Advanced Persistent Threat Protection Market Size, Share, Trends and Forecast by Offering, Deployment, Enterprise Size, Vertical, and Region, 2025-2033

Advanced Persistent Threat Protection Market 2024, Size and Trends:

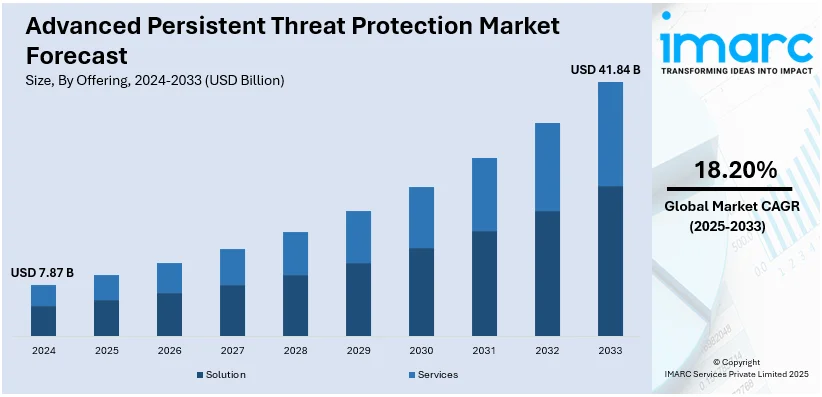

The global advanced persistent threat protection market size was valued at USD 7.87 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 41.84 Billion by 2033, exhibiting a CAGR of 18.20% from 2025-2033. North America currently dominates the market, holding a market share of over 33.5% in 2024. The market is driven by the increasing frequency of cyberattacks on critical infrastructure, the rapid adoption of digital technologies and cloud services, and stringent regulatory frameworks in the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.87 Billion |

| Market Forecast in 2033 | USD 41.84 Billion |

| Market Growth Rate (2025-2033) | 18.20% |

The advanced persistent threat protection market is driven by the increasing sophistication of cyber threats. This encourages organizations to adopt specialized defense systems, supporting the market growth. According to the statistics in 2024, organizations claimed that they have increased the cybersecurity budget by 8% against 6% in 2023, which may be explained by the focus on the further improvement of the security systems. Moreover, regulatory mandates like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) compel businesses to invest in advanced security tools, fueling the market demand. Besides this, the rapid adoption of cloud technologies and remote work trends expands attack surfaces, emphasizing the need for robust solutions, thus providing an impetus to the market. Furthermore, artificial intelligence (AI) and automation enhance detection and response capabilities, making these systems more effective, which is impelling the market growth.

The advanced persistent threat protection market in the United States is driven by the critical need to safeguard sensitive government and enterprise data from increasingly targeted cyberattacks. In line with this, the rising investments in defense and infrastructure security, particularly in the financial and healthcare sectors, amplify demand for advanced persistent threat protection solutions, aiding the market growth. Concurrently, the US leads in cybersecurity innovation, with advanced tools tailored to address specific domestic threats, contributing to the market expansion. Apart from this, the growing concerns over ransomware and state-sponsored attacks heighten the urgency for adoption, thereby propelling the market forward. For instance, in 2023, the Crime Complaint Center (IC3) of the Federal Bureau of Investigation (FBI) recorded a total of 1,193 complaints from critical infrastructure organizations, while government facilities were third on the list with 156 complaints.

Advanced Persistent Threat Protection Market Trends:

Integration of AI and machine learning (ML)

AI and machine learning (ML) are making a difference in the protection of advanced persistent threat protection through early detection and response functions. These technologies can analyze traffic and reveal anomalous behaviors, predict potential sources of attack, and trigger responses to threats that may take a lot less time than it would take a human to do. In 2024, the National Institute of Standards and Technology (NIST) released a report titled "Adversarial Machine Learning: The paper also includes the “A Taxonomy and Terminology of Attacks and Mitigations” section that bin underlines the role of AI and ML in detecting and preventing the manipulations of adversarial AI. Since attackers are using AI to create advanced malware, the integration of AI has become unavoidable. In addition, this growth in natural language processing assists in interpreting threat intelligence reports and improving situation awareness. This has led to the widespread integration of AI systems in organizational structures, as the detection of new threats remains a major growth factor within the advanced persistent threat protection market.

Focus on zero-trust architecture

The zero-trust security model is gaining traction as a foundational approach to advanced persistent threat protection. This model assumes no inherent trust within or outside the network, requiring continuous verification of users, devices, and applications. With remote work and hybrid environments becoming the norm, zero-trust frameworks mitigate risks posed by unauthorized access or compromised endpoints. Advanced technologies like micro-segmentation and multi-factor authentication are being implemented to align with this approach. For example, in December of 2024, the guide “Implementing a Zero Trust Architecture” (SP 1800-35) was published as a draft that offered best practices and demonstrated complete implementations created alongside 24 vendors. As organizations aim to secure increasingly complex and distributed IT ecosystems, the adoption of zero-trust principles continues to shape the market's trajectory.

