Adhesive Film Market Size, Share, Trends and Forecast by Film Material, Technology, Application, End Use Industry, and Region, 2025-2033

Adhesive Film Market Size and Share:

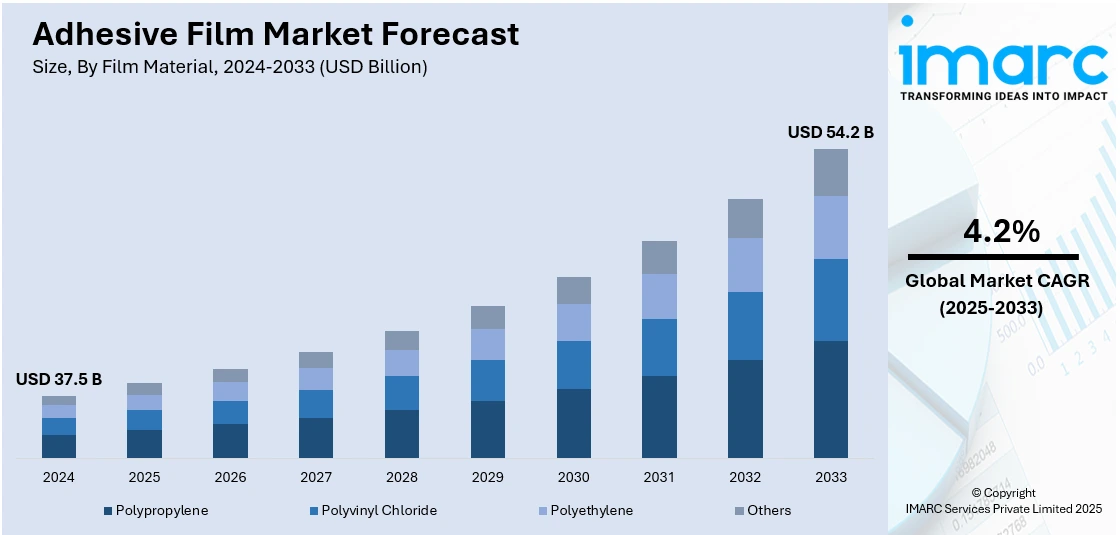

The global adhesive film market size reached USD 37.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 54.2 Billion by 2033, exhibiting a growth rate (CAGR) of 4.2% from 2025-2033. The market is experiencing robust growth, driven by the increasing demand for adhesive films in the electronics and automotive industries, widespread product application in the healthcare sector, rapid technological advancements, rising popularity of flexible packaging solutions, and the ongoing shift towards sustainable and high-performance adhesive technologies in various end-use industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 37.5 Billion |

| Market Forecast in 2033 | USD 54.2 Billion |

| Market Growth Rate (2025-2033) | 4.2% |

Adhesive films have become increasingly crucial in electronics, supporting the operation of smartphones, wearables, and flexible devices by enabling durability and slim designs. The automotive industry is using these films wherein the components of structures include lightweight materials. Adhesion technologies are replacing the use of conventional fasteners in electric vehicles for efficiency and performance improvement. Packaging innovations such as smart packaging including RFID, QR code, among others provide opportunities for the manufacturers.

The adhesive film market in the United States is steadily increasing, with advancements in key industries, such as electronics, automotive, packaging, and healthcare. The booming electronics sector, particularly related to smartphones, wearable technology, and flexible devices, contributes to the use of adhesive films. With the growth of e-commerce in the U.S., demand for seal-on-tamper-evident-smart packaging will further push the market limit. Sustainability is at the forefront driving many manufacturers in the U.S. to introduce recyclable and biodegradable films to comply with the increasingly stringent regulatory environment and consumer demand for greener products. For instance, in June 2024, Dow announced that the company’s three different adhesive systems, when used with PE film packaging, received formal recognition from the Association of Plastic Recyclers (APR) for polyethylene film recycling.

