Acetone Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition

Acetone Price Trend, Index and Forecast

Track real-time and historical acetone prices across global regions. Updated monthly with market insights, drivers, and forecasts.

Acetone Prices January 2026

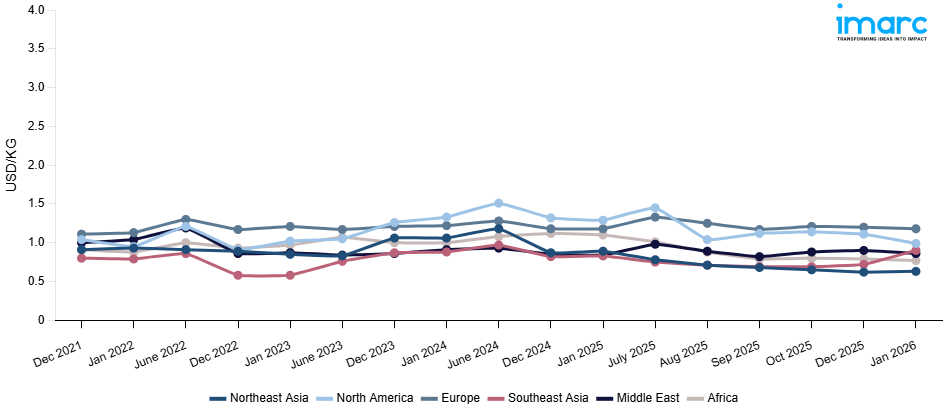

| Region | Price (USD/KG) | Latest Movement |

|---|---|---|

| Africa | 0.77 | -2.5% ↓ Down |

| Northeast Asia | 0.63 | 1.6% ↑ Up |

| Europe | 1.18 | -1.7% ↓ Down |

| Middle East | 0.86 | -4.4% ↓ Down |

| Southeast Asia | 0.9 | 25.0% ↑ Up |

| North America | 0.99 | -10.8% ↓ Down |

Acetone Price Index (USD/KG):

The chart below highlights monthly acetone prices across different regions.

Get Access to Monthly/Quarterly/Yearly Prices, Request Sample

Market Overview Q3 Ending September 2025

Africa: In Africa, acetone prices fell sharply as weak demand from coatings, adhesives, and plastics industries weighed heavily on procurement activity. The acetone price index reflected a downward trend, influenced by adequate availability of cumene feedstock and steady production. Limited downstream traction, particularly in paints and construction-related applications, restricted buying momentum. Additionally, subdued export orders to key international markets added further bearish pressure, leaving the regional market in a cautious stance this quarter.

Northeast Asia: In Northeast Asia, acetone prices declined as oversupply and subdued consumption from bisphenol-A and methyl methacrylate sectors pressured the market. The acetone price index showed bearish sentiment, supported by stable feedstock cumene supply and elevated inventory levels. Export demand remained lackluster, while domestic consumption from downstream resins and coatings industries was insufficient to absorb excess material. Overall, the region’s acetone market faced headwinds from both supply-side abundance and demand-side weakness.

Europe: In Europe, acetone prices trended lower due to subdued demand from adhesives, coatings, and solvent applications. The acetone price index reflected bearish conditions as high inventories and stable production costs provided little upward support. Industrial activity in packaging and automotive segments remained restrained, limiting consumption. Competitive imports further pressured domestic producers, and buyers largely restricted procurement to immediate needs, reflecting weak market confidence and expectations of continued downward momentum.

Middle East: In the Middle East, acetone prices weakened as reduced demand from construction-related chemicals and plastics industries weighed on market sentiment. The acetone price index dropped, influenced by steady feedstock cumene supplies and sufficient local production. Subdued export opportunities limited regional price recovery, while cautious procurement strategies from distributors reflected expectations of further softening. Overall, abundant supply and weak consumption reinforced bearish pricing this quarter.

Southeast Asia: In Southeast Asia, acetone prices fell moderately as weak downstream demand from the adhesives, coatings, and personal care industries impacted the market. The acetone price index signaled a bearish trend amid steady feedstock cumene availability and surplus inventories. Export demand remained limited, particularly from major trading partners, which further pressured regional producers. With consumption lagging and supply chains operating smoothly, the overall sentiment stayed negative, though declines were less steep than in other regions.

North America: In North America, acetone prices rose significantly as strong demand from bisphenol-A and methyl methacrylate sectors supported firm procurement activity. The acetone price index reflected bullish momentum, underpinned by steady industrial consumption from adhesives, coatings, and plastics applications. Supply disruptions at select production sites tightened regional availability, further boosting prices. While competitive imports placed some restraint, the prevailing sentiment remained positive as resilient demand outweighed supply-side concerns, making the region an outlier compared to global bearish trends.

Acetone Price Trend, Market Analysis, and News

IMARC's latest publication, “Acetone Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition,” presents a detailed examination of the acetone market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of acetone at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed acetone prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting acetone pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Acetone Industry Analysis

The global acetone industry size reached USD 7.60 Billion in 2025. By 2034, IMARC Group expects the market to reach USD 12.20 Billion, at a projected CAGR of 5.12% during 2026-2034. Market growth is driven by rising demand in the production of bisphenol-A and methyl methacrylate, expanding applications in coatings and adhesives, and increasing usage in pharmaceuticals and personal care sectors, supported by global industrial expansion and consumer demand.

Latest developments in the acetone industry:

- April 2025: Deepak Nitrite announced plans to invest INR 3,500 crore in new plants, including facilities for 185 KTA of acetone, 300 KTA of phenol, and 100 KTA of isopropyl alcohol. The expansion, approved by its subsidiary Deepak Chem Tech, will integrate acetone production with polycarbonate resin, strengthening its role in India’s chemical supply chain.

- August 2024: Taiwan Mitsui Chemicals introduced biomass-based acetone after acquiring ISCC Plus certification.

- November 2023: PYROCO2 developed a way to convert industrial CO₂ into acetone using carbon capture and utilization technology.

Product Description

Acetone (C₃H₆O) is a colorless, volatile, and flammable organic solvent with a distinct odor. It is the simplest ketone, primarily produced through the cumene process, where it is obtained as a co-product with phenol. Acetone is highly miscible with water and many organic solvents, making it an essential industrial chemical. It plays a critical role in the production of bisphenol-A, methyl methacrylate, and solvents used in coatings, adhesives, and cleaning agents. Additionally, acetone finds widespread application in pharmaceuticals, cosmetics, and personal care products due to its solvency and volatility. Its versatility across chemical synthesis, industrial processes, and consumer goods highlights its importance as a core chemical building block in global manufacturing.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Acetone |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Acetone Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of acetone price index, covering global and regional trends, spot prices at key ports, and a breakdown of Ex Works, FOB, and CIF prices.

- The study examines factors affecting acetone price trend, including raw material costs, supply-demand shifts, geopolitical impacts, and industry developments, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The acetone price chart ensure our clients remain at the forefront of the industry.

Key Questions Answered in This Report

The acetone prices in January 2026 were 0.77 USD/Kg in Africa, 0.63 USD/Kg in Northeast Asia, 1.18 USD/Kg in Europe, 0.86 USD/Kg in Middle East, 0.9 USD/Kg in Southeast Asia, and 0.99 USD/Kg in North America.

The acetone pricing data is updated on a monthly basis.

We provide the pricing data primarily in the form of an Excel sheet and a PDF.

Yes, our report includes a forecast for acetone prices.

The regions covered include North America, Europe, Asia Pacific, Middle East, and Latin America. Countries can be customized based on the request (additional charges may be applicable).

Yes, we provide both FOB and CIF prices in our report.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)