Growing emphasis on threat intelligence sharing

The growing industry and government-level threat intelligence sharing are gradually becoming one of the core trends of advanced persistent threat protection in organizations. Sharing of information at the same time with regard to the attacks and the different vectors besides the malicious internet protocols (IPs) and vulnerabilities assists the different entities in improving security. Information Sharing and Analysis Centers (ISACs) and Cybersecurity and Infrastructure Security Agency (CISA) in the United States are examples of platforms and alliances supporting this collaboration. For instance, for 2023 CY, CISA engaged almost 2,700 times with the Healthcare & Public Health Sector, over 1,700 times with the Water and Wastewater Sector, and more than 2,200 times with the K-12 Sector to share threat information and risk management measures. As a result, organizations can assemble more funds and intelligence to forecast and prevent complex threats more strongly.

Advanced Persistent Threat Protection Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global advanced persistent threat protection market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on offering, deployment, enterprise size, and vertical.

Analysis by Offering:

- Solution

- Security Information and Event Management (SIEM)

- Endpoint Protection

- Intrusion Detection System/Intrusion Prevention System (IDS/IPS)

- Next-Generation Firewall (NGFW)

- Threat Intelligence Platform

- Others

- Services

- Professional Services

- Managed Services

- Others

The solution segment dominates the market due to the growing demand for enhanced cybersecurity tools and methods to address new and changing threats. With increased threats resulting from data breaches and target attacks, organizations require stern solutions such as those that include end-point protection, intrusion detection systems, and threat analytics. Furthermore, the advances in AI and ML have enhanced the effectiveness of these solutions in minimizing risks and addressing them in real-time. Moreover, because of the increased attention paid to the consequences of cyber threats in terms of financial and reputation losses, and increased compliance regulation, businesses are increasing their spending on advanced persistent threat protection solutions, thus propelling the market forward.

Analysis by Deployment:

- Cloud

- On-premises

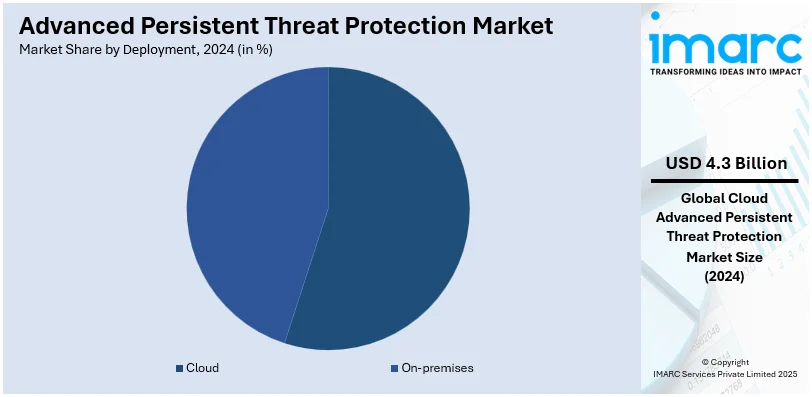

The cloud-based deployment segment holds a dominant market share of 54.7%. This segment is driven by its scalability, cost-efficiency, and ease of integration. With the use of cloud solutions becoming common every year, more companies are seeking effective security systems that allow for the safe storage and operations of data and applications. Solutions are flexible, they can be placed in the cloud, which allows organizations to adapt the level of security depending on threats and business conditions. Also, in cloud deployment, the threat can be managed centrally making it easier to detect and act on any threats that may arise. The increasing rate of digitization and work-from-home culture also increases cloud-based threat protection as organizations need threat detection and prevention in real-time across various sites. Furthermore, the comparatively reduced cost of entry and the relatively minimal requirement for hardware investment on the business’s side make cloud-based solutions a possibility for most organizations, thereby providing an impetus to the market.

Analysis by Enterprise Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

The large enterprise segment holds a significant market share of 47.5%. This segment is driven by multinational companies, as they deal with advanced levels of technology. Throughout the execution of their operations, they handle enormous volumes of information, which makes them suitable victims for complex attacks. This has in turn brought about higher spending in advanced persistent threat protection solutions to mitigate risk on their valuable resources and support their business. Increasing legal requirements for data protection and business and reputational risks associated with cyber threats have also intensified the need for advanced protection. Also, large enterprises demand AI-integrated solutions in threat identification and monitoring, and real-time response mechanisms and systems, contributing to the market expansion.

