Active Calcium Silicate Market Size, Share, Trends and Forecast by Form, Application, and Region, 2025-2033

Active Calcium Silicate Market Size and Share:

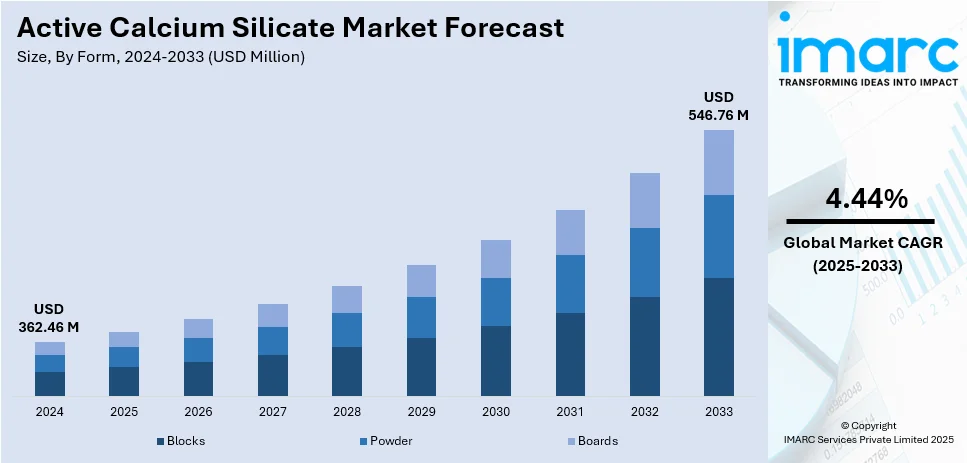

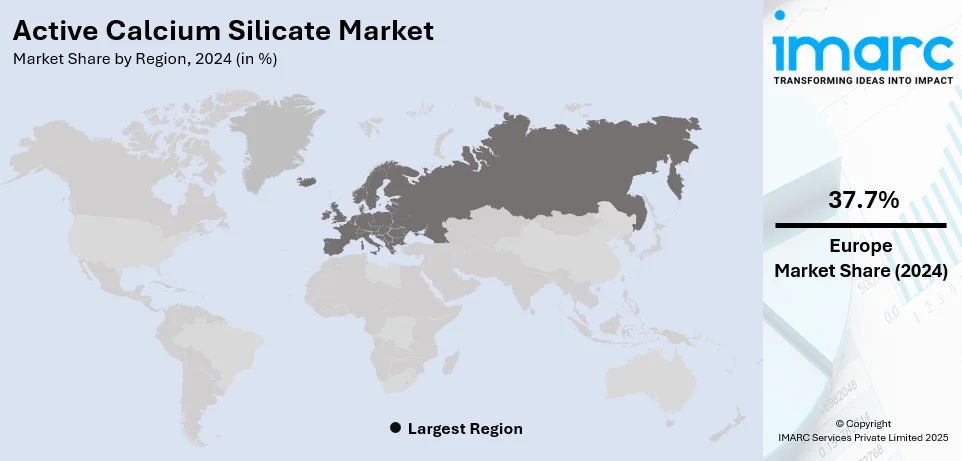

The global active calcium silicate market size was valued at USD 362.46 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 546.76 Million by 2033, exhibiting a CAGR of 4.44% from 2025-2033. Europe currently dominates the market with 37.7% of the share in 2024. The rising demand in fire-resistant construction materials due to safety regulations, heightened adoption in sustainable green buildings meeting LEED standards, and rapidly expanding industrial applications for thermal insulation and energy efficiency in high-temperature industries like oil, gas, and manufacturing are some of the factors impacting the market positively.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 362.46 Million |

|

Market Forecast in 2033

|

USD 546.76 Million |

| Market Growth Rate (2025-2033) | 4.44% |

The global market is majorly driven by the growing product usage in fire safety and insulation applications within high-risk environments in numerous end-use industries, including the construction, industrial, and commercial sectors. Similarly, rapid urbanization, particularly in emerging economies, is increasing demand for advanced building materials and in turn impelling the market. As per the World Bank, India is undergoing rapid urbanization. By 2036, its towns and cities are expected to accommodate 600 million people, making up 40 % of the population, up from 31 percent in 2011, with urban areas contributing nearly 70% to the GDP. Moreover, the ongoing shift towards sustainable and energy-efficient construction practices further fosters market growth. Besides this, significant advancements in product formulations and manufacturing technologies are expanding its application range.

