systems that utilize sensors, LiDAR, and machine learning to pre-emptively fine-tune damping for different road conditions. Also, regulatory compliance, especially in Europe and North America, is encouraging research and development (R&D) towards energy-efficient and low-emission suspension technology. The electric and autonomous vehicle revolution is redefining competition, with a concentration on adaptive chassis control and intelligent suspension systems. The aftermarket market also continues to gather speed, as people look to enhance performance, off-road features, and comfort rides, thus driving market dynamics further.

The report provides a comprehensive analysis of the competitive landscape in the advanced suspension control system market with detailed profiles of all major companies, including:

- BWI Group

- Continental AG

- Hitachi Automotive Systems Ltd.

- Infineon Technologies AG

- Lord Corporation

- Marelli Europe S.P.A.

- Schaeffler AG

- The Mando Corporation

- ThyssenKrupp AG

- ZF Friedrichshafen AG

Latest News and Developments:

- April 2024: Mahindra & Mahindra Ltd. introduced the XUV 3XO with starting prices of Rs. 7.49 Lakh. The new XUV 3XO boasts state-of-the-art technology, superior Turbo engines, and an advanced suspension design that features a Twist Beam Semi-independent Rear Suspension and a MacPherson Strut Fully Independent Front Suspension. The XUV 3XO is a testament to Mahindra's dedication to superior craftsmanship and innovation.

- January 2024: The latest model of Öhlins® Racing's ground-breaking semi-active advanced suspension system, the Öhlins SmartEC3, was launched at the EICMA motorbike expo in Milan, Italy, alongside the 2024 Honda CBR1000RR-R Fireblade SP superbike. The new Fireblade SP is the first motorcycle on the market to feature the SmartEC3 suspension.

- August 2023: Hendrickson, a prominent international developer and distributor of elastomeric and air suspension technologies and other commercial vehicle components, introduced its cutting-edge mechanical and air suspension systems, as well as axles, for use in trailers in India. With this launch, Hendrickson continues to establish cutting-edge standards in the provision of suspension technologies and bespoke materials for the international transport industry.

- November 2022: Tenneco, one of the leading original equipment manufacturers (OEMs) globally, entered into a partnership with Rivian Automotive, a prominent EV manufacturer based in the United States, to supply them with its advanced suspension control solutions. With this collaboration, the Rivian R1T and R1S electric vehicles will be equipped with the CVSA2/Kinetic H2 semi-active suspension system of Tenneco, which is a component of the Monroe Intelligent Suspension range of products.

Advanced Suspension Control System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| System Types Covered | Semi-Active Suspension System, Active Suspension System |

| Components Covered | Springs, Shock Dampeners, Struts, Control Arms, Ball Joints, Others |

| Vehicles Covered | Passenger Cars, Commercial Vehicles, Others |

| Vehicle Types Covered |

|

| Sales Channels Covered | OEMs, Aftermarket |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BWI Group, Continental AG, Hitachi Automotive Systems Ltd., Infineon Technologies AG, Lord Corporation, Marelli Europe S.P.A., Schaeffler AG, The Mando Corporation, ThyssenKrupp AG, ZF Friedrichshafen AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the advanced suspension control system market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global advanced suspension control system market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the advanced suspension control system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The advanced suspension control system market was valued at USD 17.33 Billion in 2024.

The advanced suspension control system market is projected to exhibit a CAGR of 7.5% during 2025-2033, reaching a value of USD 33.3 Billion by 2033.

The market for advanced suspension control system is growing owing to strict safety regulations, growth in luxury car demand, heightened adoption of electric vehicles, and development of AI-based predictive and adaptive suspension technology. Improvements in ride comfort, enhanced vehicle stability, and increasing inclusion of smart mobility solutions also lead to market expansion.

Europe currently dominates the advanced suspension control system market owing to the sringent safety regulations, increased demand for luxury vehicles, high growth of EVs, and AI-based predictive and adaptive suspension technologies are driving market growth, improving ride quality, stability, and overall driving experience.

Some of the major players in the advanced suspension control system market include BWI Group, Continental AG, Hitachi Automotive Systems Ltd., Infineon Technologies AG, Lord Corporation, Marelli Europe S.P.A., Schaeffler AG, The Mando Corporation, ThyssenKrupp AG, ZF Friedrichshafen AG, etc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)