Analysis by Vertical:

- BFSI

- IT and Telecom

- Retail and E-commerce

- Healthcare and Life Sciences

- Manufacturing

- Energy and Utilities

- Government and Defense

- Others

The Banking, Financial Services, and Insurance (BFSI) segment holds a substantial market share of 19.5%. This segment is primarily driven by the sector’s heightened vulnerability to cyberattacks. In addition, financial institutions are frequently attacked by hackers since they store personal and financial details of customers and transactions, respectively. Besides this, organizations employ reliable advanced persistent threat protection solutions to protect those valuable resources. High regulatory compliance standards like the General Data Protection Regulation (GDPR) and Payment Card Industry Data Security Standard (PCI DSS) are other factors that encourage organizations to invest their money on stronger cybersecurity solutions to avert fines and protect data. Also, the growth of new and more complex cyber threats, such as phishing and ransomware, has created important concerns about the need for institutions to implement real-time threat detection and response solutions. As more businesses embrace online markets and with the financial sector is significantly driving the market demand.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

North America holds a significant market share of 33.5%. This demand in this region is driven by the region’s high levels of digital transformation and technological adoption. The development and enhancement of cyber threats in ongoing innovations especially in financial, health, and government sectors make cybersecurity an urgent need. Additionally, the importance of advanced persistent threat protection for most organizations in North America to protect their valuable information, property, and infrastructure. Besides this, the increasing cyber threats, for example, the new California CCPA made companies search for stiffer security. Apart from this, the region has a large enterprise segment with huge information technology (IT) spending, and complicated architecture is also contributing to the growth in the region. Concurrently, a high rate of cloud adoption, and increased work from home, are leading to the need for enhanced persistent threat protection, significantly strengthening the market share.

Key Regional Takeaways:

United States Advanced Persistent Threat Protection Market Analysis

The United States advanced persistent threat protection market is rapidly expanding due to the rising complexity of threats facing strategic sectors like the financial, healthcare, and public sectors. The stable development of digitalization in the region, along with the increased use of cloud solutions and Internet of Things (IoT) devices, have increased the attack vector and the need for enhanced security. California Consumer Privacy Act (CCPA) and Health Insurance Portability and Accountability Act (HIPAA) put forward strict cybersecurity protocols, which is a requirement that boosts the market. The U.S. is the global center for cybersecurity development with AI and ML being the key enablers of improved threat analysis and mitigation. Several firms are seeking to implement zero-trust security models, and endpoint security solutions to counter threats posed by advanced persistent threat protection. This has also been compounded by the growing adoption of remote work and hybrid work environments to protect endpoints. Furthermore, federal funding and policy, private enterprise, and the growing government focus on a country’s cybersecurity are driving the market forward.

Europe Advanced Persistent Threat Protection Market Analysis

In Europe, the advanced persistent threat protection market is growing rapidly, fueled by increasing cyber threats targeting critical sectors like finance, healthcare, and government infrastructure. Stringent regulatory frameworks such as the General Data Protection Regulation (GDPR) and Network and Information Systems (NIS) Directive mandate robust cybersecurity measures, driving demand for advanced protection solutions. The region's accelerated adoption of digital transformation initiatives, cloud technologies, and IoT devices has expanded the attack surface, necessitating sophisticated threat detection and response systems. European organizations are increasingly adopting zero-trust architectures and AI-driven security solutions to mitigate risks associated with advanced persistent threat protection. Furthermore, collaborations between governments and private entities are bolstering cybersecurity capabilities across the region. Countries like Germany, the UK, and France are prioritizing investments in national cybersecurity infrastructure. Growing awareness of the financial and reputational damages caused by breaches is pushing enterprises to proactively invest in advanced persistent threat protection, ensuring the market's steady expansion.

Asia Pacific Advanced Persistent Threat Protection Market Analysis

The Asia Pacific advanced persistent threat protection market is experiencing significant growth due to the increasing frequency of cyberattacks targeting critical industries such as finance, healthcare, and government. Rapid digital transformation, coupled with widespread adoption of cloud computing and IoT, has expanded the region's attack surface. Regulatory frameworks like Singapore’s Cybersecurity Act and Indian Computer Emergency Response Team (CERT-In) guidelines are driving investments in advanced security solutions. As part of strengthening cybersecurity preparedness, Cybersecurity Drill “Cyber Shock – 3” was completed by the CERT-In with a duration of 10 days for Banks, Insurance Companies, SEBI Regulated Entities, Hydro-Power Organizations, Thermal-Power Utilities, Transmission & Distribution units, Grid Operation and Renewal Energy Entities. Governments and enterprises are prioritizing AI-driven and zero-trust architectures to combat sophisticated threats. Rising awareness of financial and reputational risks associated with breaches further propels the demand for advanced persistent threat protection across the region.

