Advanced Air Mobility Market Size, Share, Trends and Forecast by Component, Application, End User, Product, Type, Maximum Take-off Weight, Operating Mode, Propulsion Type, Range, and Region, 2025-2033

Advanced Air Mobility Market Size and Share:

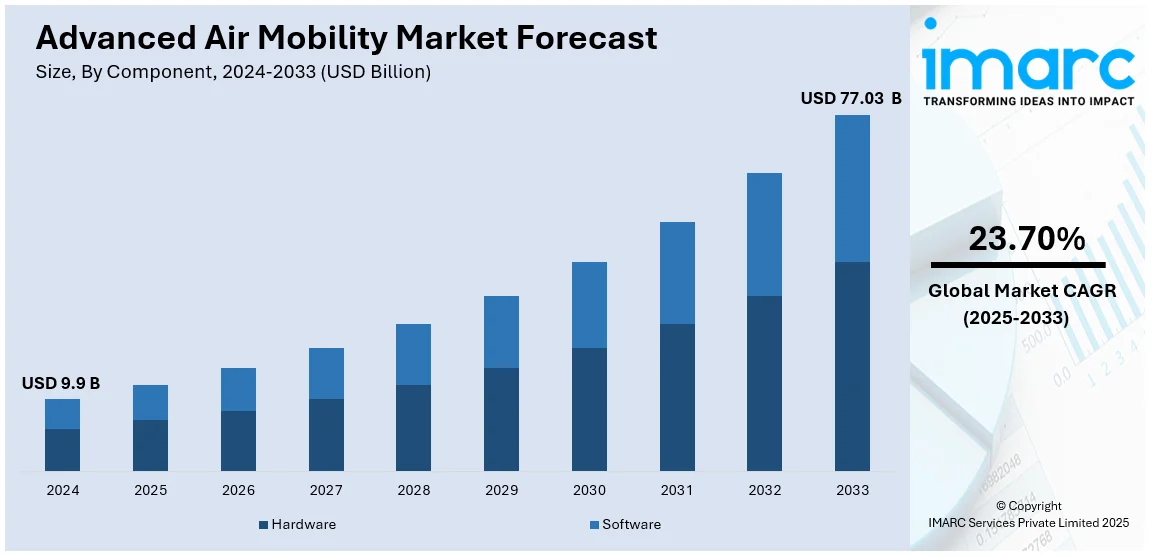

The global advanced air mobility market size was valued at USD 9.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 77.03 Billion by 2033, exhibiting a CAGR of 23.70% from 2025-2033. North America currently dominates the market, holding a market share of over 37.6% in 2024. The global market is primarily driven by continual advancements in autonomous flight technology, the ongoing development of enhanced air traffic management systems, and growing strategic collaboration between aerospace companies, governments, and private investors, all contributing to safer, more efficient, and sustainable air transportation solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.9 Billion |

| Market Forecast in 2033 | USD 77.03 Billion |

| Market Growth Rate (2025-2033) | 23.70% |

The market is majorly driven by continual technological advancements, urbanization, and the demand for sustainable transportation. In accordance with this, ongoing innovations in electric propulsion, autonomous flight systems, and lightweight materials are making air mobility solutions more feasible and efficient. For instance, Honeywell’s 2024 collaboration with Near Earth Autonomy and Leonardo Helicopters aims to enhance autonomous rotorcraft for the USMC’s Aerial Logistics Connector program, focusing on uncrewed rotorcraft for logistics and casualty evacuation, with operational aircraft targeted by 2030. The rise in urban traffic congestion is increasing demand for faster, more direct transportation options, while regulatory frameworks evolve to support advanced air mobility (AAM). Environmental concerns, including carbon reduction, further drive the development of green aviation technologies. Additionally, rising government and private investments are accelerating AAM infrastructure, supporting rapid market growth.

