Acrylamide Monomer Market Report by End-Use (Waste and Wastewater Treatment, Petroleum (Mostly Drilling Fluid), Pulp/Paper, Mining, Coating, Printing/Dying, and Others), and Region 2025-2033

Acrylamide Monomer Market Size:

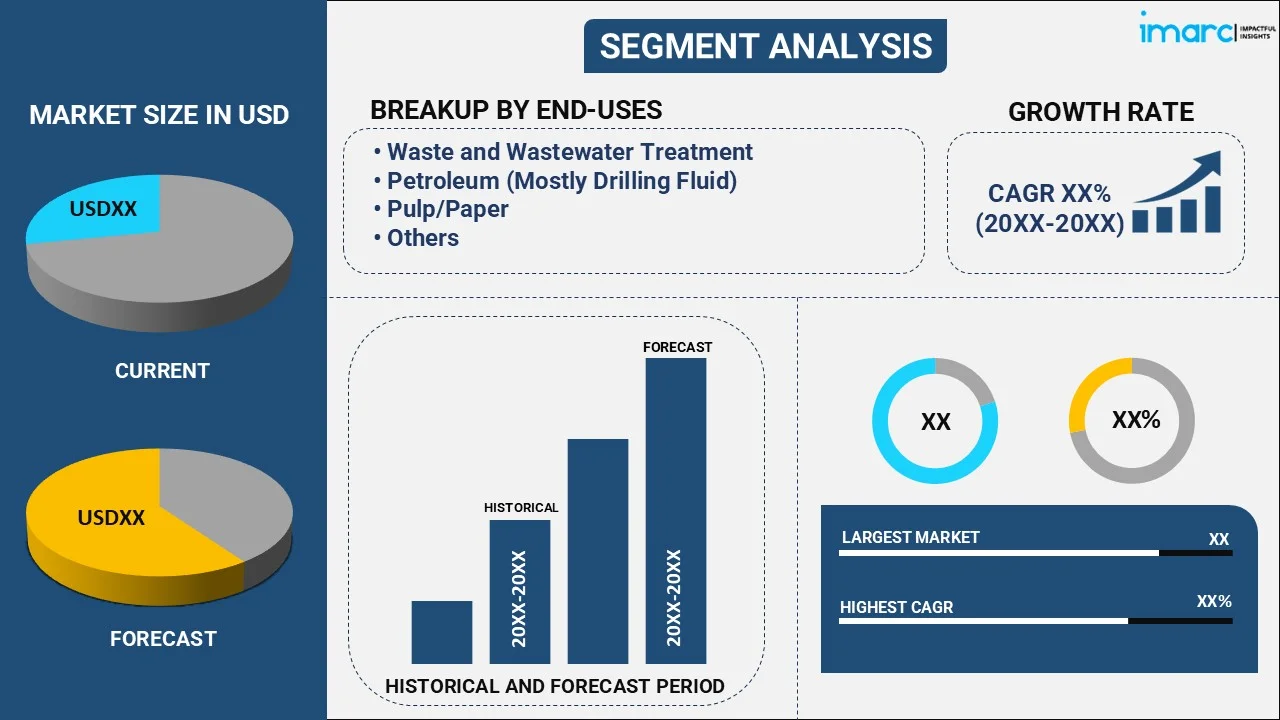

The global acrylamide monomer market size reached USD 5.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.2 Billion by 2033, exhibiting a growth rate (CAGR) of 8% during 2025-2033. The market is growing rapidly driven by the increasing product utilization in water treatment process, significant growth in the oil and gas sector, recent innovation in the pulp and paper industry, imposition of stringent environmental regulations across the globe, and the rapid expansion of the agriculture sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5.1 Billion |

|

Market Forecast in 2033

|

USD 10.2 Billion |

| Market Growth Rate 2025-2033 | 8% |

Acrylamide Monomer Market Analysis:

- Market Growth and Size: The market is witnessing stable growth, driven by expanding applications across various industries. Additionally, the rising product demand in sectors such as water treatment, paper manufacturing, and oil recovery is bolstering the market growth.

