India Dairy Alternatives Market Size, Share, Trends and Forecast by Source, Formulation, Nutrient, Distribution Channel, Product Type, and Region, 2025-2033

Market Overview:

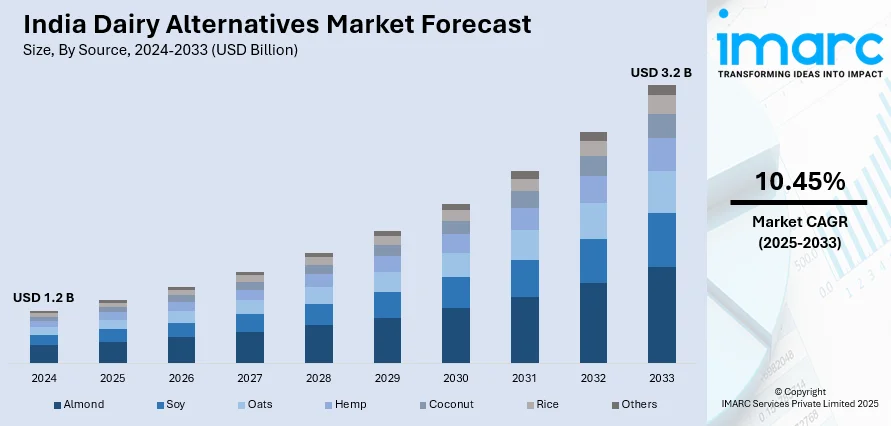

India dairy alternatives market size reached USD 1.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.2 Billion by 2033, exhibiting a growth rate (CAGR) of 10.45% during 2025-2033. The growing popularity of veganism, which has led to increased demand for plant-based alternatives across various food categories, including dairy, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 3.2 Billion |

| Market Growth Rate (2025-2033) | 10.45% |

Dairy alternatives are non-dairy products designed to replicate the taste and texture of traditional dairy items while catering to individuals with lactose intolerance, dairy allergies, or those choosing a plant-based lifestyle. Common alternatives include plant-based milk options such as almond, soy, coconut, and oat milk, which are produced by extracting liquids from nuts, legumes, seeds, or grains. These alternatives offer a variety of flavors and nutritional profiles, often fortified with vitamins and minerals like calcium and vitamin D to mimic the benefits of dairy. Additionally, soy and almond-based alternatives can be used in cooking and baking as substitutes for traditional dairy ingredients. As awareness of dietary preferences and health considerations grows, the market for dairy alternatives continues to expand, providing consumers with a diverse array of choices that align with their nutritional needs and ethical beliefs.

To get more information of this market, Request Sample

India Dairy Alternatives Market Trends:

The dairy alternatives market in India has witnessed substantial growth in recent years, primarily driven by increasing awareness of health and environmental concerns. Consumers are progressively seeking plant-based alternatives due to rising lactose intolerance and concerns about allergens present in traditional dairy products. Additionally, the growing adoption of vegan and vegetarian lifestyles has significantly contributed to the surge in demand for dairy alternatives. Furthermore, the rising prevalence of chronic health conditions, such as heart disease and obesity, has prompted individuals to explore healthier dietary options, propelling the market for plant-based alternatives. The market has also been fueled by a surge in product innovation and a diverse range of offerings, including almond milk, soy milk, oat milk, and coconut milk, catering to varied consumer preferences. Moreover, an increased emphasis on sustainable and ethical practices within the food industry has led to a shift in consumer preferences towards environmentally friendly options. The desire to reduce the carbon footprint associated with traditional dairy farming has prompted many to opt for plant-based alternatives, thereby further bolstering market growth. In conclusion, a confluence of health-conscious choices, dietary preferences, sustainability considerations, and innovative product offerings collectively propels the flourishing dairy alternatives market in India.

India Dairy Alternatives Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on source, formulation, nutrient, distribution channel, and product type.

Source Insights:

- Almond

- Soy

- Oats

- Hemp

- Coconut

- Rice

- Others

The report has provided a detailed breakup and analysis of the market based on the source. This includes almond, soy, oats, hemp, coconut, rice, and others.

Formulation Insights:

- Plain

- Sweetened

- Unsweetened

- Flavored

- Sweetened

- Unsweetened

A detailed breakup and analysis of the market based on the formulation have also been provided in the report. This includes plain (sweetened and unsweetened) and flavored (sweetened and unsweetened).

Nutrient Insights:

- Protein

- Starch

- Vitamin

- Others

The report has provided a detailed breakup and analysis of the market based on the nutrient. This includes protein, starch, vitamin, and others.

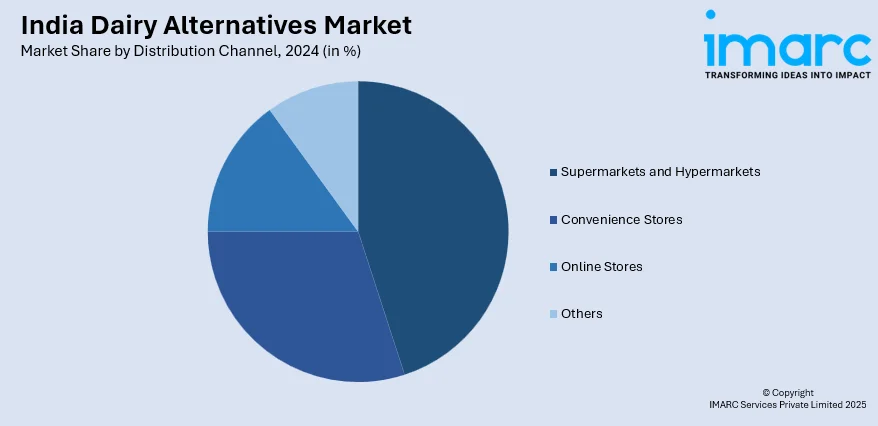

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, online stores, and others.

Product Type Insights:

- Cheese

- Creamers

- Yogurt

- Ice Creams

- Milk

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes cheese, creamers, yogurt, ice creams, milk, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East India and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East India and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Dairy Alternatives Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Almond, Soy, Oats, Hemp, Coconut, Rice, Others |

| Formulations Covered |

|

| Nutrients Covered | Protein, Starch, Vitamin, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Product Types Covered | Cheese, Creamers, Yogurt, Ice Creams, Milk, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India dairy alternatives market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India dairy alternatives market?

- What is the breakup of the India dairy alternatives market on the basis of source?

- What is the breakup of the India dairy alternatives market on the basis of formulation?

- What is the breakup of the India dairy alternatives market on the basis of nutrient?

- What is the breakup of the India dairy alternatives market on the basis of distribution channel?

- What is the breakup of the India dairy alternatives market on the basis of product type?

- What are the various stages in the value chain of the India dairy alternatives market?

- What are the key driving factors and challenges in the India dairy alternatives?

- What is the structure of the India dairy alternatives market and who are the key players?

- What is the degree of competition in the India dairy alternatives market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India dairy alternatives market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India dairy alternatives market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India dairy alternatives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)