Advanced Combat Helmet Market Size, Share, Trends and Forecast by Material, Application, and Region, 2025-2033

Advanced Combat Helmet Market Size and Share:

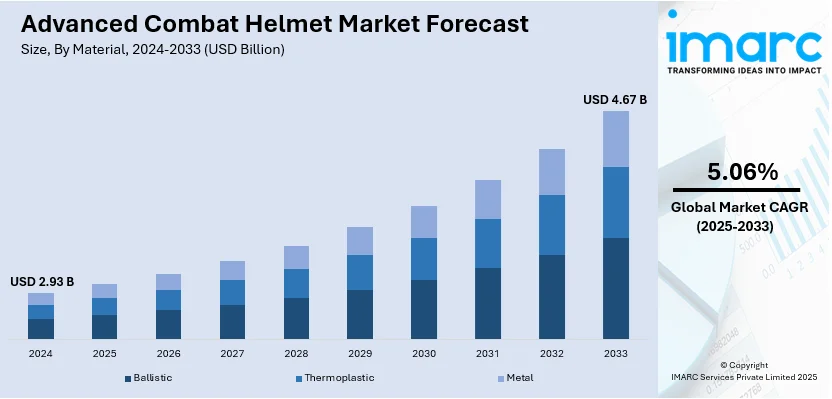

The global advanced combat helmet market size was valued at USD 2.93 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.67 Billion by 2033, exhibiting a CAGR of 5.06% from 2025-2033. North America currently dominates the market, holding a market share of over 35.4% in 2024. The market is growing due to increasing military modernization, rising defense budgets and advancements in ballistic materials. Geopolitical tensions and law enforcement adoption further boost growth. Continuous R&D and technological innovations shape the competitive landscape influencing advanced combat helmet market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.93 Billion |

|

Market Forecast in 2033

|

USD 4.67 Billion |

| Market Growth Rate (2025-2033) | 5.06% |

The advanced combat helmet market is expanding due to rising military modernization programs, increasing defense budgets and growing concerns over soldier protection. Enhanced ballistic protection, lightweight materials and integration of communication systems are driving innovation. Technological advancements including augmented reality (AR) and night vision capabilities further boost adoption. For instance, in November 2023, MKU Limited announced the launch of the Kavro Doma 360 a revolutionary rifle-rated ballistic helmet at Milipol Paris. This helmet provides uniform protection across all five zones of the head and supports seamless integration with night vision and other advanced equipment enhancing safety for military and law enforcement personnel worldwide. Demand from law enforcement agencies and special forces also fuels advanced combat helmet market demand. Geopolitical tensions and asymmetric warfare scenarios continue to accelerate procurement with manufacturers focusing on durability, comfort and multi-threat resistance for next-generation helmets.

The U.S. advanced combat helmet market is driven by rising defense spending, military modernization initiatives and increasing demand for lightweight and high-protection helmets. Enhanced ballistic resistance, integration of communication and AR technologies and night vision compatibility are key factors boosting adoption. Growing threats from asymmetric warfare and urban combat scenarios necessitate advanced protective gear. Additionally, procurement by law enforcement agencies and special forces along with ongoing research into next-generation materials like nanocomposites supports market growth and innovation in helmet design.

Advanced Combat Helmet Market Trends:

Growing Emphasis on Soldier Comfort

The helmet industry is shifting towards developing designs that prioritize both protection and comfort. This includes features like adjustable padding and ergonomic shapes to reduce fatigue during extended combat scenarios. In February 2024, the U.S. Army began deploying its latest combat helmet, known as the next-generation integrated head protection system (NG-IHPS), for soldiers engaged in close-combat situations. This helmet offers enhanced ballistic and fragmentation protection while being 40% lighter than previous models.

