Access Control Market Size, Share, Trends, and Forecast by Component, Type, End User, and Region, 2026-2034

Access Control Market Size, Share & Trends:

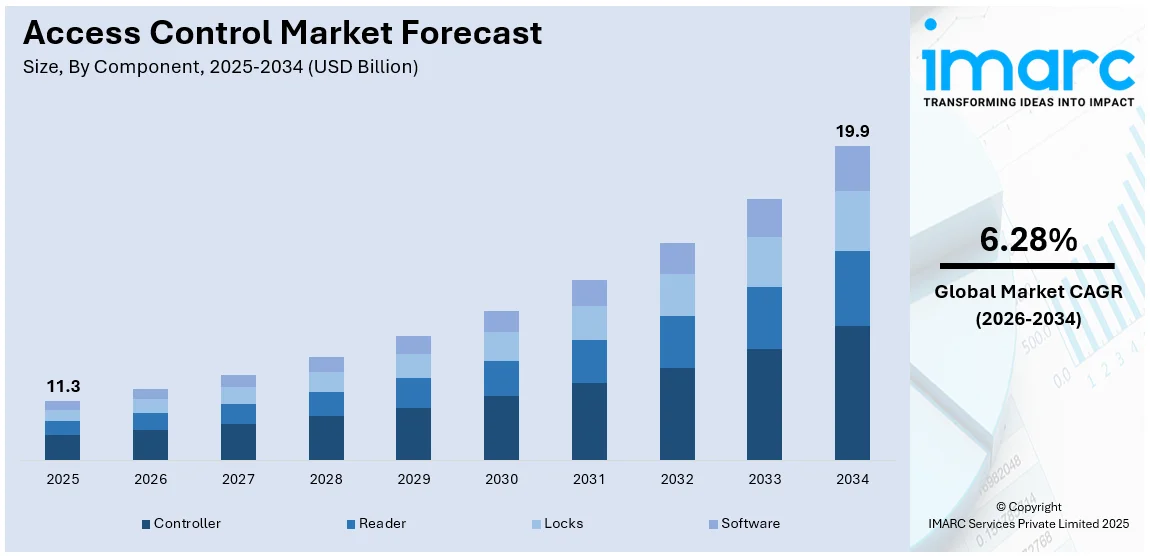

The global access control market size was valued at USD 11.3 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 19.9 Billion by 2034, exhibiting a CAGR of 6.28% from 2026-2034. North America currently dominates the market, holding a market share of over 38% in 2025. The market is experiencing steady growth driven by the rising number of cyber threats, increasing adoption of cloud-based solutions, and technological advancements in security.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 11.3 Billion |

|

Market Forecast in 2034

|

USD 19.9 Billion |

| Market Growth Rate 2026-2034 | 6.28% |

The increasing need for robust security systems is driving the access control market demand, as awareness about cyber threats and unauthorized access is growing across the world. Cloud-based access control solutions and advanced technologies such as artificial intelligence (AI), biometrics, and the Internet of Things (IoT) are significantly increasing the capabilities of systems and allowing for real-time monitoring and efficient management. Driving factors such as the contactless solutions wave prompted by COVID-19 and the increased adoption of mobile-based access control systems are transforming the market. Moreover, restrictions by the government on data privacy and security and the requirement for compliance across healthcare, finance, and commercial real estate are supplementing access control market outlook.

To get more information on this market Request Sample

The United States access control market is witnessing a lucrative growth rate. Increasing cyber and physical security threats are driving the U.S. access control market, as depicted in government alerts, such as the joint statement of the FBI and CISA about PRC activities targeting telecommunications infrastructure, announced in October 2024. There is an ever-increasing demand for advanced access control systems among organizations seeking to protect critical infrastructure, sensitive data, and facilities from emerging threats. The integration of AI and biometric technologies, growth in the adoption of mobile and cloud-based solutions, and contactless access have accelerated the adoption of access control solutions. Agencies such as Certified Information Systems Auditor (CISA) are contributing to this increased adoption through regulatory mandates, as well as stricter compliance requirements in almost every industry, particularly industries such as healthcare, finance, and government.

