Advanced IC Substrate Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Advanced IC Substrate Market Size and Share:

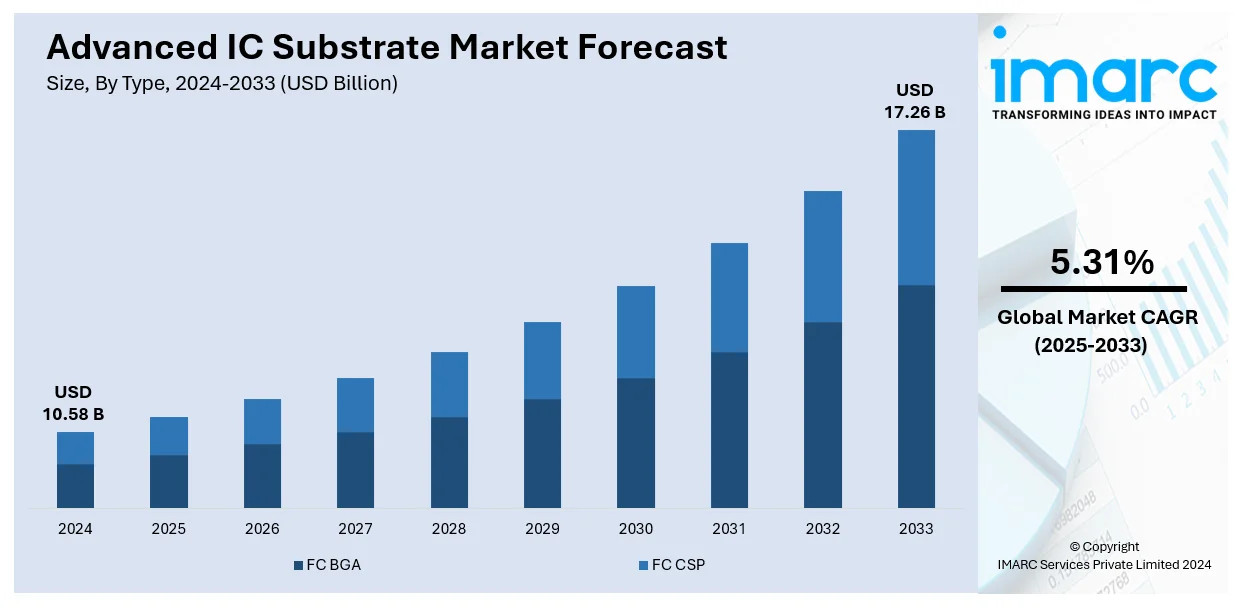

The global advanced IC substrate market size reached USD 10.58 Billion in 2024. Looking forward, the market is expected to reach USD 17.26 Billion by 2033, exhibiting a growth rate (CAGR) of 5.31% during 2025-2033. Asia Pacific currently dominates the market in 2024. The market is primarily driven by the growing demand for high-performance electronic devices, rising adoption of smaller, lighter, and more energy-efficient devices, and the increasing number of data centers and cloud computing services across the globe.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.58 Billion |

| Market Forecast in 2033 | USD 17.26 Billion |

| Market Growth Rate (2025-2033) | 5.31% |

The global market is majorly driven by the increasing adoption of advanced IC substrates, as they enable the seamless functioning of intricate electronic systems. Apart from this, the development of dedicated facilities and strategic investments by key players offer lucrative growth opportunities to the market. For example, on September 4, 2024, Onto Innovation announced the opening of its Packaging Applications Center of Excellence in Singapore, focusing on advancing cutting-edge technologies for semiconductor packaging and substrate manufacturing. This center is intended to enable the development of high-performance devices in key markets like 5G, artificial intelligence, and automotive electronics. Besides this, the increasing consumer preferences for advanced features, such as augmented reality (AR), virtual reality (VR), and high-definition (HD) displays, are contributing to the growth of the market. In addition to this, the rising utilization of the internet of things (IoT) devices around the world are impelling the growth of the market.

