Advanced Analytics Market Size, Share, and Trends by Component, Type, Deployment Mode, Business Function, Enterprise Size, Industry Vertical, Region, and Forecasts 2025-2033

Advanced Analytics Market Size & Share:

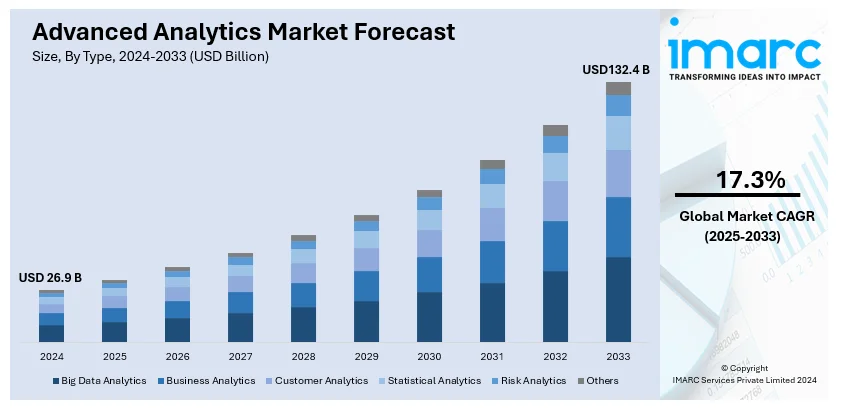

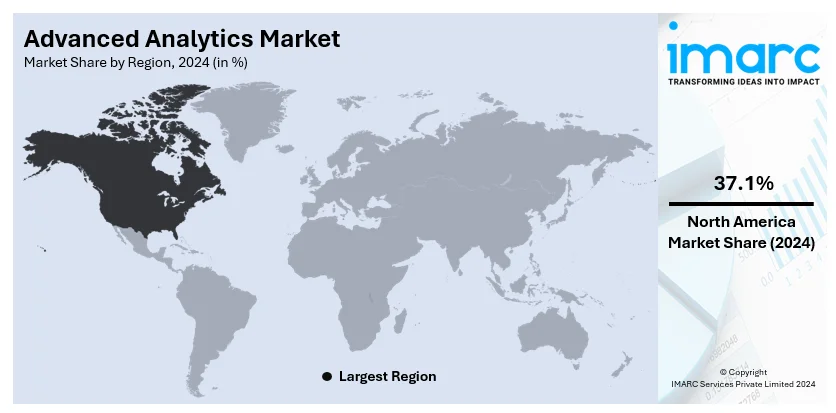

The global advanced analytics market size was valued at USD 26.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 132.4 Billion by 2033, exhibiting a CAGR of 17.3% from 2025-2033. North America currently dominates the market, holding a significant market share of over 36% in 2024. This is attributed to a robust technological infrastructure and the presence of key industry leaders.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 26.9 Billion |

|

Market Forecast in 2033

|

USD 132.4 Billion |

| Market Growth Rate 2025-2033 | 17.3% |

Several organizations are recognizing the importance of harnessing enormous amounts of structured and unstructured information to gain insights, improve customer experiences, and optimize operations. The increasing adoption of big data, advancements in AI and machine learning technologies, and expanding application areas of cloud computing have further bolstered this trend. Furthermore, the growth in demand for data-driven decision-making across diverse industries is stimulating the demand for advanced analytics solutions. In addition, the rise in digital transformation initiatives and the need for real-time analytics to address competitive pressures and evolving market demands are key factors contributing to the expansion of the market.

The United States stands out as a key market disruptor, driven by widespread digital transformation initiatives across diverse sectors where analytics is pivotal for operational optimization and strategic planning. The increasing initiatives for implementing advanced technologies in the defense sector are opening new growth avenues for the advanced analytics market growth. For instance, in July 2024, The United States Department of Defense signed a Statement of Intent (SOI) for data, analytics, and artificial intelligence cooperation with the Singapore Ministry of Defense. The SOI deploys a holistic method for technological collaboration, allowing both defense establishments to examine approaches and discuss the best practices for leveraging data, analytics, and AI capabilities at speed and scale.