Access Control Market Trends:

Security Concerns and Regulatory Compliance

Addressing security concerns is a key priority as the world is increasingly becoming more connected. Rising cyber threats, data breaches, and physical security risks make organizations invest heavily in access control systems. In 2023, the Identity Theft Resource Center reported the highest data breaches in their record, which stood at a 72% rise over the previous high while exposing millions of personal information. Access control is one of the essential components of an integrated security strategy used for securing sensitive data, protecting physical assets, and ensuring the safety of personnel. Furthermore, regulatory bodies and industry-specific standards are increasing their demands for access controls in various sectors, such as healthcare, finance, and government. Compliance with legal requirements and regulations, such as HIPAA, GDPR, and PCI DSS, necessitates robust access control measures. Hence, the access control market is witnessing significant growth, with the growing need to improve safety and legal requirements.

Technological Advancements and IoT Integration

Technological advancements are reshaping the access control market, making systems more versatile, user-friendly, and capable of integrating with emerging technologies. The adoption of biometrics, cloud-based solutions, and the Internet of Things (IoT) integration is propelling the growth of the market. According to an industrial report, there were 16.6 billion connected IoT devices by the end of 2023 (a growth of 15% over 2022). Biometric authentication methods, such as fingerprint recognition, facial recognition, and iris scanning, are gaining traction due to their accuracy and convenience. For instance, in 2023, HID Global unveiled "HID BioX," its biometric system, especially a facial recognition solution to be used seamlessly for access control integration with IoT devices while emphasizing increasing demand for secure and efficient solutions. In addition, this IoT integration enables an access control system to communicate with other devices while creating automation and security. For example, smart locks that are integrated with video surveillance, alarms, and building management systems are becoming commonplace within commercial buildings. In 2024, ASSA ABLOY unveiled a new cloud-based smart lock system that integrates with IoT devices, enabling real-time monitoring and remote access management, hence improving security and efficiency at work.

Increasing Adoption in Smart Building Solutions

Today’s buildings account for nearly 40% of global greenhouse gas emissions. That is one of the many reasons why organizations are under pressure to meet net-zero goals while accommodating continued growth with improved profits. The rising trend of smart buildings and the Internet of Things (IoT) is bolstering the growth of the market. By 2028 there will be over four billion connected IoT devices in commercial smart buildings. They will be powered by telecommunications infrastructures, with 5G and High-Efficiency Wi-Fi (6 or 6E) at the forefront, and will have smart utilities for power, waste, and water. Smart buildings integrate various technologies to enhance efficiency, security, and occupant comfort and access control plays a pivotal role in these environments. Access control systems in smart buildings go beyond traditional door entry and extend to areas like HVAC control, lighting, and occupancy monitoring. This integration allows for more efficient resource management, energy conservation, and improved safety. Businesses and property owners are increasingly adopting access control solutions to create secure and convenient environments. Smart access systems enable personalized experiences for occupants, such as touchless entry, personalized climate control, and lighting adjustments.

Evolving workforce dynamics and remote access

The evolving nature of work, shifting to remote and flexible setups, is driving the requirement for flexible and secure access control solutions. As per an industrial report, in August 2024, 22.8% of US workers reported working remotely at least part-time, representing 35.13 million people. With the emergence of remote work and a gig economy, organizations require access control systems that might help accommodate various forms of workforce dynamism. Cloud-based access control solutions are indeed key enablers of remote access management. These systems enable administrators to control and monitor access from remote locations, thereby supporting the hiring and offboarding processes for employees, contractors, and other temporary personnel efficiently. Access credentials can be granted or removed from anywhere in a remote location, thereby augmenting security and decreasing overhead. Such flexibility can be especially useful for multi-location organizations where using the solution can simplify access management in scattered locations.

Access Control Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global access control market, along with forecasts at the global, regional, and country levels from 2026-2034. The report has categorized the market based on component, type, end user, and region.

Analysis by Component:

- Controller

- Reader

- Locks

- Software

Controller led the market in 2025, accounting for 38.7% access control market share. Access control controllers are the central devices that manage and orchestrate access to secured areas. They act as the brains of the system, processing authentication requests and controlling the operation of other components. These controllers are responsible for enforcing access policies, granting, or denying access permissions, and logging access events. With the increasing complexity of access control systems and the need for advanced features like biometric authentication and IoT integration, the demand for powerful and scalable controllers is growing, making this segment a cornerstone of the access control market.

