A2 Milk Market Size, Share, Trends and Forecast by End-Use, Distribution Channel, and Region, 2026-2034

A2 Milk Market Size and Share:

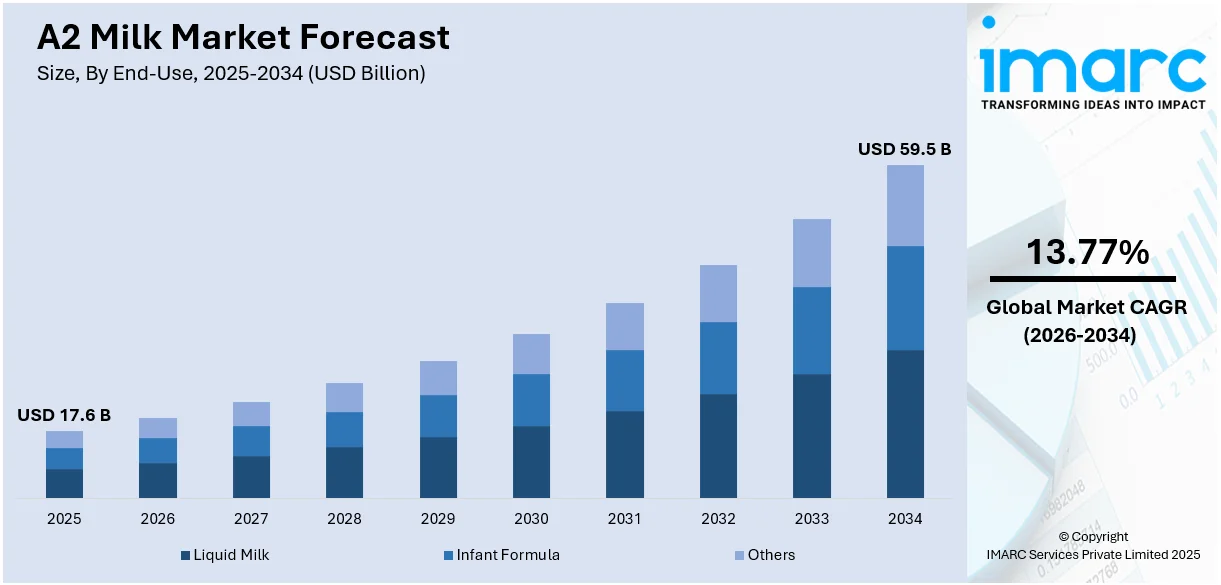

The global A2 milk market size was valued at USD 17.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 59.5 Billion by 2034, exhibiting a CAGR of 13.77% from 2026-2034. Oceania currently dominates the market, holding a market share of over 30.2% in 2025. The growth of the Oceania region is because of strong dairy farming infrastructure, advanced breeding programs, high consumer awareness, efficient supply chains, favorable trade policies, and increasing export demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 17.6 Billion |

| Market Forecast in 2034 | USD 59.5 Billion |

| Market Growth Rate 2026-2034 | 13.77% |

Consumers are prioritizing gut health, digestion, and overall well-being. A2 milk is perceived as a healthier substitute for conventional milk as it includes only A2 beta-casein, which is simpler to digest and may reduce bloating and discomfort. This growing awareness is driving the demand for A2 milk across different age groups. Moreover, the rising availability of A2 milk in supermarkets, hypermarkets, convenience stores, and e-commerce platforms is bolstering the market growth. Major retailers are dedicating more shelf space to specialty dairy products, improving visibility and accessibility. The rise of online grocery shopping further facilitates the purchase of A2 milk, making it easier for consumers to access. Additionally, companies are diversifying their product portfolios beyond liquid milk to include A2-based infant formula, flavored milk, yogurt, cheese, and butter. This expansion into new dairy categories allows brands to cater to different consumer preferences and increase market penetration.

