Acrylic Resin Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

Acrylic Resin Market Size and Share:

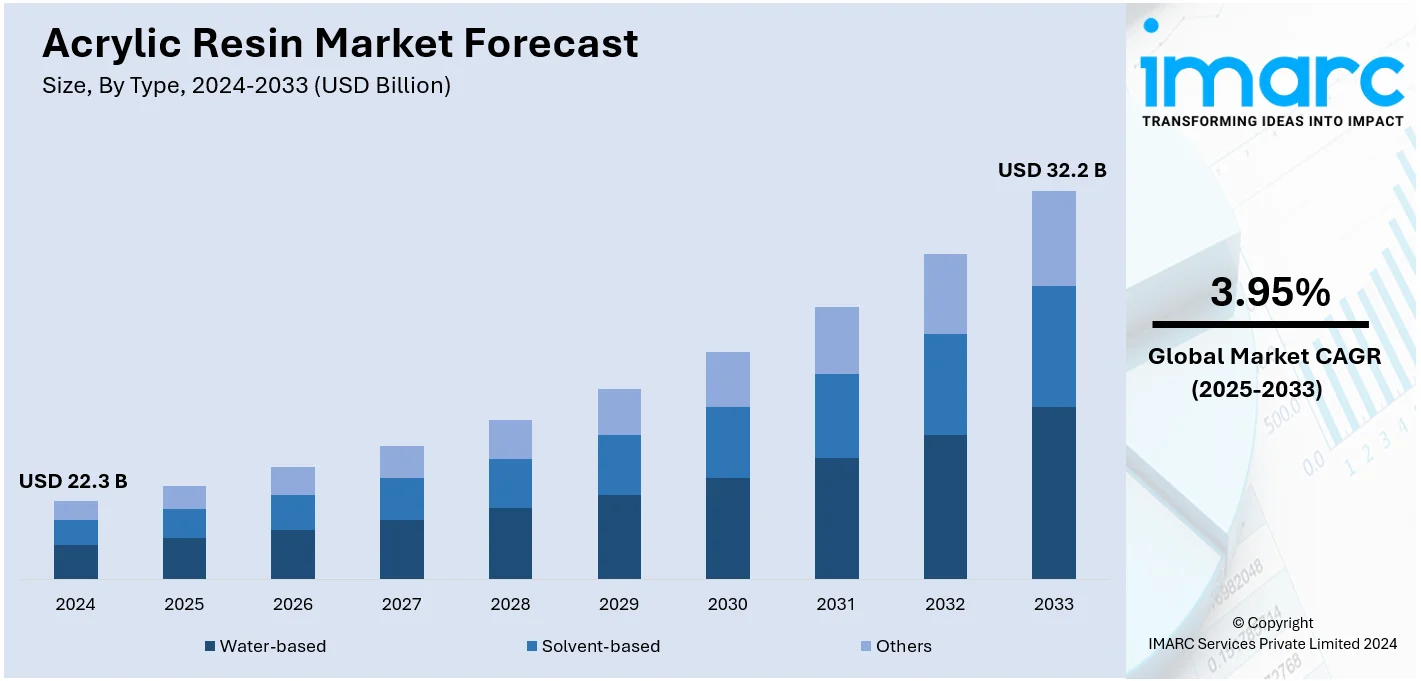

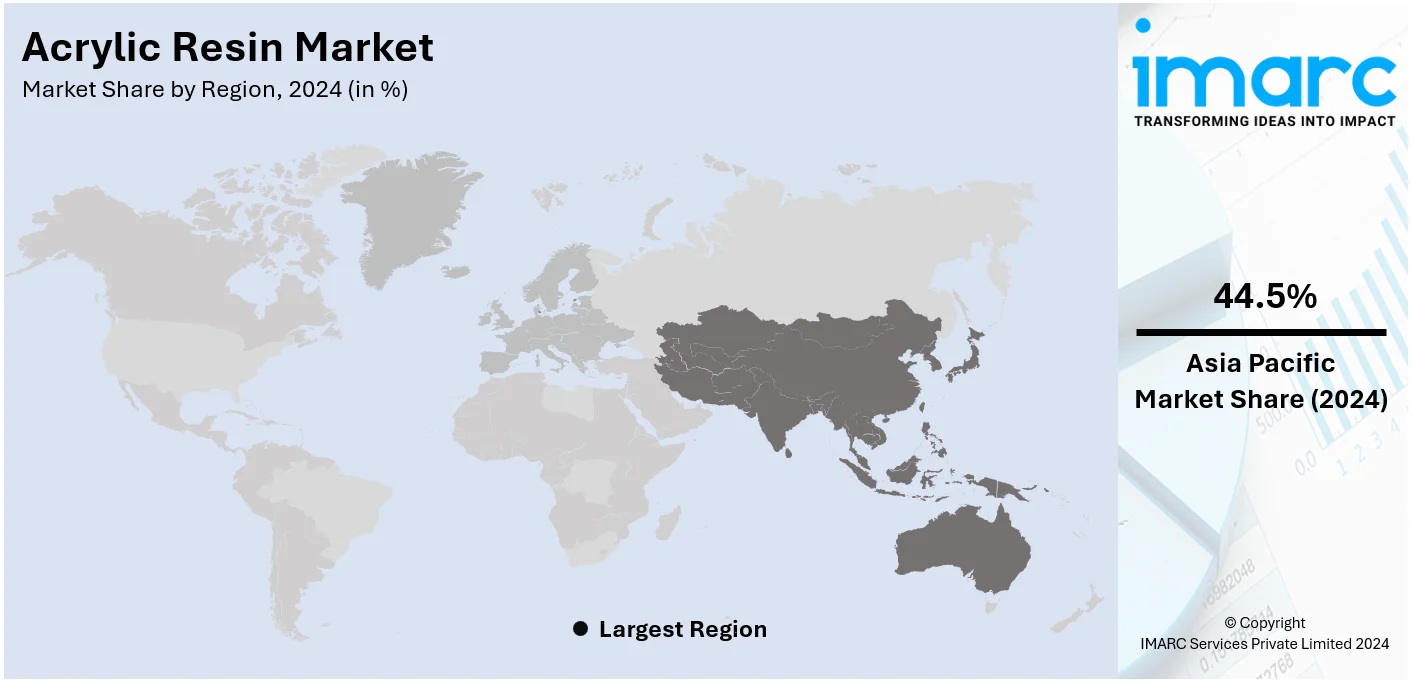

The global acrylic resin market size was valued at USD 22.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 32.2 Billion by 2033, exhibiting a CAGR of 3.95% during 2025-2033. Asia-Pacific currently dominates the market in 2024. The growing demand for acrylic-based construction materials, the rising popularity of waterborne acrylic resins, and increasing innovations in technology, such as nanotechnology, for enhancing product properties are some of the key factors propelling the market across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 22.3 Billion |

|

Market Forecast in 2033

|

USD 32.2 Billion |

| Market Growth Rate (2025-2033) | 3.95% |

The global acrylic resin market is primarily driven by its versatile applications across industries such as construction, automotive, packaging, and electronics. Its durability, weather resistance, and excellent adhesion make it a preferred material in paints, coatings, and adhesives. Moreover, in packaging, acrylic resins offer transparency and strength, meeting consumer demand for lightweight, sustainable, and ‘green’ solutions. According to the IMARC Group, the global green packaging market size reached USD 271.2 Billion in 2024 and is projected to reach USD 415.3 Billion by 2033, exhibiting a CAGR of 4.35% during 2025-2033. In addition, advancements in polymer technologies and the growing popularity of water-based acrylic formulations, which are eco-friendly and low in VOCs, further facilitate industry expansion.