Focus on Lightweight Materials

According to insights from the advanced combat helmet market analysis, manufacturers are putting greater emphasis on creating helmets from lightweight ballistic materials such as Kevlar and UHMWPE. These materials enhance protection while minimizing the physical load on soldiers during combat. In February 2024, U.S. Army paratroopers started testing a new close-combat helmet designed to stop bullets, resembling a catcher's mitt, which offers the same level of protection as earlier versions but is 22% lighter.

Increased Fundraising for Soldier Equipment Innovation

The advanced combat helmet market outlook indicates that companies are actively seeking investments to develop helmets that incorporate advanced technologies aimed at enhancing safety and functionality. This trend fosters innovation in materials and features that elevate soldier safety. In April 2024, BAYKAR achieved a record by exporting approximately US$5.5 billion worth of defense equipment.

Advanced Combat Helmet Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global advanced combat helmet market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on material and application.

Analysis by Material:

- Ballistic

- Thermoplastic

- Metal

Ballistic stands as the largest material in 2024, holding around 67.5% of the market. Ballistic materials dominate the advanced combat helmet market due to their superior impact resistance, lightweight properties, and enhanced durability. Materials like Kevlar, aramid fibers, and ultra-high-molecular-weight polyethylene (UHMWPE) provide high ballistic protection while ensuring soldier mobility and comfort. The growing need for advanced headgear capable of withstanding multiple threats, including bullets and shrapnel, drives demand. Continuous research into next-generation ballistic composites further strengthens market growth, with defense agencies prioritizing enhanced survivability and reduced fatigue for military personnel.

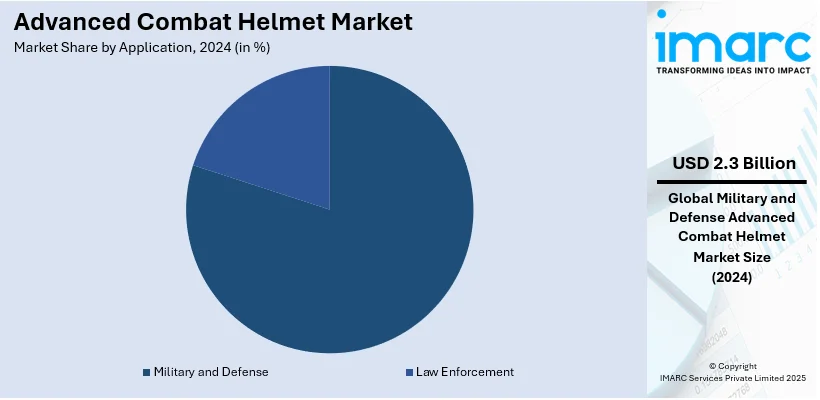

Analysis by Application:

- Military and Defense

- Law Enforcement

Military and defense sector leads the market with around 77.9% of market share in 2024. The military and defense sector dominates the advanced combat helmet market, driven by rising defense budgets, ongoing modernization programs, and increasing focus on soldier protection. Armies worldwide prioritize helmets with advanced ballistic resistance, communication integration, and lightweight designs to enhance battlefield performance. Growing threats from asymmetric warfare and urban combat further fuel demand. Governments invest in next-generation protective gear with features like augmented reality and night vision compatibility, ensuring enhanced situational awareness and survivability for military personnel in high-risk operations.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35.4%. North America leads the advanced combat helmet market due to high defense spending, continuous military modernization programs, and strong law enforcement demand. The U.S. Department of Defense invests heavily in next-generation helmets with enhanced ballistic protection, communication systems, and lightweight materials. Ongoing research in nanotechnology and advanced composites further strengthens regional dominance. Additionally, rising geopolitical tensions and counterterrorism operations drive procurement. The presence of key manufacturers and defense contractors ensures innovation, with a focus on improving soldier safety and battlefield effectiveness.

