Accountable Care Solutions Market Size, Share, Trends and Forecast by Product and Services, Deployment Mode, End User, and Region, 2026-2034

Accountable Care Solutions Market Size and Share:

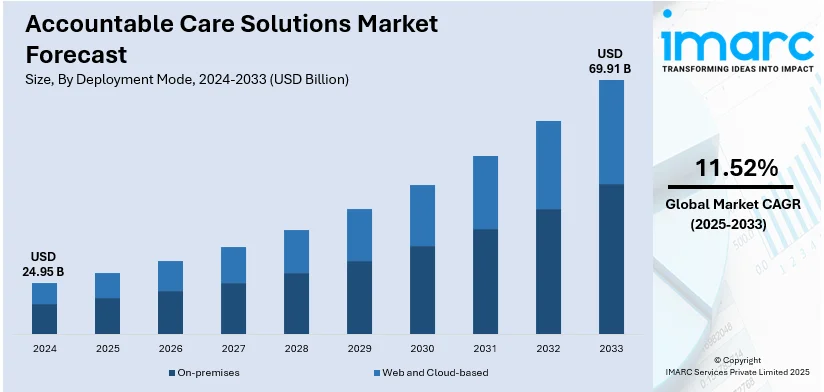

The global accountable care solutions market size was valued at USD 24.95 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 69.91 Billion by 2034, exhibiting a CAGR of 11.52% from 2026-2034. North America currently dominates the market, holding a market share of over 52.0% in 2024. The increasing accountable care solutions market share of the North American region is driven by advanced healthcare infrastructure, regulatory mandates, strong government support, rising adoption of digital health solutions, and the growing demand for value-based care.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 24.95 Billion |

| Market Forecast in 2034 | USD 69.91 Billion |

| Market Growth Rate (2026-2034) | 11.52% |

The increasing healthcare expenditures worldwide due to an aging population, chronic diseases, and expensive treatments is one of the major factors propelling the market growth. Accountable care solutions help reduce costs by improving care coordination, minimizing redundant procedures, and enhancing operational efficiency. In addition, managing population health requires comprehensive data collection and analysis to identify at-risk groups and prevent diseases. Accountable care solutions support this by integrating patient records, tracking health trends, and enabling early interventions for chronic conditions. Apart from this, the rise of virtual healthcare services, driven by convenience, is driving the need for accountable care solutions. Remote patient monitoring, virtual consultations, and artificial intelligence (AI)-driven diagnostics require robust platforms for data management and reimbursement tracking.

The United States is a crucial segment in the market, driven by the growing number of elderly patients with chronic diseases necessitates better care coordination, population health management, and outcome-based reimbursement models. Additionally, healthcare technology providers and accountable care organizations are forming strategic partnerships to enhance value-based care delivery. These collaborations focus on integrating electronic health records (EHRs), care coordination platforms, and data-driven solutions to support independent providers, enhance patient results and lower total healthcare expenses. For instance, in 2024, Astrana Health and Elation Health announced a strategic partnership to expand value-based care support for primary care providers. The collaboration will first launch in Hawai'i, providing over 100 primary care providers with integrated EHR and care enablement solutions. Their goal is to improve healthcare outcomes and reduce costs across the US by supporting independent physicians.

Accountable Care Solutions Market Trends:

Technological advancements in healthcare IT

The rapid evolution of healthcare IT systems, including Electronic Health Records (EHR), data analytics, and telehealth solutions, is a primary driver. For instance, 43% of adults want to continue using telehealth solutions after the pandemic. These technologies enable more efficient data management and sharing among healthcare providers, facilitating better patient care coordination. Advanced analytics tools help in predictive modelling and risk stratification, essential for managing population health. Furthermore, telehealth advancements have made healthcare more accessible, especially in remote areas, contributing to the overall efficiency of Accountable Care Organizations (ACOs). The integration of AI and machine learning algorithms is also enhancing clinical decision-making and operational efficiencies, which, in turn, is creating a positive accountable care solutions market outlook.

Government policies and regulations

The implementation of favorable government policies, such as the Affordable Care Act (ACA) in the United States, has been pivotal. This legislation encourages the formation of ACOs by offering financial incentives for reducing healthcare costs while maintaining or improving quality of care. Various programs under the Centers for Medicare & Medicaid Services (CMS), like the Medicare Shared Savings Program (MSSP), provide a regulatory framework and financial model that support the accountable care solutions market growth. These policies aim to shift the healthcare system from a volume-based to a value-based care model, where providers are rewarded for the quality rather than the quantity of care provided.