Adhesive Film Market Trends:

Growing Product Demand in the Electronics Industry

Electronic devices drive the demand for adhesive films and the electronic industry is one of the largest consumers of adhesive films. The e-commerce market is expected to amount to USD 219,575.6 Million in 2024 in the United States for electronics which accounts for 20.6% of the total e-commerce market share in the country. This share is expected to keep increasing in the years ahead, thereby increasing the total consumption of these films. They are being used in a variety of electronic components such as mobile phones, tablets, laptops, wearables, and others. The placement of many varieties of adhesive film types also provides different functionalities in the devices: bonding, sealing, insulation, and protection of individual parts, to ensure reliability and long-term use of the devices. It ensures consumers are also looking for something compact, lightweight, and high-performing, making it important to produce advanced adhesive films suitable for these applications.

Expanding Automotive Industry

The automobile sector's growth is one of the largest contributors to the adhesive film market size. This industry has multiple applications for adhesive films, such as NVH control, surface protection against corrosion, and bonding and sealing of internal and external components. The growing production of automobiles, along with an increased focus on lightweight and fuel-efficient designs, has led to higher demand for these films in the automotive manufacturing industry. For example, 85.4 Million motor vehicles were manufactured worldwide in the year 2022, a 5.7% increase from the previous year, which proportionally increased the demand for these films. They are preferred over conventional mechanical attachment techniques as they contribute to weight reduction, improved aesthetics, increased structural integrity, and higher design freedom.

Increasing Product Utilization in the Healthcare Sector

Application areas for adhesive films are proliferating in the healthcare sector. Such applications include pharmaceutical packaging items, wound care products, various medical devices for manufacturing products, including adhesive transdermal patches, bandages, surgical tapes, and diagnostic strips. These products serve major purposes as barrier protection, moisture control, and secure adhesion. Further, there has been a high rate of increase in demand for innovative medical devices and advanced wound care products as the population of aged patients rises, the cost of healthcare skyrockets, and the number of patients with chronic diseases is increasing. More than 129 million Americans reportedly suffer from at least one serious chronic disease. Such patients, hence, contribute to the increasing demand for adhesive films in managing postoperative and bedridden patients.

Adhesive Film Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. The report has categorized the market based on film material, technology, application, and end use industry.

Analysis by Film Material:

- Polypropylene

- Polyvinyl Chloride

- Polyethylene

- Others

Polypropylene (PP) films are lauded due to their excellent clarity, chemical resistance, and flexibility. These films are widely used in packaging applications as they provide superior barrier properties against moisture and oxygen. Additionally, PP films are favored in the automotive and electronics industries for their high tensile strength and resistance to environmental stress.

The polyvinyl chloride (PVC) films are known for their versatility and excellent adhesion properties that make them suitable for numerous applications. They are being used in the construction sector for surface protection, insulation, and decorative laminates. Besides, these films offer high abrasion resistance and resistance to chemicals and weathering, which makes them suitable for automotive interiors and signage. This exceptional property of PVC films is propelling market growth.

Polyethylene films are tough, flexible, and cost-effective in applications such as packaging that encompass shrink wrap and stretch film along with protective coverings. These films have gained acceptance in the F&B industries due to moisture barrier properties. They have been adopted in medical packaging as well as in disposable protection equipment due to their nontoxicity, and being easy to sterilize by the healthcare sectors.

Analysis by Technology:

- Water-based Adhesives

- Solvent-based Adhesives

- Hot Melt Adhesives

- Pressure-Sensitive Adhesives

- Others

Water-based adhesives use water as a carrier and are non-toxic, thus functional for many applications, from packaging to textiles and paper products. The adhesive bond of these adhesives is very strong and can be simply washed to make them preferable for health and safety-dependent applications.

Known for their strong bonding and versatility, solvent-based adhesives also find application mostly in demanding industries like automotive, aerospace, and construction. The organic solvents dissolve the adhesive material and bond strongly, resisting even the most severe conditions, ranging from high temperatures and chemicals to severe mechanical stress.

Hot melt adhesives set rapidly and have a high bond strength, making them popular in different applications. They are applied at molten temperatures, solidifying upon cooling, which then allows for immediate adhesion and considerable initial tack. These adhesives find usage in packaging, bookbinding, woodworking, and assembly.

