India E-Commerce Market Size, Share, Trends and Forecast by Type, Transaction, Payment Mode, and Region, 2026-2034

India E-Commerce Market Summary:

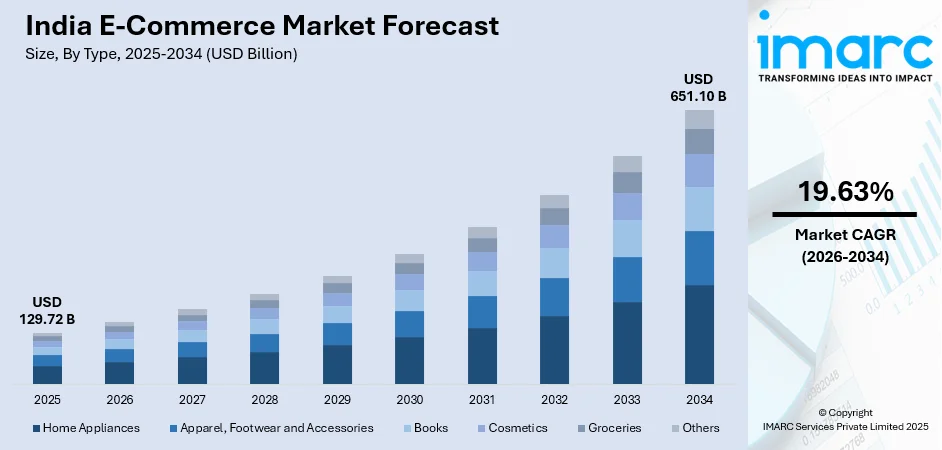

The India e-commerce market size was valued at USD 129.72 Billion in 2025 and is projected to reach USD 651.10 Billion by 2034, growing at a compound annual growth rate of 19.63% from 2026-2034.

The India e-commerce market is experiencing unprecedented expansion driven by rapidly increasing internet penetration, widespread smartphone adoption, and the proliferation of digital payment infrastructure across urban and rural areas. The growing middle-class population with rising disposable incomes, coupled with changing consumer preferences favoring convenience and variety, is accelerating online shopping adoption. Additionally, government initiatives promoting digital commerce and favorable policies supporting foreign direct investment in the sector are enhancing the India e-commerce market share.

Key Takeaways and Insights:

- By Type: Groceries dominate the market with a share of 23% in 2025, driven by the rapid expansion of quick commerce platforms and increasing consumer preference for convenient doorstep delivery of daily essentials.

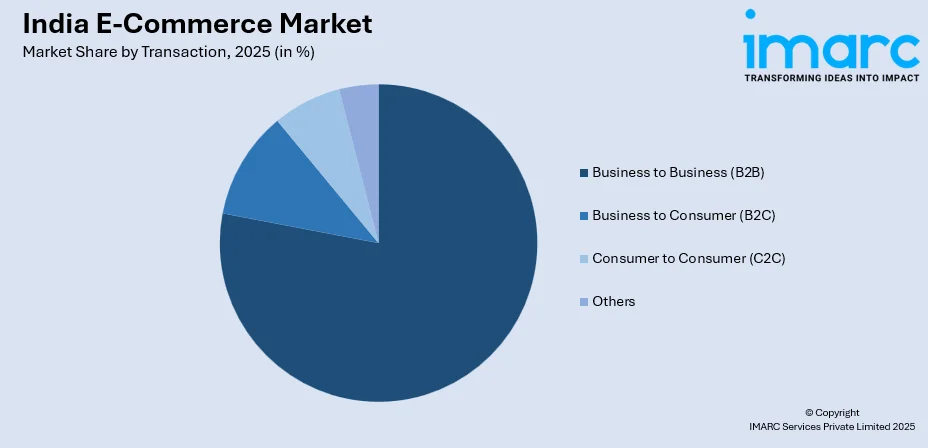

- By Transaction: Business to Business (B2B) leads the market with a share of 78% in 2025, owing to the growing digitalization of supply chains and increasing adoption of online procurement platforms by enterprises across industries.

