Active Optical Cable Market Size, Share, Trends and Forecast by Connector Type, Technology, Application, and Region, 2025-2033

Active Optical Cable Market Size and Share:

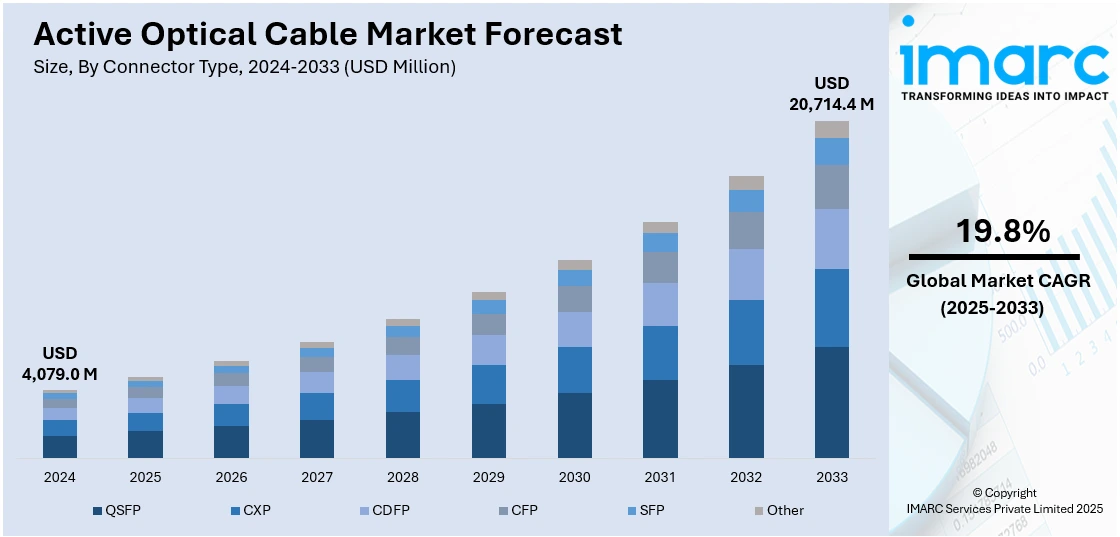

The global active optical cable market size was valued at USD 4,079.0 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 20,714.4 Million by 2033, exhibiting a CAGR of 19.8% from 2025-2033. North America currently dominates the market, holding a market share of over 37.39% in 2024. The widespread product utilization in the telecommunication industry, the growing product adoption in consumer electronics, extensive research and development (R&D) activities, and the rising demand for high-speed data transmission are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4,079.0 Million |

|

Market Forecast in 2033

|

USD 20,714.4 Million |

| Market Growth Rate 2025-2033 | 19.8% |

The global active optical cable market is witnessing resilient growth chiefly due to amplifying requirement for excellent-speed data transmission in data centers, propelled by the proliferation of 5G connectivity and cloud computing systems. For instance, as per industry reports, by 2025, 5G networks are expected to reach one-third of the global population, with up to 1.2 billion connections projected. Moreover, rising utilization of cutting-edge technologies, such as machine learning and (ML) and artificial intelligence (AI), is significantly bolstering the demand for low-latency, effective connectivity. Expansion of consumer electronics industry, combined with the growth of virtual reality applications and high-definition displays, is also magnifying the market penetration. In addition, the rapid inclination toward energy-saving, lightweight cabling solutions across key sectors aids the deployment of active optical cables, further fostering the market's positive trajectory.

To get more information on this market, Request Sample

The United States plays a critical role in the global active optical cable market, attributed to its elevated utilization of high-speed data transmission solutions and leading-edge technological infrastructure. The accelerating need for 5G network implementation, data centers, and cloud computing is bolstering the market’s expansion in the region. For instance, as per industry reports, over 300 million or 90% people in the U.S. reside in areas with 5G low-band coverage provided by all three tier-1 service providers, while 210 to 300 million have access to 5G mid-band coverage. Furthermore, major sectors, such as entertainment, telecommunications, and IT, are actively investing in upgraded connectivity solutions, significantly influencing the requirement for active optical cables. Moreover, the robust presence of leading industry players and resilient government aid for digital transformation ventures highlight the United States' significant contribution in this sector.