To get more information on this market Request Sample

The United States represents a vital part of the market, fueled by the escalating demand for dairy items that provide extra health advantages, including enhanced digestion and diminished inflammation. A2 milk is marketed as a functional dairy option, attracting individuals seeking substitutes for conventional cow's milk. Moreover, the increasing requirement for baby nutrition goods featuring natural components and digestive advantages is prompting the launch of A2-based formulas, appealing to health-aware parents looking for substitutes to traditional dairy choices. In 2023, The a2 Milk Company unveiled its a2 Platinum® Premium Infant Formula to the US market, initially offered in 250 Meijer locations and 50 Wegman’s locations. The recipe was created using fresh a2 Milk® and contained no preservatives, palm oil, corn syrup, or growth hormones. It was formulated for babies from 0 to 12 months and contained vital nutrients such as DHA and prebiotics.

A2 Milk Market Trends:

Increase in awareness about associated benefits

One of the primary factors driving the demand for A2 milk is the growing consumer awareness about its health benefits. Unlike regular cow's milk, which contains both A1 and A2 beta-casein proteins, A2 milk contains only A2 beta-casein. Research has indicated that A2 milk is easier to digest for some individuals, potentially reducing symptoms associated with lactose intolerance and milk sensitivities. The growing adoption of A2 milk aligns with the expanding lactose intolerance market, which reached USD 11.37 Billion in 2024. Looking ahead, the market is projected to reach USD 22.18 Billion by 2035, exhibiting a CAGR of 6.27% during 2025-2035, according to the IMARC Group. This perceived health advantage has been communicated effectively through various media channels, leading to increased consumer interest and subsequent demand for A2 milk.

Rise in lifestyle diseases

As lifestyle-related health problems like obesity, diabetes, and heart disease increase, consumers are becoming more careful about their food selections. This trend is significant as chronic or non-communicable diseases (NCDs) are rising worldwide, representing 73% of total deaths, as reported by the Department of Science & Technology. Consequently, there is an increase in the need for practical and easily assimilated food items that promote general well-being. A2 milk is frequently regarded as a healthier option compared to regular milk as it does not contain the A1 protein, which some people link to digestive issues and inflammation. Moreover, A2 milk is inherently abundant in vital nutrients like calcium, protein, and vitamins, promoting improved bone health and general well-being. With consumers focusing on gut health and choosing minimally processed dairy, A2 milk is becoming increasingly popular, aligning with the trend of clean-label, wellness-oriented food options.

Growing Adoption of Sustainable Packaging

Sustainability is becoming a key focus in the A2 milk market as brands adopt sustainable packaging options to meet consumer demand for products that are environmentally responsible. Firms are transitioning from traditional plastic packaging to glass containers and compostable materials to minimize their carbon footprint. Glass containers aid in maintaining milk freshness, improving product quality, and strengthening high-end brand perception. This change also aligns with the larger trend of decreasing single-use plastics and encouraging circular economies with reusable and recyclable packaging. Consumers are progressively favoring dairy items that merge health advantages with eco-friendly methods, prompting market participants to innovate in packaging options. With sustainability emerging as a key competitive factor, the use of environment-friendly packaging in the A2 milk sector is enhancing consumer confidence and brand loyalty. In 2024, Farmery launched its fresh A2 Cow Milk in eco-friendly glass bottles. The milk was sourced from indigenous cow breeds and delivered fresh within 12 hours of milking, free from chemicals and preservatives.

A2 Milk Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global A2 milk market, along with forecast at the global and regional levels from 2026-2034. The market has been categorized based on end-use and distribution channel.