The United States is a key regional market and is experiencing growth due to the rising demand for energy-efficient and sustainable building materials. This can be attributed to the implementation of stringent environmental regulations and green construction trends. Furthermore, the heightened focus on reducing energy consumption across residential, commercial, and industrial buildings is encouraging the adoption of high-performance insulation like calcium silicate, which is creating a positive market outlook. A notable example is Brimstone’s selection for a USD 189 Million investment by the U.S. Department of Energy on March 25, 2024, to construct a commercial cement plant using carbon-free calcium silicate. This process reduces CO2 emissions while producing industry-standard cement and supplementary cementitious materials. Additionally, the expansion of high-temperature industries such as petrochemical, power generation, and manufacturing further drives the need for advanced insulation. some of the other factors, such as rapid industrialization, an enhanced emphasis on fire safety, and continuous technological advancements in material formulations are also accelerating the market’s growth.

Active Calcium Silicate Market Trends:

Growing Demand in Construction

Calcium silicate has hugely benefited from fire-resistant material usage in the construction sector. According to the U.S. Census Bureau, the total construction spending in the United States in 2023 was approximately USD 2.09 Trillion, with immense demand for fireproofing and insulation materials where calcium silicate is in the core of applications. Its usage has recently become a matter of emphasis as there is increasing emphasis on the building safety measures globally and with ever-stringent regulatory standards set upon fire safety aspects, its applications have risen by many folds and have emerged prominently for producing the boards of insulating material, paneling material, and wall as well as floor or ceiling coatings against fires. The versatility of the material has put calcium silicate at a point where it provides thermal and fire protection but is also durable and easy to handle, thus placing it at a go-to point in modern construction. With acceleration in urbanization and increased demands for high-rise buildings, there is an ever-increasing demand for reliable fire-resistant materials. This has led to a higher adoption rate of calcium silicate-based products in residential, commercial, and industrial building projects, fostering substantial market growth.

Adoption in Green Building Materials

Modern construction is focusing increasingly on sustainability as a criterion that is forcing increasing usage of calcium silicate-based materials. The importance given to the sustainable construction process along with achieving the green building certificates such as LEED (Leadership in Energy and Environmental Design) increases the requirement of sustainable materials. The U.S. Green Building Council (USGBC) has reported significant growth in LEED-certified projects, with a 9% increase in 2023 over the previous year. Additionally, the USGBC highlighted a 19% growth in LEED-certified homes since 2017, showcasing the rising adoption of sustainable building practices. Since it is eco-friendly, calcium silicate has emerged as a promising material for constructing buildings with least environmental impacts. The material is asbestos-free and nontoxic. It can also be produced by energy-efficient methods to meet the demands of green building standards. Another important characteristic is that calcium silicate products are highly energy-efficient, leading to improved insulation with reduced energy consumption in buildings. This trend is driving market growth, as more architects, developers, and builders prefer to incorporate calcium silicate into their projects, particularly in environmentally conscious regions where sustainability is a key factor in construction material selection.

Expanding Use in Industrial Applications

Calcium silicate is finding its application in industrial applications rapidly, especially in terms of thermal insulation, making it suitable for industries that work at high temperatures. This includes the oil and gas, power generation, and manufacturing sectors, where operational efficiency and energy loss reduction are critical. An industry report indicates that the market for thermal insulation materials is projected to experience consistent growth over the coming years. It is expected to expand to USD 74.85 Billion by 2028 with a compound annual growth rate (CAGR) of 4.7%. The main use of calcium silicate is to generate high-temperature-resistant coatings and insulation products that avoid heat loss while shielding equipment from drastic conditions. With these properties, calcium silicate has become indispensable in furnace linings, steam pipes, and other critical industrial equipment. As industries are increasingly focusing on improving energy efficiency and reducing operating costs, the demand for calcium silicate products is likely to expand in the future. Additionally, with increased demands for protection against corrosion in industrial applications, calcium silicate provides protection from moisture and the environment, giving it a wider use in industrial applications.

