Acoustic Camera Market Size, Share, Trends and Forecast by Array Type, Measurement Type, Application, End Use, and Region, 2025-2033

Acoustic Camera Market Size and Share:

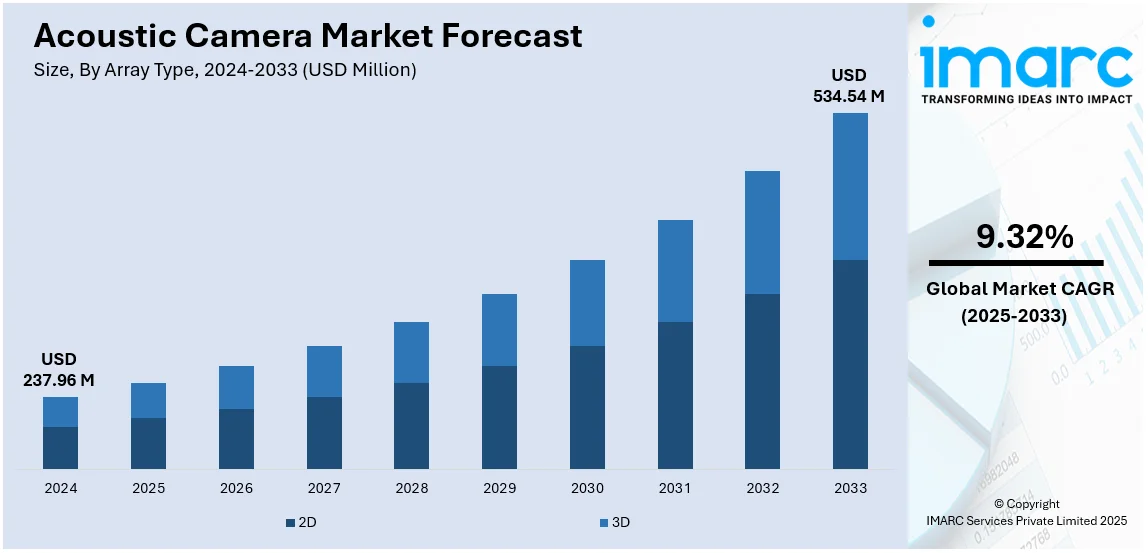

The global acoustic camera market size was valued at USD 237.96 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 534.54 Million by 2033, exhibiting a CAGR of 9.32% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 35.6% in 2024. The rising need among manufacturers for identifying and locating sound frequencies to find defects in materials and prevent leakage, along with the introduction of novel product variants, including combined video and audio acoustic cameras, is primarily stimulating the market growth across the globe.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 237.96 Million |

|

Market Forecast in 2033

|

USD 534.54 Million |

| Market Growth Rate (2025-2033) | 9.32% |

The global market is majorly driven by increasing noise reduction efforts across industries like automotive, aerospace, and manufacturing. In line with this, stricter environmental regulations and growing awareness of noise pollution, particularly from road transport, have heightened demand for advanced noise detection solutions. As of November 27, 2024, road transport contributes significantly to environmental noise pollution in the EU, affecting over 20% of the population and leading to health issues such as sleep disturbances and cardiovascular problems. Noise pollution also impacts wildlife. EU initiatives like the Zero Pollution Action Plan and Environmental Noise Directive aim to mitigate these effects. Additionally, the increasing need for enhanced product quality, precise diagnostics, and technological advancements in sensor accuracy and real-time imaging is fueling the adoption, further driving the acoustic camera market growth.

The United States is a key regional market and is expanding due to rapid industrialization, urbanization, and increased infrastructure development, which have amplified noise pollution. This has increased demand for effective noise detection technologies. Furthermore, the manufacturing sector's heightened emphasis on enhancing efficiency and reducing noise-related issues in machinery also contributes to market growth. Additionally, the automotive industry's growing adoption of acoustic cameras for design and quality control is significantly expanding the acoustic camera market share. At CES 2025, AAC Technologies presented automotive solutions focusing on acoustics, haptics, sensing, and image recognition. Highlights included advanced audio algorithms, a 7.1.4 listening room, collaboration with Premium Sound Solutions, and a haptic seat solution for an enhanced driving experience. Besides this, favorable government regulations aimed at reducing environmental noise and fostering sustainability are strengthening the market demand.