The global advanced analytics market size is majorly driven by the expansion of data sources. The rapid technological advancements in AI, machine learning, and data processing are significantly contributing to the market. Medical institutions worldwide use analytics to manage patient data efficiently, propelling its demand. Besides, the rise of connected devices generates more data for analysis, stimulating market expansion. Additionally, the e-commerce expansion and the growing financial market capabilities are providing a boost to the market.

Advanced Analytics Market Trends:

AI and Machine Learning Driving Predictive Analytics

Organizations are increasingly integrating artificial intelligence (AI) and machine learning (ML) into their analytics frameworks to enhance forecasting and automate decision-making. Around 60% of large enterprises are adopting predictive analytics tools powered by AI to improve operational efficiency and customer targeting. ML algorithms have proven to reduce churn rates by 20-30% in key sectors like retail and telecom. The fusion of AI/ML with advanced analytics is helping businesses transform raw data into actionable insights faster and with greater accuracy.

Proliferation of Real-Time Data Analytics

The demand for real-time data processing is surging as businesses aim to derive immediate insights, especially in industries like e-commerce, finance, and healthcare. Over 50% of businesses report a 25% increase in operational decision-making speed through real-time analytics implementation. Additionally, sectors like financial services have observed a 35% reduction in fraud incidents by utilizing real-time fraud detection models. The adoption of real-time analytics tools enables businesses to stay agile and adapt to rapidly changing market or customer conditions.

Growing Use of Cloud-Based Analytics Platforms

The transition to cloud-based analytics is enabling organizations to handle massive datasets while benefiting from scalability, cost savings, and remote accessibility. Cloud-based analytics adoption has grown by 40% year-over-year, with enterprises processing up to 60% of their data in cloud environments. These solutions reduce infrastructure costs by 25-30%, making analytics more accessible to mid-sized businesses. Cloud solutions are democratizing analytics by lowering barriers for organizations of all sizes, driving market growth and innovation.

Advanced Analytics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global advanced analytics market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, type, deployment mode, business function, enterprise size, industry vertical, and region.

Analysis by Component:

- Software

- Services

- Professional Services

- Managed Services

The software segment stands as the largest component in 2024, holding around 60% of the market. Advanced analytics software, encompassing tools for predictive analytics, machine learning, data visualization, and data mining, has become indispensable for businesses aiming to remain competitive. Its wide adoption across sectors such as finance, retail, healthcare, and manufacturing is a testament to its utility. For instance, financial institutions leveraging predictive analytics software have reported a 40% improvement in credit decision accuracy, reducing risks associated with non-performing assets. Additionally, companies deploying analytics software have observed a 25-30% increase in operational efficiency through automation and faster decision-making processes.

The software segment also benefits from advancements in technologies like AI and machine learning, which enhance predictive capabilities and enable real-time insights. Moreover, the scalability of software solutions allows organizations to process massive datasets efficiently. These capabilities, coupled with cost efficiency and customization options, solidify the software segment's position as the dominant component in the advanced analytics market.

Analysis by Type:

- Big Data Analytics

- Business Analytics

- Customer Analytics

- Statistical Analytics

- Risk Analytics

- Others

Big data analytics leads the market with around 32% of market share in 2024, driven by the widespread adoption of Industrial Internet of Things (IIoT) and AI technologies to process vast volumes of structured and unstructured data efficiently. Approximately 70% of large organizations globally use big data analytics to identify patterns in operational data, leading to a 25% improvement in operational efficiency. Moreover, companies utilizing big data analytics in retail experience an 18% increase in customer retention rates due to better-targeted marketing efforts. Business analytics, focusing on statistical analysis and predictive modeling, plays a pivotal role in financial forecasting, operational efficiency, and market trend analysis, further driving demand.

Big data analytics is also the fastest-growing segment within the global advanced analytics market. This growth is fueled by the increasing generation of vast data volumes across industries like retail, finance, and healthcare, coupled with advancements in AI and machine learning. Organizations are leveraging big data analytics to process and analyze complex datasets, resulting in better decision-making and operational efficiency. For example, in finance, big data analytics has reduced fraud detection times by up to 30%, while in healthcare, predictive models built on big data have improved patient outcome predictions by over 40%. The ability to integrate diverse data sources and deliver real-time insights makes big data analytics indispensable, driving its rapid adoption and expansion.