Active Calcium Silicate Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global active calcium silicate market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on form and application.

Analysis by Form:

- Blocks

- Powder

- Boards

Calcium silicate boards lead the market in 2024. These boards are increasingly in demand due to their superior fire and heat resistance properties, making them an ideal choice for high-temperature insulation and fireproofing applications. These boards are widely used in industrial settings, such as power plants, refineries, and chemical manufacturing facilities, to protect equipment from heat damage and reduce energy loss. Additionally, the growing focus on sustainable building practices and energy-efficient construction is driving the use of calcium silicate boards in commercial and residential buildings. The material’s ability to meet stringent fire safety regulations and its role in reducing energy consumption in buildings is expected to further boost its adoption in the construction sector.

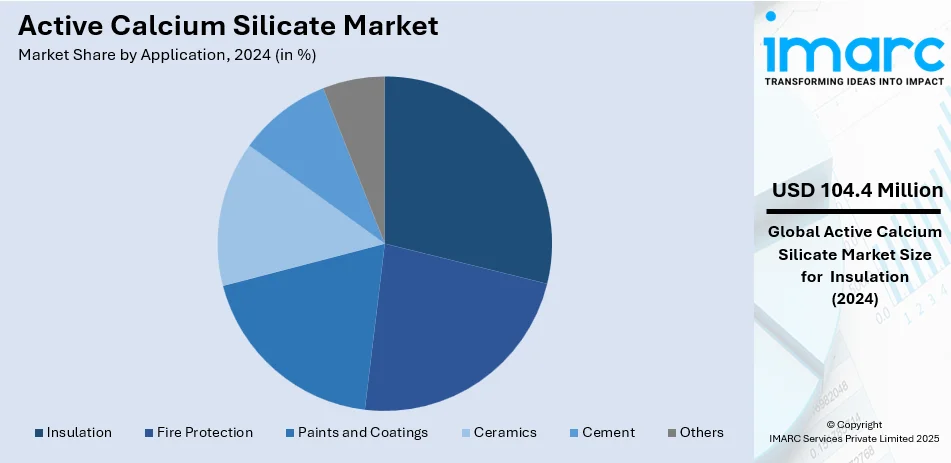

Analysis by Application:

- Insulation

- Fire Protection

- Paints and Coatings

- Ceramics

- Cement

- Others

Insulation leads the market with around 28.8% of market share in 2024 driven by increasing demand for energy-efficient solutions across industries. Stricter regulations on energy conservation and workplace safety are fueling the adoption of high-performance insulation materials. Active calcium silicate’s superior thermal resistance and lightweight properties render it ideal for industrial equipment, pipelines, and building insulation. The growing focus on sustainable construction practices and the development of green buildings have further augmented its use in residential and commercial projects. Additionally, expanding industries such as oil and gas, power generation, and manufacturing are driving demand for reliable insulation materials to reduce energy losses, optimize operational efficiency, and enhance safety standards.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe is the leading region with a market share of 37.7% in 2024 due to the widespread implementation of stringent building regulations emphasizing fire safety and energy efficiency. The region's focus on sustainable construction practices and green building certifications drives the demand for eco-friendly insulation and fireproofing materials, where active calcium silicate plays a crucial role. Significant advancements in construction technologies and the widespread adoption of high-performance materials further bolster market growth. Additionally, the region's well-established industrial base, including power generation, manufacturing, and chemical sectors, relies heavily on calcium silicate for thermal insulation and protection. Government initiatives promoting energy conservation and investments in infrastructure projects are further solidifying Europe's position as a leading market for active calcium silicate products.