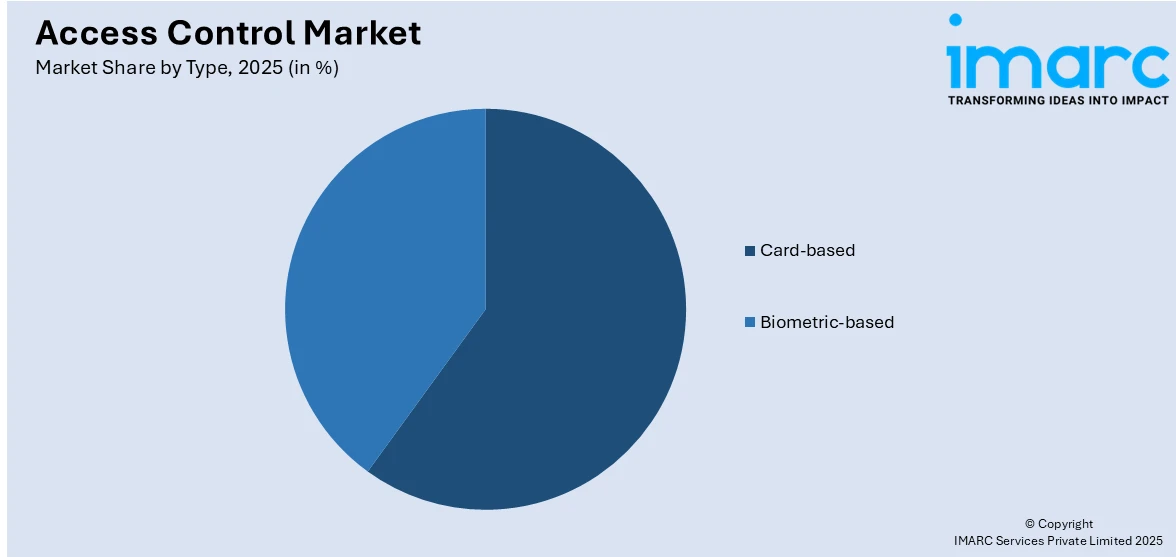

Analysis by Type:

Access the comprehensive market breakdown Request Sample

- Card-based

- Contact

- Contactless

- Biometric-based

- Fingerprint

- Face Recognition

- Face Recognition and Fingerprint

- Iris Recognition

- Others

According to the access control market forecast, the card-based segment accounted for the largest market share of 59.8%. Card-based access control comprises using physical access cards, key fobs, or smart cards as credentials to gain entry into secured areas. They are widely used due to their familiarity, ease of use, and cost-effectiveness. They offer a straightforward way of authentication that is fast to integrate with existing access control infrastructure. All the more recent these have included proximity cards, magnetic stripe cards and contactless smart cards; this, however has still maintained preference for its utility among several organizations across the industry with such scenarios or areas that prevent practical implementation and requirement of the biometric ones.

Analysis by End User:

- Government

- Military and Defense

- Commercial

- Healthcare

- Manufacturing

- Transport

- Education

- Residential

- Others

The commercial end user segment accounted for 52% market share in 2025. Commercial sector encompasses a wide range of organizations, including offices, retail stores, hotels, and entertainment venues. Access control systems in this sector are essential for safeguarding assets and data and ensuring the safety of employees and customers. The commercial segment is characterized by a diverse range of access control needs, ranging from basic office security to advanced solutions for retail loss prevention. It is also a sector that often leads in adopting the latest access control technologies to enhance security and user convenience thus strengthening the access control market growth.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of 37.9%. The growth is attributable to its strong emphasis on security, stringent regulations, and the widespread adoption of advanced technologies. Businesses and organizations prioritize security measures, including access control systems, to protect assets, data, and ensure the safety of personnel. The ongoing investments in smart buildings, IoT integration, and the need to comply with privacy and data protection laws are contributing to the growth of the market in North America.

