Advanced Driver Assistance Systems Market Report by Solution Type (Adaptive Cruise Control, Blind Spot Detection System, Park Assistance, Lane Departure Warning System, Tire Pressure Monitoring System, Autonomous Emergency Braking, Adaptive Front Lights, and Others), Component Type (Processor, Sensors, Software, and Others), Vehicle Type (Passenger Cars, Commercial Vehicles), and Region 2026-2034

Market Overview:

The global advanced driver assistance systems market size reached USD 33.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 69.3 Billion by 2034, exhibiting a growth rate (CAGR) of 8.12% during 2026-2034. The implementation of stringent safety regulations, increasing incidences of road accidents, rapid technological advancements, and growing demand for enhanced driving comfort and safety features are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 33.6 Billion |

| Market Forecast in 2034 | USD 69.3 Billion |

| Market Growth Rate 2026-2034 | 8.12% |

Advanced driver assistance systems (ADAS) refer to technologically sophisticated solutions employed in vehicles to enhance safety and driving comfort. It includes lane departure warning, automatic emergency braking, adaptive cruise control, and parking assistance. These systems are comprised of cameras, sensors, artificial intelligence (AI) algorithms, and other components to gather, interpret, and respond to real-time data from the vehicle and its surroundings. ADAS is widely used for collision avoidance, pedestrian detection, traffic sign recognition, blind-spot detection, and drowsy driver detection. It aids in reducing road fatalities, improving traffic flow, lowering fuel consumption, and decreasing carbon dioxide emissions.

To get more information on this market Request Sample

The increasing demand for enhanced driving comfort and safety features, owing to the escalating awareness among vehicle owners regarding safety standards, is catalyzing the market growth. Furthermore, the progression towards autonomous vehicles is positively influencing the market growth. ADAS is considered an important intermediate step towards fully autonomous driving, leading to increased investment in this technology by key players in the automobile industry. Moreover, the implementation of favorable policies by insurance companies to provide discounted deals for vehicles equipped with ADAS is stimulating the market growth. Apart from this, the emerging trends of urbanization and smart cities, which emphasize intelligent transport systems, are facilitating the adoption of ADAS, as these technologies align with the concept of smart mobility. Other factors, including rising vehicle electrifications, increasing investment in the development of advanced ADAS, and rapid infrastructural improvement activities, are anticipated to drive the market growth.

Advanced Driver Assistance Systems Market Trends/Drivers:

The implementation of stringent safety regulations

The imposition of stringent safety regulations by governmental bodies and international regulatory organizations around the world is a pivotal factor in propelling the market growth. Authorities across the globe have mandated or highly recommended the use of certain ADAS technologies due to their proven ability to reduce road accidents. These mandates include requirements for systems such as electronic stability control, lane departure warning, pedestrian detection, collision detection, and automatic emergency braking. The increased emphasis on safety standards pushes automobile manufacturers to incorporate more ADAS features in their vehicles. Furthermore, the move toward the standardization of ADAS technologies also encourages their adoption, as it helps to overcome compatibility and interoperability challenges. As regulations continue to evolve, the demand for ADAS is expected to increase, shaping the future of the automotive industry.

The increasing incidences of road accidents

The surge in road accidents globally due to distracted driving, speeding, weather conditions, alcohol consumption, and human error is a significant driving force behind the expanding market. ADAS technologies, such as lane departure warning, collision warning, and blind-spot detection, are specifically designed to counteract common driving errors and improve overall road safety. These systems work by providing real-time feedback and alerts to the driver and taking corrective actions when dangerous situations arise. Furthermore, the rising awareness about the role of ADAS in preventing accidents has led to increased consumer demand for such features in vehicles. This, in turn, encourages automotive manufacturers to invest more in ADAS technology development and integration, consequently expanding the market.