- Major Market Drivers: According to the acrylamide monomer market forecast, key drivers include the escalating demand for clean water and stringent water treatment regulations, growth in the oil and gas sector, and the extensive use of polyacrylamide in various industrial applications. Furthermore, the expanding agriculture sector, utilizing acrylamide for soil conditioning and water retention, is supporting the market growth.

- Technological Advancements: Recent innovations to improve the production efficiency of acrylamide and develop new formulations enhancing its application efficiency and environmental safety are positively impacting the market growth. Besides this, recent technological advancements, creating high-performance and sustainable acrylamide-based products, are expanding the acrylamide monomer market share.

- Industry Applications: The market is experiencing high product demand in industries like water treatment, petroleum sector, pulp and paper, mining, coating, and printing/dyeing industries, owing to its water-soluble polymer applications.

- Key Market Trends: As per the acrylamide monomer market forecast, key trends involve the increasing focus on producing environmentally friendly and biodegradable acrylamide polymers. Additionally, the ongoing shift towards integrating green chemistry practices in production processes to reduce environmental impact, is supporting the market growth.

- Geographical Trends: Asia leads the market due to rapid industrialization and stringent environmental regulations. Other regions are also showing significant growth, fueled by technological advancement and regulatory compliance.

- Competitive Landscape: The market is competitive, with key players focusing on expanding production capacities, engaging in research and development (R&D) to innovate, and forming strategic alliances to enhance market penetration. Furthermore, companies are also emphasizing sustainability and regulatory compliance to maintain market positions.

- Challenges and Opportunities: The market faces various challenges, such as handling the health and environmental concerns associated with acrylamide use and navigating fluctuating raw material prices. However, the growing need for efficient water treatment solutions and the potential for innovation in acrylamide production is creating new opportunities for the market growth.

Acrylamide Monomer Market Trends:

Increasing demand in water treatment

The escalating need for clean water across various sectors, including municipal, industrial, and others, is propelling the demand for acrylamide monomers. They are primarily used to manufacture polyacrylamide, which acts as a flocculant in water treatment processes. This chemical helps in clumping together suspended particles, making them easier to remove from water. Furthermore, the ongoing urbanization and industrialization across the globe, which leads to increased wastewater, elevating the necessity for effective water treatment solutions, is boosting the acrylamide monomer market size. Additionally, the tightening of wastewater treatment regulations and mandating the use of high-quality flocculants are supporting the market growth. Moreover, the rapid expansion of the water treatment industry, driven by the growing global population and the consequent rise in water scarcity issues, is driving the market growth.

Significant growth in oil and gas sector

Acrylamide monomer is used to manufacture polyacrylamide, which is extensively used in the oil and gas industry to enhance oil recovery processes. It increases the viscosity of the water injected into oil reservoirs, thereby facilitating the mobilization and ultimate recovery of oil. Furthermore, the rising demand for energy across the globe, coupled with the decreasing accessibility to conventional oil reserves, prompting oil and gas companies to rely on enhanced oil recovery (EOR) technologies to maximize the output from existing fields, is supporting the market growth. Moreover, the ongoing exploration of unconventional oil and gas resources, such as shale gas, which necessitates the use of advanced extraction methods, including hydraulic fracturing, where acrylamide-based polymers are used as friction reducers, is contributing to the acrylamide monomer market size.

Recent advancements in pulp and paper industry

The pulp and paper industry is a substantial consumer of acrylamide-based polymers, primarily using them as strength additives and flocculants to enhance paper quality and production efficiency. Additionally, the significant growth of the pulp and paper industry, owing to the rising consumption of paper and paper-based products, is strengthening the acrylamide monomer market share. Furthermore, technological advancements and innovation within the sector, leading to the development of more efficient and environmentally friendly manufacturing processes, which often involve the use of acrylamide-based chemicals, are positively impacting the market growth. These advancements not only improve the performance characteristics of paper products but also contribute to water and energy conservation, aligning with the increasing environmental sustainability trends.

Imposition of stricter environmental regulations

Governments are imposing stricter standards for wastewater discharge from various industries, including textile, paper, and chemicals, which in turn escalates the demand for effective water treatment chemicals like polyacrylamide. Along with this, the growing public awareness and concern over water pollution and its adverse effects on ecosystems and human health is acting as another growth-inducing factor. In line with this, industries are being incentivized to adopt advanced water treatment technologies, which often include the use of acrylamide-based flocculants, to comply with these strict regulations and avoid hefty fines. Furthermore, the increasing emphasis on sustainable industrial practices, prompting companies to improve their waste management processes, is bolstering the acrylamide monomer market share.