Acoustic Camera Market Trends:

Rising Applications in the Automotive Industry

The widespread adoption of electric cars is propelling the demand for acoustic cameras to test the vibration, noise, and harshness of these automobiles. This, in turn, is projected to create significant opportunities for overall market growth. For instance, according to the International Energy Agency, sales of electric cars, including plug-in hybrids and fully electric, doubled in 2021 and reached about 6.6 million. In line with this, government authorities across various countries are implementing stringent regulations and running pilot programs to minimize the noise pollution levels generated by vehicles, which is further bolstering the acoustic camera market demand. For example, the regulatory bodies in France announced a new experiment with 'noise cameras' to reduce excessive noise from moving vehicles. Apart from this, smart cars, such as automobiles with connectivity, artificial intelligence, and autonomous driving features, are emerging across the globe. This, in turn, is augmenting the demand for acoustic sensors that help in providing better information to the drivers. For example, Moritz Brandes, the Project Manager of the Hearing Car at IDMT in Oldenburg, stated that they developed and tested new sensor technologies and algorithms for source localization, signal enhancement, acoustic environment monitoring, and speech interaction on both test tracks and roads.

Increasing Focus on Reducing Noise Pollution Levels

Rising concerns about reducing noise pollution levels in manufacturing facilities are driving the adoption of acoustic cameras, which is bolstering the global market. In the past few decades, the region's manufacturing sector has increased significantly. According to the World Bank, the value added by the manufacturing industry to the GDP of the East Asia & Pacific region increased to 25%. Manufacturers from the area are adopting new techniques in manufacturing to reduce costs, save time, increase efficiency, and improve product quality. Growing manufacturing facilities across various industries and rising noise levels from multiple manufacturing plants and their associated discomfort to humans are expected to drive the demand for acoustic camera solutions in the region. Apart from this, in July 2022, Teledyne Technologies Incorporated acquired a majority interest in Noiseless Acoustics Oy. NL Acoustics is a Finnish company involved in designing and manufacturing acoustics imaging instruments and predictive maintenance solutions. Such acquisitions and strategic collaborations will continue to influence the acoustic camera market outlook in the coming years.

Numerous Advancements in Sensor Technologies

According to the acoustic camera statistics, key players are investing in sensor technologies to prevent the failure of equipment, which is also acting as another significant growth-inducing factor. For instance, Teledyne FLIR, part of Teledyne Technologies Incorporated, introduced a new set of sound imaging cameras that feature a wider acoustic detection range, up to 65Khz, along with an integrated battery and a quick start power button to render condition monitoring and inspection more efficient and effective. In line with this, SONOTEC, a German company, expanded its product portfolio with the new acoustic camera, called SONASCREEN. According to the company, the camera-generated acoustic images from ultrasound and audible frequency ranges enabled maintenance teams to locate leaks in compressed air and vacuum systems quickly. Moreover, various innovations, including the introduction of the FLIR Si124, offer easy-to-understand reporting, on-camera analytics, and predictive analysis using an AI and web tool. An inspector can perform leak cost analysis, classify leak severity, and do partial discharge pattern analysis in real-time during a survey. Once the survey is complete, the inspector can connect to their Wi-Fi network to upload images to the acoustic camera viewer.

Acoustic Camera Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global acoustic camera market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on array type, measurement type, application, and end use.

Analysis by Array Type:

- 2D

- 3D

3D stands as the largest segment in 2024. In recent times, the demand for 3D microphone arrays has experienced significant growth. CAE Software & System, a Canadian company for acoustic cameras, offers a 3D microphone array that finds extensive applications for spatial 3D Beamforming. The object is located in the array for the 3D Beamforming process. Furthermore, depending on the application it can be used between 40 up to 560 microphones. Even the array size can be chosen between 80 cm x 80 cm x 80 cm up to the integration of the microphones in a whole room.

Analysis by Measurement Type:

- Far Field

- Near Field

Near field leads the market share in 2024, as it allows localization and provides real-time analysis of non-stationary noises, such as rattles, squeaks, and clicks. Moreover, the shifting preferences from traditional techniques towards the near field acoustic camera, as it measures the velocity of particles directly, are one of the key factors propelling the market segmentation. Additionally, its non-invasive nature and capability to operate in real-time render it an ideal solution for dynamic environments. As industries increasingly prioritize efficiency and accuracy, the demand for near field technology is expected to continue rising across sectors like automotive, aerospace, and manufacturing.