Rapid technological advancements

Recent advancements in technology, including artificial intelligence (AI), machine learning (ML), sensor technology, and data analytics, are playing a crucial role in enhancing ADAS functionality and reliability. Modern ADAS relies on advanced sensors, such as radio detection and ranging (RADAR), light detection and ranging (LIDAR), ultrasonic, and camera systems, to collect data about the vehicle's environment. Advanced artificial intelligence (AI) algorithms interpret this data, enabling the system to respond appropriately to a wide variety of driving situations. Furthermore, the introduction of advanced communication technologies such as Vehicle-to-Vehicle (V2V) and Vehicle-to-Infrastructure (V2I) also contribute to the effectiveness of ADAS, offering real-time traffic and environmental information, which further improves the safety and efficiency of these systems. As technology continues to evolve, the ADAS will become more advanced and widespread, effectively propelling the growth of the ADAS market.

Advanced Driver Assistance Systems Industry Segmentation:

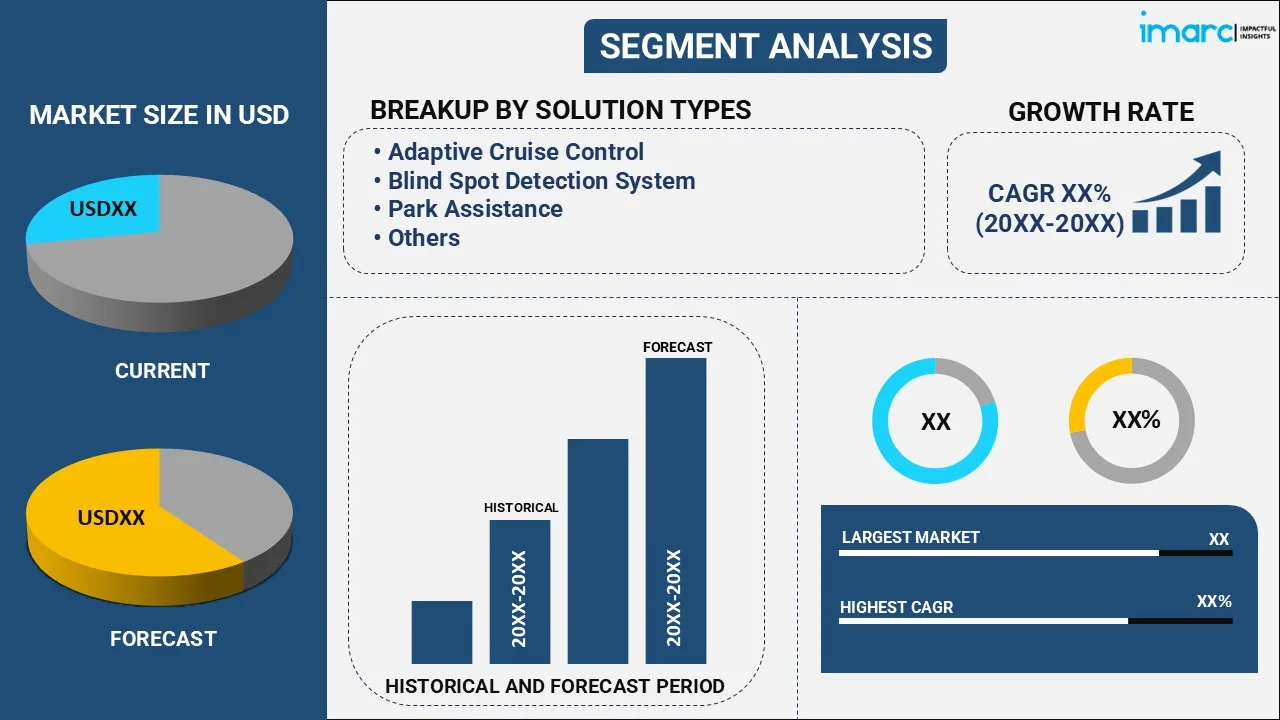

IMARC Group provides an analysis of the key trends in each segment of the global advanced driver assistance systems market report, along with forecasts at the global, regional and country levels from 2026-2034. Our report has categorized the market based on solution type, component type and vehicle type.