The United States stands out as a key regional market and is witnessing growth due to government support, technological advancements, and the growing demand for efficient transportation solutions. Similarly, favorable federal initiatives like the FAA’s Urban Air Mobility roadmap and research funding provide essential infrastructure and regulatory support. The U.S. also benefits from a thriving aerospace sector, including both established companies and startups, fostering innovation in autonomous flight, electric propulsion, and air traffic management systems. Private investments are further accelerating the development of AAM technologies. Notably, on July 23, 2024, Supernal LLC, Hyundai Motor Group's AAM company, and Sigma Air Mobility announced a partnership to develop AAM infrastructure in South and Southeast Asia, as well as Southern Europe, aiming for decarbonized and accessible air mobility. With urban congestion and sustainability goals driving demand, the U.S. market is advancing rapidly toward a new era of electric, low-emission aircraft.

Advanced Air Mobility Market Trends:

Rapid Integration of Autonomous Flight Technology

A key trend in the global air mobility market is the ongoing integration of autonomous flight technology. With constant advancements in artificial intelligence (AI), machine learning, and sensor systems, companies are increasingly focused on developing fully autonomous aircraft. For example, on January 15, 2025, Palladyne AI and Red Cat achieved a milestone with their successful multi-drone autonomous flight. Teal drones, equipped with Palladyne Pilot AI, worked collaboratively to identify, and track objects, improving situational awareness and autonomous navigation. This achievement followed their successful single-drone flight in December 2024, with plans for commercial availability by Q1 2025. Such advancements are expected to enhance safety, operational efficiency, and reduce costs, not only for air taxis and cargo drones but also for integrating advanced autonomous systems into larger aircraft, enabling the development of unmanned aviation operations across industries.

Advancements in Air Traffic Management Systems

The rise of new airspace users, including eVTOLs, drones, and autonomous aircraft, is driving the need for enhanced air traffic management (ATM) systems. With the growing volume of operations, advanced ATM systems are required to ensure safety and efficiency. These systems incorporate real-time data sharing, automated traffic control, and integrated airspace management to streamline operations and avoid conflicts. For instance, on December 17, 2024, Indra announced plans to upgrade Argentina's air traffic control systems by implementing its ManagAir solution. This modernization will standardize five control centers, optimize route planning, reduce flight times, and improve fuel efficiency. Additionally, the technology enhances sustainability by lowering CO2 emissions. As urban air mobility expands, these advancements are essential for maintaining operational efficiency and safety in congested airspace.

Increased Collaboration Among Stakeholders

The market is witnessing a growing collaboration between aerospace companies, governments, and private investors. Recognizing the complexity of developing air mobility solutions, these stakeholders are working together to create integrated ecosystems that address key challenges such as regulatory hurdles, infrastructure requirements, and safety standards. Partnerships between manufacturers, technology providers, and urban planners are crucial for developing necessary infrastructure like vertiports and charging stations to support eVTOL operations. To illustrate, on June 24, 2024, UrbanLink Air Mobility joined forces with Ferrovial Vertiports to explore the development of vertiports in U.S. markets, beginning with South Florida. This collaboration aims to enhance connectivity, sustainability, and accelerate urban air mobility. Additionally, government-private sector collaboration is vital for creating the regulatory frameworks and policies needed for safe air mobility deployment.

Advanced Air Mobility Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global advanced air mobility market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, application, end user, product, type, maximum take-off weight, operating mode, propulsion type, and range.

Analysis by Component:

- Hardware

- Software

Hardware dominates the market with a share of 83.5% in 2024, as physical components form an integral part of AAM systems and are used for the development and deployment. Demand for eVTOLs and drones is increasing, which further accelerated hardware growth during the reporting period, including propulsion systems, airframes, batteries, and navigation equipment. Advances in lightweight materials, energy-efficient power systems, and avionics will be instrumental in extending the range and improving the performance and safety of these vehicles. As the market develops, hardware investments continue to outpace software development, with manufacturers focusing on robust, reliable, and scalable systems to meet the increasing demand for urban air mobility, cargo transport, and passenger services.

Analysis by Application:

- Cargo Transport

- Passenger Transport

- Mapping and Surveying

- Special Mission

- Surveillance and Monitoring

- Others

Cargo transport is a significant growth driver in the global advanced air mobility (AAM) market, particularly as demand for faster and more efficient logistics solutions increases. With the rise of e-commerce and the need for timely deliveries, AAM offers a solution to bypass traffic and optimize delivery routes. The ability of eVTOLs to carry goods over short to medium distances while reducing fuel consumption and emissions makes it an appealing choice for logistics companies, enabling rapid, cost-effective, and environmentally sustainable cargo transportation.