Analysis by End-Use:

- Liquid Milk

- Infant Formula

- Others

Liquid milk holds the biggest market share, accounting 72.2% in 2025. Liquid milk exhibits a clear dominance in the market because of its broad consumer appeal for fresh, ready-to-consume dairy items. It is a common part of everyday meals, typically consumed directly or included in drinks like tea, coffee, and smoothies. The practicality of liquid milk, along with its health advantages, makes it a favored option for families, cafes, and foodservice establishments. The increasing recognition of A2 milk's digestive advantages further boosts its appeal, especially among those with lactose intolerance. Supermarkets, hypermarkets, and online platforms enhance its extensive market reach by guaranteeing easy access. The rise of cold chain logistics improves product longevity and distribution effectiveness, enabling broader market access. Producers emphasize eco-friendly packaging options and prolonged shelf-life technologies to align with consumer demands. The increasing trend of health-focused consumption and high-end dairy products strengthens liquid A2 milk’s leading status in the market.

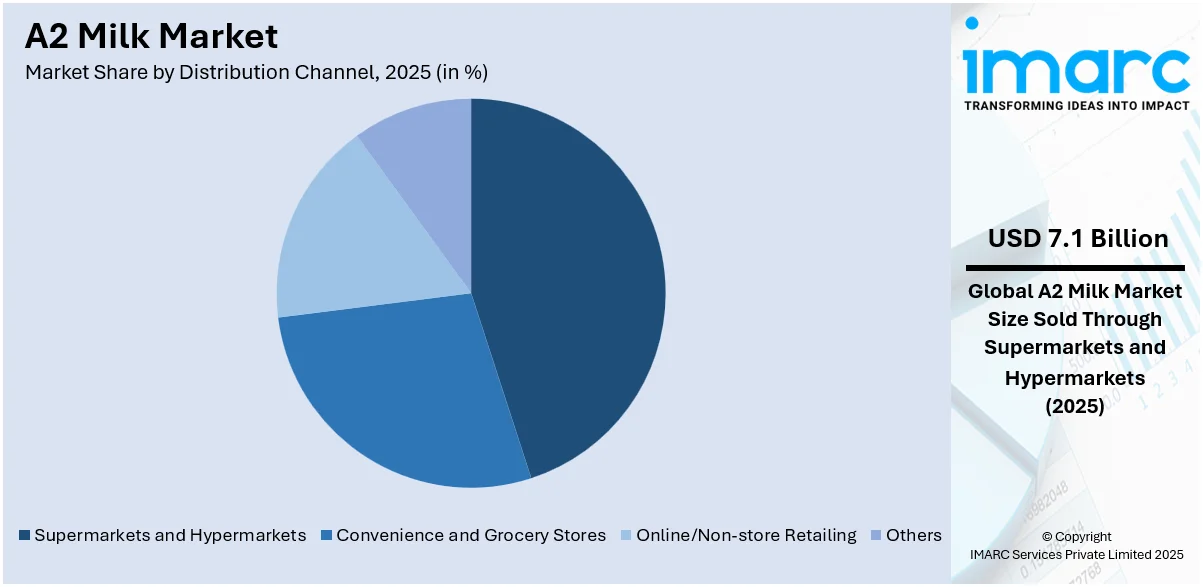

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience and Grocery Stores

- Online/Non-store Retailing

- Others

Supermarkets and hypermarkets lead the market, holding 45.9% in 2025. Supermarkets and hypermarkets function as a major distribution channel for A2 milk, offering broad market access and consumer convenience. These expansive retail locations provide a wide variety of food and drink products, featuring specialty dairy options such as A2 milk, aimed at health-aware consumers. The benefit of selling A2 milk in supermarkets and hypermarkets is the enhanced visibility it receives from substantial foot traffic, boosting brand awareness. Dedicated dairy areas guarantee a visible location, allowing shoppers to easily find A2 milk next to regular choices. Retailers frequently run in-store promotions, discounts, and sampling events, which enhance consumer interest and increase sales. The vast supply chain systems of supermarkets and hypermarkets facilitate efficient inventory control, guaranteeing consistent availability of fresh A2 milk. Furthermore, these retailers leverage digital channels, loyalty schemes, and focused advertising to inform consumers about A2 milk’s possible health advantages, enhancing brand trust and boosting overall demand.