The United States has emerged as a key regional market for acrylic resin, driven by strong demand across the construction, automotive, and packaging industries. Increasing construction and infrastructure development projects are propelling the need for acrylic-based architectural coatings, valued for their durability and weather resistance. Additionally, the packaging industry also benefits from the transparency, strength, and lightweight properties of acrylic resin, catering to sustainable packaging trends. According to the National Association of Convenience Stores (NACS), American consumers are willing to pay a premium for sustainable goods, with 80% conscious of the environmental impact of their purchases. Besides this, advancements in water-based and low-VOC acrylic formulations, driven by stringent environmental regulations, further support market growth.

Acrylic Resin Market Trends:

Growing demand for acrylic-based construction materials

The growing demand for acrylic-based construction materials is currently exerting a positive influence on the acrylic resin market. The IMARC Group reports that the global construction materials market reached USD 1,271.7 Million in 2024. Acrylic-based construction materials are being favored for their remarkable durability and exceptional weather resistance. These properties make them particularly suitable for use in exterior coatings, sealants, and adhesives, ensuring that structures remain aesthetically pleasing and structurally sound over extended periods. Moreover, the environmental consciousness prevailing in the construction industry is leading to the rising utilization of acrylic resins. As builders and developers seek sustainable and eco-friendly options, there is a rising demand for acrylic resins due to their reduced environmental impact, which is positively influencing the acrylic resin market.

Rising popularity of waterborne acrylic resins

The rising popularity of waterborne acrylic resins is propelling the overall acrylic resin market growth. In line with this, environmental concerns and stringent regulations governing volatile organic compounds (VOCs) are leading to a pronounced shift toward waterborne acrylic resins. Their low VOC content aligns with the global imperative to reduce air pollution and minimize harm to both human health and the environment. According to the World Health Organization (WHO), air pollution is the cause of death for an estimated 7 Million people worldwide every year. Data also shows that 9 out of 10 people breathe air containing high levels of pollutants. Additionally, continual research and development (R&D) efforts aimed at enhancing the performance characteristics of waterborne acrylic resins are driving their adoption across various industries. These efforts are focused on improving properties, such as ultraviolet (UV) resistance, chemical resistance, and adhesion capabilities, making waterborne acrylic resins increasingly versatile and suitable for an array of applications.

Increasing utilization of flexible packaging materials in the e-commerce sector

The acrylic resin market share is increasing as a result of the growing use of strong, flexible packaging materials in the e-commerce industry. The India Brand Equity Foundation (IBEF) states that the Indian e-commerce industry is projected to reach USD 325 Billion by 2030. Concurrently, the growing demand for packaging solutions that are both robust and versatile is necessary to maintain the quality of various products while transporting them. Acrylic resins are increasingly chosen due to their exceptional strength and flexibility, enabling the creation of packaging materials capable of withstanding the rigors of transportation and handling, thereby safeguarding the contents of packages during transit. Furthermore, the continuous innovation in acrylic resin formulations and manufacturing processes is enhancing their suitability for use in flexible packaging materials. Acrylic resins with improved barrier qualities, ultraviolet (UV) resistance, and printability are being produced as a result of this continuous research and development (R&D) effort, which makes them a desirable option for e-commerce packaging applications.

Acrylic Resin Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global acrylic resin market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application, and end user.

Analysis by Type:

- Water-based

- Solvent-based

- Others

Water-based stands as the largest component in 2024. It is also called water-based acrylic or acrylic emulsion, and is an acrylic polymer dispersed in water. It is used in a variety of applications, such as paints, coatings, adhesives, sealants, inks, and textiles. Being more environmentally friendly than solvent-based acrylic resins, it produces less VOC, which is responsible for air pollution. This makes it preferred by environmentally conscious consumers and industries. It also dries very fast, ideal for applications with fast curing or drying requirements. It offers reasonable resistance to the effects of the weather, ultraviolet radiation, and chemicals, ensuring a long-term finish. Compared with solvent-borne alternatives, they generally produce less odor during work, meaning it is possible to work within a house for an extended time comfortably.

