AC Drives Market Size, Share, Trends and Forecast by Power Rating, Voltage, Application, End-Use, and Region, 2025-2033

AC Drives Market Size, Share Analysis & Industry Growth:

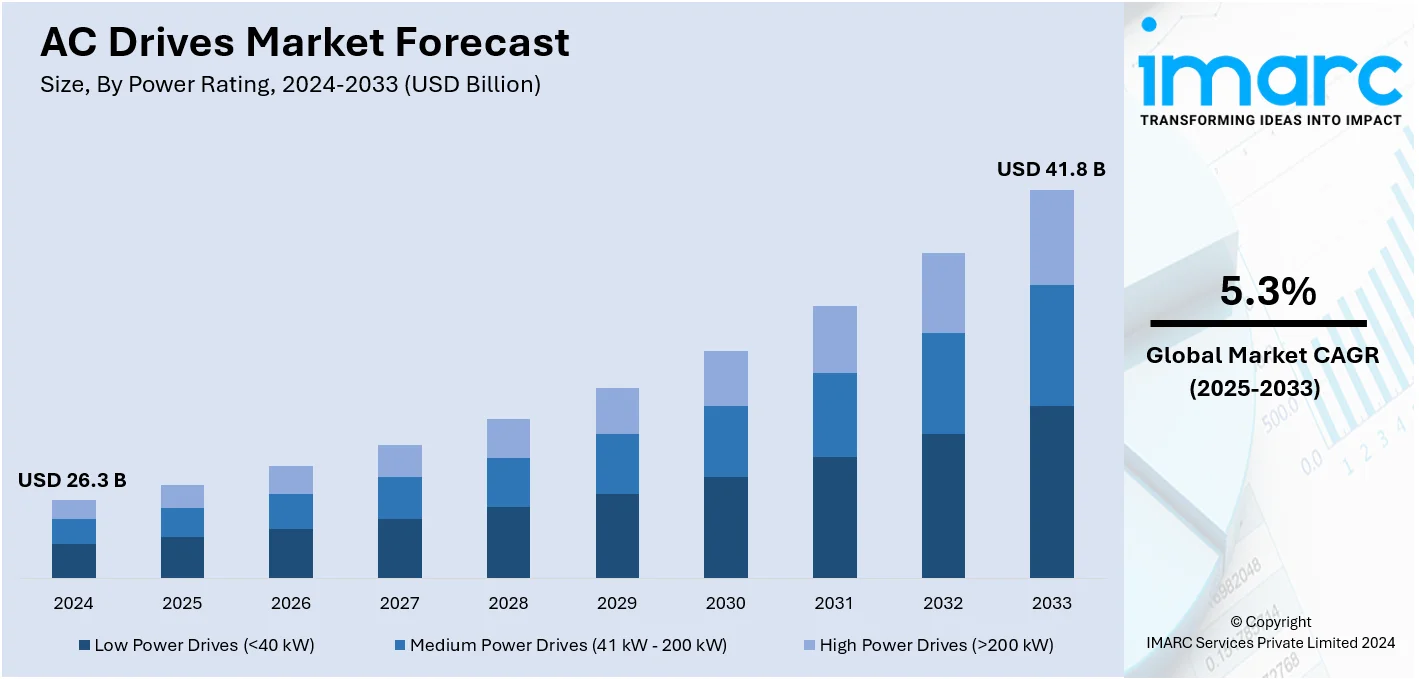

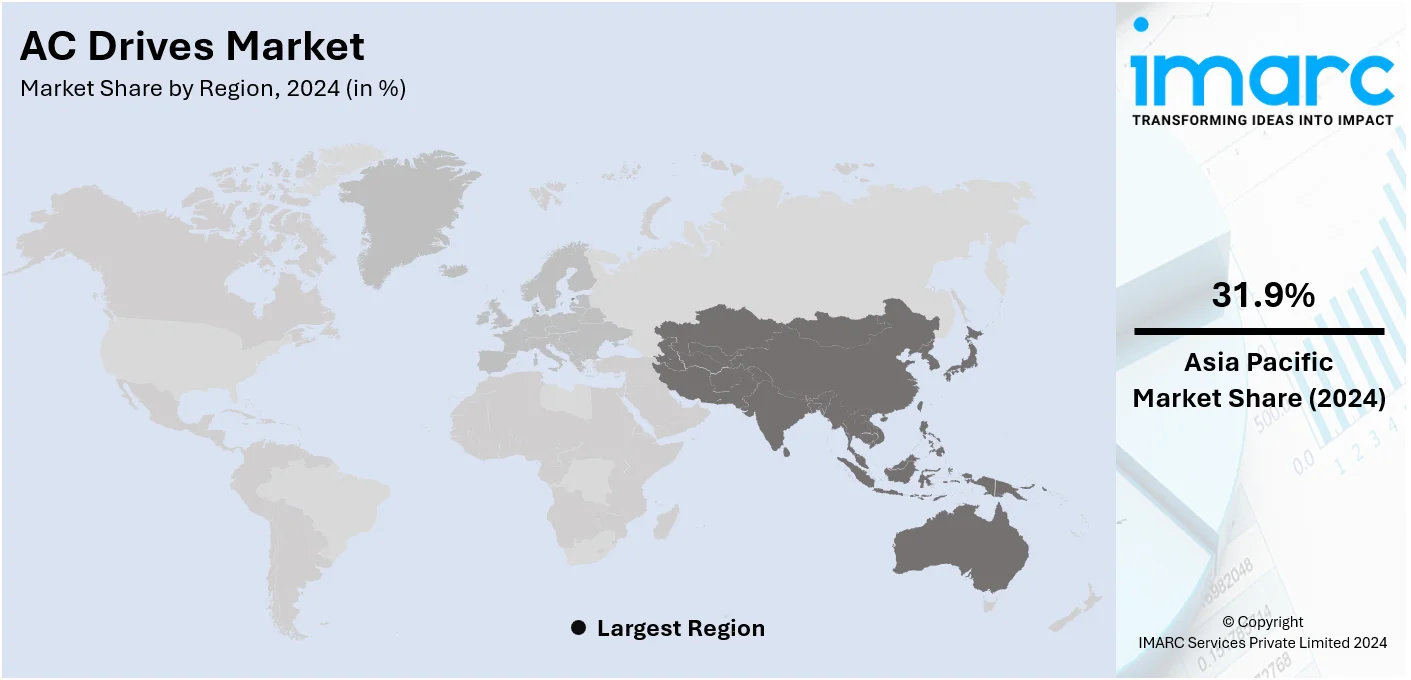

The global AC drives market size was valued at USD 26.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 41.8 Billion by 2033, exhibiting a CAGR of 5.3% during 2025-2033. Asia-Pacific currently dominates the market in 2024, holding a market share of over 31.9% in 2024. Increasing demand for energy-efficient solutions, rapid industrialization and urbanization, advancements in the Internet of Things (IoT) and Industry 4.0, stringent government regulations, and technological innovations further stimulate market expansion across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 26.3 Billion |

|

Market Forecast in 2033

|

USD 41.8 Billion |

| Market Growth Rate 2025-2033 | 5.3% |

The global AC drives market is driven by a growing emphasis on energy efficiency, increasing electricity costs, and greater awareness about environmental sustainability. The industrial sector's need for advanced motor control systems to optimize energy consumption and increase process efficiency is a major driver of market growth. Furthermore, the growth of renewable sources of energy, especially wind and solar power, demands more utilization of AC drives to level out the fluctuating output from renewable energy-based systems. The government regulations demanding energy efficiency practices and enacting standards for green building add credence to this market. The growth is also driven by the expansion of industrial automation, along with advancements in AC drive technology, such as compact designs, higher power ratings, and IoT-enabled features.

The United States stands out as a key market disruptor, driven by energy efficiency technologies in the industrial and commercial sectors. Increased electricity cost, strict government regulations, and conservation standards by the Department of Energy (DOE) are leading to the increased demand for AC drives in optimizing energy consumption. This integration is further promoted by the emphasis on industrial automation and smart manufacturing through initiatives such as Industry 4.0, focusing on improved operational efficiency and lower maintenance costs. Additionally, the pressure toward renewable energy sources such as wind and solar power requires sophisticated AC drive solutions to manage variable energy inputs. Rapid developments in AC drive technologies, including compact designs, improved reliability, and IoT-enabled features, are also driving adoption. Additionally, the increasing modernization of infrastructure and the growth of HVAC systems in residential and commercial properties substantially contribute to market growth.