Analysis by Region:

To get more information on the regional analysis of this market Request Sample

- North America

- Europe

- Oceania

- Asia

- Others

In 2025, Oceania represented the largest segment, accounting for 30.2%. Oceania leads the market because of its strong dairy sector, widespread pasture-based agriculture, and favorable climate for producing high-quality milk. The area enjoys robust government backing, rigorous quality regulations, and sophisticated breeding initiatives that guarantee a steady supply of A2-producing cattle. Elevated consumer awareness and a preference for natural, easily digestible dairy items additionally fuel market expansion. Robust research efforts concentrate on enhancing A2 milk production, optimizing processing efficiency, and fostering product innovation. Branding tactics highlight the health advantages of A2 milk, enhancing consumer confidence and interest. The area's supremacy is additionally bolstered by an emphasis on sustainability, appealing to health-minded consumers. In 2025, the a2 Milk Company initiated a new cycle of grants via its a2 Farm Sustainability Fund, providing up to NZ$35,000 or AU$30,000 to farmers in Australia and New Zealand. The fund seeks to assist initiatives centered on sustainable dairy farming methods, including minimizing greenhouse gas emissions and improving health of the soil.

Key Regional Takeaways:

United States A2 Milk Market Analysis

In North America, the market portion held by the United States was 88.90% of the overall total. The United States A2 milk market is witnessing notable growth, driven by rising consumer awareness regarding digestive health and lactose intolerance. A2 milk, which contains only A2 beta-casein protein, is gaining popularity as a healthier alternative to regular milk. The increasing preference for natural and minimally processed dairy products is further fueling market demand. According to reports, intolerance is very common in adults, with around 30 million American adults experiencing some degree of lactose intolerance by age 20. This growing prevalence is prompting consumers to shift toward easily digestible dairy options like A2 milk, which is perceived to cause fewer digestive issues. The trend of clean-label and functional foods is encouraging consumers, especially those with mild dairy sensitivities, to switch to A2 milk. Retail chains and e-commerce platforms are enhancing product accessibility and supporting market expansion. Market players are introducing A2 milk-based products such as flavored milk, yogurt, and infant formula to cater to evolving consumer preferences. With increasing health consciousness and product availability, the A2 milk market in the United States is expected to witness significant growth in the coming years.

Europe A2 Milk Market Analysis

The Europe A2 milk market is expanding steadily, driven by the rising demand for premium and functional dairy products. Growing consumer preference for healthier milk alternatives with digestive health benefits is fueling the adoption of A2 milk across the region. The increasing popularity of organic and clean-label products is also contributing to market growth, as consumers seek natural and minimally processed dairy options. One of the ambitions of the EU Farm to Fork strategy is to increase the share of organic agriculture to 25% by 2030. Also, according to the European Commission, between 2012 and 2017, the size of the organic dairy herd in the EU has increased annually by around 5.7% and the annual milk production by around 6.3 %. Austria, France and Germany, hold 51 % of the organic dairy cows in the EU. Retail supermarkets and specialty health stores are enhancing product accessibility, further supporting market expansion. Key market players are launching innovative A2 milk variants, including organic and flavored options, to attract health-conscious consumers.

Oceania A2 Milk Market Analysis

The Oceania A2 milk market is driven by the growing demand for premium dairy products with health benefits. Consumers are increasingly opting for A2 milk due to its perceived digestive health advantages and natural protein composition. The region's well-established dairy industry, combined with high consumer awareness about A2 milk benefits, is further supporting market expansion. According to IMARC Group, Australia's dairy market was valued at USD 6.7 Billion in 2024 and is projected to reach USD 10.6 Billion by 2033, growing at a CAGR of 4.64% during 2025-2033. This expanding dairy sector is expected to boost the demand for specialized dairy products like A2 milk. The growing trend of clean-label and functional foods, along with strong marketing campaigns by key brands, is enhancing product visibility. With the rising health-conscious population, the Oceania A2 milk market is expected to maintain its strong growth trajectory in the coming years.