Key Regional Takeaways:

United States Active Calcium Silicate Market Analysis

The market is expanding, mainly driven by its applications in the construction, pharmaceutical, and food sectors. According to the U.S. Census Bureau, the total construction spending in the United States in 2023 was approximately USD 2.09 Trillion, with immense demand for fireproofing and insulation materials where calcium silicate is in the core of applications. In the pharmaceutical sector, the U.S. FDA notes the extensive application of calcium silicate as an excipient in numerous drug preparations besides its role as an anticaking agent in food processing. Companies like CalciTech and FerroTec remain the largest US-based manufacturers, propelling growth with innovation through eco-friendly and sustainable production processes. In addition, government regulations regarding safety standards and sustainability are further augmenting the use of high-quality calcium silicate products. With strong demand in the U.S. market across various sectors, the U.S. remains a significant player in the global active calcium silicate market.

Europe Active Calcium Silicate Market Analysis

The active calcium silicate market has been on a constant growth trend in Europe. Steady demand from the construction, food, and personal care sectors drives this trend. According to Eurostat, in 2023, the EU had a total turnover of around EUR 1.8 Trillion (USD 1.9 Trillion) in the construction sector, with a pronounced preference for fire-resistant and insulating material such as calcium silicate. Notified by the European Food Safety Authority (EFSA), calcium silicate is rapidly on the rise in the usage in food products as an anticaking agent, which further stimulates demand. Moreover, the increasing concern for sustainability in construction has boosted the demand for more eco-friendly materials where calcium silicate's properties meet the regulatory standards. Omya and Solvay are all-front runners in this region, with high-quality environmentally friendly calcium silicate products. Government initiatives that promote sustainable construction and strict safety regulations are what are driving the growth. Its expanding market ensures that Europe will remain a prominent player in the global active calcium silicate market, both in terms of production and innovation.

Asia Pacific Active Calcium Silicate Market Analysis

The Asia Pacific market for active calcium silicate is gaining momentum with massive growth in both the construction and food sectors. According to an industry report, the Chinese government has already sanctioned USD 4.2 Trillion on infrastructure projects within 2021-2025, thereby inducing huge demand in fireproofing and insulating materials such as calcium silicate. In the food industry, Food Safety and Standards Authority of India or FSSAI reported that it is witnessing growing usage of calcium silicate as an anticaking agent. High-quality, eco-friendly calcium silicate is in focus for various construction and industrial applications in countries like Japan and South Korea. Local players, such as Shandong Dongda Chemical and Ube Materials, are increasing production to meet rising demand while partnering with global companies for advanced technology transfers. The region's emphasis on smart infrastructure and sustainable development is further fueling the market. With government-backed projects and increasing incomes, Asia-Pacific is poised to remain one of the leaders globally in the global active calcium silicate market in the near term.

Latin America Active Calcium Silicate Market Analysis

The market in Latin America is experiencing steady growth, especially in Brazil and Mexico, as demand is rising in the construction and food industries. According to an industrial report, investments in infrastructure in Brazil reached a peak in 2023 at 213 Billion Brazilian reals (approximately USD 42 Billion), thus increasing demand for fire-resistant and insulating materials such as calcium silicate. The Mexican food industry continues to remain an important driver for growth. With the support of the National Commission for the Efficient Use of Energy for the application of calcium silicate as an anticaking agent, its demand for use in both construction and industrial purposes is expected to increase given the expanding government-backed infrastructure projects as the region's middle class continues to grow. Local producers, including MexChem and Alesia, are increasing production capabilities to meet this demand, where there is an increasing focus on sustainability and ecological value. These factors are contributing to the continued growth of active calcium silicate market in Latin America.