AC Drives Market Trends:

Increasing demand for energy-efficient solutions

The rising demand for energy-saving products has been a major driver of the global market in AC drives. According to the International Energy Agency, global primary energy demand grew by approximately 2% in 2023, fuelling the rising demand for energy-saving products. This shift is driving the adoption of AC drives, offering enhanced energy efficiency and cost savings. Escalating concerns about operational costs and carbon footprint is another factor supporting the AC drives market outlook. AC drives are an integral part of precise control of motor speeds, with the result that they make it feasible for motors to run at any given speed while still using little energy. They adjust the speed of electric motor with variable torque to cut power consumption, and enhance the overall efficiency of machinery and equipment, which is further boosting the market. As a result, it is witnessing huge demand across the manufacturing, mining, petrochemicals, and oil and gas industries.

Rapid industrialization and urbanization in emerging economies

The swift industrial development and urbanization in emerging economies represents one of the key AC drives market dynamics, which has considerably increased the product demand. According to the United Nations Industrial Development Organization, global industrial sectors saw a 2.3% growth, driven by rapid industrialization, which significantly boosts the adoption of AC drives across manufacturing, mining, electricity, water supply, waste management, and other utilities. Asia, Africa, and Latin America are witnessing an upsurge in both industrial as well as urban development, which is pushing the demand for equipment on site that can manage both high-powered mechanical operation and control processes themselves, which is further creating a positive environment for the AC drives market growth. AC drives have an impact on modernization of industrial processes as they enable precision control over motor operation and help increase productivity and efficiency. Moreover, as these countries move toward a future of computer-controlled processes, the demand for energy efficient, high performance ac drives is projected to witness an upsurge, which is further increasing the AC drives market revenue.

Growth of renewable energy sectors

The growing dependence on renewable energy such as wind power and solar power has considerably burned the demand for AC drives. According to the International Energy Agency, global renewable electricity generation is expected to reach over 17,000 TWh by 2030, marking a nearly 90% increase from 2023, driving the adoption of AC drives due to their efficiency and energy-saving benefits. In renewable energy systems AC drives are essential for use as speed control components for generators and motors, which is further creating positive opportunities for the market. They help improve performance and help with power savings. In wind power generation, AC drives act to control the rotor speed so as maximize energy yield and ensure smooth operation under various wind conditions. Apart from this, the integration of AC drives in renewable energy installations also contributes to grid stability and reliability, which are critical as the share of intermittent renewable energy sources in the energy mix increases, which is fostering a positive AC drives industry outlook.

AC Drives Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global AC drives market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on power rating, voltage, application, and end-use.

Analysis by Power Rating:

- Low Power Drives (<40 kW)

- Medium Power Drives (41 kW - 200 kW)

- High Power Drives (>200 kW)

Low power drives (<40 kW) stand as the largest component with 30.0% of the market share in 2024. The low power drives (<40 kW) segment is driven by the magnifying demand for energy efficiency across various industries. Businesses are focusing on reducing operational costs and minimizing their carbon footprint by adopting technologies that enhance energy conservation. Low power drives enable precise control of motor speeds, which leads to significant energy savings and improved operational efficiency. These drives are particularly beneficial for applications involving pumps, fans, and compressors, where electricity consumption can be regulated in accordance with load requirements by varying the motor speed. Additionally, the growing awareness about environmental sustainability and the establishment of stringent energy efficiency measures by governments worldwide are encouraging the adoption of low power drives. Industries are also motivated by financial benefits and rebates provided for adopting energy-efficient technologies.

Analysis by Voltage:

- Low Voltage

- Medium Voltage

Low-voltage leads the market with a significant share of 65.8% in 2024. The low-voltage AC drives segment is driven by the escalating demand for energy efficiency across various industries. As companies aim to reduce energy consumption and lower operational costs, low-voltage AC drives offer a solution by providing precise control over motor speeds and torque. This results in significant energy savings and improved efficiency in motor-driven systems. These drives are particularly valuable in applications such as HVAC systems, pumps, fans, and conveyor belts, where varying the motor speed can lead to optimized performance and reduced power usage. Furthermore, the global push for sustainability and the implementation of stricter energy efficiency regulations by governments encourage industries to adopt energy-saving technologies such as low-voltage AC drives. Additionally, advancements in drive technology, including enhanced digital control and integration capabilities, make low-voltage AC drives even more effective in achieving energy efficiency. As energy costs continue to rise and environmental concerns become more prominent, the adoption of low-voltage AC drives is expected to increase, driven by their ability to deliver substantial energy savings and contribute to greener industrial operations.