Latin America Advanced Persistent Threat Protection Market Analysis

The Latin America advanced persistent threat protection market is evolving due to the growing volume of advanced cyber threats aimed at important industry segments including finance, energy, and government. The fast growth of digitalization in the region and the growing use of cloud services have led to a demand for enhanced cybersecurity. Laws including Brazil’s General Data Protection Law (LGPD), are promoting organizations to integrate these technologies. Moreover, a report by RSM International speaks about the general economic effects of cyberattacks in Latin America and that they focus not only on the direct monetary loss but also on the trends of development, security, and investors’ trust. Concerns about the potential financial and reputational loss due to breaches are making enterprises actively search for more sophisticated solutions, such as AI, and endpoint protection to expand their markets.

Middle East and Africa Advanced Persistent Threat Protection Market Analysis

The Middle East and Africa advanced persistent threat protection market is expanding due to the growing prevalence of cyberattacks targeting critical infrastructure, oil and gas sectors, and government organizations. Rapid digital transformation and increased cloud adoption have exposed vulnerabilities, driving demand for advanced security solutions. Regulatory measures, such as the UAE's National Cybersecurity Strategy, are pushing organizations to enhance their defenses. Rising awareness of economic and reputational damages from breaches further fuels the adoption of AI-driven and zero-trust security frameworks.

Competitive Landscape:

The competitive landscape of the advanced persistent threat protection market is driven by continuous innovation and strategic activities. Companies are focusing on integrating AI and ML into their solutions to enhance threat detection and response capabilities. Acquisitions remain a key strategy, with firms acquiring specialized platforms to strengthen their portfolios. Also, partnerships and collaborations with cloud providers are expanding market reach. Moreover, zero-trust security and endpoint protection solutions are becoming central to strategies, reflecting a shift toward comprehensive defense frameworks. Additionally, global players are tailoring region-specific offerings to meet diverse compliance and security needs, ensuring relevance in an evolving threat landscape.

The report provides a comprehensive analysis of the competitive landscape in the advanced persistent threat protection market with detailed profiles of all major companies, including:

- Broadcom, Inc

- Cisco Systems Inc.

- CrowdStrike

- CyberArk Software Ltd.

- Forcepoint

- F-Secure

- International Business Machines Corporation

- Kaspersky Lab

- Sophos Ltd

- Trend Micro Incorporated

- WiJungle

Latest News and Developments:

- In October 2024, Cisco Systems Inc. purchased Deeper Insights an AI services firm located in the United Kingdom. According to this move, it will enhance the company’s AI-based security solutions that can enhance the detection and handling of advanced threats.

- In October 2024, Sophos launched the Sophos Academy, a new learning environment for cybersecurity professionals to learn and prepare for new threats.

- In October 2024, F-Secure added new AI-based scam protection features to the F-Secure Total app. These features are designed to protect the consumer from common internet fraud, which is in line with the company’s approach to providing multi-layered protection.

- In July 2024, CrowdStrike as a Joint Cyber Defense Collaborative (JCDC) partner, worked with the Cybersecurity and Infrastructure Security Agency (CISA) to respond to an IT outage arising from a software update. It also ensured that the provision of mitigation guidance in federal networks occurred at a faster pace through this partnership which improved the organizations' protection against possible exploitation.

Advanced Persistent Threat Protection Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offerings Covered |

|

| Deployments Covered | Cloud, On-premises |

| Enterprise Sizes Covered | Small and Medium-sized Enterprises (SMEs), Large Enterprises |

| Verticals Covered | BFSI, IT and Telecom, Retail and E-commerce, Healthcare and Life Sciences, Manufacturing, Energy and Utilities, Government and Defense, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Broadcom, Inc, Cisco Systems, Inc., CrowdStrike, CyberArk Software Ltd., Forcepoint, F-Secure, International Business Machines Corporation, Kaspersky Lab, Sophos Ltd, Trend Micro Incorporated, WiJungle etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the advanced persistent threat protection market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global advanced persistent threat protection market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the advanced persistent threat protection industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global advanced persistent threat protection market was valued at USD 7.87 Billion in 2024.

The global advanced persistent threat protection market is estimated to reach USD 41.84 Billion by 2033, exhibiting a CAGR of 18.20% from 2025-2033.

The global advanced persistent threat protection market is driven by increasing cyberattack sophistication, regulatory compliance requirements, rapid digital transformation, expanding cloud adoption, remote work trends, and rising awareness of financial and reputational breach risks.

North America currently dominates the market, holding a market share of over 33.5% in 2024. The market is driven by the increasing frequency of cyberattacks on critical infrastructure, the rapid adoption of digital technologies and cloud services, and stringent regulatory frameworks in the region.

Some of the major players in the global advanced persistent threat protection market include Broadcom Inc., Cisco Systems, Inc., CrowdStrike, CyberArk Software Ltd., Forcepoint, F-Secure, International Business Machines Corporation, Kaspersky Lab, Sophos Ltd, Trend Micro Incorporated, WiJungle, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)