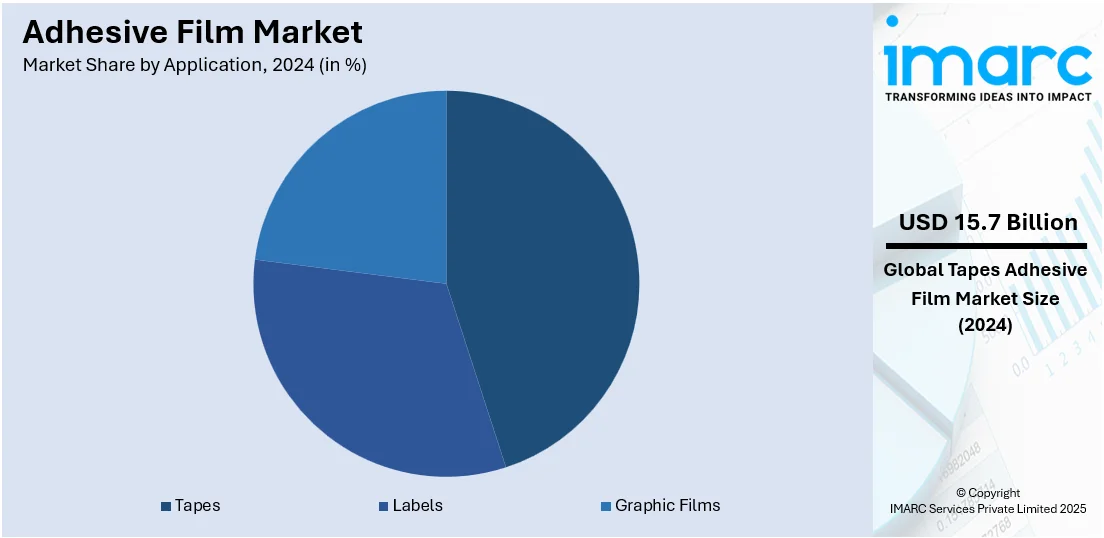

Analysis by Application:

- Tapes

- Labels

- Graphic Films

Adhesive tapes are extensively used for sealing, bonding, mounting, and insulation purposes. They play important roles in the packages and parcel boxes in the packaging industry while the automotive and construction sectors use them to bond the parts, insulate, and reinforce such structures. Moreover, the increasing use of these in the electronic industry to assemble and protect devices is further driving the growth of the adhesive film market.

Food and beverages (F&B), as well as pharmaceuticals, cosmetics, and logistics, use adhesive labels. Some functions that they perform are barcoding, tamper-proofing, and tracking a product. The ongoing shift toward smart labeling solutions such as radio frequency identification (RFID) and quick response (QR) Codes has catalyzed the growth of the market.

Adhesive graphic films are used to generate and produce visually appealing and long-lasting graphics, which withstand outdoor as well as high-traffic environments. The films work with superior printability with color with the ease of application using both short-term promotions and long-term installations. The rapid advancements in adhesive technologies led to the development of high-performance graphic films, which can provide superior adhesion, conformability, and removal properties without leaving residues.

Analysis by End Use Industry:

- Packaging

- Aerospace

- Electrical and Electronics

- Automotive and Transportation

- Others

Adhesive films in packaging are used for sealing, labeling, and securing products, ensuring they remain intact during storage and transportation. Moreover, the growing demand for flexible packaging formats, such as pouches, bags, and wraps, that increase the use of adhesive films due to their versatility, durability, and excellent barrier properties against moisture, oxygen, and contaminants is favoring the market growth.

The aerospace industry relies heavily on adhesive films for various applications, including structural bonding, surface protection, and thermal insulation. They offer lightweight and durable solutions that are critical for enhancing the performance and safety of aircraft. Moreover, these films are used in bonding composite materials, reducing the need for mechanical fasteners, which helps in weight reduction and improves fuel efficiency.