Passenger transport is another key driver in AAM’s growth. Urban air mobility, including air taxis, offers a solution to the growing traffic congestion in major cities. AAM technology provides the ability to move people quickly over short distances, reducing travel time and offering an alternative to traditional ground transportation. With advancements in safety, efficiency, and regulatory support, the sector is attracting significant investments, leading to the rapid development of passenger transport solutions like air taxis and on-demand shuttle services.

Mapping and surveying also contribute to AAM's expansion, driven by the need for real-time, high-precision data collection. Drones equipped with advanced sensors and imaging technology are increasingly used for land mapping, environmental monitoring, infrastructure inspection, and agricultural surveying. These unmanned aerial systems (UAS) provide significant advantages, such as reducing the time and cost associated with manual surveys while ensuring higher accuracy. The demand for such services continues to rise as industries increasingly recognize the value of drone-based data for decision-making, regulatory compliance, and planning.

Analysis by End User:

- Commercial

- E-Commerce

- Commercial Ridesharing Operators

- Private Operators

- Medical Emergency Organizations

- Others

- Government and Military

Commercial hold a dominant share of 71.5% in the market in 2024, driven by the growing demand for efficient, cost-effective transportation solutions. Commercial sectors, including air taxis, cargo delivery, and logistics, benefit from AAM’s ability to reduce travel time and bypass congested ground routes. Moreover, advancements in eVTOL technology, with their capability for vertical takeoff and landing, allow commercial applications to operate in densely populated urban environments with limited infrastructure. With significant investment from both private and public sectors, commercial AAM is poised to scale rapidly, driven by the need for sustainable, fast, and reliable transportation options for people and goods in urban and regional areas.

Analysis by Product:

- Fixed Wing

- Rotary Blade

- Hybrid

Rotary blade leads the market, with a share of 72.5% of the share in 2024 due to their ability to offer vertical lift and horizontal flight, making them ideal for urban air mobility applications. Their design enables efficient use of space, allowing them to operate in congested urban environments where traditional aircraft would struggle. Additionally, significant advancements in electric propulsion and battery technologies have improved the performance and efficiency of rotary blade aircraft, reducing operational prices and emissions. The growing demand for faster, sustainable, and cost-effective transportation options is accelerating their adoption, helping rotary blade aircraft dominate the AAM market.

Analysis by Type:

- Air Taxis

- Drones

- Others

Drones represent the largest share in the market propelled by their versatility, cost-effectiveness, and rapid technological advancements. As unmanned aerial vehicles (UAVs), drones can perform a wide array of tasks, from cargo delivery to surveillance, agriculture, and infrastructure inspections. Their relatively low operational costs, ability to bypass traffic, and efficiency in completing tasks make them highly attractive to businesses across various sectors. In line with this, advancements in electric propulsion, battery technology, as well as autonomous flight systems are bolstering drones' capabilities and expanding their applications. The increasing demand for fast, sustainable, and safe delivery services, especially in urban areas, is also driving the dominance of drones in the AAM market.

Analysis by Maximum Take-off Weight:

- <100 kg

- 100 - 300 kg

- >300 kg

In the advanced air mobility (AAM) market, aircraft weighing less than 100 kg are gaining traction attributed to their versatility, lower operational costs, and ease of integration into existing transportation ecosystems. These lightweight drones and vehicles are primarily used for cargo delivery, aerial inspections, and emergency medical services. Their compact size allows them to navigate urban environments efficiently, bypassing ground traffic. Additionally, innovations in battery technology and automation are improving the range and operational efficiency of these lightweight aircraft, supporting their growing adoption.