Active Optical Cable Market Trends:

Widespread Product Utilization in the Telecommunication Industry

AOC is extensively being leveraged in telecommunication networks as high-speed traffic-transfer connections between central offices and base stations. It provides reduced latency and elevated capacity connection, which fosters continuous and seamless communication. In addition, the rapidly increasing product usage in fiber-to-the-home (FTTH) implementations to grant high-speed broadband connectivity to both business and residential premises is significantly impacting the market expansion. According to the Government of UK, as of January 2024, 78.5% of UK premises had a gigabit-capable broadband connection available. Besides this, the magnifying product utilization in remote radio heads (RRHs) and distributed antenna systems (DAS) to connect radio equipment with central processing units (CPU) is aiding the market growth. Furthermore, the fueling product requirement in metro and long-haul networks to boost high-speed optical transmission over extended distances is contributing to a positive market outlook.

Growing Product Adoption in Consumer Electronics

AOC finds numerous applications in consumer electronics to enhance connectivity and improve performance. It is extensively used in high-resolution displays, such as televisions (TVs), monitors, and projectors, to transmit large amounts of data quickly and accurately, which provides an immersive viewing experience. According to India Brand Equity Foundation, electronics hardware production in the country increased from USD 31.13 Billion in FY14 to USD 60.13 Billion in FY18. Furthermore, the rising product adoption in gaming consoles and accessories to enable the transmission of high-definition (HD) video, audio, and control signals between consoles, monitors, controllers, and headsets is strengthening the market growth. Moreover, the increasing product applications in digital signage to provide the necessary bandwidth and signal integrity is favoring the market growth. Besides this, the widespread product adoption in home theatre systems to connect audio or video components, such as Blu-ray players, soundbars, receivers, and projectors, is catalyzing the market growth.

Extensive Research and Development (R&D) Activities

The emergence of innovative AOCs that are integrated with enhanced optical components, upgraded modulation techniques, and improved signal processing to promote reduced energy consumption, long-distance connectivity, and minimal signal loss, is positively impacting the market expansion. Moreover, the increase in innovative efforts regarding hybrid AOCs, which facilitate high-speed power and data transfer simultaneously with a single cable, thus saving resources and enhancing efficacy, is significantly fostering the market expansion. According to reports, internet users in India has crossed the 800 Million mark. In addition to this, the notable incorporation of optimized security features, encompassing anti-tampering services, encryption mechanisms, and authentication protocols, to guarantee the security of critical data, is bolstering the market prospect. Apart from this, the utilization of AOC in augmented and virtual reality (AR/VR) applications to enable seamless transfer of high-resolution video, audio, and tracking data between the headset and the computing device is supporting the market growth.

Active Optical Cable Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global active optical cable market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on connector type, technology, and application.

Analysis by Connector Type:

- QSFP

- CXP

- CDFP

- CFP

- SFP

- Other

QSFP stand as the largest connector type in 2024, holding around 25.4% of the market. Quad small form-factor pluggable (QSFP) is attributed to its high-speed data transmission. Furthermore, QSFP AOCs offer multichannel capability, allowing multiple data streams to be transmitted simultaneously over a single cable. Additionally, it has a small form factor compared to its alternatives, such as CXP and CFP, which makes it suitable for space-constraint applications, including data centres. Apart from this, QSFP AOCs are compatible with various networking protocols and standards, including ethernet, InfiniBand, and fibre channel, thus making them highly versatile and adaptable to diverse networking environments. Moreover, it is a cost-effective, future-proof, and scalable product that allows easy upgrades and expansion as network requirements evolve.

