Acetic Acid Market Size, Share, Trends and Forecast by Application, End-Use, and Region, 2025-2033

Acetic Acid Market Size and Share:

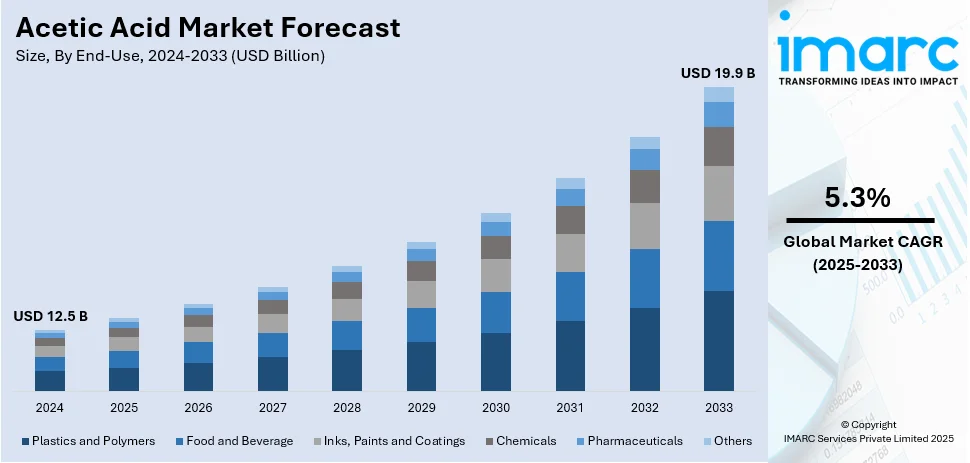

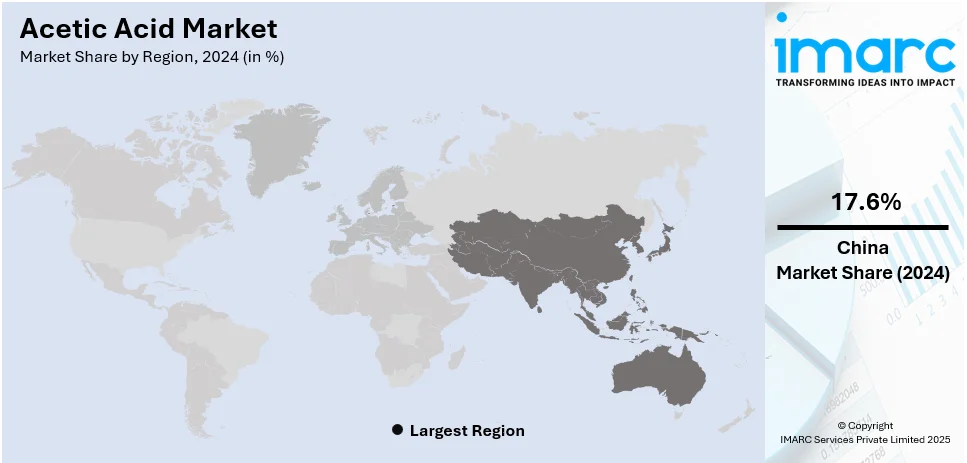

The global acetic acid market size was valued at USD 12.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 19.9 Billion by 2033, exhibiting a CAGR of 5.3% from 2025-2033. China currently dominates the market, holding a market share of over 17.6% in 2024. The acetic market share of China is growing because of its large-scale production capacity, robust industrial demand, strong chemical sector, and increasing utilization in various end-use industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 12.5 Billion |

|

Market Forecast in 2033

|

USD 19.9 Billion |

| Market Growth Rate (2025-2033) |

5.3%

|

With an increase in consumer demand for packaged and processed foods, especially in emerging economies, the need for acetic acid as a preservative and flavoring agent in food products is expanding. Moreover, acetic acid is a key raw material in the production of vinyl acetate monomer (VAM), which is further used in producing adhesives, paints, coatings, and films. The rise in construction, automotive, and consumer goods industries is driving the demand for VAM and consequently of acetic acid. Additionally, acetic acid is used in the pharmaceutical industry for manufacturing various medications, such as aspirin. As the global healthcare sector grows, there is an increase in demand for acetic acid in medical applications. Besides this, innovations in the production of acetic acid, such as improved catalysts and more efficient methods for its extraction, are contributing to reduced production costs.