Breakup by Solution Type:

To get detailed segment analysis of this market Request Sample

- Adaptive Cruise Control

- Blind Spot Detection System

- Park Assistance

- Lane Departure Warning System

- Tire Pressure Monitoring System

- Autonomous Emergency Braking

- Adaptive Front Lights

- Others

Tire pressure monitoring system dominates the market

The report has provided a detailed breakup and analysis of the market based on the solution type. This includes adaptive cruise control, blind spot detection system, park assistance, lane departure warning system, tire pressure monitoring system, autonomous emergency braking, adaptive front lights, and others. According to the report, the tire pressure monitoring system represented the largest market segment.

The tire pressure monitoring system (TPMS) is dominating the market owing to the enhanced safety regulations and standards worldwide, which mandate the installation of TPMS in new vehicles to ensure safety and reduce accidents caused by improperly inflated tires. Furthermore, a well-maintained TPMS significantly enhances fuel efficiency and extends tire life. It also alerts drivers when the tire pressure is too low, enabling prompt corrective action, which can save fuel and decrease tire wear. Apart from this, the technology behind TPMS is mature and cost-effective compared to some other ADAS technologies. This ease of integration and affordability make TPMS an attractive feature for automotive manufacturers aiming to enhance the safety profile of their vehicles without significantly increasing costs.

Breakup by Component Type:

- Processor

- Sensors

- Radar

- Ultrasonic

- LiDAR

- Others

- Software

- Others

Sensors dominate the market

The report has provided a detailed breakup and analysis of the market based on the component type. This includes processor, sensors (radar, ultrasonic, lidar, and others), software, and others. According to the report, sensors represented the largest market segment.

Sensors play a pivotal role in advanced driver assistance systems (ADAS) due to their crucial function in collecting real-time data from the vehicle's environment. This data is fundamental to the functioning of ADAS as it enables these systems to identify potential hazards, navigate the road, and make informed decisions. Different types of sensors, such as RADAR, LIDAR, ultrasonic, and camera sensors, each with their unique capabilities, allow ADAS to monitor various aspects of the vehicle's surroundings. Furthermore, the increasing trend towards higher-level automation in vehicles necessitates the use of more advanced and diversified sensor systems, which is driving the demand for sensors in ADAS. Moreover, the rapid evolution of sensor technology, which includes advancements in sensor fusion where data from different sensors are combined for more accurate and reliable perception, further contributes to their dominance in the market.

Breakup by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

Passenger cars dominate the market

The report has provided a detailed breakup and analysis of the market based on vehicle type. This includes passenger cars and commercial vehicles. According to the report, passenger cars represented the largest market segment.

Passenger cars are dominating the market as they make up the largest segment of the automotive market globally. This prevalence inherently results in a higher demand for ADAS in passenger cars compared to other vehicle types. Furthermore, consumer demand for safety and comfort in personal transportation is driving manufacturers to integrate more ADAS features in passenger cars. Features such as parking assistance, automatic emergency braking, and blind-spot detection are becoming increasingly standard in new models, even in non-luxury passenger cars. Additionally, the implementation of stringent safety regulations and standards mandating the inclusion of certain ADAS features in passenger cars is boosting the market growth. Moreover, insurance companies are increasingly offering lower premiums for passenger cars equipped with ADAS, providing a financial incentive for consumers to opt for these systems.

Breakup by Region:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance in the market, accounting for the largest advanced driver assistance systems market share

The report has also provided a comprehensive analysis of all the major regional markets, which includes North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represented the largest market segment.

The Asia Pacific region is dominating the market due to the presence of a large automotive industry. The region boasts a robust presence of key automotive manufacturers and suppliers, creating a conducive environment for the growth and adoption of ADAS. In addition, local manufacturers are increasingly integrating ADAS in vehicles, owing to the rising consumer demand for safety and advanced features. Moreover, regional governments are implementing stricter safety regulations and promoting the adoption of ADAS to reduce road fatalities, which, in turn, pushes automakers to equip their vehicles with these systems. Besides this, the region is also witnessing rapid urbanization, which is driving the demand for smarter and safer transportation systems. Along with this, the Asia Pacific region is experiencing significant advancements in infrastructure, such as 5G networks and improved road systems, which enhance the effectiveness of ADAS, further propelling its adoption.