Analysis by Technology:

- InfiniBand

- Ethernet

- HDMI

- DisplayPort

- USB

- Others

InfiniBand leads the market with around 29.2% of market share in 2024. InfiniBand is increasingly being adopted due to its high-speed data transfer abilities, magnified bandwidth, and minimized latency, positioning it as a preferable option for various applications in high-performance computing, financial trading, scientific simulations, and data analytics. Additionally, it leveraged a switched fabric topology, which bolsters network expansion and allows the uninterrupted involvement of more devices, nodes, and switches as the network advances. Moreover, InfiniBand integrates leading-edge error detection and correction features, which guarantee high dependability and data integrity, lower transmission errors, and mitigate data loss. Apart from this, it features remote direct memory access (RDMA) capability, which allows data to be transferred directly between the memory of computers, bypassing the need for CPU involvement.

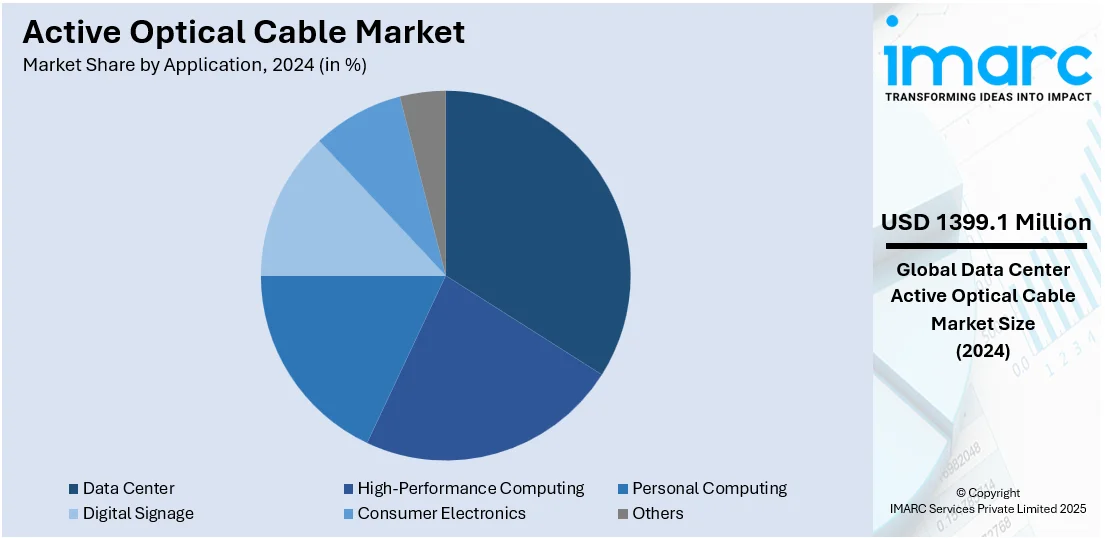

Analysis by Application:

- Data Center

- High-Performance Computing

- Personal Computing

- Digital Signage

- Consumer Electronics

- Others

Data center leads the market with around 34.4% of market share in 2024. The rising number of data centers across the globe due to the increasing demand for cloud computing, big data analytics, and digital services is providing an impetus to the market growth. AOC is widely used in data centers to provide high-speed, high-bandwidth connectivity between servers, storage systems, and networking equipment. Furthermore, it aids in supporting data-intensive applications, such as virtualization, real-time analytics, and artificial intelligence (AI). Apart from this, AOC provides reliable and long-distance connectivity solutions, which allow seamless connectivity between different buildings, floors, and server racks within a data center campus. Moreover, they offer superior signal integrity compared to copper cables, which aids in ensuring minimal degradation of data. Besides this, they are scalable, compatible, and easy-to-upgrade products that assist data centers in handling the growing demand for data-intensive applications.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 37.39%. This region is primarily driven by robust adoption of advanced data communication technologies and significant investments in cloud computing and data centers. For instance, in October 2024, eStruxture, a major Canada-based data center operator, announced a significant investment of USD 540.2 Million for the construction of a new 90MW data center facility in Alberta, Canadian province. Additionally, the region benefits from strong demand in industries such as IT, telecommunications, and consumer electronics, coupled with widespread 5G deployment. Major companies headquartered in North America, alongside supportive regulatory frameworks, further boost the market. Moreover, the increasing need for high-speed, energy-efficient connectivity solutions in the U.S. and Canada positions the region as a key contributor to the market's growth, maintaining its leadership in innovation and technology adoption.