The United States is a key regional market that is witnessing significant growth due to the increasing demand for high-performance electronic devices, necessitating advanced IC substrates that enable enhanced functionality and compactness. Moreover, the implementation of government initiatives provides substantial funding to bolster domestic semiconductor manufacturing and research, further propelling market growth. For instance, on November 21, 2024, the U.S. Department of Commerce announced up to USD 300 Million in funding to support advanced semiconductor packaging research in Georgia, California, and Arizona. The funding is aimed at developing advanced substrates crucial for high-performance computing, AI, and next-generation wireless technologies. This investment, part of the CHIPS for America initiative, will enhance U.S. competitiveness in semiconductor packaging by supporting breakthroughs in substrate technology and manufacturing. Besides this, continual technological advancements in semiconductor packaging, including flip-chip and fan-out wafer-level packaging, contribute to the development of the advanced IC substrates market.

Advanced IC Substrate Market Trends:

Rising Demand for High-performance Electronic Devices

The rising demand for advanced electronic devices, such as smartphones, tablets, personal computers (PCs), wearable devices, and laptops, is increasing the market share. The need for high-performance electronic devices is being fueled by the growing middle class and shifting lifestyles. For example, a move towards more advanced technology is shown in the rise in wearables and smart TV usage. Furthermore, it is anticipated that the widespread use of smartphones and smart devices, coupled with greater acceptance of AI-powered applications and technological breakthroughs, would propel the global consumer electronics industry to surpass USD 1 Trillion by 2028, as per an industry report. In addition, consumers are increasingly preferring electronic devices that assist in providing seamless multitasking, high-speed connectivity, and enhanced graphics performance. They are also adopting devices that provide immersive experiences to individuals. Apart from this, there is an increase in the demand for advanced IC substrates that can accommodate the integration of powerful processors, memory modules, and communication components. As a result, manufacturers are investing in substrates with optimized electrical pathways and signal integrity that ensure efficient data transfer with minimal latency.

Increasing Popularity of Miniaturization

The increasing demand for smaller, lighter, and more energy-efficient devices among individuals, along with the rising popularity of miniaturization around the world, is expanding the advanced IC substrate market size. One of the main forces behind miniaturization is the need for small and effective consumer devices. For example, according to studies, the annual cost of new electronic items for American homes is approximately USD 1,480. Americans own an average of 24 electronic devices in their homes, indicating an increasing need for smaller gadgets with better functionality. In line with this, there is a rise in the need for compact and high-density advanced IC substrates. Besides this, these substrates benefit by enabling the stacking of multiple layers of components and reducing the footprint of devices while maintaining optimal functionality. The ability to integrate various components on a single substrate enhances efficiency, reduces the risk of signal interference, and improves the overall device performance, which is offering a positive market outlook.

Growing Number of Data Centers

The rising number of data centers and cloud computing services across the globe is bolstering the growth of the market. According to reports, there are 523 hyperscale sites and 5,186 colocation sites, and there will be 5,709 public data centers globally by the end of 2024. Asia-Pacific has the largest concentration of data center locations, followed by Europe and North America. Businesses and individuals rely increasingly on cloud computing, big data analysis, and online services for storing and managing vast volumes of information. Data centers have countless servers, storage systems, and networking equipment that generate substantial heat. In line with this, there is a need for efficient thermal dissipation to prevent overheating and ensure uninterrupted operation. Besides this, advanced IC substrates offer enhanced thermal management capabilities and heat-spreading properties that assist in maintaining the reliability and longevity of these systems. Furthermore, the increasing demand for high-performance substrates that can manage heat effectively is strengthening the growth of the market.

Advanced IC Substrate Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global advanced IC substrate market report, along with forecasts at the global, regional and country levels for 2025-2033. Our report has categorized the market based on type and application.

Analysis by Type:

- FC BGA

- FC CSP

FC BGA leads the market in 2024. Flip-Chip Ball Grid Array (FC BGA) facilitates the connection of integrated circuits directly to the substrate and enhances performance. In FC BGA, the IC is flipped, and its active side is connected to the substrate using tiny solder balls, which serve as conductive connections. Substrates using the FC BGA offer higher input/output density, superior electrical performance, and smaller package sizes. It is a versatile substrate type suited for use in complex, high-speed devices, including smartphones, servers, and consumer electronics. It has been highly favored for widespread applications in advanced technologies like 5G, artificial intelligence (AI), and internet of things (IoT) due to the ability of FC BGA to handle increased signal speeds as well as being highly compact in designs. Also, this configuration offers numerous advantages, such as shorter signal paths, improved electrical performance, and enhanced thermal dissipation due to direct contact with the substrate. As consumer demand for smaller, faster, and more powerful devices increases, FC BGA's importance in the advanced IC substrate market continues to grow.