Aircraft in the 100-300 kg range are experiencing significant growth due to their capacity for transporting both cargo and passengers. These vehicles strike a balance between weight, range, and payload capacity, making them preferred for regional transportation solutions. They are especially suited for short- to medium-range operations, like intercity commutes or delivery services. The development of reliable electric propulsion systems and charging infrastructure is enhancing the appeal of this weight category, fostering faster deployment, and enabling operators to meet increasing demand for efficient urban and regional air mobility.

Aircraft weighing over 300 kg play a crucial role in the AAM market as they are typically designed for higher capacity and long-range applications, including intercity flights and freight transport. These larger eVTOLs and aircraft are ideal for commercial air taxis and logistics solutions, providing passengers or goods with faster, environmentally friendly alternatives to traditional transportation. The growth of the >300 kg segment is driven by advancements in hybrid and electric propulsion, coupled with government support for large-scale infrastructure development. Their larger payload capacity and longer range offer substantial growth opportunities, particularly in urban air mobility networks.

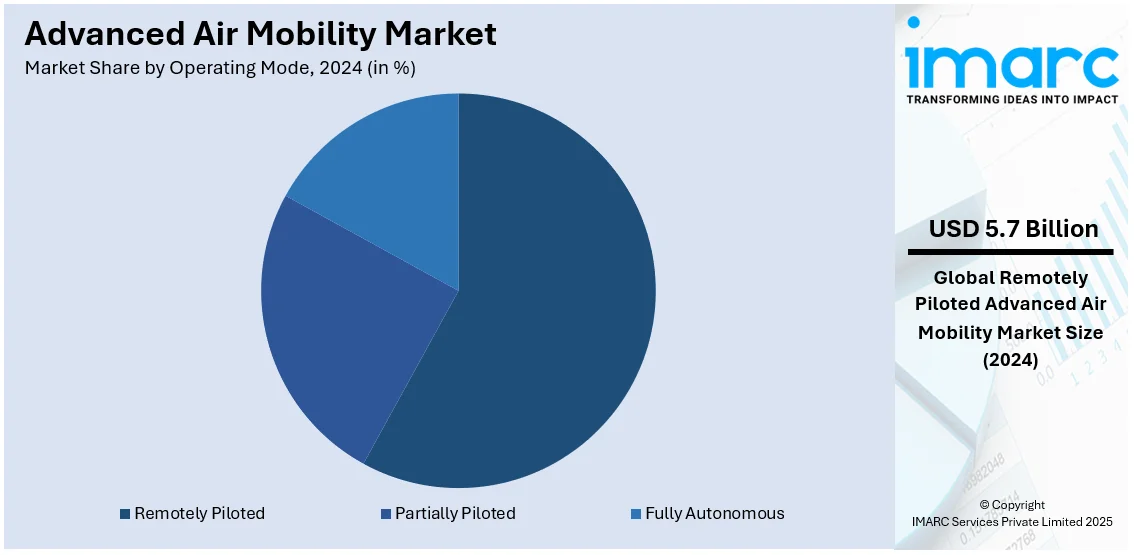

Analysis by Operating Mode:

- Remotely Piloted

- Partially Piloted

- Fully Autonomous

Remotely piloted aircraft lead the market with a 57.6% share in 2024 due to their ability to combine human oversight with automation, offering a safer, more controlled operational environment. These systems are easier to deploy compared to fully autonomous aircraft, which are still undergoing regulatory approval and technological refinement. The growing interest in cargo transport and emergency services, where safety and reliability are paramount, further boosts the demand for remotely piloted systems. Additionally, advancements in communication technology, remote monitoring, and control systems have enhanced the performance and scalability of remotely piloted aircraft, enabling widespread adoption across commercial and military sectors. This trend is expected to continue as AAM infrastructure develops.

Analysis by Propulsion Type:

- Gasoline

- Electric

- Hybrid

Gasoline-powered aircraft continue to play a role in the global advanced air mobility (AAM) market by providing reliable, long-range capabilities that are essential for certain applications. As AAM develops, gasoline-powered systems are being adapted for hybrid models, offering improved energy efficiency while maintaining high performance. The development of lightweight, high-efficiency gasoline engines is enhancing the operational capabilities of urban air mobility solutions, particularly in areas where range and payload are critical. Additionally, gasoline-powered aircraft are benefiting from technological advancements that optimize fuel usage, reducing operational costs and enhancing the overall viability of AAM in various regions and use cases.