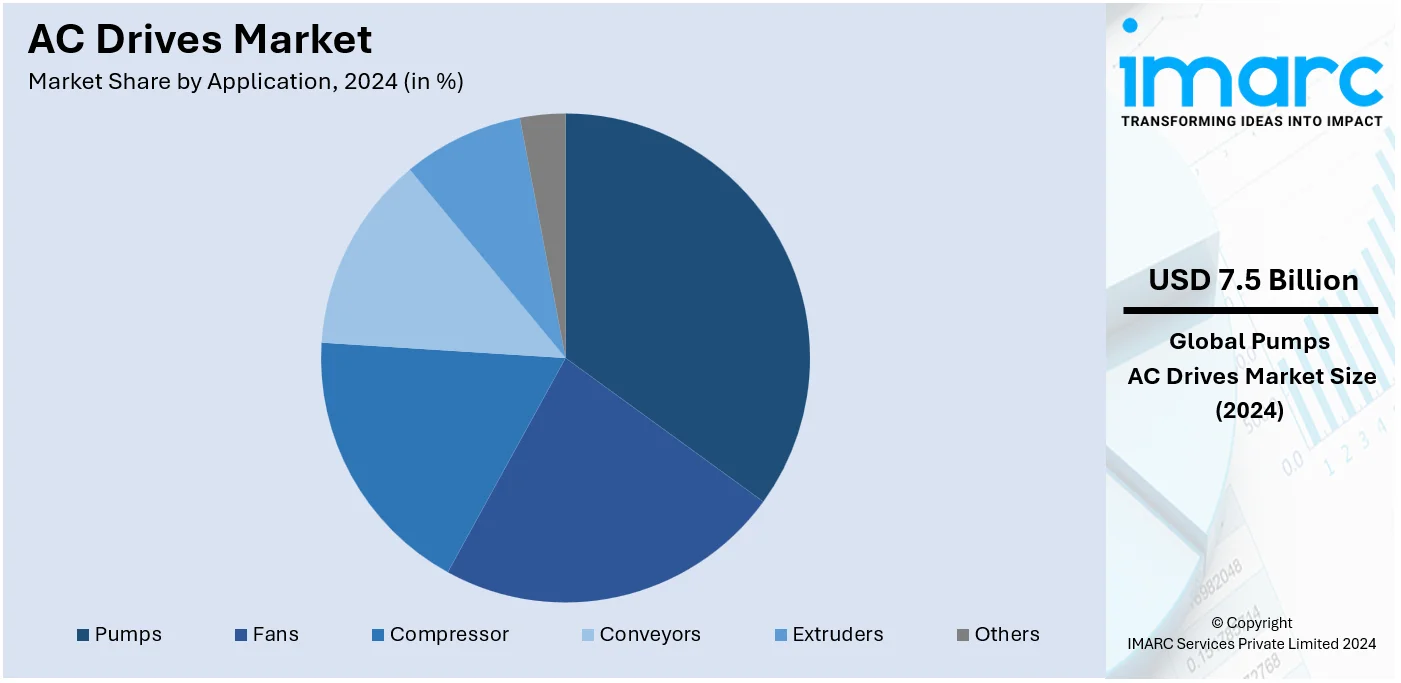

Analysis by Application:

- Pumps

- Fans

- Compressor

- Conveyors

- Extruders

- Others

Pumps lead the market with 28.6% of the AC drives market share in 2024. The industrial pumps segment is propelled by the growing demand for dependable and effective fluid handling products across various industries such as oil and gas, chemicals, power generation, and water and wastewater treatment. As industries expand and modernize, the requirement for pumps that can handle various fluids under different conditions intensifies. The emphasis on energy efficiency and sustainability also propels the adoption of advanced pump technologies that minimize energy consumption and operational costs. Furthermore, the surge in automation and Industry 4.0 technologies necessitates pumps that can integrate seamlessly with smart manufacturing systems, providing real-time monitoring and control. Regulatory pressures to reduce emissions and manage water resources more effectively drive investments in advanced pumping solutions that comply with environmental standards. Additionally, the reconstruction of aging infrastructure in developed regions and the rapid industrialization in emerging markets create substantial growth opportunities for the industrial pumps segment.