Adhesive films in the electrical and electronics sector are used for the assembly and manufacturing of electronic components, such as printed circuit boards (PCBs), displays, batteries, and sensors. They provide critical functions, including insulation, thermal management, and protection against environmental factors. Moreover, the rapid advancement of technology and the increasing miniaturization of electronic devices, boosting the demand for these films as they offer superior adhesion, flexibility, and resistance to heat and chemicals, is fueling the market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The market for adhesive films in the Asia Pacific region is driven by rapid industrialization, urbanization, and economic growth in countries such as China, India, Japan, and South Korea. Moreover, the booming manufacturing sector, particularly in the electronics, automotive, and packaging industries, is contributing to the market growth. Additionally, the increasing consumer base, rising disposable incomes, and the growing e-commerce sector boosting the need for efficient and durable packaging solutions, are favoring the market growth. The use of adhesive films in automobile interiors, EV batteries, and lightweight applications is growing. In construction, the region’s infrastructure boom, particularly in India and Southeast Asia, has boosted demand for adhesive films in flooring, insulation, and cladding applications.

Key Regional Takeaways:

North America Adhesive Film Market Analysis

In North America, the growth of the adhesive film market is steady, driven by advancing technology and strong demand from growing applications in industries such as electronics, automotive, healthcare, and packaging. Innovative materials have been developed for regionally marketed high-performance adhesive film applications in flexible electronics, lightweight vehicle construction, and tamper-evident smart packaging. In addition, the burgeoning e-commerce sector is witnessing increased demand for sealed sustainable packaging solutions. Growing environmental awareness is also prompting North American manufacturers to develop eco-friendly adhesive films to comply with stringent regulatory and consumer expectations.

United States Adhesive Film Market Analysis

Strong demand from sectors including automotive, electronics, healthcare, and packaging is propelling the adhesive film market in the US. Lightweight and long-lasting adhesive films are becoming necessary for battery installation, wire harnessing, and interior applications as EV adoption rises. As the gradual transition to an electrified future proceeded unabated, 1,189,051 new electric vehicles (EVs) were placed into service in the US. According to Kelley Blue Book data, EVs accounted for 7.6% of the U.S. vehicle market in 2023. It is higher than the 5.9% in 2022.

The use of biocompatible adhesive films in healthcare has increased due to developments in the production of medical devices and wound care products. A significant portion of the market is also made up of packaging solutions because of the expanding e-commerce sector, which accounted for 22.0% of total retail sales, according to Digital Commerce 360 analysis of U.S. Department of Commerce data. U.S. ecommerce sector demonstrated 7.6% annual growth as sales grew to about USD 1.119 Trillion in 2023 from USD 1.040 Trillion in 2022. Adhesive films are essential to packaging innovation because they provide improved branding through labelling applications and tamper-proof sealing. The market is also expanding due to sustainability trends as producers switch to recyclable and bio-based adhesive films. Investments in sustainable production methods have been stimulated by government support, such as subsidies for green manufacturing and renewable energy.

Europe Adhesive Film Market Analysis

Strong demand from the automotive, aerospace, and renewable energy sectors supports the European adhesive film industry. Lightweight adhesive films are taking the place of conventional mechanical fasteners in the automobile industry, particularly for electric vehicles, because of the region's emphasis on lowering carbon emissions. According to the data by The European Automobile Manufacturers’ Association, or ACEA, the EU auto market ended 2023 with a strong 13.9% growth over 2022, with a full-year volume of 10.5 million units. Apart from Hungary (-3.4%), all EU markets expanded over the past year. Most markets saw double-digit rises, including three of the biggest: France (+16.1%), Spain (+16.7%), and Italy (+18.9%), which together accounted for 14% of all automobile sales in Europe in 2023. Owing to their highly developed automobile sectors, nations like Germany, France, and the UK consume the most adhesive film.

Latin America Adhesive Film Market Analysis

The expansion of the construction, packaging, and automotive sectors is propelling the adhesive film market in Latin America. The use of adhesive film is highest in nations like Brazil and Mexico, which are bolstered by growing manufacturing bases and increased investments in industrial development. Adhesive films are used in the automotive industry, which contributes accounting for over 5% of Mexico's GDP and 20% of Mexican manufacturing GDP, for lightweighting and assembly purposes. The expanding food and beverage business in the area is another major factor driving the packaging sector.