- By Payment Mode: Digital wallet represents the largest segment with a market share of 39% in 2025, attributed to seamless transaction experiences, widespread UPI adoption, and consumer preference for cashless payment methods.

- By Region: North India dominates with a market share of 34% in 2025, fueled by high population density, advanced digital infrastructure, and concentration of major metropolitan markets with strong consumer purchasing power.

- Key Players: The India e-commerce market exhibits intense competitive dynamics, with established global platforms competing alongside homegrown marketplaces and emerging direct-to-consumer brands. Key players leverage technology innovation, logistics infrastructure, and diverse product portfolios to capture market share. Some of the key players include Ajio, Amazon.com Inc., Flipkart India Private Limited, Meesho Technologies Private Limited, Naaptol Online Shopping Private Limited, Nykaa E-Retail Pvt. Ltd, Purplle, Shopclues (Clues Network Pvt. Ltd.), Snapdeal Limited, and Tata Cliq.

To get more information on this market Request Sample

The India e-commerce market has transformed from a nascent digital retail segment to a cornerstone of the national economy, reshaping consumer behavior and business operations across industries. The ecosystem encompasses diverse business models including horizontal marketplaces, vertical specialty platforms, social commerce channels, and emerging quick commerce services delivering products within minutes. Amazon announced it will invest more than $35 billion in India to expand its operations, enhance artificial intelligence capabilities, strengthen logistics infrastructure, support small business growth, and create jobs, building on nearly $40 billion the company has already invested. Market expansion is extending beyond metropolitan centers into tier-II and tier-III cities, where rising internet connectivity and smartphone penetration are creating new consumer cohorts. The integration of advanced technologies including artificial intelligence, machine learning, and augmented reality is enhancing shopping experiences through personalized recommendations and virtual product trials. Infrastructure investments in logistics, warehousing, and last-mile delivery networks continue strengthening the foundation for sustained market growth.

India E-Commerce Market Trends:

Rapid Expansion of Quick Commerce Services

The emergence and accelerated growth of quick commerce platforms offering delivery within minutes has fundamentally transformed consumer expectations in the Indian market. In 2025, India’s quick commerce sector accounted for over two‑thirds of all e‑grocery orders, with companies like Blinkit, Swiggy Instamart, and others driving this shift in consumer buying behavior and expanding beyond groceries into broader product categories. These services have expanded beyond groceries to encompass diverse product categories including personal care, electronics accessories, and household essentials. The model leverages strategically located dark stores and micro-fulfillment centers to enable ultra-fast delivery promises. Consumer adoption is driven by convenience-seeking urban professionals and households valuing time savings over traditional shopping experiences.

Growth of Direct-to-Consumer Brand Ecosystem

The direct-to-consumer segment is experiencing substantial momentum as brands increasingly establish independent online channels to engage customers without intermediaries. In June 2025, Dabur India launched Siens, a new direct‑to‑consumer dietary supplements brand available through its own online store and major e‑commerce platforms, marking the company’s expansion into digital‑first nutraceuticals tailored to health‑conscious consumers. This trend enables companies to build direct relationships with consumers, gather valuable data insights, and maintain greater control over brand presentation and pricing strategies. Digital-first brands are emerging across categories including fashion, beauty, personal care, and food products. The model appeals to younger consumers seeking unique products and authentic brand experiences beyond traditional marketplace offerings.

Integration of Social Commerce Channels

Social media platforms are increasingly becoming integrated commerce channels, enabling discovery, engagement, and purchase within unified user experiences. According to a Meta study, 70% of online shoppers in India’s tier‑II and tier‑III markets now discover products through social media, with nearly 60% using features like Reels and influencer content to inform purchase decisions, highlighting how social platforms are becoming core channels for e‑commerce discovery and sales. This convergence leverages influencer marketing, user-generated content, and community recommendations to drive purchasing decisions. Live commerce features allowing real-time product demonstrations and interactive shopping sessions are gaining traction among digitally native consumers. The trend democratizes e-commerce access for small sellers and artisans who leverage social networks to reach customers directly.