Analysis by Application:

- Paints and Coatings

- Adhesives and Sealants

- Others

Paints and coatings lead the market in 2024. From the market overview of acrylic resin, these are very widely applied in paints and coating formulations due to their versatility and durability, as well as many beneficial properties. Acrylic resins are one of the most prevalent binders found in waterborne interior or exterior paints. They show a very efficient adhesive on a broad variety of substrates, such as wood, concrete, stucco, and drywall. The drying of paints is very rapid, with low odor and a long period of color retention. They are used as wall paints, trim paints, and other coatings in decorative houses and commercial structures. Acrylic-based waterproofing coatings are also utilized to protect water penetration into roofs, decks, and concrete structures. These stop moisture damage as they form an impermeable, seamless water barrier.

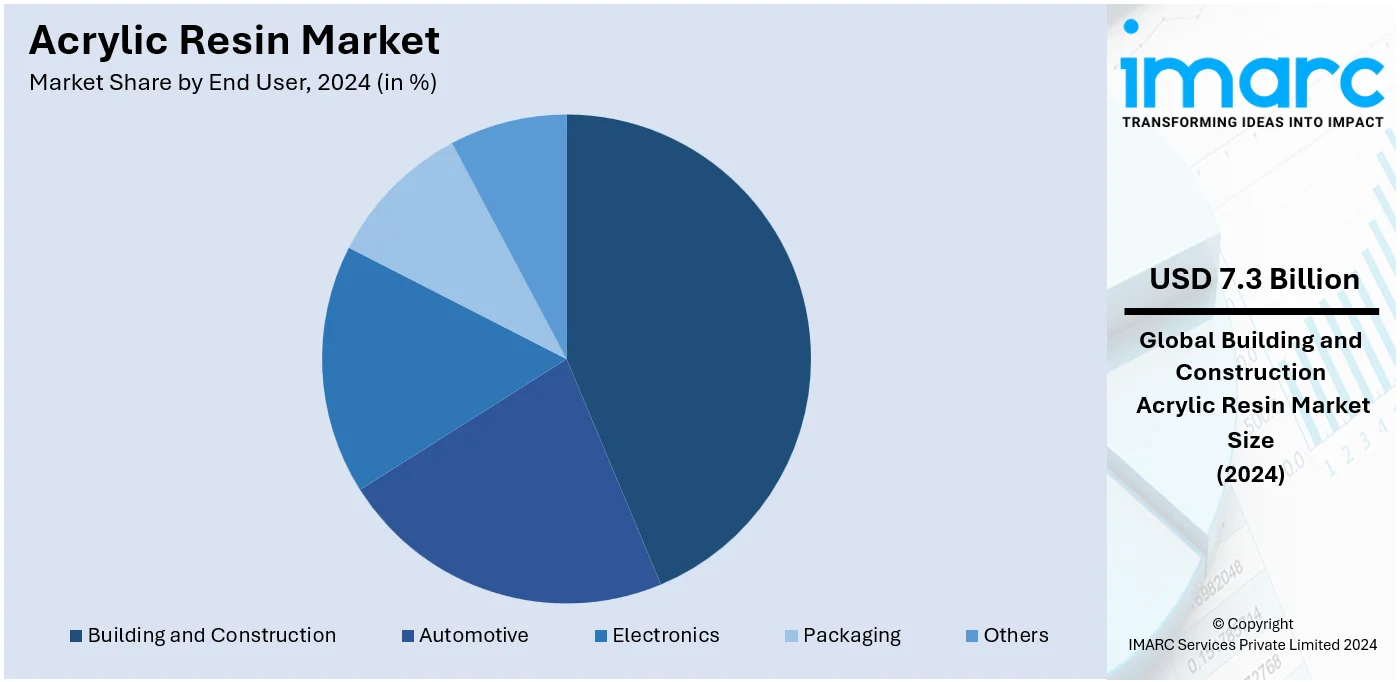

Analysis by End User:

- Automotive

- Building and Construction

- Electronics

- Packaging

- Others

Building and construction represent the leading market segment in 2024. Acrylic resins are used in the formulation of architectural coatings, which include paints, both interior and exterior. These coatings serve to protect building surfaces and contribute to their aesthetics. Acrylic-based paints have a reputation for durability, withstanding weathering, and excellent color retention. Acrylic resins are applied in textured finishes and coatings of exterior walls to give these wall surfaces both their aesthetic appeal and weather resistance. The use of acrylic-based finishes is suitable for stucco, concrete, and other substrates as an exterior wall treatment that would improve the look and durability of walls. The acrylic-based roof coating is used for flat or low-slope roofs, mainly for waterproofing and UV radiation protection. Through acrylic resins, the lifespan of the roofing materials is increased and helps save energy because the coatings reduce the absorption of sunlight and heat. Thus, the building and construction sectors embrace this material widely.

Analysis by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share. Asia Pacific leads the acrylic resin market, holding the largest share due to rapid industrialization, urbanization, and infrastructure development, particularly in countries such as China, India, and Japan. The region's booming construction and automotive industries drive significant demand for acrylic resins in paints, coatings, adhesives, and sealants. Additionally, the growing packaging, electronics, and healthcare sectors contribute to the rising consumption of these resins. Favorable government initiatives promoting manufacturing and foreign investments further support market growth. The availability of raw materials and cost-effective labor gives Asia Pacific a competitive advantage, encouraging production expansion by major global players. Environmental regulations promoting eco-friendly, water-based resins also drive the shift toward sustainable products in the region.

Key Regional Takeaways:

United States Acrylic Resin Market Analysis

A significant demand driver of acrylic resins is the search for lightweight and durable materials across different industries, such as automotive, construction, and electronics. Furthermore, acrylic resins are versatile in that they give durability, transparency, weather resistance, and ease in molding, hence applied in coatings, adhesives, and plastics. In construction, energy-efficient and aesthetically pleasing buildings also call for acrylic-based paints and sealants. Similarly, in the automotive sector, emphasis on fuel efficiency and lightweight components has given an impetus to the uptake of acrylic parts in both interiors and exteriors. The application of acrylic resins in the electronics sector is also highly pervasive, owing to its insulating nature and protective action against the adverse influences of the environment regarding sensitive components. Other than that, the popularity of green products is giving a positive market aspect. Acrylic resins are now more and more produced through environmentally friendly methods that respond to the increasing pressure of consumers and the government to decrease carbon footprints. The developments in bio-based acrylics and advanced resin formulations also serve the same purpose. The increasing demand for acrylic resins is also caused by the fast growth of e-commerce. According to a research report, in 2024, online shoppers in the United States will increase by 5.6% to reach 273.49 Million. Additionally, high-quality packaging solutions are more attractive and durable in nature. Hence, acrylic resins are the best option for this purpose.

Asia Pacific Acrylic Resin Market Analysis

The Asia Pacific acrylic resin market has experienced tremendous growth due to intensive industrialization, urbanization, and an increase in the middle-class population in this region. These resins are used by major industries such as automobile, construction, electronics, and packaging. They have immense applications due to flexibility of usage, durability, transparency, and resistance to weather conditions. This is being led by large-scale infrastructure projects and urban development across countries such as China, India, and Southeast Asian nations. Hence, the construction sector is one of the key growth drivers. India is going to spend nearly USD 1,727.05 billion on infrastructure in the seven fiscals until 2030, as per CRISIL's Infrastructure yearbook 2023. Acrylic-based paints, sealants, as well as coatings are increasingly used due to their protective, aesthetic characteristics that promote modern and energy-efficient constructions in the region. As such, the enhancement of automotive vehicle production and sales both in China, Japan, as well as India, increased the demand for lighter, high-performance materials. The electronics industry also has a strong base in the region, which creates demand for acrylic resins because of their use in protective coatings and adhesives for electronic devices. The adoption of smartphones, laptops, and other consumer electronics also boosts the market.