Middle East and Africa Adhesive Film Market Analysis

The expansion of the energy, automotive, and construction industries is propelling the adhesive film market in the Middle East and Africa (MEA). The need for adhesive films in building applications like cladding and insulation has increased due to infrastructure development, especially in GCC nations like Saudi Arabia and the United Arab Emirates. Additionally, GCC residential construction market size is projected to exhibit a growth rate (CAGR) of 4.80% during 2024-2032. Despite being smaller than in other areas, the automotive sector is growing because of rising demand for premium cars and EVs, which call for adhesive films for interior applications and assembly. The region's renewable energy projects boost the usage of adhesive films in the energy sector, specifically in the production of solar panels.

Competitive Landscape:

The major players in the market are engaged in various strategic initiatives to strengthen their market position and drive growth. They are investing in research and development (R&D) to innovate and improve the performance of adhesive films, thereby focusing on sustainability and eco-friendliness to meet increasing regulatory and consumer demands. Moreover, some companies are developing advanced formulations with enhanced bonding capabilities, greater durability, and lower environmental impact. Additionally, key players are expanding their production capacities and global footprint through mergers, acquisitions, and partnerships to serve diverse industries such as automotive, electronics, packaging, and healthcare. Furthermore, they are also leveraging advanced manufacturing technologies and automation to enhance production efficiency and reduce costs.

The global adhesive film market research report provides a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- 3M Company

- Adhesive Films Inc.

- Akzo Nobel N.V.

- Arkema

- Avery Dennison Corporation

- BASF SE

- Dow Inc.

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Nitto Denko Corporation

- Showa Denko K. K.

- Solvay

- Toray Advanced Composites

Latest News and Developments:

- July 2024: Germany-based startup Phytonics developed a self-adhesive film with microstructures to reduce glare on PV modules. It is available in sheets and rolls for new and existing PV systems.

- April 2024: BASF signed a Letter of Intent (LoI) with Youyi Group (Youyi) that marks a significant step to strengthen the strategic partnership between the two companies, focusing on the supply of butyl acrylate (BA) and 2-ethylhexyl acrylate (2-EHA) from BASF’s Zhanjiang Verbund site to meet the growing demand in China’s adhesive materials industry.

- May 2023, H.B. Fuller announced that it had completed the acquisition of UK-based family-owned adhesive manufacturer Beardow Adams. The company said the acquisition of the company will open it to a sales presence that is represented by Beardow Adams in more than 70 countries and 20,000 end-user applications.

- April 2023: Resonac Corporation announced the expansion of adhesive film capacity for semiconductor packaging in Japan.

Adhesive Film Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Film Materials Covered | Polypropylene, Polyvinyl Chloride, Polyethylene, Others |

| Technologies Covered | Water-based Adhesives, Solvent-based Adhesives, Hot Melt Adhesives, Pressure-Sensitive Adhesives, Others |

| Applications Covered | Tapes, Labels, Graphic Films |

| End Use Industries Covered | Packaging, Aerospace, Electrical and Electronics, Automotive and Transportation, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Adhesive Films Inc., Akzo Nobel N.V., Arkema, Avery Dennison Corporation, BASF SE, Dow Inc., H.B. Fuller Company, Henkel AG & Co. KGaA, Nitto Denko Corporation, Showa Denko K. K., Solvay, Toray Advanced Composites., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, adhesive film market forecast, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global adhesive film market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the adhesive film industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Adhesive film is a thin, flexible material coated with an adhesive layer that allows it to bond securely to a variety of surfaces. These films are often made from materials like plastic, paper, or metal, with adhesive tailored to provide strong, durable, and sometimes removable attachment.

The global adhesive film market was valued at USD 37.5 Billion in 2024.

IMARC estimates the global adhesive film market to exhibit a CAGR of 4.2% from 2025-2033.

The global adhesive film market is driven by increasing demand from industries like electronics, automotive, packaging, and healthcare, which require reliable and efficient bonding solutions.

Some of the major players in the global adhesive film market include 3M Company, Adhesive Films Inc., Akzo Nobel N.V., Arkema, Avery Dennison Corporation, BASF SE, Dow Inc., H.B. Fuller Company, Henkel AG & Co. KGaA, Nitto Denko Corporation, Showa Denko K. K., Solvay, Toray Advanced Composites., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)