Electric propulsion systems are the forefront of innovation in AAM, primarily driven by the need for sustainable, low-emission, and cost-effective transportation solutions. The development of electric vertical takeoff and landing (eVTOL) aircraft is particularly transformative, enabling efficient intra-city travel. The growth in electric vehicle (EV) adoption, advancements in battery technology, and decreasing battery costs are crucial drivers for the electric AAM market. With electric aircraft offering lower operational costs and a significant reduction in noise pollution, they are well-positioned to reshape air travel, particularly for urban air mobility.

Hybrid propulsion systems uses the advantages of electric and conventional power sources, making them an attractive solution for certain AAM applications. These systems offer longer range and increased reliability, which are important factors for regional and some urban operations. Hybrid technology benefits from the high energy density of conventional fuels, while also leveraging the benefits of electric propulsion in specific segments of flight, such as takeoff and landing. Hybrid systems are seen as an intermediate solution, offering the flexibility of range while still progressing toward sustainability goals. They are expected to play a significant role in the transition phase of AAM adoption, especially in markets where fully electric systems may not yet meet the required performance criteria.

Analysis by Range:

- Intracity (20 km - 100 km)

- Intercity (Above 100 km)

Intracity (20 km - 100 km) dominated the market with a share of 91.7% in 2024, driven by increasing demand for efficient urban transportation solutions. The rise in traffic congestion and the need for faster, more direct travel within cities and metropolitan areas significantly contributed to this dominance. AAM technologies, including electric vertical takeoff and landing (eVTOL) aircraft, are ideally suited for short-range flights, providing quick, sustainable options to traditional ground transportation. Additionally, the infrastructure needed for intracity operations, such as vertiports, is more easily integrated into urban environments. These factors combined to render intracity AAM the most significant market segment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

In 2024, North America accounted for 37.6% of the market due to robust government support, with initiatives like the FAA's Urban Air Mobility (UAM) roadmap promoting regulatory frameworks and research funding. Additionally, North America has a strong presence of leading aerospace companies and startups focused on developing cutting-edge technologies, such as electric vertical takeoff and landing (eVTOL) aircraft and autonomous flight systems. The market is further fueled by substantial private sector investments, enabling the rapid development and deployment of AAM infrastructure. The region’s advanced air mobility solutions are also driven by the need for sustainable, efficient urban transportation.

Key Regional Takeaways:

United States Advanced Air Mobility Market Analysis

In 2024, the United States held 86.70% of the North America advanced air mobility (AAM) market, due to its strong infrastructure, regulatory framework, and cutting-edge technological advancements. Government initiatives, such as funding for AAM research and development, are instrumental in facilitating the growth of AAM technologies. With increasing urbanization, traffic congestion, and a need for more efficient transportation, the demand for urban air mobility solutions is rapidly growing. Notably, on December 10, 2024, ACS Group, in partnership with Skyports Infrastructure, secured the contract to operate Manhattan's Downtown Heliport, marking a significant step toward transforming it into a multi-modal transportation hub. This transformation aims to integrate eVTOL aircraft, reduce truck traffic, and provide greener alternatives. Major aerospace companies like Joby Aviation, Lilium, and Urban Aeronautics are advancing the development of eVTOLs with plans for commercial operations in the coming years. Moreover, private investment and venture capital are accelerating the adoption of autonomous flight technologies, positioning the U.S. as a leader in AAM in the coming years.

Europe Advanced Air Mobility Market Analysis

The AAM market in Europe is experiencing considerable growth, fueled by a strong emphasis on sustainability, technological innovation, and regulatory progress. The European Union has been actively fostering AAM development through initiatives such as the European Union Aviation Safety Agency (EASA) regulations and funding for aviation technology research. European nations are working to create favorable regulatory environments while enhancing infrastructure, including the development of vertiports for electric vertical take-off and landing (eVTOL) aircraft. For example, on March 5, 2024, Skyports Infrastructure unveiled plans to launch the UK’s first vertiport testbed at Bicester Motion, Oxfordshire. This facility will play a key role in integrating eVTOL aircraft, enabling air taxi operations, and serving as a hub for air mobility testing. Supported by Innovate UK’s Future Flight Challenge, this project strengthens the UK’s position in the AAM sector. Countries like the U.K., Germany, and France are leading AAM projects, driving Europe toward integrated air mobility networks and fostering increased demand for electric and autonomous urban air transportation.