Europe Acrylic Resin Market Analysis

The acrylic resin market in Europe is driven by industrial growth, stringent environmental regulations, and increasing demand for sustainable materials. Key industries, such as automotive, construction, electronics, and packaging, make intensive use of acrylic resins because of their flexibility, durability, and performance in various applications. Acrylic resins are needed in the form of coatings, adhesives, and lightweight components within the automobile industry due to Europe's focus on lightweight and energy-efficient automobiles. Such materials increase fuel efficiency and reduce emissions to meet the region's required vision of maintaining a sustainable transportation infrastructure. In the construction sector, it is also in high demand. Acrylic resins are used broadly in paints, sealants, and adhesives in order to enable better building durability and, eventually, energy efficiency. Acrylic-based products are influenced by the growing demand for innovative construction materials that satisfy modern aesthetic and functional requirements. Besides this, sustainability is the main driver for the European market. Governing agencies and industries in the region are oriented toward reducing environmental impact, culminating in the adoption of bio-based and low-VOC acrylic resins. These environmentally friendly substitutes are compliant with the very strict EU frameworks of reducing carbon footprint and adopting a circular economy. In addition to that, due to the rise in online purchasing trends among locals, the application of acrylic resins has increased in the packaging industry. The share of e-shoppers increased from 53% in 2010 to 75% in 2023, an increase of 22 percentage points (pp) in the EU, according to the Council of the EU and the European Council.

Latin America Acrylic Resin Market Analysis

The growth drivers in the Latin America acrylic resin market are expanding demands in the construction, automotive, packaging, and electronics sectors with urbanization, industrialization, and development of infrastructure. According to industry reports, 88.1% of the total population of Latin America lives in urban areas in 2024. Acrylic resin is widely used in paints, coatings, and sealants, meeting the demand for durable and weather-resistant materials across the region for residential and commercial construction projects. Other than that, the automotive industry benefits from the vehicle output, which has increased as of late. This is also with respect to Brazilian and Mexican markets, which incorporate acrylic resins in their products, such as coatings, light parts, and adhesives. The packaging sector is another key market driver, supported by increased consumer goods consumption alongside the increasing volume of e-commerce. In this sector, the main advantage of acrylic resins in packaging food products lies in their high durability, aesthetics, and protection capabilities.

Middle East and Africa Acrylic Resin Market Analysis

Investment in the construction and automotive sectors is a prime growth driver for the market. Economic diversification, as well as industrial growth, are in the spotlight in this region, thereby creating a huge demand for the versatile and durable material of acrylic resins. Moreover, construction and infrastructure are significant contributors to market growth, supported by positive government initiatives for the development of smart cities, residential complexes, and commercial hubs. Acrylic resins are very much in demand for their resistance to weathering, their durability, and their aesthetic value in coatings, paints, and sealants for long-lasting applications under difficult environmental conditions. The automotive industry is also important in Gulf countries, with increased vehicle production and imports. According to a research report, Audi achieved significant sales volume in 2023 with 6% year-over-year growth in the Middle East. Acrylic resins are also utilized in automotive coatings and lightweight components to help manufacturers achieve efficiency and sustainability targets. The trend of electric vehicles will further increase demand for advanced acrylic materials.

Competitive Landscape:

The key players involved in the acrylic resin market have been contributing immensely to its growth through strategic measures such as innovative products, mergers and alliances, and increases in production. The leading manufacturers are developing highly performing, green acrylic resins that cater to the increasing trend of sustainable products with low-VOC (volatile organic compound) content. Investment in research and development (R&D) further enhances acrylic resin formulation for applications in automotive, construction, and electronics. Mergers and acquisitions are also aiding firms in expanding their product lines and geographic presence. Players are focusing on improving manufacturing efficiency to reduce costs, further driving demand. With a strong emphasis on sustainability and technological advancement, these efforts collectively facilitate overall industry expansion.