Key Regional Takeaways:

United States Access Control Market Analysis

United States accrued a market share of 76.8% in 2025 in the North America market. With the United States experiencing increased security concerns, coupled with government regulations and technological advancements, the U.S. access control market is on a growth trajectory. Cybersecurity expenses have been rising drastically in the United States since the U.S. government allocated about USD 2.9 Billion to cybersecurity efforts in 2023. Furthermore, the reliance of various industries on biometric access control systems has accelerated their adoption in corporate and government buildings. It is anticipated that, by 2024, about 45% of U.S. companies will implement biometrics-based access systems for heightened security as well as convenient access management. Cloud-based access control systems are also rapidly being adopted as organizations seek scalable, flexible security solutions. According to an industrial report, the commercial real estate sector also has a growing market as nearly 50% of office buildings are expected to install advanced access control solutions by 2025. It is further enhanced by the innovation by major players like Honeywell and ASSA ABLOY in integrated security solutions.

Europe Access Control Market Analysis

This growing market is being driven by strict data protection regulations in Europe. Access control also is on the rise in the public and private sectors. The General Data Protection Regulation in the European Union has impacted how companies and public organizations make advancements in terms of adopting systems that gain assurance over sensitive data. The UK, Germany, and France are the leading countries in terms of accepting and implementing biometric and RFID access solutions within commercial and government buildings. In the UK alone, more than 45% of public buildings and hospitals have implemented biometric systems, improving security and efficiency. Another factor fueling the market growth is the increasing demand for mobile-based access solutions, where in-store mobile credentials will be integrated into 30% of commercial office buildings in Germany by 2025. Moreover, cloud-based access control solutions are increasingly being adopted by organizations as a way to enhance flexibility and scalability when managing security systems.

Asia Pacific Access Control Market Analysis

The Asia Pacific region is a critical growth area for the global access control market, driven by the factors of urbanization, rising security concerns, and advancing technologies. In China, the government is interested in the "smart cities" initiative, which has driven the integration of more advanced access control systems, especially in public transport and government facilities. The regional market for digital identity solutions, including biometrics and RFID technologies, reached USD 34.5 billion in 2023, with significant contributions being made by countries such as India and Japan. In India, the growing need for security within commercial spaces is already widespread, with biometric systems projected to increase annually at 10% installation rates in biometric access control systems. Notably, the adoption of mobile-based access control solutions continues to grow, and as many as 40% of all commercial real estate will deploy mobile credentials by 2025. As expanding urban areas continue to push demand for integrated security solutions, particularly in the healthcare and education sectors, growth is underway.

Latin America Access Control Market Analysis

The need for greater security in commercial and residential sectors is driving the access control market across Latin America. Brazil and Mexico are key countries in the region, where fast-increasing demand for sophisticated access control systems in banking, health care, and government buildings can be foreseen. Further, as per an industrial report, by 2050, 90% of the region’s population will live in urban areas, which will also propel the demand. Biometric and RFID-based access control systems are on increasing growth adoption levels, especially in access control of large enterprises and industrial facilities.

Middle East and Africa Access Control Market Analysis

The Middle East and Africa region is focused on the modernization of security infrastructures, especially through the adoption of state-of-the-art access control systems. According to the country's roadmap Vision 2030, Saudi Arabia has integrated biometric systems into 50% of government buildings. The cloud-based access control solutions market is growing by 25% year-on-year in the UAE, especially in the commercial and retail sectors. Mobile-based access control solutions can be found in an increasing number of airports and malls, while the UAE's airports are planning for 70% of all terminals to implement mobile-based access systems by 2026.

Competitive Landscape:

Key players in the market are actively engaged in several strategic initiatives to maintain their market leadership. They are investing in research and development (R&D) activities to innovate and introduce advanced access control solutions that incorporate biometrics, IoT integration, and cloud-based capabilities. They are also focusing on expanding their global footprint through partnerships, acquisitions, and collaborations to tap into emerging markets and broaden their consumer base. Additionally, key players are enhancing user experience by developing user-friendly interfaces and mobile applications for access control management. Furthermore, they are addressing the increasing cybersecurity concerns by integrating robust security measures into their products to protect against threats and vulnerabilities, ensuring the integrity and reliability of access control systems.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Allegion plc

- Assa Abloy AB

- Axis Communications AB (Canon Inc.)