Rapid expansion of the agriculture sector

Acrylamide monomer-based polyacrylamide (PAM) is widely used in the agriculture sector for soil conditioning, erosion control, and water retention. It aids in enhancing agricultural productivity by improving soil structure, reducing irrigation needs, and increasing water-use efficiency. Furthermore, the increasing pressure to enhance agricultural output to ensure food security, owing to the rising global population, is favoring the market growth. This necessity drives the demand for advanced agricultural practices incorporating water-soluble polymers like PAM. Additionally, the expanding agriculture sector, especially in developing countries, which is adopting polyacrylamide polymers to combat water scarcity challenges and soil degradation, is strengthening the acrylamide monomer market share. Moreover, the ongoing shift towards sustainable agriculture practices, which emphasizes the importance of soil health, is driving the market growth.

Acrylamide Monomer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on end-use.

Breakup by End-Use:

- Waste and Wastewater Treatment

- Petroleum (Mostly Drilling Fluid)

- Pulp/Paper

- Mining

- Coating

- Printing/Dying

- Others

Waste and wastewater treatment accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes waste and wastewater treatment, petroleum (mostly drilling fluid), pulp/paper, mining, coating, printing/dying, and others. According to the report, waste and wastewater treatment represented the largest segment.

According to the acrylamide monomer market forecast, waste and wastewater treatment holds the majority share, owing to the rising emphasis on sustainable water management and stringent environmental regulations. In line with this, acrylamide is crucial in synthesizing polyacrylamide, which serves as a flocculant and coagulant in water treatment processes, helping to clarify water by binding suspended particles together. Furthermore, the expanding urbanization, industrialization, and the need for clean water in municipalities and industries are fueling the acrylamide monomer market size. Moreover, the rising water scarcity concerns, coupled with the imposition of stringent regulations on industrial discharges, necessitating efficient wastewater treatment solutions, are driving the market growth.

In the petroleum sector, acrylamide is predominantly used in the formulation of drilling fluids and for enhanced oil recovery (EOR) techniques. In line with this, acrylamide monomer-based products aid in increasing the viscosity of drilling fluids, which enhances the removal of rock cuttings from the drill bit and supports the stabilization of the wellbore.

The pulp and paper industry uses acrylamide-based polymers mainly as retention aids, strength additives, and to improve dry strength and wet-end chemistry, enhancing paper quality and production efficiency. Furthermore, the rising consumption of paper across the globe and the ongoing efforts to improve the environmental footprint of paper production are contributing to the acrylamide monomer market share.

Acrylamide monomer-based products are widely used in the mining industry as a flocculant to separate minerals from unwanted materials and to enable the dewatering of mine slurry. They also aid in the effective separation of target minerals from ore by aggregating fine particles, leading to improved sedimentation and filtration rates.

Acrylamide monomer-based polymers are employed in the coatings industry to improve the performance characteristics of various coating formulations. They enhance the rheological properties, adhesion, and stability of coatings, making them suitable for a wide range of applications, including paints, adhesives, and sealants. Additionally, the innovations in coating technologies and the shift towards environmentally friendly coatings are further supporting the acrylamide monomer market size.

In the printing and dyeing sector, acrylamide monomer-based polymers are utilized to enhance the quality of printed materials and textiles. They serve as fixing agents in dyeing processes, improving the fastness properties of dyes on fabrics, and are used in the manufacturing of printing pastes to improve print clarity and color intensity.

Breakup by Region:

- Asia

- United States

- Europe

- Middle East and Africa

- Others

Asia leads the market, accounting for the largest acrylamide monomer market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Asia, United States, Europe, Middle East and Africa, and others. According to the report, Asia accounted for the largest market share.