Key Regional Takeaways:

United States Active optical cable Market Analysis

In 2024, US accounted for a share of 87.3% of the North America chiller market. The active optical cable (AOC) market in the USA is currently experiencing growth driven by the increasing demand for high-speed data transmission in data centers and enterprise networks. Enterprises are actively expanding their cloud infrastructure, fueling the adoption of AOCs to support enhanced connectivity and reduce latency in hyperscale data centers. At the same time, industries such as healthcare, automotive, and telecommunications are embracing AOCs to enable advanced technologies like AI, IoT, and 5G, which require rapid and reliable data transfer. According to the American Hospital Association, there are 6,120 hospitals in the United States. Additionally, the market is witnessing a surge in adoption due to rising investments in upgrading existing IT and networking infrastructure to support higher bandwidth requirements, particularly in large-scale enterprises and universities. Manufacturers are innovating in energy-efficient and cost-effective AOCs, aligning with the increasing preference for eco-friendly technologies. Furthermore, the proliferation of streaming services and online gaming is propelling demand for AOCs in consumer electronics and home networking applications. Government initiatives supporting digital transformation and the rollout of 5G networks are further encouraging AOC deployment across various sectors. Meanwhile, the market is benefiting from the rising adoption of AOCs in military and aerospace applications, where durability and reliability are critical in high-data-volume environments.

Asia Pacific Active Optical Cable Market Analysis

The active optical cable (AOC) market in Asia Pacific is experiencing robust growth as industries are increasingly adopting high-speed data transmission solutions to meet the demands of expanding data centers, cloud computing services, and 5G networks. Enterprises are actively investing in AOC technology to enhance data transfer efficiency and reduce latency, critical for supporting large-scale digital transformation initiatives. Governments in countries like China, India, and Japan are promoting the deployment of advanced communication infrastructure, including high-performance fibre-optic systems, which is bolstering AOC adoption. Leading telecom operators and hyperscale data center providers are currently expanding their infrastructure to accommodate the surging internet traffic and streaming requirements, driving the need for reliable, energy-efficient AOCs. According to reports, India’s telecom sector is considered to be the second largest in the world with 1.17 Billion subscribers and crossing tele-density over 90%. Simultaneously, the rising popularity of video conferencing, online gaming, and augmented reality (AR)/virtual reality (VR) applications is propelling demand for high-bandwidth connectivity, fuelling AOC market growth. Manufacturers in the region are innovating in product design by focusing on lightweight, compact, and cost-effective solutions to cater to the needs of diverse industries, including automotive, aerospace, and consumer electronics. Furthermore, the integration of AOCs in advanced medical imaging and diagnostic systems is also gaining traction, reflecting the ongoing technological advancements in healthcare infrastructure across the region.

Europe Active Optical Cable Market Analysis

The active optical cable (AOC) market in Europe is currently being driven by the rising adoption of high-speed data transmission technologies in industries such as telecommunications, data centers, and consumer electronics. Telecom operators are actively expanding their 5G infrastructure and upgrading their backhaul networks to support low latency and high bandwidth requirements, fuelling the demand for AOCs. Data centers are continuously scaling their operations to accommodate the exponential growth in cloud computing, AI workloads, and big data analytics, which is propelling the integration of AOCs to enhance connectivity and reduce power consumption. According to reports, from 2017 to 2022, slightly more than 240 data centres have been completed across Europe. The proliferation of advanced video streaming platforms and gaming applications is encouraging consumer electronics manufacturers to incorporate high-performance AOCs in devices to ensure seamless user experiences. Additionally, governments and private enterprises are increasingly investing in digital transformation initiatives, including smart city projects and IoT deployments, where AOCs are playing a pivotal role in providing reliable and high-speed connectivity. The ongoing trend of adopting energy-efficient technologies is further accelerating the preference for AOCs due to their lower heat dissipation and energy-saving capabilities compared to traditional copper cables. Moreover, the presence of stringent EU regulations promoting sustainable and high-efficiency networking solutions is boosting innovation and adoption across the region.