Asia Pacific Advanced Air Mobility Market Analysis

The Asia Pacific region is emerging as a key player in the market, driven by rapid urbanization, technological progress, and strong government support for sustainable transport. Countries like China, Japan, and South Korea are making significant investments in the development of eVTOL (electric vertical takeoff and landing) aircraft and supporting urban air mobility infrastructure. China is setting ambitious goals to integrate AAM solutions, with companies like EHang and Vertical Aerospace leading the development of autonomous aerial vehicles. Japan is exploring flying cars and drones for both passenger and cargo transport, with the government aiming to establish the required regulations and infrastructure by the 2030s. A key milestone was reached on November 1, 2024, when Toyota's partner, Joby Aviation, completed the first test flight of its eVTOL in Japan. This achievement marks a significant step in air mobility, with Joby planning to introduce flying taxis in Dubai by 2026. The region is becoming a hub for AAM innovation, with increased collaborations between aerospace companies and governments.

Latin America Advanced Air Mobility Market Analysis

The market in Latin America is emerging with significant potential, driven by rapid urbanization and the need for more efficient transport solutions. Brazil, Mexico, and Argentina are at the forefront, exploring AAM technologies, particularly for urban air mobility and cargo transport. For instance, on November 4, 2024, Eve Air Mobility, Revo, and Omni Helicopters International (OHI) completed a successful urban air traffic simulation in São Paulo, integrating eVTOL operations and showcasing sustainable transportation possibilities. The market benefits from such partnerships with global aerospace companies, which are developing electric aircraft for dense urban environments. With support from venture capital and government initiatives focused on infrastructure, the region is poised for gradual adoption of AAM technologies, enhancing connectivity and mobility across major cities.

Middle East and Africa Advanced Air Mobility Market Analysis

The Middle East and Africa are expected to be at the forefront for the market given the urbanization, sustainable investments in infrastructure, and proactive governmental initiatives. Such countries as the UAE, Saudi Arabia, and South Africa are considering combining eVTOLs and autonomous drones with other solutions that would help handle transportation challenges for highly populated areas. Forefront of the UAE, particularly Dubai, is launching an air taxi and building a comprehensive AAM infrastructure in the 2030s. For instance, on November 13, 2024, Joby Aviation started the construction of its first vertiport at Dubai International Airport (DXB) as part of its planned air taxi network to be ready to launch services by the end of 2025. Ultimately, it aligns with regional ambitions for sustainability and connectivity, drivers for AAM market growth.

Competitive Landscape:

The competitive landscape of the AAM market is becoming intense as established aerospace companies and innovative startups vie for the top position. Key players are focused on developing eVTOL aircraft for urban air mobility, and traditional giants are also investing heavily in AAM technologies. For instance, on June 3, 2024, Boeing announced a USD 240 Million investment in Québec's aerospace sector for the Canadian Aerospace Development Centre, Wisk Aero's eVTOL development, and landing gear research with Héroux-Devtek. Inter-industry collaboration is a must, efforts are being made on building infrastructure, such as vertiports and air traffic management systems. Such support and funding are necessary to hasten the adoption of AAM, which sends companies racing to commercialize their technologies and gain relevant approvals for global deployment.

The report provides a comprehensive analysis of the competitive landscape in the advanced air mobility market with detailed profiles of all major companies, including:

- Airbus SE

- Aurora Flight Sciences

- Eve Air Mobility (Embraer S.A)

- Guangzhou EHang Intelligent Technology Co. Ltd.

- Joby Aviation

- Lilium GmbH

- Textron eAviation Inc.

- Wisk Aero LLC.