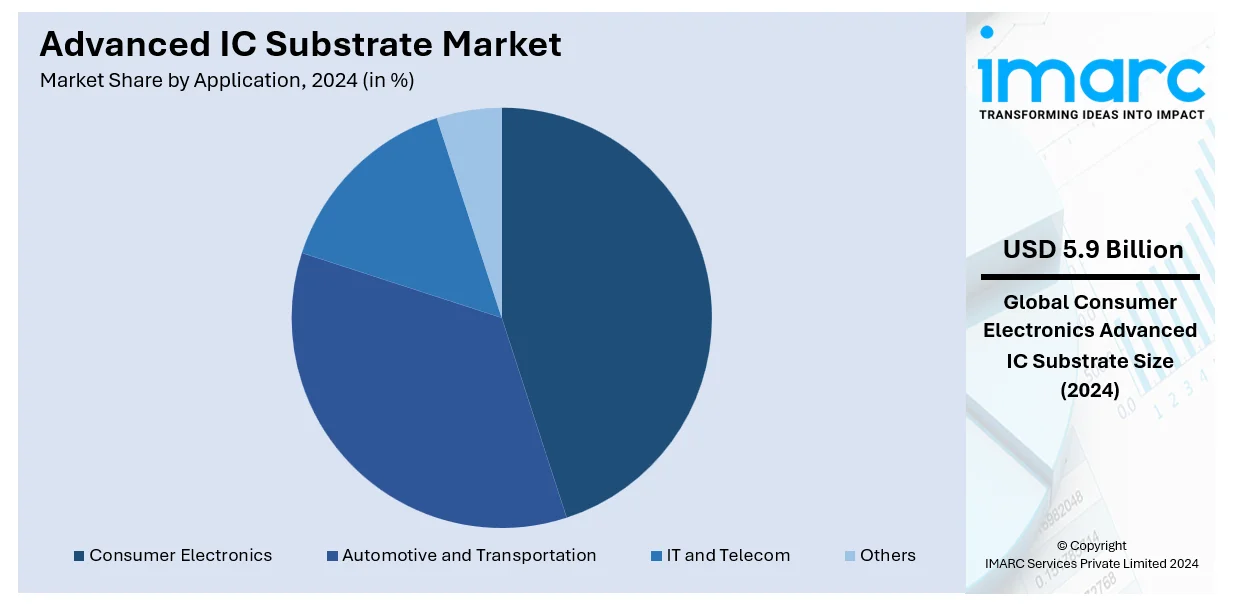

Analysis by Application:

- Consumer Electronics

- Automotive and Transportation

- IT and Telecom

- Others

Consumer electronics lead the market in 2024. Consumer electronics comprises a wide range of devices, such as smartphones, laptops, tablets, gaming consoles, and wearable gadgets. As the demand for smaller, faster, and more efficient devices grows, advanced IC substrates play a pivotal role in enabling these innovations. Also, advanced IC substrates enhance the performance and functionality of these devices. In consumer electronics, these substrates enable the integration of powerful processors, memory modules, and connectivity components and ensure seamless multitasking, high-speed data transfer, and immersive user experiences. Additionally, these substrates support advanced features, such as high-definition displays, augmented reality (AR), and artificial intelligence (AI). The rising demand for sleeker designs and extended battery life with efficient thermal management and optimized power consumption is propelling the growth of the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share due to the presence of improved manufacturing units. In line with this, the rising demand for innovative electronic devices among individuals is bolstering the growth of the market in the Asia Pacific region. Moreover, favorable government initiatives in the region are supporting the growth of the market. China, Japan, South Korea, and Taiwan are among the countries holding pivotal positions in design and production centers for IC substrates, due to their well-established presence in semiconductor manufacturing industries. Major IC substrate producers in the region fulfill the increased demand from this sector. Apart from this, the rising popularity of automotive electronics due to the increasing demand for electric vehicles (EVs) is contributing to the growth of the market in the region.