Analysis by Application:

- Noise Source Detection

- Leak Detection

- Others

Noise source detection leads the market share in 2024 due to its critical role in identifying and localizing unwanted sounds in complex environments. Acoustic cameras enable precise, real-time visualization of noise sources, helping industries such as automotive, aerospace, and manufacturing address noise pollution, improve product quality, and ensure regulatory compliance. With growing concerns over noise pollution and stricter regulations, companies are increasingly adopting noise detection technologies. According to acoustic camera market trends, these cameras offer non-invasive, efficient, and accurate solutions, making them essential for diagnosing issues like rattles, squeaks, and clicks, thus driving growth.

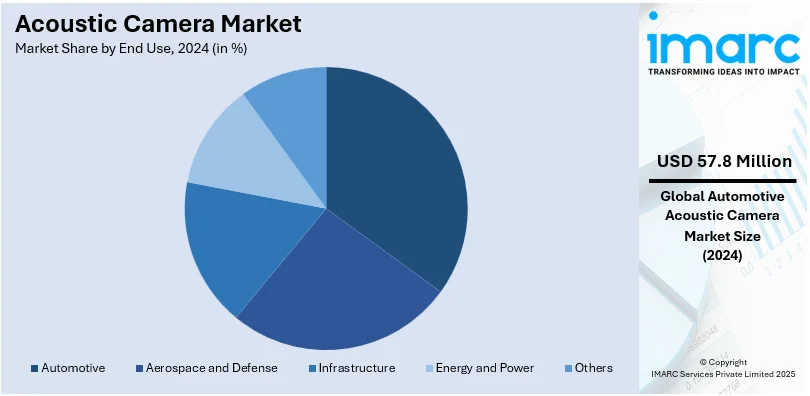

Analysis by End Use:

- Aerospace and Defense

- Infrastructure

- Energy and Power

- Automotive

- Others

Automotive dominates the market with around 24.3% of market share in 2024. The escalating demand for acoustic cameras in the automotive industry for buzz, squeak, and rattle (BSR) concerns in vehicles and production procedures is primarily driving the market growth in this segment. For instance, at the leading international expo for automotive testing, GfaiTech introduced innovative acoustic cameras and video vibration analysis software, called WaveCam. Both equipment contributed to meet the strict standards of acoustic comfort, performance, and safety.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 35.6%. The sales of passenger vehicles in the Asia Pacific region are rising. For instance, according to OICA, the number of passage cars sold in the Asia Pacific region increased from 32.21 million to 34.52 million. The rise in sales is elevating the need for equipment, such as acoustic cameras, which is propelling the regional market. Furthermore, according to the World Bank, the value added by the manufacturing industry to the GDP of the East Asia & Pacific region increased to 25%. Manufacturers in the region are adopting new techniques in the production processes to minimize costs, increase efficiency, save time, and improve product quality. Consequently, the growing manufacturing facilities across several industries and the rising noise levels from multiple manufacturing plants and their associated discomfort to individuals are bolstering the demand for acoustic camera solutions in this region.

Key Regional Takeaways:

United States Acoustic Camera Market Analysis

The expanding use of advanced tools for precise sound detection is influencing adoption in aircraft maintenance, military vehicle testing, and space system evaluations. For instance, the United States Aerospace and Defense industry is currently experiencing significant expansion, with a substantial increase in sales revenue reaching over USD 955 Billion in 2023. With strict noise regulations and the need for efficient fault identification, advanced detection solutions are being integrated into aircraft engine assessments, drone surveillance, and military vehicle diagnostics. Demand is increasing for enhanced noise source identification in supersonic jet engines and unmanned aerial systems. The necessity for precise acoustic analysis in missile guidance and naval applications is further fueling implementation. The increasing number of flight tests, satellite launches, and military drills requires real-time monitoring of sound emissions. The focus on maintaining operational efficiency and safety in air and space systems is accelerating usage. The emergence of next-generation aircraft and stealth technology is strengthening reliance on these detection systems. Upgrades in defense assets and high-speed aviation are reinforcing demand across aerospace testing facilities.