Asia Pacific A2 Milk Market Analysis

The Asia Pacific A2 milk market is witnessing rapid growth, driven by increasing consumer awareness about the health benefits associated with A2 milk. The rising prevalence of lactose intolerance and digestive health concerns is encouraging consumers to opt for A2 milk as a natural and healthier alternative. According to reports, the prevalence of neonatal lactose intolerance in China is approximately 40%, accounting for 12–30% of all children with lactose intolerance, further driving the demand for A2 milk products. Countries are experiencing a growing demand for A2 milk, supported by expanding health and wellness trends. With rising disposable income and increasing product availability through retail and online channels, the A2 milk market in the Asia Pacific is expected to expand steadily in the coming years.

Competitive Landscape:

Leading companies in the market are enhancing production capabilities, investing in innovative dairy farming methods, and bolstering their supply chains to accommodate increasing global demand. They are introducing new product variations, such as organic and fortified choices, to meet changing consumer preferences. Collaborative alliances with retailers and online marketplaces are broadening market access, whereas focused marketing efforts are increasing consumer awareness. Businesses are additionally prioritizing regulatory adherence and certification to uphold product credibility. Funds allocated for research and development (R&D) seek to improve product quality and develop specific formulations for different demographics. In 2025, The a2 Milk Company announced the launch of its a2 Genesis infant formula in mainland China by late FY25. The formula, developed with Yashili NZ, includes key HMOs, prebiotics, probiotics, and DHA for infant growth and development. This product targets advanced baby nutrition, with tailored formulas for different growth stages.

The report provides a comprehensive analysis of the competitive landscape in the A2 milk market with detailed profiles of all major companies, including:

- The A2 Milk Company Limited

- Jersey Dairy

- Lion Pty Limited (Pura and Dairy Farmers)

- Fonterra

Latest News and Developments:

- April 2024: The a2 Milk Company launched its new brand platform, ‘Only a2 Will Do’, debuting the ‘Tough Tummies’ campaign. Created by BMF Australia, the campaign highlighted how A2 Milk, free from the A1 protein, supports digestive comfort, targeting milk drinkers with sensitive stomachs across TV, OOH, and social media.

- July 2024: Fonterra partnered with Nourish Ingredients to develop innovative dairy products using precision fermentation-based fats. The collaboration aimed to enhance products like cheese, cream, and butter with Nourish's Creamilux™ lipid solutions, offering rich taste and texture while exploring applications in non-dairy categories like bakery.

A2 Milk Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD, Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| End-Uses Covered | Liquid Milk, Infant Formula, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience and Grocery Stores, Online/Non-Store Retailing, Others |

| Regions Covered | North America, Europe, Oceania, Asia, Others |

| Companies Covered | The A2 Milk Company Limited, Jersey Dairy, Lion Pty Limited (Pura and Dairy Farmers), Fonterra, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the A2 milk market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global A2 milk market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the A2 milk industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The A2 milk market was valued at USD 17.6 Billion in 2025.

The A2 milk market is projected to exhibit a CAGR of 13.77% during 2026-2034, reaching a value of USD 59.5 Billion by 2034.

The market is growing due to rising consumer preference for easily digestible dairy, increasing lactose intolerance cases, and health benefits linked to A2 beta-casein protein. Expanding organic dairy trends, premium pricing, and strong marketing by major dairy brands further support market expansion globally.

Oceania currently dominates the A2 milk market, accounting for a share of 30.2%. The dominance of the region is because of strong dairy farming infrastructure, high consumer awareness, and favorable regulatory support. Advanced breeding techniques and efficient supply chains further strengthen the market position.

Some of the major players in the A2 milk market include The A2 Milk Company Limited, Jersey Dairy, Lion Pty Limited (Pura and Dairy Farmers), Fonterra, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)