Analysis by End-Use:

- Food and Beverage

- Water and Wastewater

- HVAC

- Oil and Gas

- Power

- Metal Processing

- Chemicals

- Others

Power leads the market in 2024. The power segment is driven by the growing implementation of renewable energy sources. As the global focus shifts toward sustainable and eco-friendly energy solutions, there is a significant rise in the deployment of solar, wind, and hydropower systems. These renewable energy sources require advanced technologies to efficiently convert, manage, and distribute the generated power. For instance, solar power systems rely on inverters and controllers to convert direct current (DC) to alternating current (AC), ensuring compatibility with the grid. Similarly, wind turbines use sophisticated control systems to optimize blade angles and generator speed, maximizing energy capture. Governments worldwide are implementing policies and providing incentives to promote the use of renewables, further accelerating their adoption. Additionally, technological advancements in energy storage, such as battery systems, complement renewable energy sources by addressing intermittency issues and enhancing grid stability. The integration of smart grid technologies also plays a crucial role in managing and distributing renewable energy efficiently.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In 2024, Asia-Pacific accounted for the largest market share of 31.9%. The APAC region is driven by the increasing demand for energy-efficient solutions, which is a key factor propelling the AC drives market. As industries across Asia Pacific strive to lower operational costs and reduce their environmental impact, the adoption of AC drives is becoming essential. These drives enable precise control over motor speeds, inducing to significant energy savings and enhanced operational efficiency. The push for energy efficiency is particularly strong in countries such as China, India, and Japan, where industrial activity is high, and energy consumption is substantial. Governments in these countries are implementing stringent regulations and offering incentives to promote energy-efficient technologies, further encouraging the adoption of AC drives. Moreover, the rising awareness about sustainability and the need to cut down greenhouse gas emissions are prompting industries to invest in advanced motor control solutions. The emphasis on green manufacturing practices and the integration of smart technologies in industrial processes also contribute to the growing demand for AC drives in the APAC region.

Key Regional Takeaways:

United States AC Drives Market Analysis

In 2024, the United States accounts for over 84.30% of the AC drives market in North America. The adoption of AC drives continues to rise with the increasing integration of energy-efficient technologies in heating, ventilation, and air conditioning systems. According to reports, the US has approximately 111,849 Heating & Air-Conditioning Contractors in 2023, a 2.1% rise from 2022, boosting demand for AC drives in energy-efficient systems. Modern HVAC setups require precise motor control to optimize performance and minimize energy consumption, making AC drives indispensable. They regulate fan and pump speeds, ensuring systems operate only as needed, reducing wear and operational costs. Facilities such as commercial buildings, shopping malls, and residential complexes are increasingly prioritizing energy-saving solutions, leading to widespread use of advanced drive systems. The emphasis on sustainability and compliance with strict environmental standards enhances the acceleration of the adoption of the technologies. Industries also find AC drives critical in maintaining indoor air quality, controlling ventilation rates, and enhancing overall comfort. As these systems become more intelligent, drives are integrated with building management platforms, enabling seamless operation. This trend underlines a robust trajectory for AC drives in energy management solutions tied to HVAC systems.

Asia Pacific AC Drives Market Analysis

AC drives have emerged as a cornerstone in modern water and wastewater processing methods. The rising need for effective water resource management has driven the adoption of technologies that enhance system efficiency. For instance, India has India hosts 306 Water and Wastewater Management Tech startups, including DrinkPrime, Ecozen Solutions, Planys Technologies, Faclon Labs, and INDRA, driving innovation in the sector. In treatment plants, AC drives control pump and blower speeds, reducing energy use and ensuring precise flow regulation. Urbanization has led to the development of large-scale treatment facilities, where drives are crucial in handling variable load conditions. Advanced treatment methods, including desalination and effluent management, rely on accurate motor control, which drives provide effectively. These systems also play a critical role in reducing operational noise and prolonging equipment life. Further, they enable predictive maintenance, ensuring uninterrupted plant operations. Their integration into supervisory control systems enhances operational transparency and efficiency. This growth reflects a commitment to water conservation and sustainable practices, positioning AC drives as a vital component in infrastructure upgrades.