Market Outlook 2026-2034:

The India e-commerce market outlook remains exceptionally positive, underpinned by favorable demographic trends, accelerating digital adoption, and continued infrastructure investments. The expansion into semi-urban and rural markets presents substantial growth opportunities as internet connectivity and digital literacy improve across geographies. Technological innovations including generative AI, voice commerce, and immersive shopping experiences are expected to enhance consumer engagement and operational efficiency. Cross-border e-commerce facilitation and government support for digital exports present additional growth avenues. The market generated a revenue of USD 129.72 Billion in 2025 and is projected to reach a revenue of USD 651.10 Billion by 2034, growing at a compound annual growth rate of 19.63% from 2026-2034.

India E-Commerce Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Groceries | 23% |

| Transaction | Business to Business (B2B) | 78% |

| Payment Mode | Digital Wallet | 39% |

| Region | North India | 34% |

Type Insights:

- Home Appliances

- Apparel, Footwear and Accessories

- Books

- Cosmetics

- Groceries

- Others

The groceries dominates with a market share of 23% of the total India e-commerce market in 2025.

The groceries segment has emerged as a leading product category within India's e-commerce landscape, driven by the rapid proliferation of quick commerce platforms and changing consumer shopping patterns. Urban households increasingly prefer online grocery shopping for its convenience, time savings, and access to diverse product selections including fresh produce, packaged foods, and household essentials. In late 2025, Indian grocery‑focused startup Citymall raised $47 million in funding to expand its delivery network and challenge established quick commerce players by offering budget‑focused grocery delivery in tier‑II and tier‑III towns.

The segment's expansion is further supported by significant investments in cold chain logistics, micro-fulfillment infrastructure, and inventory management technologies that ensure product freshness and availability. E-commerce platforms have developed specialized grocery verticals offering features such as scheduled deliveries, subscription services, and personalized recommendations based on purchase history. The increasing penetration of online grocery services into smaller cities and towns represents substantial growth potential as platforms optimize unit economics for diverse geographic markets.

Transaction Insights:

Access the comprehensive market breakdown Request Sample

- Business to Business (B2B)

- Business to Consumer (B2C)

- Consumer to Consumer (C2C)

- Others

The business to business (B2B) leads with a share of 78% of the total India e-commerce market in {baseyear}.

The B2B e-commerce segment commands substantial market share, reflecting the extensive digitalization of enterprise procurement, supply chain operations, and wholesale trade across industries. Businesses are increasingly adopting online platforms for sourcing raw materials, components, and finished goods, leveraging digital channels for supplier discovery, price comparison, and transaction management. In 2025, Amazon Business reported it now supports over 1.6 million sellers in India, helping micro, small, and medium enterprises streamline procurement, access credit features, and manage compliance documents through its platform, highlighting growing adoption of digital procurement tools across business sizes. The segment encompasses diverse industries including manufacturing, retail, healthcare, and hospitality sectors seeking procurement efficiency and cost optimization.

The B2B segment's growth is underpinned by platform innovations addressing enterprise-specific requirements including bulk ordering, credit facilities, integrated invoicing, and compliance documentation. Government initiatives promoting digital commerce adoption among small and medium enterprises have accelerated B2B platform utilization. The emergence of industry-specific vertical marketplaces catering to specialized procurement needs complements horizontal platforms offering broad product categories, creating a comprehensive B2B digital commerce ecosystem.

Payment Mode Insights:

- Cash Payment

- Bank Transfer

- Card Payment

- Digital Wallet

- Others

The digital wallet dominates with a market share of 39% of the total India e-commerce market in 2025.