Analysis by Deployment Mode:

- On-premises

- Cloud-based

On-premises deployment remains the largest segment, holding around 62% of the market share in 2024. Industries like banking, financial services, and government prioritize on-premises solutions due to heightened concerns over data security, compliance, and customization. Organizations deploying on-premises advanced analytics have reported a 30-35% reduction in data breaches due to localized security protocols. Additionally, on-premises deployment allows for greater customization, which is crucial for sectors with specific analytical needs, such as healthcare and manufacturing. While the upfront costs of infrastructure setup are higher, organizations often find the long-term benefits of enhanced control and data ownership outweigh the initial investment.

On the other hand, cloud-based deployment is the fastest-growing category, fueled by its scalability, cost-effectiveness, and ease of access. Businesses increasingly adopt cloud-based analytics to handle large datasets without the need for heavy infrastructure investments. For instance, mid-sized companies report a 25-30% reduction in operational costs after transitioning to cloud analytics platforms. The flexibility of cloud solutions enables real-time collaboration and remote accessibility, which has become a critical need in the post-pandemic era. Industries like retail and e-commerce are driving the adoption of cloud-based analytics, leveraging its capabilities to enhance dynamic pricing strategies and personalize customer experiences. With the rapid advancements in cloud security and the growing adoption of hybrid models, the cloud-based segment is expected to surpass on-premises deployment in the coming years, marking a significant shift in the advanced analytics market landscape.

Analysis by Business Function:

- Supply Chain

- Sales and Marketing

- Finance

- Human Resource (HR)

- Others

In 2024, supply chain analytics represented the most popular business function globally, holding a market share of around 27%. This dominance is driven by the increasing complexity of global supply chains and the need for real-time visibility and operational efficiency. Organizations are leveraging supply chain analytics to optimize inventory management, forecast demand, and improve logistics operations. Businesses implementing supply chain analytics have reported up to a 20% improvement in order fulfillment rates and a 15% reduction in inventory carrying costs. Additionally, advanced analytics tools enable companies to proactively address potential disruptions, mitigating risks and ensuring continuity in operations.

The rapid growth of this segment is further fueled by advancements in predictive and prescriptive analytics, which empower companies to anticipate market fluctuations and align supply chain strategies accordingly. As industries embrace digital transformation, the adoption of supply chain analytics is accelerating, supported by trends like the rise of e-commerce, the adoption of IoT in logistics, and the increasing need for sustainability in supply chain operations. This dual role as the largest and fastest-growing segment underscores its critical importance in today’s dynamic business landscape.

Analysis by Enterprise Size:

- Large Enterprise

- Small and Medium-sized Enterprise

Large enterprises play a significant role in driving market demand within the advanced analytics landscape. These organizations often possess vast amounts of data from various sources and need sophisticated analytics tools to extract valuable insights. The complexity of operations within large enterprises demands advanced analytics solutions to optimize processes, enhance decision-making, and gain a competitive edge. Predictive and prescriptive analytics help these organizations forecast trends, identify opportunities, and make informed choices across multiple departments.

Large enterprises have the resources to invest in building robust analytics teams or partnering with analytics service providers. The integration of AI and machine learning into analytics strategies allows them to delve deeper into data to uncover patterns and correlations that drive strategic decisions. As large enterprises prioritize data-driven decision-making, the demand for advanced analytics solutions tailored to their needs continues to grow. Their adoption of these solutions serves as a driving force behind market expansion, propelling innovation and technological advancements in advanced analytics.