The United States is a crucial segment in the market, driven by advancements in bio-based production technologies. Innovative research focused on sustainable biomass conversion and the development of novel processes, such as light-activated methods for bio-acetic acid production, is enhancing the availability and efficiency of eco-friendly acetic acid alternatives, thereby supporting the market growth. In 2024, the U.S. Department of Energy (DOE) revealed Phase I Release 2 of the SBIR and STTR program, granting $52 million to 229 projects spanning 39 states. Among the chosen projects, New Iridium (Boulder, CO) concentrated on creating an innovative light-activated method for producing bio-acetic acid. These efforts intended to promote bioenergy research, encompassing sustainable biomass transformation and decarbonization endeavors.

Acetic Acid Market Trends:

Increasing Demand for Acetic Acid and Strategic Alliances

The replacement of PET bottles with glass bottles for alcoholic beverages is predicted to propel the product demand, which will benefit the sector in the coming years. According to an industrial report, the Middle East was expected to add a new-build acetic acid capacity of 1.30 million tons per annum by 2023, reflecting the growing need for acetic acid in the region. Furthermore, the engagement of multinational corporations and their ongoing efforts to expand and form joint ventures related to this product are expected to bolster market growth in the foreseeable future. The presence of multinational firms actively engaged in R&D and strategic activities such as expansions and collaborations contribute to the growth of the market. These organizations try to strengthen their market position and meet worldwide acetic acid demand.

Rising Demand for Vinyl Acetate Monomers and PTA

The market is expected to expand over the forecast period due to the increased usage of the product in the production of several items, including pure terephthalate acid (PTA) and vinyl acetate monomers (VAM). Vinyl acetate monomers produced from acetic acid are frequently used to make resins and polymers used in the production of textiles, paints, coatings, films, and adhesives. An industry report indicates that the overall production of vinyl acetate monomers (VAM) hit 3.2 million tons in the first half of 2022. Increased usage of VAM and other solvents in the chemical sector to produce resins and polymers for paints, coatings, films, textile adhesives, and other end products drives up market demand. VAM is also used as an adhesive to adhere to a wide range of substrates, including wood, plastic films, paper, and metals. Vinyl acetate monomers are witnessing a high demand as the industry expands, thereby bolstering the acetic acid market growth.

Growing Utilization of Ester Solvents in Coating Industry

Ester solvents are employed in the coatings industry due to their great qualities, which include evaporation rate, levelling properties, blush resistance, solvent activity, resin solubility, and good solvent release. These features are applied to coating formulation goods. According to World Bank's International Trade Statistics, Thailand imported approximately 55,530 metric tons of acetic acid in 2023, which suggests that the demand for ester solvents is increasing in the region. Coatings are also employed in autos, infrastructure, and industrial settings. The coating achieved by innovation has numerous advantages, including environmental friendliness, high-temperature resistance, strong chemical resistance, long service life of the coated film, high mechanical strength, elastic strength, and scrub resistance. Increased use of these coatings is further driving the market expansion during the acetic acid market forecast period.

Acetic Acid Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global acetic acid market, along with forecast at the global, regional and country levels from 2025-2033. The market has been categorized based on application and end-use.