Key Regional Takeaways:

United States Advanced IC Substrate Market Analysis

The main driver of the advanced IC substrate market in the US is the increasing demand for 5G infrastructure, advanced packaging technologies, and high-performance computing (HPC). Major companies like Qualcomm, AMD, Broadcom, and Intel together account for more than 50% of global chip design activity and are based in the nation, which leads in semiconductor innovation. Since these facilities require advanced IC substrates for server processors, a significant driver is the growing number of data centers across the region. More than 900 hyperscale facilities will be operational in 2023, reports indicate. The U.S. government's CHIPS and Science Act, which earmarks over USD 50 Billion for semiconductor manufacture and research and development, further promotes domestic production and thus enhances demand for IC substrates. Moreover, the growing automotive industry's dependence on autonomous technologies and electric vehicles, which are likely to comprise 50% of new car sales by 2030, according to industrial reports, increases the demand for IC substrates used in sensors and advanced driver assistance systems (ADAS). The market is further driven by the growth of consumer electronics, particularly wearables and AR/VR devices, that require small and efficient IC packaging solutions.

Europe Advanced IC Substrate Market Analysis

The Europe market for advanced IC substrates is driven by growing investments in semiconductor production as well as increasing adoption of automotive and Internet of Things technology. To significantly enhance demand for IC substrates, the European Union's Chips Act, funded with Euro 43 Billion (USD 44.90 Billion), plans to grow regional semiconductor production capacity to 20% of global market share by 2030. The increasing penetration of ADAS and entertainment systems in automobiles is primarily fueled by the automotive industry, which contributes approximately 7% to Europe's GDP, as per industry report. More than half of new cars sold in Germany, France, and Italy feature complex electrical systems requiring IC substrates. As such, these are major contributors to this list. The growth in popularity of IoT devices has also been influenced by the continent's strong emphasis on green energy and smart cities since such gadgets rely on high-performance IC substrates to achieve efficient communication. Apart from these facts, collaborations between Asian substrate producers and European chip makers will continue to enhance the technological advantage of the region; and push up growth further.

Asia Pacific Advanced IC Substrate Market Analysis

The Asia-Pacific region leads in the global advanced IC substrate market due to being an assemblage and manufacturing hub for semiconductors. According to an industry report, more than 70% of the world's semiconductors are produced in China, Taiwan, South Korea, and Japan, which has created a rise in demand for IC substrates. Because of their leading-edge packaging technologies, including 2.5D and 3D IC integration, the two leading semiconductor manufacturers, TSMC of Taiwan and Samsung of South Korea, contribute to a huge demand for substrates. China's Made in China 2025 strategy and its focus on semiconductor self-sufficiency have led to huge investments in domestic IC substrate manufacturing. Another significant growth driver is the spread of 5G devices, with over 1.2 billion 5G subscribers in Asia-Pacific by 2022, as per reports. The market is further supported by the increasing consumer electronics sector in the region, especially in India and Southeast Asia, wherein there is a marked increase in demand for wearables, gaming devices, and smartphones, all of which require small and efficient IC substrates.

Latin America Advanced IC Substrate Market Analysis

The increasing application of consumer electronics and industrial automation is driving the advanced IC substrates market in Latin America. According to an industrial report, more than 50% of semiconductor imports in the region arrive in Brazil and Mexico-the largest markets. The demand for IC substrates is also driven by the increased penetration of laptops and smartphones, with smartphone penetration likely to cross 90% by 2030, as per reports. Additionally, the automotive sector in the region, especially in Mexico, is embracing increasingly complex electronic systems, such as infotainment and safety features, which are increasing the demand for advanced IC packaging methods. The market is further supported by government plans that attract investments in manufacturing semiconductors and includes tax breaks for electronic manufacturing in Brazil. The growth of internet of things (IoT) based applications in manufacturing and agriculture helps to further support the increasing demand for IC substrates for connected devices.

Middle East and Africa Advanced IC Substrate Market Analysis

Growing telecommunications and technology investments are propelling the advanced IC substrates market in the Middle East and Africa. The demand for advanced IC substrates in telecom equipment is based on the roll-out of 5G networks in the Gulf Cooperation Council (GCC) countries, with more than 70% of metropolitan areas in the United Arab Emirates and Saudi Arabia covered by 5G by 2023, as per industry report. In addition, the stc group, a telecom company in Saudi Arabia is expanding its 5G network to over 75 cities across the country. This region is further being driven by the growth of smart city initiatives such as the Saudi NEOM project, among others, to IoT device and related semiconductor component demand. One of the main drivers in Africa is the growing smartphone penetration rate, which reached nearly 50% of the population by 2023, as per reports. Furthermore, government initiatives to create regional centers for electronics manufacturing, especially in South Africa and Kenya, are opening doors for the use of cutting-edge IC substrates.