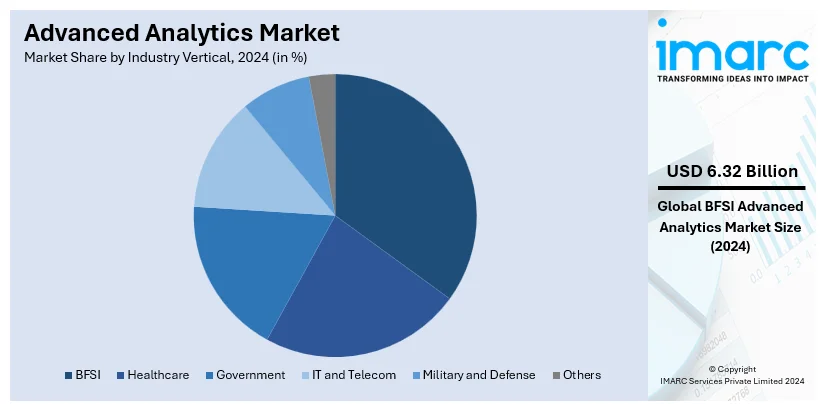

Analysis by Industry Vertical:

- BFSI

- Healthcare

- Government

- IT and Telecom

- Military and Defense

- Others

The BFSI (Banking, Financial Services, and Insurance) sector holds the largest market share of around 20% in 2024. Financial institutions increasingly adopt advanced analytics to enhance credit scoring, detect fraudulent activities, and offer personalized financial products. For example, organizations using advanced fraud detection analytics report a 40% reduction in fraud losses, while predictive analytics in credit risk management has improved loan default prediction accuracy by 30%. Additionally, the BFSI sector relies heavily on analytics to navigate regulatory compliance, streamline operations, and improve investment strategies, making it the dominant vertical in this market.

On the other hand, the healthcare sector is the fastest-growing category, propelled by the increasing adoption of advanced analytics in clinical decision support, patient care, and operational efficiency. Advanced analytics is also playing a pivotal role in accelerating drug discovery and enabling precision medicine by analyzing vast genomic datasets. As the global healthcare landscape evolves to focus more on data-driven care, the adoption of advanced analytics in this sector is expected to continue its rapid growth, transforming the way healthcare is delivered and managed.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest advanced analytics market share of over 37%. The presence of prominent analytics solution firms, coupled with significant investments in research and development, strengthens North America's position. For example, over 65% of organizations in North America report utilizing advanced analytics in decision-making, with industries like BFSI and healthcare leading the way in adoption. Additionally, the sector benefits from regulatory frameworks that encourage data utilization and innovation, such as healthcare analytics designed to improve patient results and fraud detection systems in financial services.

Additionally, the Asia Pacific is the most quickly expanding area, driven by swift industrialization, digital advancements, and the rising use of analytics in developing economies such as India, China, and Southeast Asia. The expansion is additionally driven by government efforts encouraging digital transformation and smart city initiatives, which depend significantly on advanced analytics. Moreover, the rising penetration of cloud technologies and an expanding e-commerce sector are driving demand for advanced analytics tools, positioning Asia Pacific as a key growth driver in the global market.

Key Regional Takeaways:

United States Advanced Analytics Market Analysis

The United States is the most lucrative market in North America, which accounted for around 90% market share in 2023. The country leads in technological advancements and significant investment in AI, cloud-based analytics solutions, and big data, with companies adopting analytics platforms to streamline operations, enhance business intelligence, and optimize customer experiences. The growing push towards automation and real-time analytics is one of the key trends in the U.S. market.

The U.S. is home to global technology giants including Google, Microsoft, and IBM, which thereby steers innovation in advanced analytics technologies. The increasing collaborations of these tech giants with emerging companies is projected to further boost the market potential. For instance, in August 2024, Microsoft Corporation announced a strategic partnership with Palantir Technologies Inc. to introduce cutting-edge and secure cloud, AI, and analytics capabilities to the U.S. Defense and Intelligence Community. This is a first-of-its-kind, comprehensive suite of technology that will enable critical national security missions to implement Microsoft’s best-in-class large language models (LLMs) with the help of Azure OpenAI Service within Palantir’s AI Platforms (AIP) in Microsoft’s government and classified cloud environments.

Europe Advanced Analytics Market Analysis

Strict data protection laws in Europe, particularly the General Data Protection Regulation (GDPR), establish stringent rules for organizations handling personal data of EU residents. Such strict laws compel organizations to adopt secure and compliant analytics solutions. The region is experiencing robust growth across industries, including finance, automotive, and manufacturing where predictive analytics improves production efficiency, risk management, and customer engagement capabilities.