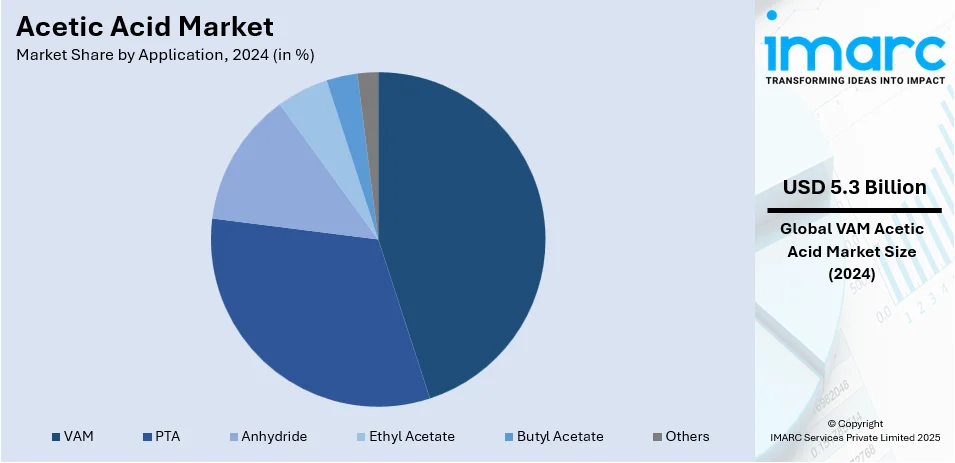

Analysis by Application:

- VAM

- PTA

- Anhydride

- Ethyl Acetate

- Butyl Acetate

- Others

VAM leads the market with 42.0% of the market share in 2024. According to the acetic acid market report, VAM represents the largest segment since it is a crucial component used in the production of polymers and resins for textiles, paints, films, coatings, and adhesives. It is also used to manufacture ethylene vinyl alcohol (EVOH), a barrier resin for plastic bottles, food packaging, and petrol tanks. VAM is used as a barrier resin for plastic bottles. It can also function as an adhesive because of its outstanding bonding properties with different materials like wood, paper, metals, and plastic films. Significant expansion in the previously mentioned sectors is resulting in an increased need for vinyl acetate monomers. Additional VAM derivatives, like vinyl chloride-vinyl acetate copolymers, are utilized in creating adhesives and sealants. Technological developments aimed at developing polymers and other products that employ VAM as raw materials effectively improve product demand for vinyl acetate monomers, therefore contributing to the acetic acid market revenue.

Analysis by End-Use:

- Plastics and Polymers

- Food and Beverage

- Inks, Paints and Coatings

- Chemicals

- Pharmaceuticals

- Others

According to the report, inks, paints, and coatings held the largest market share due to the rising need for automotive paints. Furthermore, increased demand for the product in the digital printing, packaging, and labeling sectors, which are used to make printing inks, is creating a positive acetic acid market outlook. When VAM is polymerized to produce polyvinyl acetate or other important components of the paint industry, paint and coating formulations require a large amount of the resulting vinyl acetate monomer. Acetic acid is a primary raw ingredient used in the synthesis of vinyl acetate monomer, which is then used to produce polyvinyl acetate. Polyvinyl acetate is also utilized in the production of paint and coatings. Consumer lifestyle changes, as well as an increase in house renovations and redecorating, are bolstering demand for paints and coatings, which in turn influences the product demand and by extension is resulting in a favorable acetic acid market overview.

Regional Analysis:

- China

- North America

- Western/Eastern Europe

- North East Asia

- South East Asia

- Middle East & Africa

In 2024, China accounted for the largest market share of 17.6%. According to the report, China is the largest global market. The increasing use of the product in chemical and other industries represents one of the major factors supporting the market growth in China. Moreover, the growing investments in chemical and petrochemical projects due to the recent boom of shale gas and oil slates are influencing the market positively in the country. For instance, in 2024, Saudi Aramco announced plans to expand its liquids-to-chemicals business in response to the growing demand in Asia, especially China. This included the $10 billion Gulei project in Fujian, China, which will be operational by 2030. Besides this, the rising adoption of the product in the packaging and film industries is strengthening the market growth in the country and offering numerous acetic acid market recent opportunities.