Europe AC Drives Market Analysis

In the food and beverage sector, precision, hygiene, and energy efficiency are paramount, fuelling the use of AC drives. According to reports, the food & drink wholesaling industry in Europe comprises approximately 445,000 businesses, showcasing its vast scale and economic significance. Manufacturing lines for processes such as mixing, packaging, and refrigeration heavily depend on motor control for seamless operations. Drives enable precise adjustments to speed and torque, ensuring consistency in production while reducing energy wastage. Compliance with strict hygiene standards has prompted the use of drives in sealed and washdown-capable motors. Beverage filling lines, refrigeration units, and bakery equipment benefit significantly from their energy-saving capabilities. Additionally, drives support soft start and stop mechanisms, reducing mechanical stress on machinery, which extends equipment life. The increasing emphasis on automation has also amplified their adoption, as drives are integral to robotics and conveyor systems in factories. As production facilities expand, the demand for solutions that offer flexibility and operational efficiency continues to grow.

Latin America AC Drives Market Analysis

The escalating electricity demand has led to increased adoption of AC drives in power generation and distribution. For instance, electricity demand in Brazil is projected to grow by 3.4% annually until 2034, boosting power generation to meet rising needs. This growth benefits AC drives, enabling efficient energy use and supporting industrial expansion. Drives are instrumental in regulating motors in power plants, assuring optimal functionality and productivity. Their ability to control speed and torque is particularly valuable in renewable energy applications, where varying conditions demand adaptability. Drives reduce energy losses in systems such as cooling towers, turbines, and compressors. Moreover, they enhance operational reliability and help meet emission control requirements by optimizing energy use. These technologies have become critical in infrastructure expansion efforts, enabling plants to operate at their full potential while minimizing environmental impacts.

Middle East and Africa AC Drives Market Analysis

AC drives have become essential in oil and gas operations, offering precise motor control that enhances efficiency and safety. For instance, the GCC's oil sector is projected to boost economic growth to 4.5% by 2025, supported by new gas field developments. This expansion enhances demand for AC drives, vital for strengthening energy efficiency in industrial applications. Upstream, midstream, and downstream processes leverage drives for pump control, compressor operations, and pipeline applications. Drives are recognized for their capacity to handle variable load conditions and maintain energy efficiency in harsh environments. By reducing operational wear, they ensure equipment longevity and lower maintenance costs. Their integration with monitoring systems enables real-time adjustments, reducing operational interruption and optimizing production. As the sector focuses on sustainable practices, the role of drives in reducing energy consumption gains prominence, ensuring their continued adoption.

Leading AC Drives Companies:

The main participants in the AC drives market are implementing strategic actions to stimulate growth and address changing consumer needs. Businesses are significantly allocating funds toward research and development to improve and advance the efficiency, reliability, and connectivity of AC drives. Sophisticated technologies, including AI and IoT, are incorporated in AC drives to oversee performance in real-time, avert possible malfunctions, and provide enhanced efficiency, catering to the increasing need for intelligent energy solutions. Strategic alliances, joint ventures, and takeovers are prevalent among major participants to enhance their product range and regional footprint. Numerous manufacturers are concentrating on creating energy-efficient options that comply with global energy standards and regulations, drawing in many eco-aware industries.

The report provides a comprehensive analysis of the competitive landscape in the AC drives market with detailed profiles of all major companies, including:

- ABB Ltd

- Danfoss Group

- Schneider Electric Se

- Siemens AG

- Mitsubishi Electrical Corporation

- Fuji Electric Co. Ltd.

- Emerson Electric Co.

- Hitachi Ltd

- Parker Hannifin Corporation

- Rockwell Automation, Inc.

- Toshiba International Corporation

- WEG SA

- Yaskawa Electric Corporation

Latest News and Developments:

- December 2024: Yaskawa Electric Corporation has launched the LA700 AC drive for elevator applications, improving ride comfort, durability, and maintainability. The new product, introduced on December 2, 2024, addresses challenges in elevator inverters, offering easier adjustments. This launch underscores the growing adoption of AC drives in enhancing elevator systems' efficiency and performance.