Latin America Active Optical Cable Market Analysis

The active optical cable (AOC) market in Latin America is witnessing growth driven by region-specific developments across various industries. Telecommunications providers are actively expanding fibre-to-the-home (FTTH) deployments to meet the surging demand for high-speed internet in urban and semi-urban areas, particularly in countries like Brazil and Mexico. According to the Brazilian Institute of Geography and Statistics, broadband usage already surpassed 90% of Brazilian households in 2023. Data centers are increasingly adopting AOCs to optimize their infrastructure as cloud services and edge computing are rapidly proliferating to support growing digitalization efforts across enterprises. Enterprises in the region are continuously upgrading their IT networks with high-bandwidth solutions to accommodate rising volumes of video conferencing, remote work, and online learning. Governments are implementing connectivity improvement initiatives to bridge the digital divide in underserved areas, which is spurring the demand for reliable and high-performance optical interconnect solutions. The region's gaming and entertainment sectors are leveraging AOCs to enhance the user experience, driven by the popularity of online streaming platforms and e-sports. Additionally, technology manufacturers are collaborating with local partners to introduce cost-effective AOC products tailored to Latin American markets, addressing price sensitivity and ensuring widespread adoption. These drivers are collectively contributing to the consistent growth of the active optical cable market in the region, reflecting its evolving technological landscape.

Middle East and Africa Active Optical Cable Market Analysis

The Middle East and Africa active optical cable (AOC) market is experiencing growth driven by the region's ongoing expansion of data centers and cloud infrastructure, as organizations are increasingly adopting high-performance computing and storage solutions to handle surging data traffic. Telecom operators are actively upgrading their network infrastructure to 5G, enhancing demand for high-speed, low-latency connectivity solutions, including AOCs. According to the Independent Communications Authority of South Africa (ICASA), telecommunications sector employment increased by 46.36%. In addition, governments across the region are investing in smart city projects, which require robust communication networks and advanced optical technologies for seamless data transmission. Industries such as oil and gas, finance, and healthcare are implementing digital transformation initiatives, leveraging AOCs for reliable connectivity in high-bandwidth applications. The region’s growing interest in streaming services, online gaming, and e-commerce is fuelling demand for high-speed broadband connectivity, prompting service providers to adopt AOCs to support the backbone of these networks. Furthermore, key market players are launching customized AOC products tailored to harsh environmental conditions, catering to the unique requirements of the Middle East and Africa. With the proliferation of IoT devices and edge computing solutions, organizations are increasingly relying on AOCs to enable high-speed connections and efficient data exchange in their operational frameworks, positioning AOCs as integral to the region’s technological evolution.

Competitive Landscape:

The global active optical cable market is marked by intense competition among key players aiming to capitalize on rising demand for high-speed data transmission solutions. Prominent companies are focused on strategic mergers, acquisitions, and innovations to enhance their market share. For instance, in December 2023, Silicon Line GmbH, a prominent ultra-low-power technology company for high-speed video and imaging interconnects, announced strategic partnership with Leopard Imaging Inc., an intelligent camera design company, to showcase MIPI D-PHY-based active optical cable solutions for transmitting high-resolution camera MIPI signals over long distances. Furthermore, emerging players are entering the market with advanced, cost-efficient solutions to compete with established brands. Additionally, the industry is witnessing significant investment in research and development to cater to sectors such as data centers, telecommunications, and consumer electronics. Regional expansion and collaboration with tech giants further define the competitive dynamics.

The report provides a comprehensive analysis of the competitive landscape in the active optical cable market with detailed profiles of all major companies, including:

- Amphenol Communications Solutions

- Broadcom Inc.