Digital wallets have established market leadership within e-commerce payment methods, benefiting from the widespread adoption of unified payment interface technology and mobile-first consumer behavior. The seamless transaction experience, instant payment confirmation, and elimination of card details entry have made digital wallets the preferred payment method for online purchases. Integration across e-commerce platforms, combined with cashback incentives and reward programs, reinforces consumer preference for wallet-based payments. The Government of India and the Reserve Bank of India have overseen rapid growth in digital payments, with UPI accounting for around 85% of all digital transactions in the country, underscoring how government‑backed payment infrastructure is driving the broader adoption of wallet and digital payment methods in e‑commerce.

The segment's expansion reflects India's broader digital payments transformation, with consumers increasingly comfortable conducting financial transactions through mobile applications. E-commerce platforms have optimized checkout experiences for wallet payments, reducing transaction friction and cart abandonment rates. The interoperability of payment systems and growing acceptance across merchant categories strengthen digital wallets' position as the dominant e-commerce payment method, supporting continued segment growth.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India exhibits a clear dominance with a 34% share of the total India e-commerce market in 2025.

North India's market leadership is attributed to the concentration of major metropolitan centers including the National Capital Region, substantial population base, and advanced digital infrastructure supporting e-commerce operations. The region benefits from high consumer awareness, established logistics networks, and strong presence of fulfillment centers enabling rapid delivery services. Urban consumers in northern cities demonstrate high adoption rates for online shopping across diverse product categories.

The region's e-commerce growth extends beyond metropolitan areas into tier-II and tier-III cities where rising internet penetration and smartphone ownership are creating new consumer markets. Platform investments in regional language interfaces and localized content enhance accessibility for diverse consumer segments. The presence of major e-commerce companies' operational headquarters and technology hubs in the region further strengthens the ecosystem supporting sustained market expansion.

Market Dynamics:

Growth Drivers:

Why is the India E-Commerce Market Growing?

Expanding Internet Penetration and Smartphone Adoption

The rapid expansion of internet connectivity and smartphone ownership across India represents a foundational driver of e-commerce market growth. Affordable mobile devices and competitive data pricing have democratized internet access, bringing online shopping within reach of previously underserved populations in semi-urban and rural areas. The India smartphone market reached 153.3 Million units in 2024 and is projected to grow to 277.1 Million units by 2033, reflecting increasing device penetration that further enables online shopping adoption. The mobile-first nature of Indian internet usage aligns perfectly with e-commerce platform strategies optimized for smartphone interfaces. Improved network infrastructure including expanding coverage and faster connection speeds enhances the online shopping experience, reducing friction in browsing, selection, and transaction completion. This digital connectivity expansion continuously enlarges the addressable consumer base for e-commerce platforms.

Robust Digital Payments Infrastructure

India's world-leading digital payments ecosystem provides critical infrastructure supporting e-commerce transaction growth. India’s Unified Payments Interface (UPI) has emerged as the world’s largest real‑time retail payments system, accounting for nearly half of global real‑time payment transaction volumes, according to an International Monetary Fund (IMF) report cited by the Government of India in 2025. The widespread adoption of unified payment interface technology has transformed consumer payment behavior, making cashless transactions seamless and convenient. The interoperability of payment systems enables consumers to transact across platforms using preferred methods without friction. The emergence of innovative payment solutions including buy-now-pay-later services and embedded credit offerings expands purchasing power and enables higher-value transactions. These mature payments infrastructure reduces barriers to online commerce adoption and supports continued market expansion.

Rising Middle-Class Population and Disposable Incomes

The expanding Indian middle class with growing disposable incomes represents a powerful demand driver for e-commerce market growth. Economic development and increasing household prosperity are creating consumer cohorts with both the financial capacity and aspirational desires to purchase diverse products online. Urbanization trends concentrate these affluent consumers in areas with strong digital infrastructure and efficient delivery networks. Younger demographics entering the workforce bring digital-native shopping behaviors and preferences for online commerce. The combination of population growth, rising prosperity, and generational shifts toward digital channels creates sustained momentum for e-commerce market expansion.

Market Restraints:

What Challenges the India E-Commerce Market is Facing?