Key Regional Takeaways:

North America Acetic Acid Market Analysis

In North America, the market portion held by the United States was 83.50% of the overall total. This acetic acid market of North America is burgeoning with increasing demand from chemicals, food, and plastics. Industrial reports mention that in 2019, U.S. production volume of acetic acid stood at around 3.1 million metric tons. Demand for VAM, which is extensively used in the production of adhesives, paints, and coatings, drives the acetic acid market. Also, the growing application of acetic acid in the food and beverage sector, along with biodegradable plastic, will drive market growth. The dominant players in this particular region are Eastman Chemical Company and Celanese Corporation, with a continuous focus on increasing production capacities and sustainability of production methodologies. Innovations in bio-based acetic acid production will bolster consumer demand for green products, shaping the future landscape of the market in the years to come.

Western/Eastern Europe Acetic Acid Market Analysis

The acetic acid market in Western and Eastern Europe is experiencing demanding conditions from chemicals, food, and plastics. In the year 2023, as per the International Trade Statistics of the World Bank, the EU was reportedly importing the largest share of acetic acid from external markets, with about 348,226 metric tons from the USA, 152,733 metric tons from the UK, and 74,716.5 metric tons from China. The region is unable to fully rely on internal production for requirements to be met while trade remains the biggest propellant. Some other aspects currently affecting the market are stringent EU regulations and a push for sustainability and green production practices. Also, the rising demand for VAM (vinyl acetate monomer), being used in adhesives and paints, and further expansion of the food and beverage sector can be considered as the main factors working towards the growth of this market.

North East Asia Acetic Acid Market Analysis

The North East Asian acetic acid market is supported not just by industrial use but also by foreign trade. According to an industry report, Japan imported about 127,000 tons of acetic acid in 2023, reflecting its foreign reliance on local demand. The region is also a dominant producer of vinyl acetate monomer (VAM), one of the key derivatives of acetic acid and used in adhesives, paints, and coatings. The highest producers of acetic acid in the region are Japan, South Korea, and Taiwan, yet Japan's import data also reveal a huge deficit between local production and demand. Growing demand for the food and beverage industry, and the manufacture of biodegradable plastics, is also impacting the market.

South East Asia Acetic Acid Market Analysis

The South East Asian market for acetic acid is expanding as a result of increasing industrial demand, especially in chemical and plastic production. For example, Thailand imported around 55,530 metric tons of acetic acid in 2023, as per World Bank's International Trade Statistics. Likewise, the Philippines imported around 9,583 metric tons in the same year. This emphasizes the region's import dependence to provide for the expanding demand for acetic acid. The market also depends on growing consumption in the food and beverages industry, besides biodegradable plastics. Owing to high demand for environmentally friendly products coupled with improved technological processes in producing acetic acid, South East Asia remains one of the significant markets for the product globally.

Middle East and Africa Acetic Acid Market Analysis

The Middle East and Africa are witnessing growing demand for acetic acid as a result of expansion in industry and rising production of chemicals. A leading consulting firm predicted that the Middle East would add 1.30 million tons per year new-build acetic acid capacity by 2023, with developments in Oman and Iran. The region is concentrating on the development of its production capacity in order to accommodate domestic demand, with nations like Saudi Arabia also leading growth with investments in the manufacturing sector. South Africa similarly contributes to the regional market with firms like Denel producing acetic acid both for local use and for export. The market is also enhanced by increasing usage in food processing, plastics, and paints applications.

Competitive Landscape:

Major players operating in the industry are involved in new product launches, capacity expansion, acquisition, joint ventures, and partnerships to gain a competitive edge in the market. For instance, Celanese, one of the reliable acetic acid companies, has increased the production capacities of various facilities for the product in recent years to improve its presence in the market and support the high demand for acetic acid. Some of the market players are also acquiring other companies to expand their market presence. They are also implementing sustainable practices, such as using bio-based feedstocks and reducing environmental impact, to appeal to environmentally conscious individuals and meet regulatory requirements. In 2024, Lenzing Group collaborated with CPL Prodotti Chimici and Oniverse to launch biobased acetic acid for dyeing fabrics. The biobased acetic acid, a by-product of pulp manufacturing, lowered CO2 emissions by more than 85% when compared to fossil-based options. This advancement promoted sustainable textile manufacturing and improved environmental advantages in dyeing methods.