- Corning Incorporated

- Dell Inc.

- Eaton

- Gigalight

- IOI Technology Corporation

- JPC Connectivity

- Linkreal Co., Ltd.

- Molex, LLC (Koch IP Holdings, LLC)

- Siemon

- TE Connectivity

Latest News and Developments:

- January 2025: OWC launched the the USB4 40Gb/s Active Optical Cable, which allows connectivity up to 15 feet without losing speed. They also announced the general availability of the Thunderbolt 5 Hub, which turns a single connection into three Thunderbolt 5 ports and one USB-A port. These products are designed to streamline workflows for creative professionals.

- April 2025: Lessengers announced plans to showcase a range of products at OFC 2025, including the 1.6T transceiver, 800G/400G optical transceiver, active optical cable solutions, and upcoming connectivity advancements featuring co-packaged and near-packaged optical assemblies.

- February 2022: II-VI Incorporated, a frontrunner in optical communications technology, unveiled its new pluggable optical line subsystem (POLS) in the compact QSFP form factor, designed for eight-channel 400ZR/ZR+ transport in data center interconnects (DCIs).

- March 2022: Lumentum Operations LLC showcased its innovative optical and photonic products at the Optical Fiber Communication Conference and Exhibition (OFC) 2022. One of the products in its lineup was vertical-cavity surface-emitting lasers (VCSELs), which can be used for low-cost, high-performance active optical cable applications.

- March 2023: Jabil Inc. revealed that its photonics division is enhancing its design, manufacturing, and testing capabilities, leading to the introduction of a new family of Active Optical Cables (AOC). This expansion positions Jabil to effectively meet the fast-evolving demands of optics-driven network and data center architectures, while also supporting the growing wave of artificial intelligence (AI), cloud computing, high-performance computing (HPC), and machine learning (ML) applications.

Active Optical Cable Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Connector Types Covered | QSFP, CXP, CDFP, CFP, SFP, Others |

| Technologies Covered | InfiniBand, Ethernet, HDMI, DisplayPort, USB, Others |

| Applications Covered | Data Center, High-Performance Computing, Personal Computing, Digital Signage, Consumer Electronics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amphenol Communications Solutions, Broadcom Inc., Corning Incorporated, Dell Inc., Eaton, Gigalight, IOI Technology Corporation, JPC Connectivity, Linkreal Co., Ltd., Molex, LLC (Koch IP Holdings, LLC), Siemon, TE Connectivity, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the active optical cable market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global active optical cable market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the active optical cable industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Active Optical Cables (AOCs) are high-performance data transmission solutions that integrate optical fibers with electrical components, enabling faster, longer-distance communication compared to traditional copper cables. Widely used in data centers, telecommunications, and consumer electronics, AOCs offer enhanced bandwidth, reduced latency, and lower electromagnetic interference, meeting modern connectivity demands.

The global active optical cable market was valued at USD 4,079.0 Million in 2024.

IMARC estimates the global active optical cable market to exhibit a CAGR of 19.8% during 2025-2033.

The market is chiefly driven by increasing data center expansion, rising demand for high-speed connectivity, advancements in 4K/8K video transmission, and the growing adoption of cloud computing and artificial intelligence. Moreover, enhanced bandwidth, energy efficiency, and reduced signal loss significantly support the market’s steady growth trajectory.

In 2024, QSFP represented the largest segment by connector type, driven by its high-speed data transfer capabilities.

InfiniBand leads the market by technology, driven by its superior data transfer speed and efficiency.

Data center is the leading segment by application, driven by rising demand for high-speed connectivity solutions.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global active optical cable market include Amphenol Communications Solutions, Broadcom Inc., Corning Incorporated, Dell Inc., Eaton, Gigalight, IOI Technology Corporation, JPC Connectivity, Linkreal Co., Ltd., Molex, LLC (Koch IP Holdings, LLC), Siemon, TE Connectivity, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)