The report provides a comprehensive analysis of the competitive landscape in the acrylic resin market with detailed profiles of all major companies, including:

- Arkema S.A

- BASF SE

- DIC Corporation

- Dow Inc.

- Koninklijke DSM N.V.

- Mitsubishi Chemical Corporation

- Mitsui Chemicals Inc

- NIPPON SHOKUBAI CO. LTD.

- Showa Denko Materials Co. Ltd.

- Solvay S.A.

- Sumitomo Chemical Co. Ltd.

Latest News and Developments:

- October 2024: Arkema has produced ethyl acrylate from bioethanol at its acrylic monomer facility in Carling, France. This will allow Arkema to enter rapidly expanding markets with its specialty resins and additives that are bio-based and have a lower carbon content.

- July 2024: Engineered Polymer Solutions (EPS) announced the expansion of its industrial wood portfolio with the launch of EPS 2460, a new all-acrylic polymer that is an exceptional choice for flat and semi-gloss coatings. With this technology, customers will be able to create solutions that satisfy their performance needs without requiring additional fluorosurfactants.

- March 2024: DIC Corporation announced that its subsidiary IDEAL CHEMI PLAST PRIVATE LTD., based in the Indian state of Maharashtra, has commenced operations at a new production facility for coating resins for automotive and infrastructure applications in the Supa Japanese Industrial Zone in February 2024.

Acrylic Resin Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Water-based, Solvent-based, Others |

| Applications Covered | Paints and Coatings, Adhesives and Sealants, Others |

| End Users Covered | Automotive, Building and Construction, Electronics, Packaging, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arkema S.A, BASF SE, DIC Corporation, Dow Inc., Koninklijke DSM N.V., Mitsubishi Chemical Corporation, Mitsui Chemicals Inc, NIPPON SHOKUBAI CO. LTD., Showa Denko Materials Co. Ltd., Solvay S.A., Sumitomo Chemical Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the acrylic resin market from 2019-2033.

- The acrylic resin market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the acrylic resin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Acrylic resin is a synthetic polymer derived from acrylic acid or methacrylic acid. Known for its durability, transparency, and weather resistance, it is widely used in applications such as adhesives, coatings, paints, and molding compounds. Acrylic resin is valued for its versatility, providing strong adhesion, aesthetic appeal, and resistance to UV light and moisture.

The acrylic resin market was valued at USD 22.3 Billion in 2024.

IMARC estimates the global acrylic resin market to exhibit a CAGR of 3.95% during 2025-2033.

The growing demand for durable and weather-resistant coatings in construction and automotive industries, increased use of acrylic resins in water-based paints and adhesives, rising applications in packaging for enhanced durability and aesthetics, expansion of electronics and consumer goods sectors, and advancements in acrylic resin technologies are the primary factors driving the global acrylic resin market.

According to the report, water-based represented the largest segment by type due to its low environmental impact, compliance with stringent regulations, and reduced volatile organic compound (VOC) emissions.

Paints and coatings lead the market by application due to their excellent durability, adhesion, and weather resistance, making them ideal for construction, automotive, and industrial applications.

Building and construction hold the largest market share by end user due to the extensive use of acrylics resin in paints, adhesives, and sealants for durable, weather-resistant finishes.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global acrylic resin market include Arkema S.A, BASF SE, DIC Corporation, Dow Inc., Koninklijke DSM N.V., Mitsubishi Chemical Corporation, Mitsui Chemicals Inc, NIPPON SHOKUBAI CO. LTD., Showa Denko Materials Co. Ltd., Solvay S.A., Sumitomo Chemical Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)