- Bosch Security Systems LLC

- Dormakaba Holding AG

- Honeywell International Inc.

- IDEMIA

- Identiv Inc.

- Johnson Controls International

- NEC Corporation (AT&T Inc.)

- Nedap N.V.

- Panasonic Corporation

- Schneider Electric SE

- Thales Group

Latest News and Developments:

- November 2024: Allegion Ventures announced that they made a lead investment in Serenity's Series A funding. An AI-powered EHS software provider, Serenity is famed for scalable cloud solutions, such as OSHA reporting and mobile inspections, that enhance safety, compliance, and operational efficiency. Serenity's groundbreaking technology is great news for Allegion in advancing global workplace safety.

- June 2024: Honeywell announced the completion of its USD 4.95 billion purchase of Carrier's Global Access Solutions business, adding brands LenelS2, Onity, and Supra to Honeywell's security solutions portfolio. The portfolio aligns with megatrends such as automation and enhanced opportunities for cloud-based innovation. With the purchase, earnings accretion is expected in the first year.

- April 2024: IDEMIA Public Security and SECURE Systems launched a solution that allows the MorphoWave biometric terminal to work in transparent card reading mode. This innovation, compliant with ANSSI, enables wider deployment of contactless biometric technology in secure environments.

- February 2023: Identiv Inc., a global innovator in digital identification and security in the Internet of Things (IoT), entered an exclusive strategic agreement with Trace-ID, a leading provider of UHF RFID technology and solutions based in Spain. The partnership with Trace-ID expands Identiv's manufacturing footprint, allowing the company to add to its already-extensive product line and bolstering its position as a worldwide leader in specialty RFID technology. In addition, it will enable Identiv to deliver industrial UHF RFID solutions for many use cases in numerous industry sectors.

- January 2023: Abloy Oy (a part of the ASSA ABLOY Group) and Assa Abloy AB revealed their new and jointly developed, ABLOY Key Deposit for Keyless Access. It enables keyless access to properties with a smartphone via a Bluetooth Low Energy (BLE) connection. With the deposit, property managers can conveniently grant different user groups access to properties via the users’ mobile phones, without the need for unnecessary key logistics and access control.

Access Control Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Controller, Reader, Locks, Software |

| Types Covered |

|

| End Users Covered | Government, Military and Defense, Commercial, Healthcare, Manufacturing, Transport, Education, Residential, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Allegion plc, Assa Abloy AB, Axis Communications AB (Canon Inc.), Bosch Security Systems LLC, Dormakaba Holding AG, Honeywell International Inc., IDEMIA, Identiv Inc., Johnson Controls International, NEC Corporation (AT&T Inc.), Nedap N.V., Panasonic Corporation, Schneider Electric SE, Thales Group |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the access control market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global access control market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the access control industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Access control is a security mechanism used to regulate who or what can view, use, or access resources in a computing environment, physical location, or organizational system. It ensures that only authorized individuals or systems have access to sensitive data, areas, or functionalities while preventing unauthorized access.

The access control market was valued at USD 11.3 Billion in 2025.

IMARC estimates the global access control market to exhibit a CAGR of 6.28% from 2026-2034.

The market is experiencing steady growth driven by the rising number of cyber threats, increasing adoption of cloud-based solutions, and technological advancements in security.

According to the report, controller represented the largest segment by component, driven by its central role in managing access permissions and integrating with various access points.

Card-based segment leads the market by type owing to its widespread adoption, cost-effectiveness, and familiarity among users.

The commercial end user is the leading segment, driven by the increasing need for secure, scalable, and customizable access control solutions in corporate offices, retail, and hospitality sectors.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global access control market include Allegion plc, Assa Abloy AB, Axis Communications AB (Canon Inc.), Bosch Security Systems LLC, dormakaba Holding AG, Honeywell International Inc., IDEMIA, Identiv Inc., Johnson Controls International, NEC Corporation (AT&T Inc.), Nedap N.V., Panasonic Corporation, Schneider Electric SE, Thales Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)