Europe Acoustic Camera Market Analysis

Demand is rising for sound detection technologies in manufacturing facilities where precision in machinery testing and production line monitoring is critical. According to reports, the EU's industrial production in 2021 increased by 8.5% compared with 2020. It continued with an increase in 2022 by 0.4% compared with 2021. Quality assessment in high-speed production lines requires non-invasive detection of mechanical faults, making sound imaging a preferred tool for early-stage issue identification. Increasing reliance on predictive maintenance and automation is reinforcing its importance in ensuring operational continuity. In sectors such as metal processing, electronics fabrication, and food packaging, the need for detecting irregular sounds in fast-moving conveyor belts and robotic systems is strengthening demand. In industrial robotics, precise noise analysis is being integrated into preventive maintenance programs to avoid unexpected downtime. The adoption of automated inspection tools to detect welding defects, leaks in pressure systems, and variations in machining processes is contributing to market growth. Increased emphasis on enhancing production efficiency without manual intervention is supporting the rapid deployment of sound-based diagnostics.

Asia Pacific Acoustic Camera Market Analysis

The rise in demand for sound detection tools is being driven by stringent noise level compliance in vehicle design, safety enhancements in electric and hybrid models, and the need for early fault identification in engine components. Growth in manufacturing hubs is increasing investments in testing facilities, where real-time sound mapping is essential for optimizing performance. According to India Brand Equity Foundation, the automobile sector received a cumulative equity FDI inflow of about USD 35.65 Billion between April 2000 - December 2023. The shift toward electric and hybrid models has intensified interest in detecting battery vibrations, motor noise, and drivetrain irregularities. Advancements in active noise cancellation and in-car acoustic experience are supporting increased integration in vehicle testing. With automated assembly lines producing a high volume of vehicles, ensuring component reliability through precise noise detection has become a priority. The expansion of mobility solutions, including ride-sharing and autonomous transport, requires advanced audio monitoring for improved passenger comfort and safety. As automotive design moves toward quieter cabins and refined aerodynamics, integration is growing across testing centers.

Latin America Acoustic Camera Market Analysis

The focus on efficient facility maintenance and enhanced equipment longevity is fueling the adoption of noise detection solutions across power generation sites. Rising installation of wind turbines has led to demand for detecting structural anomalies in rotor blades and generators. For instance, between 2023 and 2028, Latin America will add 165 GW in net renewable capacity, a 100% increase compared to the previous five-year period. The expansion of hydroelectric projects is driving the need for sound-based monitoring of pressure valves, turbine bearings, and pump systems. Gas-powered plants are integrating noise diagnostics to optimize combustion chamber efficiency and minimize operational failures. The adoption of sound analysis tools in thermal power plants is growing to detect boiler leaks and turbine imbalances. Continuous inspection of high-voltage substations and grid connections is driving interest in non-contact noise monitoring. Efforts to improve efficiency in fossil fuel and renewable energy operations are reinforcing investment in acoustic analysis. The growing shift toward preventive maintenance strategies in large-scale power infrastructure is strengthening the adoption of advanced sound detection technologies.

Middle East and Africa Acoustic Camera Market Analysis

The growing number of large-scale construction and urban expansion projects is accelerating the demand for sound detection systems in structural health monitoring. According to reports, Saudi Arabia's construction sector is booming, with over 5,200 projects currently underway, valued at USD 819 Billion. The use of noise mapping tools in tunnels, bridges, and skyscrapers is becoming more prevalent for assessing material integrity and early fault detection. The need to monitor stress and strain in large infrastructure projects is leading to increased application in predictive maintenance. The expansion of high-speed rail networks and underground transportation is reinforcing the importance of precise sound-based assessments in ensuring safety. Construction sites are implementing sound monitoring for detecting equipment malfunctions and identifying potential hazards. The rise in smart city developments is encouraging integration in noise pollution control and building acoustics optimization. As infrastructure projects become more complex, reliance on advanced acoustic analysis to maintain structural safety and efficiency is growing across multiple sectors.