Latest News and Developments:

- January 7, 2025: Tata Elxsi and CSIR-National Aerospace Laboratories (NAL) signed a Memorandum of Understanding (MoU) to collaborate on Advanced Air Mobility (AAM) technologies. The partnership focuses on UAVs, UAM, and eVTOL development, combining Tata Elxsi’s tech expertise with NAL’s aeronautical knowledge to drive innovation, accelerate product development, and support both global and Indian markets.

- December 3, 2024: CRISALION Mobility selected IFS Cloud as its management software for advanced air mobility projects. The platform will support the design, manufacturing, and maintenance of CRISALION's eVTOL aircraft and remotely operated vehicles. IFS Cloud will streamline regulatory processes, enhance efficiency, and provide lifecycle support, strengthening CRISALION’s position in the AAM market.

- June 5, 2024: Airbus and Avincis announced a partnership to develop Advanced Air Mobility (AAM) solutions in Europe. They will collaborate on defining operations and mission profiles for eVTOL aircraft, focusing on emergency services, including medical, search and rescue, and firefighting. This partnership builds on Airbus’s longstanding relationship with Avincis and aims to create a sustainable AAM ecosystem.

- May 6, 2024: UrbanLink Air Mobility, a South Florida-based start-up, announced plans to be the first U.S. airline to incorporate electric vertical takeoff and landing (eVTOL) aircraft into its operations. The company aims to revolutionize transportation with zero-emission AAM solutions, starting certification in Q4 2025 and launching services by Summer 2026.

- April 3, 2024: AFWERX showcased efforts to safely integrate Advanced Air Mobility (AAM) into national airspace at the XPONENTIAL 2024 convention in San Diego from April 22-25, 2024. The event will feature discussions on AAM challenges, including airspace modernization, autonomy, and security. AFWERX will also host panels and meetings with industry and government stakeholders to accelerate AAM development.

- February 27, 2024: Bristow Group and The Helicopter Company (THC) signed a Memorandum of Understanding to explore Advanced Air Mobility (AAM) opportunities in Saudi Arabia. The partnership aims to enhance innovation and sustainability in vertical aviation, contributing to Saudi Arabia’s Vision 2030 by transforming its general aviation industry and adopting new technologies in the growing aviation ecosystem.

Advanced Air Mobility Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software |

| Applications Covered | Cargo Transport, Passenger Transport, Mapping and Surveying, Special Mission, Surveillance and Monitoring, Others |

| End Users Covered |

|

| Products Covered | Fixed Wing, Rotary Blade, Hybrid |

| Types Covered | Air Taxis, Drones, Others |

| Maximum Take-off Weights Covered | <100 kg, 100 - 300 kg, >300 kg |

| Operating Modes Covered | Remotely Piloted, Partially Piloted, Fully Autonomous |

| Propulsion Types Covered | Gasoline, Electric, Hybrid |

| Ranges Covered | Intracity (20 km - 100 km), Intercity (Above 100 km) |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Airbus SE, Aurora Flight Sciences, Eve Air Mobility (Embraer S.A), Guangzhou EHang Intelligent Technology Co. Ltd., Joby Aviation, Lilium GmbH, Textron eAviation Inc., Wisk Aero LLC., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the advanced air mobility market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global advanced air mobility market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the advanced air mobility industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The advanced air mobility market was valued at USD 9.9 Billion in 2024.

The advanced air mobility market is projected to exhibit a CAGR of 23.70% during 2025-2033, reaching a value of USD 77.03 Billion by 2033.

The key factors driving the global market include technological advancements in autonomous flight, urbanization, demand for sustainable transportation, innovations in electric propulsion, and increased collaboration among aerospace companies, governments, and private investors, supporting safer, efficient, and green air transportation solutions.

North America currently dominates the advanced air mobility market, accounting for a share exceeding 37.6%. This dominance is fueled by government support, technological advancements, and private investments driving rapid AAM development and infrastructure.

Some of the major players in the advanced air mobility market include Airbus SE, Aurora Flight Sciences, Eve Air Mobility (Embraer S.A), Guangzhou EHang Intelligent Technology Co. Ltd., Joby Aviation, Lilium GmbH, Textron eAviation Inc., and Wisk Aero LLC., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)