Key Regional Takeaways:

United States Advanced Combat Helmet Market Analysis

In 2024, the United States accounted for over 88.60% of the advanced combat helmet market in North America. The United States advanced combat helmet market is driven by increasing defense expenditure and the continuous evolution of military technologies. The U.S. Department of Defense states that the Biden-Harris Administration's proposed Fiscal Year (FY) 2025 budget request of USD 849.8 Billion for the Department of Defense (DoD) underscores the government's commitment to military modernization and enhanced soldier protection. This focus has accelerated the development of helmets that offer superior ballistic protection, lightweight construction, and enhanced situational awareness. Advancements in materials such as high-performance fibers and composite polymers contribute to improved durability and impact resistance while maintaining comfort and mobility for soldiers. The integration of smart technologies, including augmented reality (AR) displays, real-time communication systems, and sensor-based threat detection, is gaining traction, enhancing battlefield efficiency. Growing concerns about asymmetric warfare, counterterrorism operations, and the need for improved soldier protection in urban and high-risk environments further fuel market expansion. Research and development efforts are fostering next-generation combat helmets with adaptive modular designs, allowing for customizable configurations based on mission requirements. Additionally, the increasing adoption of lightweight, ergonomic designs with advanced ventilation systems enhances soldier endurance and performance.

Europe Advanced Combat Helmet Market Analysis

The European advanced combat helmet market is witnessing steady expansion, supported by modernization initiatives within military forces. The European Defence Agency's data reveals that member states’ defense expenditure is set to reach €326 Billion (USD 349.2 Billion) in 2024, accounting for 1.9% of the EU’s GDP. This increasing investment underscores the region’s commitment to enhancing soldier protection and battlefield capabilities. There is a strong emphasis on developing helmets with high ballistic resistance, lightweight construction, and enhanced communication capabilities to improve battlefield efficiency. Innovations in material science, such as the use of nanotechnology and high-performance synthetic fibers, are driving the production of next-generation helmets with superior impact absorption and durability. The European advanced combat helmet market is expected to grow due to joint military collaborations, multinational security initiatives, and a hybrid warfare focus. The market is expected to experience sustained development in the coming years, as military forces prioritize improved helmet resistance and situational awareness systems.

Asia Pacific Advanced Combat Helmet Market Analysis

The Asia Pacific advanced combat helmet market is experiencing significant growth due to increased defense investments and widespread military modernization programs. A key indicator of this regional defense transformation is China’s rapid military advancement, with modern and advanced fighters rising from just 4% of the country’s air force in 2004-05 to 58% in 2024, according to the Observer Research Foundation. This substantial shift reflects the broader emphasis on military modernization, which extends to enhancing soldier protection and battlefield capabilities. The demand for helmets with superior ballistic protection, lightweight construction, and integrated communication systems is rising as defense forces focus on improving soldier survivability in diverse combat environments. Advancements in materials like aramid fibers, carbon composites, and impact-resistant polymers are enabling the development of durable, lightweight helmets. The Asia Pacific advanced combat helmet market is expected to grow due to domestic defense equipment, research, and modernization efforts.

Latin America Advanced Combat Helmet Market Analysis

The Latin American advanced combat helmet market is expanding, driven by ongoing military modernization efforts and the growing need for improved soldier protection. Reflecting this trend, Mexico’s military expenditure reached USD 11.8 Billion in 2023, according to reports, highlighting the region’s increasing investment in defense capabilities. Defense forces are increasingly prioritizing helmets with advanced ballistic resistance, ergonomic designs, and integrated communication features to enhance operational effectiveness. The rising focus on modular helmet systems that allow for mission-specific configurations is contributing to market growth. The market for personal protective equipment is expected to grow due to advancements in lightweight composite materials and impact-resistant polymers, with increased defense budgets and research focusing on night vision compatibility, tactical communication systems, and anti-fragmentation capabilities.

Middle East and Africa Advanced Combat Helmet Market Analysis

The Middle East and Africa advanced combat helmet market is expanding due to rising defense expenditures, modernization initiatives, and the need to improve soldier protection in diverse combat environments. A key driver of this growth is Saudi Arabia’s Vision 2030 plan, which aims to allocate 50% of its military budget domestically and mandate foreign defense firms to establish local offices or partnerships. This initiative is accelerating domestic defense manufacturing and fostering innovation in advanced protective gear. The market is expected to grow due to increasing demand for superior ballistic protection, lightweight materials, and integrated communication and night vision systems. Advancements in material technology, such as high-performance fibers and composite polymers, are contributing to this growth.