Increasing healthcare costs and need for efficient resource utilization

The escalating cost of healthcare globally is a significant catalyst for the accountable care solutions market. With aging populations and the rising prevalence of chronic diseases, there is an urgent need to manage healthcare resources more efficiently. According to the UN, the global population aged 65 and over is projected to rise from 10% in 2022 to 16% by 2050. These solutions offer a model to achieve cost-effectiveness by emphasizing preventive care, reducing hospital readmissions, and avoiding unnecessary tests and procedures. By focusing on patient outcomes and aligning provider incentives towards efficiency and quality, these solutions help in curbing the overall expenditure in the healthcare system, making them increasingly attractive to payers, providers, and patients alike. As a result, this is influencing the market positively.

Accountable Care Solutions Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global accountable care solutions market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on product and services, deployment mode, and end user.

Analysis by Product and Services:

- Electronic Health/Medical Records

- Healthcare Analytics

- Revenue Cycle Management Solutions (RCM)

- Claims Management Solutions

- Payment Management Solutions

- Support and Maintenance Services

- Others

Electronic health records (EHRs) are primarily driven by the need for improved healthcare quality, operational efficiency, and better patient outcomes. Government initiatives and financial incentives, particularly in developed countries, promote widespread adoption, with mandates for interoperability and data standardization playing a crucial role. EHR integration with other healthcare IT solutions, such as clinical decision support systems (CDSS), population health management, and telehealth platforms, enhances patient data accessibility and seamless care coordination. The rise of AI and ML in EHRs is improving predictive analytics, automating administrative tasks, and optimizing treatment plans. Privacy and security concerns, including risks related to cyber threats and data breaches, are being addressed with blockchain, encryption, and multi-factor authentication. The growing emphasis on value-based care, personalized medicine, and patient engagement tools is further accelerating EHR adoption, making them central to the modernization and digital transformation of healthcare systems worldwide.

Analysis by Deployment Mode:

- On-premises

- Web and Cloud-based

Web and cloud-based represent the largest segment, accounting 58.7% of market share in 2024. Web and cloud-based solutions in healthcare are gaining momentum due to their cost-effectiveness, scalability, and ability to support seamless data integration. The flexibility and accessibility of cloud technology enable real-time data sharing and collaboration among healthcare providers, improving clinical workflows and patient outcomes. Enhanced security features, including encryption, multi-factor authentication, and compliance with regulatory standards such as HIPAA and GDPR, make cloud solutions more appealing to healthcare organizations. The ongoing digital transformation, coupled with the exponential growth of healthcare data from electronic health records (EHRs), medical imaging, and connected devices, is driving the shift towards cloud-based systems. AI-powered analytics, embedded in cloud platforms, are enhancing diagnostics, predictive modeling, and personalized treatment planning. The pandemic has further accelerated the adoption of remote and virtual healthcare services, including telemedicine, remote patient monitoring, and AI-driven chatbots, all of which rely heavily on cloud infrastructures to ensure accessibility, scalability, and efficient patient management.

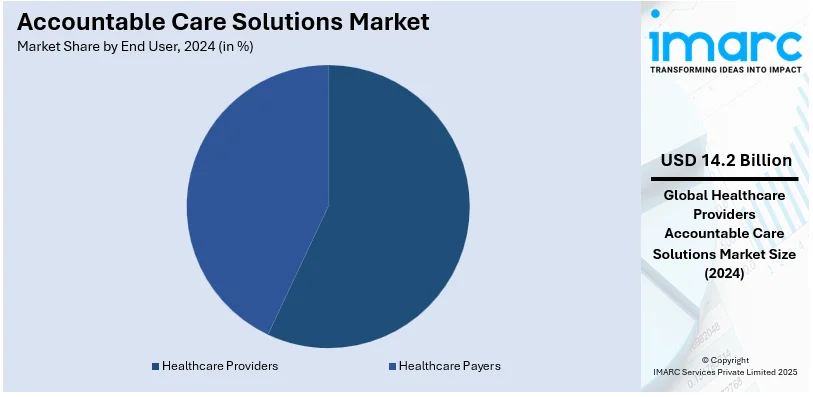

Analysis by End User:

- Healthcare Providers

- Healthcare Payers

Healthcare providers lead the market with around 56.8% of market share in 2024. Healthcare providers are increasingly adopting advanced technologies to improve patient care and operational efficiency. The push towards value-based care necessitates better data management and analytics capabilities, enabling providers to optimize treatment outcomes and reduce costs. Regulatory requirements, including interoperability standards and data privacy laws, further drive technology adoption, compelling healthcare organizations to upgrade their IT infrastructure. The rise of telehealth and remote patient monitoring amid the pandemic has accelerated digital transformation, allowing continuous patient engagement and timely interventions. AI and ML are enhancing diagnostics, predictive analytics, and workflow automation, improving clinical decision-making. Additionally, the growing focus on personalized medicine, driven by genomic data integration and precision therapies, is transforming healthcare delivery models. Cloud-based solutions and blockchain technology are strengthening data security and accessibility, fostering seamless communication across healthcare networks. The increasing emphasis on patient-centric care models further fuels investments in digital health innovations and smart healthcare solutions.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America represents the largest segment, holding 52.0% of the market share. The region is at the forefront of adopting advanced healthcare technologies due to its robust healthcare infrastructure, solid regulatory systems, and substantial healthcare expenditure. The area's emphasis on lowering healthcare expenses while enhancing care quality promotes technology utilization. The existence of major healthcare IT firms and continual investments in research and development play a crucial role. Moreover, patient-focused healthcare policies and the implementation of value-driven care models in the US and Canada are vital. The area's willingness to adopt emerging technologies such as AI and blockchain in healthcare enhances its market standing. In 2024, the Biden administration introduced the ACO Primary Care Flex model to enhance primary care for Medicare recipients. This five-year optional model will offer advanced and monthly prospective payments to accountable care organizations (ACOs) beginning in January 2025. Its goal is to establish stable cash flow for providers and encourage team-oriented care and value-driven care methods.

Key Regional Takeaways:

United States Accountable Care Solutions Market Analysis

In North America, the share of the market occupied by the United States accounted for 91.60% of the entire total. The United States is experiencing a rise in accountable care initiatives fueled by significant funding in healthcare infrastructure. As per reports, the US pharmaceutical sector saw 25 private equity transactions declared in Q3 2024, totaling a value of USD 2.3 Billion. This expansion is driven by the demand to enhance care coordination, lower expenses, and improve patient outcomes in a complicated healthcare environment. The movement towards value-driven care models, along with government programs such as the Affordable Care Act, encourages providers to implement accountable care organizations (ACOs) and comparable frameworks. Moreover, escalating healthcare costs, an older demographic, and the growing incidence of chronic illnesses are driving the system towards more efficient and cohesive care provision, rendering accountable care models a vital approach for sustainable healthcare. The focus on data analytics and interoperability enhances the adoption and improvement of these solutions, facilitating superior population health management and tailored care.

Europe Accountable Care Solutions Market Analysis

The aging population of Europe is a key driver of the increasing adoption of accountable care solutions. WHO states that the population over the age of 60 is increasing very quickly in the WHO European Region. There were 215 Million in 2021; it is expected to be 247 Million by 2030 and more than 300 Million by 2050. The growing pressure of age-related chronic conditions calls for a move towards coordinated and integrated care models that can successfully address complex health requirements. Governments and healthcare providers are increasingly realizing the benefits of accountable care in enhancing patient outcomes, minimizing hospital readmissions, and managing healthcare expenses. In addition, the focus on patient-centered care and the encouragement of preventative health are driving the accountable care solutions market demand. The need for increased efficiency and sustainability in European healthcare systems also favors the application of these models.

Asia Pacific Accountable Care Solutions Market Analysis

The Asia-Pacific area is witnessing a swift rise in the implementation of accountable care solutions because of a combination of factors. An increasing population, along with the escalating occurrence of chronic illnesses, requires enhanced healthcare services and better resource distribution. For example, the population of India in 2025 is 1,454,606,724, reflecting a 0.89% rise compared to 2024. Governments in the region are progressively emphasizing universal health coverage and value-based care models, which are fueling the demand for accountable care solutions and comparable integrated care strategies. Additionally, rising healthcare spending and an expanding middle class are driving the need for superior quality care, which accountable care solutions can provide. Technological progress, such as telemedicine and data analysis, is significantly aiding the deployment and efficiency of these solutions among varied and frequently spread-out populations.

Latin America Accountable Care Solutions Market Analysis

Increased expenditure on healthcare as a result of rising disposable income in Latin America is driving the adoption of accountable care solutions. Reports indicate that Latin America's aggregate disposable income will increase by almost 60% between 2021 and 2040. As people have more money to spend on their health, they are seeking better quality and more inclusive care. This heightened demand, combined with the necessity of enhancing access to care in numerous regions, is propelling the use of accountable care models. These models hold the promise of enhancing care coordination, improving patient outcomes, and managing costs, and thus, they are a promising choice for providers and payers in the region.

Middle East and Africa Accountable Care Solutions Market Analysis

The increasing number of healthcare centers in the Middle East and Africa is opening a door for the implementation of accountable care solutions. Based on the Dubai Healthcare City Authority report, Dubai's health sector experienced high growth, with 4,482 private healthcare facilities and 55,208 licensed practitioners by 2022, expected to grow further by 3-6% in facilities and 10-15% in practitioners in 2023. As healthcare infrastructure increases, there is a requirement that these facilities be running efficiently and effectively. Accountable care models can assist in enhancing care coordination, lowering costs, and improving patient outcomes within these growing healthcare systems. In addition, the growing rate of chronic conditions in the region is also propelling the demand for more coordinated and integrated care, with accountable care solutions serving as an effective tool in enhancing population health.