Logistics and Infrastructure Challenges in Remote Areas

Despite improvements, logistics infrastructure limitations in rural and remote areas constrain e-commerce market penetration beyond urban centers. Last-mile delivery challenges including poor road connectivity, address ambiguity, and scattered populations increase operational costs and delivery timelines. These infrastructure gaps create service quality disparities between metropolitan and non-metropolitan markets, limiting platform expansion and consumer adoption in underserved regions.

High Return Rates and Reverse Logistics Costs

Elevated product return rates, particularly in categories such as fashion and apparel, impose significant operational and financial burdens on e-commerce platforms. Reverse logistics costs including pickup, inspection, refurbishment, and restocking erode margins and complicate inventory management. The challenge is amplified by consumer expectations for hassle-free returns, requiring platforms to balance customer experience with operational sustainability.

Intense Competition and Margin Pressures

The highly competitive e-commerce landscape characterized by aggressive discounting, promotional spending, and customer acquisition costs creates persistent margin pressures for market participants. Competition from well-capitalized global platforms, domestic marketplaces, and emerging quick commerce players intensifies pricing pressures. Platforms must balance growth investments with profitability objectives while maintaining competitive offerings to retain price-sensitive consumers.

Competitive Landscape:

The India e-commerce market exhibits intense competitive dynamics characterized by the presence of established global technology companies alongside well-funded domestic platforms and emerging category specialists. Market leaders compete across dimensions including product selection breadth, pricing competitiveness, delivery speed, customer experience, and technology innovation. Strategic initiatives encompass geographic expansion into underserved markets, category diversification, logistics infrastructure investments, and technology acquisitions. The competitive landscape is evolving with the emergence of quick commerce players, social commerce platforms, and direct-to-consumer brands challenging traditional marketplace models. Partnerships with financial services providers, logistics companies, and brand manufacturers strengthen platform ecosystems and competitive positioning.

Some of the key players include:

- Ajio

- Amazon.com Inc.

- Flipkart India Private Limited

- Meesho Technologies Private Limited

- Naaptol Online Shopping Private Limited

- Nykaa E-Retail Pvt. Ltd

- Purplle

- Shopclues (Clues Network Pvt. Ltd.)

- Snapdeal Limited

- Tata Cliq

Recent Developments:

- In December 2025, Dealshare has launched a 2‑hour delivery model in Jaipur, aiming to expand to Kolkata, Lucknow, and Ghaziabad. The value‑commerce platform’s fast delivery innovation combines affordability with efficient last‑mile logistics, positioning it to compete with larger e‑commerce players.

India E-commerce Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Home Appliances, Apparel, Footwear and Accessories, Books, Cosmetics, Groceries, Others |

| Transactions Covered | Business to Business (B2B), Business to Consumer (B2C), Consumer to Consumer (C2C), Others |

| Payment Modes Covered | Cash Payment, Bank Transfer, Card Payment, Digital Wallet, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Companies Covered | Ajio, Amazon.com Inc., Flipkart India Private Limited, Meesho Technologies Private Limited, Naaptol Online Shopping Private Limited, Nykaa E-Retail Pvt. Ltd, Purplle, Shopclues (Clues Network Pvt. Ltd.), Snapdeal Limited, Tata Cliq, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India e-commerce market size was valued at USD 129.72 Billion in 2025.

The India e-commerce market is expected to grow at a compound annual growth rate of 19.63% from 2026-2034 to reach USD 651.10 Billion by 2034.

Groceries dominate the India e-commerce market with a 23% share, driven by the rapid expansion of quick commerce platforms and increasing consumer preference for convenient online grocery shopping and doorstep delivery services.

Key factors driving the India e-commerce market include expanding internet penetration and smartphone adoption, robust digital payments infrastructure, rising middle-class population with growing disposable incomes, and government initiatives supporting digital commerce.

Major challenges include logistics and infrastructure limitations in remote areas, high return rates and reverse logistics costs, intense competition creating margin pressures, and regulatory complexities affecting cross-border and multi-state operations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)