Competitive Landscape:

The advanced combat helmet market is highly competitive, with companies focusing on innovation, material advancements, and technological integration. Manufacturers prioritize lightweight, high-durability helmets with enhanced ballistic protection and communication compatibility. Research into nanocomposites, augmented reality integration, and night vision capabilities drives product differentiation. Defense contracts and military modernization programs influence market positioning, with firms competing for government tenders. Collaborations with defense agencies and investments in R&D strengthen market presence. Additionally, law enforcement and special forces procurement contribute to demand, encouraging continuous product development. Strategic partnerships, mergers, and acquisitions shape the competitive landscape, enhancing manufacturing capabilities and global reach.

The report provides a comprehensive analysis of the competitive landscape in the advanced combat helmet market with detailed profiles of all major companies, including:

- ArmorSource LLC

- Avon Protection plc

- Ballistic Armor Co.

- Chase Tactical LLC

- Gentex Corporation

- MKU Limited

- Point Blank Enterprises Inc.

- Safariland LLC

Latest News and Developments:

- In November 2024, NFM Group unveiled two state-of-the-art 4th generation combat helmets—HJELM™ HC 120MT and HJELM™ HC 160F—at Milipol 2024. These helmets are specifically crafted for military and law enforcement use, offering improved protection, comfort, and functionality.

- In February 2024, U.S. Army paratroopers started testing a new close-combat helmet designed to stop bullets. This helmet, similar in protective function to its predecessor, is 22% lighter and provides comparable safety.

- In June 2024, ArmorSource ramped up production to meet the rising demand for its innovative helmets, Aire II and Crew II, from the U.S. and allied forces. Following successful evaluations and integration by the U.S. Army, orders surged, prompting the company to invest in tooling to prevent backorders and ensure a reliable supply of high-quality head protection in response to increasing global security threats.

- In November 2024, Gentex Corporation partnered with a U.S. Navy OTA to develop the Next Generation Fixed Wing Helmet (NGFWH), aimed at enhancing safety in Naval Aviation. This helmet has been verified for use with multiple aircraft, featuring reduced weight and improved balance. The 18-month project is scheduled for operational deployment in late 2025, aimed at bolstering pilot safety and effectiveness.

Advanced Combat Helmet Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Ballistic, Thermoplastic, Metal |

| Applications Covered | Military and Defense, Law Enforcement |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ArmorSource LLC, Avon Protection plc, Ballistic Armor Co., Chase Tactical LLC, Gentex Corporation, MKU Limited, Point Blank Enterprises Inc., Safariland LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the advanced combat helmet market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global advanced combat helmet market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the advanced combat helmet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The advanced combat helmet market was valued at USD 2.93 Billion in 2024.

IMARC estimates the advanced combat helmet market to reach USD 4.67 Billion by 2033, exhibiting a CAGR of 5.06% during 2025-2033.

The advanced combat helmet market is driven by rising military modernization, increasing defense budgets, and growing demand for enhanced soldier protection. Advancements in ballistic materials, integration of communication and night vision systems, and evolving asymmetric warfare threats further boost adoption. Law enforcement procurement also contributes to market expansion.

North America holds the largest share due to high defense spending, ongoing military modernization, and strong law enforcement demand. The U.S. Department of Defense invests heavily in next-generation helmets with advanced ballistic protection, communication integration, and lightweight materials, further strengthening the region’s market dominance.

Some of the major players in the advanced combat helmet market include ArmorSource LLC, Avon Protection plc, Ballistic Armor Co., Chase Tactical LLC, Gentex Corporation, MKU Limited, Point Blank Enterprises Inc., Safariland LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)