Competitive Landscape:

Major players in the market are putting money into sophisticated analytics, AI-powered decision support, and cloud-based systems to improve interoperability and simplify data sharing. They are extending strategic alliances with healthcare providers, payers, and governmental bodies to enhance value-based care efforts. Businesses are combining population health management tools with EHRs to enhance patient involvement and care coordination. Security protocols are being enhanced to safeguard confidential health information in light of the growing digitalization. Vendors are also focusing on regulatory compliance and scalable solutions to cater to healthcare systems of different sizes. Market leaders are integrating advanced technologies with care platforms to gain a competitive edge and address the growing demand for healthcare solutions. In 2025, IntusCare raised $11.5M to expand its geriatric care solutions, bringing its total funding to over $27M. The funds will support the launch of CareHub, a platform designed to improve care management and integration for seniors. The company aims to enhance AI-driven solutions and extend its services to ACOs and SNPs.

The report provides a comprehensive analysis of the competitive landscape in the accountable care solutions market with detailed profiles of all major companies, including:

- Aetna Inc. (CVS Health Corporation)

- Athenahealth Inc.

- eClinicalWorks

- Epic Systems Corporation

- International Business Machines Corporation

- McKesson Corporation

- NextGen Healthcare Inc.

- Oracle Corporation

- UnitedHealth Group Incorporated

- Veradigm Inc.

- ZeOmega Inc.

Latest News and Developments:

- December 2024: Mobile-health Network Solutions (MNDR) has launched ManaSocial, a new digital healthcare engagement platform. ManaSocial connects users, healthcare professionals, and organizations for knowledge sharing and support on health topics. This platform is expected to boost MNDR's growth in the expanding digital health market and drive revenue.

- October 2024: BharatBox has partnered with GoQii to launch a metaverse health and wellness platform. This collaboration aims to integrate fitness tracking and personalized wellness programs within a virtual environment. The platform will offer immersive experiences for users to engage in health and fitness activities.

- August 2024: Pfizer has launched PfizerForAll, a digital platform simplifying healthcare access for Americans. The platform helps patients with conditions like migraine, COVID-19, and flu, and those seeking adult vaccinations. PfizerForAll connects users with healthcare professionals, facilitates vaccine booking, medication delivery, and offers potential savings on Pfizer prescriptions.

- July 2024: WHO/Europe has launched the Strategic Partners’ Initiative for Data and Digital Health (SPI-DDH). This network unites 53 member states and partners to advance data and digital solutions in healthcare. SPI-DDH will address digital health transformation challenges and promote access to safe, affordable, and person-centered digital health technologies.

- April 2024: Innovaccer has launched an AI-powered quality management solution to help ACOs meet electronic Clinical Quality Measures (eCQM) reporting requirements. The enhanced solution assists with gap closures, optimized worklist management, and data flow for high-quality patient care. It also supports both eCQM and MIPS CQM reporting, ensuring compliance with CMS quality reporting initiatives.

Accountable Care Solutions Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment

|

| Products and Services Covered | Electronic Health/Medical Records, Healthcare Analytics, Revenue Cycle Management Solutions (RCM), Claims Management Solutions, Payment Management Solutions, Support and Maintenance Services, Others |

| Deployment Modes Covered | On-premises, Web and Cloud-based |

| End Users Covered | Healthcare Providers, Healthcare Payers |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aetna Inc. (CVS Health Corporation), Athenahealth Inc., eClinicalWorks, Epic Systems Corporation, International Business Machines Corporation, McKesson Corporation, NextGen Healthcare Inc., Oracle Corporation, UnitedHealth Group Incorporated, Veradigm Inc., ZeOmega Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the accountable care solutions market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global accountable care solutions market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the accountable care solutions industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The accountable care solutions market was valued at USD 24.95 Billion in 2024.

The accountable care solutions market is projected to exhibit a CAGR of 11.52% during 2025-2033, reaching a value of USD 69.91 Billion by 2033.

The market is growing due to rising healthcare costs, regulatory mandates, value-based care adoption, and advancements in healthcare IT. Increased demand for data analytics, EHR interoperability, population health management, and AI-driven decision support are further contributing to the market growth, improving patient outcomes and cost efficiency.

North America currently dominates the accountable care solutions market, accounting for a share of 52.0%. The dominance of the region is due to advanced healthcare infrastructure, regulatory mandates, strong government support, increasing adoption of digital health solutions, and the growing demand for value-based care.

Some of the major players in the accountable care solutions market include Aetna Inc. (CVS Health Corporation), Athenahealth Inc., eClinicalWorks, Epic Systems Corporation, International Business Machines Corporation, McKesson Corporation, NextGen Healthcare Inc., Oracle Corporation, UnitedHealth Group Incorporated, Veradigm Inc., ZeOmega Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)