Middle East and Africa Active Calcium Silicate Market Analysis

The Middle East and Africa are presently experiencing an increased active calcium silicate market on account of up-escalation infrastructure development along with increasing industrial applications. The UAE government passed a budget of AED 64.1 Billion, which is equivalent to USD 17.5 Billion, in October 2023 to stimulate the growth of the construction sector. A total of AED 2.6 Billion or USD 708 Million was set aside for infrastructure and economic resources projects in 2024, as per reports. The increased investment in construction activities fuels demand for materials such as calcium silicate, especially for fireproofing and insulation purposes. Their investment in infrastructures and industrial developments has further boosted market demand in Africa, and regional players such as Arabian Minerals and Arab Chemical Industries are augmenting their production to meet the fast-growing demand for high-quality, environment-friendly calcium silicate products. As governments in the Middle East and Africa continue to focus on the growth of infrastructure, the market is likely to grow in this region and place it in a prime position worldwide.

Competitive Landscape:

The competitive landscape of the active calcium silicate market is characterized by the presence of numerous regional and global players focused on expanding their product portfolios and market reach. The major manufacturers are emphasizing innovation to develop advanced, high-performance products that cater to diverse applications, including fireproofing, insulation, and industrial coatings. On the other hand, the regional players are increasingly competing through cost-effectiveness and localized supply chains. Strategic partnerships, mergers, and acquisitions are prevalent as companies are aiming to strengthen their foothold and leverage synergies. Besides this, the growing emphasis on eco-friendly solutions are prompting manufacturers to adopt sustainable production processes. Additionally, the rising investments in research and development (R&D) to enhance product properties, such as thermal resistance and durability, further intensify competition in the market.

The report provides a comprehensive analysis of the competitive landscape in the active calcium silicate market with detailed profiles of all major companies, including:

- 2K Technologies

- Etex Group

- Johns Manville (Berkshire Hathaway)

- MLA Group of Industries

- Neelkanth Finechem LLP

- Ramco Industries Ltd.

- Sanmati Mascot Exim

- Sibelco

- Skamol Group

- Soben International (Asia Pacific) Ltd.

- Weifang Hongyuan Chemical Co. Ltd

- Xella International

Latest News and Developments:

- January 2025: PQ Corporation announced the acquisition of Sibelco's specialty silicate business in Sweden, strengthening its European network. CEO Al Beninati emphasized leveraging expertise to support growth for new Nordic customers.

- May 2023: Etex completed its acquisition of Skamol, a specialty insulation expert, bolstering its sustainable offerings. This strategic move strengthens Etex’s presence in the high-temperature insulation market, expands geographic reach, and enhances its lightweight construction portfolio. Skamol’s 300 employees join Etex to support global growth in energy-efficient and sustainable building solutions.

Active Calcium Silicate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Blocks, Powder, Boards |

| Applications Covered | Insulation, Fire Protection, Paints and Coatings, Ceramics, Cement, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 2K Technologies, Etex Group, Johns Manville (Berkshire Hathaway), MLA Group of Industries, Neelkanth Finechem LLP, Ramco Industries Ltd., Sanmati Mascot Exim, Sibelco, Skamol Group, Soben International (Asia Pacific) Ltd., Weifang Hongyuan Chemical Co. Ltd, Xella International, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the active calcium silicate market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global active calcium silicate market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the active calcium silicate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The active calcium silicate market was valued at USD 362.46 Million in 2024.

The active calcium silicate market is projected to exhibit a CAGR of 4.44% during 2025-2033.

The active calcium silicate market is driven by growing demand in industries such as construction, automotive, and electronics due to its fire-resistant and insulation properties. Increased use in cement production, alongside its eco-friendly characteristics, and rising construction activities globally, further fuel the market's growth.

Europe currently dominates the market driven by the widespread implementation of stringent building regulations emphasizing fire safety and energy efficiency.

Some of the major players in the active calcium silicate market include 2K Technologies, Etex Group, Johns Manville (Berkshire Hathaway), MLA Group of Industries, Neelkanth Finechem LLP, Ramco Industries Ltd., Sanmati Mascot Exim, Sibelco, Skamol Group, Soben International (Asia Pacific) Ltd., Weifang Hongyuan Chemical Co. Ltd, Xella International, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)