Competitive Landscape:

Major players in the market are continuously investing in research and development (R&D) activities to develop advanced IC substrate materials and technologies. They are exploring novel materials with improved thermal conductivity, signal integrity, and electrical performance to cater to high-performance applications. Semiconductor companies and consumer electronics are acquiring partnerships. Strategic collaborations enable expertise, technology, and resource sharing which leads to developing solutions specific to the markets involved. Furthermore, companies are improving their manufacturing techniques to achieve improved precision, scalability, and low cost for making advanced IC substrates. This includes adopting advanced technologies, such as lithography, laser drilling, and advanced packaging techniques, which is increasing the competition among companies.

The report provides a comprehensive analysis of the competitive landscape in the orthopedic prosthetics market with detailed profiles of all major companies, including:

- ASE Group

- AT & S Austria Technologie & Systemtechnik Aktiengesellschaft

- Fujitsu Limited

- Ibiden Co. Ltd.

- JCET Group Co. Ltd

- Kinsus Interconnect Technology Corp.

- Korea Circuit Co. Ltd.

- KYOCERA Corporation

- LG Innotek Co. Ltd.

- Nan Ya PCB Co. Ltd. (Nan Ya Plastics Corporation)

- TTM Technologies Inc.

- Unimicron Technology Corporation (United Microelectronics Corporation)

Recent Developments:

- October 2024: KLA launched a wide range of IC substrates with the goal of developing semiconductor packaging technology. Inspection, metrology, and data analytics solutions designed to satisfy the requirements of intricate IC substrate production processes are included in this portfolio. The advancements address issues in advanced packaging applications such system-in-package designs and heterogeneous integration by concentrating on enhancing yield, performance, and reliability.

- October 2024: DuPont and Zhen Ding Technology Group signed a partnership to promote advanced printed circuit board (PCB) technology. Accelerating innovation in next-generation PCB solutions for uses like high-performance computing, 5G, and artificial intelligence is the goal of the alliance. To solve industry issues and promote improvements in design and production efficiency, it will make use of Zhen Ding's manufacturing skills and DuPont's knowledge in material science.

- February 2023: LG Innotek unveiled the latest FC-BGA for the first time at the 'CES 2023'. It is highly integrated, multi layered, large scaled, and has fine patterning and a lot of micro vias.

Advanced IC Substrate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | FC BGA, FC CSP |

| Applications Covered | Consumer Electronics, Automotive and Transportation, IT and Telecom, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | ASE Group, AT & S Austria Technologie & Systemtechnik Aktiengesellschaft, Fujitsu Limited, Ibiden Co. Ltd., JCET Group Co. Ltd, Kinsus Interconnect Technology Corp., Korea Circuit Co. Ltd., KYOCERA Corporation, LG Innotek Co. Ltd., Nan Ya PCB Co. Ltd. (Nan Ya Plastics Corporation), TTM Technologies Inc., Unimicron Technology Corporation (United Microelectronics Corporation), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, advanced IC substrate market forecast, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global advanced IC substrate market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the advanced IC substrate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global Advanced IC Substrate market was valued at USD 10.58 Billion in 2024.

The market is expected to reach USD 17.26 Billion by 2033, exhibiting a growth rate (CAGR) of 5.31% from 2025-2033.

The growth of the global advanced IC substrate market is primarily driven by the increasing demand for high-performance semiconductors in applications like 5G, AI, and IoT. The growing trend of miniaturization, advancements in electronic devices, and the shift toward high-density interconnects (HDI) also play a significant role in driving market expansion.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global Advanced IC Substrate market include ASE Group, AT & S Austria Technologie & Systemtechnik Aktiengesellschaft, Fujitsu Limited, Ibiden Co. Ltd., JCET Group Co. Ltd, Kinsus Interconnect Technology Corp., Korea Circuit Co. Ltd., KYOCERA Corporation, LG Innotek Co. Ltd., Nan Ya PCB Co. Ltd. (Nan Ya Plastics Corporation), TTM Technologies Inc., and Unimicron Technology Corporation (United Microelectronics Corporation), among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)