Competitive Landscape:

The global acoustic camera market is highly competitive, with several key players vying for market share through innovative product offerings and strategic partnerships. Companies are focusing on advancing their technology to provide more precise, user-friendly, and cost-effective solutions. Key players, who are investing in research and development (R&D) to enhance their acoustic camera capabilities and meet diverse industry needs. Additionally, the market is witnessing the rise of startups offering cutting-edge solutions, contributing to dynamic competition. As industries seek better noise control and monitoring solutions, market participants are expanding their product portfolios and forming alliances to strengthen their position in the global market.

The report provides a comprehensive analysis of the competitive landscape in the acoustic camera market with detailed profiles of all major companies, including:

- Brüel & Kjær (Spectris Plc)

- CAE Software & Systems GmbH

- gfai tech GmbH

- Microflown Technologies

- Norsonic AS

- Polytec GmbH

- Siemens AG

- Signal Interface Group

- SINUS Messtechnik GmbH

- SM Instruments

- Sorama

Latest News and Developments:

- July 2024: SDT Ultrasound Solutions launched the CRY8120 Series Acoustic Imaging Camera, developed by CRYSOUND. This advanced device marks a major advancement in industrial inspection technology, delivering exceptional precision and performance. The CRY8120 offers enhanced personalization to meet specific operational needs. It sets a new standard for acoustic imaging in industrial applications.

- June 2024: Head Acoustics launched the Head Visor VMA V acoustic camera, designed to visually display sound sources in real-time. Utilizing up to 120 microphones, it projects sound sources onto a 7-inch touch display over a real-world image. This innovative system enables users to accurately identify noise sources for enhanced noise mitigation, soundproofing, or acoustic tuning.

- June 2024: CRYSOUND unveils the CRY8120 Series Acoustic Imaging Cameras, enhancing industrial inspection. These advanced devices detect gas leaks, partial discharges, and mechanical issues with high precision. The next-gen technology ensures faster, more accurate fault detection. This innovation sets new standards for industrial maintenance and safety.

- April 2024, Hikmicro is showcasing its latest thermal imaging and acoustic cameras at Control 2024 in Stuttgart. The company highlights solutions for process monitoring, leak detection, and condition-based maintenance. Key offerings include the SP series thermal imaging cameras and AI series acoustic cameras, which help reduce production costs and carbon footprint while enabling ISO 50001-compliant reporting.

- March 2024, FLIR, a Teledyne Technologies company, introduced the Si2 series of advanced acoustic imagers. Designed for industrial applications, Si2 detects compressed air leaks, partial discharges, and mechanical faults while accurately quantifying gas leaks. The technology enhances maintenance efficiency by providing real-time diagnostics for energy loss and equipment failures.

Acoustic Camera Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Array Types Covered | 2D, 3D |

| Measurement Types Covered | Far Field, Near Field |

| Applications Covered | Noise Source Detection, Leak Detection, and Others |

| End Uses Covered | Aerospace and Defense, Infrastructure, Energy and Power, Automotive, and Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Brüel & Kjær (Spectris Plc), CAE Software & Systems GmbH, gfai tech GmbH, Microflown Technologies, Norsonic AS, Polytec GmbH, Siemens AG, Signal Interface Group, SINUS Messtechnik GmbH, SM Instruments, Sorama, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the acoustic camera market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global acoustic camera market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the acoustic camera industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The acoustic camera market was valued at USD 237.96 Million in 2024.

The acoustic camera market is projected to exhibit a CAGR of 9.32% during 2025-2033, reaching a value of USD 534.54 Million by 2033.

The key factors driving the global market include increasing noise reduction efforts across industries, stricter environmental regulations, rising awareness of noise pollution, heightened demand for advanced noise detection technologies, and continual technological advancements in sensor accuracy and real-time imaging.

Asia Pacific currently dominates the acoustic camera market, accounting for a share exceeding 35.6%. This dominance is fueled by rising vehicle sales, manufacturing growth, and stringent noise level compliance across industries.

Some of the major players in the acoustic camera market include Brüel & Kjær (Spectris Plc), CAE Software & Systems GmbH, gfai tech GmbH, Microflown Technologies, Norsonic AS, Polytec GmbH, Siemens AG, Signal Interface Group, SINUS Messtechnik GmbH, SM Instruments, and Sorama, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)