Competitive Landscape:

The leading players in the market are heavily investing in research and development (R&D) to introduce cutting-edge technologies, enhance system efficiency, and reduce costs. They are focusing on innovations in areas such as artificial intelligence (AI), machine learning (ML), and sensor fusion to advance ADAS capabilities. Furthermore, companies are forming strategic partnerships and collaborations with automakers and other industry stakeholders to share expertise and accelerate the development of ADAS. Besides this, the leading companies are bolstering their manufacturing and supply chain to meet the growing demand for ADAS. This includes scaling production, optimizing processes, and strengthening relationships with suppliers. Moreover, key market players are working closely with regulatory bodies to ensure their systems meet evolving safety standards. They are actively involved in discussions and consultations related to future regulations and standards for ADAS and autonomous vehicles.

The report has provided a comprehensive analysis of the competitive landscape in the global advanced driver assistance systems market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Autoliv Inc.

- Continental AG

- Denso Corporation

- Hyundai Mobis Co. Ltd (Hyundai Motor Group)

- Magna International Inc.

- Mobileye (Intel Corporation)

- Robert Bosch GmbH

- Texas Instruments Incorporated

- Valeo

- ZF Friedrichshafen AG

Recent Developments:

- In Jan 2023, Continental AG announced a partnership with Ambarella Inc. to develop end-to-end hardware and software solutions for ADAS systems.

- In April 2021, Denso Corporation announced that it had delivered ADAS products for the new Lexus LS and Toyota Mirai advanced drive system.

- In November 2021, Hyundai Mobis Co. Ltd (Hyundai Motor Group) announced that it had developed the world’s first urban ADAS called Mobis Parking System (MPS).

Advanced Driver Assistance Systems Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Solution Types Covered | Adaptive Cruise Control, Blind Spot Detection System, Park Assistance, Lane Departure Warning System, Tire Pressure Monitoring System, Autonomous Emergency Braking, Adaptive Front Lights, Others |

| Component Types Covered |

|

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Autoliv Inc., Continental AG, Denso Corporation, Hyundai Mobis Co. Ltd (Hyundai Motor Group), Magna International Inc., Mobileye (Intel Corporation), Robert Bosch GmbH, Texas Instruments Incorporated, Valeo, ZF Friedrichshafen AG etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the advanced driver assistance systems market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global advanced driver assistance systems market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the advanced driver assistance systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global advanced driver assistance systems market was valued at USD 33.6 Billion in 2025.

We expect the global advanced driver assistance systems market to exhibit a CAGR of 8.12% during 2026-2034.

The increasing consumer inclination towards improved safety, security, comfort, and luxury in vehicles is primarily driving the global advanced driver assistance systems market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous manufacturing units for advanced driver assistance systems.

Based on the solution type, the global advanced driver assistance systems market can be bifurcated into adaptive cruise control, blind spot detection system, park assistance, lane departure warning system, tire pressure monitoring system, autonomous emergency braking, adaptive front lights, and others. Currently, tire pressure monitoring system exhibits a clear dominance in the market.

Based on the component type, the global advanced driver assistance systems market has been divided into processor, sensors, software, and others. Among these, sensors currently account for the majority of the global market share.

Based on the vehicle type, the global advanced driver assistance systems market can be categorized into passenger cars and commercial vehicles. Currently, passenger cars hold the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Asia-Pacific currently dominates the global market.

Some of the major players in the global advanced driver assistance systems market include Autoliv Inc., Continental AG, Denso Corporation, Hyundai Mobis Co. Ltd (Hyundai Motor Group), Magna International Inc., Mobileye (Intel Corporation), Robert Bosch GmbH, Texas Instruments Incorporated, Valeo, and ZF Friedrichshafen AG.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)