The players in the region strongly focus on sustainability, with analytics increasingly being integrated into green technologies and environmental initiatives. In addition, increasing investments for expanding the reach of companies in other key markets is opportunistic for the market participants. For instance, in November 2024, big xyt, a Frankfurt-based data analytics company in the BFSI sector, secured funding of €10 Million from Finch Capital. The company aims to employ the funds to expand its market presence in prominent markets, including Europe, the United States, and Asia Pacific.

Asia Pacific Advanced Analytics Market Analysis

The advanced analytics market in Asia-Pacific is experiencing rapid growth, driven by widespread digital transformation efforts across several countries in the region. Key sectors including finance and healthcare are increasingly adopting analytics tools for improved decision-making and customer experience. Countries including China, India, and Japan are witnessing rapid transformation, with significant investments in AI, machine learning, and predictive analytics. Additionally, government support for digital initiatives, such as the development of smart cities and advanced manufacturing, further accelerates analytics adoption and supports market growth in the region. The demand for cloud-based and real-time analytics solutions is also expanding, facilitating easier data management.

Latin America Advanced Analytics Market Analysis

The increasing internet penetration in Latin America is significantly propelling the growth of the advanced analytics market. For instance, according to an article published by Data Portal, as of January 2024, Brazil had 187.9 million internet users. At the beginning of 2024, Brazil had an internet penetration rate of 86.6% of its population. Advanced analytics tools are essential for processing this data to provide real-time insights.

Middle East and Africa Advanced Analytics Market Analysis

Several MEA countries have implemented policies and made substantial investments to foster AI and analytics adoption. For instance, Saudi Arabia's Vision 2030 plan emphasizes the development of AI and data analytics to diversify the economy and improve public services, further propelling the advanced analytics market growth in the region.

Competitive Landscape:

Leading market companies are strengthening the market growth by pioneering innovation, expertise, and comprehensive solutions. Their robust platforms offer a range of applications, from predictive analytics to prescriptive recommendations, catering to diverse business needs. The companies also contribute to market growth by offering consultancy services and helping businesses navigate the complexities of data analysis. Their thought leadership and educational initiatives promote the adoption of advanced analytics, fostering a data-driven culture. Moreover, their partnerships and collaborations with other technology providers create ecosystems that support holistic solutions. Key companies support businesses seeking transformative insights by continuously pushing the boundaries of what analytics can achieve. Their contributions propel the entire market forward, encouraging innovation, driving adoption, and shaping the future of data-driven decision-making.

The report provides a comprehensive analysis of the competitive landscape in the advanced analytics market with detailed profiles of all major companies, including:

- Absolutdata Technologies Inc. (Infogain Corporation)

- Adobe Inc.

- Altair Engineering Inc.

- Alteryx Inc.

- Amazon Web Services Inc. (Amazon.com Inc.)

- Fair Isaac Corporation (FICO)

- Hewlett Packard Enterprise Company

- International Business Machines Corporation

- Microsoft Corporation

- Moody's Analytics Inc. (Moody's Corporation)

- SAS Institute Inc.

- TIBCO Software Inc.

Latest News and Developments:

- January 2025: The Government of Indian announced plans to launch an AI-backed data analytics platform to enhance trade insights. The initiative aims to provide consistent and accurate trade data, addressing issues like gold import data errors. A committee from the commerce and finance ministries has been formed to oversee this project.

- January 2025: Clarivate launched DRG Fusion, a new life sciences analytics platform powered by real-world data. The platform helps biopharma and medtech organizations optimize commercial strategies, improve patient outcomes, and navigate complex market dynamics. It features modular workflows tailored to specific business needs like patient journey analysis, market access optimization, and commercial targeting.

- October 2024: Oracle introduced Oracle Analytics Intelligence for Life Sciences, a platform driven by AI aimed at optimizing data analysis for organizations in the life sciences sector. The platform combines real-world data, including CancerMPact and multiomics, to deliver actionable insights that enhance therapeutic strategies and boost patient outcomes. It merges Oracle Health Data Intelligence with cloud infrastructure to enhance clinical research and decision-making.