The report provides a comprehensive analysis of the competitive landscape in the acetic acid market with detailed profiles of all major companies, including:

- British Petroleum Plc

- Celanese Corporation

- Daicel Corporation

- Eastman Chemical Company

- GNFC Limited

- HELM AG

- LyondellBasell Industries N.V.

- Mitsubishi Chemical Corporation

- PetroChina

- SABIC

- Showa Denko K.K.

- Sinopec

- Svensk Etanolkemi AB (SEKAB)

- Wacker Chemie AG.

Latest News and Developments:

- November 2024: INEOS and GNFC signed an MOU to build a world-scale 600kt Acetic Acid plant in Bharuch, Gujarat, India. This joint venture aims to reduce India's reliance on imported acetic acid, addressing local demand and supporting economic growth. The project is expected to be completed by 2028.

- September 2024: INEOS has acquired the Eastman Texas City site for approximately USD 500 million, including a 600kt Acetic Acid plant. The acquisition also explores a potential long-term supply agreement for vinyl acetate monomer. INEOS aims to drive global growth in its Acetyls business while benefiting from competitively priced feedstocks and the site's sustainable future.

- February 2024: The U.S. Department of Energy has approved Celanese Corporation as a vendor for low-carbon acetic acid products under the ECO-CC name. These products are made using carbon capture and utilization technology, resulting in significant reductions in greenhouse gas emissions. Celanese's ECO-CC solutions offer significant reductions in greenhouse gas emissions and present opportunities for eligible U.S. government entities to decrease their carbon footprint in various applications.

- September 2023: Eastman Chemical Company revealed that it has finalized a deal to sell its Texas City Operations in Texas City, Texas, to INEOS Acetyls, a subsidiary of the INEOS Group, which is a worldwide producer and provider of acetic acid and associated chemicals.

- March 2023: The U.S. engineering group acquired Acetica, an acetic acid carbonylation technology developed by Japan’s Chiyoda. This technology uses methanol and carbon monoxide for acetic acid production, though the acquisition cost remains undisclosed.

Acetic Acid Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD, Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | VAM, PTA, Anhydride, Ethyl Acetate, Butyl Acetate, Others |

| End-Uses Covered | Plastics and Polymers, Food and Beverage, Inks, Paints and Coatings, Chemicals, Pharmaceuticals, Others |

| Regions Covered | China, North America, Western/Eastern Europe, North East Asia, South East Asia, Middle East & Africa |

| Companies Covered | British Petroleum Plc, Celanese Corporation, Daicel Corporation, Eastman Chemical Company, GNFC Limited, HELM AG, LyondellBasell Industries N.V., Mitsubishi Chemical Corporation, PetroChina, SABIC, Showa Denko K.K., Sinopec, Svensk Etanolkemi AB (SEKAB), Wacker Chemie AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the acetic acid market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global acetic acid market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the acetic acid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The acetic acid market was valued at USD 12.5 Billion in 2024.

The acetic acid market is projected to exhibit a CAGR of 5.3% during 2025-2033, reaching a value of USD 19.9 Billion by 2033.

Key factors driving the acetic acid market include increasing demand from end-user industries such as food and beverages, textiles, and chemicals, as well as its growing use in manufacturing products like plastics, adhesives, and solvents. Technological advancements and expanding industrial applications further supporting the market growth.

China currently dominates the acetic acid market, accounting for a share of 17.6%. The dominance of the region is due to its strong industrial base, low production costs, high demand in manufacturing, and significant export capabilities in global markets.

Some of the major players in the acetic acid market include British Petroleum Plc, Celanese Corporation, Daicel Corporation, Eastman Chemical Company, GNFC Limited, HELM AG, LyondellBasell Industries N.V., Mitsubishi Chemical Corporation, PetroChina, SABIC, Showa Denko K.K., Sinopec, Svensk Etanolkemi AB (SEKAB), Wacker Chemie AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)