- November 2024: At the 2024 Smart Production Solutions show in Nuremberg, Inovance showcased its eco-friendly MV33 AC motor and MD630 AC drive, designed to meet Europe’s stringent environmental standards. The new product range also introduced the IntelliPulse design philosophy, focusing on sustainability and energy efficiency. This represents a major milestone in the developing adoption of AC drives in industrial automation.

- August 2024: Yaskawa's GA800 AC drive, combines power, flexibility, and performance, catering to diverse motor applications from simple pumps to high-precision systems. The expanded GA800 product line now includes 480V drives ranging from 400 to 1000 HP, offering configurable options and enhanced network communication features. This expansion boosts the adoption of AC drives, supporting industries in optimizing energy efficiency and operational control.

- June 2024: Danfoss has unveiled its next-generation iC2 and iC7 intelligent variable frequency drives in India, receiving strong support from industry partners during launch events in Pune and Mumbai. These advanced AC drives are engineered to improve operational efficiency and significantly enhance energy savings. As a key player in India's decarbonisation efforts, Danfoss aims to revolutionize multiple industry sectors with this innovative energy-efficient technology.

- February 2024: ABB India has launched the next-generation ACH180 compact drive, designed specifically for HVACR systems, offering energy-efficient control of high-efficiency motors. Its compact design reduces costs and simplifies cabinet installation, helping businesses meet the highest IE5 efficiency standards. This drive supports India’s growing demand for sustainable heating and cooling solutions while contributing to emission reduction goals.

AC Drives Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Power Ratings Covered | Low Power Drives (<40 kW), Medium Power Drives (41 kW - 200 kW), High Power Drives (>200 kW) |

| Voltages Covered | Low Voltage, Medium Voltage |

| Applications Covered | Pumps, Fans, Compressor, Conveyors, Extruders, Others |

| End-Uses Covered | Food and Beverage, Water and Wastewater, HVAC, Oil and Gas, Power, Metal Processing, Chemicals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | ABB Ltd, Danfoss Group, Schneider Electric Se, Siemens AG, Mitsubishi Electrical Corporation, Fuji Electric Co. Ltd., Emerson Electric Co., Hitachi Ltd, Parker Hannifin Corporation, Rockwell Automation, Inc., Toshiba International Corporation, WEG SA, Yaskawa Electric Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the AC drives market from 2019-2033.

- The market research report provides the latest information on the market drivers, challenges, and opportunities in the global AC drives market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the AC drives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

AC drives or variable frequency drives (VFDs) are electronic devices used to control the speed and torque of electric motors by varying the frequency and voltage of the power supply.

The global AC drives market was valued at USD 26.3 Billion in 2024.

IMARC Group estimates the global AC Drives market to exhibit a CAGR of 5.3% during 2025-2033.

The global AC drives market is driven by the increasing demand for energy-efficient solutions, industrial automation, government regulations promoting energy conservation, advancements in technology, and the adoption of renewable energy sources.

According to the report, low power drives (<40 kW) represented the largest segment by power rating, driven by their widespread application in small-scale industrial processes, HVAC systems, and consumer appliances, where energy efficiency and cost-effectiveness are key considerations.

Low-voltage leads the market by voltage due to their widespread use in various applications, such as HVAC systems, industrial automation, and pump control, where they provide efficient motor control at relatively lower power ratings.

Pumps represent the largest segment due to their widespread use in industries such as water treatment, oil and gas, chemicals, and HVAC, where energy-efficient motor control is crucial for optimizing performance and reducing operational costs.

Power holds the maximum number of shares due to the widespread application of AC drives in power generation, transmission, and distribution systems to improve energy efficiency and optimize motor performance.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global AC drives market include ABB Ltd, Danfoss Group, Schneider Electric Se, Siemens AG, Mitsubishi Electrical Corporation, Fuji Electric Co. Ltd., Emerson Electric Co., Hitachi Ltd, Parker Hannifin Corporation, Rockwell Automation, Inc., Toshiba International Corporation, WEG SA, Yaskawa Electric Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)