Asia represents the largest market segment, driven by rapid industrialization, urbanization, and the expanding scope of end-use industries such as water treatment, textile, paper, and oil and gas. Additionally, the presence of a large population base in the region, escalating demands for clean water, is bolstering the acrylamide monomer market size. Furthermore, the increasing environmental consciousness, leading to stringent water treatment regulations, is acting as another growth-inducing factor. Moreover, the booming manufacturing sectors, rising investments in infrastructure, and growing emphasis on sustainable industrial practices are strengthening the acrylamide monomer market share.

In the United States, the acrylamide market is characterized by advanced industrial sectors, stringent environmental regulations, and a well-established oil and gas industry. Furthermore, the extensive product utilization in water and wastewater treatment, reflecting the country's strong emphasis on environmental sustainability and the protection of water resources, is acting as another growth-inducing factor.

Europe's acrylamide market is driven by stringent regulatory standards, a focus on environmental sustainability, and the advanced state of its industrial and municipal water treatment facilities. Additionally, the rising commitment in the region to reduce industrial pollution and enhance water quality, which translates into sustained demand for water treatment chemicals, including acrylamide-based flocculants, is driving the acrylamide monomer market share.

The Middle East and Africa (MEA) region exhibits growing potential in the acrylamide market, primarily driven by the burgeoning oil and gas sector and the increasing need for water treatment solutions. Furthermore, the increasing focus on addressing the water scarcity challenges, improving agricultural practices, and developing industrial sectors, which collectively drive the demand for acrylamide-based polymers, is strengthening the market growth.

Leading Key Players in the Acrylamide Monomer Industry:

Leading firms are investing in expanding their production capacities to meet the growing global demand for acrylamide and its derivatives. It involves upgrading existing facilities, constructing new plants, and implementing advanced technologies to enhance production efficiency and reduce environmental impact. Furthermore, several manufacturers are focusing on research and innovations to develop new formulations of acrylamide that offer improved performance, reduced environmental impact, and better cost-efficiency. Besides this, major companies are engaging in partnerships, joint ventures, and collaborations with other companies, research institutions, and technology providers to share technological expertise, expand market reach, co-develop new products, and enter new geographical markets.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- SNF Group

- China National Petroleum Corporation

- Kemira

- Beijing Hengju Oilfield

- BASF

- Dia-Nitrix

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News:

- In December 2022, SNF Group announced the expansion of its water-treatment and water-conditioning polymer production plant in Louisiana, where it produces acrylamide monomer and polyacrylamide powders and emulsions.

- In June 2021, Kemira completed the capacity expansion for emulsion polymers in North America. It involves the installation of new state-of-the art production units for emulsion polymers and biobased acrylamide monomer.

Acrylamide Monomer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | ‘000 Tons, Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End-Uses Covered | Waste and Wastewater Treatment, Petroleum (Mostly Drilling Fluid), Pulp/Paper, Mining, Coating, Printing/Dying, Others |

| Regions Covered | Asia, United States, Europe, Middle East and Africa, Others |

| Companies Covered | SNF Group, China National Petroleum Corporation, Kemira, Beijing Hengju Oilfield, BASF, Dia-Nitrix, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the acrylamide monomer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global acrylamide monomer market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the acrylamide monomer industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global acrylamide monomer market reached a value of USD 5.1 Billion in 2024.

According to the estimates by IMARC Group, the global acrylamide monomer market is expected to exhibit a CAGR of 8% during 2025-2033.

The market growth is currently being hampered due to the rising cases of the coronavirus disease (COVID-19), lockdowns imposed by governments of several countries, disrupted supply chains and temporary closure of various manufacturing units.

The extensive applications of acrylamide monomer in various end use industries represent one of the key factors impelling the market growth. For instance, acrylamide monomer is extensively used as a friction reducer in shale gas refineries and as a co-monomer in superabsorbent polymers.

With the increasing environmental concerns, governments of numerous countries are introducing stringent regulations that mandate industrial and municipal plants to limit their waste, which, in turn, is creating a positive impact on the market growth.

Based on the end-use, the market has been segregated into the waste and wastewater treatment, petroleum (mostly drilling fluid), pulp/paper, mining, coating, printing/dying, and others.

Region-wise, the market has been segmented into the United States, Asia, Europe, Middle East and Africa, and others.

Leading industry players are SNF Group, China National Petroleum Corporation, Kemira, Beijing Hengju Oilfield, BASF and Dia-Nitrix Co, Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)