- October 2024: Broadvoice launched Advanced Analytics to enhance customer experience (CX) management by consolidating data from UCaaS and CCaaS platforms. This new feature provides real-time insights and trend analysis, enabling businesses to optimize operations, improve service levels, and drive revenue growth. The integration of AI further boosts agent performance and proactive problem-solving.

- August 2024: X introduced an updated Audience Insights feature for Premium users, providing new analytics tools to help marketers and publishers better understand their audience's demographics, including age, gender, and location. The updated platform also includes insights into active user times to improve posting strategies. This development aims to make X more competitive with third-party analytics tools, though the advanced features are exclusive to Premium subscribers.

- In September 2024, Amazon Web Services and Oracle unveiled the launch of Oracle Database@AWS, a solution that enables users to access Oracle Autonomous Database on dedicated infrastructure and Oracle Exadata Database Service within AWS ecosystem. With the help of this platform, the customers can seamlessly and securely connect and analyze data across Oracle Database services and applications that run on AWS to get quicker and deeper insights without the need to build pipelines.

- In September 2024, HireClix announced the launch of HireClix Advanced Analytics Dashboard. The solution streamlines data sources and determines the key areas of spend and associated performance, enabling enhanced clarity into which recruitment investments are feasible and which are not.

- In March 2024, Adobe announced a major upgrade to Adobe Experience Cloud to enable brands to unify the data of customers across their organization, while deriving value from generative AI. The platform offers a single view of customers across every channel, leveraging AI to analyze data and deliver actionable insights in real-time.

Advanced Analytics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered |

|

| Types Covered | Big Data Analytics, Business Analytics, Customer Analytics, Statistical Analytics, Risk Analytics, Others |

| Deployment Modes Covered | On-premises, Cloud-based |

| Business Functions Covered | Supply Chain, Sales and Marketing, Finance, Human Resource (HR), Others |

| Enterprise Sizes Covered | Large Enterprise, Small and Medium-sized Enterprise |

| Industry Verticals Covered | BFSI, Healthcare, Government, IT and Telecom, Military and Defense, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Absolutdata Technologies Inc. (Infogain Corporation), Adobe Inc., Altair Engineering Inc., Alteryx Inc., Amazon Web Services Inc. (Amazon.com Inc.), Fair Isaac Corporation (FICO), Hewlett Packard Enterprise Company, International Business Machines Corporation, Microsoft Corporation, Moody's Analytics Inc. (Moody's Corporation), SAS Institute Inc., TIBCO Software Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the advanced analytics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global advanced analytics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the advanced analytics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Advanced analytics is a transformative technology that empowers businesses to unearth invaluable insights from their data. Its sophisticated techniques enable organizations to make informed decisions and drive growth. Analyzing historical data and spotting trends helps anticipate future outcomes, contributing to strategic planning.

The advanced analytics market was valued at USD 26.9 Billion in 2024.

IMARC estimates the global advanced analytics market to exhibit a CAGR of 17.27% during 2025-2033.

The rising integration of AI and machine learning with advanced analytics to achieve diverse business goals, gather information, and analyze unstructured and structured data, is primarily driving the global advanced analytics market.

In 2024, software represented the largest segment by component, driven by the increasing adoption and availability of diverse tools and solutions.

Big data analytics leads the market by type owing to its exceptional ability to process and analyze vast and complex datasets.

The BFSI industry is the leading segment by industry vertical, driven by an increasing need for data-driven insights to optimize operations, manage risk, and enhance customer experiences.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global advanced analytics market include Absolutdata Technologies Inc. (Infogain Corporation), Adobe Inc., Altair Engineering Inc., Alteryx Inc., Amazon Web Services Inc. (Amazon.com Inc.), Fair Isaac Corporation (FICO), Hewlett Packard Enterprise Company, International Business Machines Corporation, Microsoft Corporation, Moody's Analytics Inc. (Moody's Corporation), SAS Institute Inc., TIBCO Software Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)